Академический Документы

Профессиональный Документы

Культура Документы

Saphelp Money Markets

Загружено:

satya_avanigadda690 оценок0% нашли этот документ полезным (0 голосов)

35 просмотров7 страницFSCM Money market

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFSCM Money market

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

35 просмотров7 страницSaphelp Money Markets

Загружено:

satya_avanigadda69FSCM Money market

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

Money Market

PDF download from SAP Help Portal:

http://help.sap.com/saphelp_erp60_sp/helpdata/en/26/79ba340378f873e10000009b38f83b/frameset.htm

Created on August 17, 2014

The documentation may have changed since you downloaded the PDF. You can always find the latest information on SAP Help Portal.

Note

This PDF document contains the selected topic and its subtopics (max. 150) in the selected structure. Subtopics from other structures are not included.

2014 SAP SE or an SAP affiliate company. All rights reserved. No part of this publication may be reproduced or transmitted in any form or for any purpose

without the express permission of SAP SE. The information contained herein may be changed without prior notice. Some software products marketed by SAP SE

and its distributors contain proprietary software components of other software vendors. National product specifications may vary. These materials are provided by

SAP SE and its affiliated companies ("SAP Group") for informational purposes only, without representation or warranty of any kind, and SAP Group shall not be

liable for errors or omissions with respect to the materials. The only warranties for SAP Group products and services are those that are set forth in the express

warranty statements accompanying such products and services, if any. Nothing herein should be construed as constituting an additional warranty. SAP and other

SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE in Germany and other

countries. Please see www.sap.com/corporate-en/legal/copyright/index.epx#trademark for additional trademark information and notices.

Table of content

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 1 of 7

Table of content

1 Money Market

1.1 Fixed-Term Deposits

1.2 Deposits at Notice

1.3 Commercial Paper

1.4 Interest Rate Instruments

1.5 Cash Flow Transactions

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 2 of 7

1 Money Market

Purpose

Money Market transactions are used for short to medium-term investments and for borrowing liquid funds.

Integration

The Money Market area is a sub component of the Transaction Manager and is closely integrated with other components.

You can implement cash management decisions in the Money Market area based on the liquidity surplus or deficit determined in Cash Management. The system

records the impact transactions have on the liquidity of a company by value date, for each flow in Cash Management. To do this, the data from the Money Market

is transferred to Cash Management automatically. This integration simplifies the work processes involved in transaction management from entering potential

transactions through to the related accounting activities. The Money Market area comprises functions for period-based accrual/deferral, key date valuation and

foreign currency valuation, and for disclosing profits and losses.

It is also closely linked to the Financial Accounting (FI) component since all the data that is relevant for posting in the Money Market area is automatically

transferred to FI.

You can maintain current market data (exchange rates, securities prices, reference interest rates, indexes etc.) in various ways:

Manually

Using a Market data file interface: You maintain the relevant data in an external application (such as Microsoft Excel), either manually or via a data provider,

and then import the data into the system in a format compatible with SAP.

By transferring the market data to the system from a spreadsheet

Datafeed: You can use the datafeed connection to make real-time market data available in the system.

To access the market data management functions in the application menu, choose Treasury and Risk Management -> Basic Functions -> Market Data

Management . Alternatively, you can access them in the Money Market area under Environment -> Market Data .

You access the Money Market component by choosing Accounting Treasury and Risk Management Transaction Manager Money Market.

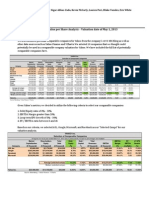

The following graphic shows how the above-mentioned components relate to each another:

Features

Trading

The trading area contains functions for entering money market transactions. It also enables you to also call up information on transactions or make changes at a

later date. Collective processing functions are available to help you manage your transactions efficiently.

The product types in the Money Market area are:

Fixed-Term Deposits

Deposits at Notice

Commercial paper

Interest rate instruments

Cash flow transactions

Facilities

Back office

Once you have entered financial transactions in the trading area, you settle them in the back office. The back office area also contains functions for checking and

changing the transactions. Transaction postprocessing primarily involves:

Adding any missing transaction data that is needed to process the transaction further

Preparing for posting and payment (for example, by checking the accounts used)

Generating correspondence in the form of internal or external confirmations.

The collective processing functions are also available in the back office. This area also includes functions for netting transactions and for entering and editing

references.

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 3 of 7

Accounting

Once you have entered the transactions in the Trading area and checked them and added any missing details in the Back Office , you then need to process

them for accounting purposes. The accounting area includes functions for transferring data to Financial Accounting, such as posting reports or position

management postings. It also includes functions for parallel valuation.

Master Data Management

Financial transaction processing in the Transaction Manager is based on master data.

Information System

The information system provides a range of reports for analyzing your money market transactions. The Money Market Information System is part of the Transaction

Manager Information System, which offers analyses and evaluations across the whole of the Treasury and Risk Management dataset.

The link to the SAP drilldown reporting tool and SAP Query also allows you to define your own reports in addition to those provided by SAP.

See also:

Information System

The following diagram represents the architecture of the financial transactions.

1.1 Fixed-Term Deposits

Use

The trading of fixed-term deposits (including overnight money and eurocurrency) includes transactions with fixed interest rates and an end of term arranged at the

start. This includes the transaction types fixed-term deposit investment and fixed-term deposit borrowing. If the authorized business partners and corresponding

payment details are already defined in the standing instructions, the required entries are restricted to the required entries in the structural characteristics. In

addition to functions for entering and changing fixed-term deposits, the system also supports functions for rollovers and reversals.

You only have to define the standard interest calculation method and the calendar you want to use once, and these will then be used as default values for the

transaction.

Prerequisites

Before you can use the Money Market component, you have to maintain master data. You have to

Create your business partners , assign the corresponding roles to these partner and maintain the transaction authorizations.

Set up the Standing Instructions (correspondence, payment details) and release the business partner.

You also have to make the following settings in Customizing:

Define the product type (if you do not want to use one of the standard product types delivered with the system, you can define your own product types). You

create financial transactions and manage positions on the basis of product types. A fixed-term deposit is one example of a product type in the Money

Market area.

Define the transaction type . Transaction types determine the type of transactions that can be concluded with a particular product type. They also control the

transaction and position management process. An example of this is the Investment or Borrowing of fixed-term deposits.

Define the Flow Type. These describe the various changes to the cash flows. Example: Increase in the nominal amount

You must assign flow types to transaction types.

Define the condition type. This setting controls which structural characteristics are displayed when you create transactions. Example: Nominal interest

For more information, see the relevant section in the Implementation Guide.

You can then define Money Market transactions in the system.

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 4 of 7

Features

For more detailed information, see Processing Fixed-Term Deposits and Creating Fixed-Term Deposits.

1.2 Deposits at Notice

Use

In trading with deposits at notice, investment and borrowing takes place without defined due dates. The deposit at notice function therefore not only includes the

functions available in the fixed-term deposit area, but also a function for giving notice; in other words, in addition to entering the amounts and conditions, you enter

the notice period and the interest payment date and frequency.

Prerequisites

Before you can use the Money Market component, you have to maintain master data.

Create your business partners, assign the corresponding roles to this partner and maintain the transaction authorizations.

Set up the Standing Instructions (correspondence, payment details) and release the business partner.

You also have to make the following settings in Customizing:

Define the product type (if you do not want to use one of the standard product types delivered with the system, you can define your own product types). You

create financial transactions and manage positions on the basis of product types. A Deposit at notice is an example of a product type in the Money Market

area.

Define the transaction type . Transaction types determine the type of transactions that can be concluded with a particular product type. They also control the

transaction and position management process. Example: Investment or borrowing for deposits at notice.

Define the condition type. This setting controls which structural characteristics are displayed when you create transactions. Example: Nominal interest

Define the Flow Type. These describe the various changes to the cash flows. Example: Increase in the nominal amount

For more information, see the relevant section in the Implementation Guide.

You can then define Money Market transactions in the system.

Features

For further details, see Processing Deposits at Notice and Creating Deposits at Notice.

1.3 Commercial Paper

Use

Commercial Paper transactions are transactions on which no interest payments are made during the term of the transaction. Instead, two business partners agree

on a repayment amount to be repaid to the investor by the borrower at the end of the life of the contract.

A company requires 1 million for three months. The amount is discounted using a pre-defined yield. The company receives the discounted amount, 980,000

from an investor. At the end of the term, the company repays the full amount of 1 million.

Activities

You specify the nominal amount and the yield that you are looking to achieve. The system calculates the payment amount the investor must pay to the creditor at

the start of the term by discounting. Alternatively, you can specify your own interest calculation on the basis of a given rate. In the cash flow, the system displays

the principal increase (based on the nominal amount and the discounting amount) at the start of the term and the repayment of the nominal value at the end of the

term.

Alternatively, you can display the discounted principal increase at the start of the term and the repayment of the NPV and the interest flow at the end of the term.

You have to set this up in Customizing when you define the transaction types.

Prerequisites

Before you can use the Money Market component, you have to maintain master data. You have to

You have to create your Business Partners, assign the corresponding roles to these partners and maintain the transaction authorizations.

You have to set up the Standing Instructions (correspondence, payment details) and release the business partner.

You also have to make the following settings in Customizing:

Define the Product Type (if you do not want to use one of the standard product types delivered with the system, you can define your own product types). You

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 5 of 7

create financial transactions and manage positions on the basis of product types. Deposit at Notice is one example of a product type in the Money Market

area

Define the Transaction Type . Transaction types determine the type of transactions that can be concluded with a particular product type. They also control the

transaction and position management process. An example of this is the Investment or Borrowing of deposits at notice.

Define the Condition Type . This setting controls which structural characteristics are displayed when you create transactions. Example: Nominal interest

Define the Flow Type . These describe the various changes to the cash flows. Example: Increase in the nominal amount

For more information, see the relevant section in the Implementation Guide.

You can then define Money Market transactions in the system.

Features

For more detailed information, see Processing Commercial Paper and Creating Commercial Paper.

You can also use the Net Present Value to help you determine the payment amount.

1.4 Interest Rate Instruments

Use

An interest rate instrument is a money market transaction with additional structural characteristics, such as variable interest and installment repayment.

In order to calculate the corresponding interest receivables or payables, you must carry out an interest rate adjustment. See Interest Rate Adjustment.

Prerequisites

Before you can use the Money Market component, you have to maintain master data.

You have to create your Business Partners, assign the corresponding roles to these partners and maintain the transaction authorizations.

You have to set up the Standing Instructions (correspondence, payment details) and release the business partner.

You also have to make the following settings in Customizing:

Define the Product Type (if you do not want to use one of the standard product types delivered with the system, you can define your own product types). You

create financial transactions and manage positions on the basis of product types. An example of a product type in the money market area is an interest rate

instrument .

Define the Transaction Type. Transaction types determine the type of transactions that can be concluded with a particular product type. They also control the

transaction and position management process. Example: Investment or borrowing transaction for an interest rate instrument.

Define the Flow Type. These describe the various changes to the cash flows. Example: Increase in the nominal amount

You must assign flow types to transaction types.

Define the Condition Type. This setting controls which structural characteristics are displayed when you create transactions. Example: Nominal interest

For more information, see the relevant section in the Implementation Guide.

You can then define Money Market transactions in the system.

Features

To manage interest rate instruments, you can use the standard functions and processes for entering, editing and processing transactions, managing their status,

and transferring data to Financial Accounting.

Activities

For details on the relevant activities, see Processing Interest Rate Instruments and Creating Interest Rate Instruments.

1.5 Cash Flow Transactions

Use

With cash flow-based transactions you can manage transactions whose structural characteristics cannot be mapped by the standard product categories.

You can enter and process transactions by entering their cash flow. A cash flow is a chronological sequence of flows: you enter the term alongside the cash flow

that results from the transaction structure. This enables you to map your financial transactions flexibly.

Integration

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 6 of 7

On the basis of this, the system not only supports the processes for entering and processing these types of transactions in the trading area, but also the

processes that build on these in the back office and accounting areas.

Prerequisites

Before you can use the Money Market component, you have to maintain master data. You have to

You have to create your Business Partners, assign the corresponding roles to these partners and maintain the transaction authorizations.

You have to set up the Standing Instructions (correspondence, payment details) and release the business partner.

You also have to make the following settings in Customizing:

Define the Product Type (if you do not want to use one of the standard product types delivered with the system, you can define your own product types). You

create financial transactions and manage positions on the basis of product types. An example of a product type in the money market area is a cash flow

transaction .

Define the Transaction Type. Transaction types determine the type of transactions that can be concluded with a particular product type. They also control the

transaction and position management process. Example: Investment or Borrowing for cash flow transactions.

Define the Condition Type. This setting controls which structural characteristics are displayed when you create transactions. Example: Nominal interest

Define the Flow Type. These describe the various changes to the cash flows. Example: Increase in the nominal amount

For more information, see the relevant section in the Implementation Guide.

You can then define Money Market transactions in the system.

Features

For more detailed information, see Processing Cash Flow Transactions, Creating Cash Flow Transactions and Cash Flow.

PUBLIC

2014 SAP SE or an SAP affiliate company. All rights reserved.

Page 7 of 7

Вам также может понравиться

- SEPA COnfiguration GuideДокумент19 страницSEPA COnfiguration Guidesatya_avanigadda6980% (5)

- Change Cost Centre Standard HierarchyДокумент11 страницChange Cost Centre Standard Hierarchysatya_avanigadda69Оценок пока нет

- Automatic Period OpeningДокумент21 страницаAutomatic Period Openingcdhars100% (1)

- Sepa Direct Debit Pain 008Документ38 страницSepa Direct Debit Pain 008satya_avanigadda69Оценок пока нет

- Varalakshmi Vratham Pooja Vidhanam in TeluguДокумент23 страницыVaralakshmi Vratham Pooja Vidhanam in Telugusatya_avanigadda69Оценок пока нет

- f110 Payment Run CheckДокумент24 страницыf110 Payment Run CheckPRADEEP.4067Оценок пока нет

- FICO Dispute Management E-Learning ModulesДокумент2 страницыFICO Dispute Management E-Learning Modulessatya_avanigadda69Оценок пока нет

- Sepa Direct Debit Pain 008Документ38 страницSepa Direct Debit Pain 008satya_avanigadda69Оценок пока нет

- AIST Reverse Settlement of AUCДокумент6 страницAIST Reverse Settlement of AUCsatya_avanigadda69Оценок пока нет

- 89 Introduction To SAP Transaction ManagerДокумент25 страниц89 Introduction To SAP Transaction ManagerV Anil Kumar100% (1)

- f110 Payment Run CheckДокумент24 страницыf110 Payment Run CheckPRADEEP.4067Оценок пока нет

- Ac810 Treasury Management Basic FunctionsДокумент297 страницAc810 Treasury Management Basic FunctionsSiri GannavarapuОценок пока нет

- Transaction ManagerДокумент52 страницыTransaction Managersatya_avanigadda69Оценок пока нет

- Saphelp Money MarketsДокумент7 страницSaphelp Money Marketssatya_avanigadda69Оценок пока нет

- SAP FICO BanK ConfigurationДокумент46 страницSAP FICO BanK ConfigurationSriram RangarajanОценок пока нет

- FI Fixed AssetДокумент81 страницаFI Fixed AssetVivek Kumar0% (1)

- Cash JournalДокумент7 страницCash JournalASHOKA GOWDAОценок пока нет

- End User Guide To Asset Accounting in Sap Fi, SAP, SAP, SAP, SAP, SAP Oiasud Oaisud Oaisu Oiasudoiausd Oiusadoiausodiu Oaisudoiasudoiasud OasiudДокумент69 страницEnd User Guide To Asset Accounting in Sap Fi, SAP, SAP, SAP, SAP, SAP Oiasud Oaisud Oaisu Oiasudoiausd Oiusadoiausodiu Oaisudoiasudoiasud OasiudDenis DelismajlovicОценок пока нет

- Financial Accounting TFIN 50_1 SummaryДокумент30 страницFinancial Accounting TFIN 50_1 SummaryssvaasanОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- FRM ErrataДокумент6 страницFRM Erratapeieng0409Оценок пока нет

- 15-16-17-18 - Assignment - Long Term LiabilitiesДокумент7 страниц15-16-17-18 - Assignment - Long Term LiabilitiesOliviane Theodora WennoОценок пока нет

- Chap 002Документ63 страницыChap 002محمد عقابنةОценок пока нет

- ACI Dealing Certificate: SyllabusДокумент12 страницACI Dealing Certificate: SyllabusKhaldon AbusairОценок пока нет

- Financial Accounting MasterДокумент80 страницFinancial Accounting Mastertimbuc202Оценок пока нет

- API 553 Refinery Control ValvesДокумент519 страницAPI 553 Refinery Control ValvesvasudhaОценок пока нет

- Hotel Valuation TechniquesДокумент20 страницHotel Valuation Techniquesgallu35Оценок пока нет

- Part A: Theory Section: Fire Insurance ClaimДокумент35 страницPart A: Theory Section: Fire Insurance Claimjahnvi saraiyaОценок пока нет

- Yahoo! Inc. Valuation ProjectДокумент8 страницYahoo! Inc. Valuation ProjectNigar_AbbasОценок пока нет

- A141 Tutorial 4 Bkal1013Документ6 страницA141 Tutorial 4 Bkal1013CyrilraincreamОценок пока нет

- Interest TheoryДокумент167 страницInterest TheoryHaydarRPОценок пока нет

- M2.2e Diy-Problems (Answer Key)Документ13 страницM2.2e Diy-Problems (Answer Key)Liandrew MadronioОценок пока нет

- Deep Value InvestingДокумент14 страницDeep Value InvestingBenjaminRavaruОценок пока нет

- Whittle WorkbookДокумент14 страницWhittle WorkbookOsvaldo100% (3)

- February 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsДокумент3 страницыFebruary 2017 Subject: Financial Management 2 FM: 100 Program: BBA Semester V PM: 50 Subject Code: BBK2233 Time: 3hrsAditi JoshiОценок пока нет

- University of Gloucestershire: Corporate FinanceДокумент16 страницUniversity of Gloucestershire: Corporate Financeshujon007Оценок пока нет

- Effective Interest Rate Method Excel TemplateДокумент49 страницEffective Interest Rate Method Excel Templatet766074Оценок пока нет

- Principles of Financial ComputingДокумент73 страницыPrinciples of Financial ComputingOmar Al-KarimyОценок пока нет

- Problems - Valuation of Bonds and StocksДокумент1 страницаProblems - Valuation of Bonds and StocksShubham AggarwalОценок пока нет

- Karnal's cost of sales calculationДокумент14 страницKarnal's cost of sales calculationArslan AlviОценок пока нет

- FA SumsДокумент34 страницыFA SumsDubai SheikhОценок пока нет

- 1 Far East Bank V Phil DepositДокумент15 страниц1 Far East Bank V Phil DepositGie CortesОценок пока нет

- As-28 (Impairment of Assets)Документ11 страницAs-28 (Impairment of Assets)api-3828505100% (1)

- SAP Dictionary FrenchДокумент747 страницSAP Dictionary FrenchClaudio Di FrancescoОценок пока нет

- PLAN AND ANALYZE DEVELOPMENT PROJECTSДокумент133 страницыPLAN AND ANALYZE DEVELOPMENT PROJECTSJoe Kpozoi100% (1)

- WORKING CAPITAL MANAGEMENT ADVISORY SERVICESДокумент9 страницWORKING CAPITAL MANAGEMENT ADVISORY SERVICESJonas Mondala80% (5)

- C. FIG Analyst Training - Partie IIДокумент136 страницC. FIG Analyst Training - Partie IIFabrizioОценок пока нет

- Accounting for Merchandising OperationsДокумент73 страницыAccounting for Merchandising OperationsYohanna SisayОценок пока нет

- Notes Ayable: Non-Interest Bearing NoteДокумент1 страницаNotes Ayable: Non-Interest Bearing NoteChris Tian FlorendoОценок пока нет

- IA2Документ12 страницIA2John FloresОценок пока нет