Академический Документы

Профессиональный Документы

Культура Документы

Quiz Bowl

Загружено:

jayrjoshuavillapando0 оценок0% нашли этот документ полезным (0 голосов)

118 просмотров3 страницыQuiz bowl sample questions

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документQuiz bowl sample questions

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

118 просмотров3 страницыQuiz Bowl

Загружено:

jayrjoshuavillapandoQuiz bowl sample questions

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

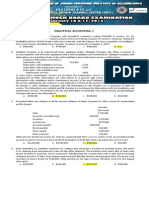

EASY

1. AC09301 Corporation had 700,000 shares of common

stock authorized and 300,000 shares outstanding at

December 31, 2011. The following events occurred during

2012

January 31 Declared 10% stock dividends

June 30 Purchased 100,000 shares

August 1 Reissued 50,000 shares

November 30 Declared 2-for-1 stock split

At December 31, 2012, how many shares of common stocks

are outstanding?

a. 560,000 b. 600,000 c. 630,000 d.

660,000

2. When a new partner is admitted into a partnership and

the new partner receives a capital credit less than the

tangible assets contributed, which of the following explains

the difference?

I. The new partner's goodwill has been recognized.

II. The old partners received a bonus from the new partner.

a. I only b. II only c. Either I or II d. Neither I nor II

3. If the demand for mac and cheese decreases as income

increases, mac and cheese is a(n)

a. complementary good. b. normal good c. inferior good. d.

substitute good.

4. On December 31, 2006, general ledger of AC09301

Companys account receivable showed a balance of

P1,400,000. Because of continuing decrease in expected cash

flows on its financial assets, AC09301 Company has decided

to estimate the cash flows of the outstanding receivables.

The estimates are based on the expected peso amount to

be received on the outstanding receivables; the category

(age) which also includes the length and period of

collectability and time factor for similar borrowers.

Category Amount Time Factor

A P400,000 .909

B 300,000 .826

C 250,000 .751

D 150,000 .683

How much should AC09301 Company report its account

receivable in its December 31, 2006 balance sheet?

5. On December 31, 2010, AC09301 Corporation held wool

(agricultural produce) that it had purchased from three other

farms at a cost of P30,000. The fair value less cost to sell of

this wool was determined to be P32,000 at the year-end.

This wool was subsequently sold for P33,000 (after

deducting cost to sell of P500) on February 14, 2011.

At December 31, 2010, how much is the carrying amount of

the wool?

6. On 1 July 2010, Miserable Co. handed over to a client a

new computer system. The contract price for the supply of

the system and after-sales support for 12 months was

P800,000. Miserable estimates the cost of the after-sales

support at P120,000 and it normally marks up such costs by

50% when tendering for support contracts. The revenue

Miserable should recognize in its financial year ended 31

December 2010 is:

AVERAGE

1. On December 31, 2007, the cash items of Shinno owned

and operated by A were listed below:

Coins and currency ,P50,000; Checks received from

customers, P600,000; Certificate of deposit, term: 12 months,

P800,000;Petty cash fund, P4,000; Postage stamps, P600;

Bank A, checking account balance, P2,100,000; Post-dated

check, customer, P10,000; Money order from customer,

P15,000; Cash in savings account, P100,000; Bank draft from

customer, P40,000; Utility deposit to gas company,

refundable, P5,000; Cash advance received from customer,

P8,000; NSF check, P20,000; Cash advance to company

executive, collectible upon demand, P200,000; Bank B,

checking account, overdraft, P20,000; IOUs from employees,

P12,000

What amount of cash and cash equivalents should DHair

Company report in its December 31, 2007 balance sheet?

2. On November 15, 2008, Socrates entered in to a

commitment to purchase 200,000 units of raw material X for

P8,000,000 on March 15, 2009. Socrates entered into this

purchase commitment to protect itself against the volatility

in the price of raw material X. By December 31, 2008, the

purchase price of material X had fallen to P35 per unit.

However, by March 15, 2009, when Socrates took delivery of

the 200,000 units, the price of the material had risen to P42

per unit. How much will be recognized as gain on purchase

commitment on March 15, 2009?

a. P1,400,000 b. P1,000,000 c. P400,000 d. P 0

3. At the end of the year 2011, the carrying amount of a

certain asset is P350,000 and has an accumulated

depreciation of P140,000, has a useful life of ten years and

depreciated using straight line method. At what year the

asset was acquired when the asset is purchased at the

beginning of the year?

a. 2008 b. 2007 c. 2009 d. 2006

4. The inventory on hand at December 31, 2008 for Fair

Company valued at a cost of P947,800. The following items

were not included in this inventory amount:

a. Purchased goods, in transit, shipped FOB destination

invoice price P32,000 which included freight charges of

P1,600.

b. Goods held on consignment by Fair Company at a sales

price of P28,000, including sales commission of 20% of the

sales price.

c. Goods sold to Garcia Company, under terms FOB

destination, invoiced for P18,500 which includes P1,000

freight charges to deliver the goods. Goods are in transit.

d. Purchased goods in transit, terms FOB shipping point,

invoice price P48,000, inclusive of freight cost, P3,000.

e. Goods out on consignment to Manil Company, sales price

P36,400, shipping cost of P2,000.

Assuming that the company's selling price is 140% of

inventory cost, the adjusted cost of Fair Company's inventory

at December 31, 2008 should be

a. P1,039,300 b. P1,039,500 c. P1,055,700 d.

P1,037,300

5. The partnership of X and Y shares profits and losses in the

ratio of 60 percent to X and 40 percent to Y. For the year

2008, partnership net income was double X's withdrawals.

Assume X's beginning capital balance was $80,000, and

ending capital balance (after closing) was $140,000.

Partnership net income for the year was:

a. $120,000 b. $300,000 c. $500,000 d. $600,000

DIFFICULT

1. During the course of your examination of the financial

statements of H Co., a new client, for the year ended

December 31, 2008, you discover the following:

P3,000.

by

P5,000.

purchased on January 2, 2007, for P1,500. The entire amount

was charged as an expense in 2007.

During 2008 the company received a P1,000 cash advance

from a customer for merchandise to be manufactured and

shipped during 2009. The P1,000 had been credited to sales

revenues. The company's gross profit on sales is 50%.

Net income reported on the 2008 income statement (before

reflecting any adjustments for the above items) is P20,000.

The proper net income for 2008 is

a. P26,500 c. P23,500

b. P16,500 d. P20,500

2. The price of circuit boards used in the manufacturing of

LCD televisions has fallen. This will lead to ________ LCD

televisions.

a. an increase in the supply of

b. a decrease in the supply of

c. an increase in the quantity supplied of

d. a decrease in the quantity supplied of

3. On January 1, 2006, Cherry Company issued its 10%, 5-

year convertible debt instrument with a face amount of

P5,000,000 for P5,217,344. Interest is payable every

December 31 of each year. The debt instrument is

convertible into 50,000 ordinary shares with a par value of

P100. When the debt instruments were issued, the prevailing

market rate of interest for similar debt without conversion

option is 11%. The Company incurred transaction cost of

P70,000 related to the issue of the compound instrument.

(Carry PV factors up to 3 decimal places)

How much of the net proceeds represent the equity

component?

4. Joy Corp. is engaged in a research and development

project to produce a new product. In the year ended

December 31, 2007, the company spent P1,200,000 on

research and concluded that there were sufficient grounds

to carry the project on to its development stage and a

further P750,000 had been spent on development. At that

date management had decided that they were not

sufficiently confident in the ultimate profitability of the

project and wrote off all the expenditure to date to the

income statement. In 2008 further direct development costs

have been incurred of P800,000 and the development work

is now almost complete with only an estimated P100,000 of

costs to be incurred in the future. Production is expected to

commence within the next few months. Unfortunately the

total trading profit from sales of the new product is not

expected to be as good as market research data originally

forecasted and is estimated at only P1,500,000. Assuming

the other criteria given in PAS 38 are met, how much should

be capitalized as of December 31, 2008?

Вам также может понравиться

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- NFJPIA Mockboard 2011 P1Документ7 страницNFJPIA Mockboard 2011 P1jhefster_81Оценок пока нет

- Resa P2 Final April 2008Документ15 страницResa P2 Final April 2008Arianne Llorente100% (1)

- Quiz Bowl 10Документ9 страницQuiz Bowl 10mark_somОценок пока нет

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationДокумент7 страницPractical Accounting 1: 2011 National Cpa Mock Board ExaminationkonyatanОценок пока нет

- Nfjpia Mockboard 2011 p1 - With AnswersДокумент12 страницNfjpia Mockboard 2011 p1 - With AnswersRhea SamsonОценок пока нет

- p1 Midterm 2012Документ8 страницp1 Midterm 2012marygraceomacОценок пока нет

- Practical Accounting IIДокумент5 страницPractical Accounting IIJennylyn Marace100% (1)

- Practical Accounting 1-MockboardzДокумент9 страницPractical Accounting 1-MockboardzMoira C. Vilog100% (1)

- Amount Owed by The Business AccountingДокумент3 страницыAmount Owed by The Business Accountingelsana philipОценок пока нет

- 13th NCR Cup Series 7 SGVДокумент9 страниц13th NCR Cup Series 7 SGVrcaa04Оценок пока нет

- Fin AcctgДокумент9 страницFin AcctgCarl Angelo0% (1)

- On March 31 Accounting 101732636556Документ3 страницыOn March 31 Accounting 101732636556elsana philipОценок пока нет

- Prac2 ReviewerДокумент12 страницPrac2 ReviewerRay Jhon Ortiz0% (1)

- Far Probs - EvaluationДокумент7 страницFar Probs - EvaluationArvin John Masuela100% (1)

- PPL Cup AverageДокумент7 страницPPL Cup AverageRukia KuchikiОценок пока нет

- Financial Quali - AДокумент9 страницFinancial Quali - ACarl AngeloОценок пока нет

- Jpia Cup p1Документ65 страницJpia Cup p1Joy Montalla Sangil80% (5)

- Practical Accounting IiДокумент18 страницPractical Accounting IiFerb CruzadaОценок пока нет

- The Review Schooj. of AccountancyДокумент17 страницThe Review Schooj. of AccountancyYukiОценок пока нет

- BFJPIA Cup Level 3 P1Документ9 страницBFJPIA Cup Level 3 P1Blessy Zedlav LacbainОценок пока нет

- #Test Bank - Finc - L Acctg. 2 - 3 (V)Документ34 страницы#Test Bank - Finc - L Acctg. 2 - 3 (V)Nhaj100% (1)

- Practical Accounting Part 1Документ18 страницPractical Accounting Part 1Jonacress Callo CagatinОценок пока нет

- RESA Final Preboard P1Документ10 страницRESA Final Preboard P1rjn191% (11)

- AP Problems 2012Документ22 страницыAP Problems 2012Jake Manansala0% (1)

- Pract 1Документ22 страницыPract 1Ros Yaj NivrameОценок пока нет

- Practical Accounting 1 With AnswersДокумент10 страницPractical Accounting 1 With Answerslibraolrack50% (8)

- CPA Reviewer FARДокумент14 страницCPA Reviewer FARCristine LetranОценок пока нет

- 2nd Year Reviewer Midterms (Compatibility)Документ11 страниц2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- Advance Accounting2 FinalsДокумент6 страницAdvance Accounting2 FinalsClarice Kristine SalesОценок пока нет

- p1 AДокумент8 страницp1 Aincubus_yeahОценок пока нет

- Practical Accounting 2 First Pre-Board ExaminationДокумент15 страницPractical Accounting 2 First Pre-Board ExaminationKaren Eloisse89% (9)

- Auditing ProblemsДокумент10 страницAuditing ProblemsLouie De La TorreОценок пока нет

- Practical Accounting QuizzesДокумент3 страницыPractical Accounting QuizzesMichelle ValeОценок пока нет

- Wrwftauditing Problems Watitiw: Page 1 of 7Документ7 страницWrwftauditing Problems Watitiw: Page 1 of 7Ronnel TagalogonОценок пока нет

- Cfas Fs PreparationДокумент3 страницыCfas Fs PreparationEvelina Del RosarioОценок пока нет

- AuditingДокумент5 страницAuditingJona Mae Milla0% (1)

- Cluster 1 (Financial Acctg)Документ11 страницCluster 1 (Financial Acctg)Carl Angelo100% (1)

- Acctg 5Документ6 страницAcctg 5Charmane MatiasОценок пока нет

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsОт EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsОценок пока нет

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryОт EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Guide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)От EverandGuide to Japan-Born Inventory and Accounts Receivable Freshness Control for Managers 2017 (English Version)Оценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017От EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers 2017Оценок пока нет

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryОт EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionОт EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for Managers: English versionОценок пока нет

- Guide to Japan-born Inventory and Accounts Receivable Freshness Control for managersОт EverandGuide to Japan-born Inventory and Accounts Receivable Freshness Control for managersОценок пока нет

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryОт EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Sales Financing Revenues World Summary: Market Values & Financials by CountryОт EverandSales Financing Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityОт EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityРейтинг: 4 из 5 звезд4/5 (2)

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsОт EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsОценок пока нет

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideОценок пока нет

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОт EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОценок пока нет

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryОт EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Compendium of Supply and Use Tables for Selected Economies in Asia and the PacificОт EverandCompendium of Supply and Use Tables for Selected Economies in Asia and the PacificОценок пока нет

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesОт EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesОценок пока нет

- P1 - Property, Plant and EquipmentДокумент2 страницыP1 - Property, Plant and EquipmentjayrjoshuavillapandoОценок пока нет

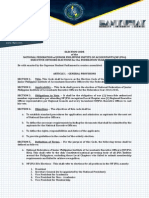

- Constitution and By-Laws of FEU JPIAДокумент11 страницConstitution and By-Laws of FEU JPIAjayrjoshuavillapandoОценок пока нет

- NFJPIA Election Code FY 1415Документ10 страницNFJPIA Election Code FY 1415jayrjoshuavillapandoОценок пока нет

- Summary - IAS 16 PPEДокумент3 страницыSummary - IAS 16 PPEjayrjoshuavillapandoОценок пока нет

- Psa 120 PDFДокумент9 страницPsa 120 PDFMichael Vincent Buan SuicoОценок пока нет

- Process Costing (Questionnaires)Документ9 страницProcess Costing (Questionnaires)Aimee Therese AguilarОценок пока нет

- NF JPIA Election Code 2014Документ9 страницNF JPIA Election Code 2014jayrjoshuavillapandoОценок пока нет

- TB Raiborn - Activity-Based Management and Activity-Based CostingДокумент31 страницаTB Raiborn - Activity-Based Management and Activity-Based Costingjayrjoshuavillapando100% (1)

- Class 12 Accountancy Project (Specific) Ratio Analysis PidiliteДокумент18 страницClass 12 Accountancy Project (Specific) Ratio Analysis PidiliteAvirup Chakraborty53% (38)

- Mrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalДокумент21 страницаMrunal (Economic Survey Ch7) International Trade, FTA, PTA, ASIDE, E-BRC, CEPA Vs CECA Difference Explained MrunalHamdard BoparaiОценок пока нет

- Demographic Study 2011 - Entire Study - Entire Study - Corrected 3-11-11Документ212 страницDemographic Study 2011 - Entire Study - Entire Study - Corrected 3-11-11ltisdbondsОценок пока нет

- Debt RestructuringДокумент2 страницыDebt RestructuringVicong PogiОценок пока нет

- Investment and Security Laws ProjectДокумент3 страницыInvestment and Security Laws ProjectUmesh Kumar33% (3)

- INDIABULLS CoppanyДокумент101 страницаINDIABULLS CoppanyJasmandeep brarОценок пока нет

- Alfred HartДокумент160 страницAlfred HartNicolae Ion CatalinОценок пока нет

- Analysis of Problems and Prospects of Small Scale Industries in IndiaДокумент107 страницAnalysis of Problems and Prospects of Small Scale Industries in IndiaPrateek Agarwal100% (3)

- ProposalДокумент24 страницыProposalKumar Subedi0% (1)

- Lecture 1. Introduction: Financial Risk ManagementДокумент44 страницыLecture 1. Introduction: Financial Risk Managementsnehachandan91Оценок пока нет

- 1602Документ2 страницы1602Rhizz RamirezОценок пока нет

- A Study On Non - Performing Assets: Subramani (1MV16MBA81)Документ22 страницыA Study On Non - Performing Assets: Subramani (1MV16MBA81)binduОценок пока нет

- 05 TRENNERY The Origin and Early History of Insurance Including The Contract On BottomryДокумент40 страниц05 TRENNERY The Origin and Early History of Insurance Including The Contract On BottomryJul A.Оценок пока нет

- Specom Cases Outline FinalsДокумент29 страницSpecom Cases Outline FinalsJas Em BejОценок пока нет

- CashДокумент29 страницCashQuendrick SurbanОценок пока нет

- Sample SBA Valuation Eng LTR PDFДокумент3 страницыSample SBA Valuation Eng LTR PDFDhaval JobanputraОценок пока нет

- Withholding Tax Invoices in Oracle APДокумент8 страницWithholding Tax Invoices in Oracle APvijaymselvamОценок пока нет

- Case No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Документ107 страницCase No. 16-Cv-4014 CATERBONE v. The United States of America, Et - Al., COMPLAINT UPDATED December 12, 2016 Ver 2.0Stan J. Caterbone0% (1)

- Financial Markets and Instruments - GurukpoДокумент5 страницFinancial Markets and Instruments - GurukpoKiran SoniОценок пока нет

- Pershing Square GSE Complaint (Claims Court)Документ39 страницPershing Square GSE Complaint (Claims Court)CapForumОценок пока нет

- W-9 Tax FormДокумент4 страницыW-9 Tax FormMika DjokaОценок пока нет

- EBL FinalДокумент31 страницаEBL FinalAbdul KaderОценок пока нет

- Seth Klarman Notes 170510 (CFA Institute)Документ5 страницSeth Klarman Notes 170510 (CFA Institute)neo269100% (2)

- Defibering UnitДокумент3 страницыDefibering UnitArie MambangОценок пока нет

- Cds BloombergДокумент30 страницCds BloombergSharad Dutta100% (1)

- 51198bos40905 cp4 PDFДокумент41 страница51198bos40905 cp4 PDFShubham VyasОценок пока нет

- Yee Sue Luy v. Almeda, 70 Phil. 141Документ7 страницYee Sue Luy v. Almeda, 70 Phil. 141FD BalitaОценок пока нет

- Buenaventura Vs MetrobankДокумент8 страницBuenaventura Vs MetrobankI'm a Smart CatОценок пока нет

- 17 ConclusionДокумент13 страниц17 ConclusionAjayGupta100% (1)

- PDF Serv LetДокумент1 страницаPDF Serv Letshahaluddin NaqviОценок пока нет