Академический Документы

Профессиональный Документы

Культура Документы

Ib (New)

Загружено:

krupamayekarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ib (New)

Загружено:

krupamayekarАвторское право:

Доступные форматы

(1)

In January 2005, Mr. E was diagnosed with lung cancer and put in a claim to the irm. !"er si# years

earlier, in $o"em%er 1&&', he had ta(en out lie and critical illness insurance co"er worth )150,000.

*ter carrying out en+uiries, the irm ound that in ,eptem%er 1&&- Mr. E.s /0 had recorded that Mr. E

was consuming appro#imately '0 units o alcohol a wee( (21 units is the recommended ma#imum

wee(ly amount or men). In 1e%ruary 1&&' Mr. E.s alcohol consumption was up to '2 units a wee( %ut

%y July o the ne#t year it had gone down to a more moderate 203 units a wee(.

4he irm said this diered greatly rom the declaration Mr. E made when applying or insurance. 5e

had said then that his a"erage alcohol consumption was i"e units a day (65 per wee(). 4he irm told

him that i it had %een aware o his drin(ing ha%its, it would ha"e increased his premium %y 2007

6008. It reused to pay the claim and it returned his premium, a"oiding the policy rom its start date.

Mr. E was e#tremely angry with the irm.s response. 5e said that when he applied or the insurance he

had answered all the irm.s +uestions accurately. 5e pointed out that he had, at that time, %een the

sole carer or his newly7%orn daughter and could not ha"e handled his responsi%ilities i he had %een

drin(ing as hea"ily as %eore. 4he irm still maintained that he was li(ely to ha"e %een drin(ing more

than he had claimed.

Complaint upheld

when the complaint was reerred to us we ound no e"idence concerning Mr. E.s drin(ing ha%its at the

time he applied or the insurance. 4he amount he had said he was drin(ing (i"e units a day or 65

units a wee() was close to the 203 units a wee( that his /0 had recorded eight months later. Mr. E

had gi"en a plausi%le e#planation or his answer and the irm had no 9ustiication or disregarding it.

*s there was no e"idence o non7disclosure or misrepresentation, we re+uired the irm to reinstate the

policy and meet the claim. 4he irm agreed to pay the ull sum o )150,000, plus interest.

(2)

In :ecem%er 2001, Mr. and Mrs. ; applied or term lie assurance and critical illness insurance. 4his

included own occupation co"er, which paid %eneits i either o them was una%le to continue with their

own occupation %ecause o permanent total disa%lement.

In response to the irm.s +uestions they %oth stated that they were not "currently receiving any

medical treatment or attention or awaiting any medical or surgical consultation, test or investigation"

and had "never had any medical or surgical treatment, including investigations, tests, scan or X-rays

for any mental or nervous illness (including depression) lasting for more than 3 months and/or

requiring more than ! consecutive days off wor"".

4he irm accepted the application on the condition that, since signing the application, Mr. and Mrs. ;

had not "suffered any illness or required any medical attention or changed occupation".

4wo years later, Mrs. ; su%mitted a claim or rheumatoid arthritis %ut the irm reused to meet it. It

said her medical records showed that she had %een consulting a doctor or carpal tunnel syndrome

and depression or a%out eight years %eore the date when she applied or the policy. ,he had not

disclosed this.

In addition, she had ne"er disclosed that < ater she had su%mitted her application %ut a ew days

%eore it was accepted < she had seen her doctor or pain and swelling in her an(le. *nd she had ailed

to tell the irm that, %eore she recei"ed the irm.s oer o acceptance, she had changed her

occupation.

4he irm said that although it was entitled to treat the whole policy as "oid rom the start, it would not

do this. 5owe"er, it would e#clude claims or Mrs. ;.s pre"ious health pro%lems and would no longer

pro"ide the own occupation cover. =nhappy with this, Mr. and Mrs. ; reerred the complaint to us.

Complaint rejected

we did not consider there to %e any %asis or re+uiring the irm to pay the sum insured or Mrs. ;.s

rheumatoid arthritis. ;e accepted that there was no lin( %etween her carpal tunnel syndrome and

depression and the onset o her rheumatoid arthritis. 5owe"er, this did not change the act that, in

response to clear +uestions, she had ailed to disclose inormation a%out her health.

In our opinion it was air and reasona%le o the irm to oer to rewrite the policy on the terms it would

ha"e oered originally > i it had %een gi"en the correct inormation. Mr. and Mrs. ; appeared to ha"e

gi"en "ery little thought to the accuracy o their answers, and their non7disclosure appeared to %e at

least rec"less, which would ha"e entitled the irm to "oid the policy.

(3)

Mr. 1 reerred his complaint to us when he was una%le to resol"e matters with his %an(. 5e had held a

current account with the same %an( or a num%er o years, and the o"erdrat acility had always %een

renewed automatically, without comment.

,o Mr. 1 said he had %een urious when he disco"ered the %an( had withdrawn the acility without

gi"ing him any notice. 4his had caused him some diiculties, since he had %een o"erdrawn at the

time. *nd although he managed airly speedily to transer his account to a dierent %an(, in the

meantime he had %een charged su%stantial interest, at the rate or unauthori?ed o"erdrats.

Complaint upheld

the %an( said it had made a num%er o (documented) telephone calls to Mr. 1 a%out the diiculties on

his account. *nd it said it could pro"ide comprehensi"e internal notes on its concerns a%out his

account, up to the point when it withdrew the o"erdrat acility.

It was clear rom the %an(@s records that Mr. 1 had %een ha"ing considera%le pro%lems (eeping his

current account in good order. *nd his che+ues had occasionally %een returned unpaid. 5owe"er, there

was nothing to suggest the %an( had e"er made its concerns clear to Mr. 1, either during the telephone

calls or at any other time.

;e accepted Mr. 1@s statement that the telephone calls had consisted o %rie re+uests that he call at

the %ranch or an Aaccount reviewA. 5e had interpreted these re+uests as Astandard mar"eting calls",

made with the intention o selling him some new product or ser"ice, so he had ignored them. $othing

speciic had %een said in the calls a%out his account and he had %een gi"en no reason to suspect his

o"erdrat acility was in 9eopardy.

4he %an(@s decision to withdraw the o"erdrat was a legitimate e#ercise o its commercial 9udgement.

5owe"er, we did not %elie"e this decision had %een carried out airly. In our "iew, the %an( should

ha"e gi"en Mr. 1 a clear warning a%out what would happen i he did not run his account properly. *nd

it should ha"e gi"en him a reasona%le amount o notice %eore withdrawing the o"erdrat acility.

;e accepted that the %an(@s ailure to gi"e a clear warning or any notice had caused Mr. 1 stress and

diiculty, %ecause he had %een orced to arrange a new account at short notice. ,o we said the %an(

should pay him )150 in recognition o the incon"enience it had caused.

;e also thought it unair o the %an( to charge Mr. 1 interest at its Aunauthori#edA rate, ollowing its

withdrawal o the acility. ,o we said the %an( should reund to Mr. 1 the dierence %etween its normal

rate o interest and the rate it had charged him.

(4)

A Frozen Accounts 5 and Ms 0 operated a pet supplies %usiness as a partnership. 4he partnership

had se"eral acilities with the %an( including an E140!, machine, a %usiness credit card and a

%usiness trading account. Either proprietor was authori?ed to operate the accounts.

4he partners %ecame in"ol"ed in a inancial dispute and ceased to operate the %usiness together. Ms 0

continued to trade as a sole proprietor, and the rele"ant change o ownership orms or the registered

%usiness name were lodged.

Ms 0.s dispute with the %an( arose when she deposited unds she had earned as a sole proprietor into

the partnership account, and drew che+ues against these unds. *s soon as the %an( %ecame aware o

the partnership dispute, it ro?e the account and dishonored the che+ues Ms 0 had issued. Ms 0 said

that she was una%le to continue to trade and was orced to close the %usiness.

Ms 0 argued that the %an( should not ha"e ro?en the account when it had %een a %an( oicer who

had ad"ised her to continue to use the partnership account. 4he %an( oicer concerned denied gi"ing

Ms 0 this ad"ice.

Issue

4he main issue or the case manager.s consideration was whether the %an( oicer had ad"ised Ms 0

that she could continue to operate the partnership account. It was diicult to determine this issue

%ecause there was no documentation recording the nature o the discussion %etween Ms 0 and the

%an( oicer.

Besolution

4he !m%udsman considered that a conciliation conerence was an appropriate method o trying to

resol"e the matter. 4he dispute was resol"ed at the conerence, with the %an( agreeing to pay Ms 0

C&,000. 4he early conciliation conerence a"oided the need or a long and diicult in"estigation.

(5)

Unauthorised Credit Card Transaction

Ms D applied or a credit card %ut says the application was declined and she ne"er recei"ed the card.

,ome time later, Ms D was contacted to ma(e payments on a de%t o C1,000 owing on the credit card

account. *lthough Ms D did not %elie"e she was responsi%le or the de%t, she %ecame ner"ous when

the %an( threatened to list the deault with a credit reporting agency. ,he reluctantly agreed to repay

C50 per month towards the de%t.

Ms D then recei"ed a letter rom a collection agency demanding repayment o the ull amount o the

de%t. Ms D contacted the %an( to as( how the account could ha"e %een opened in her name when her

application was declined. ,he re+uested copies o the identiication that had %een shown when the

account was opened, %ut she was ad"ised that she would ha"e to pay a ee or the inormation.

* deault listing was su%se+uently entered against Ms D.s name and when this was disco"ered, Ms D

wrote to the 1inancial !m%udsman ,er"ice re+uesting assistance.

4he dispute was reerred to the %an( or its consideration. 4he %an( conducted an in"estigation into

the matter and ad"ised that its records showed that the credit card application had, in act, %een

appro"ed %ut that it was not a%le to conirm that Ms D had recei"ed the card. 4he %an( accepted that

the card may ha"e %een used raudulently %y a third party, and the dispute was promptly resol"ed

with the %an( agreeing to e#tinguish Ms D.s lia%ility or the de%t and remo"ing the deault listing.

Travel-personal accident-total and irrecoverable loss of sight-policyholder retaining 3%

vision- hether loss sight claim valid!

4he policyholder went on holiday with her amily to 1lorida on 1 January 1&&'. 4hree days ater

arri"ing, they were in"ol"ed in a serious road accident. 4hey contacted the assistance company and

the policyholder and her daughter were hospitali?ed.

4he policyholder su%mitted a claim or loss o sight under the personal accident section o the policy.

,he said she had no useul "ision in her let eye and there was no prospect o impro"ement.

4he insurer insisted on o%taining additional medical e"idence. 4he insurer.s consultant concluded that

the policyholder had lost all central "ision %ut retained a small amount o peripheral "ision, which he

estimated at 2768. In his opinion, AIn theory, Ethe policyholderF had retained sight in the let eye.

5owe"er, it was so minimalG it EwouldF %e o no practical use to her. 1or practical purposes, Ethe

policyholderF had lost all sight with the let eyeA. 4he policy stipulated that the )25,000 %eneit was

paya%le only or Atotal and irreco"era%le loss o all sight in one or %oth eyesA. 4he insurer contended

that this pro"ision should %e interpreted literally and that thereore the claim was not "alid. 5owe"er,

ollowing our in"ol"ement, it oered an e# gratia payment o )12,500. 4he policyholder considered her

claim should %e met in ull.

Complaint upheld

;e noted that the ;orld 5ealth !rganisation deined Aproound %lindnessA as the ina%ility to

distinguish ingers at a distance o 10 eet. 4he Boyal $ational Institute or the Hlind ad"ised that only

a%out 1'8 o %lind people were classed as totally %lind and the ma9ority o those could distinguish

%etween light and dar(. ;e concluded that AsightA implied an a%ility to discern o%9ects. !n this %asis

we were satisied that the policyholder had, or all practical purposes, suered a total loss o sight. ;e

re+uired the insurer to meet the claim in ull, together with interest, rom the date o the accident.

(-)

Travel-curtailment-death of relative-relative resident abroad-hether policyholders return

to U!"! covered!

1ollowing the death o his mother in Denya, the policyholder and his wie had to return home to the =D

rom their holiday in *msterdam. 4he insurer reused to meet the claim as the policyholder.s mother

was not resident in the =D. It reerred to the policy section which co"ered curtailment due to Ithe

death, se"ere in9ury or serious illness o an immediate relati"e resident in the =nited DingdomJ.

Complaint upheld

*lthough the policy wording was unam%iguous, we considered that its application was unair in the

circumstances. 4he country in which the policyholder.s mother was resident at the time o her death

did not seem rele"ant, as he and his wie had irst to return home to the =nited Dingdom. 4he insurer

agreed to meet the claim.

(')

Cash machine-account-holding firm responsible!

Mrs. 4 had a %an( account with irm *. ,he tried unsuccessully to withdraw )60 rom this account,

using a cash machine owned %y irm H, a mem%er o the same cash machine networ( as irm *. ,he

later managed to withdraw the )60 rom another machine.

5owe"er, irm * de%ited her account with the irst (unsuccessul) withdrawal as well as with the

second one. 1irm * said that was not its responsi%ility and that Mrs. 4 should pursue a complaint

against irm H.

Complaint upheld

5a"ing e#amined the records or irm H.s cash machine, we were satisied that Mrs. 4 had not recei"ed

the irst )60. 5er complaint was thereore not a%out irm H.s machine ailing to issue the money, as

irm * had apparently suggested. It was a%out irm * de%iting her account with money she had not

recei"ed. ;e re+uired irm * to credit Mrs. 4.s account, and to compensate her or the incon"enience it

had caused %y trying to o% o her complaint.

Вам также может понравиться

- Important Points For Life Insurance Sector and Related Questions and AnswerДокумент41 страницаImportant Points For Life Insurance Sector and Related Questions and AnswerPavan Krishna OОценок пока нет

- Insurance Digest ConcealmentДокумент4 страницыInsurance Digest ConcealmentWresen Ann JavaluyasОценок пока нет

- Proof of Loss: A Quick Guide to Processing Insurance Claim for Insured with Their AdjusterОт EverandProof of Loss: A Quick Guide to Processing Insurance Claim for Insured with Their AdjusterРейтинг: 5 из 5 звезд5/5 (2)

- Hernandez v. Go, Ac No 1526Документ4 страницыHernandez v. Go, Ac No 1526vylletteОценок пока нет

- OPEÑA Insuance Week7Документ8 страницOPEÑA Insuance Week7yannie isananОценок пока нет

- Aetna Life Ins. Co. v. Moore, 231 U.S. 543 (1913)Документ11 страницAetna Life Ins. Co. v. Moore, 231 U.S. 543 (1913)Scribd Government DocsОценок пока нет

- Motoring Troubles: Winter 2014Документ4 страницыMotoring Troubles: Winter 2014api-273967536Оценок пока нет

- Chapter 9 MisrepДокумент7 страницChapter 9 Misrepapi-234400353Оценок пока нет

- Case StudyДокумент5 страницCase StudyTilak SalianОценок пока нет

- Labor Review DigestДокумент24 страницыLabor Review DigestBenjieSalesОценок пока нет

- Argente V West Coast G.R. No. L-24899 March 19, 1928Документ9 страницArgente V West Coast G.R. No. L-24899 March 19, 1928Dar CoronelОценок пока нет

- Concealement PolicyДокумент15 страницConcealement PolicypogsОценок пока нет

- CONCEALEMENTPOLICYДокумент15 страницCONCEALEMENTPOLICYpogsОценок пока нет

- Case Digest LawДокумент16 страницCase Digest LawRenarah Yeshmeer100% (1)

- EthicoMoral Aspects of NursingДокумент18 страницEthicoMoral Aspects of NursingGemarie Adarlo CastilloОценок пока нет

- Insurance FinalДокумент54 страницыInsurance FinalHarold ApostolОценок пока нет

- O' Gilvie Et Al Vs United StatesДокумент2 страницыO' Gilvie Et Al Vs United Statestiamia_painterОценок пока нет

- Argente V West CoastДокумент3 страницыArgente V West CoastRoland OliquinoОценок пока нет

- Notice of Intent To File LawsuitДокумент3 страницыNotice of Intent To File LawsuitKNOWLEDGE SOURCE100% (3)

- Bullets in Bioethics, NLE, NUrse, NursingДокумент3 страницыBullets in Bioethics, NLE, NUrse, NursingKatОценок пока нет

- Equitable Pci Bank v. NG Sheung Ngor (2007)Документ2 страницыEquitable Pci Bank v. NG Sheung Ngor (2007)Charmaine MejiaОценок пока нет

- Philamcare Health System vs. CA: FactsДокумент8 страницPhilamcare Health System vs. CA: FactsPaul EsparagozaОценок пока нет

- Jeffries v. Life Ins. Co., 89 U.S. 47 (1875)Документ8 страницJeffries v. Life Ins. Co., 89 U.S. 47 (1875)Scribd Government DocsОценок пока нет

- The Insular Life Assurance Company, Ltd. v. Feliciano Full TextДокумент7 страницThe Insular Life Assurance Company, Ltd. v. Feliciano Full TextCessy Ciar KimОценок пока нет

- Philhealth Vs Chinese General HospitalДокумент12 страницPhilhealth Vs Chinese General HospitalMarx AndreiOscar Villanueva YaunОценок пока нет

- De Ysasi III vs. NLRCДокумент1 страницаDe Ysasi III vs. NLRCDeus Dulay100% (1)

- Checklist For Administration of TrustДокумент3 страницыChecklist For Administration of Trustgreysonjames4455Оценок пока нет

- Argent v. West CoastДокумент4 страницыArgent v. West CoastHency TanbengcoОценок пока нет

- Andres V Crown G.R. No. L-10874 January 28, 1958Документ2 страницыAndres V Crown G.R. No. L-10874 January 28, 1958Jay ShelleОценок пока нет

- Labor Law 1 Case DigestДокумент16 страницLabor Law 1 Case DigestRochelle Mae De GuzmanОценок пока нет

- Insurance Digest 14Документ23 страницыInsurance Digest 14Antonio Palpal-latocОценок пока нет

- Insurance Cases FinalsДокумент65 страницInsurance Cases FinalsErik SorianoОценок пока нет

- Ang vs. Fulton Fire InsuranceДокумент3 страницыAng vs. Fulton Fire InsuranceVerdeth Marie WaganОценок пока нет

- Insular Life Assurance Company Vs FelicianoДокумент1 страницаInsular Life Assurance Company Vs FelicianoKayzer SabaОценок пока нет

- Insurance PHILAMCARE Vs CA DigestДокумент6 страницInsurance PHILAMCARE Vs CA DigestPao MillanОценок пока нет

- Insurance Law Case Digest August 21 2019Документ19 страницInsurance Law Case Digest August 21 2019Ma.Rebecca Fe MelendresОценок пока нет

- How To Prevent, Detect and Investigate Fraudulent Claims: Fraud in The Public ServicesДокумент14 страницHow To Prevent, Detect and Investigate Fraudulent Claims: Fraud in The Public ServicesshrishivankarОценок пока нет

- Termsandcondition Home DeclarationДокумент3 страницыTermsandcondition Home DeclarationGarimaОценок пока нет

- Bankers Manual - Top Secret - Volume IIIДокумент75 страницBankers Manual - Top Secret - Volume IIIShane-Charles Wenzel100% (4)

- Woman Files Lawsuit To Prove She Is AliveДокумент15 страницWoman Files Lawsuit To Prove She Is AliveFindLawОценок пока нет

- Ascertaining and Controlling RisksДокумент41 страницаAscertaining and Controlling RisksLucky James AbelОценок пока нет

- Ascertaining and Controlling RisksДокумент41 страницаAscertaining and Controlling RisksUser 010897020197Оценок пока нет

- Insurance MidtermДокумент11 страницInsurance MidtermCriscell JaneОценок пока нет

- Concealment CasesДокумент10 страницConcealment CasescholericmissОценок пока нет

- Health Insurance Product DetailsДокумент7 страницHealth Insurance Product DetailssatishrasalОценок пока нет

- IRDA MemorandumДокумент3 страницыIRDA MemorandumMoneylife Foundation100% (1)

- Compiled DigestДокумент31 страницаCompiled DigestAngela AquinoОценок пока нет

- Assignment 3 InsuranceДокумент33 страницыAssignment 3 InsuranceKing AlduezaОценок пока нет

- July 2002Документ26 страницJuly 2002ScribeSucksDickОценок пока нет

- QBE Issues Forum Insurance Fraud - April 2013Документ8 страницQBE Issues Forum Insurance Fraud - April 2013QBE European OperationsОценок пока нет

- Banking & InsuranceДокумент2 страницыBanking & InsuranceLAXMIRAWATОценок пока нет

- Insular Life Assurance vs. Feliciano Et Al.Документ11 страницInsular Life Assurance vs. Feliciano Et Al.Jaja Ordinario Quiachon-AbarcaОценок пока нет

- 16 Sanidad Vs AguasДокумент3 страницы16 Sanidad Vs Aguaskristian datinguinooОценок пока нет

- 04 Paluwagan NG Bayan vs. KingДокумент6 страниц04 Paluwagan NG Bayan vs. KingArkhaye SalvatoreОценок пока нет

- Articles 21 and 32 DigestДокумент14 страницArticles 21 and 32 DigestKrisna Athena Caruz NeriОценок пока нет

- Verification & Certification of Non Forum ShoppingДокумент35 страницVerification & Certification of Non Forum ShoppingMaricris AcostaОценок пока нет

- Shahnaz HusainДокумент2 страницыShahnaz HusainrpdesaiОценок пока нет

- Case Study On Women EntrepreneurshipДокумент10 страницCase Study On Women EntrepreneurshipkrupamayekarОценок пока нет

- Breakup: Housekeeping & Office Support Services Site:: CategoryДокумент2 страницыBreakup: Housekeeping & Office Support Services Site:: CategorykrupamayekarОценок пока нет

- Breakup - Jul'14 To Dec'14 For WaitersДокумент2 страницыBreakup - Jul'14 To Dec'14 For WaiterskrupamayekarОценок пока нет

- (446995147) 14.vol - 01 - Issue - 05 MEENU GOYAL Women PaperДокумент20 страниц(446995147) 14.vol - 01 - Issue - 05 MEENU GOYAL Women PaperkrupamayekarОценок пока нет

- NestleДокумент31 страницаNestlekrupamayekarОценок пока нет

- Ngo AarambhДокумент23 страницыNgo AarambhkrupamayekarОценок пока нет

- Ngo AarambhДокумент23 страницыNgo AarambhkrupamayekarОценок пока нет

- Questionnaire On ParleДокумент3 страницыQuestionnaire On Parlekrupamayekar92% (13)

- Full Project On SunsilkДокумент28 страницFull Project On Sunsilkkrupamayekar40% (5)

- Drverghese Kurien, Former Chairman of Thegcmmf, Is Recognized As A Key Person Behind The SuccessДокумент14 страницDrverghese Kurien, Former Chairman of Thegcmmf, Is Recognized As A Key Person Behind The Successkrupamayekar75% (4)

- Index: NO. Particulars Page NoДокумент3 страницыIndex: NO. Particulars Page NokrupamayekarОценок пока нет

- Downsizing in Axis BankДокумент10 страницDownsizing in Axis BankkrupamayekarОценок пока нет

- HRM in TcsДокумент42 страницыHRM in TcskrupamayekarОценок пока нет

- Research Methodology On DmartДокумент33 страницыResearch Methodology On Dmartkrupamayekar57% (7)

- Chapter 10Документ22 страницыChapter 10krupamayekarОценок пока нет

- NisanДокумент8 страницNisankrupamayekarОценок пока нет

- Lux SoapДокумент6 страницLux SoapkrupamayekarОценок пока нет

- LICENSES Full Documentation STDДокумент511 страницLICENSES Full Documentation STDffssdfdfsОценок пока нет

- Grievance 1Документ10 страницGrievance 1usham deepika100% (1)

- Comments of Google, Inc., Hipmunk, Inc., Kayak Software Corporation, Skyscanner Limited, Travelzoo, Inc., and Tripadvisor LLCДокумент21 страницаComments of Google, Inc., Hipmunk, Inc., Kayak Software Corporation, Skyscanner Limited, Travelzoo, Inc., and Tripadvisor LLCNSAPrismОценок пока нет

- Olive & The Dreadful Ploger - Proposal PDFДокумент9 страницOlive & The Dreadful Ploger - Proposal PDFSarah SaifiОценок пока нет

- Pulido GraftДокумент4 страницыPulido GraftJoan EvangelioОценок пока нет

- Industrial Organization Markets and Strategies 2Nd Edition Belleflamme Solutions Manual Full Chapter PDFДокумент55 страницIndustrial Organization Markets and Strategies 2Nd Edition Belleflamme Solutions Manual Full Chapter PDFnhatmaiqfanmk100% (9)

- National Municipal Accounting Manual PDFДокумент722 страницыNational Municipal Accounting Manual PDFpravin100% (1)

- Supply Chain Management - Darden's RestaurantДокумент26 страницSupply Chain Management - Darden's RestaurantShameen Shazwana0% (1)

- ACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFДокумент41 страницаACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFCami50% (2)

- General InformationДокумент5 страницGeneral InformationPawan KumarОценок пока нет

- ICON Brochure Low ResДокумент4 страницыICON Brochure Low ResLuis Adrian Gutiérrez MedinaОценок пока нет

- RR No 21-2018 PDFДокумент3 страницыRR No 21-2018 PDFJames Salviejo PinedaОценок пока нет

- Business Management Ethics 1Документ29 страницBusiness Management Ethics 1Christy Malabanan100% (1)

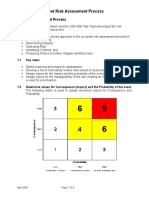

- 4 Fleet Risk Assessment ProcessДокумент4 страницы4 Fleet Risk Assessment ProcessHaymanAHMEDОценок пока нет

- Literature ReviewДокумент6 страницLiterature Reviewanon_230550501Оценок пока нет

- RAMPT Program PlanДокумент39 страницRAMPT Program PlanganeshdhageОценок пока нет

- Write UpДокумент5 страницWrite UpAli Tariq ButtОценок пока нет

- Sap FicaДокумент34 страницыSap Ficahoney_213289% (9)

- Republic Act No 1400Документ8 страницRepublic Act No 1400anneОценок пока нет

- ARTA PresentationДокумент45 страницARTA PresentationRaissa Almojuela Del Valle0% (1)

- PAT Ch1 - Eurotech V CuizonДокумент1 страницаPAT Ch1 - Eurotech V CuizonAlthea M. SuerteОценок пока нет

- Tutorial 3 QN 3Документ2 страницыTutorial 3 QN 3Rias SahulОценок пока нет

- MR Smart Has 75 000 Invested in Relatively Risk Free Assets ReturningДокумент1 страницаMR Smart Has 75 000 Invested in Relatively Risk Free Assets ReturningAmit PandeyОценок пока нет

- DepreciationДокумент35 страницDepreciationAlexie Gonzales60% (5)

- Special Lecture 1 Accounting For A Merchandising & Manufacturing Business Learning ObjectivesДокумент9 страницSpecial Lecture 1 Accounting For A Merchandising & Manufacturing Business Learning ObjectivesJenelee Angela MagnoОценок пока нет

- Confirmation - Delta Air LinesДокумент5 страницConfirmation - Delta Air LinesAkinoJohnkennedyОценок пока нет

- The Demand Curve Facing A Competitive Firm The ...Документ3 страницыThe Demand Curve Facing A Competitive Firm The ...BLESSEDОценок пока нет

- FAQ International StudentsДокумент2 страницыFAQ International StudentsНенадЗекавицаОценок пока нет

- Guidance To BS 7121 Part 2 2003Документ4 страницыGuidance To BS 7121 Part 2 2003mokshanОценок пока нет

- Schneider Electric Annual Report 2011Документ280 страницSchneider Electric Annual Report 2011Abdullah MelhemОценок пока нет