Академический Документы

Профессиональный Документы

Культура Документы

Econ Assign

Загружено:

Francisco Marvin100%(1)100% нашли этот документ полезным (1 голос)

52 просмотров5 страницbe

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документbe

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

52 просмотров5 страницEcon Assign

Загружено:

Francisco Marvinbe

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

4. CMI, Inc.

, manufactures small electrical appliances and has recently introduced an

innovative new dessert maker for frozen yogurt that has the clear potential to offset

the weak pricing and sluggish volume growth experienced during recent periods.

Monthly demand and cost relations for CMIs frozen dessert maker are as follows:

P = Php 60 - (Php 0.005*Q) TC = Php 100,000 + (Php 5*Q) + (Php 0.0005*Q

2

)

MR I = TR/Q = Php 60 (Php0.01*Q) MC = TC/Q = Php 5 + (Php 0.001*Q)

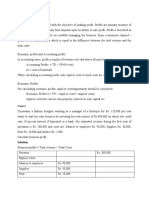

(a) Set up a table or spreadsheet for CMI output (Q), price (P), total revenue

(TR), marginal revenue (MR), total cost (TC), marginal cost (MC), total profit

(). Establish a range for Q from 0 to 10,000 in increment of 1,000 (i.e., 0,

1,000, 2,000, .., 10,000)

(*Maam, we made this in Excel, then we screenshot it and pasted here in our output)

(b) Using the Q in (a), calculate, create graph for with TR, TC, and . At what

price/output combination is total profit maximized? Why? At what

price/output combination is total revenue maximized? Why?

The price/output combination at which total profit is maximized is P = Php

35 and Q = 5,000 units. At that point, MR = MC and total profit is maximized

at 37,500. The price/output combination at which total revenue is

maximized is at P = Php 30 and Q = 6,000 units. At that point, MR = 0 and

total revenue is maximized at Php 180,000.

Using the CMI, Inc spreadsheet, a graph with TR, TD, and as dependent

variables, and units of output (Q) as the independent variable appears as

follows:

(c) Determine these profit maximizing and revenue-maximizing price/output

combinations analytically. In other words, use CMIs profit and revenue

equations to confirm tour answers to (b).

To find profit-maximizing output level analytically, set M = MR MC = 0 or

MR = MC, and solve for Q. Because

MR = MC

Php 60 (0.01*Q) = Php 5 + Php 0.001*Q

0.011Q = 55

Q = 5,000

At Q = 5,000

P = Php 60 Php 0.005 (5,000)

= Php 35

= - Php 100,000 + Php 55 (5,000) Php 0.0055 (5,000

2

)

= 175,000 137,500

= Php 37,5000

This is a profit maximum because total profit is falling for Q >5,000.

To find the revenue-maximizing profit output level, set MR = 0, and solve for

Q. Thus

MR = Php 60 (Php 0.01*Q) = 0

0.01Q = 60

Q = 6,000

At Q = 6,000

P = Php 60 Php 0.005 (6,000)

= Php 30

= TR TC

= (Php 60 Php 0.005Q)Q Ph 100,000 Php 5Q Php 0.0005Q

2

= -Php 100,000 + 55Q Php 0.0055 Q

2

= - Php 100,000 + 55 (6,000) Php 0.0055 (6,000

2)

= - Php 100,000 + 330,000 Php 0.0055 (36,000,000)

= - Php 100,000 + 330,000 Php 198,000

= Php 32,000

This is a revenue maximum because total revenue is decreasing for output

beyond Q > 6,000.

(d) Given downward sloping demand and marginal revenue curves and positive

marginal costs, the profit-maximizing price/output combination is always at

a higher price and lower production level than the revenue-maximizing

price-output combination. This stems from the fact profit is maximized when

MR = MC, whereas revenue is maximized when MR = 0. It follows that profits

and revenue are only maximized at the same price/output combination in

the unlikely event that MC = 0.

2

2

2

2

2

Вам также может понравиться

- Solution Manual Chap 8Документ5 страницSolution Manual Chap 8sshahar2Оценок пока нет

- Managerial Economics Michael Baye Chapter 8 AnswersДокумент6 страницManagerial Economics Michael Baye Chapter 8 Answersneeebbbsy8980% (10)

- Managerial Economics and Business Strategy 8th Edition Baye Solutions ManualДокумент6 страницManagerial Economics and Business Strategy 8th Edition Baye Solutions Manualoutscoutumbellar.2e8na100% (27)

- Managerial Economics - Lecture 3Документ18 страницManagerial Economics - Lecture 3Fizza MasroorОценок пока нет

- Chapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EДокумент5 страницChapter 10: Market Power: Monopoly and Monopsony: P MC 1 + 1 EKalyan SaikiaОценок пока нет

- Chapter 8: Answers To Questions and Problems: Managerial Economics and Business Strategy, 5eДокумент5 страницChapter 8: Answers To Questions and Problems: Managerial Economics and Business Strategy, 5eadityaintouch100% (1)

- Msci 607: Applied Economics For ManagementДокумент4 страницыMsci 607: Applied Economics For ManagementRonak PatelОценок пока нет

- Profit Versus Revenue MaximizationДокумент2 страницыProfit Versus Revenue Maximizationsambalikadzilla6052Оценок пока нет

- Managerial Economics Assignment Biruk TesfaДокумент13 страницManagerial Economics Assignment Biruk TesfaBirukee ManОценок пока нет

- Exam Questions:: Microe Conomics and Macr OE Conomic S Qu e Stio N 1Документ26 страницExam Questions:: Microe Conomics and Macr OE Conomic S Qu e Stio N 1Anirbit GhoshОценок пока нет

- End-Of-Chapter Answers Chapter 10 PDFДокумент13 страницEnd-Of-Chapter Answers Chapter 10 PDFSiphoОценок пока нет

- q1222 EconnnДокумент6 страницq1222 EconnnSina TempioraryОценок пока нет

- Instructor's Manual To Accompany Managerial EconomicsДокумент2 страницыInstructor's Manual To Accompany Managerial Economicssambalikadzilla6052100% (1)

- 14 - Ton Nu My Duyen - EBBA 11.1 - Assignment 8Документ8 страниц14 - Ton Nu My Duyen - EBBA 11.1 - Assignment 8Tôn Nữ Mỹ Duyên100% (1)

- Assignment 8Документ8 страницAssignment 8eric stevanusОценок пока нет

- UYGULAMA DERSÝ SORU VE CEVAPLARI (Practice Q & A)Документ5 страницUYGULAMA DERSÝ SORU VE CEVAPLARI (Practice Q & A)Wail Fouaad Maa'ni MohammedОценок пока нет

- Solution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFДокумент10 страницSolution-BECO575-Worksheet 3 (8 And10 - Market Structures) PDFSara HalabiОценок пока нет

- ME Answer Keys (Problem Set-7) - 2020Документ10 страницME Answer Keys (Problem Set-7) - 2020aksОценок пока нет

- Solution To Practice Problems Ch.2: Q P Q PДокумент3 страницыSolution To Practice Problems Ch.2: Q P Q PSamerОценок пока нет

- Exercise 21 ProfitДокумент4 страницыExercise 21 ProfitSulhan YildirimОценок пока нет

- Economics 370 Microeconomic Theory Problem Set 6 Answer KeyДокумент3 страницыEconomics 370 Microeconomic Theory Problem Set 6 Answer KeyHM TohaОценок пока нет

- EMBA Induction Session 3Документ28 страницEMBA Induction Session 3Dhananjay ShrivastavОценок пока нет

- Numerical ProblemsДокумент10 страницNumerical ProblemsBisam Binod KhanalОценок пока нет

- ECON357 v2 Assignment 2B!!Документ16 страницECON357 v2 Assignment 2B!!hannahОценок пока нет

- Problem Set - Perfect Competition AnswersДокумент3 страницыProblem Set - Perfect Competition AnswersKhushi GuptaОценок пока нет

- Managerial Economics Assignment 1: TR Q TR QДокумент1 страницаManagerial Economics Assignment 1: TR Q TR QFatima KhalidОценок пока нет

- Week 2 SolutionsДокумент6 страницWeek 2 SolutionsAnton BochkovОценок пока нет

- Chapter 8 - Competitive Market SolutionsДокумент10 страницChapter 8 - Competitive Market SolutionsenglishlessonsОценок пока нет

- This Study Resource Was: D Profit TR TC Profit $ 37,500Документ4 страницыThis Study Resource Was: D Profit TR TC Profit $ 37,500himanshu shuklaОценок пока нет

- Economic Concept of Cost - Production and Cost - Short Run Cost Function - Long Run Cost FunctionДокумент23 страницыEconomic Concept of Cost - Production and Cost - Short Run Cost Function - Long Run Cost FunctionAkshatОценок пока нет

- L6B Profit MaximizationДокумент42 страницыL6B Profit Maximizationkurumitokisaki967Оценок пока нет

- Managerial Economics - Lecture 4Документ18 страницManagerial Economics - Lecture 4Fizza MasroorОценок пока нет

- Written Assignment Week 4Документ5 страницWritten Assignment Week 4Shiraz ShafqatОценок пока нет

- Workshop 4 Perfect Competition Solutions-2Документ15 страницWorkshop 4 Perfect Competition Solutions-2GiovanniNico33Оценок пока нет

- Answer Keys (Problem Set-4)Документ6 страницAnswer Keys (Problem Set-4)srivastavavishistОценок пока нет

- Numerical ProblemsДокумент10 страницNumerical ProblemsAnup kattelОценок пока нет

- Maths Work Sheet (1) Chapter - 1Документ10 страницMaths Work Sheet (1) Chapter - 1ibsaashekaОценок пока нет

- Practice: 1. Suppose There Is A Perfectly Competitive Industry Where All The Firms AreДокумент10 страницPractice: 1. Suppose There Is A Perfectly Competitive Industry Where All The Firms Aremaddie isnt realОценок пока нет

- Chapter 2 Q&P Answers SanchezДокумент14 страницChapter 2 Q&P Answers SanchezRobert Jr.Оценок пока нет

- Managerial Economics Ass2Документ5 страницManagerial Economics Ass2Hajra AОценок пока нет

- The Marketing and Accounting Departments of Pharmed Caplets, Inc. Have Provided You With The FollowingДокумент6 страницThe Marketing and Accounting Departments of Pharmed Caplets, Inc. Have Provided You With The Followinghimanshu shuklaОценок пока нет

- 120 PointsДокумент14 страниц120 PointsCảnh DươngОценок пока нет

- Economics PG Problem Set 2 Ans Due DateДокумент15 страницEconomics PG Problem Set 2 Ans Due DateHuỳnh LinhОценок пока нет

- BUS 438 (Durham) - HW 8 - Capital Budgeting 3Документ5 страницBUS 438 (Durham) - HW 8 - Capital Budgeting 3sum pradhanОценок пока нет

- ECO200 Sample Term Test 2 - Winter 2024 - SolutionДокумент12 страницECO200 Sample Term Test 2 - Winter 2024 - Solutionyitongli1024Оценок пока нет

- CHP 2 SolДокумент17 страницCHP 2 SolZakiah Abu KasimОценок пока нет

- Answer MidДокумент3 страницыAnswer MidWill KaneОценок пока нет

- Microeconomics SampleДокумент4 страницыMicroeconomics SampleSaumyaKumarGautamОценок пока нет

- MGEC HW3 SolutionsДокумент4 страницыMGEC HW3 SolutionsKiran S JoseОценок пока нет

- AnswerДокумент6 страницAnswerAinin Sofea FoziОценок пока нет

- Managerial Eco - AssugnmentДокумент14 страницManagerial Eco - AssugnmentAbdullah NomanОценок пока нет

- Practice Problem Set 2 SolutionsДокумент4 страницыPractice Problem Set 2 SolutionsHemabhimanyu MaddineniОценок пока нет

- RSP AnalysisДокумент4 страницыRSP AnalysispalepukaushikОценок пока нет

- EC260 Assignment 2Документ11 страницEC260 Assignment 2mitty101sanОценок пока нет

- Eco Assignment 2Документ19 страницEco Assignment 2mdmahamudulislam17Оценок пока нет

- Corporate Finance Tutorial 5 - SolutionsДокумент8 страницCorporate Finance Tutorial 5 - Solutionsandy033003Оценок пока нет

- The Food Service Professionals Guide To: Bar & Beverage Operation Bar & Beverage Operation: Ensuring Maximum SuccessОт EverandThe Food Service Professionals Guide To: Bar & Beverage Operation Bar & Beverage Operation: Ensuring Maximum SuccessРейтинг: 5 из 5 звезд5/5 (1)

- The Food Service Professionals Guide To: Increasing Restaurant Sales: Boost Your Profits By Selling More Appetizers, Desserts, & Side ItemsОт EverandThe Food Service Professionals Guide To: Increasing Restaurant Sales: Boost Your Profits By Selling More Appetizers, Desserts, & Side ItemsОценок пока нет

- The Food Service Professionals Guide To: Controlling Restaurant & Food Service Operating CostsОт EverandThe Food Service Professionals Guide To: Controlling Restaurant & Food Service Operating CostsОценок пока нет

- The Food Service Professionals Guide To: Building Restaurant Profits: How to Ensure Maximum ResultsОт EverandThe Food Service Professionals Guide To: Building Restaurant Profits: How to Ensure Maximum ResultsОценок пока нет

- Crim 2 - First CasesДокумент37 страницCrim 2 - First CasesFrancisco MarvinОценок пока нет

- Increased by Percentage 19.8% 26.8% 30.45%Документ1 страницаIncreased by Percentage 19.8% 26.8% 30.45%Francisco MarvinОценок пока нет

- Agency For Vol Recit 020214Документ9 страницAgency For Vol Recit 020214Francisco MarvinОценок пока нет

- Cir V Mobil (Francisco) DoctrineДокумент3 страницыCir V Mobil (Francisco) DoctrineFrancisco MarvinОценок пока нет

- Cano18 To 20Документ11 страницCano18 To 20Francisco MarvinОценок пока нет

- Evidence - Cases For Recit 132Документ9 страницEvidence - Cases For Recit 132Francisco MarvinОценок пока нет

- MIAA v. Court of Appeals IssueДокумент3 страницыMIAA v. Court of Appeals IssueFrancisco MarvinОценок пока нет

- Filipina Sy V. Ca and Fernando Sy - FranciscoДокумент5 страницFilipina Sy V. Ca and Fernando Sy - FranciscoFrancisco MarvinОценок пока нет

- Bates VДокумент1 страницаBates VFrancisco MarvinОценок пока нет

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsДокумент1 страницаYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinОценок пока нет

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsДокумент1 страницаYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinОценок пока нет

- NCC Chapter 2Документ3 страницыNCC Chapter 2Francisco MarvinОценок пока нет

- Tan V Del RosarioДокумент1 страницаTan V Del RosarioFrancisco MarvinОценок пока нет

- Southern Cross Cement Corporation VДокумент1 страницаSouthern Cross Cement Corporation VFrancisco MarvinОценок пока нет

- G.R. No. 85279Документ13 страницG.R. No. 85279JP TolОценок пока нет

- NaagДокумент6 страницNaagFrancisco MarvinОценок пока нет

- Republic Act No 6809 Age of Majority 18Документ1 страницаRepublic Act No 6809 Age of Majority 18Adrianne BenignoОценок пока нет

- Case Doctrines in Labor Relations: Kiok Loy v. NLRCДокумент24 страницыCase Doctrines in Labor Relations: Kiok Loy v. NLRCFrancisco MarvinОценок пока нет

- MorganДокумент3 страницыMorganFrancisco MarvinОценок пока нет

- MPДокумент7 страницMPFrancisco MarvinОценок пока нет

- Indivisibility & Indivisible Obligation Solidarity & Solidarity ObligationДокумент2 страницыIndivisibility & Indivisible Obligation Solidarity & Solidarity ObligationFrancisco MarvinОценок пока нет

- Mallari VДокумент4 страницыMallari VFrancisco MarvinОценок пока нет

- MPДокумент7 страницMPFrancisco MarvinОценок пока нет

- North-South Airline Group 5-1Документ13 страницNorth-South Airline Group 5-1Francisco Marvin100% (1)

- Parlor GamesДокумент1 страницаParlor GamesFrancisco MarvinОценок пока нет

- Manpri CaseДокумент6 страницManpri CaseFrancisco MarvinОценок пока нет

- People Vs Lase 219 SCRA 584 DigestДокумент7 страницPeople Vs Lase 219 SCRA 584 DigestFrancisco MarvinОценок пока нет

- Manpri Case07 GilletteДокумент7 страницManpri Case07 GilletteFrancisco MarvinОценок пока нет

- Ethics Doctrines FinalДокумент60 страницEthics Doctrines FinalFrancisco MarvinОценок пока нет

- Steps in Hypothesis Test For A Significant Regression ModelДокумент1 страницаSteps in Hypothesis Test For A Significant Regression ModelFrancisco MarvinОценок пока нет