Академический Документы

Профессиональный Документы

Культура Документы

Endowment Funds

Загружено:

Syed Muhammad Ali Sadiq0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров1 страницаendowment fund

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документendowment fund

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

27 просмотров1 страницаEndowment Funds

Загружено:

Syed Muhammad Ali Sadiqendowment fund

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

ENDOWMENT FUNDS

An endowment fund is created when a donor or the Board of Trustees specify

that a gift is to be invested and only the income earned on that gift may be spent

for a specific purpose. The gift amount is referred to as the principal or corpus

and is held in a fund that is managed by the Finance Department. There are two

basic types of endowment funds --- true endowment and quasi endowment. A

true endowment is defined as an endowment in which the donor stipulates that

the corpus must be held inviolate and in perpetuity and invested to generate

income to be spent for a specific purpose. Funds that are designated as

endowment by the governing board of an institution (Board of Trustees) are

called quasi endowment. These funds are also invested for the purpose of

generating expendable income for a given purpose, but, as the funds are

internally designated as endowment, the governing board can decide to spend

the funds at any time. In some cases, donors will allow for the corpus of their

endowment to be spent. This is also categorized as a quasi endowment. To

spend the principal of a quasi endowment fund requires Board of Trustee

approval or donor authorization.

The principal or corpus funds are designated within Banner as 5xxxxx or 6xxxxx.

Quasi endowment funds begin with a 5 and the income they generate is posted

to endowment income funds beginning with 23. True endowment is denoted by

funds beginning with 6; the endowment income funds begin with 24. Gifts to

endowment funds are deposited to a 5xxxxx or 6xxxxx fund number.

The endowment spending allocation is calculated by the Treasurers Office

according to guidelines set by the Investment Committee of the Board of

Trustees. During the budget process, financial managers are provided with the

amount their endowment funds will earn for the upcoming fiscal year. This

amount will not change during the fiscal year unless additional gifts are received

in the endowment fund. The income allocation is posted to the endowment

income funds during the course of the fiscal year on a monthly basis and is

subject to a 10% surcharge. Endowment income is credited to account 4511 in

funds 23xxxx and 24xxxx; the 10% surcharge is debited to account 559 within

the same fund.

Endowment income is to be spent in accordance with the restrictions set forth by

the donor at the time the endowment was established. Financial managers

should have copies of endowment fund agreements or other documentation that

specifies the restrictions set forth by the donors and are responsible to ensure

funds are being expended in accordance with the donors specifications. The

Institutes Overdraft Policy does not apply to endowment income funds in the

same manner as other types of funds. As each income fund is guaranteed a

specific allocation for the fiscal year that is credited to the fund on a monthly

basis, expenses can be charged up to the income allocation threshold at any

given point during the fiscal year. However, expenses can not exceed the

income allocation projection for the fiscal year.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Документ1 страницаOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Getting Paid MathДокумент3 страницыGetting Paid Mathapi-26818659543% (7)

- TAX 2 ExercisesДокумент22 страницыTAX 2 ExercisesWinter Summer50% (4)

- IBC Vs Amarilla Tax Case DigestДокумент3 страницыIBC Vs Amarilla Tax Case DigestCJОценок пока нет

- Eastern Telecommunications Phil Inc V CIR - DigestДокумент1 страницаEastern Telecommunications Phil Inc V CIR - DigestKate GaroОценок пока нет

- 11 5Документ47 страниц11 5Syed Muhammad Ali SadiqОценок пока нет

- Business Plan Contents PDFДокумент2 страницыBusiness Plan Contents PDFSyed Muhammad Ali SadiqОценок пока нет

- Star Vega Insurance Software BrochureДокумент8 страницStar Vega Insurance Software BrochureSyed Muhammad Ali SadiqОценок пока нет

- Business Plan ContentsДокумент28 страницBusiness Plan ContentsSyed Muhammad Ali SadiqОценок пока нет

- Promotech Gulf Industry LLC March 2015 QuotationДокумент1 страницаPromotech Gulf Industry LLC March 2015 QuotationSyed Muhammad Ali SadiqОценок пока нет

- Draft TT Ali SadiqДокумент1 страницаDraft TT Ali SadiqSyed Muhammad Ali SadiqОценок пока нет

- Bank Signature Authority LetterДокумент1 страницаBank Signature Authority LetterSyed Muhammad Ali SadiqОценок пока нет

- Bank Signature Authority LetterДокумент1 страницаBank Signature Authority LetterSyed Muhammad Ali SadiqОценок пока нет

- Animated Panels-Patent Not IssuedДокумент14 страницAnimated Panels-Patent Not IssuedSyed Muhammad Ali SadiqОценок пока нет

- A Detailed Comparison BetweenДокумент11 страницA Detailed Comparison BetweenSyed Muhammad Ali SadiqОценок пока нет

- Draft TT Ali SadiqДокумент1 страницаDraft TT Ali SadiqSyed Muhammad Ali SadiqОценок пока нет

- Roxio Easy VHS To DVD: Getting Started GuideДокумент28 страницRoxio Easy VHS To DVD: Getting Started GuideSyed Muhammad Ali SadiqОценок пока нет

- Analysis: RES Core IndicatorДокумент1 страницаAnalysis: RES Core IndicatorSyed Muhammad Ali SadiqОценок пока нет

- Risk Aggregation2 PDFДокумент57 страницRisk Aggregation2 PDFSyed Muhammad Ali SadiqОценок пока нет

- Company Value, Real Options and Financial LeverageДокумент3 страницыCompany Value, Real Options and Financial LeverageSyed Muhammad Ali SadiqОценок пока нет

- Company Value, Real Options and Financial LeverageДокумент3 страницыCompany Value, Real Options and Financial LeverageSyed Muhammad Ali SadiqОценок пока нет

- Scan0012 PDFДокумент1 страницаScan0012 PDFSyed Muhammad Ali SadiqОценок пока нет

- CIO DashboardДокумент1 страницаCIO DashboardrfgouveiasОценок пока нет

- MovieДокумент1 страницаMovieSyed Muhammad Ali SadiqОценок пока нет

- ERM Guide July 09Документ109 страницERM Guide July 09Syed Muhammad Ali SadiqОценок пока нет

- Risk Aggregation1Документ72 страницыRisk Aggregation1Syed Muhammad Ali SadiqОценок пока нет

- Complaint LetterДокумент1 страницаComplaint LetterSyed Muhammad Ali SadiqОценок пока нет

- Chief Financial Officer For An ElectronicsДокумент2 страницыChief Financial Officer For An ElectronicsSyed Muhammad Ali SadiqОценок пока нет

- OECD - Thinking Beyond Basel III - Necessary Solutions For Capital and LiquidityДокумент23 страницыOECD - Thinking Beyond Basel III - Necessary Solutions For Capital and LiquidityFederico CellaОценок пока нет

- L 2 Ss 12 Los 39Документ9 страницL 2 Ss 12 Los 39Syed Muhammad Ali SadiqОценок пока нет

- Epct Filing GuidelinesДокумент39 страницEpct Filing GuidelinesSyed Muhammad Ali SadiqОценок пока нет

- ABDC ContainerStudy Trucking Prefeasibility FinalДокумент16 страницABDC ContainerStudy Trucking Prefeasibility FinalSyed Muhammad Ali SadiqОценок пока нет

- CV of Muhammad Ali SadiqДокумент5 страницCV of Muhammad Ali SadiqSyed Muhammad Ali SadiqОценок пока нет

- Corporate Rates (Summer 2011)Документ4 страницыCorporate Rates (Summer 2011)Syed Muhammad Ali SadiqОценок пока нет

- Muhammad Ali Sadiq: Career ObjectiveДокумент3 страницыMuhammad Ali Sadiq: Career ObjectiveSyed Muhammad Ali SadiqОценок пока нет

- Taxation Issues in Cyberspace With Special Reference To Double TaxationДокумент5 страницTaxation Issues in Cyberspace With Special Reference To Double TaxationMohnish KОценок пока нет

- ICICI Special PricingДокумент1 страницаICICI Special PricingsouravptuОценок пока нет

- Corruption PDFДокумент19 страницCorruption PDFJuan ValerОценок пока нет

- Dusty Johnson October 2024 FECДокумент161 страницаDusty Johnson October 2024 FECPat PowersОценок пока нет

- 1st Freshmen Tutorial Activity 1Документ2 страницы1st Freshmen Tutorial Activity 1Stephanie Diane SabadoОценок пока нет

- BYJU's July PayslipДокумент2 страницыBYJU's July PayslipGopi ReddyОценок пока нет

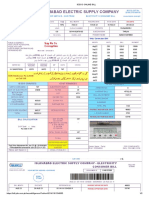

- Iesco Online BillДокумент2 страницыIesco Online BillZohaib EliОценок пока нет

- Last Pay CertificateДокумент2 страницыLast Pay Certificatekingfairgod100% (1)

- دور التسيير الجبائي في تحسين الأداء المالي للمؤسسات الاقتصاديةДокумент22 страницыدور التسيير الجبائي في تحسين الأداء المالي للمؤسسات الاقتصاديةKeslani MedОценок пока нет

- 1601CДокумент2 страницы1601CRoldan Agad SarenОценок пока нет

- CIA15 - Study Guide1 - Public FinanceДокумент4 страницыCIA15 - Study Guide1 - Public FinanceLovely Cabuang100% (1)

- Mombasa County CBROP 2019Документ46 страницMombasa County CBROP 2019Mombasa CountyОценок пока нет

- Accounting Past Paper 2Документ2 страницыAccounting Past Paper 2Noshair AliОценок пока нет

- Estate Under Administration-Tax2Документ15 страницEstate Under Administration-Tax2onet88Оценок пока нет

- 444 PDFДокумент1 страница444 PDFRELIABLE ORGANIC CERTIFICATION ORGANIZATIONОценок пока нет

- PART I - 34ptsДокумент8 страницPART I - 34ptsJuleen Evette MallariОценок пока нет

- IT-BR010 - Documents Needed When Submitting Your Income Tax Return ITR12 at A SARS Branch - External BrochureДокумент4 страницыIT-BR010 - Documents Needed When Submitting Your Income Tax Return ITR12 at A SARS Branch - External Brochurekatniss0013Оценок пока нет

- IT CalculatorДокумент49 страницIT CalculatorMotheesh ReddyОценок пока нет

- Advance - Tax (Inter)Документ5 страницAdvance - Tax (Inter)Shrinivas kc 12A2Оценок пока нет

- Journal Entries Receipt On Advance in GST - Accounting Entries in GSTДокумент8 страницJournal Entries Receipt On Advance in GST - Accounting Entries in GSTCAMSBABJI MAHОценок пока нет

- National Income Models with Government and Net ExportsДокумент13 страницNational Income Models with Government and Net ExportsKratika PandeyОценок пока нет

- Sandisk Storage Malaysia Sdn. BHDДокумент1 страницаSandisk Storage Malaysia Sdn. BHDJtech Connection EnterpriseОценок пока нет

- On MAT and AMT WRO0533356 - FinalДокумент25 страницOn MAT and AMT WRO0533356 - FinalOffensive SeriesОценок пока нет

- PSBA REFRESHER TAXATION QUIZДокумент10 страницPSBA REFRESHER TAXATION QUIZEdnalyn CruzОценок пока нет

- BEPS AnalyzeДокумент2 страницыBEPS AnalyzeMurilo Domene de SiqueiraОценок пока нет