Академический Документы

Профессиональный Документы

Культура Документы

Pricing Maths Tutorial Case Study On WALMART

Загружено:

o3283Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pricing Maths Tutorial Case Study On WALMART

Загружено:

o3283Авторское право:

Доступные форматы

Tutorial 2: Sensitivity Analysis

Problem 1 (Exam 2007): The Classic Furniture Company is trying to determine the

optimal quantities to make of six possible products: tables and chairs made of o

ak, cherry, and pine. The products are to be made using the following resources:

labour hours and three types of wood. The availability of each resource as well

as each item's resource usage (technological coefficients) are shown in the Excel

layout (Figure 1). Minimum production requirements are as follows: at least 3 e

ach of oak and cherry tables, at least 10 each of oak and cherry chairs, and at

least 5 pine chairs. The objective function coefficients in Figure 1 refer to th

e unit profit per item. The LP Sensitivity Report is shown in Figure 2.

Classic Furniture Company

Oak tables 3 75 7.5 200 Oak chairs 30 35 3.5 30 Cherry Cherry tables chairs 3 35

.56 90 60 9 240 1 1 1 1 1 6 36 180 40 Pine tables 0 45 4.5 Pine chairs 75 20 2

Number of units Profit per unit () Constraints Labour hours Oak (pounds) Cherry (

pounds) Pine (pounds) Min oak tables Min cherry tables Min oak chairs Min cherry

chairs Min pine chairs

5178.33 <- Objective 517.83 <= 1500 <= 2000 <= 3000 <= 3 >= 3 >= 30 >= 35.56 >=

75 >= LHS Sign 1000 1500 2000 3000 3 3 10 10 5 RHS

Figure 1: Excel layout

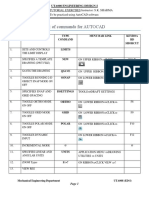

Microsoft Excel 11.0 Sensitivity Report

Adjustable Cells Cell $D$6 $E$6 $F$6 $G$6 $H$6 $I$6 Name Number of units Oak tab

les Number of units Oak chairs Number of units Cherry tables Number of units Che

rry chairs Number of units Pine tables Number of units Pine chairs Final Value 3

30 3 35.56 0 75 Reduced Cost 0 0 0 0 -45 0 Objective Coefficient 75 35 90 60 45

20 Allowable Increase 158.33 1E+30 310 1E+30 45 1E+30 Allowable Decrease 1E+30

23.75 1E+30 46.5 1E+30 10

Constraints Cell $J$9 $J$10 $J$11 $J$12 $J$13 $J$14 $J$15 $J$16 $J$17 Name Labou

r hours Oak (pounds) Cherry (pounds) Pine (pounds) Min oak tables Min cherry tab

les Min oak chairs Min cherry chairs Min pine chairs Final Value 517.83 1500 200

0 3000 3 3 30 35.56 75 Shadow Price 0 1.17 1.67 0.5 -158.33 -310 0 0 0 Constrain

t R.H. Side 1000 1500 2000 3000 3 3 10 10 5 Allowable Increase 1E+30 4132.86 289

3 9643.33 3 3.83 20 25.56 70 Allowable Decrease 482.17 600 920 2800 3 3 1E+30 1E

+30 1E+30

Figure 2: Sensitivity Report Answer each of the following questions, each of whi

ch is independent of the others.

a) What is the optimal solution? Which constraints are binding? b) Interpret the

shadow prices of the following three constraints: labour hours, the amount of c

herry wood available, and the minimum production quantity for oak tables. c) Sup

pose Classic Furniture are forced to produce at least one table in pine. What wo

uld be the impact on profit? d) Classic Furniture can purchase an additional 1,0

00 pounds of oak at a price of 0.75 per pound. Should Classic Furniture buy this

wood and do they need to change the current production plan? (Why?) What would b

e the impact on profit? e) Classic Furniture is considering the production of co

ffee tables. One coffee table would make a profit of 55 while its production requ

ires 30 pounds of oak, 10 pounds of cherry and 5 hours of labour. Should the com

pany produce coffee tables? Why (not)? f) It appears that Classic Furniture unde

restimated the profit of each item by 10%. Should Classic Furniture adapt the pr

oduction plan? Why (not)? g) Tables and chairs usually sell as sets. For each ty

pe of wood, the number of chairs produced should not exceed 10 times the number

of tables produced. What constraints should be added to the LP to reflect these

conditions? Does the current solution satisfy these constraints? Problem 2: (Exa

m 2005) Steelco has received an order for 100 tonnes of steel. The order must co

ntain at least 3.5 tonnes of nickel, at most 3 tonnes of carbon, and exactly 4 t

onnes of manganese. Steelco receives 200/tonne for the order. To fill the order,

Steelco can combine four alloys, whose chemical composition is given in Table 1.

Steelco wants to maximise profit (revenues costs). Formulate Steelco's problem as

an LP and solve it with Excel Solver. Table 1: Alloy composition and cost Alloy

1 6% 3% 8% 120 Alloy 2 3% 2% 3% 100 Alloy 3 2% 5% 2% 80 Alloy 4 1% 6% 1% 60

Nickel Carbon Manganese Cost/tonne

After solving Steelco's problem with excel solver, use the sensitivity report to a

nswer the following questions: a) What is the optimal solution? Which constraint

s are binding? b) In what range of cost values for alloy 2 does the current solu

tion remain optimal? Can you calculate the new profit if alloy 2 costs 90/tonne?

c) Interpret the shadow prices of the different constraints? d) Suppose the cost

per tonne of both alloy 2 and 4 decreases by 20. Will this change the optimal so

lution? Why or why not? Can you calculate the new profit?

e) Suppose the order should contain at least 3.55 tonnes of nickel. Would this c

hange affect the profit? What about the optimal solution? f) Suppose that Steelc

o can use also alloy 5. Alloy 5 costs 100/tonne and contains 2% of nickel, 1% of

carbon and 0.3% of manganese. Would you advise Steelco using alloy 5 in the orde

r? g) Suppose alloys 1, 2, 3 and 4 contain respectively 2%, 3%, 1% and 4% of sil

icon. The 100 tonne steel order should contain at most 2.5 tonnes of silicon. Sh

ould Steelco revise its production plan?

Steelco

No. of tons Selling price () Cost () Profit () Constraints Nickel constraint Carbon

constraint Manganese constraint Order size = 100 tons Alloy 1 25 200 120 80 0.0

6 0.03 0.08 1 Alloy 2 62.5 200 100 100 0.03 0.02 0.03 1 Alloy 3 0 200 85 115 0.0

2 0.05 0.02 1 Alloy 4 12.5 200 60 140 0.01 0.06 0.01 1

10000 3.5 2.75 4 100 LHS

<-- Objective >= <= = = Sign 3.5 3 4 100 RHS

Figure 3: Excel layout Steelco

Figure 4: Sensitivity report Steelco Problem 3 (4.22 & 4.23): The Good-to-Go Sui

tcase Company makes three kinds of suitcases: (1) Standard, (2) Deluxe and (3) L

uxury styles. Each suitcase goes through four production stages: (1) cutting and

colouring, (2) assembly, (3) finishing, and (4) quality and packaging. The tota

l number of hours available in each of these departments is 630, 600, 708, and 1

35 respectively.

Each Standard suitcase requires 0.7 hours of cutting and colouring, 0.5 hours of

assembly, 1 hour of finishing and 0.1 hours of quality and packaging. The corre

sponding numbers for each Deluxe suitcase are 1 hour, 0.83 hours, 0.67 hours, an

d 0.25 hours, respectively. Likewise, the corresponding numbers for each Luxury

suitcase are: 1 hour, 0.67 hours, 0.9 hours, and 0.4 hours, respectively. The sa

les revenue for each type of suitcase is as follows: Standard 36.05, Deluxe 39.5 a

nd Luxury 43.3. The material costs are Standard 6.25, Deluxe 7.5 and Luxury 8.5.The

hourly cost of labour for each department is: cutting & colouring 10, assembly 6,

finishing 9, and quality and packaging 8. a) Formulate an LP to determine how much

suitcases Good-to-Go should make so as to maximise profit. Enter this problem i

nto Excel and find the optimal solution. (Use the answer and sensitivity report

to answer the following questions.) b) What is the optimal production plan? Whic

h of the resources are scarce? c) Suppose Good-to-Go is considering a polishing

process, the cost of which would be added directly to the price. Each Standard s

uitcase would require 10 minutes of time of this treatment, each Deluxe suitcase

would need 15 minutes and each Luxury suitcase would need 20 minutes. Would the

current production plan change as a result of this additional process if 170 ho

urs of polishing time were available? Explain your answer. d) Suppose Good to-Go

is considering the possible introduction of two new products: the Compact model

and the Kiddo model (for children). Market research suggests that Good-to-Go can

sell the Compact model for no more than 30, whereas the Kiddo model would go for

as much as 37.5 to speciality toy stores. The amount of labour and the cost of r

aw materials for each possible new product are as follows: Cost Category Cutting

and colouring (hr.) Assembly (hr.) Finishing (hr.) Quality and packaging (hr.)

Raw materials () Compact 0.5 0.75 0.75 0.2 5 Kiddo 1.20 0.75 0.5 0.2 4.5

Would it be economically attractive to make any of these models? Explain your an

swer.

Вам также может понравиться

- Pricing Maths Tutorial (Case Study On WALMART)Документ4 страницыPricing Maths Tutorial (Case Study On WALMART)Goody Boy FahimОценок пока нет

- A Book of Vintage Designs and Instructions for Making Furniture and Other Household Items - Containing Two Kitchen Tables, a Hanging Tool Chest, How to Make a Box Curb, a Lemonade Set Carrier and a Fretwork Letter RackОт EverandA Book of Vintage Designs and Instructions for Making Furniture and Other Household Items - Containing Two Kitchen Tables, a Hanging Tool Chest, How to Make a Box Curb, a Lemonade Set Carrier and a Fretwork Letter RackОценок пока нет

- Lecture 3 AssignmentДокумент3 страницыLecture 3 AssignmentFairuz MeidianaОценок пока нет

- Painting, Furniture Finishing and Repairing - A Compilation of Helpful Articles for Craftsmen, Home Owners, Painters and HandymenОт EverandPainting, Furniture Finishing and Repairing - A Compilation of Helpful Articles for Craftsmen, Home Owners, Painters and HandymenОценок пока нет

- Revision Exercise (Final Exam)Документ8 страницRevision Exercise (Final Exam)elizabeth cheahОценок пока нет

- Taller OPT-SoluciónДокумент14 страницTaller OPT-SoluciónMauricio Alejandro Buitrago Soto100% (1)

- Knitted Animal Nursery: 37 gorgeous animal-themed knits for babies, toddlers, and the homeОт EverandKnitted Animal Nursery: 37 gorgeous animal-themed knits for babies, toddlers, and the homeОценок пока нет

- Soal UTS PO1 Kelas C 2022Документ3 страницыSoal UTS PO1 Kelas C 2022Dini AniartiОценок пока нет

- Selected LP Apps Handouts 3Документ88 страницSelected LP Apps Handouts 3Yusuf FauziОценок пока нет

- ExercisesДокумент6 страницExercisesAna Carolina TeixeiraОценок пока нет

- Instructions: Answer Minimum Five Out of Seven Questions. All Questions Carry Equal Marks (5 10 50)Документ4 страницыInstructions: Answer Minimum Five Out of Seven Questions. All Questions Carry Equal Marks (5 10 50)Abhishek RaghavОценок пока нет

- Selected LP Apps HandoutsДокумент88 страницSelected LP Apps HandoutsJaquel100% (3)

- Ques 2.20Документ46 страницQues 2.20AkshatAgarwal0% (1)

- Apps Stat and Optimization Models Homework 1 Over Chapter 2 Book ProblemsДокумент8 страницApps Stat and Optimization Models Homework 1 Over Chapter 2 Book ProblemsxandercageОценок пока нет

- Homework 1: Linear OptimizationДокумент4 страницыHomework 1: Linear Optimizationankita mazumdarОценок пока нет

- Optimization Methods in Management Science: MIT 15.053, Spring 2013Документ9 страницOptimization Methods in Management Science: MIT 15.053, Spring 2013AnifaОценок пока нет

- Iv Year Mechanical EngineeringДокумент4 страницыIv Year Mechanical EngineeringChandiga RichardОценок пока нет

- Selected LP Apps Handouts 3 PDFДокумент88 страницSelected LP Apps Handouts 3 PDFcarlette110% (1)

- Exam Review - Module 3Документ7 страницExam Review - Module 3Cameron BelangerОценок пока нет

- Assignment B TechДокумент5 страницAssignment B TechAbhishekKumarОценок пока нет

- Linear ProДокумент25 страницLinear ProApoorv SaxenaОценок пока нет

- 3-Solved Problems - Sensitivity AnalysisДокумент8 страниц3-Solved Problems - Sensitivity AnalysissreedeviishОценок пока нет

- Project 02 - Using Linear Programming To Make Business DecisionsДокумент4 страницыProject 02 - Using Linear Programming To Make Business DecisionsIzaan Ahmed KhanОценок пока нет

- Duality&Sensitivity PDFДокумент4 страницыDuality&Sensitivity PDFjaved alamОценок пока нет

- INTRODUCTION TOnLINEAR PROGRAMMINGДокумент9 страницINTRODUCTION TOnLINEAR PROGRAMMINGPrincess Amber0% (2)

- SSG 811 2021 - 2022 - 2023 Lecture 2Документ15 страницSSG 811 2021 - 2022 - 2023 Lecture 2Oladimeji AladerokunОценок пока нет

- Answer: (A) Let X X X X: b6 b9 j6 j9Документ4 страницыAnswer: (A) Let X X X X: b6 b9 j6 j9Majdouline ZnaidiОценок пока нет

- LP Assignement 2022 SolutionДокумент11 страницLP Assignement 2022 Solutionsohilamohsen46Оценок пока нет

- Practice Problems 01Документ2 страницыPractice Problems 01Rube KieronОценок пока нет

- OR - LPP For ClassДокумент8 страницOR - LPP For ClassMuhammad Ibrahim IsahОценок пока нет

- 1 (I) - Unbounded - Since There Is No Single Poiny in Feasible Region That Can Maximize The FunctionДокумент5 страниц1 (I) - Unbounded - Since There Is No Single Poiny in Feasible Region That Can Maximize The FunctionPolu Vidya SagarОценок пока нет

- Business Maths..Linear Programming 2Документ114 страницBusiness Maths..Linear Programming 2muhammadtaimoorkhan100% (4)

- Linear ProgrammingДокумент4 страницыLinear ProgrammingHelbert Agluba PaatОценок пока нет

- Cutting Stock ProblemДокумент14 страницCutting Stock ProblemGnanadeepanDeepanОценок пока нет

- Review For Exam 2Документ4 страницыReview For Exam 2abhdonОценок пока нет

- 29 Haneen 2171114351 ASS2Документ14 страниц29 Haneen 2171114351 ASS2King Of DarknessОценок пока нет

- PPC ProblemДокумент7 страницPPC ProblemNiponIslamBeckham100% (1)

- Operation Research HWДокумент5 страницOperation Research HWMuhammad Raditya RahagiОценок пока нет

- Qba341 LPДокумент7 страницQba341 LPArham SheikhОценок пока нет

- Qba341 LPДокумент7 страницQba341 LPArham SheikhОценок пока нет

- Linear Programming ExamplesДокумент5 страницLinear Programming ExamplesEdlyn PangilinanОценок пока нет

- PR Vani 2 No 2Документ12 страницPR Vani 2 No 2ivania nuryantariОценок пока нет

- What-If Analysis For Linear Programming Solution To Solved ProblemsДокумент4 страницыWhat-If Analysis For Linear Programming Solution To Solved ProblemsRamya KosarajuОценок пока нет

- 2017 QPДокумент8 страниц2017 QPShivamОценок пока нет

- 2013 Case Study AnsДокумент4 страницы2013 Case Study Anspranav4560Оценок пока нет

- Linear ProgrammingДокумент26 страницLinear Programmingvsuarezf2732100% (1)

- Practice Problems: Chapter 12, Inventory Management Problem 1Документ7 страницPractice Problems: Chapter 12, Inventory Management Problem 1xandercageОценок пока нет

- Taree A AaaaaaaДокумент13 страницTaree A AaaaaaaJhon Ambrosio NayraОценок пока нет

- Assignments With SolutionДокумент14 страницAssignments With SolutionBryan Denver CabantacОценок пока нет

- Chapter 81 PDFДокумент8 страницChapter 81 PDFAftab KhanОценок пока нет

- Test Power 1Документ3 страницыTest Power 1Aliff HaikalОценок пока нет

- Tool Rack ManufacturingДокумент28 страницTool Rack ManufacturingabdullahmohbekhitОценок пока нет

- 2lp Modelinggraph SolnДокумент56 страниц2lp Modelinggraph SolnTanzeel HussainОценок пока нет

- ECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Документ6 страницECO121 - Test 01 - Individual Assignment 01 - Fall2023 1Diệp TrịnhОценок пока нет

- Inventory Problems CH13Документ4 страницыInventory Problems CH13الف تاتОценок пока нет

- Problem 3Документ4 страницыProblem 3Julrick Cubio Egbus0% (1)

- Inventory ExampleДокумент14 страницInventory ExampleSrijan Shetty100% (1)

- 10a-Linear ProgrammingДокумент24 страницы10a-Linear ProgrammingChieMae Benson QuintoОценок пока нет

- Roles IT Services Company Career Framework Sushant 20aug2014Документ9 страницRoles IT Services Company Career Framework Sushant 20aug2014o3283Оценок пока нет

- Win Big Gambling Club: ConstraintsДокумент1 страницаWin Big Gambling Club: Constraintso3283Оценок пока нет

- Fifth Avenue Industries (Make-Buy) : ConstraintsДокумент2 страницыFifth Avenue Industries (Make-Buy) : Constraintso3283Оценок пока нет

- Larry Fredendall's Sinking Fund: A B C D A B C D AДокумент2 страницыLarry Fredendall's Sinking Fund: A B C D A B C D Ao3283Оценок пока нет

- International City Trust: ConstraintsДокумент4 страницыInternational City Trust: Constraintso3283Оценок пока нет

- Burn-Off Diet Drink: ConstraintsДокумент2 страницыBurn-Off Diet Drink: Constraintso3283Оценок пока нет

- Hong Kong Bank: ConstraintsДокумент2 страницыHong Kong Bank: Constraintso3283Оценок пока нет

- L13 SensitivityДокумент217 страницL13 Sensitivityo3283Оценок пока нет

- LP - OmmdДокумент16 страницLP - Ommdo3283Оценок пока нет

- LP Case Bedford SteelДокумент4 страницыLP Case Bedford Steelo3283Оценок пока нет

- OMMD - Case Solution - Merton Truck CompanyДокумент4 страницыOMMD - Case Solution - Merton Truck Companyo3283Оценок пока нет

- Kxu Chap03 SolutionДокумент16 страницKxu Chap03 Solutiono3283Оценок пока нет

- Bihar Schedule Reference Parliamentary Constituencies Schedule No: 3BДокумент2 страницыBihar Schedule Reference Parliamentary Constituencies Schedule No: 3Bo3283Оценок пока нет

- Solved Problems - Continuous Random VariablesДокумент4 страницыSolved Problems - Continuous Random VariablesDahanyakage WickramathungaОценок пока нет

- Lesson Plan - Maths - Create Graphs Based On Data CollectedДокумент2 страницыLesson Plan - Maths - Create Graphs Based On Data Collectedapi-464562811Оценок пока нет

- Rotor Flux Estimation Using Voltage Model of Induction MotorДокумент5 страницRotor Flux Estimation Using Voltage Model of Induction MotorBobby RinaldiОценок пока нет

- Quant Checklist 132 PDF 2022 by Aashish AroraДокумент70 страницQuant Checklist 132 PDF 2022 by Aashish AroraRajnish SharmaОценок пока нет

- RM 4Документ37 страницRM 4RHEALYN GEMOTOОценок пока нет

- Frequency Distribution Table GraphДокумент10 страницFrequency Distribution Table GraphHannah ArañaОценок пока нет

- Linear Algebra With Applications 9th Edition Leon Solutions ManualДокумент32 страницыLinear Algebra With Applications 9th Edition Leon Solutions ManualLafoot BabuОценок пока нет

- 3 - ANN Part One PDFДокумент30 страниц3 - ANN Part One PDFIsmael EspinozaОценок пока нет

- Aits 2021 FT Ix Jeem.Документ16 страницAits 2021 FT Ix Jeem.Atharv AtoleОценок пока нет

- Elementary Quantitative Methods QMI1500 Semesters 1 and 2: Tutorial Letter 101/3/2021Документ26 страницElementary Quantitative Methods QMI1500 Semesters 1 and 2: Tutorial Letter 101/3/2021natashasiphokazi2015Оценок пока нет

- An Introduction To Artificial Neural NetworkДокумент5 страницAn Introduction To Artificial Neural NetworkMajin BuuОценок пока нет

- MA-345 NMC: 1 Root Finding MethodsДокумент5 страницMA-345 NMC: 1 Root Finding MethodsZakir HussainОценок пока нет

- DatalabДокумент5 страницDatalabjackОценок пока нет

- 01otr 02ourДокумент53 страницы01otr 02ourKeerthana KОценок пока нет

- Trig BookДокумент174 страницыTrig BookJosé Maurício FreireОценок пока нет

- Data Mininig ProjectДокумент28 страницData Mininig ProjectKarthikeyan Manimaran67% (3)

- Hydra 325 Laboratory Experiment No.1Документ2 страницыHydra 325 Laboratory Experiment No.1lalguinaОценок пока нет

- Programmable Logic ControllersДокумент31 страницаProgrammable Logic Controllersgpz10100% (15)

- Concrete Mix Design Is MethodДокумент29 страницConcrete Mix Design Is MethodChirag TanavalaОценок пока нет

- 06 Logic ControlДокумент162 страницы06 Logic ControlTejo AlamОценок пока нет

- Central Force Problem: Reduction of Two Body ProblemДокумент7 страницCentral Force Problem: Reduction of Two Body ProblemParasIvlnОценок пока нет

- Math 10 Week 2Документ10 страницMath 10 Week 2Myla MillapreОценок пока нет

- The Mechanism of Activated Digusion Through Silica GlassДокумент9 страницThe Mechanism of Activated Digusion Through Silica GlassElenaОценок пока нет

- Pattern in Nature and The Regularities in The WorldДокумент11 страницPattern in Nature and The Regularities in The Worldjake simОценок пока нет

- Aristo Zenon Ve Stadyum ParadoksuДокумент21 страницаAristo Zenon Ve Stadyum Paradoksuaysel alagozОценок пока нет

- Phet Alpha DecayДокумент2 страницыPhet Alpha DecayAndika Sanjaya100% (1)

- Self-Practice Coding QuestionsДокумент2 страницыSelf-Practice Coding QuestionsNguyen HoangОценок пока нет

- Developing A Value-Centred Proposal For Assessing Project SuccessДокумент9 страницDeveloping A Value-Centred Proposal For Assessing Project SuccessAmit GandhiОценок пока нет

- List of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareДокумент15 страницList of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareShakeelОценок пока нет

- Phase Difference & Phase RelationshipsДокумент24 страницыPhase Difference & Phase RelationshipsGabriel Carl AlpuertoОценок пока нет

- Principles of Welding: Processes, Physics, Chemistry, and MetallurgyОт EverandPrinciples of Welding: Processes, Physics, Chemistry, and MetallurgyРейтинг: 4 из 5 звезд4/5 (1)

- The Aqua Group Guide to Procurement, Tendering and Contract AdministrationОт EverandThe Aqua Group Guide to Procurement, Tendering and Contract AdministrationMark HackettРейтинг: 4 из 5 звезд4/5 (1)

- A Place of My Own: The Architecture of DaydreamsОт EverandA Place of My Own: The Architecture of DaydreamsРейтинг: 4 из 5 звезд4/5 (242)

- Real Life: Construction Management Guide from A-ZОт EverandReal Life: Construction Management Guide from A-ZРейтинг: 4.5 из 5 звезд4.5/5 (4)

- Civil Engineer's Handbook of Professional PracticeОт EverandCivil Engineer's Handbook of Professional PracticeРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Post Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&AОт EverandPost Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&AОценок пока нет

- Estimating Construction Profitably: Developing a System for Residential EstimatingОт EverandEstimating Construction Profitably: Developing a System for Residential EstimatingОценок пока нет

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedОт EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedРейтинг: 5 из 5 звезд5/5 (1)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesОт EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesОценок пока нет

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialОт EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialОценок пока нет

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionОт EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionРейтинг: 4.5 из 5 звезд4.5/5 (2)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideОт Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideРейтинг: 3.5 из 5 звезд3.5/5 (7)

- Sustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsОт EverandSustainable Design and Build: Building, Energy, Roads, Bridges, Water and Sewer SystemsОценок пока нет

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsОт EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsРейтинг: 3.5 из 5 звезд3.5/5 (3)

- The Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyОт EverandThe Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyРейтинг: 4 из 5 звезд4/5 (1)

- Building Construction Technology: A Useful Guide - Part 1От EverandBuilding Construction Technology: A Useful Guide - Part 1Рейтинг: 4 из 5 звезд4/5 (3)

- Essential Building Science: Understanding Energy and Moisture in High Performance House DesignОт EverandEssential Building Science: Understanding Energy and Moisture in High Performance House DesignРейтинг: 5 из 5 звезд5/5 (1)

- Fire Protection Engineering in Building DesignОт EverandFire Protection Engineering in Building DesignРейтинг: 4.5 из 5 звезд4.5/5 (5)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsОт EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Starting Your Career as a Contractor: How to Build and Run a Construction BusinessОт EverandStarting Your Career as a Contractor: How to Build and Run a Construction BusinessРейтинг: 5 из 5 звезд5/5 (3)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseОт EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseРейтинг: 5 из 5 звезд5/5 (3)

- An Architect's Guide to Construction: Tales from the Trenches Book 1От EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1Оценок пока нет