Академический Документы

Профессиональный Документы

Культура Документы

Urban Industrial Land Redevelopment and Contamination Risk

Загружено:

Tecnohidro Engenharia AmbientalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Urban Industrial Land Redevelopment and Contamination Risk

Загружено:

Tecnohidro Engenharia AmbientalАвторское право:

Доступные форматы

.

Journal of Urban Economics 47, 414442 2000

doi:10.1006rjuec.1999.2147, available online at http:rrwww.idealibrary.com on

Urban Industrial Land Redevelopment and

Contamination Risk

1

Daniel T. McGrath

Senior Fellow, Great Cities Institute, Uniersity of Illinois at Chicago, 412 S. Peoria

Street, Suite 400, Chicago, Illinois 60607-7067

E-mail: dmcgrath@uic.edu

Received December 6, 1996; revised July 22, 1999

This study examines the role of contamination risk on urban industrial redevel-

opment in the City of Chicago. The theoretical framework is the myopic optimal

redevelopment rule which states that the redevelopment of an urban parcel will

occur when the parcels value through conversion to a new use, net of construction

costs, exceeds the value of the same parcel continuing in its current use. Contami-

nation liability is modeled as a land demolition cost that is capitalized into bid

value. Assuming that the magnitude of this land demolition cost is a function of the

a priori probability of contamination, the effects of contamination risk on land

value and on the probability of redevelopment are estimated. 2000 Academic Press

1. INTRODUCTION

Over the past few years, intense discussion in the legal, urban planning,

and economic policy literature has concerned the relationship between

land contamination risk and the redevelopment of urban industrial prop-

erty. The general view is that the current federal and state regulatory

requirements regarding remediation of any discovered contamination

places substantial legal and financial barriers to the redevelopment of

urban industrial land. This is believed to be one of the forces contributing

to employment deconcentration and to the acceleration of industrial

development at the urban fringe of our metropolitan areas. This view has

prompted municipal officials to begin to take on the financial responsibil-

ity for the remediation of contaminated industrial properties; the belief is

1

This research was funded by the John D. and Catherine T. MacArthur Foundation and

conducted for the City of Chicagos Brownfields Forum. I express my thanks to Commissioner

Henry Henderson of the City of Chicagos Department of Environment for assistance in

assembling the data for this research. I also express thanks to Joe Persky, John McDonald,

and Gib Bassett of the University of Illinois at Chicago and to the anonymous referees for

their helpful comments and suggestions.

414

0094-1190r00 $35.00

Copyright 2000 by Academic Press

All rights of reproduction in any form reserved.

REDEVELOPMENT AND CONTAMINATION RISK 415

that this public investment will make the central city more competitive in

attracting industrial users for these properties. However, despite the

importance of this issue to the economic viability of our central cities, no

empirical estimates utilizing current urban economic theory exist of the

impact of uncertain contamination liability on industrial redevelopment.

The purpose of this paper is to begin to fill this gap by presenting an

empirical estimation describing the effect of contamination risk on the

industrial land market in the City of Chicagoin terms of both the impact

on land value and the effect on the probability of redevelopment.

The theoretical framework for this investigation is the myopic optimal

w x w x

redevelopment rule put forth by Brueckner 1 and Wheaton 13 in their

independent development of spatial growth models of metropolitan areas.

This rule states that the redevelopment of a parcel will take place when

the value of the parcel converted to a new use, net of construction costs,

exceeds the value of the parcel remaining in its current usethat is, when

there is a positive value differential on a given parcel. The myopic optimal

redevelopment rule has been supported empirically by two recent studies.

w x

The first is Rosenthal and Helsley 12 who present empirical support for

this theory to explain residential redevelopment in the City of Vancouver,

w x

BC. The second is Munneke 10 who finds support for this theory to

explain commercial and industrial redevelopment activity within the City

of Chicago.

Following the econometric methodology utilized by Rosenthal and Hels-

w x w x

ley 12 and Munneke 10 , this paper explores the question: Of the

industrial properties in the City of Chicago for which there is evidence of

redevelopment, what role has contamination risk played in their redevel-

opment? This is accomplished by modeling contamination liability as a

demolition cost, the magnitude of which is a function of the parcels a

priori probability of contamination. Assuming that this demolition cost

would be capitalized into a parcel bid value, an estimate of the extent to

which investors discount land value to account for contamination risk is

determined. The determination of the effect of contamination risk on land

value thus produces a way to identify the relationship between contamina-

tion risk and the probability of redevelopment.

The principal dataset for this research is a group of 195 industrial

properties that were sold within Chicago during the 10-year period from

August 1983 through November 1993. Of the total, 95 properties represent

parcels that were sold for redevelopment. These observations were created

through matching industrial property sales records from the City of

.

Chicagos land use database The Harris-REDI file with the Citys indus-

trial building and demolition permit databases. The rest of the observa-

tions, a control group of 100 properties, were chosen randomly from the

Harris-REDI file. The probability of contamination was assigned according

DANIEL T. MCGRATH 416

w x

to a scale developed by Noonan and Vidich 11 and based on a land-use

investigation for each of the 195 parcels in the dataset within the 1949 and

1979 Sanborn Fire Insurance Maps.

The next section presents a more detailed discussion of the myopic

optimal redevelopment rule, identifies the assumptions used in this empiri-

cal application of the theory, and then derives the functional forms for the

land value and structural probit models. The third section discusses the

econometric methodology and identifies the specific econometric tech-

nique utilized to correct for possible selection bias. The fourth section is a

discussion of the data used for this research, and the last two sections

present the empirical results and conclusions.

2. THE MODEL AND ASSUMPTIONS

2.A. Literature Reiew

The development of dynamic urban redevelopment models began with

w x w x

Brueckner 1 and Wheaton 13 in response to the inadequacies of static

equilibrium models of urban land-use for describing growth and change in

urban structure. These authors derive an optimal redevelopment rule that

identifies the economic conditions under which redevelopment will occur:

that the present value of revenue obtainable from a parcel converted to a

new use, net of capital development costs, must equal or exceed the

present value of the gross revenue from the existing capital stock on the

parcel. This is expressed as

r t , S*rL L r t , SrL L . .

yc t S* G , 1 . .

i i

.

where r t, S*rL is the revenue per acre obtainable from optimal capital

redevelopment, which depends on time t, and the ratio of optimal, new

.

capital S* to the amount of land L; i is the discount rate; c t is the unit

cost of capital at time t; and S is the existing capital on the parcel. The left

.

side of Eq. 1 is the present value of the parcel in its redeveloped state,

denoted V

R

. The right side of the equation is the present value of the

C

.

parcel remaining in its current use, denoted V . Thus, Eq. 1 is rewritten

most simply as

V

R

yV

C

G0. 2 . .

Restating, a parcel will be redeveloped when the present value of the

parcel in its new use, which capitalizes the construction costs, minus the

present value of the same parcel remaining in its current usethat is, the

R C

.

value differential, V yV is greater than or equal to zero.

REDEVELOPMENT AND CONTAMINATION RISK 417

The first empirical exploration of the optimal redevelopment rule was

w x

undertaken by Rosenthal and Helsley 12 in an examination of the

redevelopment of single family dwellings in Vancouver, BC. In addition to

finding strong empirical support for this theory in residential redevelop-

ment, Rosenthal and Helsley argue that if net demolition costs are zero,

then a new method for determining the value of vacant land emerges that

avoids some of the problems of hedonic estimation methods. These co-

authors also present the most generalized expression of the optimal

redevelopment rule: that the marginal costs of delaying redevelopment

must equal or exceed the marginal benefits of delaying redevelopment.

Incorporating the assumptions that:

.

1 landowners are myopic; that is, they act as if the level of income

obtainable from redevelopment will remain constant into the future,

.

2 capital costs are constant,

.

3 no structural depreciation occurs, and

.

4 demolition costs are zero,

the optimal redevelopment rule reduces to the form derived by Brueckner

and Wheaton.

w x

Munneke 10 presents empirical support that the optimal redevelop-

ment rule describes the redevelopment of commercial and industrial

properties in the City of Chicago during the decade of the 1980s. Addition-

ally, Munneke asserts that the assumption of a zero demolition cost might

not be appropriate for industrial properties and makes an argument that if

demolition costs are a significant component of the redevelopment deci-

sion, then these costs must be incorporated into the redevelopment rule.

In Munnekes analysis, the structural demolition costs are incorporated

R C

.

outside the value differential term V yV , and the parcels capital-to-

land ratio SrL is found to be a statistically significant proxy variable for

the structural demolition costs.

2.B. Contamination Liability as Demolition Costs

Assume that the contamination liability for a given industrial parcel can

be modeled as two separate demolition costs. The first is associated with

the existing structure, as would be the case for asbestos or lead contamina-

tion. The second is associated with the land, as would be the case for PCB

w x

or heavy metal soil contamination. As identified by Munneke 10 , the

structural demolition cost D

S

would be a function of the existing capital-

to-land ratio for the parcel, SrL. However, it makes intuitive sense that

structures of a certain vintage andror prior industrial use would have a

higher likelihood of contamination and thus have a higher structural

demolition cost. Increases in demolition cost associated with any possible

DANIEL T. MCGRATH 418

structural contamination would be readily apparent to a redeveloper

through inspection of the existing structure. Therefore, in addition to

being a function of the parcels capital-to-land ratio, the structural demoli-

tion cost would also be a function of the conditionrdepreciation level d, or

S S

.

D sD SrL, d .

The estimation of remediation costs associated with land contamination

is more uncertain for a redeveloper, and this fact is at the center of the

brownfields debate. However, over the 19 years since the passage of

CERCLA,

2

as industrial redevelopers have gained more experience with

the legal requirements and subsequent financial implications of this act,

one might reasonably expect that contamination liability would, over time,

become to some extent predictable and capitalized into parcel bid value.

This paper takes the view that there exists an observable environmental

variable E that can accurately determine a priori the land contamination

liability associated with a given parcel to be redeveloped. Thus, the land

demolition costs would become a function of the environmental variable,

L L

.

or D sD E .

2.C. Value Equations and Functional Forms

Every industrial location can be represented by a quantity of industrial

real estate R, which is a function of the land area L and the amount of

w x

capital on the site, S 8 . The value of any given parcel of industrial real

estate would be expressed as the quantity of industrial real estate units of

. .

unknown scale , R L , S , times the unit price of industrial real estate, P.

i

w x

Consistent with the functional form proposed by Mills 9 , the per real

estate unit price P is a function of the temporal market conditions and of

the locational and neighborhood characteristics that distinguish the differ-

ent spatial real estate markets within an urban area. Thus, for an ith

industrial parcel in its current use, the value V

C

is written as

C C

P X =R L , S

. .

i i i

C

V s

i

i

P

C

e

C

0

q

C

X

C

i

.

s =R L , S , 3 .

.

i i

i

where P

C

is the price per real estate unit of industrial real estate in its

current use, R is the units of industrial real estate, L is the amount of land

area, S is the measure of existing capital in units of floor space, i is the

interest rate, and X

C

is the vector of explanatory variables other than land

i

2

The Comprehensive Environmental Response, Compensation, and Liability Act, other-

wise known to as Superfund.

REDEVELOPMENT AND CONTAMINATION RISK 419

and capital for the ith current-use parcel that determines the temporal

and spatial variations in the unit real estate price within the urban area.

Another simplifying assumption is that the elasticity of substitution of L

for S is equal to 1, which allows the use of a CobbDouglas functional

form, or R sL

. Dividing this expression by the land area of the

i i i

parcel, L , would produce an expression for the observed per-square-foot

i

value. Taking logs, the functional form for the current-use value equation

is written as

C

V

i

C C C

ln sA q y1 ln L q ln S q X , 4 . .

i i i

L

i

C

w

C

x

where A is a constant which equals ln P q , is the elasticity of

0

land value to land area, is the elasticity of land value to floor space, and

the other variables are as previously defined.

Accounting for the two demolition variables produces a functional form

for redeveloped parcels that is fundamentally different from the above-de-

.

scribed current-use functional form, Eq. 4 . The value function of an ith

optimally redeveloped parcel is written as

R R R

R q X

0 i

P e S .

i

U U

R S

V s =R L , S yc t S yD , d . .

i i i i i

/

i L

i

L yD

L

E L , 5 . .

i i i

where S* is the optimal level of structural capital following parcel redevel-

opment, which is not directly observable at the time of sale and where D

S

and D

L

are the respective demolition costs defined on a per-square-foot

basis. Assume that the optimal capital for an ith parcel of industrial land is

a function of the amount of land, L , and its location within the urban

i

area, X

R

, and is written as

i

S

U

ss L , X

R

. 6 .

.

i i i

Thus, for redeveloped parcels, the per-square-foot present value equation

becomes

R R R R

V P X R L , s L , X

. .

i i i i i

R

s yc t s L , X .

.

i i

L i

i

S

i

S L

yD , d yD E . 7 . .

i i

/

L

i

DANIEL T. MCGRATH 420

It would be convenient if the value equations for V

C

and V

R

were of

similar form, that is, if the left side of the estimating equations for both

C R

w x

V and V was expressed as ln VrL . Therefore, in its most generalized

i i

w

R

x

form, an expression for ln V rL can be written as

i i

R

V S

i i

R

ln sg X , L , , d , E , 8 .

i i i i

L L

i i

where X

R

is the vector of variables determining the spatial and temporal

i

variations in the parcels unit price and is not necessarily the same vector

C

.

of variables that determine V , L is the land area of the parcel, S rL is

i i i

the existing capital-to-land ratio, d is some measure of the depreciation of

i

the existing capital on the parcel, and E is the a priori measure of land

i

contamination for the parcel. Assuming a log-linear specification for the

function g gives

R

V

i

R R

ln s q Y , 9 .

0 i

L

i

where Y

R

is defined as the full vector of independent variables expressed

i

.

on the left side of Eq. 8 . This approach is justified as a Taylor series

. .

expansion of Eq. 7 . In the actual estimation of Eq. 9 , the expansion is

carried out as far as it has explanatory power. The rationale here is to

linearize and produce an easily estimatable and comparable functional

expression for V

R

that can be utilized in the two-stage method to correct

for possible selection bias between the redeveloped and current-use prop-

erties and thus obtain consistent estimates for the value differential,

R C

.

V yV , for each parcel in the dataset.

3. ECONOMETRIC METHODOLOGY

The industrial redevelopment decision can be tested empirically through

the use of a structural probit model. Following closely the estimation

w x w x

procedure used by Rosenthal and Helsley 12 and by Munneke 10 , this

model is written as

R

s V

R

yV

C

q i s1, 2, . . . , N, 10 .

.

i i i i

where

R

represents the criterion function or index which indicates when

i

R C

.

redevelopment will take place upon sale, V yV is the parcels value

i i

2

.

differential, and is the error term which is assumed to be N 0, . A

i

parcel is redeveloped upon sale if

R

)0 and remains in its current use if

i

R

F0. In the probit estimation over the entire sample,

R

is assigned

i i

the value of 1 for parcels that were redeveloped upon sale and 0 for

REDEVELOPMENT AND CONTAMINATION RISK 421

parcels remaining in their current use. If the criterion for redevelopment is

determined by a parcels value differential, the probit estimation proce-

dure will identify the coefficient, , as significant and of a positive value.

.

R

To accomplish the probit estimation of Eq. 10 , estimates for both V

and V

C

are required to calculate the value differential for each parcel.

However, only one value, either V

R

or V

C

, is ever observed at the time of

a parcels sale. It is assumed that in a competitive land market, the sale

prices of industrial parcels sold for redevelopment will reveal V

R

and that

the sale prices for current-use parcels will reveal V

C

. The estimation of

both V

R

and V

C

for each parcel is accomplished by separating the dataset

into these two groups and then regressing the observed sale prices on the

vectors of observable spatial and temporal variables that determine value

for each group respectively. Using the estimated coefficients from each

value function, an estimate for the value differential is thus obtained for

each parcel in the combined dataset.

If one assumes that these estimated value equations take on a linear

form, then the value differential can be written as

V

R

yV

C

s

R

Y

R

y

C

X

C

q y , 11 . .

.

i i i i i i

where Y

R

and X

C

are the vectors of the observable spatial and temporal

i i

characteristics determining redeveloped and current-use value, respec-

tively,

R

and

C

are the respective coefficients of the redeveloped and

current-use value equations, and the error terms and are assumed to

i i

2

.

2

.

be ;N 0, and ;N 0, .

i i

. .

Substituting Eq. 11 into the original structural probit model 10 , the

reduced-form probit model is derived as

sZ y , 12 .

i i i

where is the vector of all coefficients, Z is the vector of the union of all

i

.

explanatory variables, and the error term s y q .

i i i i

.

The estimation of the structural probit equation 10 follows the two-

w x w x

stage procedure developed by Lee 5 and outlined by Maddala 7 . This

method involves the substitution of estimated endogenous variables into

the criterion function prior to its estimation via a probit analysis. The first

step in this procedure is to use the probit method to estimate the reduced

.

form probit equation 12 to obtain estimates for based on the dichoto-

mous observations of Rthat is, whether or not the ith parcel was

redeveloped.

The second step is to estimate the respective redeveloped and current-use

value functions in a way that produces unbiased estimates for the coeffi-

cients

R

and

C

. As discussed above, only one value, either V

R

or V

C

,

DANIEL T. MCGRATH 422

will ever be observed when a parcel is sold. However, the original criterion

.

function, Eq. 10 , requires the calculation of the value differential for all

observations in the dataset. The individual value functions for V

R

and V

C

are estimated separately by regressing parcel sale prices on the vectors of

observable spatial and temporal characteristics for each parcel Y

R

and X

C

,

i i

respectively. Since the data have been divided into two separate groups,

unobserved characteristics favorable to each group may exist, and selection

bias becomes a possibility. Expressed more formally, when selection bias is

present, the conditional expectation of the error terms of the value

equations will not be zero. Consistent and unbiased estimates of the value

equation parameters are obtained by defining new error terms,

U

and

i

U

, and by the introduction of new estimated explanatory variables W

R

i i

and W

C

, the Mills ratios, into their respective equations. By including the

i

Mills ratios into the value functions, the conditional expectation of both

U

i

and

U

is now zero. The values of W

R

and W

C

are computed for each

i i i

observation in the combined dataset using the estimates of obtained

.

from the initial probit estimation of the reduced form probit equation 12

identified in step 1. The respective redeveloped and current-use value

equations to be estimated are written as

z .

i

U

R R R

V s Y y q

i i i

/

z .

i

s

R

Y

R

y W

R

q

U

13 .

i i i

and

z .

i

U

C C C

V s X q q

i i i

/

1 y z .

i

s

C

X

C

q W

C

q

U

, 14 .

i i i

where

U

s q W

R

,

U

s y W

C

, is the covariance be-

i i i i i i

tween and , is the is the covariance between and , is the

standard normal density function, and is the cumulative normal density

. .

function. Estimation of Eqs. 13 and 14 using OLS produces the re-

quired consistent and unbiased estimates for the value function coeffi-

cients

R

and

C

. Additionally, statistical significance of the Mills ratio in

the OLS estimation signals the presence of selection bias between the data

subsets.

One problem resulting from the insertion of the Mills ratios into the

value functions is that it results in a downward bias in the estimated

standard errors of the coefficients. This downward bias could result in

REDEVELOPMENT AND CONTAMINATION RISK 423

variables erroneously being identified as significant. To correct for this

w x

bias in the standard errors, a procedure developed by Lee et al. 6 must be

implemented to produce the correct asymptotic covariance matrix. In this

analysis, all models utilizing the two-stage method have utilized this

procedure, built into the econometrics software, to obtain unbiased esti-

mated standard errors for the value function coefficients.

Obtaining consistent and unbiased estimates for

R

and

C

in step 2

allows the estimation of the value differential for each observation in the

dataset. Thus, the structural probit equation to be estimated becomes

R

Diff

s V q ,

.

i i i

Diff

R R

C C

where V sV yV s Y y X . 15 .

i i i i i

4. DISCUSSION OF DATA

The principal dataset is a group of 195 redeveloped and current-use

property sale transactions that occurred within the City of Chicago from

August 1983 through November 1993. These records were obtained from

the City of Chicagos Harris-REDI database maintained by the Citys

Department of Planning and Development. The Harris-REDI database is

a combination of the Citys Harris Land-use Data with land sale transac-

.

tions compiled by Real Estate Data, Inc. REDI , which have been

gathered from all real estate transfer declarations filed with Cook County.

The redeveloped property data subset is a group of 95 redeveloped

industrial properties. This subset was created by matching the 8043 indus-

trial land sale transactions with 1867 industrial building permit records and

the Citys 881 industrial demolition permit records that were issued by the

City of Chicago Department of Buildings from January 1984 through

December 1993. Information concerning the neighborhood racial composi-

tion for the parcels in the database was obtained by matching the records

with 1990 census information.

The criterion used to identify whether a parcel was purchased for

redevelopment is whether the sold parcel had an industrial demolition

permit andror an industrial building permit filed with the Department of

Buildings within 24 months of the sale date and is currently zoned for

industrial use. If so, then the property is considered to have been pur-

chased for redevelopment. Including industrial building permits in addition

to industrial demolition permits produces a softer redevelopment rule.

Often, existing structures are not completely removed by the new user, but

through additional construction, the existing structure is substantially

modified for a new use. This situation falls somewhere in between the

DANIEL T. MCGRATH 424

hard redevelopment criteria in which all existing capital is removed and

the case where a parcel is purchased for current use and remains essen-

tially unchanged. The intention here is to identify those industrial parcels

that show evidence of investment by a redeveloper, whether through

complete demolition or through modification of the existing structure.

The salerpermit address matching was verified by visual investigation of

each parcel in the Sanborn Fire Insurance Maps of the City of Chicago.

Additionally, to ensure that the identified address match represents a

property that is currently in industrial use and was not purchased for

conversion to either residential or commercial use, the current zoning of

each property was verified as industrial by site identification in the 1994

Chicago Zoning Ordinance zoning maps.

The current-use group of sales is a set of 100 observations chosen

randomly from the industrial sale record. These properties were verified to

have no building or demolition permits associated with them any time after

their sale and are also currently zoned for manufacturing.

The environmental variable E, which has been hypothesized to be a

significant determinant of the land contamination liability faced by a

buyerrredeveloper and subsequently a determinant of the land demolition

costs, is represented by the a priori probability of the parcels contamina-

tion. This continuous variable was identified for specific land uses by

w x

Noonan and Vidich 11 in a survey of completed cleanups by 17 environ-

mental engineering firms in the northeast U.S. Table 1 outlines the

individual a priori probabilities of contamination for 25 specific categories

of land use. Denoted as PROBCON in the redeveloped and current-use

valuation models, this variable is used to signal higher liability costs

because, at present, there are no publicly available remediation cost

databases which might be used to produce an accurate remediation cost

estimate or to produce statistically significant contamination risk factors.

In an effort to duplicate the process a buyer would have undertaken in a

Phase I environmental investigation, a historical land-use investigation was

undertaken for each of the 195 properties in the database. To determine

this land use, each property was researched in both the 1949 and 1975

versions of the Sanborn Fire Insurance Maps. These maps, available on

microfilm, provide a wealth of land-use information, identifying the spe-

cific company using the site at the time and often the specific nature of the

industrial activity. From this investigation, each property has been assigned

an SIC-code interpretation which best represents the historical land use.

From this SIC-code interpretation, a value of the a priori probability of

contamination has been identified from Noonan and Vidichs classifica-

tion. The definitions and the summary of the statistics of the variables

used in this analysis are presented in Table 2.

REDEVELOPMENT AND CONTAMINATION RISK 425

TABLE 1

The A-priori Probability of Contamination Based on Historical Land Use

Probability of

Commercial and Industrial Land Use Categories Contamination

1. Former coal gas plants, fuel distributors, chemical distributors, .99

airports, incinerators

2. Auto salvage yards, plastic manufacture, electric utility, refining, .95

hazardous waster storagertransfer

3. Oil and other petroleum storage .92

4. Metal plating, landfills, chemical manufacture, metal finishingr .90

tool & dye, laboratories

5. Heavy industrial manufacturing, power plants, paper manufacturing, .88

gas stations

6. Tanneries .87

7. Urban vacantrabandoned land, furniture repair and stripping, .85

circuit board manufacturers, tank farms, waste treatment plants

8. Metal working and fabrication .83

9. Railroad yards and right of ways, vehicle maintenance facilities .82

10. Refuse recycling facilities, machine shops, electronics assembly .80

facilities, agricultural mixersrformulators, high technology

manufacturing

11. Junkyards, electronics manufacture .79

12. Industrial parks, automotive assembly facility, light industrial .75

manufacturing

13. Dry cleaners .74

14. Auto repair shops .72

15. Chemical research facility .70

16. Trucking terminal, textile printing and finishing .65

17. Resource recovery facilities, electricalrplumbingrHVAC service .60

18. Photographic .53

19. Auto dealerships, fabric dyeing establishments, pharmaceutical .50

establishments

20. Highways, research facilities .40

21. Warehouses .35

22. Gas utilities .35

23. Retail property .25

24. Residential, rural vacant property, hospitals .20

.

25. Offices non-manufacturing .13

w x

Source: Noonan and Vidich 11 .

DANIEL T. MCGRATH 426

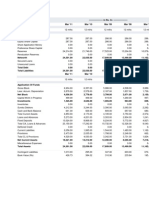

TABLE 2

Statistical Summary of the Land Use Data

Full Redeveloped Current-Use

Sample Parcels Parcels

. . .

Ns150 Ns95 Ns100

Std. Std. Std.

Mean Dev. Mean Dev. Mean Dev.

LNUP 2.5811 1.1494 2.5150 1.2315 2.6438 1.068

Natural Log of the

Parcel per sq. ft.

sale price

LNA 10.3329 1.1841 10.5885 1.1977 10.09 1.1239

Natural Log of the

land area in sq. ft.

LNSPACE 9.9283 2.9283 9.6997 3.9631 10.1455 1.3391

Natural Log of the

building area in

sq. ft.

LAND 69,341 142,584 82,905 158,991 56,546 124,471

Parcel land area in

square feet

CBD 5.6384 2.8056 5.7687 2.8966 5.5146 2.7251

Distance in miles

from the central

business district

intersection of

LaSalle and

.

Jackson Streets

LNORTHD 0.5538 0.4984 0.6316 0.4849 0.4800 0.5021

1 if the parcel is

north of Lake St.,

0 otherwise

AGE 54.33 23.74 54.29 23.98 54.37 23.65

Age of the building

in years

COND 1.5897 0.6255 1.5158 0.5809 1.6600 0.6547

Condition Code of

the building based

on external survey

by City of Chicago:

1 sexcellent,

2 sgood, 3 sfair,

4 spoor

DAYS 2018.9 966.9 1877.3 862.2 2153.3 1043.4

Number of days

from the initial

saledate in

the dataset,

8r1r83

REDEVELOPMENT AND CONTAMINATION RISK 427

TABLE 2Continued

Full Redeveloped Current-Use

Sample Parcels Parcels

. . .

Ns150 Ns95 Ns100

Std. Std. Std.

Mean Dev. Mean Dev. Mean Dev.

PCNTAFAM 0.2953 0.3804 0.2184 0.3197 0.3683 0.4188

Percentage of

African-American

population within

census tract of

parcel

CAPINT 1.4526 2.1187 1.2632 2.0079 1.6324 2.2139

Capital Intensity as

measured by the

building floor area

divided by parcel

land area

PROBCON 0.6778 0.2240 0.6785 0.2248 0.6770 0.2243

The a-priori

probability of

parcel

contamination

based on

historical

land use

VALDIFF y24.493 634.603 190.511 569.232 y228.747 628.497

The estimated value

differential

R C

.

V yV

of the parcel in

000s of 1995$

5. EMPIRICAL RESULTS

5.A. The Reduced Form Probit Results

As previously discussed in Section 3, the two-stage method requires the

.

initial estimation of the reduced form probit equation 12 . Although the

purpose of this initial step is to facilitate the calculation of the Mills ratios

W

R

and W

C

, which are then included as estimated variables in their

respective value functions, the estimation results are by themselves of

particular interest. The estimation results, presented in Table 3, identify

two separate estimations, Model 1 and Model 2. Model 2 includes the

structural and land demolition variables, CAPINT, the capital intensity of

the parcel, and PROBCON, the a priori probability of contamination

DANIEL T. MCGRATH 428

TABLE 3

Estimation Results of the Reduced Form Probit

Model 1 Model 2

Intercept y3.616 y3.650

. .

2.533 2.540

LNA 0.652 0.778

. .

Natural Log of land area in sq. ft. 3.876 3.805

LNSPACE y0.287 y0.414

. .

Natural Log of the building area in sq. ft. 2.499 2.567

LAND y1.743E-06 y1.841E-06

. .

Parcel land area in square feet 1.830 1.915

CBD y0.345 y0.038

. .

Distance in miles from the central business 8.745 0.949

district intersection of LaSalle and Jackson

.

Streets

LNORTHD 0.385 0.400

. .

1 if the parcel is north of Lake St., 1.940 1.962

0 otherwise

AGE 0.009 0.009

. .

Age of the building in years 1.889 1.881

COND y0.099 y0.112

. .

Condition Code of the building based on 0.586 0.658

external survey by City of Chicago

DAYS y1.556E-04 y1.483E-04

. .

Number of days from the initial saledate in 1.468 1.386

the dataset, 8r1r83

PCNTAFAM y0.587 y0.626

. .

Percentage of African-American population 2.155 2.260

within census tract of parcel

CAPINT 0.079

.

Capital Intensity as measured by the building 1.158

floor area divided by parcel land area

PROBCON y0.076

.

The a-priori probability of parcel 0.167

contamination based on historical industrial

land use of the parcel

LLF y116.653 y116.640

LRI 0.1365 0.1366

Note: The absolute values of the t statistics are presented n parentheses. The dependent

variable in the reduced-form probit is REDEV which takes on the value of 1 if the parcel was

redeveloped and 0 otherwise. The LRI is analogous to the R

2

statistic in an OLS model. See

w x

Greene 2 , p. 651.

REDEVELOPMENT AND CONTAMINATION RISK 429

TABLE 4

OLS Estimation Results of Redeveloped Value Equations

Model VR1 Model VR2

Intercept 2.350 4.114

. .

2.379 3.903

LAND y1.296E-05 y1.525E-05

. .

Parcel land area in square feet 2.577 3.197

LANDSQ 3.083E-11 3.779E-11

2

. . .

LAND 1.654 2.142

LANDCB y1.635E-17 y1.994E-17

3

. . .

LAND 1.508 1.947

CBD y0.984 y0.773

. .

Distance from the central business district 2.506 2.080

.

intersection of LaSalle and Jackson Streets

CBDSQ 0.178 0.150

2

. . .

CBD 2.877 2.527

CBDCD y0.009 y0.008

3

. . .

CBD 3.053 2.795

LNORTHD 0.499 0.385

. .

1 if the parcel is north of Lake St., 2.293 1.714

0 otherwise

DAYS 1.722E-03 1.859E-03

. .

Number of days from the initial saledate 4.064 4.740

dataset, 8r1r83

DAYSQ y4.400E-07 y4.430E-07

2

. . .

DAYS 4.120 4.522

PCNTAFAM 2.760 3.116

. .

Percentage of African-American 2.151 2.661

population within census tract

of parcel

PAFAMSQ y3.526 y3.713

.

2

. .

PCNTAFAM 2.574 2.969

Demolition variables

COND y0.520

.

Condition code of the building based 3.623

on external survey by City of Chicago

CAPINT 0.293

.

Capital intensity as measured by the building 1.991

floor area divided by parcel land area

CAPINTSQ y0.017

2

. .

CAPINT 1.668

PROBCON y4.593

.

The a priori probability of parcel 2.005

contamination based on historical land use

PCONSQ 3.242

2

. .

PROBCON 1.667

R

W y0.679 y0.175

R

. .

Mills ratio for V 1.614 0.359

2

Adj. R 0.542 0.623

Note: The absolute values of the t statistics are presented in parentheses. Ns95. The

dependent variable is LNUP, the natural log of the per square foot sale price in real 1995$.

DANIEL T. MCGRATH 430

TABLE 5

OLS Estimation Results of Current-Use Value Equations

Model VC1 Model VC2

Intercept 7.418 7.667

. .

7.617 7.928

LNA y0.669 y0.731

. .

Natural log of the land area in sq. ft. 4.204 4.991

LNSPACE 0.397 0.426

. .

Natural log of the bulding area in sq. ft. 3.848 4.331

CBD y0.350 y0.349

. .

Distance from the central business district 2.986 2.969

.

intersection of LaSalle and Jackson Streets

CBDSQ 0.023 0.023

2

. . .

CBD 2.441 2.497

LNORTHD 0.405 0.374

. .

1 if the parcel is north of Lake St., 2.060 1.968

0 otherwise

AGE y0.006 y0.008

. .

Age of the building in years 1.254 1.704

COND y0.321 y0.273

. .

Condition code of the building based on external 2.153 1.864

survey by City of Chicago

PCNTAFAM y0.687 y0.565

. .

Percentage of African-American population 2.676 2.287

within census tract of parcel

PROBCON y0.281

.

The a priori probability of parcel 0.799

contamination based on historical land use

C

W 0.076 0.273

C

. .

Mills ratio for V 0.128 0.511

2

Adj. R 0.5086 0.5080

Note: The absolute values of the t statistics are presented in parentheses. The dependent

variable is LNUP, the natural log of the per square foot sale price in real 1995$.

based on historical land use, for the estimation of Mills ratios for the value

equations, VR2 and VC2, presented in Tables 4 and 5, respectively. Model

1 excludes these variables, as they are not included in the specifications of

either VR1 or VC1.

3

The results of these two initial probit estimations can be interpreted as

identifying the contribution of the explanatory variables to the probability

of redevelopment outside their role in determining the level of value

3

Note that while the variable COND, the condition code of the existing structure, is also

considered a determinant of the structural demolition variable D

S

, it is included in both

Model 1 and Model 2 because the variable COND is one of the variables in vector X

C

which

i

determines current-use value V

C

.

REDEVELOPMENT AND CONTAMINATION RISK 431

differential. Of particular interest is the contribution of PROBCON. Its

insignificance in Model 2 identifies that there is no systematic contribution

of the a priori probability of contamination to the probability of redevelop-

ment between the redeveloped and current-use data groups. If the redevel-

oped and current-use data subsets are indeed representative samples, this

initial result suggests that there is not a fundamental investor bias against

contaminated properties within Chicago due to contamination risk.

5.B. Redeeloped Value Equations

The OLS estimation results of the two specifications of the redeveloped

value equations are presented in Table 4. Model VR1 excludes the

structural and land demolition variables, CAPINT, COND, and PROB-

CON, whereas Model VR2 is specified with these variables.

The log-linear functional form is justified as a Taylor series expansion of

.

Eq. 7 . Explanatory variables were expanded out as far as they were

significant in the OLS estimations. A number of variables exhibit complex,

R

.

non-linear relationships to ln V rL . The redeveloped value function

exhibits statistically significant cubic relationships with respect to both

. .

land area LAND and distance from the central business district CBD ,

w x

which is consistent with the results presented by Munneke 10 . The cubic

relationship with respect to CBD identifies a rapid decline in value as

parcel distance from the CBD increases with a local minimum at 3.7 miles

representing a 70% decline in average unit bid value from a CBD

.

location and with a local maximum at 8.7 miles representing a 50%

.

decline in average unit bid value from a CBD location . Also significant is

the dummy variable, LNORTHD, which identifies whether a parcel has a

north or south location within the City. North-side parcels command on

average a unit price about 47% higher than similar south-side parcels. The

spatial pattern described by these spatial variables identifies the lowest

industrial land values to be the near southern locations between 2.5 and 5

miles from the CBDlocations generally regarded as the Citys most

socially and economically distressedand the highest to be on the north

side between 7 and 10 miles from the CBD, areas close to OHare Airport.

While land contamination exists in all the industrial areas of the City of

Chicago, there are many contaminated sites on the predominantly

African-American south side, and there is a general perception that the

Citys African-American neighborhoods bear more environmental contam-

w x

ination risk, despite empirical evidence to the contrary 2 . Thus, it was

important to control for race in determining the effect of contamination

risk on land value, in order to eliminate the possibility that the reductions

in land value are in fact due to the impact of distressed social and

economic conditions associated with African-American neighborhoods in

Chicago. The variable PCNTAFAM identifies the percentage of African-

DANIEL T. MCGRATH 432

American population within the census tract of the parcel. Both Models

VR1 and VR2 exhibit statistically significant quadratic relationships with

respect to neighborhood African-American population percentages. Parcel

unit bid value declines from a central maximum of about 40% African-

American population. In other words, parcels in census tracts of about

40% African-American population have the highest bid values. One expla-

nation for this result is that the quadratic form for the variable PC-

NTAFAM may be capturing a value discount effect associated with areas

of high Hispanic population. It is well documented that in the City of

Chicago African-American neighborhoods are typically segregated from

w x

Hispanic neighborhoods 2 , and areas of high Hispanic population tend to

have low African-American population.

4

Both redeveloped value models, VR1 and VR2, exhibit a strongly

significant quadratic temporal trend in unit bid value. The quadratic

expression of the variable DAYS, which is the number of days from the

.

first sale-date observation 8r1r83 , identifies a trend of substantial

increase in unit land bid value that peaked around the end of April 1989,

followed by a decline which brought unit bid value back to a level only

slightly above their average level in 1983. On average, the April 1989 unit

bid value is about 600% above the unit bid value in August 1983. This date

is consistent with the peak of real estate speculation that was occurring in

land markets nationwide and the high regional and national economic

growth period of the late 1980s. Interestingly, by the last date in the

dataset, November 1993, average unit prices had returned to approxi-

mately their original level.

The vector of structural and land demolition variables, CAPINT, COND,

and PROBCON, respectively, all exhibit significance in the redeveloped

.

value equation VR2. Capital intensity CAPINT , as measured by the

structure floor space divided by building land area, exhibits a significant

quadratic relationship to parcel unit bid value. Parcel unit bid value

increases with increasing capital intensity, with a local maximum at a

capital intensity value of about 9, and exhibits declines in unit value at

higher capital intensities. The variable COND represents the condition

code of the building as identified by visual inspection of the structure by

the Chicago Department of Buildings. COND is a whole number from 1 to

4, with 1 representing a sound structure with no obvious repair needed, 2

4

Further analysis supports this hypothesis. An analysis of the parcels in the dataset shows a

significant inverse relationship between African-American and Hispanic population percent-

ages. Additionally, when the quadratic form for the variable PCNTAFAM is substituted with

a dummy variable that takes on the value of 1 when the census tract is greater than 75%

African-American or greater than 75% Hispanic or greater than 95% African-American and

.

Hispanic combined 0 otherwise , statistical significance of the dummy variable and all other

variables are maintained in both the redeveloped and current-use value models.

REDEVELOPMENT AND CONTAMINATION RISK 433

representing a structure needing minor repair, 3 representing a structure

needing major repair, and 4 identifying an uninhabitable, dilapidated

structure. In both the redeveloped and current-use data groups, the

COND variable ranged from 1 to 3 with no structures of condition code 4

being represented in the data. As expected, the estimation results of

Model VR2 show that a unitary increase in COND results in a 40%

decrease in a parcels unit value. Clearly, if a high quality structure exists

on a parcel purchased for redevelopment, the redeveloper will have to pay

the salvage value of the existing structure. Also, given that this study uses a

softer redevelopment rule, it is possible that the existing structures were

incorporated into the redevelopment of the site.

Of most importance is the impact of the environmental variable PROB-

CON, which represents the a priori probability of contamination based on

historical land-use. Model VR2 exhibits a significant quadratic relationship

with respect to the contamination risk associated with the parcel. The

relationship between the probability of contamination and parcel unit bid

value is presented in Fig. 1. There is a rapid decline in parcel unit bid

value as contamination risk rises, which comes to a local minimum at

contamination probability of about 75%, with a very slight increase at

higher probabilities of contamination. This slight rise in value effect could

be an artifact of the data, and perhaps a better functional form for

FIG. 1. Impact of the probability of contamination on average unit bid value.

DANIEL T. MCGRATH 434

PROBCON would be a negative exponential form rather than a quadratic.

5

However, parcels of greatest public concern have tended to be those with

highest contamination risk. The slight increase in value at high levels of

contamination risk could be interpreted as evidence of redevelopment

following more intense governmental scrutiny and response on the most

contaminated of sites and thus perhaps identifies the capture of scale

economies in remediation technology for the most contaminated sites by

responsible parties.

Figure 2 presents the distributions of the estimated sale price discounts

per parcel associated with the structural and land demolition variables.

The estimated structural demolition discounts were calculated for each of

the 95 parcels in the redeveloped group by identifying the total combined

discount associated with the variables COND, CAPINT, and CAPINTSQ.

Similarly, the land demolition discounts were calculated for each parcel by

identifying the combined discount associated with the variables PROB-

CON and PCONSQ. The respective structural and land demolition dis-

5

Statistical significance is maintained in the model with the contamination variable speci-

fied in natural log form.

FIG. 2. Frequency distribution of estimated sale price discounts per parcel to account for

structural and land demolition costs.

REDEVELOPMENT AND CONTAMINATION RISK 435

counts were then assembled into normalized distributions. As expected,

the structural demolition discount has a median value of about y$287,000

per parcel and exhibits only a 4% probability of actually being positive.

Further investigation of the four observations that exhibit positive struc-

tural demolition discounts shows that their average discount was substan-

.

tially positive q$342,000 and all four parcels have a condition code equal

to 1, identifying a high quality structure on the parcel. This is consistent

with the view that when high quality structures exist on parcel, investors

seeking to redevelop the parcel have to pay the salvage value of the

building, whether it is utilized or razed for redevelopment.

The distribution of estimated land demolition exhibits a somewhat

skewed distribution, and the land demolition or contamination discounts

are quite high on a per parcel basis. The median land demolition discount

is approximately y$1.9 million dollars per parcel or about y$1 million per

acre, although discounts between y$400,000 and y$800,000 occurred

w x

with the most frequency. For comparison, Noonan and Vidich 11 calcu-

late from their survey of site remediations that the total cost of remedia-

tion, which includes Phase I, Phase II, and cleanup, is on average about

$290,000, with a minimum and maximum cost identified at $111,000 and

$914,000, respectively.

6

The contribution of the structural and land demolition variables to the

explanatory power of the redeveloped value function is significant, improv-

ing the adjusted R

2

by six percentage points, from 0.542 to 0.623. Lastly,

the coefficient of the Mills ratio in the redeveloped value function VR1 is

nearly significant, which could be interpreted as indicating a model mispec-

ification without the inclusion of the demolition variables. More impor-

tantly, however, the Mills ratio is insignificant in Model VR2, identifying

that, with the inclusion of the demolition variables, model specification is

improved and selection bias is likely not present between the redeveloped

and current-use data groups.

5.C. Current-Use Value Equations

The results of the two specifications of the current-use equations, VC1

and VC2, are presented in Table 5. Model VC1 is specified without the

land demolition variable PROBCON, and Model VC2 is specified with this

variable to test if the probability of contamination is a significant determi-

nant of current-use value as well as for redeveloped value. The variable

COND, the condition code of the structure, is included in both VC1 and

VC2. This is because the condition of the structure is relevant to purchase

of a parcel remaining in its current use, and it is not intended as a proxy

6

Dollar values converted to 1995$. It is not clear if these dollar figures represent cleanup

costs per site or per acre.

DANIEL T. MCGRATH 436

for any structural demolition costs as is the case for the redeveloped value

equation. The variable PROBCON in Model VC2 is insignificant, al-

though, consistent with expectations, the sign of the coefficient is negative.

C

.

The functional form for V , Eq. 4 , resulted from the imposition of a

CobbDouglas functional form for the real estate variable, or R sL

.

Focusing on the results for Model VC2, the coefficient of LNA is negative

and significant, indicating that, for current-use parcels, the per-square-foot

unit value declines with increasing land area. The coefficient of LNA is

.

equal to y1 , where represents the elasticity of land value to land

area in a CobbDouglas functional form. is estimated within the

current-use data group to be equal to 0.269. The coefficient of LNSPACE

in the model is equal to , which represents the elasticity of land value to

floor space. In Model VC2, the coefficient of LNSPACE is positive and

significant and identifies that the elasticity of land value to building space

is equal to 0.426.

Of the locational variables, the influence of CBD and LNORTHD on

unit bid value are significant for current-use parcels, with unit bid value

exhibiting a quadratic relationship with respect to CBD. The average unit

bid value declines to a minimum reduction of about 70% at 7.5 miles from

the CBD, rising thereafter. A north location relative to a south location

gains 35% in unit bid value. Similar to the redeveloped group of parcels,

the sector with highest average unit value is the northwest sector of the

city, outside nine miles from the central business district.

Both of the site-specific explanatory variables, COND and AGE, are

statistically significant. Each unit increase in condition code decreases unit

bid value by 39% and each additional 10 years to the structures age

decreases unit value by about 8%. The racial population variable PC-

NTAFAM, which identifies the percentage of African-American popula-

tion within the census tract of the parcel, also has a large and significant

effect on current-use unit value. A 10% increase in census tract African-

American population reduces parcel unit bid value about 6%. Lastly, the

coefficient of the Mills ratio is not significant, again identifying no selec-

tion bias between the redeveloped and current-use data groups.

5.D. Structural Probit Results

The redeveloped and current-use value equations estimated above are

used to calculate the value differential for each property in the full

dataset. The value differential for each property is the difference in the

estimated value identified by the redeveloped value equation minus the

R C

.

predicted value identified by the current-use value equation, or V yV .

This measurement of estimated parcel value differential is then used in the

.

structural probit model, Eq. 15 , to test the hypothesis that redevelopment

REDEVELOPMENT AND CONTAMINATION RISK 437

occurs when the value of parcel converted to a new use exceeds the

parcels current-use value.

Similar to the previously mentioned situation caused by the inclusion of

.

an estimated variable the Mills ratio in the value equations, since the

probit model is estimated using a variable that is itself estimated from the

value equations, there may be bias in the standard errors of the probit

model. In this probit analysis, the standard errors shown are uncorrected,

so there is a possibility that they may be biased downwards.

7

The results of the various specifications of the structural probit equa-

tions are presented in Table 6. The dependent variable of the probit model

is REDEV, which takes on the value of 1 if a parcel is among the

redeveloped properties and 0 if it is among the current-use properties. The

estimated values of the dependent variable REDEV are interpreted as the

probability of redevelopment occurring contingent upon a sale. The ex-

planatory variable in the structural probit model is VALDIFF, which is the

estimated value differential calculated as the difference between the

predicted redeveloped value and the predicted current-use value for all

observations.

For Probit Model 1 in Table 6, which uses as a measure for VALDIFF

the difference between VR1 and VC1 model specifications that exclude

7

Recognizing the possibility of standard error bias but leaving the standard errors uncor-

rected is the standard approach to this problem, due to the complexity of the correction

w x w x

procedure. This approach is the same as used by Munneke 10 . See also Lee 4 .

TABLE 6

Estimation Results of the Structural Probit

Value

differential

.

Constant VALDIFF LLF LRI

Model 1 0.000698 y127.748 0.054

.

Excluding demolition variables 3.342

VALDIFFsVR1 yVC1 y0.119778 0.000809 y127.039 0.060

. .

1.185 3.398

Model 2 0.001470 y118.076 0.126

.

Including demolition variables 4.426

VALDIFFsVR2 yVC2 y0.027682 0.001469 y118.034 0.126

. .

0.290 4.437

Note: The absolute values of the t statistics are presented in parentheses. The dependent

variable in the structural probit is REDEV which takes on the value of 1 if the parcel was

redeveloped and 0 otherwise. The LRI is analogous to the R

2

statistic in an OLS model. See

w x

Greene 2, p. 651 .

DANIEL T. MCGRATH 438

.

the demolition variables , the impact of VALDIFF on the probability of

redevelopment is positive and significant. The significance of VALDIFF in

Probit Model 1 is maintained for probit model specifications that both

include and exclude a constant term, although the constant is statistically

insignificant. The insignificance of the constant term is an interesting

result, given the fact that the demolition variables have been excluded

R

w x

from the redeveloped value function V . Munneke 10 argues that if the

value differential is the only determinant in the criterion function, then a

significant constant term would represent a fixed demolition cost for

industrial property. However, Munneke finds in his probit analysis of

industrial properties that the inclusion of a constant term, while statisti-

cally significant, eliminates the significance of the value differential vari-

able for industrial properties.

8

In this analysis, the insignificance of the

constant term in the Probit Model 1 supports the view that demolition

costs are likely to be systematically related to some characteristic of the

parcel that would certainly be capitalized into land value and thus become

part of the parcels value differential.

Model 2 uses the value equations specified with the demolition variables

VR2 and VC2 to calculate VALDIFF. The mean value for VALDIFF is,

as expected, positive for the redeveloped subset of parcels, and, on

average, parcels in the redeveloped group have realized about $190,500 in

.

1995$ gain in value through conversion to a new use. The standard

deviation of VALDIFF is quite large, however, at $558,000. Also, as

expected for the current-use group, the predicted value differential is

negative with a value of y$229,000 and a standard deviation of $635,000.

In Probit Model 2, the significance of the VALDIFF variable is substan-

tially enhanced, and, as in Probit Model 1, the constant term is insignifi-

cant. Probit Model 2 identifies that, for industrial properties in the City of

Chicago, a value differential on the order of $957,000 will result in a 90%

probability of redevelopment by the private market. The estimated rela-

tionship between the magnitude of the value differential and the predicted

probability of redevelopment, as estimated by Probit Model 2, is presented

in Fig. 3.

The significance of the coefficient for the VALDIFF variable in the

structural probit model allows identification of an estimated relationship

between the a priori probability of land contamination and the probability

of industrial redevelopment. This relationship, presented in Fig. 4, is

produced by calculating the value differential at the sample means of the

8

w x

Also in Munnekes 10 analysis, he finds the inclusion of a capital intensity variable into

the probit model is statistically significant. From this result, he argues that demolition costs

are systematically related to the amount of capital on an industrial parcel and that this is a

significant determinant of redevelopment.

REDEVELOPMENT AND CONTAMINATION RISK 439

FIG. 3. Estimated relationship between value differential and probability of redevelop-

ment for industrial real estate in Chicago for Model 2: Valdiff sVR2 yVC2.

redeveloped parcels for all variables other than PROBCON. The value of

PROBCON is allowed to vary between 0 and 1. The change in the value

.

differential VALDIFF associated with the change in PROBCON is then

translated into a change in the probability of redevelopment, as specified

by the structural probit model. In a separate evaluation, hypothetical

FIG. 4. Estimated relationship between the a priori probability of contamination and the

probability of redevelopment evaluated at the sample means.

DANIEL T. MCGRATH 440

reductions of contamination risk to zero i.e., setting the variable PROB-

.

CON to zero for each parcel in the redeveloped group produced an

average increase of 35 percentage points in the probability of redevelop-

ment for each parcel, to an average probability of redevelopment of 92%.

6. CONCLUSION

The results of this study support two major conclusions. First, this

analysis provides strong support for the view that investors who are

purchasing land for industrial redevelopment are discounting their bid

value to account for contamination risk in a systematic fashion, and within

the City of Chicago contamination risk appears to have been fully capital-

ized into industrial land values. The magnitude of this discounta median

76% unit value discount which translates to about a median $1.9 million

per parcel discount or about a $1.0 million per acre discount in 1995$is

somewhat higher in comparison to the limited information we have for the

magnitude of private voluntary cleanup costs, including Phase I, Phase II,

and remediation expenditures. Therefore, it is possible that investors are

perhaps either overestimating the financial liability or that the discounts

incorporate the present value of required legal costs certain to be part of

any site redevelopment. However, the results suggest that contamination

risk is not, per se, a detriment to redevelopment. Contamination risk

reduces the value of land, which in the short term reduces the value

differential available to an investor and increases the scale of financial

capital required for redevelopment. The evidence here suggests that in-

vestors, at least those in Chicago, could expect to recoup the expenditures

required to remove contamination liability through increase in land value

after site remediation.

Second, this study provides additional empirical evidence to support the

myopic redevelopment rule in explaining industrial redevelopment activity

in an urban area, and this analysis is the first to utilize the myopic optimal

redevelopment rule to estimate the relationship between land contamina-

tion risk and the probability of urban industrial redevelopment. On aver-

age, a hypothetical cleanup of the average parcel in the dataset, with a 0.67

probability of contamination and a value differential on the order of

$190,000, improves the probability of redevelopment about thirty-five

percentage points, from 0.57 to 0.92.

The evidence presented here concerning the capitalization of contami-

nation risk shows that, while there is not a fundamental bias against

contaminated industrial parcels within the urban core, the financial bur-

den, estimated at approximately $1 million per acre, without question

increases the scale of financial capital required for private market redevel-

opment. The evidence here also suggests that a publicly funded cleanup

would substantially increase land value and thus increase the parcels value

REDEVELOPMENT AND CONTAMINATION RISK 441

differential. This could substantially increase the probability of a parcels

redevelopment by the private market, as well as increase the property tax

revenue from the parcel. For these reasons, combined with the reduction

in risk to human health and ecosystems, more aggressive municipal gov-

ernmental intervention in site remediation might indeed be justified. The

evidence here suggests that it quite possible for a publicly funded remedia-

tion of a contaminated site to increase, in the short term, the probability of

redevelopment by the private market, but only after some serious scrutiny

of the other systematic determinants of land value and thus value differ-

.

ential for the parcel in question. Intervention would be optimal on

marginal properties that have the locational and other site characteristics

which, but for the existence of contamination risk, would clearly be

desirable to an industrial user. For such properties, the gain in land value

and the subsequent increase in value differential resulting from a site

remediation might indeed bring the parcel into a more competitive posi-

tion in the private industrial real estate market and could be viewed as a

viable strategy to attract jobs to a central-city location. Therefore, under-

standing the spatial patterns of value differential for industrial parcels

within the urban core could be a very important strategy for local govern-

ments to optimize their efforts, specifically publicly funded site cleanups,

to attract new industrial users for brownfield properties within the urban

core.

REFERENCES

1. J. K. Brueckner, A vintage model of urban growth, Journal of Urban Economics, 8,

.

389402 1980 .

2. D. Coursey et al., Environmental Racism in the City of Chicago: The History of EPA

Hazardous Waste Sites in African-American Neighborhoods, unpublished paper,

.

University of Chicago 1994 .

.

3. W. H. Greene, Econometric Analysis, MacMillan, New York 1993 .

4. L. F. Lee, Unionism and wage rates: A simultaneous equations model with qualitative

.

and limited dependent variables, International Economic Reiew, 19, 415433 1978 .

.

5. L. F. Lee, Identification and estimation in binary choice models with limited censored

.

dependent variables, Econometrica, 47, 977995 1979 .

6. L. F. Lee, G. S. Maddala, and R. P. Trost, Asymptotic covariance matrices of two stage

probit and two state tobit methods for simultaneous models with selectivity, Econo-

.

metrica, 48, 491503 1980 .

7. G. S. Maddala, Limited Dependent and Qualitative Variables in Econometrics, Cam-

.

bridge Univ. Press, Cambridge, UK 1983 .

8. J. F. McDonald, The substitution of land for other inputs in urban areas, Papers of the

.

Regional Science Association, 48, 3952 1981 .

9. E. S. Mills, The value of urban land, in The Quality of the Urban Environment H. S.

. .

Perloff, Ed. , Johns Hopkins, Baltimore, MD 1971 .

DANIEL T. MCGRATH 442

10. H. J. Munneke, Redevelopment decisions for commercial and industrial properties,

.

Journal of Urban Economics, 39, 229253 1996 .

11. F. Noonan and C. A. Vidich, Decision analysis for utilizing hazardous waste site

.

assessments in real estate acquisition, Risk Analysis, 12, No. 2, 245251 1992 .

12. S. S. Rosenthal and R. W. Helsley, Redevelopment and the urban land price gradient,

.

Journal of Urban Economics, 35, 182200 1994 .

13. W. C. Wheaton, Urban spatial development with durable but replaceable capital, Journal

.

of Urban Economics, 12, 5367 1982 .

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Revolving Line of Credit AgreementДокумент9 страницRevolving Line of Credit AgreementRobert ArkinОценок пока нет

- FORM 16 TITLEДокумент5 страницFORM 16 TITLEPunitBeriОценок пока нет

- Production of I.V. Fluids (Saline and Dextrose) - Intravenous Solution (IV) Manufacturing Business With Blow-Fill-Seal (BFS) Technology.-412392 PDFДокумент80 страницProduction of I.V. Fluids (Saline and Dextrose) - Intravenous Solution (IV) Manufacturing Business With Blow-Fill-Seal (BFS) Technology.-412392 PDFBon Joey Bernesto100% (1)

- Understanding The NexusДокумент52 страницыUnderstanding The NexusbhuvanaОценок пока нет

- Guidance For in Situ Chemical Oxidation of Contaminated Soil and GroundwaterДокумент172 страницыGuidance For in Situ Chemical Oxidation of Contaminated Soil and GroundwaterTecnohidro Engenharia AmbientalОценок пока нет

- Numerical Model Investigation For Potential Methane Explosion and Benzene Vapor Intrusion Associated With High-Ethanol Blend ReleasesДокумент8 страницNumerical Model Investigation For Potential Methane Explosion and Benzene Vapor Intrusion Associated With High-Ethanol Blend ReleasesTecnohidro Engenharia AmbientalОценок пока нет

- Integrating Risk Analysis and Decision Support in Electricity Asset ManagementДокумент8 страницIntegrating Risk Analysis and Decision Support in Electricity Asset ManagementEjaj SiddiquiОценок пока нет

- Stock Market Gaps TradingДокумент21 страницаStock Market Gaps TradingneagucosminОценок пока нет

- Coupled Phenomena in Environmental GeotechnicsДокумент681 страницаCoupled Phenomena in Environmental GeotechnicsTecnohidro Engenharia AmbientalОценок пока нет

- Banking MCQДокумент5 страницBanking MCQJT GalОценок пока нет