Академический Документы

Профессиональный Документы

Культура Документы

Creating VAT Ledgers in Tally

Загружено:

surasu0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров4 страницыTally Leger Creation

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTally Leger Creation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров4 страницыCreating VAT Ledgers in Tally

Загружено:

surasuTally Leger Creation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Show

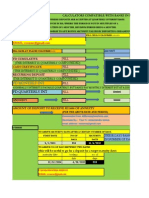

Creating VAT Ledgers

Input VAT

To create a Input VAT Ledger,

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

Enter the Name of the Input VAT ledger you wish to create, for e.g., Input VAT @ 4% 1.

Select Duties & Taxes as the group name in the Under field. 2.

Select VAT from the Type of Duty/Tax list in the field Type of Duty/Tax. 3.

Select the requisite VAT/Tax Class, for e.g., Input VAT @ 4% from the VAT/TAX Class list. 4.

Percentage of Calculation and Method of Calculation are updated automatically based on the Type of

Duty/Tax and VAT/Tax Class selected.

5.

For Rounding Method select as Not Applicable 6.

Creating VAT Ledgers http://www.tallysolutions.com/website/CHM/TallyERP9/Dealer_Excise/...

1 of 4 02-Sep-14 11:39

6. Press Enter to Accept to save 6.

Note: It is recommended t o create separate Input VAT ledgers with appropriate VAT classification for

different rat es of VAT. However, Tally.ERP 9 provides you the flexibility t o use a common Input VAT ledger

for different rates, by select ing VAT classification as Not Applicable and allows select ion of required

classification from the list of VAT/Tax Class while recording a transaction.

Output VAT

To create a Output VAT Ledger,

Go to Gateway of Tally > Accounts Info. > Ledgers > Create

Enter the Name of the output VAT ledger you wish to create, for e.g., Output VAT @ 4% 1.

Select Duties & Taxes as the group name in the under field. 2.

Select VAT from the Type of Duty/Tax list in the field Type of Duty/Tax. 3.

Select the requisite VAT/Tax Class, for e.g., Output VAT @ 4% from the VAT/TAX Class list. 4.

Creating VAT Ledgers http://www.tallysolutions.com/website/CHM/TallyERP9/Dealer_Excise/...

2 of 4 02-Sep-14 11:39

Percentage of Calculation and Method of Calculation are updated automatically based on the Type of

Duty/Tax and VAT/Tax Class selected.

5.

Creating VAT Ledgers http://www.tallysolutions.com/website/CHM/TallyERP9/Dealer_Excise/...

3 of 4 02-Sep-14 11:39

Press Enter to Accept to save 6.

Note: It is recommended t o create separate Output VAT ledgers wit h appropriat e VAT classification for

different rat es of VAT. However, Tally.ERP 9 provides you the flexibility t o use a common Out put VAT ledger

for different rates, by select ing VAT classification as Not Applicable and allows select ion of required

classification from the list of VAT/Tax Class while recording a transaction.

www.tallysolutions.com

Creating VAT Ledgers http://www.tallysolutions.com/website/CHM/TallyERP9/Dealer_Excise/...

4 of 4 02-Sep-14 11:39

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- All Banking Calculator April 2012Документ28 страницAll Banking Calculator April 2012surasuОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- TDL Reference ManualДокумент628 страницTDL Reference ManualhanifmitОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- PanchangamДокумент3 страницыPanchangamsurasuОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Tintumon JokesДокумент53 страницыTintumon JokesHIRANGER100% (2)

- Endhiran StillsДокумент43 страницыEndhiran Stillssurya069Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Coex: Architecture Comprehensive Course: ORQUESTA, RONALD P. - 201610154 Bsarch 5-1Документ9 страницCoex: Architecture Comprehensive Course: ORQUESTA, RONALD P. - 201610154 Bsarch 5-1RONALD ORQUESTAОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Study of Selected Petroleum Refining Residuals Industry StudyДокумент60 страницStudy of Selected Petroleum Refining Residuals Industry StudyOsama AdilОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Mach4 G and M Code Reference ManualДокумент81 страницаMach4 G and M Code Reference ManualMegi Setiawan SОценок пока нет

- An Analysis of Stravinsky's Symphony of Psalms Focusing On Tonality and HarmonyДокумент68 страницAn Analysis of Stravinsky's Symphony of Psalms Focusing On Tonality and Harmonyr-c-a-d100% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Internetworking: 1 Coms22101 Lecture 9Документ12 страницInternetworking: 1 Coms22101 Lecture 9Pradeep RajaОценок пока нет

- Características Clínicas y Resultados de Los Pacientes Con COVID-19 Con Ventilación Invasiva en ArgentinaДокумент10 страницCaracterísticas Clínicas y Resultados de Los Pacientes Con COVID-19 Con Ventilación Invasiva en ArgentinaSMIBA MedicinaОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Person Name: NDT Management CoordinatorДокумент4 страницыPerson Name: NDT Management CoordinatorDendy PratamaОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ultima X Series Instruction Manual - enДокумент141 страницаUltima X Series Instruction Manual - enStefano EsmОценок пока нет

- Je Tire 006084Документ7 страницJe Tire 006084AmerОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Lean ManufacturingДокумент28 страницLean ManufacturingagusОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Periodicity in 3D Lab Report FormДокумент2 страницыPeriodicity in 3D Lab Report FormZIX326100% (1)

- Thesis PDFДокумент115 страницThesis PDFRavi KumarОценок пока нет

- Design of Absorber: 5.1 AbsorptionsДокумент13 страницDesign of Absorber: 5.1 AbsorptionsNaya Septri HanaОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- (Paul Cilliers, Rika Preiser) Complexity, DifferenceДокумент302 страницы(Paul Cilliers, Rika Preiser) Complexity, Differencehghghgh100% (3)

- Design of Machine Elements - IДокумент69 страницDesign of Machine Elements - IAnonymous utfuIcnОценок пока нет

- 42re TechДокумент7 страниц42re Techmontrosepatriot100% (2)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Understanding Water Discounts and Lye Solution in SoapmakingДокумент7 страницUnderstanding Water Discounts and Lye Solution in SoapmakingIoanaОценок пока нет

- CharacterizigPlant Canopies With Hemispherical PhotographsДокумент16 страницCharacterizigPlant Canopies With Hemispherical PhotographsGabriel TiveronОценок пока нет

- Product Position and Overview: Infoplus.21 Foundation CourseДокумент22 страницыProduct Position and Overview: Infoplus.21 Foundation Courseursimmi100% (1)

- Theodore Sider - Logic For Philosophy PDFДокумент377 страницTheodore Sider - Logic For Philosophy PDFAnonymous pYK2AqH100% (1)

- Mathematical Model of Transportation ProblemДокумент14 страницMathematical Model of Transportation ProblemwasimghghОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Brugg Cables Presentation ECMC PDFДокумент47 страницBrugg Cables Presentation ECMC PDFlilcristiОценок пока нет

- On The Way To Zero Defect of Plastic-Encapsulated Electronic Power DevicesPart III Chip Coating Passivation and DesignДокумент8 страницOn The Way To Zero Defect of Plastic-Encapsulated Electronic Power DevicesPart III Chip Coating Passivation and DesignJiyang WangОценок пока нет

- Air-Pollution-Meteorology UNIT IIДокумент91 страницаAir-Pollution-Meteorology UNIT IIDR. Ramesh ChandragiriОценок пока нет

- Change To ModbusTCP Slave R102Документ8 страницChange To ModbusTCP Slave R102Евгений МалыченкоОценок пока нет

- ELTE 307 - DR Mohamed Sobh-Lec - 5-1-11-2022Документ28 страницELTE 307 - DR Mohamed Sobh-Lec - 5-1-11-2022Lina ElsayedОценок пока нет

- Dayton Miller's Ether-Drift ExperimentsДокумент33 страницыDayton Miller's Ether-Drift Experimentsxreader0Оценок пока нет

- Grade 4 Decimals: Answer The QuestionsДокумент4 страницыGrade 4 Decimals: Answer The QuestionsEduGainОценок пока нет

- Che 243 Fluid Dynamics: Problem Set #4 Solutions: SolutionДокумент9 страницChe 243 Fluid Dynamics: Problem Set #4 Solutions: SolutionKyungtae Park100% (2)

- Lipid WorksheetДокумент2 страницыLipid WorksheetMANUELA VENEGAS ESCOVARОценок пока нет