Академический Документы

Профессиональный Документы

Культура Документы

Lane Asset Management Stock Market Commentary September 2014

Загружено:

Edward C LaneАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lane Asset Management Stock Market Commentary September 2014

Загружено:

Edward C LaneАвторское право:

Доступные форматы

Market Recap for August 2014

August was an interesting month, recovering from a weaker July. Looking back over

the events for the month, it might be summarized as a month with encouraging do-

mestic economic news, weakness in Europe (Italy slipped into recession as industrial

production in the Eurozone weakened), recovery in Latin America (largely Brazil and

Mexico), and weakness in China and Japanall supported by what appeared to be a

cooling of tensions between Russia and Ukraine. U.S. second quarter GDP rose to

4.2% in the second revision from the earlier 4.0% in the initial reading. U.S. job open-

ings jumped to a high not seen since 2007, Zacks reports Q2 corporate earnings ad-

vanced over 8% from the same period last year, and the report of existing home sales

experienced its biggest increase in a year. The outlook for interest rates has shifted

from the beginning of the year with lowered expectations for rate increases (some are

saying they dont expect the Fed to increase the Fed Funds rate until late 2015 or pos-

sibly later, and the extremely low sovereign bond yields outside the U.S., along with the

improving U.S. economy, promote greater U.S. Treasury pur-

chases from abroad, further restraining U.S. interest rates).

Investment Outlook

At least as far as the U.S. economy is concerned, theres plenty of

reason to be optimistic or, maybe better put, less fearful. Just a

few reasons why:

The latest report of The Conference Board Leading Economic

Index improved sharply and the Boards economist reports

that growth should continue at a strong pace for the remain-

der of the year.

The Federal Reserves Beige Book survey of business contacts

revealed that all 12 Fed districts reported growing economic

activity (its unusual for all 12 districts to do so).

The latest Economist/FT survey of business executives see the

U.S. (and global) economy improving over the next 6 months

though the enthusiasm since January of this year.

Zacks Research reports that not only are total earnings for

the S&P 500 on track to reach a new all-time quarterly record,

but Q2s earnings growth strength has been broad-based

and that estimates for the current period havent fallen as

much as has been the trend in recent quarters.

As the total return of the S&P 500 index is already running above

9% year-to-date, some softness in equity performance for the bal-

ance of the year should come neither as a surprise nor as a major

source of concern.

Stock Market Commentary

September 9, 2014

Lane Asset Management

The charts on the following pages use mostly exchange-traded funds (ETFs) rather than market indexes since indexes cannot be invested in directly nor do they reflect the total return

that comes from reinvested dividends. The ETFs are chosen to be as close as possible to the performance of the indexes while representing a realistic investment opportunity. Pro-

spectuses for these ETFs can be found with an internet search on their symbol. Past performance is no guarantee of future results.

SPY is an exchange-traded fund designed to match the experience of the S&P 500 index adjusted for dividend reinvestment. Its prospectus can be found online. Past performance is no

guarantee of future results.

Page 2

Lane Asset Management

Last week, I remarked, while its too early to bet the ranch, we have three things potentially working for a

recovery on a technical basis: the strength of a long term price channel, a spike in volume in the last few

days consistent with prior reversals, and retention of our upward trend (the 50DMA). Well, history did re-

peat itself one more time as the trend was retained and the spike in volume once again led to a recovery

at least so far. From a technical perspective, I see little indication of an imminent significant correction to

the S&P 500 (Im not necessarily so sanguine about other markets or specific U.S. sectors). Some analysts point to low volume as an indication

of lack of enthusiasm about the current market, and they may be right. My take is a little different in that the current volume may, in part at

least, be just seasonal. In any event, lack of enthusiasm may possibly be taken as good news since it suggests a lot of buying power on the side-

lines (UBS Wealth Management reported last month that There is also still a good deal of money sitting in cash at negative real rates, waiting to

move into riskier assets with higher potential returns. Just under 30 percent of assets invested with UBS Wealth Management are in cash. Our clients re-

main primarily concerned with market valuations and the disappointing pace of the global economic recovery since 2009.) Furthermore, as discussed

on the next page, the recent run up in stock prices and P/E ratios may be less of a problem than meets the eye.

S&P 500 Total Return (SPY)

SPY is an exchange-traded fund designed to match the experience of the S&P 500 index adjusted for dividend reinvestment. Its prospectus can be found online. Past performance is no

guarantee of future results.

Page 3

Lane Asset Management

The question of whether the U.S. Stock market is in a bubble has been plaguing investors for months as the

S&P 500 has enjoyed a 25% per year compound annualized return since its bottom in March 2009 while its

P/E ratio has risen to a level looking like a near maximum of the last 100+ years, other than the period

around 2000 and again around 2007. So, is the S&P 500 in a bubble? I think not. While there are other tech-

nical and fundamental factors to give a more complete picture, here are two that lead me to this conclusion.

First, while the post-2009 gain has been impressive, the S&P 500 (using SPY as an investable proxy), is almost exactly on the same pace it has been

on for the last 35 years, namely, about 10%/year, as shown in the chart on the left below. Second, while the P/E ratio is certainly at the high end of

the historical range, it is nowhere near the bubble levels that have contributed to the angst of many investors. Furthermore, with an increasing

number of stock buybacks, corporations get an automatic boost to their P/E ratio making historical comparisons a little less, well, comparable. A

balanced portfolio is always wise, but I wouldnt be too concerned today that were likely to see a 2000/2007-type event hit equities in the foresee-

able future. A pullback is a normal event that long term investors should take in stride. One can either ride it through or try to capture a piece

for an asset rebalancing. For committed equity money that can withstand a correction of 10% or so, the market doesnt look all that bad to me.

S&P 500 Total Return (SPY)

VEU is an exchange-traded fund designed to match the experience of the FTSE All-world (ex U.S.) Index. Its prospectus can be found online. Past performance is no guarantee of

future results.

Page 4

Lane Asset Management

International equities, represented here by Vanguards ETF, VEU, had a rough time of it in August as

Europe struggled with a weak economy exacerbated by tensions with Russia over Ukraine. At this point,

prices for the broad index are trendless and momentum isnt much better. On a country-specific basis,

India continues to outshine the broad index while Europe, Japan and South Korea are holding it back. In-

terestingly, Germany, which has taken a beating over the last several months (and reflects so much of

Europes equity behavior), has now reached a multi-year low point relative to the S&P 500 and is starting to add strength. While it may take

some time for Germany and Europe to overcome their economic headwinds, this may be a good time to start building a position in Europes

strongest economy. Overall, I remain underweight the broad index in favor of U.S. equities (see the next page).

All-world (ex U.S.) Equities (VEU)

SPY, VEU, and LQD are exchange-traded funds designed to match the experience of the S&P 500, (with dividends), the FTSE All-world (ex US) index, and the iBoxx Investment Grade

Corporate Bond Index, respectively. Their prospectuses can be found online. Past performance is no guarantee of future results.

Page 5

Lane Asset Management

Asset allocation is the mechanism investors use to enhance gains and reduce volatility over the long term. One useful tool Ive

found for establishing and revising asset allocation comes from observing the relative performance of major asset sectors (and

within sectors, as well). The charts below show the relative performance of the S&P 500 (SPY) to an investment grade corporate

bond index (LQD) on the left, and to the Vanguard All-world (ex U.S.) index fund (VEU) on the right.

On the left, equities continue to outperform bonds as economic developments in the U.S. continue to show strength, especially corporate prof-

its,, the principal driver of equity prices over the long term. If the channel continues to hold, an interruption in this outperformance becomes

increasingly likely. Nevertheless, I see no reason to become more conservative in a long-term asset allocation.

On the right, the trend of the relative strength of U.S. equities against the broad international index moved from an inconclusive posture to a

one more consistent with the upward channel favoring the U.S. For the foreseeable future, an allocation to international equities needs to be

country or region specific to capitalize on any recent strength.

I continue to retain my strategic allocation to equities over bonds and stay below a strategic allocation to international equities.

Asset Allocation and Relative Performance

PFF seeks to track the investment results of the S&P U.S. Preferred Stock Index (TM) which measures the performance of a select group of preferred stocks . LQD is an ETF designed to

match the experience of the iBoxx Investment Grade Corporate Bond Index. Prospectuses can be found online. Past performance is no guarantee of future results.

Page 6

Lane Asset Management

Investment grade corporate bonds lost their momentum in June but have since recovered as the pattern of

pause that occurred in March seems to have repeated. Bonds and other income-oriented investments will

continue to provide portfolio balance as investors are nervous about the sustainability of equity performance.

On a year-to-date basis, there are quite a few alternative income investments that have outperformed invest-

ment grade corporate bonds, including REITs, preferred stocks, convertible bonds, long term Treasury bonds,

and emerging market bonds.

Shown on the right below is the relative performance of the preferred stock index fund, PFF, compared to investment grade corporate bonds on

a total return basis. Even though PFF has recently lost momentum, I believe the higher yield relative to LQD (currently about 6.9% vs. 3.5%)

will continue to attract investors and, in any event, provide balance and diversification to the income portion of an asset allocation.

Income Investing

Page 7

Lane Asset Management

Shown below is a comparison of the 10-year Treasury yield to the S&P 500 since 1980. A lot has been said about what is

expected to happen to equity prices when interest rates rise as they are destined to do. While its quite understandable

to be concerned that rising rates will slow down corporate investment and consumer purchases, its not at all clear that,

in the current low interest rate environment, that rising rates will suppress stock prices (other than an initial emotional

reaction) for anything more than a short term reaction.

What this chart shows is that prior to about 1999 when interest rates were generally above 5%, periods of rising rates were often associated

with weakness in stock prices. However, following 1999 with interest rates below 5%, rising rates were often associated with rising stock prices

and falling rates were associated with falling stock prices. Indeed, the orange line at the bottom of the graph that shows the 60-week correla-

tion between the S&P 500 and the 10-year Treasury yield shows generally negative correlation before 1999 and generally positive correlation af-

ter, 2014 notwithstanding.

The securities markets, both equity and income investments, are in an unprecedented spot on account of the exogenous influence global central

bank policy of ultra low interest policy rates and bond purchase programs. With all the speculation about the potential negative long term im-

pact of these policies, especially as they get unwound, its just possible that the impact will be a whole lot less disruptive than many might think.

Interest Rates and Equities

Page 8

Lane Asset Management

Shown on the left below is a 5-year comparison of the 10-year Treasury yield to the 2-Year Treasury yield. Whats inter-

esting about this chart is that the spread widened in the latter part of 2013 and has narrowed in 2014. The 2013 widening

appears to be linked to Fed Chair Bernankes initial comments about ending Quantitative Easing and the resulting im-

pact on long term interest rates (known as the Taper Tantrum). The tightening in 2014 is a little more complicated in

that the narrowing spread looks like an indication of anticipation of an increase in the Fed Funds rate while something

else is happening to long term rates, perhaps a flight to safety reflecting concern about a potential equity market correc-

tion. The 2014 drop in correlation in the movement between the two rates is also unusual and again might be pointing to anticipation of move-

ment in the Fed Funds rate. While the interpretation of the rate movements is not totally clear to me, it could mean that the anticipation will

reduce the rate shock when the Fed Funds rate is actually increased, as it inevitably will be (many think some time next year).

On the right is a snapshot of the yield curves at the beginning of 2011 (purple) and today (red). As a flat yield curve is associated with a reces-

sion, the flattening of the curve since 2011 (continuing this past month) provides some level of concern though we have a long way to go before

we reach the flatness typical of recent recessions.

Interest Rates and the Yield Curve

Edward Lane is a CERTIFIED FINANCIAL PLANNER. Lane Asset Manage-

ment is a Registered Investment Advisor with the States of NY, CT and

NJ. Advisory services are only offered to clients or prospective clients

where Lane Asset Management and its representatives are properly li-

censed or exempted. No advice may be rendered by Lane Asset Man-

agement unless a client service agreement is in place.

Investing involves risk including loss of principal. Investing in interna-

tional and emerging markets may entail additional risks such as currency

fluctuation and political instability. Investing in small-cap stocks includes

specific risks such as greater volatility and potentially less liquidity.

Small-cap stocks may be subject to higher degree of risk than more es-

tablished companies securities. The illiquidity of the small-cap market

may adversely affect the value of these investments.

Investors should consider the investment objectives, risks, and charges

and expenses of mutual funds and exchange-traded funds carefully for a

full background on the possibility that a more suitable securities trans-

action may exist. The prospectus contains this and other information. A

prospectus for all funds is available from Lane Asset Management or

your financial advisor and should be read carefully before investing.

Note that indexes cannot be invested in directly and their performance

may or may not correspond to securities intended to represent these

sectors.

Investors should carefully review their financial situation, making sure

their cash flow needs for the next 3-5 years are secure with a margin

for error. Beyond that, the degree of risk taken in a portfolio should be

commensurate with ones overall risk tolerance and financial objectives.

The charts and comments are only the authors view of market activity

and arent recommendations to buy or sell any security. Market sectors

Page 9

Lane Asset Management

Disclosures

Periodically, I will prepare a Commentary focusing on a specific investment issue.

Please let me know if there is one of interest to you. As always, I appreciate your feed-

back and look forward to addressing any questions you may have. You can find me at:

www.LaneAssetManagement.com

Edward.Lane@LaneAssetManagement.com

Edward Lane, CFP

Lane Asset Management

Kingston, NY

Reprints and quotations are encouraged with attribution.

and related exchanged-traded and closed-end funds are selected based on his opinion

as to their usefulness in providing the viewer a comprehensive summary of market

conditions for the featured period. Chart annotations arent predictive of any future

market action rather they only demonstrate the authors opinion as to a range of pos-

sibilities going forward. All material presented herein is believed to be reliable but its

accuracy cannot be guaranteed. The information contained herein (including historical

prices or values) has been obtained from sources that Lane Asset Management (LAM)

considers to be reliable; however, LAM makes no representation as to, or accepts any

responsibility or liability for, the accuracy or completeness of the information con-

tained herein or any decision made or action taken by you or any third party in reli-

ance upon the data. Some results are derived using historical estimations from available

data. Investment recommendations may change without notice and readers are urged

to check with tax advisors before making any investment decisions. Opinions ex-

pressed in these reports may change without prior notice. This memorandum is based

on information available to the public. No representation is made that it is accurate or

complete. This memorandum is not an offer to buy or sell or a solicitation of an offer

to buy or sell the securities mentioned. The investments discussed or recommended in

this report may be unsuitable for investors depending on their specific investment ob-

jectives and financial position. The price or value of the investments to which this re-

port relates, either directly or indirectly, may fall or rise against the interest of inves-

tors. All prices and yields contained in this report are subject to change without notice.

This information is intended for illustrative purposes only. PAST PERFORMANCE

DOES NOT GUARANTEE FUTURE RESULTS.

Вам также может понравиться

- Saving Social SecurityДокумент39 страницSaving Social SecurityEdward C LaneОценок пока нет

- Why President Biden Should Eliminate Corporate Taxes To Build Back BetterДокумент5 страницWhy President Biden Should Eliminate Corporate Taxes To Build Back BetterEdward C LaneОценок пока нет

- Market Outlook - September 30, 2023Документ11 страницMarket Outlook - September 30, 2023Edward C LaneОценок пока нет

- The Federal Debt - Should We WorryДокумент3 страницыThe Federal Debt - Should We WorryEdward C LaneОценок пока нет

- Is It Time To Eliminate Federal Corporate Income TaxesДокумент30 страницIs It Time To Eliminate Federal Corporate Income TaxesEdward C LaneОценок пока нет

- LAM Stock Market in Focus August 2022Документ14 страницLAM Stock Market in Focus August 2022Edward C LaneОценок пока нет

- On Federal Deficits and Debt, Monetary and Fiscal PolicyДокумент26 страницOn Federal Deficits and Debt, Monetary and Fiscal PolicyEdward C Lane100% (1)

- The Green New Deal and Modern Monetary TheoryДокумент3 страницыThe Green New Deal and Modern Monetary TheoryEdward C LaneОценок пока нет

- LAM Commentary Q1 2017Документ11 страницLAM Commentary Q1 2017Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary Q3 2018Документ14 страницLane Asset Management Stock Market Commentary Q3 2018Edward C LaneОценок пока нет

- The Green New Deal and Modern Monetary TheoryДокумент3 страницыThe Green New Deal and Modern Monetary TheoryEdward C LaneОценок пока нет

- Lane Asset Management - Commentary Q2 2017Документ13 страницLane Asset Management - Commentary Q2 2017Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary Q2-Q3 2018Документ14 страницLane Asset Management Stock Market Commentary Q2-Q3 2018Edward C LaneОценок пока нет

- LAM Commentary Q4 2018 - 2019 OutlookДокумент18 страницLAM Commentary Q4 2018 - 2019 OutlookEdward C LaneОценок пока нет

- Lane Asset Management Market and Economic Commentary Q1/2018Документ16 страницLane Asset Management Market and Economic Commentary Q1/2018Edward C LaneОценок пока нет

- Lane Asset Management Commentary Aug 2016Документ8 страницLane Asset Management Commentary Aug 2016Edward C LaneОценок пока нет

- Lane Asset Management Market Commentary For Q3 2017Документ15 страницLane Asset Management Market Commentary For Q3 2017Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary For January 2017Документ9 страницLane Asset Management Stock Market Commentary For January 2017Edward C LaneОценок пока нет

- Stock Market Commentary November 2015Документ9 страницStock Market Commentary November 2015Edward C LaneОценок пока нет

- Lane Asset Management Commentary Dec 2016Документ9 страницLane Asset Management Commentary Dec 2016Edward C LaneОценок пока нет

- Lane Asset Management Commentary For November 2016Документ14 страницLane Asset Management Commentary For November 2016Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary September 2015Документ10 страницLane Asset Management Stock Market Commentary September 2015Edward C LaneОценок пока нет

- Lane Asset Management Stock Market and Economic Commentary February 2016Документ11 страницLane Asset Management Stock Market and Economic Commentary February 2016Edward C LaneОценок пока нет

- Lane Asset Management Economic and Stock Market Commentary Sept. 2016Документ9 страницLane Asset Management Economic and Stock Market Commentary Sept. 2016Edward C LaneОценок пока нет

- Lane Asset Management Stock Market Commentary July 2016Документ12 страницLane Asset Management Stock Market Commentary July 2016Edward C LaneОценок пока нет

- Stock Market Commentary June 2016Документ10 страницStock Market Commentary June 2016Edward C LaneОценок пока нет

- Lane Asset Management 2015 Review and 2016 Fearless ForecastДокумент20 страницLane Asset Management 2015 Review and 2016 Fearless ForecastEdward C LaneОценок пока нет

- Stock Market Commentary August 2015Документ9 страницStock Market Commentary August 2015Edward C LaneОценок пока нет

- Lane Asset Management Commentary For October 2015Документ9 страницLane Asset Management Commentary For October 2015Edward C LaneОценок пока нет

- Stock Market Commentary For July 2015Документ10 страницStock Market Commentary For July 2015Edward C LaneОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Barclays Weekly Options Report Vols Die HardДокумент10 страницBarclays Weekly Options Report Vols Die HardVitaly ShatkovskyОценок пока нет

- Chem 215 Myers: The Heck ReactionДокумент8 страницChem 215 Myers: The Heck ReactiondubstepoОценок пока нет

- Nhai Im 2013-14 02-04-13Документ30 страницNhai Im 2013-14 02-04-13Pankaj GoyenkaОценок пока нет

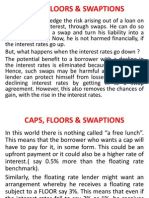

- Five-Caps, Floors & Swaptions 8Документ8 страницFive-Caps, Floors & Swaptions 8Akhilesh SinghОценок пока нет

- TWSE Stocks ListДокумент118 страницTWSE Stocks Listaria smorderОценок пока нет

- June 2014 (IAL) MS - Unit 1 Edexcel Chemistry A-LevelДокумент24 страницыJune 2014 (IAL) MS - Unit 1 Edexcel Chemistry A-LevelNabindra RuwaliОценок пока нет

- Bac Cmo PrimerДокумент39 страницBac Cmo Primerjms1999Оценок пока нет

- Oppenheimer Investing Through The Credit CycleДокумент12 страницOppenheimer Investing Through The Credit CycleKapil AgrawalОценок пока нет

- TimidДокумент13 страницTimid公孫堂傲100% (2)

- Duration Gap and Market RiskДокумент3 страницыDuration Gap and Market RiskPatrick SchubertОценок пока нет

- COST ESTIMATE GUIDELINES AND REFERENCES How to Avoid Bidding ErrorsДокумент48 страницCOST ESTIMATE GUIDELINES AND REFERENCES How to Avoid Bidding ErrorsJM Carlos89% (28)

- Chapter 11: Radical Reactions: Multiple ChoiceДокумент24 страницыChapter 11: Radical Reactions: Multiple Choicelp_blackout50% (2)

- NYSE Traded Listed Bonds SymbolДокумент153 страницыNYSE Traded Listed Bonds SymbolbboyvnОценок пока нет

- Solutions and SolubilityДокумент45 страницSolutions and SolubilityAishah JamalОценок пока нет

- Calpine's Growth Strategy and Financing OptionsДокумент17 страницCalpine's Growth Strategy and Financing OptionsAmrita PrasadОценок пока нет

- Organic Problems1Документ9 страницOrganic Problems1Sung-Eun KimОценок пока нет

- Isbm - 1 - Introduction To Risk ManagementДокумент89 страницIsbm - 1 - Introduction To Risk Managementarathi_bhat100% (1)

- Chapter 16 Halogen DerivativesДокумент11 страницChapter 16 Halogen DerivativesSabina SabaОценок пока нет

- Military Polyurethane Adhesive StudyДокумент5 страницMilitary Polyurethane Adhesive StudyAsim MansoorОценок пока нет

- Exercise 6 - 1 Multiple Choice QuestionsДокумент2 страницыExercise 6 - 1 Multiple Choice QuestionsJellai TejeroОценок пока нет

- Markets and Commodity Figures: Total Market Turnover StatisticsДокумент6 страницMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupОценок пока нет

- Chapter 33Документ82 страницыChapter 33sa3oudihimarОценок пока нет

- Definition DebenturesДокумент8 страницDefinition DebenturesDipanjan DasОценок пока нет

- Cpa Review School of The Philippines 3Документ1 страницаCpa Review School of The Philippines 3Jhopel Casagnap EmanОценок пока нет

- TestsДокумент8 страницTestsAyush GuptaОценок пока нет

- Unit 8 The D-And F - Block Elements I. Answer The Following Questions. Each Question Carries One MarkДокумент9 страницUnit 8 The D-And F - Block Elements I. Answer The Following Questions. Each Question Carries One MarkDeva RajОценок пока нет

- Bond Prices and Yields: Bodie, Kane, and Marcus 9 EditionДокумент20 страницBond Prices and Yields: Bodie, Kane, and Marcus 9 EditionBerry FransОценок пока нет

- Milestones in Structural ElucidationДокумент18 страницMilestones in Structural ElucidationluckydineshОценок пока нет

- International Capital Market Case Study - Part 1. Basic Knowledge of Capital MarketДокумент27 страницInternational Capital Market Case Study - Part 1. Basic Knowledge of Capital Marketmanojbhatia1220Оценок пока нет

- Indemnity BondДокумент1 страницаIndemnity BondaggarwalbhaveshОценок пока нет