Академический Документы

Профессиональный Документы

Культура Документы

Acct 205 Sun Photography Cycle With Answers Acct205

Загружено:

Jamie Robles0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров3 страницыRose Glass began a new photography business on December 1 called "Sun Photography, Inc." she invested $10,000 cash and $25,000 of Photography Equipment in the company. She pre-paid $6,000 cash for an insurance policy to cover the next 6 months.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документRose Glass began a new photography business on December 1 called "Sun Photography, Inc." she invested $10,000 cash and $25,000 of Photography Equipment in the company. She pre-paid $6,000 cash for an insurance policy to cover the next 6 months.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

65 просмотров3 страницыAcct 205 Sun Photography Cycle With Answers Acct205

Загружено:

Jamie RoblesRose Glass began a new photography business on December 1 called "Sun Photography, Inc." she invested $10,000 cash and $25,000 of Photography Equipment in the company. She pre-paid $6,000 cash for an insurance policy to cover the next 6 months.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

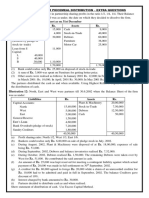

Accounting 205 Sun Photography Inc.

Cycle Problem Beth Lasky, CPA JD

Name ________________________________

Instructions: Rose Glass begun a new photography business on December 1 called Sun Photography, Inc.

1. Prepare journal entries to record the events below.

2. Post your Journal entries to the ledgers provided.

3. Prepare the adjusting entries from the facts provided.

4. Post the adjusting entries to your ledgers.

5. Prepare an Adjusted Trial Balance from your ledgers.

6. Prepare financial statements from you Adjusted Trial Balance, first an Income Statement, then a

Statement of Owners Equity, then a Balance Sheet.

7. Prepare closing entries and post them to the ledgers.

December

1 Rose invested $10,000 cash and $25,000 of photography equipment in the company in exchange

for common stock. The equipment is estimated to have a 10 year life and a $1,000 salvage value.

2 Rose pre-paid $6,000 cash for an insurance policy to cover the next 6 months. Coverage is to begin

immediately.

5 Rose purchased photography supplies for $2,000 on account.

7 Rose photographed rare pieces of art for the NOLA Museum and sent a bill for $4,000.

10 City Park paid Rose $6,000 in advance to photograph park wildlife for a new book to be published soon.

11 Rose photographed a wedding on Bayou St. John and was paid $2,000 cash.

15 Rose paid $1200 towards her account payable.

18 Rose paid $1,000 cash to her assistant for her salary.

20 The Museum of Art paid Rose $2,500 in partial payment of the bill Rose sent previously.

30 Rose paid $500 cash for December utilities.

30 Rose paid herself a $4000 dividend.

Dec. 1 Cash 10,000

Photography Equipment 25,000

Common Stock 35,000

2 Prepaid Insurance 6,000

Cash 6,000

5 Supplies 2,000

Accounts payable 2,000

7. Accounts receivable 4,000

Photography fees earned 4,000

10. Cash 6,000

Unearned revenue 6,000

11. Cash 2,000

Photography fees earned 2,000

15. Accounts Payable 1200

Cash 1200

18 Salaries Expense 1,000

Cash 1,000

20. Cash 2,500

Accounts receivable 2,500

30 Utilities Expense 500

Cash 500

30. Dividends 4,000

Cash 4,000

Adjusting Entries Please record adjusting entries as of December 31 based on the facts below.

1.) Rose records one months depreciation on the equipment. The equipment cost $25,000 is estimated to have

a 10 year life and a $1,000 salvage value. (Note: For one months depreciation take the annual amount and

divide by 12)

Depreciation expense 200

Accumulated depreciation 200

(25,000 1,000)/10 = 2,400 per year/12 = $200 per month.

2) Rose records the expiration of one months pre-paid insurance during December. Rose had paid $6,000 for

an insurance policy to cover six months.

Insurance expense 1,000

Prepaid Insurance 1,000

$6,000/6 - $1,000 per month

3) An inventory at the end of the month revealed that only $1200 of photography supplies remained on hand.

Rose had bought $2,000 at the beginning of the month.

Supplies expense 800

Supplies 800

$2000 1200 = 800 used.

4) Rose performed 1/3 of the photography services promised to City Park. City Park had paid Rose $6,000 in

advance to photograph park wildlife for a new book to be published soon.

Unearned Revenue 2,000

Photography Fees earned 2,000

5) Rose records $800 of unrecorded and unpaid salaries owed to her assistant at year end.

Salaries expense 800

Salaries Payable 800

6) Late in months, Rose completed a project for the Jazz and Heritage Foundation to document Mardi Gras

Indians at Christmas. She has not yet sent her bill or recorded the $2500 she earned.

Accounts receivable 2500

Photography Fees earned 2500

Sun Photography

Income Statement

For the Year Ended Dec. 31

Revenues:

Photography fees earned .................................. $10,500

Expenses:

Depreciation Expense ...................................... 200

Insurance Expense ........................................ 1,000

Salaries Expense ........................................... 1,800

Supplies Expense ............................................ 800

Utilities Expense ............................................... 500

Total Expenses ........................................ 4300

Net income $6,200

Sun Photography

Statement of Retained Earnings

For the Year Ended Dec. 31

Retained Earnings, December. 1 ............................ $ 0

Add: Net income ................................................ 6,200

Less: Dividends ................................................... (4,000)

Retained Earnings, December 31 ........................... $2,200

Sun Photography

Balance Sheet

As of December 31

Assets Liabilities

Cash ..................................... $7,800 Accounts payable ............... $ 800

Accounts receivable 4,000 Salaries Payable 800

Supplies ............................... 1,200 Unearned Revenue 4,000

Prepaid Insurance ................ 5,000 Total Liabilities 5,600

Equipment 25,000 Equity

Less: Accum. Depr. 200 24,800 Common Stock 35,000

Retained Earnings 2,200

Total Equity 37,200

Total assets ......................... $42,800 Total liabilities & equity ...... $42,800

Please record your closing Entries and post them to the ledgers

Revenue 10,500

Income Summary 10,500

Income Summary 4,300

Depreciation Expense ...................................... 200

Insurance Expense ........................................ 1,000

Salaries Expense ........................................... 1,800

Supplies Expense ............................................ 800

Utilities Expense ............................................... 500

Income Summary 6,200

Retained Earnings 6,200

Retained Earnings 4,000

Dividends 4000

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Co Blue PrintДокумент52 страницыCo Blue PrintBewqetu SewMehone100% (1)

- BPM Financial Modelling Fundamentals Practical Exercise SolutionsДокумент19 страницBPM Financial Modelling Fundamentals Practical Exercise SolutionsDaria YurovaОценок пока нет

- Review Maam Tormis 1Документ10 страницReview Maam Tormis 1Kristy Dela CernaОценок пока нет

- Tangible Non-Current Assets: QuestionsДокумент5 страницTangible Non-Current Assets: QuestionsЕкатерина КидяшеваОценок пока нет

- Ohada Accounting Plan PDFДокумент72 страницыOhada Accounting Plan PDFNchendeh Christian50% (2)

- Module 6 Leasing (Final)Документ74 страницыModule 6 Leasing (Final)Endrit MansakuОценок пока нет

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesДокумент8 страницDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaОценок пока нет

- Piecemeal - Extra QuestionsДокумент4 страницыPiecemeal - Extra Questionskushgarg627Оценок пока нет

- Chapter 2 Cost Terms, Concepts, and ClassificationsДокумент4 страницыChapter 2 Cost Terms, Concepts, and ClassificationsQurat SaboorОценок пока нет

- Self Study Solutions Chapter 5Документ16 страницSelf Study Solutions Chapter 5Jannatul FerdousОценок пока нет

- Delicatessen and Bakery Business PlanДокумент26 страницDelicatessen and Bakery Business PlanJeorge PaxОценок пока нет

- C&MДокумент18 страницC&MSultanaQuader50% (2)

- AP-5906 ReceivablesДокумент6 страницAP-5906 ReceivablesjhouvanОценок пока нет

- Soce2023bskeforms Form1Документ1 страницаSoce2023bskeforms Form1Jamer Ain't SimpОценок пока нет

- Sugarcane Juice Beverage: 1.0 Product and Its ApplicationsДокумент6 страницSugarcane Juice Beverage: 1.0 Product and Its Applicationsygnakumar100% (2)

- Coop 7Документ2 страницыCoop 7hoxhiiОценок пока нет

- Business Studies Paper 3Документ6 страницBusiness Studies Paper 3nkosiissexyОценок пока нет

- Emirates ReportДокумент23 страницыEmirates Reportrussell92Оценок пока нет

- Managerial Accounting Wey Chapter 2Документ88 страницManagerial Accounting Wey Chapter 2Steven ShamОценок пока нет

- (Ahmed Riahi-Belkaoui) Earnings Measurement, DeterДокумент200 страниц(Ahmed Riahi-Belkaoui) Earnings Measurement, DeterdolutamadolutamaОценок пока нет

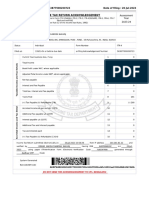

- Itr Fy 22-23-1Документ5 страницItr Fy 22-23-1Omkar kaleОценок пока нет

- Tax 267 Feb21 PyqДокумент8 страницTax 267 Feb21 PyqKenji HiroОценок пока нет

- Chapter FourДокумент14 страницChapter FourMuzamel AbdellaОценок пока нет

- Chapter 7: Accounting For The Business-Type Activities of State and Local GovernmentsДокумент37 страницChapter 7: Accounting For The Business-Type Activities of State and Local GovernmentshagdincloobleОценок пока нет

- Jonaxx Trading Corporation 1ST PageДокумент1 страницаJonaxx Trading Corporation 1ST PageRona Karylle Pamaran DeCastroОценок пока нет

- Chapter 3 Adjusting The AccountsДокумент87 страницChapter 3 Adjusting The AccountsDuyen Dang Binh Phuong100% (1)

- Strb200809 FullДокумент352 страницыStrb200809 FullRohan MaakanОценок пока нет

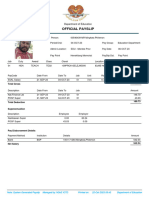

- Official Payslip: Department of EducationДокумент1 страницаOfficial Payslip: Department of Educationphillmingkwa2017Оценок пока нет

- BUS020 Chapter 1 (Outline - Libby Libby)Документ5 страницBUS020 Chapter 1 (Outline - Libby Libby)Amanda RodriguezОценок пока нет

- Ratio AnalysisДокумент37 страницRatio AnalysisPriya SaxenaОценок пока нет