Академический Документы

Профессиональный Документы

Культура Документы

NVCA Yearbook 2014

Загружено:

gmswamyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

NVCA Yearbook 2014

Загружено:

gmswamyАвторское право:

Доступные форматы

N

A

T

I

O

N

A

L

V

E

N

T

U

R

E

C

A

P

I

T

A

L

A

S

S

O

C

I

A

T

I

O

N

2

0

1

4

NATIONAL VENTURE

CAPITAL ASSOCIATION

YEARBOOK 2014

INCLUDING STATISTICS FROM THE

PricewaterhouseCoopers/National Venture Capital Association

MoneyTree Report based on data from Thomson Reuters

2014 National Venture Capital Association Yearbook | 1

NVCA THOMSON REUTERS

March 2014

Dear Colleague:

We are delighted to present to you the NVCA 2014 Yearbook, prepared by Thomson Reuters. This is the

17

th

edition in a series launched in early 1998. Since then, much has changed in the industry. One thing

that has not changed, however, is our commitment to bring accurate and responsible transparency to this

powerful economic force called venture capital. You will fnd in this publication new and updated charts

that track investment activity in the United States. Refecting our dynamic environment, for the frst time

we provide a chapter on Growth Equity an asset subclass that did not exist in its present form when we

printed the frst edition of this publication.

More changes are already in the works. For example, in recognition of the strong and broad emergence of

corporate venture capital groups and direct corporate investment over the past few quarters, we will soon

be changing our methodology to be more inclusive of solo (i.e., without a traditional venture investor in

the round) and early corporate investment into companies. Further, we will also include corporate direct

investment from the corporation itself, not just from a separate or captive entity. Stay tuned.

The industrys goal remains the same: to create fast-growing and sustainable companies, introduce new

technologies, and improve medical care and patient well-being, while providing an attractive return to

those who trust the industry with their capital. Whether by traditional venture capital, corporate venture

capital, growth equity, or a number of new and energized investment vehicles, we are here to report that

the beat goes on.

As always, your feedback and suggestions are welcome. Please feel free to contact us at research@nvca.

org or through any NVCA director or staff member.

Very truly yours,

Diana Frazier Bobby Franklin John S. Taylor

FLAG Capital Management NVCA President and CEO NVCA Head of Research

NVCA Director and

Chair, Research Committee

2 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

NVCA BOARD OF DIRECTORS 2013-2014

EXECUTIVE COMMITTEE

Josh Green Scott Sandell

Mohr, Davidow Ventures New Enterprise Associates

Chair Chair-Elect

Anne Rockhold Jonathan Callaghan

Accel Partners True Ventures

Treasurer Executive Committee At-Large

Bruce Evans Jonathan Leff

Summit Partneer Deerfeld Management

Executive Committee At-Large Executive Committee At-Large,

Research Committee

AT-LARGE

Diana Frazier Mark Leschly

FLAG Capital Rho Ventures

Research Chair Research Committee

John Backus Maria Cirino

New Atlantic Ventures .406 Ventures

David Douglass Claudia Fan Munce

Delphi Ventures IBM Venture Capital Group

Norm Fogelsong Venky Ganesan

Institutional Venture Partners Menlo Ventures

Robert Goodman Mark Gorenberg

Bessemer Venture Partners Zetta Venture Partners

Jason Green Adam Grosser

Emergence Capital Partners Silver Lake Kraftwerk

James Healy Ross Jaffe

Sofnnova Ventures Versant Ventures

Scott Kupor Ray Leach

Andreessen Horowitz Jumpstart, Inc

David Lincoln Robert Nelsen

Element Partners ARCH Venture Partners

Art Pappas Sue Siegel

Pappas Ventures GE Ventures

2014 National Venture Capital Association Yearbook | 3

NVCA THOMSON REUTERS

2014

National Venture Capital Association Yearbook

For the National Venture Capital Association

Prepared by Thomson Reuters

Copyright 2014 Thomson Reuters

The information presented in this report has been gathered with the utmost care

from sources believed to be reliable, but is not guaranteed. Thomson Reuters disclaims

any liability including incidental or consequential damages arising from

errors or omissions in this report.

4 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

National Venture Capital Association

1655 Fort Myer Drive, Suite 850

Arlington, Virginia 22209-3114

Telephone: 703-524-2549

Telephone: 703-524-3940

www.nvca.org

President and CEO

Bobby Franklin

President Emeritus

Mark G. Heesen

Head of Research

John S. Taylor

Senior Vice President of Federal Policy and Political Advocacy

Jennifer Connell Dowling

Vice President of Federal Life Science Policy

Kelly Slone

Vice President of Federal Policy and Political Advocacy

Emily Baker

Vice President of Communications

Ben Veghte

Vice President of Membership and Member Firm Liaison

Janice Mawson

Vice President of Administration

Roberta Catucci

Director of Business Development

Hannah Veith

Manager of Administration and Meetings

Allyson Chappell

Accounting Manager

Beverley Badley

Research Lab

Mavis Moulterd (Emeritus), Annie Black, Liberty Benjamin

Lab Assistants

Thea Shepherd, Lexi Oscar, Gracie Baker

Thomson Reuters

3 Times Square, 18th Floor

New York, NY 10036

Telephone: 646-223-4431

Fax: 646-223-4470

www.thomsonreuters.com

Global Head of Deals & Private Equity

Stephen N. Case II

Head of Deals and Private Equity Operations

Katarzyna Namiesnik

Global Business Manager Private Equity

Jim Beecher

Editor-in-Charge

David Toll

Global Private Equity Operations Manager

Anna Aquino-Chavez

Press Management

Matthew Toole

Senior Content Specialist

Michael D. Smith

Content Specialist

Paul Pantalla

Data Specialist

Francis S. Tan

Senior Art Director

David Cooke

Sales Manager Publications (Buyouts, VCJ, peHUB)

Greg Winterton (646-223-6787)

ThomsonONE.com Sales:

1-877-365-1455

National Venture Capital Association 2014 Yearbook

2014 National Venture Capital Association Yearbook | 5

NVCA THOMSON REUTERS

TABLE OF CONTENTS

What is Venture Capital? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .9

Industry Resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Commitments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . 11

Investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13

Exits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . 14

Industry Resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . 17

Capital Commitments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .23

Investments.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27

Exits: IPOs and Acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .71

Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .71

Growth Equity Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .85

Methodology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .85

Appendix A: Glossary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Appendix B: MoneyTree Report Criteria . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .105

Appendix C: MoneyTree Geographical Defnitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .107

Appendix D: Industry Codes (VEICs). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109

Appendix E: Industry Sector VEIC Ranges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .113

Appendix F: Stage Defnitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .115

Appendix G: Data Sources and Resources. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117

Appendix H: International Convergence. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .119

Appendix I: US Accounting Rulemaking and Valuation Guidelines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .121

Appendix J: Non-US Private Equity . . . . . . . . . . . . . . .. . . . . . . . . . . . . . .. . . . . . . . . . . . . . .. . . . . . . . . . . . . . .. . . . . . . . . 125

6 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

This page is intentionally left blank.

2014 National Venture Capital Association Yearbook | 7

NVCA THOMSON REUTERS

WHAT IS VENTURE CAPITAL?

Venture capital has enabled the United States to support its entrepreneur-

ial talent and appetite by turning ideas and basic science into products

and services that are the envy of the world. Venture capital funds build

companies from the simplest form perhaps just the entrepreneur and an

idea expressed as a businessplan to freestanding, mature organizations.

Risk Capital for Business

Venture capital frms are professional, institutional managers of risk capi-

tal that enables and supports the most innovative and promising compa-

nies. This money funds new ideas that could not be fnanced with tradi-

tional bank fnancing, that threaten established products and services in a

corporation, and that typically require fve to eight years to be launched.

Venture capital is quite unique as an institutional investor asset class.

When an investment is made in a company, it is an equity investment in a

company whose stock is essentially illiquid and worthless until a company

matures fve to eight years down the road. Follow-on investment provides

additional funding as the company grows. These rounds, typically oc-

curring every year or two, are also equity investment, with the shares al-

located among the investors and management team based on an agreed

valuation. But, unless a company is acquired or goes public, there is

little actual value.Venture capital is a long-term investment.

More Than Money

The U.S. venture industry provides the capital to create some of the most

innovative and successful companies. But venture capital is more than

money. Venture capital partners become actively engaged with a com-

pany, typically taking a board seat. With a startup, daily interaction with

the management team is common. This limits the number of startups in

which any one fund can invest. Few entrepreneurs approaching venture

capital frms for money are aware that they essentially are asking for 1/6

of a person! Yet that active engagement is critical to the success of the

fedgling company. Many one- and two-person companies have received

funding but no one- or twoperson company has ever gone public!Along

the way, talent must be recruited and the company scaled up. Ask any

venture capitalist who has had an ultra-successful investment and he or

she will tell you that the company that broke through the gravity evolved

from the original business plan concept with the careful input of an expe-

rienced hand.

Deal Flows Where The Buys Are

For every 100 business plans that come to a venture capital frm for fund-

ing, usually only 10 or so get a serious look, and only one ends up being

funded. Theventure capital frm looks at the management team, the con-

cept, the marketplace, ft to the funds objectives, the value-added po-

tential for the frm, and the capital needed to build a successful business.

A busy venture capital professionals most precious asset is time. These

days, a business concept needs to address world markets, have superb

scalability, be made successful in a reasonable timeframe, and be truly

innovative. A concept that promises a 10 or 20 percent improvement on

something that already exists is not likely to get a close look.

Many technologies currently under development by venture capital frms

are truly disruptive technologies that do not lend themselves to being em-

braced by larger companies whose current products could be cannibalized

by this. Also, with the increased emphasis on public company quarterly

results, many larger organizations tend to reduce spending on research and

development and product development when things get tight. Many tal-

ented teams have come to the venture capital process when their projects

were turned down by their companies.

Common Structure Unique Results

While the legal and economic structures used to create a venture capi-

tal fund are similar to those used by other alternative investment asset

classes, venture capital itself is unique. Typically, a venture capital frm

will create a Limited Partnership with the investors as LPs and the frm

itself as the General Partner. Each fund, or portfolio, is a separate part-

nership. A new fund is established when the venture capital frm obtains

necessary commitments from its investors, say $100 million. The money

is taken from investors as the investments are made. Typically, an initial

funding of a company will cause the venture fund to reserve three or four

times that frst investment for follow-on fnancing. Over the next three to

eight or so years, the venture frm works with the founding entrepreneur to

grow the company. The payoff comes after the company is acquired or

goes public. Although the investor has high hopes for any company get-

ting funded, only one in six ever goes public and one in three is acquired.

Venture Capital Backed Companies

Known for Innovative Business Models

Employment at IPO and Now

Company As of IPO Current # Change

The Home Depot

650

331,000 330,350

Starbucks Corporation 2,521 160,000 157,479

Staples 1,693 89,019 87,326

Whole Foods Market, Inc. 2,350 69,500 67,150

eBay

138 31,500 31,362

Venture Capital Backed Companies

Known for Innovative Technology Products

Employment at IPO and Now

Company As of IPO Current # Change

Microsoft 1,153 94,000 92,847

Intel Corporation 460 100,100 99,640

Medtronic, Inc. 1,287 45,000 43,713

Apple Inc. 1,015 76,100 75,085

Google 3,021 53,861 50,840

JetBlue 4,011 12,070 8,059

Source: Global Insight; Updated fromThomsonOne 2/2013

8 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Economic Alignment of all Stakeholders

An American Success Story

Venture capital is rare among asset classes in that success is truly shared.

It is not driven by quick returns or transaction fees. Economic success

occurs when the stock price increases above the purchase price. When

a company is successful and has a strong public stock offering, or is ac-

quired, the stock price of the company refects its success. The entrepre-

neur benefts from appreciated stock and stock options. The rank and fle

employees throughout the organization historically also do well with their

stock options. The venture capital fund and its investors split the capi-

tal gains per a pre-agreed formula. Many college endowments, pension

funds, charities, individuals, and corporations have benefted far beyond

the risk-adjusted returns of the public markets.

Whats Ahead

Much of venture capitals success has come from the entrepreneurial spirit

pervasive in theAmerican culture, fnancial recognition of success, access

to good science, and fair and open capital markets. It is dependent upon

a good fow of science, motivated entrepreneurs, protection of intellec-

tual property, and a skilled workforce. The nascent deployment of ven-

ture capital in other countries is gated by a countrys or regions cultural

ft, tolerance for failure, services infrastructure that supports developing

companies, intellectual property protection, effcient capital markets, and

the willingness of big business to purchase from small companies.

2014 National Venture Capital Association Yearbook | 9

NVCA THOMSON REUTERS

EXECUTIVE SUMMARY

During 2013, many of the metrics describing the venture capital indus-

try in the United States were similar to those of the prior three years, with

the exception of a pickup in the breadth of the IPO markets. The decline

in capital managed continued as expected, but not as much as some were

anticipating. A record proportion of venture deals focused on companies

in the seed and early stages, while a number of companies long in the

portfolios fnally went public, led by Biotechnology companies in the frst

half of 2013. Investment in early-stage life science companies continued

to fall during the year, although a fourth-quarter increase in frst fundings

of Biotechnology companies was encouraging.

Fundraising remained very challenging for the majority of venture

frms. This is largely because of a dearth of healthy exits through 2012

that would have distributed yet-unrealized returns to current fund inves-

tors. Aside from the Facebook IPO in 2012 ($16.0B of the $21.5B raised

in 2012), 2013 was a much-improved year with 81 venture-backed IPOs.

Remarkably, over half of them were Biotechnology companies. Early

signs for 2014 suggest that IPO momentum carried forward into at least

the frst part of the year.

A healthy venture capital ecosystem requires its metrics to be in bal-

ance. And while the quality of new business opportunities, known as deal

fow, remains very high and the best opportunities are getting funded,

stresses remain.

Introduction

The National Venture Capital Association 2014 Yearbook provides

a summary of venture capital activity in the United States. This ranges

from investments into portfolio companies to capital managed by general

partners to fundraising from limited partners to valuations of companies

receiving venture capital investments to exits of the investments by ei-

ther IPOs or mergers and acquisitions. The statistics for this publication

were assembled primarily from the MoneyTree Report by Pricewater-

houseCoopers and the National Venture Capital Association, based on

data from Thomson Reuters and analyzed through the Thomson ONE.

com (formerly VentureXpert) database of Thomson Reuters, which has

been endorsed by the NVCA as the offcial industry activity database.

Subscribers to Thomson ONE can recreate most of the charts in this pub-

lication and report individual deal detail and more granular statistics than

those provided herein.

Industry Resources

The activity level of the US venture capital industry is roughly half

of what it was at the 2000-era peak. For example, in 2000, 1,050 frms

each invested $5 million or more during the year. In 2013, the count was

roughly half that at 548.

Venture capital under management in the United States by the end of

2013 decreased to $192.9 billion. However, looking behind the numbers,

we know that the industry continues to contract from the circa 2004 high

of $288.9 billion. The peak capital under management that year was a

statistical anomaly caused when funds raised at the height of the 2000 tech

bubble were joined by new capital raised post bubble.

The slight downtick in frms and capital managed (Fig. 1.04) in 2013

understates a consolidating industry. The average venture capital frm

shrunk to 6.7 principals per frm from 8.7 just six years earlier. The corre-

sponding drop in headcount to under 6,000 principals is almost one-third

lower than 2007 levels. This meant that there was a general increase in the

average amount of capital managed by each principal. It is possible going

forward that the number of principals per frm will increase as the number

of frms decreases. This is because the bulk of the capital being commit-

ted today is being raised by larger, specialty, and boutique frms. For our

purposes here, we defne a principal to be someone who goes to portfolio

company board meetings. That is, deal partners would be included and

frm CFOs would not be included.

Contrary to some popular misconceptions, only 43 frms managed more

than $1 billion. By comparison, 277 frms managed less than $25 million.

Commitments

The year 2013 continued to be a very challenging fundraising year for

most venture capital frms in the United States. This was due to a lack of

recent distributions caused by the tight exit markets, lackluster returns by

many venture funds over the past decade compared with the prior decade,

and a challenge for the largest alternative asset investors to place money in

many of the smaller funds in this asset class because of scale. Only $16.8

billion was raised by 187 funds. This was considerably less than the $19.6

billion raised in 2012 or the $19.0 billion raised in 2011. The amount of

new commitments each year by venture capital funds continued to be less

than the amount they invested in companies.

Investments

Measuring industry activity by the total dollars invested in a given year

shows that the industry has remained generally in the $20 billion to $30

billion range since 2002. In 2013, $29.5 billion was invested in 3,382

companies through 4,041 deals. The number of deals was 4% higher than

2012 counts, but was essentially the same as 2011. The number of frst-

time fundings increased in 2013 to 1,334 companies from the previous

1,275, but it remains near the top of the healthy range of 1,000 to 1,400

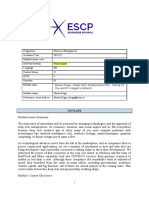

Figure 1.0

Venture Capital Under Management Summary Statistics

1993 2003 2013

No. of VC Firms in Existence 370 951 874

No. of VC Funds in Existence 613 1,788 1,331

No. of Professionals 5,217 14,777 5,891

No. of First Time VC Funds Raised 25 34 53

No. of VC Funds Raising Money This Year 93 160 187

VC Capital Raised This Year ($B) 4.5 9.1 16.8

VC Capital Under Management ($B) 29.3 263.9 192.9

Avg VC Capital Under Mgt per Firm ($M) 79.2 277.5 220.7

Avg VC Fund Size to Date ($M) 40.2 94.4 110.3

Avg VC Fund Size Raised This Year ($M) 48.3 102.9 89.7

Largest VC Fund Raised to Date ($M) 1,775.0 6,300.0 6,300.0

10 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

frst-time fundings in a year. Further parsing the data shows 50% of the in-

vestment dollars going to California companies, down from 53% in 2012

but consistent with the previous three years. The year 2013 saw a record

56% of the fnancing rounds going to seed and early stage companies,

compared with a more typical one-third of deals. A carefully watched sta-

tistic is the investment in the life sciences. It is possible that the downward

plummet in frst-time life sciences investment is starting to reverse, led

by Biotechnology, but it is still too early to be sure. Corporate Venture

investment continues to gain considerable strength and presence in the

overall industry.

Software was the leading sector in 2013, receiving 37.3% of the total

dollars. The second largest sector was Biotechnology, which was less than

half that amount at 15.4% of total investment. Among frst fundings, Soft-

ware led the way with 591 companies getting their initial venture capital

rounds. This is more than 46% of the frst fundings. Again in 2013, the

second most active frst-funding sector is Media and Entertainment at 170

frst fundings.

California-domiciled venture capital frms made investments in 38

states in 2013. Approximately 48% of all the money invested in Califor-

nia came from California-domiciled frms. Conversely, California-based

frms concentrated 68% of their investment dollars within the state.

The number and reach of corporate venture capital groups increased

in 2013, along with the visibility of this group. These groups provided

an estimated 10.5% of the venture capital invested by all venture groups.

They were involved in 16.9% of the deals the highest level in fve years.

Going forward, all signs suggest that these groups are becoming more

involved alongside traditional venture frms in deals, as well as initiating

corporate venture group syndicates to do deals in lieu of, or in advance of,

investment rounds by traditional venture frms.

Exits

Once successful portfolio companies mature, venture funds generally

exit their positions in those companies by taking them public through an

initial public offering (IPO) or by selling them to presumably larger orga-

nizations (acquisition, M&A, or trade sale). This then lets the venture

fund distribute the proceeds to investors, raise a new fund for future in-

vestment, and invest in the next generation of companies. We consider

each type of exit separately.

During 2013, 81 venture-backed companies went public in the United

States, marking the strongest full-year total for the number of new ven-

ture-backed listings since 2007. Remarkably, more than half of them were

Biotechnology IPOs, many of those being modestly sized. While the total

dollars raised in 2012 was higher at $21.5 billion, it is important to re-

member that $16.0 billion of that came from the Facebook IPO alone.

The remaining $5.5 billion was raised by the remaining 48 IPOs in 2012.

It was a very different story in 2013. $11.1 billion was raised by 81 com-

panies. The increase in mean and median time to exit refects the fact that

many of these IPOs were mature companies, and many of them were in

the life sciences space, which had been awaiting an IPO opportunity for

months, and in some cases, years.

NVCA is encouraged by the increase in smaller IPOs and biotech IPOs

in light of its 2012 legislative successes with the JOBS Act and creating a

pathway for FDA Reform.

The M&A space continued to soften in 2013, with the total number of

deals falling from 473 in the prior year to 376. Total proceeds fell by 27%.

Note that only 94 of the 376 acquisitions had reported deal values. Histori-

cally, deals with unreported sales prices are fairly diminutive, and in many

cases, fre sales. However, an increasing number of deal term sheets spec-

ify a non-disclosure restriction on all parties. So going forward, all but the

largest and most visible acquisitions may be hard to measure. Observers

have wondered why, given the huge amounts of cash on the balance sheets

of technology and Biotechnology giants, more acquisitions are not occur-

ring. We did see a furry of acquisitions in early 2014, perhaps signaling

an increase in that kind of activity.

Growth Equity

This edition of the NVCA Yearbook, prepared by Thomson Reuters, for

the frst time profles US growth equity investment in its own chapter. The

NVCA believes growth equity investing is an important segment of the

overall venture capital industry. Venture capitalists help create and grow

companies; growth equity investors are strongly focused on the growth

component of that mission and help companies scale through fat part of

their hiring curves. The NVCA also believes that growth equity invest-

ing is a critical component of the emerging growth company fnancing

continuum and has become, in many respects, the private alternative to

the public markets for both emerging growth companies and their earlier

stage venture capital backers.

Growth equity really emerged as an asset class in 2000 and continues

strong today. In 2013, we identifed 342 growth equity deals in the United

States. This compares with 406 in 2012, but is very much in line with

the past several years. A disclosed $12.3 billion in equity investment was

reported for 2013. This does not count the approximately 105 deals for

which no dollar equity amounts were disclosed.

2014 National Venture Capital Association Yearbook | 11

NVCA THOMSON REUTERS

0

50

100

150

200

250

300

350

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

Figure 2.0

Capital Under Management

U.S. Venture Funds ($ Billions)

1985 to 2013

0

20

40

60

80

100

120

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

Figure 3.0

Capital Commitments

To U.S. Venture Funds ($ Billions)

1985 to 2013

12 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 5.0

Venture Capital Investments in 2013 By Industry Group

Industry Group # Companies # Deals Investment

Amt ($Bil)

# Companies # Deals Investment

Amt ($Bil)

Information Technology 2,360 2,784 20 1009 1009 3.5

Medical/Health/Life Science 649 816 6.9 167 167 1.2

Non-High Technology 373 440 2.7 157 157 0.4

Total 3,382 4,041 29.6 1,334 1,334 5.1

Initial Investments All Investments

0

20

40

60

80

100

120

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

Figure 4.0

Venture Capital Investments ($ Billions)

1985 to 2013

2014 National Venture Capital Association Yearbook | 13

NVCA THOMSON REUTERS

Seed

3%

Early Stage

34%

Expansion

33%

Later Stage

30%

Figure 6.0

Venture Capital Investments in 2013

By Stage

Biotechnology

15%

Business Products and

Services 0.4%

Computers and Peripherals 2%

Consumer Products and

Services 4%

Electronics/Instrumentation

1%

Financial Services

2%

Healthcare Services

1%

Industrial/Energy

5%

IT Services

7%

Media and Entertainment

10%

Medical Devices and

Equipment

7%

Networking and Equipment

2%

Retailing/Distribution

1%

Semiconductors

2%

Software

37%

Telecommunications

2%

Other

0.2%

Figure 7.0

Venture Capital Investments in 2013

By Industry Sector

14 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 8.0 2013 Investments By State

State Number of

Companies

Pct of

Total

Investment

($ Millions)

Pct of

Total

California 1,280 40% 14,769.7 50%

Massachusetts 326 10% 3,079.3 10%

New York 287 9% 2,870.4 10%

Texas 101 3% 1,315.5 4%

Washington 134 4% 913.2 3%

Maryland 76 2% 664.5 2%

Virginia 85 3% 593.8 2%

Pennsylvania 154 5% 446.5 2%

Illinois 49 2% 434.9 1%

Colorado 62 2% 428.8 1%

All Others 676 21% 4,028.6 14%

Total 3,230 29,545.2

Figure 9.0 Venture-Backed IPOs

Year Num of IPOs Offer Amount

($Mil)

Med Offer Amt

($Mil)

Mean Offer Amt

($Mil)

Post Offer Value

($Mil)

Med Post Value

($Mil)

Mean Post Value

($Mil)

Median Age At

IPO (Years)

Mean Age At IPO

(Years)

1985 48 763 13 16 2,020 37 48 3.0 4.0

1986 105 2,417 13 23 166,032 52 1866 4.0 4.0

1987 86 2,125 17 25 10,972 46 155 4.0 4.0

1988 43 769 15 18 21,117 51 571 3.0 4.0

1989 42 873 16 21 4,443 50 131 4.0 4.0

1990 47 1,108 20 24 5,886 60 178 4.0 4.0

1991 120 3,726 27 31 17,611 81 202 5.0 5.0

1992 150 5,443 24 36 15,955 68 146 5.0 5.0

1993 175 6,154 25 35 14,808 75 130 5.0 6.0

1994 138 3,952 24 29 10,344 68 94 5.0 5.0

1995 184 7,859 36 43 19,300 104 152 4.0 5.0

1996 256 12,716 35 50 51,511 112 240 3.0 4.0

1997 141 5,829 33 41 19,101 99 148 3.0 6.0

1998 78 4,125 43 53 24,655 164 324 3.0 3.0

1999 280 23,975 69 86 147,341 304 532 3.0 3.0

2000 238 27,443 83 115 108,783 325 494 3.0 4.0

2001 37 4,130 80 112 19,233 327 534 4.0 4.0

2002 24 2,333 89 97 8,322 266 347 3.0 5.0

2003 26 2,024 71 78 7,412 252 285 5.0 6.0

2004 82 10,032 70 122 50,268 254 613 6.0 6.0

2005 59 5,113 68 87 39,702 202 673 5.0 5.0

2006 67 7,065 86 105 71,124 283 1078 5.0 6.0

2007 91 12,339 98 136 68,203 365 749 6.0 6.0

2008 7 765 83 109 3,645 278 521 7.0 7.0

2009 13 1,980 123 152 9,192 548 707 6.0 7.0

2010 70 7,774 93 111 114,981 428 1643 5.0 6.0

2011 51 10,690 106 210 94,657 606 1856 6.0 7.0

2012 49 21,460 89 438 122,168 371 2493 7.0 8.0

2013 81 11,068 91 137 62,700 354 784 7.0 8.0

*Age at IPO is dened as time elapsed from rst funding round until IPO date.

2014 National Venture Capital Association Yearbook | 15

NVCA THOMSON REUTERS

Figure 10.0

Venture-Backed Mergers & Acquisitions by Year

Year Number Total Number Known Price Average

1985 7 3 300.2 100.1

1986 8 1 63.4 63.4

1987 11 4 667.2 166.8

1988 17 9 920.7 102.3

1989 21 10 746.9 74.7

1990 19 7 120.3 17.2

1991 16 4 190.5 47.6

1992 69 43 2119.1 49.3

1993 59 36 1332.9 37.0

1994 84 57 3208.4 56.3

1995 92 58 3801.8 65.5

1996 108 76 8230.8 108.3

1997 145 100 7798.0 78.0

1998 189 113 8002.0 70.8

1999 228 155 38710.6 249.7

2000 379 245 79996.4 326.5

2001 384 175 25115.6 143.5

2002 365 166 11913.2 71.8

2003 323 134 8240.8 61.5

2004 402 199 28846.1 145.0

2005 446 201 19717.3 98.1

2006 484 208 24291.0 116.8

2007 488 201 30745.5 153.0

2008 417 134 16236.9 121.2

2009 351 109 12364.9 113.4

2010 523 150 17707.3 118.0

2011 490 169 24093.2 142.6

2012 473 132 22694.2 171.9

2013 376 94 16586.5 176.5

($ Millions)

16 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 11.0

Growth Equity Investments ($ Billions)

2000 to 2013*

0

5

10

15

20

25

30

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

Totals include only disclosed amounts. Many growth equity deal amounts are not reported.

2014 National Venture Capital Association Yearbook | 17

NVCA THOMSON REUTERS

INDUSTRY RESOURCES

The activity level of the US venture capital industry is roughly half of what it was at the 2000-era peak. For example, in 2000, 1,050 frms each invested

$5 million or more during the year. In 2013, the count was roughly half that at 548.

Venture capital under management in the United States by the end of 2013 decreased to $192.9 billion as calculated using the methodology described

below. However, looking behind the numbers, we know that the industry continues to contract from the circa 2006 high of $288.9 billion. The peak

capital under management that year was a statistical anomaly caused by funds raised at the height of the 2000 tech bubble were joined by new capital

raised post bubble.

The slight downtick in frms and capital managed (Fig. 1.04) in 2013 perhaps understates a consolidating industry. The average venture capital frm

shrunk to 6.7 principals per frm from 8.7 just six years earlier. The corresponding drop in headcount to under 6,000 principals is almost one-third

lower than 2007 levels. This meant that there was a general increase in the average amount of capital managed by each principal. It is possible going

forward that the number of principals per frm will increase as the number of frms decreases. This is because the bulk of the capital being committed

today is being raised by larger, specialty, and boutique frms. For our purposes here, we defne a principal to be someone who goes to portfolio company

board meetings. That is, deal partners would be included and frm CFOs would not be included.

Geographic location of the largest venture frms is quite concentrated. 49% of the industrys California-domiciled frms manage capital, although these

frms may be actively investing in other states and countries. This concentration has been consistent for several years and may increase going forward,

given the movement of some East Coast funds westward. Taken together, the top fve states (California, Massachusetts, New York, Connecticut, and

Illinois) hold 81.1% of total venture capital in this country, essentially the same as a year ago.

Contrary to some popular misconceptions, only 43 frms managed more than $1 billion. By comparison, 277 frms managed less than $25 million.

Methodology

Historically, we have calculated industry size using a rolling eight

years of fundraising proxy for capital managed, number of funds, num-

ber of frms, etc. The number of frms in existence will vary on a rolling

eight-year basis as frms raise new funds or do not raise funds for more

than eight years. Currently, we know the industry is consolidating, but the

eight-year model now includes fund vintage years 2006-2013.

Under this methodology, we estimate that there are currently 874 frms

with limited partnerships in existence. To clarify, this is actually stating

that there are 874 frms that have raised a venture capital fund in the last

eight years. In reality, only 548 of them invested at least $5 million in

companies in 2013, and 136 of them invested more than $5 million in frst

rounds for a company.

For this publication, we are primarily counting the number of frms with

limited partnerships and are excluding other types of investment vehicles.

From that description, it may appear that the statistics for total industry

resources may be underestimated. However, this must be balanced with

the fact that capital under management by captive and evergreen funds is

diffcult to compare equitably to typical limited partnerships with fxed

lives. For this analysis only, the frms counted for capital under manage-

ment include frms with fxed-life partnerships and venture capital funds

they raised. If a frm raised both buyout and venture capital funds, only

the venture funds would be counted in the calculation of venture capital

under management.

Venture capital under management can be a complex statistic to esti-

mate. Indeed, capital under management reported by frms can differ from

frm to frm as theres not one singular defnition. For example, some frms

include only cumulative committed capital, others may include commit-

ted capital plus capital gains, and still other frms defne it as committed

capital after subtracting liquidations. To complicate matters, it is diffcult

to compare these totals to European private equity frms, which include

capital gains as part of their capital under management measurements.

For purposes of the analysis in this publication, we have tried to clarify

the industry defnition of capital under management as the cumulative to-

tal of committed capital less liquidated funds or those funds that have

completed their life cycle. Typically, venture capital frms have a stated

10-year fxed life span, except for life science funds, which are often

established as 12-year funds. Figure 1.09 shows the reality of fund life.

Thomson Reuters calculates capital under management as the cumulative

amount committed to funds on a rolling eight-year basis. Current capital

under management is calculated by taking the capital under management

calculation from the previous year, adding in the current years funds

commitments, and subtracting the capital raised eight years prior.

For this analysis, Thomson Reuters classifes venture capital frms us-

ing four distinct types: private independent frms, fnancial institutions,

corporations, and other entities. Private independent frms are made up

of independent private and public frms including both institutionally and

non-institutionally funded frms and family groups. Financial institu-

tions refers to frms that are affliates and/or subsidiaries of investment

banks and non-investment bank fnancial entities, including commercial

banks and insurance companies. The corporations classifcation includes

venture capital subsidiaries and affliates of industrial corporations. In

2013, we will modify the methodology to refect virtually all direct cor-

porate investment because many of the corporate venture investors do not

operate out of a separate fund or group. The capital under management

statistics reported in this section consist primarily of venture capital frms

investing through limited partnerships with fxed commitment levels and

fxed lives and do not include non-vintage evergreen funds or true cap-

tive corporate industrial investment groups without fxed commitment

levels. The term evergreen funds refers to funds that have a continuous

infusion of capital from a parent organization, as opposed to the fxed life

and commitment level of a closed-end venture capital fund.

18 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 1.01

Capital Under Management U.S. Venture Funds ($ Billions)

1985 to 2013

0

50

100

150

200

250

300

350

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

2014 National Venture Capital Association Yearbook | 19

NVCA THOMSON REUTERS

Figure 1.03

Distribution of Firms By Capital Managed 2013

Figure 1.02

Total Capital Under Management By Firm Type 1985 to 2013

1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

Private Independent 11,766 14,721 17,459 18,850 22,369 22,722 21,893 22,643 25,162 28,490 33,308 40,201 51,940 76,560 119,121

Financial Institutions 3,388 3,520 3,447 3,190 2,719 2,793 2,384 2,214 2,431 2,873 3,688 5,070 7,061 10,238 15,291

Corporations 1,582 1,545 1,895 1,989 1,931 1,963 1,907 2,032 1,517 1,564 1,526 2,219 2,531 3,425 8,169

Other 864 914 900 871 781 722 616 312 190 273 378 410 667 877 1,119

Total 17,600 20,700 23,700 24,900 27,800 28,200 26,800 27,200 29,300 33,200 38,900 47,900 62,200 91,100 143,700

Figure 1.02 (Continued)

Total Capital Under Management By Firm Type 1985 to 2013

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Private Independent 187,356 221,327 222,028 224,828 233,595 241,637 255,315 239,643 194,573 171,016 174,722 186,032 186,676 179,202

Financial Institutions 22,980 24,459 23,945 23,015 21,659 21,110 18,325 13,914 6,034 4,708 5,620 7,734 7,970 6,615

Corporations 12,995 14,153 14,126 13,886 13,627 13,467 13,297 8,990 4,294 3,125 3,688 4,860 4,892 6,401

Other 1,469 2,061 2,201 2,170 2,219 1,986 1,963 1,754 1,399 851 670 674 662 682

Total 224,800 262,000 262,300 263,900 271,100 278,200 288,900 264,300 206,300 179,700 184,700 199,300 200,200 192,900

0

50

100

150

200

0

-

1

0

1

0

-

2

5

2

5

-

5

0

5

0

-

1

0

0

1

0

0

-

2

5

0

2

5

0

-

5

0

0

5

0

0

-

1

0

0

0

1

0

0

0

+

164

113 114

107

132

82

53

43

This chart shows capital committed to US venture rms in active funds. While much of the capital is managed by larger rms, of the 808 rms included in this calculation at the

end of 2013, roughly 62% of them (498) managed $100 million or less. By comparison, just 43 rms managed active funds totaling more than $1 billion.

20 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 1.04

Fund and Firm Analysis 2013

Fund

Vintage

Year

Total

Cumulative

Funds

Total

Cumulative

Firms

Total

Cumulative

Capital ($B)

Existing

Funds

Firms That Raised

Funds in the Last

8 Vintage Years

Capital

Managed

($B)

Avg Fund

Size ($M)

Avg Firm

Size ($M)

1985 631 323 20 532 294 17.6 33.1 59.9

1986 707 353 23.4 590 324 20.7 35.1 63.9

1987 810 388 27.4 670 353 23.7 35.4 67.1

1988 888 406 30.9 701 365 24.9 35.5 68.2

1989 980 435 35.9 728 380 27.8 38.2 73.2

1990 1037 451 38.2 716 383 28.2 39.4 73.6

1991 1075 458 40.4 639 360 26.8 41.9 74.4

1992 1147 478 44.1 601 352 27.2 45.3 77.3

1993 1244 509 49.3 613 370 29.3 47.8 79.2

1994 1342 542 56.7 635 385 33.2 52.3 86.2

1995 1498 608 66.2 688 425 38.9 56.5 91.5

1996 1648 670 78.8 760 471 47.9 63.0 101.7

1997 1862 764 98.1 882 545 62.2 70.5 114.1

1998 2099 843 129.3 1062 616 91.1 85.8 147.9

1999 2435 969 184.1 1360 736 143.7 105.7 195.2

2000 2851 1111 268.9 1704 866 224.8 131.9 259.6

2001 3096 1194 311.3 1852 923 262 141.5 283.9

2002 3178 1211 319 1836 921 262.3 142.9 284.8

2003 3286 1264 330.1 1788 951 263.9 147.6 277.5

2004 3451 1332 349.9 1803 985 271.1 150.4 275.2

2005 3626 1402 376.3 1764 1009 278.2 157.7 275.7

2006 3815 1481 418.2 1716 1022 288.9 168.4 282.7

2007 4034 1567 448.4 1599 1016 264.3 165.3 260.1

2008 4221 1631 475.2 1370 886 206.3 150.6 232.8

2009 4327 1672 491 1231 823 179.7 146.0 218.3

2010 4456 1736 503.7 1278 853 184.7 144.5 216.5

2011 4621 1801 529.4 1335 881 199.3 149.3 226.2

2012 4785 1868 550 1334 883 200.2 150.1 226.7

2013 4957 1938 569.2 1331 874 192.9 144.9 220.7

The correct interpretation of this chart is that since the beginning of the industry to the end of 2013, 1,938 rms had been founded and

4,957 funds had been raised. Those funds totaled $569.2 billion. At the end of 2013, 874 rms as calculated using our eight-year methodol-

ogy managed 1,331 individual funds, with each fund typically being a separate limited partnership. Capital under management, again

calculated using a rolling eight years of fundraising, by those rms at the end of 2013 was $192.9 billion.

2014 National Venture Capital Association Yearbook | 21

NVCA THOMSON REUTERS

Figure 1.05

Number of Active Investors 1985 to 2013

Year # of Active

Investors

# of Active First

Round Investors

# of Active Life

Science Investors

1985 92 11 1

1986 115 24 12

1987 112 29 13

1988 119 32 26

1989 116 22 23

1990 101 25 18

1991 81 14 15

1992 104 34 31

1993 92 35 29

1994 110 46 33

1995 184 95 53

1996 251 122 63

1997 344 138 83

1998 411 169 87

1999 717 321 106

2000 1,050 546 148

2001 760 220 155

2002 534 137 147

2003 509 136 165

2004 579 202 201

2005 562 183 193

2006 572 192 197

2007 630 238 236

2008 602 212 219

2009 463 105 173

2010 508 136 177

2011 549 159 195

2012 534 139 175

2013 548 136 179

Firms included in each count must have invested $5 million in that year in that

category. Life Sciences investor count includes investment in companies in

the two MoneyTree Categories: Biotechnology/Pharma and Medical Devices/

Equipment.

Figure 1.06

Principals Information

Year No.

Principals

Per Firm

Estimated

Industry

Principals

Avg Mgt

Per Principal

($M)

2007 8.7 8665 30.0

2008 8.5 7293 28.3

2009 8.6 6760 26.4

2010 8.0 6328 25.7

2011 7.4 6231 28.6

2012 7.0 5887 33.8

2013 6.7 5891 32.8

Figure 1.07

Top 5 States By Capital Under

Management 2013

State ($ Millions)

CA 94,076.6

MA 32,636.6

NY 19,480.4

CT 5,815.1

IL 4,517.3

Total* 156,526.1

*Total includes above 5 states only

The correct interpretation of this chart is that since the beginning of the in-

dustry to the end of 2013, 1,938 rms had been founded and 4,957 funds had

been raised. Those funds totaled $569.2 billion. At the end of 2013, 874 rms

as calculated using our eight-year methodology managed 1,331 individual

funds, with each fund typically being a separate limited partnership. Capital

under management, again calculated using a rolling eight years of fundrais-

ing, by those rms at the end of 2013 was $192.9 billion.

22 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 1.08

Capital Under Management By State 1985-2013

State 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

CA 5,024 5,974 6,815 7,051 8,318 8,192 8,257 8,258 9,062 9,978 12,015 15,379 20,289 27,452 51,226

MA 2,252 2,580 3,409 3,775 4,179 4,057 3,761 4,636 4,830 5,179 6,553 6,980 9,859 15,397 22,905

NY 3,382 4,428 4,370 4,160 5,598 5,805 5,455 5,308 5,904 6,968 8,246 9,995 10,311 19,676 26,659

CT 1,297 1,444 1,807 1,876 1,714 1,713 1,570 1,665 1,927 2,088 2,064 2,194 3,323 4,492 6,787

IL 474 493 725 907 863 876 840 944 1,202 1,275 1,419 1,263 1,939 2,191 3,693

TX 458 493 727 726 798 840 777 809 935 1,143 1,145 1,233 1,688 3,001 4,797

PA 281 347 376 396 564 601 604 598 569 738 822 1,332 1,750 2,105 3,090

NJ 616 713 752 740 736 954 885 549 511 695 958 1,489 1,563 2,177 2,715

DC 36 38 38 40 41 42 42 40 25 24 146 1,698 2,382 2,504 2,661

WA 316 409 387 425 398 385 199 243 227 178 299 463 680 1,081 1,796

MD 91 95 121 117 159 164 98 115 374 784 914 1,523 2,012 2,649 3,513

CO 365 431 399 518 618 575 557 531 616 565 475 552 867 1,165 3,337

VA 73 79 79 85 105 92 56 42 35 32 48 73 252 508 1,238

NC 34 55 87 90 125 114 110 111 108 146 123 294 620 806 1,009

MN 200 297 340 677 749 886 815 768 841 896 877 514 618 715 1,093

UT 9 19 20 15 15 16 16 10 10 25 31 31 94 96 131

MI 112 120 126 123 124 38 14 14 13 10 41 41 66 77 439

GA 89 95 176 260 263 276 264 263 433 432 434 361 765 1,077 1,164

TN 103 128 192 185 216 260 278 271 199 291 306 455 465 745 1,059

DE 39 41 40 39 47 41 41 14 41 51 100 122 115 117 116

MO 562 586 619 596 603 658 656 645 107 137 119 125 148 111 217

OH 860 897 976 838 256 259 275 305 427 469 447 377 692 766 1,247

FL 125 131 173 193 196 133 110 98 151 223 321 304 380 690 1,072

IN 45 56 56 78 97 88 80 97 99 109 111 194 176 192 207

WI 183 100 99 96 104 104 79 79 81 163 168 196 180 204 174

AL 126 132 132 128 135 137 137 138 6 6 6 6 5 24 33

AZ 41 44 44 73 75 76 75 34 44 43 44 10 10 38 38

LA 7 7 7 7 7 5 2 11 22 31 49 90 277 367 444

KY 15 16 16 16 0 0 0 0 0 7 21 21 21 21 21

ME 1 1 20 25 26 26 26 28 29 98 89 87 88 89 207

ID 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

ND 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

OK 1 29 29 28 37 38 37 37 38 9 10 32 23 67 66

OR 170 177 205 241 244 247 229 117 73 74 77 30 30 40 40

NM 71 100 136 133 170 257 244 232 205 179 154 152 121 12 12

SD 0 0 0 0 0 0 0 0 0 0 0 10 10 85 84

HI 2 2 2 2 2 2 2 0 0 0 2 2 2 2 11

KS 0 0 0 0 0 13 13 13 14 14 37 37 57 43 43

IA 50 52 105 102 81 82 62 62 54 55 5 5 16 17 16

VT 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

2014 National Venture Capital Association Yearbook | 23

NVCA THOMSON REUTERS

Figure 1.08 (Continued)

Capital Under Management By State 1985-2013

State 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999

NH 24 25 25 50 50 51 50 51 27 27 47 19 66 67 66

NE 0 0 0 1 1 1 1 1 11 11 105 137 139 141 140

MT 0 1 1 1 1 1 1 1 1 0 0 0 0 0 0

MS 0 0 0 0 0 0 0 0 0 0 11 11 11 12 11

PR 0 0 0 0 0 9 9 9 9 9 9 9 49 40 40

WY 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

SC 1 1 1 1 15 15 15 15 15 15 29 52 37 37 37

RI 15 16 16 36 37 37 36 36 22 22 23 0 2 2 2

NV 0 0 0 0 0 0 0 0 0 0 0 0 0 0 24

WV 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

AR 2 2 2 2 2 2 2 0 0 0 0 0 0 0 19

UNK 46 48 48 47 31 31 21 0 0 0 0 0 0 0 0

AK 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 17,600 20,700 23,700 24,900 27,800 28,200 26,800 27,200 29,300 33,200 38,900 47,900 62,200 91,100 143,700

Figure 1.08b

Capital Under Management By State 1985-2013

State 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

CA 85,153 105,283 105,172 107,896 113,719 119,881 128,655 117,244 100,374 87,469 90,424 96,923 99,386 94,077

MA 37,341 45,970 47,440 47,019 47,553 48,784 53,712 50,417 37,146 30,861 30,528 30,209 32,914 32,637

NY 38,938 39,981 38,421 37,176 36,710 36,242 29,115 25,441 13,205 12,198 13,599 18,628 17,653 19,480

CT 8,260 10,623 10,462 10,431 12,066 11,984 13,336 11,699 10,426 7,428 8,201 8,940 6,928 5,815

IL 4,308 4,747 5,202 5,559 5,685 5,163 5,286 4,239 3,620 3,282 3,065 4,595 4,451 4,517

TX 6,881 8,001 7,932 7,806 8,259 8,486 8,242 6,589 5,467 4,193 4,057 4,735 4,455 4,215

PA 6,241 6,344 6,241 6,532 6,439 6,509 7,037 7,143 4,642 4,482 4,495 4,250 4,220 3,623

NJ 3,633 4,315 4,231 4,444 4,083 4,074 5,160 5,022 4,135 3,917 3,965 3,691 3,503 3,447

DC 3,899 4,172 4,739 4,616 3,401 3,582 4,641 5,047 4,833 4,632 4,049 4,527 4,193 3,369

WA 2,803 3,687 3,691 3,568 4,629 4,590 4,597 5,174 4,625 3,721 3,691 3,708 2,943 3,303

MD 5,119 5,383 5,165 5,047 4,811 4,762 4,744 4,433 2,934 3,005 2,927 3,134 3,282 2,854

CO 4,781 5,293 5,438 5,416 5,229 4,882 4,664 3,011 1,603 974 1,139 1,148 1,187 1,635

VA 2,524 2,638 2,652 2,822 2,868 3,338 3,367 3,014 1,801 2,226 2,271 2,081 2,056 1,583

NC 1,367 1,448 1,599 1,803 1,644 1,468 1,678 1,564 1,211 1,238 1,730 1,631 1,726 1,558

MN 2,238 2,189 2,366 2,359 2,361 2,441 2,593 2,473 1,639 1,657 1,319 1,323 1,426 1,531

UT 268 475 449 560 589 546 651 1,259 1,335 1,144 1,209 1,245 1,422 1,429

MI 588 591 590 631 859 912 946 685 919 976 1,065 1,263 1,045 1,203

GA 2,311 2,160 2,154 2,077 2,109 1,835 1,940 1,931 808 783 787 921 882 1,122

TN 1,237 1,281 1,162 1,174 1,043 1,089 887 716 624 614 840 857 845 795

DE 114 80 69 28 15 15 15 251 256 404 504 653 755 756

MO 307 450 418 407 504 1,232 1,293 1,385 1,317 1,182 1,189 1,192 1,324 561

OH 1,850 1,874 1,876 1,855 1,986 1,806 1,722 1,329 713 565 522 573 456 529

FL 1,785 1,751 1,684 1,592 1,577 1,802 1,525 1,284 557 801 875 832 834 529

24 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 1.08b (Continued)

Capital Under Management By State 1985-2013

State 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

IN 663 662 651 684 593 595 608 617 136 342 343 309 344 345

WI 246 245 152 152 133 105 207 254 182 185 212 237 309 339

AL 107 107 107 155 173 225 227 219 359 363 366 391 376 317

AZ 101 104 145 180 180 199 171 173 130 118 263 261 311 295

LA 476 651 648 631 663 502 431 353 336 196 265 282 217 249

KY 21 21 14 14 14 21 219 221 226 228 230 216 223 216

ME 202 290 218 219 214 215 310 194 198 108 109 109 110 110

ID 14 14 14 14 14 14 84 86 73 74 74 74 75 75

ND 0 0 0 0 0 0 0 0 13 13 14 14 14 58

OK 140 140 139 139 117 117 111 121 47 47 48 48 48 50

OR 100 100 112 83 85 85 76 78 34 40 29 29 38 46

NM 12 12 12 33 35 69 74 77 79 80 114 84 83 42

SD 178 178 177 177 175 175 103 113 32 32 48 48 40 40

HI 11 11 11 9 16 16 16 7 14 14 43 44 36 36

KS 42 42 42 19 19 0 0 0 0 0 0 14 14 34

IA 16 60 60 55 65 53 60 67 69 39 39 39 29 29

VT 16 43 43 43 43 43 43 57 41 14 19 19 19 29

NH 65 65 65 46 47 0 11 11 11 11 11 11 16 16

NE 175 165 164 71 38 38 38 38 0 0 2 2 3 3

MT 0 0 0 0 0 0 2 2 2 2 2 2 2 2

MS 11 39 39 28 28 28 29 30 30 1 1 1 1 1

PR 39 68 68 68 68 29 29 30 31 1 1 1 1 1

WY 118 117 117 117 117 118 118 119 0 0 0 0 0 0

SC 36 37 51 38 15 20 20 20 21 20 5 6 6 0

RI 2 26 26 35 35 33 33 33 34 10 10 0 0 0

NV 23 23 33 33 33 33 33 9 10 10 0 0 0 0

WV 21 21 21 21 21 21 21 21 0 0 0 0 0 0

AR 19 19 19 19 19 19 19 0 0 0 0 0 0 0

UNK 0 0 0 0 0 0 0 0 0 0 0 0 0 0

AK 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Total 224,800 262,000 262,300 263,900 271,100 278,200 288,900 264,300 206,300 179,700 184,700 199,300 200,200 192,900

Figure 1.09

Life of IT Funds in Years

Life of IT Funds In Years % of Funds

<= 10 7%

11-12 20%

13-14 27%

15-16 22%

17-18 14%

>=19 10%

This chart tracks the year in which a 10-year fund is, in

fact, dissolved. These later periods are referred to as

out years. Historically, after the 10th year, only a few

companies that typically do not have huge upside potential

remain in the portfolios. But the slow pace of exits in recent

years has resulted in a number of good, mature companies

remaining in portfolios well past the nominal 10-year mark.

Life science funds tend to have lives two years longer than

typical technology funds. In preparing this chart, partial

years are rounded to the nearest whole year. So 10.4 years

would round to 10 years, and 10.5 years would round up to

11 years. The median life span of a fund in this analysis is

14.17 years.

Source: Adams Street Partners, based on

2010 analysis of dissolved funds.

2014 National Venture Capital Association Yearbook | 25

NVCA THOMSON REUTERS

CAPITAL COMMITMENTS

Methodology

The Thomson Reuters/National Venture Capital Association sample in-

cludes US-based venture capital funds. Classifcations are based on the

headquarters location of the fund, not the location of the venture capital

frm. The sample excludes fund of funds.

Effective November 1, 2010, Thomson Reuters venture capital fund

data has been updated in order to provide more consistent and relevant

categories for searching and reporting. As a result of these changes, there

may be shifts in fundraising statistics from legacy editions of this publica-

tion due to reclassifcation of funds based on analysis of actual activity by

primary market, nation, and/or fund stages.

As defned by Thomson Reuters, capital commitments, also known as

fundraising, are frm capital commitments to private equity/venture capi-

tal limited partnerships by outside investors. For purposes of these statis-

tics, the terms capital commitments, fundraising, and fund closes

are used interchangeably. There are three data sources for tracking capital

commitments: (1) SEC flings that are regularly monitored by our research

staff, (2) surveys of the industry routinely conducted by Thomson Re-

uters, and (3) verifed industry press and press releases from venture frms.

Capital commitments are stated on either (1) a calendar-year basis when

committed (for example, throughout this chapter) or (2) a vintage-year

basis, which is designated once the fund starts investing (for example,

fgure 1.04). The data in this chapter is by calendar year and incrementally

measures how much in new commitments funds raised during the calen-

dar year. Consider, for example, a venture capital frm that announces it

will begin raising a $200-million fund in late 2011, raises $75 million in

2012, and subsequently raises the remaining $125 million in 2013. In this

chapter, nothing would be refected in 2011, $75 million would be counted

in 2012, and $125 million would be counted in 2013. Assuming it started

investing and made its frst capital call in 2013, the entire fund would then

be considered to be a vintage year 2013 fund. In Figure 1.04, for example,

this hypothetical fund would show in the totals for 2013.

Note that fund commitments presented in this publication do not in-

clude those corporate captive venture capital funds that are funded by a

corporate parent, which do not typically raise capital from outside inves-

tors.

The year 2013 continued to be a very challenging fundraising year for most venture capital frms in the United States. This is due to a lack of recent

distributions caused by the tight exit markets, lackluster returns by many venture funds over the past decade compared with the prior decade, and a

challenge for the largest alternative asset investors to place money in many of the smaller funds in this asset class because of scale. Only $16.8 billion

was raised by 187 funds. This is considerably less than the $19.6 billion raised in 2012 or the $19.0 billion raised in 2011. The amount of new commit-

ments each year by venture capital funds continues to be less than the amount they invested in companies.

The top fundraising state in 2013 was Massachusetts at $5.5 billion, which edged typical leader California at $5.3 billion. New York was third largest

at about half that amount. Much further behind, Washington state and Virginia rounded out the top fve. Combined, Massachusetts and California funds

raised 64% of the total. Adding in New York, the top three states raised more than three-quarters (77%) of the total amount.

The Thomson Reuters taxonomy considers venture capital and buyout/mezzanine to be the two components of Private Equity. Figures 2.02 and 2.05

show venture capitals decreasing share of the private equity dollars. Venture capital raised 24% of the asset class allocations in 2009 compared with

11% in 2013.

26 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

0

20

40

60

80

100

120

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

(

$

B

i

l

l

i

o

n

s

)

Year

Figure 2.01

Capital Commitments To U.S. Venture Funds ($ Billions)

1985 to 2013

2014 National Venture Capital Association Yearbook | 27

NVCA THOMSON REUTERS

Figure 2.02

Capital Commitments To Private Equity Funds 1985-2013

Year Sum ($Mil) % of Total PE No. Funds Sum ($Mil) No. Funds Sum ($Mil) No. Funds

1985 3,759.9 56% 118 2,971.8 21 6,731.7 139

1986 3,584.5 42% 101 5,043.7 32 8,628.2 133

1987 4,379.1 21% 116 16,234.6 47 20,613.6 163

1988 4,209.7 28% 104 10,946.4 54 15,156.1 158

1989 4,918.8 29% 106 12,068.5 78 16,987.3 184

1990 3,077.5 26% 85 8,831.5 64 11,909.0 149

1991 1,900.3 31% 40 4,242.1 27 6,142.4 67

1992 5,223.1 33% 80 10,752.5 58 15,975.6 138

1993 4,489.2 21% 93 16,961.7 81 21,451.0 174

1994 7,636.7 27% 136 20,157.0 99 27,793.7 235

1995 9,387.3 26% 161 27,040.7 108 36,428.0 269

1996 11,550.0 26% 168 32,789.4 104 44,339.3 272

1997 17,741.9 30% 242 42,165.3 134 59,907.2 376

1998 30,641.7 33% 290 61,636.4 172 92,278.1 462

1999 53,420.2 51% 428 51,363.2 164 104,783.4 592

2000 101,417.9 56% 634 79,164.8 170 180,582.7 804

2001 38,923.4 43% 324 51,388.3 137 90,311.7 461

2002 10,388.1 23% 203 35,123.3 124 45,511.4 327

2003 9,144.7 20% 160 35,946.4 123 45,091.1 283

2004 17,656.3 23% 211 59,837.4 158 77,493.7 369

2005 30,071.9 22% 233 107,746.6 206 137,818.6 439

2006 31,107.6 17% 236 152,899.7 219 184,007.3 455

2007 29,401.0 11% 235 234,460.4 266 263,861.4 501

2008 25,052.7 12% 214 176,340.7 232 201,393.5 446

2009 16,122.0 24% 159 50,145.9 149 66,267.9 308

2010 13,243.3 20% 173 51,901.5 177 65,144.8 350

2011 18,962.3 21% 186 70,344.2 210 89,306.5 396

2012 19,554.6 15% 208 108,076.4 226 127,631.0 434

2013 16,765.7 11% 187 130,256.2 214 147,021.9 401

Venture Capital Buyouts and Mezzanine Capital Total Private Equity

28 | 2014 National Venture Capital Association Yearbook

THOMSON REUTERS NVCA

Figure 2.03

Venture Capital Fund Commitments 1985-2013 ($ Millions)

State 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004

MA 201.88 1,460.41 546.89 279.00 2,260.07 489.77 473.90 493.63 940.19 1,860.48 2,364.08 1,516.09 3,757.76 9,346.10 9,065.81 15,399.96 3,092.69 7,754.42 1,233.34 2,148.71

CA 1,249.69 972.35 1,268.36 966.91 1,523.51 1,010.69 549.12 1,331.19 1,388.50 1,829.06 3,106.99 3,724.04 5,717.43 8,525.24 21,928.12 44,218.83 14,166.13 2,767.31 5,634.15 8,731.29

NY 534.28 356.09 973.09 813.49 338.52 529.47 180.08 1,051.12 367.79 1,158.41 1,954.71 1,875.06 2,601.56 5,200.95 7,586.57 16,691.77 9,721.17 2,598.46 1,596.98 1,797.30

WA 37.41 33.48 231.25 40.69 161.45 142.81 55.43 381.89 137.00 282.50 193.64 326.00 393.97 1,406.64 1,802.52 3,687.77 2,232.20 185.50 75.63 893.91

VA 299.07 155.86 310.63 357.37 61.50 129.50 150.00 300.30 419.25 388.28 260.20 424.93 1,165.98 1,067.56 2,842.58 1,813.40 3,464.30 46.73 165.00 1,756.45

TN 253.67 61.34 119.67 0.35 125.00 243.46 75.00 110.00 176.58 401.30 213.13 605.75 117.61 1,001.84 569.79 1,040.86 651.68 392.11 560.62 196.70

CO 4.20 7.47 24.18 0.00 49.25 13.61 50.00 0.00 224.90 479.20 66.50 439.00 145.00 768.15 839.70 1,989.92 340.45 380.50 105.00 161.52

TX 89.43 47.02 324.62 157.79 26.20 57.20 94.40 247.17 277.82 182.81 229.68 295.21 575.13 466.35 1,298.59 964.19 1,103.18 477.86 701.08 432.30

PA 31.50 70.55 32.23 69.90 79.71 0.40 0.00 0.00 114.22 0.00 19.35 216.40 252.88 432.62 1,942.08 2,414.30 512.63 117.96 93.92 83.89

OH 25.00 126.13 37.40 59.51 0.00 0.00 5.00 48.00 39.90 36.87 128.50 239.32 179.99 408.79 640.30 1,174.61 888.01 83.03 1.20 955.27

MI 38.74 0.00 0.00 4.80 0.00 0.00 0.00 0.00 0.00 0.00 130.00 820.00 667.60 391.50 359.60 778.29 622.18 314.80 0.00 324.48

MN 20.00 23.45 72.50 0.00 34.07 0.00 0.00 40.00 0.00 115.90 83.77 149.00 109.07 266.36 254.81 261.55 36.93 22.40 93.25 0.00

IL 0.00 3.50 10.00 12.80 15.00 2.00 0.00 17.00 5.00 0.00 7.00 20.00 165.40 255.99 884.03 2,211.92 119.15 37.48 196.27 71.95

NC 9.70 0.00 36.00 10.70 29.30 0.00 35.00 0.00 133.28 105.00 106.00 0.00 77.70 250.00 325.88 954.75 25.75 7.95 56.00 1.00

UT 13.60 109.75 51.20 417.50 20.00 161.80 16.20 946.30 65.85 164.05 46.80 35.50 207.97 216.70 106.57 1,826.52 16.50 275.50 26.00 49.80

GA 0.00 0.00 15.10 65.00 0.00 14.00 0.00 0.00 56.00 0.00 74.19 34.30 40.85 181.00 30.00 917.90 19.00 0.00 0.00 55.00

MO 54.05 73.06 54.65 12.10 117.98 44.52 166.60 30.10 109.70 181.65 113.60 264.00 783.90 177.00 1,240.76 2,751.47 536.61 85.66 387.97 450.73

WI 6.50 7.00 31.48 22.80 38.12 0.60 0.00 0.00 0.00 63.45 10.10 183.50 349.00 173.68 180.41 613.41 119.64 74.90 275.86 17.31

ND 2.56 0.00 86.98 75.00 0.00 30.38 0.00 67.00 4.43 85.97 10.00 0.00 364.95 58.00 658.58 662.03 329.95 101.70 4.88 209.72

DC 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10.60 14.20 169.00 18.26 23.95 87.95 51.00 373.35 69.50 26.50 52.00 0.00 72.98

LA 0.00 10.50 0.80 0.00 0.00 0.00 0.00 0.00 0.00 27.00 0.00 0.00 17.00 50.00 61.50 126.00 231.65 0.00 34.30 40.30

KS 0.00 31.82 0.00 0.00 10.30 0.00 0.00 0.00 0.00 0.00 0.00 24.29 0.00 45.30 0.00 110.10 0.00 0.00 0.00 0.00

MS 150.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 5.00 30.00 0.00 137.00 16.35 11.00 49.00 18.70

OR 643.50 0.00 33.26 0.00 0.00 53.13 0.00 0.00 63.60 0.00 11.30 6.00 45.40 25.03 79.63 64.77 286.20 0.00 0.00 80.30

VT 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 11.00 0.00 22.00 14.00 131.00 1.00 0.00 0.00 5.00

IN 0.00 10.00 0.00 27.30 16.30 4.70 0.00 49.00 0.00 20.00 0.00 116.11 0.00 12.80 20.00 103.30 0.00 10.00 35.56 17.00

FL 0.00 0.00 30.00 0.00 0.00 0.00 0.00 0.00 0.00 32.00 32.00 0.00 0.00 10.00 0.00 65.00 0.00 14.00 0.00 2.20

CT 10.73 0.00 60.05 0.00 0.00 0.00 0.00 56.00 0.00 0.00 5.00 0.00 10.50 1.78 5.00 21.00 26.00 0.00 0.00 10.00

NJ 5.00 0.00 6.70 32.50 0.00 0.00 0.00 0.00 3.00 13.50 0.00 26.00 11.30 0.30 320.80 241.00 8.00 0.00 64.84 63.33

MD 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 20.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

OK 16.60 0.00 0.00 24.50 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 25.00 0.00 0.00 0.00

AL 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 2.60 0.00 0.00 0.00 9.50 0.00 0.00 2.53 0.00 7.86

SD 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

IA 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 12.00 0.00 0.00 0.00 0.00 30.00 0.00 0.00 0.00 0.00

RI 49.42 0.00 0.00 40.00 0.00 0.00 15.00 0.00 0.00 0.00 20.00 0.00 50.00 0.00 0.00 0.00 0.00 11.20 8.80 0.00

HI 0.00 0.00 22.04 947.60 0.00 0.00 0.00 2.00 0.00 58.80 0.00 21.65 0.00 0.00 126.89 0.00 76.45 15.60 2.95 0.00