Академический Документы

Профессиональный Документы

Культура Документы

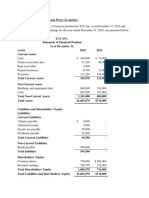

Priya Incorporation: Balance Sheet at December 31 Amount in Rs. '000 Assets 2014 2013

Загружено:

Vidyadhar Raju VarakaviОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Priya Incorporation: Balance Sheet at December 31 Amount in Rs. '000 Assets 2014 2013

Загружено:

Vidyadhar Raju VarakaviАвторское право:

Доступные форматы

1

Priya Incorporation

Balance Sheet at December 31

Amount in

Rs. '000

Assets 2014 2013

Cash 180 200

Accounts receivable, net 850 830

Inventory 620 560

Total current assets 1650 1590

Plant and equipment 7540 6650

Accumulated depreciation (1920) (1500)

Total assets 7270 6740

Equities 2014 2013

Accounts payable 220 190

Accrued expenses 450 440

Total current liabilities 670 630

Long term debt 1000 950

Total liabilities 1670 1580

Common stock, no par value 4000 4000

Retained earnings 1600 1160

Total equities 7270 6740

2

Income Statement for 2014

Particulars

Amount in

Rs. '000

Sales 8650

Cost of goods sold 4825

Gross profit 3825

Operating expenses

Depreciation 420

Other 2135 2555

Income before interest and tax 1270

Interest expenses 70

Income before tax 1200

Income tax @ 30% 360

Net income 840

Cash Flow Statement for 2014

Particulars

Amount in

Rs. '000

Net Cash flow from operating activities:

Collection from customers 8630

Payments to suppliers (4855)

Payments for operating expenses (2163)

Interest paid (72)

Taxes paid (320)

Net Cash provided by operations 1220

Cash flow from investing activities: purchase of plant and equipment (890)

Cash flow from financing activities:

payment of dividend (400)

Proceeds from new long term debt Issue 50 (350)

Change in cash (decrease) (20)

Cash balance, beginning of the year 200

Cash balance, end of the year 180

Priya Inc. had 200,000 shares of common stock outstanding throughout the year.

The market price of the stock at the end was Rs.65 per share. All sales are on credit.

3

Required:

Compute the following ratio as of the end of 2014 or for the year ended December 31, 2014,

whichever is appropriate.

Liquidity Ratios

1 Current ratio

2 Quick ratio

3 Accounts receivable turnover

4 Days sales in accounts receivable

5 Inventory turnover

6 Days Sales in inventory

Profitability Ratios

1 Gross Profit ratio

2 Return on sales

3 Return on assets

4 Return on common equity

5 Earning per share

6 Dividend yield

7 Payout ratio

8 EVA, Assuming cost of capital is 12%

Solvency Ratios

1 Debt ratio

2 Times interest earned

3 Cash flow to total debt

Valuation Ratios

1 Price earning ratio

2 Price to book value

3 Market Capitalization / Sales

Вам также может понравиться

- CFI - FMVA Practice Exam Case Study AДокумент18 страницCFI - FMVA Practice Exam Case Study AWerfelli MaramОценок пока нет

- Forecasting ProblemsДокумент7 страницForecasting ProblemsJoel Pangisban0% (3)

- BUS322Tutorial9 SolutionДокумент15 страницBUS322Tutorial9 Solutionjacklee1918100% (1)

- Blaine SolutionДокумент4 страницыBlaine Solutionchintan MehtaОценок пока нет

- Ss11 646 Corporate FinanceДокумент343 страницыSs11 646 Corporate Financed-fbuser-32825803100% (12)

- Tutorial QuestionsДокумент15 страницTutorial QuestionsWowKid50% (2)

- Financial Ratios For Dar Al Shefaa Corporation 2015Документ6 страницFinancial Ratios For Dar Al Shefaa Corporation 2015Lina Jardaneh (Lina Jardaneh)Оценок пока нет

- 2018 - Session11 - 12 FSA - PGP - SentДокумент40 страниц2018 - Session11 - 12 FSA - PGP - SentArty DrillОценок пока нет

- Analysis of Financial StatementДокумент10 страницAnalysis of Financial StatementAli QasimОценок пока нет

- EPCRДокумент71 страницаEPCRYinka JosephОценок пока нет

- 2023 - Session12 - 13 FSA2 - MBA - SentДокумент32 страницы2023 - Session12 - 13 FSA2 - MBA - SentAkshat MathurОценок пока нет

- CAPE U1 Ratio QuestionДокумент12 страницCAPE U1 Ratio QuestionNadine DavidsonОценок пока нет

- Operating Cash Inflows: Income Statement ItemsДокумент2 страницыOperating Cash Inflows: Income Statement ItemsKBSОценок пока нет

- Wa0035.Документ5 страницWa0035.Barack MikeОценок пока нет

- Balance Sheet Formula Excel TemplateДокумент5 страницBalance Sheet Formula Excel TemplateD suhendarОценок пока нет

- Practice Problems, CH 12Документ6 страницPractice Problems, CH 12scridОценок пока нет

- KKL25Документ5 страницKKL25kalharaeheliyaОценок пока нет

- CH 13Документ4 страницыCH 13Sri HimajaОценок пока нет

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Документ9 страницSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19Оценок пока нет

- MK - Kuliah MM 2-20Документ33 страницыMK - Kuliah MM 2-20Dewi Murni Susanti100% (1)

- Financial RatiosДокумент9 страницFinancial RatiosEdelvies Mae BatawangОценок пока нет

- PT Fabm 2 AND BFДокумент12 страницPT Fabm 2 AND BFLushelle JiОценок пока нет

- Accounting Assignment (100) : A. B. C. The Journal EntryДокумент2 страницыAccounting Assignment (100) : A. B. C. The Journal EntryFaiaz ShahreearОценок пока нет

- Iis 1333@HK 031715 41347Документ39 страницIis 1333@HK 031715 41347william zengОценок пока нет

- Acctg Activity 2Документ12 страницAcctg Activity 2aceasistido56Оценок пока нет

- Chapter 2Документ2 страницыChapter 2sitholeandile610Оценок пока нет

- Financial AccountingДокумент3 страницыFinancial AccountingSimran MittalОценок пока нет

- 02 Arus Kas SoalДокумент5 страниц02 Arus Kas SoalRafif Gayuh IslamiОценок пока нет

- Practice Problems, CH 5Документ7 страницPractice Problems, CH 5scridОценок пока нет

- Bail Am Tren LopДокумент10 страницBail Am Tren LopquyruaxxОценок пока нет

- Tutorial Questions - Trimester - 2210.Документ26 страницTutorial Questions - Trimester - 2210.premsuwaatiiОценок пока нет

- Sesi 13 & 14Документ10 страницSesi 13 & 14Dian Permata SariОценок пока нет

- Copy 1 ACC 223 Practice Problems For Financial Ratio AnalysisДокумент3 страницыCopy 1 ACC 223 Practice Problems For Financial Ratio AnalysisGiane Bernard PunayanОценок пока нет

- Balance Sheet Asset: Total Current AssetsДокумент2 страницыBalance Sheet Asset: Total Current AssetsTrinh VũОценок пока нет

- Norco Annual Report 2018Документ104 страницыNorco Annual Report 2018Jigar Rameshbhai PatelОценок пока нет

- Ratio Analysis 30 03Документ23 страницыRatio Analysis 30 03Vanshika Mathur0% (1)

- Course Folder Fall 2022Документ26 страницCourse Folder Fall 2022Areeba QureshiОценок пока нет

- Sesi 13 & 14Документ15 страницSesi 13 & 14Dian Permata SariОценок пока нет

- Analisis Laporan KeuanganДокумент15 страницAnalisis Laporan KeuanganMhmmd HirziiОценок пока нет

- Case-Cartwright-Projected Statements-BlankДокумент4 страницыCase-Cartwright-Projected Statements-BlankQB XОценок пока нет

- Financial Analysis - Accounting ReviewДокумент29 страницFinancial Analysis - Accounting ReviewdewongerОценок пока нет

- Unit 4 Working Capital ManagementДокумент56 страницUnit 4 Working Capital Managementshubh sharmaОценок пока нет

- Hitungan Ta - RevДокумент8 страницHitungan Ta - Revfajar aljogjaОценок пока нет

- Indian Institute of Management Rohtak: End Term ExaminationДокумент14 страницIndian Institute of Management Rohtak: End Term ExaminationaaОценок пока нет

- BT B Sung Chapter 45Документ2 страницыBT B Sung Chapter 45Yến Nhi VũОценок пока нет

- Interpretation of Final Accounts: Ratio AnalysisДокумент25 страницInterpretation of Final Accounts: Ratio AnalysisNguyễn Hạnh LinhОценок пока нет

- ACCN 304 Revision QuestionsДокумент11 страницACCN 304 Revision QuestionskelvinmunashenyamutumbaОценок пока нет

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesДокумент29 страницChapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesChieMae Benson QuintoОценок пока нет

- Evaluating Financial PerformanceДокумент31 страницаEvaluating Financial PerformanceShahruk AnwarОценок пока нет

- ALMI Annual Report 2014Документ90 страницALMI Annual Report 2014ReginaОценок пока нет

- MGMTPM28376rCorrPr Working Capital ManagementДокумент35 страницMGMTPM28376rCorrPr Working Capital ManagementAngita TiwaryОценок пока нет

- Review FinalДокумент10 страницReview FinalNguyen Minh QuanОценок пока нет

- WA2Документ3 страницыWA2Ahmed HassaanОценок пока нет

- 02C) Financial Ratios - ExamplesДокумент21 страница02C) Financial Ratios - ExamplesMuhammad AtherОценок пока нет

- Financial Statement Analysis Part 2Документ10 страницFinancial Statement Analysis Part 2Kim Patrick VictoriaОценок пока нет

- Assignment 6Документ8 страницAssignment 6Lara Lewis AchillesОценок пока нет

- SABV Topic 5 QuestionsДокумент5 страницSABV Topic 5 QuestionsNgoc Hoang Ngan NgoОценок пока нет

- AsdasdДокумент20 страницAsdasdTanvir Ahmad ShourovОценок пока нет

- PBCC ActivitiesДокумент25 страницPBCC ActivitiesykwaiОценок пока нет

- Chapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongДокумент12 страницChapter 5 Assignment Introductory Accounting Name: Nguyen Mai PhuongMai Phương NguyễnОценок пока нет

- Arid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherДокумент3 страницыArid Agriculture University, Rawalpindi: Online Mid-Term Exam - Spring 2021 To Be Filled by TeacherDeadPool Pool100% (1)

- Unit 4 - Cash Flow Statement AnalysisДокумент12 страницUnit 4 - Cash Flow Statement Analysissikute kamongwaОценок пока нет

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsДокумент5 страницFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliОценок пока нет

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Creative and Design, Digital - IRIS 2015Документ1 страницаCreative and Design, Digital - IRIS 2015Vidyadhar Raju VarakaviОценок пока нет

- Infrastructural Decisions in Operations StrategyДокумент5 страницInfrastructural Decisions in Operations StrategyVidyadhar Raju VarakaviОценок пока нет

- © Cambridge Resources International: Private Public Partnerships in InfrastructureДокумент6 страниц© Cambridge Resources International: Private Public Partnerships in InfrastructureVidyadhar Raju VarakaviОценок пока нет

- Overview of Concessions, Bots, Dbo Projects ConcessionДокумент4 страницыOverview of Concessions, Bots, Dbo Projects ConcessionVidyadhar Raju VarakaviОценок пока нет

- CSR ActivitiesДокумент2 страницыCSR ActivitiesVidyadhar Raju VarakaviОценок пока нет

- OM Topic 2Документ7 страницOM Topic 2Vidyadhar Raju VarakaviОценок пока нет

- Probability Mean and MedianДокумент8 страницProbability Mean and MedianKrishnendu ShawОценок пока нет

- 5th Question HR Problems in Modular ManufacturingДокумент1 страница5th Question HR Problems in Modular ManufacturingVidyadhar Raju VarakaviОценок пока нет

- 5th Question HR Problems in Modular ManufacturingДокумент1 страница5th Question HR Problems in Modular ManufacturingVidyadhar Raju VarakaviОценок пока нет

- An Inadequate National Food Security Bill 2011Документ40 страницAn Inadequate National Food Security Bill 2011Vidyadhar Raju VarakaviОценок пока нет

- MRP OverviewДокумент6 страницMRP OverviewRao KakaralaОценок пока нет

- The ClauseДокумент23 страницыThe ClauseChinnashekarОценок пока нет

- SMODДокумент10 страницSMODVidyadhar Raju VarakaviОценок пока нет

- Basic Concepts of Financial AccountingДокумент107 страницBasic Concepts of Financial AccountingVidyadhar Raju VarakaviОценок пока нет

- Clause Types: Independent & Dependent andДокумент11 страницClause Types: Independent & Dependent andJhay EmОценок пока нет

- WS Retail Services Pvt. LTD.,: Grand TotalДокумент1 страницаWS Retail Services Pvt. LTD.,: Grand TotalVidyadhar Raju VarakaviОценок пока нет

- American WellДокумент6 страницAmerican WellPreetam Joga75% (4)

- Clause Types: Independent & Dependent andДокумент11 страницClause Types: Independent & Dependent andJhay EmОценок пока нет

- Case StudyДокумент14 страницCase StudyVidyadhar Raju VarakaviОценок пока нет

- An Inadequate National Food Security Bill 2011Документ40 страницAn Inadequate National Food Security Bill 2011Vidyadhar Raju VarakaviОценок пока нет

- RESPONSIBILITY ACCOUNTING - A System of Accounting Wherein Performance, Based OnДокумент8 страницRESPONSIBILITY ACCOUNTING - A System of Accounting Wherein Performance, Based OnHarvey AguilarОценок пока нет

- Ajinomoto Group 2020Документ84 страницыAjinomoto Group 2020Trinh AnhОценок пока нет

- 7 8 Equivalence Rev 1Документ32 страницы7 8 Equivalence Rev 1Mateo, Elijah Jonathan C.Оценок пока нет

- An 979 MBA Sem II Financial Management14Документ4 страницыAn 979 MBA Sem II Financial Management14Riya AgrawalОценок пока нет

- Capital Structure in A Perfect Market: ©2017 Pearson Education, IncДокумент10 страницCapital Structure in A Perfect Market: ©2017 Pearson Education, IncShelby DavidsonОценок пока нет

- Fundamentals of Corporate Finance 9th Edition Brealey Test BankДокумент25 страницFundamentals of Corporate Finance 9th Edition Brealey Test BankJamesOrtegapfcs100% (51)

- Nissim and Penman - Ratio Analysis and Equity Valuation From Research To PracticeДокумент46 страницNissim and Penman - Ratio Analysis and Equity Valuation From Research To PracticebarakinishuОценок пока нет

- Management Control and Strategic Performance Measurement Strategic Investment Units and Transfer PricingДокумент68 страницManagement Control and Strategic Performance Measurement Strategic Investment Units and Transfer PricingPhia Teo100% (1)

- Responsibility Accounting ModuleДокумент12 страницResponsibility Accounting ModuleDUMLAO, ALPHA CYROSE M.Оценок пока нет

- 19710SP 3 BSTДокумент7 страниц19710SP 3 BSTShivansh JaiswalОценок пока нет

- IRR Vs WACCДокумент4 страницыIRR Vs WACC04071990100% (1)

- Tugas 12 - C16 - Distributions To ShareholdersДокумент9 страницTugas 12 - C16 - Distributions To ShareholdersIqbal BaihaqiОценок пока нет

- KPJ Healthcare Berhad (NUS ANalyst)Документ11 страницKPJ Healthcare Berhad (NUS ANalyst)noniemoklasОценок пока нет

- Profitability MethodologyДокумент32 страницыProfitability MethodologyLawrence BweupeОценок пока нет

- 1 Risk and ReturnДокумент24 страницы1 Risk and ReturnMohammad DwidarОценок пока нет

- DCF ModellДокумент7 страницDCF ModellVishal BhanushaliОценок пока нет

- Icaew Cfab Mi 2019 SyllabusДокумент12 страницIcaew Cfab Mi 2019 SyllabusAnonymous ulFku1vОценок пока нет

- SUbsidy Dependance IndexДокумент4 страницыSUbsidy Dependance IndexMuhammad Umer NiazОценок пока нет

- Chapter 1 - Foundations of Engineering EconomyДокумент28 страницChapter 1 - Foundations of Engineering EconomyBich Lien PhamОценок пока нет

- Business & Corporate FinanceДокумент5 страницBusiness & Corporate Financearbaz khanОценок пока нет

- Vergina Natasha - CASE STUDY CAPITAL STRUCTUREДокумент4 страницыVergina Natasha - CASE STUDY CAPITAL STRUCTUREVergina NatashaОценок пока нет

- Working Capital Management of L&TДокумент18 страницWorking Capital Management of L&TDeepak Jaiswal0% (1)

- APECS Financial Modelling Test (Updated) - DarrenДокумент22 страницыAPECS Financial Modelling Test (Updated) - DarrenDarren WongОценок пока нет

- Pacific Grove Spice Company Case CalculationsДокумент11 страницPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- Finance Test Review 3Документ32 страницыFinance Test Review 3Shaolin105Оценок пока нет