Академический Документы

Профессиональный Документы

Культура Документы

Balance Sheet Managementmodule D

Загружено:

Muralidhar GoliОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance Sheet Managementmodule D

Загружено:

Muralidhar GoliАвторское право:

Доступные форматы

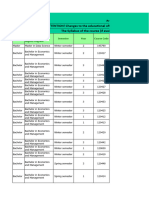

BALANCE SHEET MANAGEMENT MODULE D

1). As per BASEL-II, tier-3 capital is allowed to meet which additional category of risk: market risk

2). Money at call and short notice includes all loans made in the interbank call money market that is

repayable within 15 days notice.

3). Net interest income (NII): interest income interest expenses

4). Net interest margin (NIM): net interest income / average total assets

5). Net interest margin can be viewed as the spread on earning assets.

6). the ratio of the shareholders funds to the total assets measures the shifts in the ratio of owned funds

to total funds. This fact assesses the sustenance capacity of the bank.

7). Price matching basically aims to maintain spreads by ensuring that deployment of liabilities will be at

a rate higher than the costs.

8). Price matching exercise would indicate whether the institution is in a position to benefit from rising

interest rates by having a positive gap (assets>liabilities) or whether it is in a position to benefit from

declining interest rates by a negative gap (liabilities>assets).

9). the banks balance sheet comprises of sources and uses of funds liabilities and net worth from the

sources of the bank funds, where as assets represent uses of funds to generate revenue for the bank.

10). Systemic risk is the risk that a default by one financial institution will create a ripple effect that

leads to defaults by other financial institutions and threatens the stability of the financial system.

11). in calculating the Cooke ratio both on balance sheet and off balance sheet items are considered.

The ratio is used to calculate banks total risk-weighted assets. It is a measure of the banks total credit

exposure.

12). A borrower is required to pay part of principal and accrued interest every month as per loan

agreement. He is promptly paying interest every month, but not paying principal for the past four

months. The account will be classified as sub standard asset.

13). Pillar 1 of capital framework relates to: minimum capital requirements.

14). Pillar-3 of capital framework relates to: market discipline.

15). CRAR: capital to risk weighted assets

16). CAR: capital adequacy ratio

17). for calculating the capital charge for credit risk under standardized approach, an unrated bank will

be assigned 100% risk weight.

18). the concept of expected loss (EL) and UN expected loss (UL) are used in calculating capital charge on

operational risk.

19). As per RBI guidelines, when did the Indian banks with overseas presence and foreign banks in India

migrate to BASEL-II guidelines? 31-03-2008

20). Banks are required to accumulate data for five years before it can use for internal models in

calculate capital charge for operational risk.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Letter of CreditДокумент1 страницаLetter of CreditMuralidhar GoliОценок пока нет

- DEMONITISATIONДокумент2 страницыDEMONITISATIONMuralidhar GoliОценок пока нет

- Memorised CAIIB BFM Questions MAY 2013Документ3 страницыMemorised CAIIB BFM Questions MAY 2013Pratheesh Tulsi33% (3)

- BFM CДокумент10 страницBFM CMuralidhar Goli100% (1)

- Rating MigrationДокумент1 страницаRating MigrationMuralidhar GoliОценок пока нет

- Risk Management IДокумент2 страницыRisk Management IMuralidhar GoliОценок пока нет

- Caiib Sample QuestionsДокумент15 страницCaiib Sample QuestionsVijay25% (4)

- ABM-numerical With Solutions by Neeraj AgnihotriДокумент23 страницыABM-numerical With Solutions by Neeraj AgnihotriMuralidhar Goli100% (5)

- Hospital BedsДокумент21 страницаHospital BedsMuralidhar GoliОценок пока нет

- Full Page PhotoДокумент1 страницаFull Page PhotoMuralidhar GoliОценок пока нет

- Abm CCДокумент3 страницыAbm CCMuralidhar GoliОценок пока нет

- BFM BДокумент12 страницBFM BMuralidhar GoliОценок пока нет

- Jaiib QuesДокумент30 страницJaiib QuesMuralidhar GoliОценок пока нет

- PC Magazine - March 2014Документ152 страницыPC Magazine - March 2014Muralidhar GoliОценок пока нет

- Bed MakingДокумент14 страницBed MakingHarold Haze Cortez100% (1)

- AptitudeДокумент5 страницAptitudeKamaraj MuthupandianОценок пока нет

- Recruitment Notice 2011 NoДокумент5 страницRecruitment Notice 2011 NoSrikant PandeyОценок пока нет

- NurseДокумент89 страницNurseMuralidhar Goli100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Crisis in KeynesДокумент8 страницCrisis in KeynesAppan Kandala VasudevacharyОценок пока нет

- Importance of International FinanceДокумент4 страницыImportance of International FinanceNandini Jagan29% (7)

- Dictionary of EconomicsДокумент764 страницыDictionary of Economicsalimojalima100% (1)

- Educational Offer Social Sciences and Humanities Area 2023-2024Документ192 страницыEducational Offer Social Sciences and Humanities Area 2023-2024WASIM LAGHARIОценок пока нет

- Micro Problem SetДокумент5 страницMicro Problem SetAkshay JainОценок пока нет

- 4th. Elasticity of Demand and SupplyДокумент25 страниц4th. Elasticity of Demand and SupplyLia CollineОценок пока нет

- Market Structure and Powerful Setups - Wade FX SetupsДокумент153 страницыMarket Structure and Powerful Setups - Wade FX Setupspg_hardikar97% (38)

- Venture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhallДокумент24 страницыVenture Capital & Ventre Capitalist: Made By: Gagan Vats Priyanka Tuteja Achal Jain Akshat DhalltarunshridharОценок пока нет

- 201232621Документ48 страниц201232621The Myanmar TimesОценок пока нет

- Offshore WindДокумент18 страницOffshore WindHimanshu BhandariОценок пока нет

- Microeconomics Test 3Документ26 страницMicroeconomics Test 3a24dkОценок пока нет

- Business Finance AssignmentДокумент3 страницыBusiness Finance Assignmentk_Dashy8465Оценок пока нет

- (Harry Braverman) Labor and Monopoly CapitalДокумент183 страницы(Harry Braverman) Labor and Monopoly CapitalwordbenderОценок пока нет

- Bator, 1958Документ30 страницBator, 1958Francisco Pinheiro CatalãoОценок пока нет

- Equipment Favorable Market Unfavorable Market Maximax or OptimisticДокумент2 страницыEquipment Favorable Market Unfavorable Market Maximax or OptimisticÃshrąf ShorbajiОценок пока нет

- (English-French) Degrowth, Explained (DownSub - Com)Документ11 страниц(English-French) Degrowth, Explained (DownSub - Com)MOHAMED EL BARAKAОценок пока нет

- Linus Straight S Utility Function Is U A B AДокумент1 страницаLinus Straight S Utility Function Is U A B Atrilocksp SinghОценок пока нет

- ECO - Chapter 01 The Subject Matter of EconometricsДокумент42 страницыECO - Chapter 01 The Subject Matter of EconometricsErmias GuragawОценок пока нет

- 02 Online Activity 1 (TQM)Документ1 страница02 Online Activity 1 (TQM)Chelle DatlagОценок пока нет

- Aumann - 1962 - Utility Theory Without The Completeness AxiomДокумент6 страницAumann - 1962 - Utility Theory Without The Completeness Axiomapi-256525507Оценок пока нет

- Martin J Pring PDFДокумент64 страницыMartin J Pring PDFAlvianKrisnhaDewanggaОценок пока нет

- Theories of DividendДокумент2 страницыTheories of DividendBALRAM SHAHОценок пока нет

- Financial Market Problems and FormulasДокумент3 страницыFinancial Market Problems and FormulasNufayl KatoОценок пока нет

- Discovery of Comparative Advantage - Aldrich 2004Документ21 страницаDiscovery of Comparative Advantage - Aldrich 2004Oana CozmaОценок пока нет

- Ere 2Документ24 страницыEre 2Adey NgОценок пока нет

- The Blueprint of Telecommunication IndustryДокумент9 страницThe Blueprint of Telecommunication IndustryTage Nobin100% (1)

- RRL JamДокумент4 страницыRRL JamJam DomingoОценок пока нет

- 4.HG Manur Ch-4 Significance and Concept of Terms of TradeДокумент13 страниц4.HG Manur Ch-4 Significance and Concept of Terms of Tradeদুর্বার নকিবОценок пока нет