Академический Документы

Профессиональный Документы

Культура Документы

22 Sep 2014 Breakouts

Загружено:

Ajith Chand BhandaariАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

22 Sep 2014 Breakouts

Загружено:

Ajith Chand BhandaariАвторское право:

Доступные форматы

9/22/2014 1 / 2 economicnerd.blogspot.

in

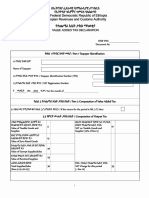

O H L C Buy above Sell Bellow EXP

OPTIDX NIFTY / 8050 / CE 71 136 47.25 113.35 182.52 245.51 179.63 0.73 26.46 92.34 36.27

OPTIDX NIFTY / 6400 / PE 0.7 1 0.35 0.35 1.34 1.79 1.30 0.01 0.18 0.68 12.48

OPTSTK ASHOKLEY / 40 / PE 1.15 1.15 0.4 0.45 1.54 2.07 1.52 0.01 0.22 0.78 28.27

OPTSTK AXISBANK / 420 / CE 1.35 2.05 0.7 1.25 2.78 3.75 2.74 0.03 0.38 1.39 11.21

OPTSTK CROMPGREAV / 200 / PE 1.4 1.6 0.55 0.6 2.16 2.91 2.14 0.01 0.31 1.09 23.78

OPTSTK FEDERALBNK / 130 / CE 0.6 1.75 0.6 1.5 2.37 3.19 2.34 0.02 0.34 1.19 16.67

OPTSTK HEROMOTOCO / 3000 / CE 20.15 45.2 15.65 35.8 60.80 81.83 60.16 0.05 9.03 30.70 196.34

OPTSTK INDUSINDBK / 630 / CE 7.5 16.5 5.7 14.7 22.23 29.93 22.01 0.03 3.29 11.21 106.82

OPTSTK JPPOWER / 15 / PE 0.8 1 0.35 0.5 1.34 1.79 1.30 0.01 0.18 0.68 12.48

OPTSTK JUSTDIAL / 1750 / CE 30 30 10.5 11.75 40.06 53.82 38.97 0.44 5.50 20.35 12.48

OPTSTK POWERGRID / 135 / PE 0.9 1.15 0.4 0.5 1.54 2.07 1.52 0.01 0.22 0.78 28.27

OPTSTK RANBAXY / 580 / PE 3.9 4.75 1.65 2.55 6.38 8.58 6.28 0.02 0.93 3.23 37.82

OPTSTK SAIL / 75 / PE 1.15 3 1.05 2.95 4.01 5.38 3.90 0.04 0.55 2.04 12.48

OPTSTK SKSMICRO / 320 / CE 4.3 4.3 1.5 1.75 5.75 7.74 5.63 0.05 0.81 2.92 17.96

OPTSTK SSLT / 280 / PE 4 5.6 1.95 2.3 7.50 10.09 7.36 0.05 1.07 3.80 23.22

OPTSTK TATAGLOBAL / 170 / CE 1.9 5 1.75 3.85 6.68 8.97 6.50 0.07 0.92 3.39 12.48

OPTSTK TATAMOTORS / 540 / PE 17 17 5.95 6.8 22.70 30.50 22.08 0.25 3.12 11.53 12.48

OPTSTK TCS / 2850 / CE 1.1 2 0.7 1.55 2.67 3.59 2.60 0.03 0.37 1.36 12.48

OPTSTK TVSMOTOR / 220 / PE 7.15 7.15 2.5 3 9.55 12.84 9.31 0.10 1.32 4.85 13.76

OPTSTK VOLTAS / 250 / CE 1.25 2.9 1 1.75 3.91 5.27 3.87 0.01 0.57 1.97 47.26

OPTSTK VOLTAS / 240 / PE 8.2 8.2 2.85 4 11.00 14.80 10.82 0.05 1.59 5.57 33.13

In case of In case of

If the market opens above "buy above" buy the Indice / Stock/ Option and exit on Target1.

Target 2 & Target 3 are extended targets. Same is apllicable for the sell side. All above are

Intraday Levels.

Risk Disclosure

Futures and options trading have large potential rewards, but also large potential risk. You must

be aware of the risks and be willing to accept them in order to invest in the futures and

options markets. Trade with risk capital only. The past performance of any trading strategy

or methodology is not necessarily indicative of future results. Past performance is no

guarantee of future results and should not be interpreted as a forecast of future

performance. We make no promise as to the performance of the account and while the

investment objective is major capital appreciation over time no representation is being made or

implied that any account will or is likely to achieve profit. The value of your investments can

decrease as well as increase and, as such, funds invested should constitute risk capital. The risk

of loss in trading commodities and options can be substantial. You should therefore

carefully consider whether such trading is suitable for you in light of your financial

9/22/2014 2 / 2 economicnerd.blogspot.in

carefully consider whether such trading is suitable for you in light of your financial

condition. The high degree of leverage that is often obtainable in Commodity trading can

Work against you as well as for you. The use of leverage can lead to large losses as well as gains.

You should carefully consider whether your financial condition permits you to participate

in futures trading. In so doing, you should be aware that futures and options trading can

quickly lead to large losses as well as gains. Such trading losses can sharply reduce the value

of your investment. All information provided on these pages is for fair use. Normal copyright

protections apply to all commercial use of any documents or information.

economicnerd@gmail.com is not responsible for any loss due to inaccuracies in the information

provided. Nothing presented here should be construed as investment advice or

recommendations.

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- End of Week 05 June 2015 Global ViewДокумент2 страницыEnd of Week 05 June 2015 Global ViewAjith Chand BhandaariОценок пока нет

- Global View 03 Aug 2015 To 7 Aug 2015Документ1 страницаGlobal View 03 Aug 2015 To 7 Aug 2015Ajith Chand BhandaariОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- 20 July 2015 24 July 2015 Global Market AnalysisДокумент1 страница20 July 2015 24 July 2015 Global Market AnalysisAjith Chand BhandaariОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- 10 Aug 15 14 Aug 15 Global Market ViewДокумент1 страница10 Aug 15 14 Aug 15 Global Market ViewAjith Chand BhandaariОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- 6JULY201510JULY2015GLOBALMARKETSДокумент1 страница6JULY201510JULY2015GLOBALMARKETSAjith Chand BhandaariОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- 08 June 2015 12 June 2015 Nifty Futures Weekly LevelsДокумент1 страница08 June 2015 12 June 2015 Nifty Futures Weekly LevelsAjith Chand BhandaariОценок пока нет

- 12 June 2015 End of Week Global Market AnalysisДокумент1 страница12 June 2015 End of Week Global Market AnalysisAjith Chand BhandaariОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- 28june2015 Global MarketsДокумент1 страница28june2015 Global MarketsAjith Chand BhandaariОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- 12 June 2015 End of Week Global Market AnalysisДокумент1 страница12 June 2015 End of Week Global Market AnalysisAjith Chand BhandaariОценок пока нет

- 26 Mar 2015 NiftyДокумент3 страницы26 Mar 2015 NiftyAjith Chand BhandaariОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- 18 - 2015 Global Weekly NewsletterДокумент3 страницы18 - 2015 Global Weekly NewsletterAjith Chand BhandaariОценок пока нет

- Week 17 2015 Global News LetterДокумент3 страницыWeek 17 2015 Global News LetterAjith Chand BhandaariОценок пока нет

- Week 16 2015 Global News LetterДокумент3 страницыWeek 16 2015 Global News LetterAjith Chand BhandaariОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- 05 April 2015 Global Weekly News LetterДокумент8 страниц05 April 2015 Global Weekly News LetterAjith Chand BhandaariОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 15 March 2015 Global ViewДокумент8 страниц15 March 2015 Global ViewAjith Chand BhandaariОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 05 April 2015 JublfoodДокумент3 страницы05 April 2015 JublfoodAjith Chand BhandaariОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- A New Addition This Week: Economicnerd - Blogspot.InДокумент3 страницыA New Addition This Week: Economicnerd - Blogspot.InAjith Chand BhandaariОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- 15 March 2015 NiftyДокумент3 страницы15 March 2015 NiftyAjith Chand BhandaariОценок пока нет

- 25 Mar 2015 Nifty & Colpal IntradayДокумент3 страницы25 Mar 2015 Nifty & Colpal IntradayAjith Chand BhandaariОценок пока нет

- 22 March 2015 Global Weekly PDFДокумент8 страниц22 March 2015 Global Weekly PDFLaura PetersОценок пока нет

- 23 Mar 2015 NiftyДокумент3 страницы23 Mar 2015 NiftyAjith Chand BhandaariОценок пока нет

- 24 March 2015 NiftyДокумент3 страницы24 March 2015 NiftyAjith Chand BhandaariОценок пока нет

- 17 March 2015 NiftyДокумент3 страницы17 March 2015 NiftyAjith Chand BhandaariОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- 18 March 2015 ::: NiftyДокумент3 страницы18 March 2015 ::: NiftyAjith Chand BhandaariОценок пока нет

- 16 March 2015 NiftyДокумент3 страницы16 March 2015 NiftyAjith Chand BhandaariОценок пока нет

- 15 March 2015 Global ViewДокумент8 страниц15 March 2015 Global ViewAjith Chand BhandaariОценок пока нет

- 18 March 2015 ::: NiftyДокумент3 страницы18 March 2015 ::: NiftyAjith Chand BhandaariОценок пока нет

- 13 March 2015 Weekly Pick AsianpaintДокумент3 страницы13 March 2015 Weekly Pick AsianpaintAjith Chand BhandaariОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Our Performance Today: Economicnerd Blogspot INДокумент3 страницыOur Performance Today: Economicnerd Blogspot INAjith Chand BhandaariОценок пока нет

- 12 March 2015 NiftyДокумент3 страницы12 March 2015 NiftyAjith Chand BhandaariОценок пока нет

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Документ2 страницыIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)Anonymous Pog15DОценок пока нет

- Bichar BigyanДокумент25 страницBichar Bigyanrajendra434383% (12)

- Introduction to Study of Textile OrganizationДокумент48 страницIntroduction to Study of Textile OrganizationShyam C AОценок пока нет

- Sipcot 1Документ1 страницаSipcot 1sfdsddsОценок пока нет

- RenatoPolimeno Resume 2010 v01Документ2 страницыRenatoPolimeno Resume 2010 v01Isabela RodriguesОценок пока нет

- Market Structure and Game Theory (Part 4)Документ7 страницMarket Structure and Game Theory (Part 4)Srijita GhoshОценок пока нет

- VAT Declaration FormДокумент2 страницыVAT Declaration FormWedaje Alemayehu67% (3)

- G4-Strataxman-Bir Form and DeadlinesДокумент4 страницыG4-Strataxman-Bir Form and DeadlinesKristen StewartОценок пока нет

- S Poddar and Co ProfileДокумент35 страницS Poddar and Co ProfileasassasaaОценок пока нет

- Global Hotels and ResortsДокумент32 страницыGlobal Hotels and Resortsgkinvestment0% (1)

- Taxes are the Lifeblood of GovernmentДокумент23 страницыTaxes are the Lifeblood of GovernmentVikki AmorioОценок пока нет

- HUL EthicsДокумент29 страницHUL EthicsRimci KalyanОценок пока нет

- MB m.2 Amd 9series-GamingДокумент1 страницаMB m.2 Amd 9series-GamingHannaОценок пока нет

- Smart Beta: A Follow-Up to Traditional Beta MeasuresДокумент15 страницSmart Beta: A Follow-Up to Traditional Beta Measuresdrussell524Оценок пока нет

- Hong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Документ19 страницHong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Anonymous BJNqtknОценок пока нет

- Transfer by Trustees To Beneficiary: Form No. 4Документ1 страницаTransfer by Trustees To Beneficiary: Form No. 4Sudeep SharmaОценок пока нет

- Blue and Gray Modern Marketing Budget PresentationДокумент14 страницBlue and Gray Modern Marketing Budget PresentationPPTI 40 I Gede Arinata KP.Оценок пока нет

- Global Market Segmentation TechniquesДокумент84 страницыGlobal Market Segmentation TechniquesRica de los SantosОценок пока нет

- KjujДокумент17 страницKjujMohamed KamalОценок пока нет

- Cold Chain Infrastructure in IndiaДокумент17 страницCold Chain Infrastructure in Indiainammurad12Оценок пока нет

- Account statement showing transactions from Dec 2016 to Feb 2017Документ4 страницыAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuОценок пока нет

- Business Model Analysis of Wal Mart and SearsДокумент3 страницыBusiness Model Analysis of Wal Mart and SearsAndres IbonОценок пока нет

- ERUMGROUP 2019 - General PDFДокумент20 страницERUMGROUP 2019 - General PDFAlok KaushikОценок пока нет

- 5014 Environmental Management: MARK SCHEME For The May/June 2015 SeriesДокумент3 страницы5014 Environmental Management: MARK SCHEME For The May/June 2015 Seriesmuti rehmanОценок пока нет

- Far QuizДокумент7 страницFar QuizMeldred EcatОценок пока нет

- Bhattacharyya2013 PDFДокумент24 страницыBhattacharyya2013 PDFFermando CamposОценок пока нет

- Karachi Stock Exchange QuotationДокумент19 страницKarachi Stock Exchange QuotationKingston KimberlyОценок пока нет

- Marketing Plan - NikeДокумент32 страницыMarketing Plan - NikeHendra WijayaОценок пока нет

- QR 0298 Economy 17A 22:10: Boarding PassДокумент2 страницыQR 0298 Economy 17A 22:10: Boarding PassannaОценок пока нет

- 43-101 Bloom Lake Nov 08Документ193 страницы43-101 Bloom Lake Nov 08DougОценок пока нет