Академический Документы

Профессиональный Документы

Культура Документы

Profitability and Deposit Pricing

Загружено:

Sajid AliАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Profitability and Deposit Pricing

Загружено:

Sajid AliАвторское право:

Доступные форматы

PROFITABILITY AND DEPOSIT PRICING

The goal of bank management should be to maximize deposit revenues and minimize deposit

costs in an effort to maximize bank profitability. Cost/revenue analysis is one way in which

managers can better understand how deposit pricing decisions are affecting bank profitability.

Figure shows how bank costs and revenues change as the deposit base is expanded. The S-

shaped cost curve assumes economies of scale as deposits initially are expanded,

Which gradually reduce costs per unit deposits; however, diseconomies at some deposit level

increase costs per unit deposits and cause the cost curve to increase at an increasing rate. Total

bank costs equal fixed costs of land, buildings, and equipment, plus variable costs of deposits

and other activities. Total bank revenues include deposit revenues, loan and security portfolio

revenues, and other revenues. Profit maximization requires the following: (1) minimization of

total costs at each output level; (2) maximization of total revenues at each output level; and (3)

marginal total costs equal marginal total revenues (i.e., the cost of an additional dollar of deposits

equals the revenue it would provide when invested by the bank). The latter marginal

cost/revenue condition is represented in Figure at the deposit level where the slopes of the total

cost and total revenue curves are equal. Upper and lower breakeven points occur where costs and

revenues equal one another in absolute (rather than marginal) terms. These points describe the

output range within which the bank can profitably operate.

Once an optimal deposit level is estimated, the task of the pricing committee is to minimize net

deposit costs for the target deposit base. Some of the ways in which banks have been reducing

deposit costs in recent years are (1) truncating checks (i.e., not returning cleared checks to

customers) (2) levying stricter penalties for early withdrawal on time deposits (3) reducing the

number of deposit products to avoid spreading resources too thin; (4) using weekly or monthly

interest compounding instead of daily compounding; and (5) waiting for customers to ask for

higher-interest products rather than automatically moving their funds to these products.

Obviously, these cost-cutting techniques are not always successful because customers may

become dissatisfied with the bank's service and withdraw their deposits.

LENDING AND DEPOSIT COSTS

Deposit costs can be affected by bank loan policies. For example, most loans require that

compensating (deposit) balances be maintained by the borrower. Such balances are inexpensive

to maintain because they usually pay no interest) require no promotional expenditures, and

have minimum transactions costs (e.g., customer information is already on file). Another

advantage of compensating balances is that they are a relatively stable source of deposits that is

less likely to be withdrawn than other deposits, thus lowering the cost per unit risk of deposits.

Another way in which loan policy can lower deposit costs is through tie-in arrangements

between deposit and loan services. Those customers that have deposit accounts could be

provided greater access to credit For instance; many farm operators hold deposit accounts at rural

banks not so much to earn interest but to establish a banking relationship that would enable them

to obtain loans when needed. Thus, the credit function can be used by banks not only to raise

deposit funds (i.e., compensating balances) but to reduce deposit costs.

CUSTOMER RELATIONSHIP PRICING

Relationship banking is an expression that includes the total financial needs of the public rather

than just specific needs. It also includes fulfilling long-term needs, as opposed to immediate

needs, such as cashing a check. This can be done by cross-selling a variety of services that tends

to lower user costs and increase convenience compared with selling each service separately.

Also, patrons are viewed as clients, as opposed to customers, according to this viewpoint. This

pricing strategy greatly increased in importance subsequent to the Financial Services

Modernization Act of 1999, which expands the array of products and services that bank holding

companies can provide to full-blown securities and insurance activities. Many banks set goals of

selling (on average) three to five financial services to each customer. Managers are appropriately

rewarded in their compensation for achieving multiple product sales.

PROMOTIONAL PRICING

Promotional pricing is used to introduce new products. In brief, the product is priced below cost

to attract market attention. More frequently, promotional pricing is used to support or rejuvenate

demand for existing products. Some of the potential reasons for such promotions include

increasing or protecting market share, modifying existing products, developing brand recognition

or overall bank image, targeting particular market segments of the population in certain

geographic areas,' and increasing sales to a cost efficient level at which economies of scale can

be obtained.

OTHER MARKETING ELEMENTS RELATED TO PRICING

Product Differentiation

Designing products and services to meet the needs of specific market segments is known as

product differentiation. As mentioned earlier, banks typically must price their liabilities in

different ways to compete effectively for funds. If banks did not differentiate their products, and

instead competed side-by-side for the same customers, many customers might be forced to

purchase products that are not priced to fit their needs.

Distribution

Another part of the pricing decision that bank managers should consider is the physical delivery

of deposit services to the public. The problem here is one of logistics-namely, how to optimize

the time and place preferences of customers, while minimizing bank operating costs net of

associated revenues. Banks have two basic distribution channels from which to choose: (1) retail

channels that distribute services to the general public (e.g., driven teller windows, ATMs, and

internet access), and (2) wholesale channels that distribute large volume services to corporate

enterprises and government units (e.g., lock boxes, electronic transfers of funds, and oversight of

cash management functions).

ESTIMATING THE COSTS OF BANK FUNDS

Cost Definitions

The acquisition of bank funds entails incurring both financial and operating costs. Financial costs

pertain to explicit payments to lenders minus revenues obtained from service charges and fees,

whereas operating costs relate to land, labor, and equipment expenditures. When discussing the

costs of bank funding, it is also necessary to distinguish between average costs and marginal

costs. Average costs are simply calculated by dividing the total dollar costs of funds by the dollar

amount of funds. Marginal costs are the incremental costs of acquiring an additional dollar of

funds. Marginal costs are superior to average costs because they more accurately reflect current

costs as opposed to past costs.

WEIGHTED-AVERAGE COST OF FUNDS

On an aggregate basis, costs of bank funds are measured in weighted average terms. The

weighted-average cost of funds can be calculated by summing the average cost of each source of

funds times the proportion of total funds raised from each respective source of funds,

We may write this average cost of funds as follows:

where CT is the weighted average cost of funds, Cn is the average cost of the nth source of

funds, Fn is the funds acquired from the nth source of funds, and TF is the total funds acquired

by the bank. The ratio F,/TF is the proportion of total funds obtained from a particular source of

funds, or the weight used for this source's average cost of funds. Theoretically, the average costs

of the individual sources of funds, or Cn' are equal to one another as well as to CT, after

adjusting for differences in risk. This must be so because the bank would naturally acquire funds

from the cheapest risk-adjusted source until its cost per unit risk rose to the cost per unit risk of

other funds' sources.

PURPOSES OF COST ANALYSES

Performance Reports

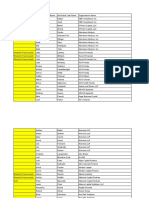

Table 13-5 provides example historical cost data for different sources of funds (excluding ,;

equity) that could be included in a performance report, Funds available for investment are less

than the amount of funds acquired by the amount of reserves required (because of either legal

requirements or management preferences). Financial costs equal total interest costs net of service

revenues, and operating costs are based on allocated expenses for labor, premises, occupancy

expenses, and other operations associated with physically producing accounts. The total cost of

funds is divided by funds available for investment to obtain the average cost of each type of

fund. Notice that reserve requirements raise the effective cost of funds, which is associated with

funds usable for investment purposes. The final step is to calculate the weighted average cost of

funds by applying equation (13.1). As shown in Table 13-5, this historical cost equaled 7.12

percent.

The information displayed in Table 13-5 can be used by the pricing committee to identify both

problems and opportunities. For example, public deposits were costing an average of 10 percent,

which exceeds the average cost of any other type of funds, even though the risk associated with

these funds is relatively low (because government accounts are a fairly stable source of deposits).

Thus, management could work on reducing the cost of public deposits. On the other hand, the

average cost of demand deposits was only about 1 percent, well below the cost of other kinds of

funds. Bank management could increase promotional expenses, lower service charges and fees,

or increase implicit service returns (by increasing operating expenses) to expand this relatively

inexpensive source of funds. This kind of historical overview of costs can help guide bank

management in minimizing the costs of funds in the future. In turn, cost minimizing behavior of

bank managers causes the marginal costs of all sources of funds to remain about the same,

including the cost of equity funds, on a risk-adjusted basis.

Вам также может понравиться

- Tanner 2003Документ20 страницTanner 2003Sajid AliОценок пока нет

- SMch05 EZДокумент8 страницSMch05 EZSajid AliОценок пока нет

- MBA (M) Incomplete: Muhammad Ghazali Khan Sharif KhalidДокумент1 страницаMBA (M) Incomplete: Muhammad Ghazali Khan Sharif KhalidSajid AliОценок пока нет

- 2014 Lean Management Enterprise Compendium With LinksДокумент164 страницы2014 Lean Management Enterprise Compendium With LinksSajid AliОценок пока нет

- Amazon SolutionДокумент8 страницAmazon SolutionSajid AliОценок пока нет

- LeadershipДокумент14 страницLeadershipSajid AliОценок пока нет

- How Culture Affects LeadershipДокумент9 страницHow Culture Affects LeadershipSajid AliОценок пока нет

- Discounted Cash Flow Valuations - 6Документ51 страницаDiscounted Cash Flow Valuations - 6Sajid AliОценок пока нет

- SWOTДокумент3 страницыSWOTSajid Ali0% (1)

- LeadershipДокумент14 страницLeadershipSajid AliОценок пока нет

- Bank Al Falah Matrix FinalДокумент4 страницыBank Al Falah Matrix FinalSajid AliОценок пока нет

- Research Method ReportДокумент11 страницResearch Method ReportSajid AliОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 05 Anti Money LaunderingДокумент15 страниц05 Anti Money LaunderingRaghu PalatОценок пока нет

- SIPRI Milex Data 1949 2019Документ352 страницыSIPRI Milex Data 1949 2019SachumquОценок пока нет

- Financial Accounting Punjab University: Question Paper 2018Документ4 страницыFinancial Accounting Punjab University: Question Paper 2018aneebaОценок пока нет

- Newsearchalgorithm PDFДокумент15 страницNewsearchalgorithm PDFYogesh PrasadОценок пока нет

- Bank Statement 1 Fusionn 1 PDFДокумент6 страницBank Statement 1 Fusionn 1 PDFBenny BerniceОценок пока нет

- Internship Report On Bank of AJK PDFДокумент8 страницInternship Report On Bank of AJK PDFazharrashid100% (1)

- Statement 5563 Jul-23Документ4 страницыStatement 5563 Jul-23Allison LesterОценок пока нет

- Lec 5 B Problem Journal 2 A-6Документ9 страницLec 5 B Problem Journal 2 A-6Shahjahan DashtiОценок пока нет

- Extra Event Individual First Name Individual Last Name Organization NameДокумент72 страницыExtra Event Individual First Name Individual Last Name Organization Namekarthik83.v209Оценок пока нет

- Bank GuaranteeДокумент10 страницBank GuaranteesaidrajanОценок пока нет

- VLL A17A Dec2011Документ143 страницыVLL A17A Dec2011Victor RamirezОценок пока нет

- Chapter 3 2Документ180 страницChapter 3 2dОценок пока нет

- Prudential Regulations For Microfinance Banks (MFBS)Документ23 страницыPrudential Regulations For Microfinance Banks (MFBS)Abid RasheedОценок пока нет

- Chandru 123Документ28 страницChandru 123MathanОценок пока нет

- Bank of Africa, Burkina Faso ScamsДокумент2 страницыBank of Africa, Burkina Faso ScamsVIJAY KUMAR HEERОценок пока нет

- Corporate BondДокумент14 страницCorporate BondRavi WadherОценок пока нет

- HSBCДокумент2 страницыHSBCВлад АнгелОценок пока нет

- ERP of SCBДокумент12 страницERP of SCBMohammad Shaniaz Islam100% (2)

- Financial Analysis of SBI Bank PROJECT (MANSI)Документ110 страницFinancial Analysis of SBI Bank PROJECT (MANSI)manan88% (8)

- BilledStatements 4806 16-10-22 18.18Документ2 страницыBilledStatements 4806 16-10-22 18.18Harsh NawariaОценок пока нет

- Price Earnings Ratio AnalysisДокумент7 страницPrice Earnings Ratio AnalysisNimish VarmaОценок пока нет

- Industry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankДокумент66 страницIndustry Profile Banking Industry in India:: Study On Agricultural Credit Facility of Canara BankGoutham BindigaОценок пока нет

- Banzai Life ScenariosДокумент13 страницBanzai Life Scenariosapi-385889456Оценок пока нет

- Bank Po InterviewДокумент13 страницBank Po InterviewShikha MishraОценок пока нет

- Invoice SHPL 22-23 055 2023-03-31Документ2 страницыInvoice SHPL 22-23 055 2023-03-31vconceiveОценок пока нет

- Foreign Exchange Management Act, 1999 (FemaДокумент52 страницыForeign Exchange Management Act, 1999 (FemaDhronacharya100% (1)

- Philippine Stock ExchangeДокумент25 страницPhilippine Stock ExchangeJessa Raga-as100% (1)

- Liability For Dishonor of Cheques ProjectДокумент25 страницLiability For Dishonor of Cheques ProjectAbhijeet TalwarОценок пока нет

- History of Andhra Bank: Bhogaraju Pattabhi SitaramayyaДокумент7 страницHistory of Andhra Bank: Bhogaraju Pattabhi SitaramayyaTeja Krishna MutluriОценок пока нет

- Digital Wallet Platform in Europe PDFДокумент2 страницыDigital Wallet Platform in Europe PDFAnand KrishnaОценок пока нет