Академический Документы

Профессиональный Документы

Культура Документы

SVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department Observations

Загружено:

paramsn0 оценок0% нашли этот документ полезным (0 голосов)

57 просмотров8 страницrisk assessment

Оригинальное название

Risk-09-RAM

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документrisk assessment

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

57 просмотров8 страницSVP-Advances (Eastern Zone) : VP & Head (SME Centre-BBSR) : Rameswar Agro Industries PVT LTD Replies To Risk Department Observations

Загружено:

paramsnrisk assessment

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 8

SVP-Advances (Eastern Zone):

VP & Head (SME Centre-BBSR):

Rameswar Agro Indstr!es Pvt "td

Re#$!es to R!s% &e#artment o'servat!ons

January 21, 2009

('servat!on o) R!s% &e#tt Re#$* to R!s% Comment

('servat!on o) VP +R!s%,:

The sanct!on of takeover of

Corporation Bank Term Loans should

be after compliance all their terms of

sanction letter dt 1!2!200"#includin$

%romoters mar$in of &0!11' for TL2,

repayment(e)istin$ and future,

additional capital infusion for cost

escalation #*s 9 lacs as per

comparative sheet and any other

e)penses, on +ithdra+al of unsecured

for tenor of TL etc! so as to ensure this

is not treated as restructured!

The promoters have already brou$ht in the funds

presently as unsecured loan and *,-.%L has

initiated steps to convert the unsecured loan to

paid(up capital so as to increase the capital to *s

&00 lacs! The process is likely to be completed

+ithin ne)t 2(& days! /e shall ensure obtainin$

Copy of 0orm(2 1 0orm(2 before disbursement of

credit facilities!

Term Loan a3cs +ith Corporation Bank is re$ular

as on date! .ecessary undertakin$ shall be

obtained for continuation of unsecured loan as

ori$inally estimated so as to achieve desired

4nancial levera$e position!

567 Center to con4rm reconciliation

and end use of disbursed TL amounts!

/e have rechecked the TL sanctioned,

repayment schedule stipulated 1 present o3s

+ith Corporation Bank 89etails attached as

anne)ure to ,ppl .ote: and observe that there

are .; irre$ularity in the a3cs as on date!

,s far as end(use is concerned, +e have recently

inspected the unit 1 found that the assets

creation has been in line +ith envisa$ed pro<ect

parameters! The unit has commenced

commercial operation nearly 1= years back! ;ur

overall impression about the unit is satisfactory!

Takeover norms be complied +ith! .oted for compliance!

The pro<ect e)ecution in the last 9

months have been only to the tune of

1" lacs +hich is a point of concern(

reasons be obtained and satis4ed!

,s detailed in our ,ppl .ote, o+in$ to technical

di>culty 8chan$e in scope of pro<ect and startin$

of pro<ect completion3repayment date:, the

residual Term Loan +as not availed from

Corporation Bank! The promoters completed

pro<ect +ork to the e)tent of *s 1" lacs from

their internal sources! ?o+ever, +ith sanction of

the proposed facility, +e e)pect the cape) to be

completed +ithin the revised time frame!

The valuation of property is optimistic

particularly considerin$ @alin$a

?atchery is havin$ ne$ative .et +orth

and likely to be +ound up(only land

price maybe realiAed!

/e have assi$ned the valuation +ork to our

empanelled valuer 1 the report is e)pected

shortly! The unit as +ell as collateral are

strate$ically located 8.ear @handa$iri 5Buare on

.!?(2: and the valuation estimated by the

promoters is considered acceptable! ,s far as

.e$ative .et+orth 8of *s 29 lacs: of @alin$a

1

?atchery is concerned, the promoters have

infused lon$ term unsecured loan of *s 9C lacs

into the Company! -f the same is considered as

Buasi eBuity, then the Company +ould have a

.et +orth of *s &" lacs as on 6arch &1, 200"

+ith Aero term liability!

*atin$ con4rmed at 567(! Thou$h +ith credit enhancement throu$h

mort$a$e of immovable property, the 4nal credit

ratin$ +orks out to 567(&85;:! ?o+ever, as per

the su$$estion, +e have accepted the ratin$ as

567( and accordin$ly, the note is placed to

Competent ,uthority for sanction!

%resent cash Do+ and sources of

capital infusion be ascertained apriori!

The promoters have already infused ma<ority of

the fund as unsecured loan, +hich +ill be

converted to paid(up capital prior to

disbursement of credit facilities! The promoters

are in business for last t+o decades and are

4nancially stron$ 8evident from total funds

invested in *,-.%L 1 @alin$a ?atchery! 0urther,

the promoters have recently sold oE part of their

land holdin$ to raise capital, +hich is bein$

invested in the t+o businesses! Therefore, +e do

not envisa$e any issue +ith re$ards to infusion

of capital!

There is duplication in machineries the

reasons for +hich be ascertained! The

operatin$ e>ciency and mar$ins be

compared +ith similar siAed peers!

%ro<ect cost of TL& be veri4ed!

5ince the Company is settin$ up second rice mill

plant +ith F tph, there is bound to be certain

duplication of machineries! ?o+ever, +e have

rechecked the scope of earlier pro<ects 84nanced

by Corporation Bank: and there is no case of

double 4nancin$ 1 separate assets are bein$

created under the proposed cape)! 9etailed

Chartered 7n$ineer certi4cate +ith re$ards to

cost of TL(& shall be obtained before

disbursement of limits!

,dvance be monitored by 567 Center,

this bein$ a G/atchH account!

.oted for compliance!

.o e)cess borro+in$ be allo+ed!

7nhanced CC be allo+ed after pro<ect

completion! 5hort(term funds be not

used for TL servicin$, or promoters

contribution!

,s per the second method of lendin$, the

Company is eli$ible for CC limit of *s 220 lacs

for 0I 200"(09 and *s &00 lacs for 0I 2009(10!

The Company has reBuested for disbursement of

full limit of *s &00 lacs since this is the main

season for procurement of paddy!

The shortfall is mainly on account of considerin$

term loan installments as part of current liability!

-f the same is e)cluded, the Current *atio +orks

out to above 1!&& 1 there +ould no e)cess

borro+in$!

?o+ever, +e have noted the observations and

shall restrict the CC dra+l to *s 220 lacs till

6arch &1, 2009 87li$ible limit as per 6%B0

2

method: and shall disburse the residual amount

durin$ 0I 2009(10 sub<ect to availability of

dra+in$ po+er!

Rat!ng

The %resent ratin$ assi$ned is

$enerally in order!

0actual!

5ince the 4nancial year 200C(0" +as the 4rst full

year of commercial operation, the sales 1

pro4tability C,J* +ere not available for ratin$

purpose! 9ue to this, the score +ith respect to

$ro+th parameters +ere nil! This also lo+ered

the 4nancial ratin$ of the Company! ?o+ever,

once the Company completes the current

4nancial year, +e e)pect the 4nancial as +ell as

overall ratin$ to improve si$ni4cantly!

The *atin$ ;utlook has some

uncertainties due to the delay in the

pro<ect of the company, +hich is

presently under implementation!

The promoters have a successful track record of

timely implementation of 4rst phase of the

pro<ect, +hose commercial operation started as

per schedule! ;nce the proposed limit is

disbursed, +e e)pect the promoters to

implement the pro<ect as per schedule!

-!nanc!a$ Parameters

The captioned credit proposal is for

takeover of the e)istin$ TL 3 CC limits

of the company +ith Corporation Bank

and some enhancement are also

proposed! ,s per the sanction of

Corporation Bank, the e)pansion

pro<ect undertaken by the company

+as to be completed by 12!02!200"!

?o+ever, the same has yet not been

completed! The reasons for the same

needs to be ascertained and

commented upon!

,s detailed in our ,ppl .ote, there +as no delay

in 4rst pro<ect, +hich +as completed +ell +ithin

time i!e! &1

st

9ecember 200F! The *epayment

+as started in 1

st

January 200C and continuin$

till date as per repayment schedule prescribed

by Corporation Bank! The second pro<ect +as

conceived in the month of 5eptember 200C!

?o+ever, the company $ot the sanction in

0ebruary 200" due to internal process of Corp

Bank! 9ue to shorta$e of pro<ect implementation

period 8from " months to months:, the

Company could complete part of pro<ect by June

200" 8payment started:! -n the meantime

promoters revised their ori$inal plan and

proposed a ne+ boiled plant instead of a F T%?

ra+ plant! Therefore the total loan reBuired a

revision +ith fresh enhancement! The chan$e in

scope of pro<ect is considered as <usti4ed 1

hence accepted for our sanction!

The companyKs $ross block as on

6arch &1, 200C +as *s! 2" lacs,

+hich +ere in line +ith the pro<ect cost

of *s! &1 lacs considered under TL -

by Corporation Bank!

The company added 4)ed assets

+orth *s! C0 lacs in 0I 200C(0" and

C/-% as on 6arch &1, 200" +as *s!

20 lacs! This indicates that an

amount of *s! &10 lacs has been spent

on the e)pansion pro<ect of the

company +here the total pro<ect cost

+as *s! FC lacs! The company is no+

indicatin$ pro<ect investment as *s!

0actual!

;+in$ to technical di>culty 8chan$e in scope of

pro<ect and startin$ of pro<ect

completion3repayment date:, the residual Term

Loan +as not availed from Corporation Bank!

The promoters completed pro<ect +ork to the

e)tent of *s 1" lacs from their internal sources!

?o+ever, +ith sanction of the proposed facility,

+e e)pect the cape) to be completed +ithin the

revised time frame!

3

22" lacs till 9ecember 12, 200", +hich

means only *s! 1" lacs, has been

further added in the pro<ect in last

nine months! This indicates some

problem in the pro<ect implementation

and needs to be probed further!

The pro<ect components may be

reconciled on item(to(item basis! ,ny

overrun in the individual head should

be funded by additional promoters

contribution, +hich has been

stipulated by Corporation Bank!

/e have already reconciled item +ise pro<ect

cost 8details attached as anne)ure to our ,ppl

.ote: and no cost overrun has been considered

for our assistance! The Company has a$reed to

meet the additional fund3./C reBuirements if

any!

The $earin$ position of the company is

improvin$ mainly by conversion of the

e)istin$ unsecured loan into eBuity as

also treatment of a part as Buasi

eBuity! The compliance of this

stipulation be ensured strictly and

before disbursement! The 5hare

application money should also be

converted into paid up capital

immediately!

0actual!

,s detailed above, the promoters have proposed

increase in paid up capital to *s &20 lacs 8*s &00

lacs prior to disbursement: and lon$ term

unsecured loan of *s 1F0 lacs durin$ current

4nancial years! The Company has already

initiated the process of 4lin$ the form +ith *;C

+ith re$ards to conversion of share application

money3unsecured loan to eBuity!

The company has unsecured loans

from 635 @alin$a ?atcheries %vt Ltd!

L*s! 1!1" CrM and one 6r 9 * %atnaik

L*s! 1!2 CrM! The lon$(term

availability of these funds shall be

critical for the cash Do+ stability of the

company!

The Company has submitted that the unsecured

loan contributed by 63s @alin$a ?atcheries %vt

Ltd +ill be converted to share capital durin$ the

year! ?o+ever, the funds contributed by 6r

%atnaik +ill continue as lonm$ term unsecured

loan durin$ the year! ;nce the land deal is

formaliAed 86r %atnaik is buyin$ land from the

promoters:, the money can be capitaliAed in the

books of the Company!

Thou$h, the company is stated to be

into +orkin$ in the premium se$ment,

the %,T mar$ins have been modest

only for 0I 200" L,uditedM as also for

0I 2009 LestimatedM!

The company is no+ plannin$ to cater

the $eneral se$ment in vie+ of some

$overnment re$ulation, but there is a

sharp <ump in the %,T mar$ins by

almost 200', +hich needs to be

properly analysed and <usti4ed!

The 4nancial year 200C(0" +as the 4rst full year

of operation! The Company earned %B9-T mar$in

of more than 10' durin$ the year, +hich is in

line +ith industry standard! The %,T mar$in +as

mar$inally lo+er 1!""' mainly on account of

depreciation 1 4nancial char$es! The Company

has conservatively estimated %B9-T 1 %,T

mar$in of 11!02' and 1!02' for 0I 200"(09,

+hich is considered as acceptable!

5ince the cape) pro$ram +ill result in more of

boiled rice production 8hi$her demand in local

market:, the Company +ould be able to increase

Jovt! 5upplies under %95 scheme +herein the

mar$in is normally hi$her! 0urther, +ith

commercial operation of 2

nd

unit, the Company

+ould be able to enter custom millin$ business,

+herein the pro4tability mar$in is normally

4

hi$her! 0urther, +ith increase in capacity, the

economy of scale +ill ensure reduction in

operational3 overhead cost, thus resultin$ in a

hi$her pro4tability! Therefore, the estimates

made by the Company for 0I 2009(10 8%B9-T of

1': is considered as acceptable!

Corporation Bank in its sanction of

enhanced CC limit has linked the

release of the same to the completion

of the e)pansion pro<ect! The pro<ect is

not yet completed but it is proposed to

release entire limit includin$ a further

enhancement by *s! F2 lacs! The CC

limit presently should be pe$$ed at

the current operative levels allo+ed by

Corporation bank and the enhanced

limits should be released only after

completion of the pro<ect!

The Cash Credit limit allo+ed by Corporation

Bank for even the e)istin$ " tph plant is

considered inadeBuate! /e have veri4ed the

reBuirements +ith the other (2 e)istin$ rice

mills in our portfolio and observe that the

reBuest made by the Company is $enuine 1

need based!

The holdin$ pattern estimated by the Company

in line +ith past3industry trend 1 the /C limit

+orks out to *s 220 lacs and *s &00 lacs

respectively for 0I 200"(09 and 2009(10!

,ccordin$ly, +e propose to disburse the /C limit

sub<ect to availability of dra+in$ po+er!

The outstandin$ in the CC limit +ith

Corporation Bank +as *s! 12C lacs as

on 6arch &1, 200", +hich +as in

e)cess of the sanctioned operative

limit of *s! 12"!20 lacs! The same

needs to be e)amined!

Corporation Bank had sanctioned total limit of *s

2&2 lacs 8enhancement from *s 12" lacs: and

had allo+ed dra+l to the e)tent of *s 12& lacs

pendin$ completion of second phase of pro<ect!

The overdra+in$ of *s 2 lacs as on 6arch &1,

200" may be due to interest application as on

the year( end date!

The company in its pro<ect report has

stated that the e)pansion pro<ect shall

allo+ it to use some common facilities!

?o+ever, items like Boiler and 7T%

have been considered under both the

"T%9 as also F T%9 plant! There

separate reBuirement be e)amined as

per the technical necessities!

5ince the t+o plants 8" tph and F tph: are

separate, the Company is reBuired to have

separate Boiler, 7T% and millin$ eBuipments, for

both the units! ?o+ever, the common assets

include entry3e)it $ates, boundary, /ei$hbrid$e,

Jo(do+n, 5tora$e 5pace, Nehicles, etc!

The pro<ect cost and operatin$ ratios

may be compared +ith similar pro<ects

done by our bank!

/e have compared the pro<ect cost of *,-.%L

+ith units of our e)istin$ portfolio such as

Jayala)mi ,$ro 1 6an$alam *ice 6ill, brief

details of +hich is furnished hereunderO

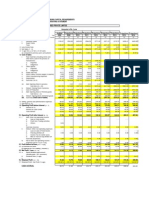

8*s in lacs:

%articular

s

6an$alam Jayala)mi

,$ro

*ames+a

r ,$ro

Capacity 9 tph 9 tph 1 tph

%ro< Cost ""&!00 "F0!00 10!00

T!L "0!00 22!00 FFF!00

5ales 2F21!00 2200!00 2&&!00

%B9-T

8':

12!02' 1&!1' 1!1C'

%,T 8': &!2&' !&' 2!99'

T;L3T./ 2!F& 2!9C 2!2

The cost envisa$ed by *,-.%L is considered in

line +ith the estimates of these units! 0urther,

5

the revenue 1 pro4tability ratios considered by

the promoters are also in line +ith industry

trend.

The core promoterKs mar$in for the

second e)pansion pro<ect LTL ---M at a

cost of *s! 22F!C0 lacs has been

indicated as *s! 22!C0 lacs only +hich

is only 10' of the pro<ect cost! This is

lo+ and ideally the promoters should

be brin$in$ resources pendin$ the

disbursement of the subsidy!

%endin$ disbursement of Corporation Bank loan,

the promoters have already infused si$ni4cant

amount of fund into the business! The overall

promoters mar$in vis(P(vis our Term Loan +orks

out to 2' e)cludin$ cost of land, +hich is

considered as satisfactory by industry standard!

The 0,C* in the pro<ect also +ork out to 1!F& as

on 6arch &1, 2009 +hich is above the stipulated

level! -f the market value of land is included, the

0,C* +ill improve to more than 2!20 and is

considered as acceptable!

Bs!ness Parameters

The company, other+ise, is operatin$

at about 22(F0' capacity utiliAation

on t+o 5hift basis! The necessity for

e)pandin$ capacity may be seen in

this li$ht also! -t may also be seen

+hether the $overnment re$ulation for

custom millin$ shall be applicable to

only part of the companyKs facilities as

$enerally these stipulations are on

$ross capacities! The pro4tability

aspect may be put to such sensitivity

test!

The year 200C(0" +as the 4rst full year of

operation durin$ +hich the Company achieved

capacity utiliAation of 22(F0'! The Company

started the year +ith a *a+ *ice %lant 8demand

for boiled rice is normally hi$her in ;rissa:. -n

addition to e)pandin$ the capacity of e)istin$

unit to include boiled rice plant, the second unit

has been planned to cater the need of all three

se$ments such as %remium 5e$ment, *ural 1

6iddle Class as +ell as Jovt! 5upply 8custom

millin$:! /ith these combined facility, the

Company +ill be in a position to come up as a

full(Ded$ed inte$rated unit! The capacity

addition is e)pected to increase the top line as

+ell as conseBuent bottom line of the Company!

Management Parameters

The reasons behind ne$ative net(

+orth of the $roup associate 635

@alin$a ?atcheries be looked into form

mana$ement practices an$le!

63s @alin$a ?atchery %vt! Ltd is operatin$ a

%oultry Qnit for last t+o decades! The poultry

business continues on a lo+ scale even till date!

/ith <oinin$ of youn$er members into the

business, the family decided to enter food

processin$ 1 +arehousin$ business durin$ 0I

2002(0F! 0urther, on account of business non(

viability, the promoters have decided to

$radually e)it from %oultry Business and

concentrate fully on food processin$ business!

The Company has been adversely aEected

durin$ last fe+ years due to bird(Du and entry of

other or$aniAed3unor$aniAed players into the

business! The accumulated loss resulted in a

ne$ative net+orth as on 6arch &1, 200"!

?o+ever, t.e #romoters .ave !n)sed $ong

term nsecred $oan o) Rs /01 $acs !nto t.e

Com#an*2 I) t.e same !s cons!dered as

3as! e3!t*4 t.en t.e Com#an* wo$d

.ave a 5et wort. o) Rs /67 $acs as on

Marc. 684 9::7 w!t. ;ero term $!a'!$!t*2

@?%L has diversi4ed into meat processin$ and

6

+arehousin$ business in the recent past! The

Company does not en<oy any credit facility from

any bank e)cept a pled$e 4nance limit from

5tate Bank -ndia! /e have discretely enBuired

+ith local 5B- ;>cials and they have $iven

positive opinion on the promoters! -nfact, 5B- has

also started pursuin$ +ith the promoters for the

*ice 6ill pro<ect!

The corporation Bank sanction letter

dtd 1F!09!200F indicates e)posure of

QT- Bank in @alin$a ?atechries %vt Ltd!

The same may be looked into and

commented upon!

-n the referred sanction, Corporation Bank has

called for credit opinion from QT- Bank due to

featurin$ of our Bank in the Balance 5heet of the

Company. /e have veri4ed our record and

observe that no credit facility +as ever $ranted

to the Company in the past! The featurin$ of

name may be due to some liability relationship

at that point of time!

Sectora$ (t$oo%

%olicies of Central 3 5tate Jovt! in

respect of procurements, pricin$ etc!

shall have a direct bearin$ on the

sector!

/e have not e)perienced any ma<or policy

chan$e in ;rissa +ith respect to *ice 6ill

se$ment and all the e)istin$ units in our

portfolio are doin$ +ell! The promoters are into

the business of food processin$ business for a

lon$ time and are 4nancially stron$ to +ithstand

any re$ulatory chan$es by the central3state

$overnment!

Secr!t* Strctre

The land securities both primary and

collateral are primarily leasehold land

from --9C;! The valuations as such be

done conservatively more so in vie+ of

the stated fact about closure of

operations of @alin$a ?atcheries +hich

could also result in erosion of

valuation!

-ncidentally, the value of F!F ,cre land

transferred to *amesh+ar ,$ro

-ndustries %vt Ltd! in the second half

of 0I 200F(0C is *s! 2F!F1 lacs only!

The basis of valuation of the ad<acent

land admeasurin$ 2!2 ,cre for *s! !"2

Crores may be looked into detail!

/e have recently inspected the unit as +ell as

collaterals! The Company is oEerin$ around 2

acres of prime land 8& k!ms from @handa$iri

5Buare on .!?(2:! The value estimated by the

Company is around *s !"2 Crs, +hich in our

vie+ is considered as acceptable! 0urther the

property is considered as fairly marketable in its

present form and likely to attract premium due

to its pro)imity to ?i$h+ay!

9ue to intra($roup transfer, the consideration

value may be lo+er! ?o+ever, +e shall obtain a

detailed valuation from our empanelled la+yer

before disbursement of credit facility!

The land details be properly reconciled

as there has been transfer of land

from kalin$a ?atcheries to *amesh+ar

,$ro and it may be con4rmed that the

proper --9C; consent is available!

The Copy of -9C; .;C for transfer of F!FF acres

of land from kalin$a ?atcheries to *amesh+ar

,$ro has been obtained 1 held in our record!

/e have speci4ed submission of speci4c .;C

from -9C; for creation of mort$a$e on the land

in favour of our Bank +ithin &0 days from the

date of disbursement!

7

(t.ers

This +ould be an G/atch accountK and

revie+ freBuency of si) months be

maintined,

.oted for compliance!

S.as.! B Prasad B R 5anda

Manager (Cred!t) Asst V!ce Pres!dent

(Cred!t)

8

Вам также может понравиться

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankДокумент32 страницыFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankTest bank World0% (1)

- Audit Planning MemoДокумент7 страницAudit Planning Memoga_arn67% (3)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- FanDuel/State of Georgia AgreementДокумент13 страницFanDuel/State of Georgia AgreementJonathan RaymondОценок пока нет

- Bhagavad Gita SanskritДокумент108 страницBhagavad Gita SanskritMaheshanand Mainali100% (1)

- Solution Maf503 - Jan 2018Документ8 страницSolution Maf503 - Jan 2018anis izzatiОценок пока нет

- Power-Up Builders - Case MaterialsДокумент4 страницыPower-Up Builders - Case Materialsvincent blackОценок пока нет

- p4 2017 Sepdec Hybrid QДокумент14 страницp4 2017 Sepdec Hybrid QDlamini SiceloОценок пока нет

- Toll Road Project Case StudyДокумент6 страницToll Road Project Case StudyHéctor Augusto DíazОценок пока нет

- Assurance and Audit Practice Nov 2007Документ5 страницAssurance and Audit Practice Nov 2007samuel_dwumfourОценок пока нет

- Question f8 Audit RiskДокумент4 страницыQuestion f8 Audit RiskTashfeenОценок пока нет

- Accounting StandardДокумент33 страницыAccounting StandardPooja BaghelОценок пока нет

- DPT4 & MBP4Документ2 страницыDPT4 & MBP4shamitds06Оценок пока нет

- Credit Appraisal Process Followed in Allahabad BankДокумент42 страницыCredit Appraisal Process Followed in Allahabad BankParthapratim DebnathОценок пока нет

- NotestoStockExchangeMarch200228 6 02Документ3 страницыNotestoStockExchangeMarch200228 6 02Vijay RaiyaniОценок пока нет

- Auditing - RF-12 Quiz BowlДокумент12 страницAuditing - RF-12 Quiz BowlWilson CuasayОценок пока нет

- Prac 1 Final PreboardДокумент10 страницPrac 1 Final Preboardbobo kaОценок пока нет

- A. The Importance of Capital BudgetingДокумент16 страницA. The Importance of Capital BudgetingManish ChaturvediОценок пока нет

- Chap 019Документ90 страницChap 019Ho Yuen Chi EugeneОценок пока нет

- Questions For Project Management Subject: Question 1 Case Study - CompulsoryДокумент13 страницQuestions For Project Management Subject: Question 1 Case Study - CompulsorySomnath KhandagaleОценок пока нет

- AuditДокумент4 страницыAuditZainab SarfrazОценок пока нет

- Final Exam - Winter 2024Документ4 страницыFinal Exam - Winter 2024preeti.9223Оценок пока нет

- Knowledge Quiz: Performance ObjectiveДокумент11 страницKnowledge Quiz: Performance Objectivecseiji20% (5)

- Case Study Based (Without Answers)Документ14 страницCase Study Based (Without Answers)mshivam617Оценок пока нет

- Project Appraisal-1 PDFДокумент23 страницыProject Appraisal-1 PDFFareha RiazОценок пока нет

- Project Appraisal 1Документ23 страницыProject Appraisal 1Fareha RiazОценок пока нет

- Case Set 7 - Subsequent Events and Going ConcernДокумент5 страницCase Set 7 - Subsequent Events and Going ConcernTimothy WongОценок пока нет

- Advanced Financial Management: Thursday 10 June 2010Документ10 страницAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasОценок пока нет

- Corporate Finance Assignment - 1Документ14 страницCorporate Finance Assignment - 1nsmkarthickОценок пока нет

- fm2 mq1Документ4 страницыfm2 mq1Ramon Jonathan SapalaranОценок пока нет

- Module 4 - Cash Flow EstimationДокумент5 страницModule 4 - Cash Flow Estimationkhaireyah hashimОценок пока нет

- Home Loan ProjectДокумент15 страницHome Loan Projectrashmishetty03Оценок пока нет

- Auditing - RF-12 Quiz BowlДокумент12 страницAuditing - RF-12 Quiz BowlAngel TumamaoОценок пока нет

- AEC 205 - EXAM 1 1-21-22 PSBA Test I - TheoriesДокумент5 страницAEC 205 - EXAM 1 1-21-22 PSBA Test I - TheoriesLaisa DejumoОценок пока нет

- Group 1 Budget ProcessДокумент26 страницGroup 1 Budget ProcessCassie ParkОценок пока нет

- CFA Level 1 Corporate Finance E Book - Part 2Документ31 страницаCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentОценок пока нет

- Chapter Four Capital Budgeting/Investment DecisionДокумент10 страницChapter Four Capital Budgeting/Investment DecisionBenol MekonnenОценок пока нет

- AA-AuditingДокумент6 страницAA-AuditingKim Ngọc HuyềnОценок пока нет

- Capital BudgetingДокумент18 страницCapital BudgetingYash ChaurasiaОценок пока нет

- Sanction Letter Pages For TLДокумент5 страницSanction Letter Pages For TLgtyhОценок пока нет

- Cash Flow and Financial PlanningДокумент48 страницCash Flow and Financial PlanningIsmadth2918388100% (1)

- Iii - Proforma Statement of Financial Position (20 PoДокумент6 страницIii - Proforma Statement of Financial Position (20 PoRaymond RocoОценок пока нет

- PT - Cash and Cash Equivalents Period Ended - Audit ObjectivesДокумент32 страницыPT - Cash and Cash Equivalents Period Ended - Audit ObjectivesVera Magdalena HutaurukОценок пока нет

- Cases - Problems Module 4 - 2011Документ3 страницыCases - Problems Module 4 - 2011Uday KumarОценок пока нет

- Project Appraisal - Stages FlowchartДокумент6 страницProject Appraisal - Stages FlowchartAshokОценок пока нет

- Afm June 2010 QT AnsДокумент21 страницаAfm June 2010 QT AnsBijay AgrawalОценок пока нет

- Name Email-ID Smart Task No. Project Topic: Abhishek Dongre 02 Project Finance - Modeling and AnalysisДокумент3 страницыName Email-ID Smart Task No. Project Topic: Abhishek Dongre 02 Project Finance - Modeling and AnalysisAbhishek DongreОценок пока нет

- p4sgp 2010 Jun Q PDFДокумент10 страницp4sgp 2010 Jun Q PDFsabrina006Оценок пока нет

- Trade Finance Proposal-Buyers CreditДокумент8 страницTrade Finance Proposal-Buyers Creditneeraj9696cОценок пока нет

- IAS 23 - SemДокумент3 страницыIAS 23 - SemMeo MeoОценок пока нет

- FM-1 CH 6Документ11 страницFM-1 CH 6HEОценок пока нет

- FME520 Practice QuestionsДокумент3 страницыFME520 Practice QuestionsMatende SimionОценок пока нет

- Loans & Advances Basic Bank LTDДокумент19 страницLoans & Advances Basic Bank LTDZubair RazaОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ5 страницFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Management - Part 1 For PrintingДокумент13 страницFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasОценок пока нет

- Harshit Gaur (Intern)Документ4 страницыHarshit Gaur (Intern)Harshit GaurОценок пока нет

- Governmental Accounting Agency Funds and Cash and Investment PoolsДокумент4 страницыGovernmental Accounting Agency Funds and Cash and Investment PoolsAdrianna Nicole HatcherОценок пока нет

- 21St Century Computer Solutions: A Manual Accounting SimulationОт Everand21St Century Computer Solutions: A Manual Accounting SimulationОценок пока нет

- CMA2009Документ21 страницаCMA2009paramsn0% (1)

- Not Contactable Clients For Incentive Calculation - Sep'14Документ1 000 страницNot Contactable Clients For Incentive Calculation - Sep'14paramsnОценок пока нет

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedДокумент1 страницаOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnОценок пока нет

- Ffr-I 30.06.09Документ1 страницаFfr-I 30.06.09paramsnОценок пока нет

- Clarification 16.01.09Документ5 страницClarification 16.01.09paramsnОценок пока нет

- Particulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11Документ1 страницаParticulars Opening Closing Balance Balance Rameswar Agro Industries Pvt. Ltd.-10-11paramsnОценок пока нет

- Syndicate DD CircularДокумент6 страницSyndicate DD CircularparamsnОценок пока нет

- Milling Agreement FAQДокумент1 страницаMilling Agreement FAQparamsnОценок пока нет

- Estimated Projected BS & PL09!10!11Документ21 страницаEstimated Projected BS & PL09!10!11paramsnОценок пока нет

- Food and Procurement Policy KMS 2009 - 10Документ16 страницFood and Procurement Policy KMS 2009 - 10paramsn0% (1)

- Trading Account Closure Form/RequestДокумент1 страницаTrading Account Closure Form/RequestparamsnОценок пока нет

- Rice Milling Industry: Diagnostic Study ReportДокумент62 страницыRice Milling Industry: Diagnostic Study ReportVigneshwaran AiyappanОценок пока нет

- FIGLДокумент58 страницFIGLparamsnОценок пока нет

- JAIIB LowДокумент10 страницJAIIB LowVimal RamakrishnanОценок пока нет

- Sreeragam Exports Pvt. LTDДокумент8 страницSreeragam Exports Pvt. LTDparamsnОценок пока нет

- SubhadraДокумент1 страницаSubhadraparamsnОценок пока нет

- Revised NMFP GuidelinesДокумент98 страницRevised NMFP GuidelinesparamsnОценок пока нет

- Iiiiiii II: OJ CDДокумент17 страницIiiiiii II: OJ CDparamsnОценок пока нет

- Article of AssociationДокумент12 страницArticle of AssociationparamsnОценок пока нет

- United India InsuranceДокумент10 страницUnited India Insurancegowtham19892003Оценок пока нет

- North Orissa University: Vision of The UniversityДокумент36 страницNorth Orissa University: Vision of The UniversityparamsnОценок пока нет

- To The President, Biju Janata Dal, Odisha, BhubaneswarДокумент1 страницаTo The President, Biju Janata Dal, Odisha, BhubaneswarparamsnОценок пока нет

- Mienral Based IndustriesДокумент11 страницMienral Based IndustriesparamsnОценок пока нет

- Notification Chhattisgarh Gramin Bank Officers OfficeAsstДокумент10 страницNotification Chhattisgarh Gramin Bank Officers OfficeAsstCareerNotifications.comОценок пока нет

- Help Line Numbers in OJEE Cell Ojee 2012 163Документ1 страницаHelp Line Numbers in OJEE Cell Ojee 2012 163Kanhu PadhiОценок пока нет

- Expenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentДокумент8 страницExpenditure Target of Rs 16,65,297 Crore in 2013-14. Plan Expenditure Is at Rs 5,55,320 Crore - Up 29 Per CentparamsnОценок пока нет

- GanjamДокумент3 страницыGanjamparamsnОценок пока нет

- Government Expenditure and BudgetДокумент33 страницыGovernment Expenditure and Budgetparamsn100% (1)

- 2013 LalPir Power LTD ProspectusДокумент84 страницы2013 LalPir Power LTD ProspectusMuhammad Usman Saeed0% (1)

- Full Download Solution Manual For Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck PDF Full ChapterДокумент36 страницFull Download Solution Manual For Interpreting and Analyzing Financial Statements 6th Edition by Schoenebeck PDF Full Chapterooezoapunitory.xkgyo4100% (18)

- 2010 07 06 - 010528 - Byp1 4Документ3 страницы2010 07 06 - 010528 - Byp1 4Muhammad RamadhanОценок пока нет

- SourceДокумент27 страницSourceAnonymous kwi5IqtWJОценок пока нет

- Financial Derivatives Assignment - MridulДокумент8 страницFinancial Derivatives Assignment - MridulsahilОценок пока нет

- Siti Hapija Binti Basir - Ba2424a - Fin546 Individual AssignmentДокумент2 страницыSiti Hapija Binti Basir - Ba2424a - Fin546 Individual AssignmentpijaОценок пока нет

- Altman Z, Messod Beneish M, Piotroski F-ScoresДокумент4 страницыAltman Z, Messod Beneish M, Piotroski F-ScoresInternational Journal in Management Research and Social ScienceОценок пока нет

- International Investment Law TextbookДокумент31 страницаInternational Investment Law TextbookChloe SteeleОценок пока нет

- NCCMP ProjectДокумент76 страницNCCMP Projectaman_luthra1611Оценок пока нет

- IFRS 9 NotesДокумент42 страницыIFRS 9 NotesSalman Saeed100% (1)

- Aec64 Audit 2 Notes-22-24Документ3 страницыAec64 Audit 2 Notes-22-24Althea RubinОценок пока нет

- A Study On Analysis of Relationship Between Risk and Return of Reliance Mutual FundДокумент24 страницыA Study On Analysis of Relationship Between Risk and Return of Reliance Mutual FundsharathambaОценок пока нет

- Chapter 13Документ13 страницChapter 13Haseeb Ahmed ShaikhОценок пока нет

- L 7 Portfolio-Construction-Guide - Vanguard PDFДокумент36 страницL 7 Portfolio-Construction-Guide - Vanguard PDFRajesh AroraОценок пока нет

- Cdic Abbreviated Brochure enДокумент1 страницаCdic Abbreviated Brochure enChris DoeОценок пока нет

- Trading Rules and ProceduresДокумент20 страницTrading Rules and ProceduresAmir Shahzad TararОценок пока нет

- Narayana HealthДокумент127 страницNarayana HealthmishikaОценок пока нет

- Issue of WarrantsДокумент1 страницаIssue of WarrantsDhruvi KothariОценок пока нет

- Dr. Gede Pardianto, SP.MДокумент4 страницыDr. Gede Pardianto, SP.Myudimindria3598Оценок пока нет

- Certified Financial Services AuditorДокумент8 страницCertified Financial Services AuditorMa. Kathleen ReyesОценок пока нет

- Steampunk Settlement: Cover Headline Here (Title Case)Документ16 страницSteampunk Settlement: Cover Headline Here (Title Case)John DeeОценок пока нет

- RPT 02 - Sales KpisДокумент3 страницыRPT 02 - Sales Kpisapi-513411115Оценок пока нет

- AggrivateДокумент14 страницAggrivatemvtharish138Оценок пока нет

- Bfuture University in Egypt Money, Banking, and Financial Markets Quiz 1 Answer All The Following QuestionsДокумент2 страницыBfuture University in Egypt Money, Banking, and Financial Markets Quiz 1 Answer All The Following QuestionsMrmr GawadОценок пока нет

- FCN Training AcademyДокумент5 страницFCN Training AcademyDhrupal TripathiОценок пока нет

- How Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountДокумент11 страницHow Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountRenéОценок пока нет

- The Crescent Standard Investment Bank LimitedДокумент3 страницыThe Crescent Standard Investment Bank LimitedhammasОценок пока нет

- Assignment BM014 3.5 3 DMKGДокумент7 страницAssignment BM014 3.5 3 DMKGDavid CarolОценок пока нет