Академический Документы

Профессиональный Документы

Культура Документы

Customer Solutions Model

Загружено:

InvestingSidekickАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Customer Solutions Model

Загружено:

InvestingSidekickАвторское право:

Доступные форматы

Customer Solutions Profit

So I set out to find the answer. I interviewed dozens of customers to get a sense of how

Factset operated. Piecing together fragments of information from all these

conversations, I eventually put together a clear picture of how Factset had designed

their business. Heres what I learned.

The business information marketplace in which both Factset and my client, Data

House, were operating involved close to a thousand major customers. But within that

arena, to maintain a strong growth curve, Factset needed to capture only twenty new

customers per year. Knowing this, they developed a powerful approach to make that

happen.

Once Factset identified a company as a potential customer for their information

services, theyd send a team of two or three people to work there. They would spend two

or three months, sometimes longer, learning everything they could about the customer

how they ran their business, how their systems worked (and didnt work), and what they

really cared about. Based on this genuine knowledge of the customer, Factset then

developed customized information products and services tailored to the specific

characteristics and economics of the account. Once they landed the account, they spent

a ton of time integrating their product into the customers systems. During this process,

Factsets revenues were tiny and their costs were huge. If you looked at a monthly P&L

for a particular account, youd see they were losing a ton of money. Costs of $10,000

might be charged against revenues of $3,000.

After three or four months, Factsets products would be woven into the daily flow of

the customers operations. Their software would be debugged and working fine. Now

Factset didnt need three people working fulltime on the account. One person could

maintain the service, probably part-time. And as the word spread among the clients

employees about how powerful Factsets data was and how effectively Factsets service

had been customized to their specific needs, they began taking more and more

advantage of it. Factsets monthly costs fell from $10K to $8K, while monthly revenues

started to grow, from $3K to $5K to $12K.

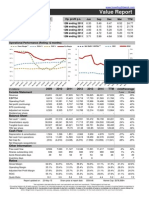

. ..What were Factsets margins?

How much do you think?

Steve grabbed a pencil and began jotting down numbers. Lets see, he considered.

Twenty-four million dollars in revenue generated by a staff of about forty people. How

much would payroll costs be? These folks would probably be well paid. Some might

make just sixty or seventy thousand, but a bunch would be in six figures. Steve seemed

to recall hearing that benefits usually amounted to about fifty percent of salaries. So

even well rewarded, the people would cost no more than, say, $200,000 apiece,

counting salary, benefits, the whole nine yards. He multiplied. That makes eight million

in payroll.

How much would overhead be? Steve wondered aloud.

Use ten percent, Zhao suggested.

Okay, figure ten percent of revenue for overhead$2.4 million. Then there would be

licensing fees for the rights to the information being sold.

Those might amount to another ten percent. Throw in a few more points for other costs .

. . Ill guess forty percent operating marginabout ten million bucks, all told.

Zhao smiled. Very, very close.

So Data House came nowhere near what Factset accomplished.

Thats true.

I dont get it. You laid out the whole plan for them, didnt you? Are you saying that Data

House didnt choose to follow the winning strategy, even after they knew it would

work?

About right.

Steve shook his head. Wow. I guess that must have been one of the worst organizations

youve ever encountered. Did you ever work with any other company that simply refused

to be successful?

Actually, it happens all the time. I can give you the complete recipe for the secret sauce,

and the chances are good that you still wont use it.

Thats strange. Why visit the doctor, then ignore his advice?

Its a bit of a mystery. Theres probably no one reason why people seem to prefer failure

to success. We know that change can be psychologically threateningthats part of the

answer. In the case of Data House, they may have realized that following the Factset

model would have taken a lot of hard workmuch more than they were accustomed to.

Thats part of the answer, too. But I think the ultimate explanation is a simple one. To

succeed in business, you have to have a genuine, honest-to-goodness interest in

profitability. And most people dont.

Zhao leaned back and spread his hands wide. Thats all there is to it.

Steve frowned. Can that really be true? he wondered. Its hard to believe.

Thats all for now. Todays profit model was a simple one. But what is it, Steve? Whats

the idea?

Steve thought for a moment. Then he said, Invest time and energy in learning all there

is to know about your customers. Then use that knowledge to create specific solutions

for them. Lose money for a short time. Make money for a long time.

From The Art of Profitability by Adrian Slywotzky

What are the distinguishing characteristics of this business model, of this profit model?

(1) Intimate knowledge of the customer; and (2) customization of products and services

into (3) integrated solutions that address (3) the customers mission-critical problems

(4) in such a way that these solutions are woven into the daily fabric of the customers

business operations.

Once all four legs of that model have been locked in, it is very hard to compete against

the incumbent, especially in a slow-growing, smallish market. It can command very high

margins with impunity and earn returns far above its cost of capital. Further, if it has

captured the lions share of the market, its gains will accelerate, leaving competitors in

its wake. It is a moated enterprise, a franchise. You can count on its earnings and you

can calculate its earnings power value. It would take a revolutionary leap of some kind

(Amazons threat to Walmart, for example), or sustained bout of self-abuse to threaten

it.

If you understand this Customer Solutions profit model, any company employing it is in

your circle of competence. Isnt that why Buffett bought IBM? It is a customer solutions

play rather than a tech play.

So what?

Well, first, I have found that despite the-everyone-is-special-in-their-own-special-way

heterogeneity of business, profit models, like plot lines in fiction or film, recur with

surprising regularity. Understanding the elements and structure of a profit model well

gives one the opportunity to recognize it where others may not. I believe Buffetts

purchase of an important stake in IBM to be an example of this.

Second, I have found that categorizing companies by profit model is an effective way of

gaining insight into the strengths and weaknesses of an investment case. It is far better,

in my view, than the headline categorizations of industrial organization popularized by

Michael Porter and reformulated somewhat by Bruce Greenwald. Economies of scale,

brand power, switching costs, and so forth, very easily deteriorate into hollow,

vacuous bumper sticker slogans. If youve ever participated in a strategy session, youll

know what I mean.

Consider now a business like Howdens Joinery, listed in the UK. I will quote from the

Chairmans essay at the front of its 2011 Annual Report:

250,000 local builders hold credit accounts with Howdens because we provide the

products and services they require in order to run a successful business of their own.

Through our national network of 509 depots we offer the builder a range of well-

designed, well-made kitchens and associated joinery and hardware, all of which is

available all the time in every depot. We sell to the builder on a trade-only basis, with a

confidential discount that allows him to determine his margin and a net monthly

account that gives him the ability to manage his cash flow requirements.

Howdens has acquired national scale, but it remains a local business, serving local

builders who do not want to waste time travelling long distances or dealing with

impersonal, centralised operations. Each depot runs its own customer accounts;

employees are engaged locally; and profit-sharing is calculated locally, not centrally.

Howdens customers expect to see familiar faces in their depot and rely on people they

know to offer them sound advice.

A typical Howdens depot occupies around 10,000 square feet and employs about a

dozen people. The depot is a low-cost operation, located on a trading estate rather than

a high street, with convenient access and parking for the builder. Rent averages 5 per

square foot and the typical depot fit-out cost is around 170,000.

The depot is able to keep everything in stock, and Howdens is able to refine stock levels,

because each depot manager can use local knowledge to tailor re-order requirements to

suit the needs of his or her customers...

The results we are reporting for 2011 reflect the inherent profitability of the business,

and its capacity to generate cash, which has allowed us to grow and develop as well as

meet our legacy obligations

Ill start at the beginning, with the Howdens model, which is based on a number of well-

defined elements.

First, and principally, it is trade only, which means a constant focus on serving one

customer the small builder. We must not forget that we supply builders, who in turn

supply people like us. Only Howdens can offer: a well-designed range of rigid cabinets,

frontals and joinery that are easy to install, saving the builder time and therefore

money; a quality of construction that means our kitchens do not break, look good and

work well, saving more time and money (we call it fitability); a confidential discount

that allows builders to determine their own margin and make a living; and a net

monthly account that allows them to manage their cash flow.

Second, we promise small builders everywhere that all our ranges are available locally,

all the time, so they can pick up a complete kitchen when they need it, and they can

finish their job and get paid by their customers, which means they can pay us.

Third, Howdens is a local business. We have 509 local depots, because builders do not

want to waste time driving to and fro they want to get on with the job. Their account is

with their local depot. The depot staff know what each account customer needs. And so

there are no misunderstandings, and no call centres, which saves everybody a lot of

time, as well as money. Local also means that each Howdens depot is fully

accountable for its own performance. Depot managers hire their own staff, refine their

own stock to suit local needs, market it themselves to their own customers, and adjust

their own pricing to suit local conditions. They are wholly responsible for their own

sales and their own margin. Depot managers and staff are all incentivised to drive more

sales and more margin, as efficiently as possible. Their bonus is based on a share of their

locally generated profit less any stock loss there is virtually no stock loss. It is

therefore not surprising that depot managers and staff are keen, willing and able to open

new accounts and make sure that they trade.

Last year they opened 76,000 new accounts, which equated to 38,000 net new accounts

in just one year. The total number of credit accounts now stands at almost 250,000. On

any given day, you can observe the combination of around 80 million of stock, spread

across 509 depots, with 1,000 kitchen planners capable of planning up to 3,000

kitchens per day, 600 depot-based telesales people, 700 sales reps out on the road

looking for new customers, and 250,000 existing customers also out on the road

looking for their next job to be getting on with all of which makes Howdens a

business to be reckoned with.

Fourth, we run Howdens as a focused and therefore low-cost operation, with high

volumes and predictable sales. We have invested in our own manufacturing capability to

ensure better service, greater efficiency, and no waste whether of money, people,

process or space. Our trade depots are typically 10,000 square feet in size, with rent of

around 5 per square foot. They are located on trading estates not retail parks. We do

not have glossy showrooms. Our depots open early in the morning and are shut on

Saturday afternoons and Sundays. So altogether, they are not like High Street retailers

at all, and their costs are very different too.

As I have remarked before, the Howdens model only works if it is

implemented as a whole, which means all of the elements are non-

negotiable [emphasis added]. Our model was designed when the business began in

1995. Its aim is to enable the business to find solutions to complexity efficiently and

profitably, because we are engaged in a highly complex activity that of getting kitchens

into homes and making sure they work

We are seeing an increased level of trust from builders keen to benefit from our

knowledge, as well as from the other aspects of our offer, including the attractive terms I

have described, and our planning facilities, which are second to none. As we have always

said, builders follow the work and right now, proportionately, we are seeing more

money spent by the private sector and less by the public sector.

I mentioned at the start of this review that continuing investment had been a critical

factor in our ability to outperform the market and to continue to take market share in

these challenging times. But what we have invested in? The short answer is that we have

invested in serving one customer. That means making sure that we can offer our

customer both service and efficiency, which together are the drivers of margin and

market share. In order to improve service, we have invested in customer awareness. We

provide each of our 250,000 account customers with catalogues, videos, samples and

plans of kitchens, worktops, joinery and flooring to support their sales. We have also

invested in focused advertising aimed at the end-user or consumer, rather than at our

customer, the small builder, because we have observed that this helps the builder to

market the whole range of Howdens products to an expanding population of aware

consumers

Furthermore, manufacturing supports our reputation with our customers. Builders do

not like surprises with product.

They prefer to buy from manufacturers, and feel they know what they are getting, from

people with credibility and a track record. By manufacturing product ourselves, we are

also investing in supporting the margin of the business as a whole and growing it,

compared to others because of the inherent efficiencies of not producing for anyone

else. There is also the matter of security of supply. This is extremely important to a

business that makes over 3.5 million cabinets and 860,000 worktops last year. We have

also invested in the systems that control the manufacturing process, and by so doing

have supported our ability to increase productivity and reduce waste. For example, we

have invested in robots at the end of the production line, which have helped us gain

more efficiency in the smooth transition from manufacturing to warehouse. Our

investment in systems underpins our sales activity too. For example, we have invested in

the latest CAD technology that means we can offer the builder an industry leading

design service to support his sale, and he can fit a properly planned kitchen as quickly

and efficiently as possible

We know the importance of vigilance and we monitor everything, all the time sales,

margin, stock, cash, and the performance of every part of the business. In this market,

we need to be quick on our feet. The way Howdens is organised means we are very close

to where sales happen, and that is a source of competitive advantage. Vigilance also

means responsiveness in every area. If a depot has an IT problem, we see it the moment

it happens, and will set about fixing it immediately. If a customer account does not trade

for 15 months, we close it, so that we keep a clean account base and know that we are

tracking only active customers. We control credit by means of our nett monthly account,

which is tightly managed, so that our total cost of credit, including debt recovery and

bad debts, still remains less than 1.5% of sales.

What this all adds up to is that Howdens outperforms because we are clear about what

we are doing. We design and build a professional product, with an up-to-the-minute

design, that requires a professional fit, and we sell it to professional fitters who can go

and pick it up from local stock day in, day out; and because we give them a truly reliable

service, and a confidential discount, they can make a living out of it.

You might recognize the customer solution profit model in that opening essay. (1)

Intimate knowledge of the customer; and (2) customization of products and services

into (3) integrated solutions that address (3) the customers mission-critical problems

(4) in such a way that these solutions are woven into the daily fabric of the customers

business operations.

It is a conscious, coherent, comprehensive, and sophisticated business model that

should allow it to earn returns that are far above its cost of capital and well in excess of

that earned by other home and construction supply companies operating in the UK

market.

It has much more in common with IBM and Factset Research Systems than it does with

Home Retail Group, Kingfisher, or even Travis Perkins. It would take something

special, something other than the hum-drum of daily competition, to knock Howdens

down.

And if you recognize Howdens as an effective, successful example of the customer

solutions profit model, you will have an insight into the investment case if its shares fall.

In May of 2012, for example, Howdens shares were priced at 109p, or at half its current

earnings power, even though it boasts 60% gross margins, 22% after-tax operating

margins, and 20% returns on invested capital. Investors looking only at its financial

statements would worry that such performance was unsustainable. An intelligent,

prepared investor, on the other hand, would be thinking of the quality of the underlying

business, as though a businessman considering a private purchase of the whole

company. And that investor would have an advantage over the market.

This post is the first of twenty or so in a series.

If you finds this approach interesting and know of any small, listed companies that

employ this profit model, go ahead and name them in the comments section below.

Disclosure: No position in FDS, HWDN, or IBM.

Вам также может понравиться

- The Changing World of Sales ManagementДокумент91 страницаThe Changing World of Sales ManagementNasir Ali100% (1)

- Comsats University Business Policy and Strategy CourseДокумент3 страницыComsats University Business Policy and Strategy CourseHasnain ButtОценок пока нет

- Frame Connect Deliver: Introducing Service Operations Management Understanding The Challenges For Operations ManagersДокумент27 страницFrame Connect Deliver: Introducing Service Operations Management Understanding The Challenges For Operations Managersalan16Оценок пока нет

- The New Aaa Supply Chain: Hau L. LeeДокумент4 страницыThe New Aaa Supply Chain: Hau L. LeeNataly Alonso Chavero100% (1)

- Recruitment & Selection 1Документ63 страницыRecruitment & Selection 1Anuj ShahОценок пока нет

- Concept of JND: Just Notiecable DifferenceДокумент10 страницConcept of JND: Just Notiecable Differencefazela shaukatОценок пока нет

- Business Strategy December 2011 Exam PaperДокумент10 страницBusiness Strategy December 2011 Exam PaperTAPKОценок пока нет

- Porter's Five Forces Model On Automobile IndustryДокумент6 страницPorter's Five Forces Model On Automobile IndustryBhavinShankhalparaОценок пока нет

- The US Dollar Store Case StudyДокумент3 страницыThe US Dollar Store Case StudyChryss John QuerolОценок пока нет

- Contemporary Issues in ManagementДокумент11 страницContemporary Issues in ManagementDuane EdwardsОценок пока нет

- Mkt350 FinalsДокумент2 страницыMkt350 FinalsMashiat Kabir MuskanОценок пока нет

- Introduction To Operations Management #2Документ29 страницIntroduction To Operations Management #2goldzilaОценок пока нет

- Australia Apparel Retail 71776Документ40 страницAustralia Apparel Retail 71776love angelОценок пока нет

- CP 206 SCM Rough PDFДокумент37 страницCP 206 SCM Rough PDFKumardeep SinghaОценок пока нет

- EntrepreneurshipДокумент118 страницEntrepreneurshipXuan Thuong PhamОценок пока нет

- Supply Chain Management at WalmartДокумент16 страницSupply Chain Management at WalmartLovanda SebayangОценок пока нет

- IKEA Case StudyДокумент24 страницыIKEA Case StudyVinayak ChennuriОценок пока нет

- Kmart Final DraftДокумент48 страницKmart Final Draftrinzo100% (1)

- A Study On HRM Challenges of Tata Consultancy Services During Covid 19 PandemicДокумент5 страницA Study On HRM Challenges of Tata Consultancy Services During Covid 19 Pandemicmax thomasОценок пока нет

- Amazaon Supply Chain ManagementДокумент5 страницAmazaon Supply Chain Managementsherif_ali76Оценок пока нет

- Toyota Motor Corporation Market AnalysisДокумент4 страницыToyota Motor Corporation Market AnalysisRandy Teofilo MbaОценок пока нет

- Zara The Speeding BulletДокумент3 страницыZara The Speeding BulletSomnath Manna100% (1)

- Week 5 Lecture SlidesДокумент50 страницWeek 5 Lecture SlidesPhuong NhungОценок пока нет

- 4564-2469-13-00-40 - SQA IMM Assignment Only V3 Turnatin FileДокумент36 страниц4564-2469-13-00-40 - SQA IMM Assignment Only V3 Turnatin FileHussain K.JamalОценок пока нет

- Sri Lanka's apparel industry drives economyДокумент7 страницSri Lanka's apparel industry drives economyDave MihirОценок пока нет

- Walmart FinalДокумент47 страницWalmart Finalchetankhanna93100% (1)

- Case Study 6: Operations Management - EMBA 553Документ1 страницаCase Study 6: Operations Management - EMBA 553Daniel Ghossein0% (2)

- Is the Consumer Really King in IndiaДокумент40 страницIs the Consumer Really King in IndiaNeha UmbrekarОценок пока нет

- Wipro's Commitment to EthicsДокумент13 страницWipro's Commitment to Ethicsakshay panwarОценок пока нет

- Microsoft CSR CampaignДокумент16 страницMicrosoft CSR CampaignChristopher EckОценок пока нет

- BigBazaar and Kishore BiyaniДокумент30 страницBigBazaar and Kishore BiyaniChitra Vaswani100% (1)

- Zara: Fast Fashion in The Digital Age: by Vanessa Burb Ano, Bennett Chiles, and Dan J. W AngДокумент36 страницZara: Fast Fashion in The Digital Age: by Vanessa Burb Ano, Bennett Chiles, and Dan J. W AngAnkur PrasunОценок пока нет

- Porter Five Forces MorisonДокумент3 страницыPorter Five Forces MorisonAsad SyedОценок пока нет

- Ethics & Human Resource Management (HRM)Документ19 страницEthics & Human Resource Management (HRM)Amritpal Kaur100% (1)

- Doing Business in India A Country Commercial Guide For U S CompaniesДокумент181 страницаDoing Business in India A Country Commercial Guide For U S CompaniesInsideout100% (19)

- Chapter Review: 1-8e CasesДокумент5 страницChapter Review: 1-8e Casesnikhil0% (1)

- Altria GroupДокумент3 страницыAltria Groupmonika sharmaОценок пока нет

- Vertical Integration & Zara Retailing: Presented By-Amkoa, Sally Lin, Xinqi Senecha, Niharika Towers, KathleenДокумент17 страницVertical Integration & Zara Retailing: Presented By-Amkoa, Sally Lin, Xinqi Senecha, Niharika Towers, KathleenShashwat ShuklaОценок пока нет

- A. Company OverviewДокумент12 страницA. Company Overviewsauvik ghoshОценок пока нет

- HSBC Global StandardДокумент2 страницыHSBC Global StandardTivanthini GkОценок пока нет

- Customer Is The KingДокумент4 страницыCustomer Is The KingHiratek InternationalОценок пока нет

- Managerial Economics Notes 13Документ25 страницManagerial Economics Notes 13bevinj100% (4)

- Tata Group's Growth StrategiesДокумент6 страницTata Group's Growth Strategiesajay krishnaОценок пока нет

- Honda (HMSI) CaseДокумент12 страницHonda (HMSI) CaseRajesh Bansal100% (2)

- 1.introduction To Business, Strategy, Objectives and PolicyДокумент39 страниц1.introduction To Business, Strategy, Objectives and PolicyJigar Patel0% (1)

- Final Examination (21355)Документ13 страницFinal Examination (21355)Omifare Foluke Ayo100% (1)

- Intrapreneurship ProposalДокумент1 страницаIntrapreneurship ProposalndaphОценок пока нет

- Retailing Managemen T: Text and CasesДокумент16 страницRetailing Managemen T: Text and Casesbiotech_savvyОценок пока нет

- Structural Analysis of Telecommunication and Tele Services IndustryДокумент6 страницStructural Analysis of Telecommunication and Tele Services IndustryVigneshwarОценок пока нет

- Bus210 Week5 Reading1Документ33 страницыBus210 Week5 Reading1eadyden330% (1)

- Case AnalysisДокумент43 страницыCase AnalysisRafidul Islam50% (2)

- Brewing Peace Philippines: Customer Relationship Management: I1v2e5y5pubsДокумент9 страницBrewing Peace Philippines: Customer Relationship Management: I1v2e5y5pubsRaja RamОценок пока нет

- Strategic ManagementДокумент39 страницStrategic ManagementNguyen Hanh ChiОценок пока нет

- OMB Assignment Brief JAN 17Документ9 страницOMB Assignment Brief JAN 17Rafid RahmanОценок пока нет

- The Corporate Culture Company: Nike I. Corporate Culture of The CompanyДокумент2 страницыThe Corporate Culture Company: Nike I. Corporate Culture of The CompanyMycs MiguelОценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Managing Britannia: Culture and Management in Modern BritainОт EverandManaging Britannia: Culture and Management in Modern BritainРейтинг: 4 из 5 звезд4/5 (1)

- Berkshire Hathaway Equity ResearchДокумент2 страницыBerkshire Hathaway Equity ResearchInvestingSidekickОценок пока нет

- QuizДокумент3 страницыQuizInvestingSidekickОценок пока нет

- Johnson Johnson Stock Analysis ReportДокумент2 страницыJohnson Johnson Stock Analysis ReportInvestingSidekickОценок пока нет

- Verizon Stock Analysis ReportДокумент2 страницыVerizon Stock Analysis ReportInvestingSidekickОценок пока нет

- Oracle Stock Analysis ReportДокумент2 страницыOracle Stock Analysis ReportInvestingSidekickОценок пока нет

- Cisco Stock Analysis ReportДокумент2 страницыCisco Stock Analysis ReportInvestingSidekickОценок пока нет

- IBM Stock Analysis ReportДокумент2 страницыIBM Stock Analysis ReportInvestingSidekick100% (1)

- Microsoft Stock Analysis ReportДокумент2 страницыMicrosoft Stock Analysis ReportInvestingSidekickОценок пока нет

- Boeing Stock Analysis ReportДокумент2 страницыBoeing Stock Analysis ReportInvestingSidekick100% (1)

- Google Stock Analysis ReportДокумент2 страницыGoogle Stock Analysis ReportInvestingSidekickОценок пока нет

- Netflix Stock Analysis ReportДокумент2 страницыNetflix Stock Analysis ReportInvestingSidekickОценок пока нет

- EAM Solar ProspectusДокумент178 страницEAM Solar ProspectusInvestingSidekickОценок пока нет

- Apple Stock Analysis ReportДокумент2 страницыApple Stock Analysis ReportInvestingSidekickОценок пока нет

- House Buying Vs RentingДокумент14 страницHouse Buying Vs RentingInvestingSidekickОценок пока нет

- EAM Solar ProspectusДокумент178 страницEAM Solar ProspectusInvestingSidekickОценок пока нет

- Gencorp Annual Report 2013Документ177 страницGencorp Annual Report 2013InvestingSidekickОценок пока нет

- IBM 10 Year FinancialsДокумент1 страницаIBM 10 Year FinancialsInvestingSidekickОценок пока нет

- The Washington Post Company 1971 Annual ReportДокумент33 страницыThe Washington Post Company 1971 Annual ReportInvestingSidekickОценок пока нет

- Guerrilla Selling E-BookДокумент270 страницGuerrilla Selling E-BookRichard Wanjohi100% (7)

- Hitting-The-target - PWC Target Audience InspirationДокумент16 страницHitting-The-target - PWC Target Audience InspirationIoana PanaОценок пока нет

- IMC Introduction and ElementsДокумент34 страницыIMC Introduction and Elementsshivam chughОценок пока нет

- Promotional Concepts and StrategiesДокумент4 страницыPromotional Concepts and StrategiesCatsCanFly 2DaSkyОценок пока нет

- C v Omar Gouda مطلوب وظيفة مدير مخازن وقطع غيارДокумент3 страницыC v Omar Gouda مطلوب وظيفة مدير مخازن وقطع غيارالتوظيف والتعليمОценок пока нет

- Report On CavinKare Private LimitedДокумент4 страницыReport On CavinKare Private LimitedSuyash KulkarniОценок пока нет

- Arcade Business Plan ExampleДокумент54 страницыArcade Business Plan ExampleJoseph QuillОценок пока нет

- 2015 Performance Partner Program Deal Registration GuideДокумент6 страниц2015 Performance Partner Program Deal Registration GuideWalid OsamaОценок пока нет

- Ethical Issues in PricingДокумент15 страницEthical Issues in PricingFaezah Samsudin0% (1)

- IBM Design Thinking 1.0: How IBM Made Sense of Generic Design Thinking' For Tens of Thousands of PeopleДокумент16 страницIBM Design Thinking 1.0: How IBM Made Sense of Generic Design Thinking' For Tens of Thousands of PeopleYash TanejaОценок пока нет

- Sale of Goods Act overviewДокумент6 страницSale of Goods Act overviewShalini Nisha100% (1)

- B Plan M-Pesa Nehema BahatiДокумент42 страницыB Plan M-Pesa Nehema BahatisamuelОценок пока нет

- Retail Supervisor ResumeДокумент7 страницRetail Supervisor Resumezys0vemap0m3100% (1)

- Profit CentersДокумент22 страницыProfit CentersRaj GuptaОценок пока нет

- Salam, Istisna, SarfДокумент42 страницыSalam, Istisna, SarfSari ManiraОценок пока нет

- Sociological Barriers in The Quality of Production: Małgorzata Suchacka - Nicole HorákováДокумент622 страницыSociological Barriers in The Quality of Production: Małgorzata Suchacka - Nicole HorákováCristiana AmarieiОценок пока нет

- Sales Force ManagementДокумент7 страницSales Force ManagementFisher100% (1)

- Daniel P PinkДокумент12 страницDaniel P PinkNautОценок пока нет

- Vinod Resume Exp1Документ2 страницыVinod Resume Exp1karthik.loticОценок пока нет

- Optimize product design with QFDДокумент33 страницыOptimize product design with QFDYeshwant SureshОценок пока нет

- Importance of understanding other cultures for travellersДокумент35 страницImportance of understanding other cultures for travellersAnonymous uWlv9rllaОценок пока нет

- MK0006 - Services Marketing and Customer Relationship Management Assignment Set-1Документ10 страницMK0006 - Services Marketing and Customer Relationship Management Assignment Set-1RK Singh0% (1)

- Chapter 14 Products and Services For BusinessДокумент15 страницChapter 14 Products and Services For BusinessDonald PicaulyОценок пока нет

- Printable Medical Device 30-60-90 Day Plan Template PDF FormatДокумент9 страницPrintable Medical Device 30-60-90 Day Plan Template PDF FormatSanjib Ray100% (1)

- Objective S: After Reading This Chapter, You Should Be Able ToДокумент255 страницObjective S: After Reading This Chapter, You Should Be Able ToRobin RichardsonОценок пока нет

- FDI Aspects for Inbound InvestmentsДокумент68 страницFDI Aspects for Inbound InvestmentsMitesh MehtaОценок пока нет

- Introduction To Business MGT 211 LecturesДокумент167 страницIntroduction To Business MGT 211 LecturesNomaanAhmadshah50% (2)

- Scope of StudyДокумент4 страницыScope of StudyNareshОценок пока нет

- Personal Profile:: Contact Edwin F. Nyamubi P.O. Box 31731, Dar Es Salaam. Tanzania. East AfricaДокумент5 страницPersonal Profile:: Contact Edwin F. Nyamubi P.O. Box 31731, Dar Es Salaam. Tanzania. East AfricaKudoveli KilluminateОценок пока нет

- Market Leader 3rd Edition - PreIntermediate - Course Book-132-140Документ9 страницMarket Leader 3rd Edition - PreIntermediate - Course Book-132-140NikolaОценок пока нет