Академический Документы

Профессиональный Документы

Культура Документы

The Cost of Capital: Learning Objectives

Загружено:

jamn1979Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Cost of Capital: Learning Objectives

Загружено:

jamn1979Авторское право:

Доступные форматы

After reading this chapter, students should be able to:

Explain what is meant by a firms weighted average cost of capital.

Define and calculate the component costs of debt and preferred stock.

Explain why retained earnings are not free and use three approaches to

estimate the component cost of retained earnings.

riefly explain why the cost of new e!uity is higher than the cost of

retained earnings, calculate the cost of new e!uity, and calculate the

retained earnings breakpoint""which is the point where new e!uity would

have to be issued.

riefly explain the two alternative approaches that can be used to account

for flotation costs.

#alculate the firms composite, or weighted average, cost of capital.

$dentify some of the factors that affect the overall, composite cost of

capital.

riefly explain how firms should evaluate pro%ects with different risks,

and the problems encountered when divisions within the same firm all use

the firms composite &A## when considering capital budgeting pro%ects.

'ist and briefly explain the three separate and distinct types of risk that

can be identified, and explain the procedure many firms use when developing

sub%ective risk"ad%usted costs of capital.

(se the #A)* to directly estimate the cost of capital for specific pro%ects

or divisions.

$dentify and explain the two approaches that have been used to estimate

individual assets betas.

'ist some problem areas in estimating the cost of capital.

Harcourt, Inc. Learning Objectives: 10 - 1

Chapter 10 The Cost of Capital

LEARNING OBJECTIVES

#hapter +, uses the rate of return concepts covered in previous chapters,

along with the concept of the weighted average cost of capital -&A##., to

develop a corporate cost of capital for use in capital budgeting.

&e begin by describing the logic of the &A##, and why it should be used

in capital budgeting. &e next explain how to estimate the cost of each

component of capital, and how to put the components together to determine the

&A##. &e go on to discuss factors that affect the &A##, how to ad%ust the

cost of capital for risk, and estimating pro%ect risk. /hen, we discuss how

to use the #A)* to estimate the risk"ad%usted cost of capital, and we discuss

techni!ues for measuring beta risk. &e conclude the chapter with a discussion

on some problem areas in the cost of capital.

/he details of what we cover, and the way we cover it, can be seen by

scanning Blueprints, #hapter +,. 0or other suggestions about the lecture,

please see the 1'ecture 2uggestions3 in #hapter 4, where we describe how we

conduct our classes.

DA52 67 #8A)/E9: : 60 ;< DA52 -;,"minute periods.

Lecture Suggestions: 10 - 2 Harcourt, Inc.

LECTURE SUGGESTIONS

+,"+ )robable Effect on

k

d

-+ " /. k

s

&A##

a. /he corporate tax rate is lowered. = , =

b. /he 0ederal 9eserve tightens credit. = = =

c. /he firm uses more debt> that is, it

increases its debt?assets ratio. = = ,

d. /he dividend payout ratio is

increased. , , ,

e. /he firm doubles the amount of capital

it raises during the year. , or = , or = , or =

f. /he firm expands into a risky

new area. = = =

g. /he firm merges with another firm

whose earnings are counter"cyclical

both to those of the first firm and

to the stock market. " " "

h. /he stock market falls drastically,

and the firms stock falls along with

the rest. , = =

i. $nvestors become more risk averse. = = =

%. /he firm is an electric utility with a

large investment in nuclear plants.

2everal states propose a ban on

nuclear power generation. = = =

+,"4 eta -market. risk refers to the pro%ects effect on the corporate beta

coefficient. &ithin"firm -corporate. risk refers to the pro%ects

Harcourt, Inc. Answers and Solutions: 10 -

ANS!ERS TO EN"-O#-C$A%TER &UESTIONS

effect on the stability of the firms earnings. 2tand"alone risk refers

to the inherent riskiness of the pro%ects expected returns when viewed

alone. /heoretically, beta -market. risk is the most relevant measure

because of its effect on stock prices.

+,": /he cost of capital for average"risk pro%ects would be the firms cost

of capital, +, percent. A somewhat higher cost would be used for more

risky pro%ects, and a lower cost would be used for less risky ones. 0or

example, we might use +4 percent for more risky pro%ects and @ percent

for less risky pro%ects. /hese choices are arbitrary.

+,"A Each firm has an optimal capital structure, defined as that mix of debt,

preferred, and common e!uity that causes its stock price to be

maximiBed. A value"maximiBing firm will determine its optimal capital

structure, use it as a target, and then raise new capital in a manner

designed to keep the actual capital structure on target over time. /he

target proportions of debt, preferred stock, and common e!uity, along

with the costs of those components, are used to calculate the firms

weighted average cost of capital, &A##.

/he weights could be based either on the accounting values shown on

the firms balance sheet -book values. or on the market values of the

different securities. /heoretically, the weights should be based on

market values, but if a firms book value weights are reasonably close

to its market value weights, book value weights can be used as a proxy

for market value weights. #onse!uently, target market value weights

should be used in the &A## e!uation.

+,"; An increase in the risk"free rate will increase the cost of debt.

9emember from #hapter ;, k C k

90

= D9) = ') = *9). /hus, if k

90

increases so does k -the cost of debt.. 2imilarly, if the risk"free

rate increases so does the cost of e!uity. 0rom the #A)* e!uation, k

s

C

k

90

= -k

*

D k

90

.b. #onse!uently, if k

90

increases k

s

will increase too.

+,"E $n general, failing to ad%ust for differences in risk would lead the

firm to accept too many risky pro%ects and re%ect too many safe ones.

6ver time, the firm would become more risky, its &A## would increase,

and its shareholder value would suffer.

Answers and Solutions: 10 - ' Harcourt, Inc.

+,"+ A,F Debt> E,F E!uity> k

d

C @F> / C A,F> &A## C @.@EF> k

s

C G

&A## C -w

d

.-k

d

.-+ " /. = -w

c

.-k

s

.

,.,@@E C -,.A.-,.,@.-+ " ,.A. = -,.E.k

s

,.,@@E C ,.,4+E = ,.Ek

s

,.,H< C ,.Ek

s

k

s

C +:F.

+,"4 )

p

C IAH.;,> D

p

C I:.<,> k

p

C G

k

p

C

)

D

p

p

k

p

C

IAH.;,

I:.<,

C <F.

+,": )

,

C I:,> D

+

C I:.,,> g C ;F> 0 C +,F> k

s

C G> k

e

C G

k

s

C

,

+

)

D

= g C

I:,.,,

I:.,,

= ,.,; C +;F.

k

e

C

. 0 + - )

D

,

+

= g C

,.+,. " I:,-+

I:.,,

= ,.,;

C

I4H.,,

I:.,,

= ,.,; C +E.++F.

+,"A )ro%ects A, , #, D, and E would be accepted since each pro%ects return

is greater than the firms &A##.

+,"; a. k

d

-+ " /. C +:F-+ " ,. C +:.,,F.

b. k

d

-+ " /. C +:F-,.<,. C +,.A,F.

c. k

d

-+ " /. C +:F-,.E;. C <.A;F.

+,"E k

d

-+ " /. C ,.+4-,.E;. C H.<,F.

Harcourt, Inc. Answers and Solutions: 10 - (

SOLUTIONS TO EN"-O#-C$A%TER %ROBLE)S

+,"H k

p

C

I@4.+;

I+,,-,.++.

C

I@4.+;

I++

C ++.@AF.

+,"< a. k

s

C

,

+

)

D

= g

k

s

C ,.,E =

I:E

I:.+<

k

s

C +A.<:F.

b. 0 C -I:E.,, " I:4.A,.?I:E.,, C I:.E,?I:E.,, C +,F.

c. k

e

C D

+

?J)

,

-+ " 0.K = g C I:.+<?I:4.A, = EF C @.<+F = EF C +;.<+F.

+,"@ #apital 2ources Amount #apital 2tructure &eight

'ong"term debt I+,+;4 A,.,F

E!uity +,H4< E,.,

I4,<<, +,,.,F

&A## C w

d

k

d

-+ " /. = w

c

k

s

C ,.A-,.+:.-,.E. = ,.E-,.+E.

C ,.,:+4 = ,.,@E, C +4.H4F.

+,"+, k

s

C D

+

?)

,

= g C I4-+.,H.?I4A.H; = HF

C <.E;F = HF C +;.E;F.

&A## C w

d

-k

d

.-+ " /. = w

c

-k

s

.> w

c

C + " w

d

.

+:.@;F C w

d

-++F.-+ " ,.:;. = -+ " w

d

.-+;.E;F.

,.+:@; C ,.,H+;w

d

= ,.+;E; " ,.+;E;w

d

",.,+H C ",.,<;w

d

w

d

C ,.4, C 4,F.

+,"++ a. k

d

C +,F, k

d

-+ " /. C +,F-,.E. C EF.

D?A C A;F> D

,

C I4> g C AF> )

,

C I4,> / C A,F.

)ro%ect A: 9ate of return C +:F.

)ro%ect : 9ate of return C +,F.

k

s

C I4-+.,A.?I4, = AF C +A.A,F.

b. &A## C ,.A;-EF. = ,.;;-+A.A,F. C +,.E4F.

c. 2ince the firms &A## is +,.E4F and each of the pro%ects is e!ually

risky and as risky as the firms other assets, *E# should accept

)ro%ect A. $ts rate of return is greater than the firms &A##.

)ro%ect should not be accepted, since its rate of return is less

than *E#s &A##.

Answers and Solutions: 10 - * Harcourt, Inc.

+,"+4 Enter these values: 7 C E,, )L C ";+;.+E, )*/ C :,, and 0L C +,,,, to

get $ C EF C periodic rate. /he nominal rate is EF-4. C +4F, and the

after"tax component cost of debt is +4F-,.E. C H.4F.

+,"+: Debt C A,F, E!uity C E,F.

)

,

C I44.;,, D

,

C I4.,,, D

+

C I4.,,-+.,H. C I4.+A, g C HF.

k

s

C

,

+

)

D

= g C

;, . 44 I

+A . 4 I

= HF C +E.;+F.

&A## C -,.A.-,.+4.-+ " ,.A. = -,.E.-,.+E;+.

C ,.,4<< = ,.,@@+ C +4.H@F.

+,"+A a. k

s

C

,

+

)

D

= g C

I4:

I4.+A

= HF C @.:F = HF C +E.:F.

b. k

s

C k

90

= -k

*

" k

90

.b

C @F = -+:F " @F.+.E C @F = -AF.+.E C @F = E.AF C +;.AF.

c. k

s

C ond rate = 9isk premium C +4F = AF C +EF.

d. /he bond"yield"plus"risk"premium approach and the #A)* method both

resulted in lower cost of common stock estimates than the D#0 method.

2ince financial analysts tend to give the most weight to the D#0

method, the firms cost of common stock should be estimated to be

about +E.: percent.

+,"+; a. &ith a financial calculator, input 7 C ;, )L C "A.A4, )*/ C ,, 0L C

E.;,, and then solve for $ C <.,4F <F.

b. D

+

C D

,

-+ = g. C I4.E,-+.,<. C I4.<+.

c. k

s

C D

+

?)

,

= g C I4.<+?I:E.,, = <F C +;.<+F.

+,"+E a. k

s

C

,

+

)

D

= g

,.,@ C

IE,.,,

I:.E,

= g

,.,@ C ,.,E = g

g C :F.

b. #urrent E)2 I;.A,,

'ess: Dividends per share :.E,,

9etained earnings per share I+.<,,

9ate of return ,.,@,

$ncrease in E)2 I,.+E4

)lus: #urrent E)2 ;.A,,

7ext years E)2 I;.;E4

Alternatively, E)2

+

C E)2

,

-+ = g. C I;.A,-+.,:. C I;.;E4.

+,"+H a. After"tax cost of new debt: k

d

-+ " /. C ,.,@-+ " ,.A. C ;.AF.

#ost of common e!uity:

#alculate g as follows:

&ith a financial calculator, input 7 C @, )L C ":.@,, )*/ C ,, 0L C

H.<,, and then solve for $ C <.,+F <F.

k

s

C

,

+

)

D

= g C

IE;.,,

<,. -,.;;.-IH.

= ,.,< C

IE;.,,

IA.4@

= ,.,< C ,.+AE C

+A.EF.

b. &A## calculation:

After"tax &eighted

#omponent &eight #ost C #ost

DebtJ,.,@-+ " /.K ,.A, ;.AF 4.+EF

#ommon e!uity -9E. ,.E, +A.EF <.HEF

+,.@4F

+,"+< a. k

d

-+ " /. C ,.+,-+ " ,.:. C HF.

k

p

C I;?IA@ C +,.4F.

k

s

C I:.;,?I:E = EF C +;.H4F.

b. &A##:

After"tax &eighted

#omponent &eight #ost C #ost

DebtJ,.+,-+ " /.K ,.+; H.,,F +.,;F

)referred stock ,.+, +,.4,F +.,4F

#ommon stock ,.H; +;.H4F ++.H@F

&A## C +:.<EF

c. )ro%ects + and 4 will be accepted since their rates of return exceed

the &A##.

+,"+@ a. beta C w

/D

b

/D

= &

9D

b

9D

C -,.H;.+.; = -,.4;.,.; C +.4;.

/his is the corporate beta.

b. k

s

C k

90

= -k

*

" k

90

.b C @F = -+:F " @F.+.4; C +AF.

c. /he divisional costs of capital are:

k

/D

C @F = AF-+.;. C +;F. k

9D

C @F = AF-,.;. C ++F.

/herefore, for average pro%ects within each division, these rates

would be used. $f a pro%ect were %udged to be more or less risky

than average for the division, these divisional costs of capital

would be increased or decreased.

+,"4, /he detailed solution for the spreadsheet problem is available both on

the instructors resource #D"96* and on the instructors side of the

8arcourt #ollege )ublishers web site:

http:??www.harcourtcollege.com?finance?concise:e.

+,"4+ /he detailed solution for the cyberproblem is available on the

instructors side of the 8arcourt #ollege )ublishers web site:

http:??www.harcourtcollege.com?finance?concise:e.

Computer/Internet Applications: 10 - 10 Harcourt, Inc.

S%REA"S$EET %ROBLE)

C+BER%ROBLE)

Cole,a- Te.h-olo/ies I-.0

Cost of Capital

10-22 COLEMAN TECHNOLOGIES IS CONSIDERING A MAJOR EXPANSION PROGRAM THAT HAS

BEEN PROPOSED BY THE COMPANYS INFORMATION TECHNOLOGY GROUP. BEFORE

PROCEEDING WITH THE EXPANSION, THE COMPANY NEEDS TO DEVELOP AN

ESTIMATE OF ITS COST OF CAPITAL. ASSUME THAT YOU ARE AN ASSISTANT TO

JERRY LEHMAN, THE FINANCIAL VICE-PRESIDENT. YOUR FIRST TAS IS TO

ESTIMATE COLEMANS COST OF CAPITAL. LEHMAN HAS PROVIDED YOU WITH THE

FOLLOWING DATA, WHICH HE BELIEVES MAY BE RELEVANT TO YOUR TAS!

1. THE FIRMS TAX RATE IS "0 PERCENT.

2. THE CURRENT PRICE OF COLEMANS 12 PERCENT COUPON, SEMIANNUAL

PAYMENT, NONCALLABLE BONDS WITH 1# YEARS REMAINING TO MATURITY IS

$1,1#%.&2. COLEMAN DOES NOT USE SHORT-TERM INTEREST-BEARING DEBT ON

A PERMANENT BASIS. NEW BONDS WOULD BE PRIVATELY PLACED WITH NO

FLOTATION COST.

%. THE CURRENT PRICE OF THE FIRMS 10 PERCENT, $100 PAR VALUE,

'UARTERLY DIVIDEND, PERPETUAL PREFERRED STOC IS $111.10.

". COLEMANS COMMON STOC IS CURRENTLY SELLING AT $#0 PER SHARE. ITS

LAST DIVIDEND (D

0

) WAS $".1*, AND DIVIDENDS ARE EXPECTED TO GROW AT

A CONSTANT RATE OF # PERCENT IN THE FORESEEABLE FUTURE. COLEMANS

BETA IS 1.2, THE YIELD ON T-BONDS IS & PERCENT, AND THE MARET RIS

PREMIUM IS ESTIMATED TO BE + PERCENT. FOR THE BOND-YIELD-PLUS-

RIS-PREMIUM APPROACH, THE FIRM USES A " PERCENTAGE POINT RIS

PREMIUM.

#. COLEMANS TARGET CAPITAL STRUCTURE IS %0 PERCENT LONG-TERM DEBT, 10

PERCENT PREFERRED STOC, AND +0 PERCENT COMMON E'UITY.

TO STRUCTURE THE TAS SOMEWHAT, LEHMAN HAS ASED YOU TO ANSWER THE

FOLLOWING 'UESTIONS.

Harcourt, Inc. Integrated Case: 10 - 11

INTEGRATE" CASE

Integrated Case: 10 - 12 Harcourt, Inc.

A. 1. WHAT SOURCES OF CAPITAL SHOULD BE INCLUDED WHEN YOU ESTIMATE COLEMANS

WEIGHTED AVERAGE COST OF CAPITAL (WACC),

ANSWER! J286& 2+,"+ /896(M8 2+,": 8E9E.K /8E &A## $2 (2ED )9$*A9$'5 069

*AN$7M '67M"/E9* #A)$/A' $7LE2/*E7/ DE#$2$672, i.e., 069 #A)$/A'

(DME/$7M. /8(2, /8E &A## 286('D $7#'(DE /8E /5)E2 60 #A)$/A' (2ED /6

)A5 069 '67M"/E9* A22E/2, A7D /8$2 $2 /5)$#A''5 '67M"/E9* DE/,

)9E0E99ED 2/6#N -$0 (2ED., A7D #6**67 2/6#N. 2869/"/E9* 26(9#E2 60

#A)$/A' #672$2/ 60

-+. 2)67/A7E6(2, 767$7/E9E2/"EA9$7M '$A$'$/$E2 2(#8 A2 A##6(7/2

)A5A'E A7D A##9(A'2 A7D -4. 2869/"/E9* $7/E9E2/"EA9$7M DE/, 2(#8 A2

76/E2 )A5A'E. $0 /8E 0$9* (2E2 2869/"/E9* $7/E9E2/"EA9$7M DE/ /6

A#O($9E 0$PED A22E/2 9A/8E9 /8A7 Q(2/ /6 0$7A7#E &69N$7M #A)$/A'

7EED2, /8E7 /8E &A## 286('D $7#'(DE A 2869/"/E9* DE/ #6*)67E7/.

767$7/E9E2/"EA9$7M DE/ $2 ME7E9A''5 76/ $7#'(DED $7 /8E #62/ 60

#A)$/A' E2/$*A/E E#A(2E /8E2E 0(7D2 A9E 7E//ED 6(/ &8E7 DE/E9*$7$7M

$7LE2/*E7/ 7EED2, /8A/ $2, 7E/ 6)E9A/$7M 9A/8E9 /8A7 M9622 6)E9A/$7M

&69N$7M #A)$/A' $2 $7#'(DED $7 #A)$/A' EP)E7D$/(9E2.

A. 2. SHOULD THE COMPONENT COSTS BE FIGURED ON A BEFORE-TAX OR AN AFTER-TAX

BASIS,

ANSWER! J286& 2+,"A 8E9E.K 2/6#N86'DE92 A9E #67#E97ED )9$*A9$'5 &$/8 /862E

#69)69A/E #A28 0'6&2 /8A/ A9E ALA$'A'E 069 /8E$9 (2E, 7A*E'5, /862E

#A28 0'6&2 ALA$'A'E /6 )A5 D$L$DE7D2 69 069 9E$7LE2/*E7/. 2$7#E

D$L$DE7D2 A9E )A$D 096* A7D 9E$7LE2/*E7/ $2 *ADE &$/8 A0/E9"/AP

D6''A92, A'' #A28 0'6& A7D 9A/E 60 9E/(97 #A'#('A/$672 286('D E D67E

67 A7 A0/E9"/AP A2$2.

A. %. SHOULD THE COSTS BE HISTORICAL (EMBEDDED) COSTS OR NEW (MARGINAL)

COSTS,

ANSWER! J286& 2+,"; A7D 2+,"E 8E9E.K $7 0$7A7#$A' *A7AME*E7/, /8E #62/ 60

#A)$/A' $2 (2ED )9$*A9$'5 /6 *ANE DE#$2$672 /8A/ $7L6'LE 9A$2$7M 7E&

#A)$/A'. /8(2, /8E 9E'ELA7/ #6*)67E7/ #62/2 A9E /6DA52 *A9M$7A'

#62/2 9A/8E9 /8A7 8$2/69$#A' #62/2.

Harcourt, Inc. Integrated Case: 10 - 1

B. WHAT IS THE MARET INTEREST RATE ON COLEMANS DEBT AND ITS COMPONENT

COST OF DEBT,

ANSWER! J286& 2+,"H /896(M8 2+,"@ 8E9E.K #6'E*A72 +4 )E9#E7/ 67D &$/8 +;

5EA92 /6 *A/(9$/5 $2 #(99E7/'5 2E''$7M 069 I+,+;:.H4. /8(2, $/2 5$E'D

/6 *A/(9$/5 $2 +, )E9#E7/:

, + 4 :

4@ :,

R R R R R R

"+,+;:.H4

E, E, E,

E, E,

+,,,,

E7/E9 7 C :,, )L C "++;:.H4, )*/ C E,, A7D 0L C +,,,, A7D /8E7 )9E22

/8E $ (//67 /6 0$7D k

d

?4 C $ C ;.,F. 2$7#E /8$2 $2 A 2E*$A77(A' 9A/E,

*('/$)'5 5 4 /6 0$7D /8E A77(A' 9A/E, k

d

C +,F, /8E )9E"/AP #62/ 60

DE/.

2$7#E $7/E9E2/ $2 /AP DED(#/$'E, (7#'E 2A*, $7 E00E#/, )A52 )A9/

60 /8E #62/, A7D #6'E*A72 9E'ELA7/ #6*)67E7/ #62/ 60 DE/ $2 /8E

A0/E9"/AP #62/:

k

d

-+ " /. C +,.,F-+ " ,.A,. C +,.,F-,.E,. C E.,F.

OPTIONAL 'UESTION

SHOULD YOU USE THE NOMINAL COST OF DEBT OR THE EFFECTIVE ANNUAL COST,

ANSWER! 6(9 +, )E9#E7/ )9E"/AP E2/$*A/E $2 /8E 76*$7A' #62/ 60 DE/. 2$7#E /8E

0$9*2 DE/ 8A2 2E*$A77(A' #6()672, $/2 E00E#/$LE A77(A' 9A/E $2 +,.4;

)E9#E7/:

-+.,;.

4

" +., C +.+,4; " +., C ,.+,4; C +,.4;F.

86&ELE9, 76*$7A' 9A/E2 A9E ME7E9A''5 (2ED. /8E 9EA267 $2 /8A/ /8E

#62/ 60 #A)$/A' $2 (2ED $7 #A)$/A' (DME/$7M, A7D #A)$/A' (DME/$7M

#A28 0'6&2 A9E ME7E9A''5 A22(*ED /6 6##(9 A/ 5EA9"E7D. /8E9E069E,

(2$7M 76*$7A' 9A/E2 *ANE2 /8E /9EA/*E7/ 60 /8E #A)$/A' (DME/$7M

D$2#6(7/ 9A/E A7D #A28 0'6&2 #672$2/E7/.

C. 1. WHAT IS THE FIRMS COST OF PREFERRED STOC,

Integrated Case: 10 - 1' Harcourt, Inc.

ANSWER! J286& 2+,"+, /896(M8 2+,"+: 8E9E.K 2$7#E /8E )9E0E99ED $22(E $2

)E9)E/(A', $/2 #62/ $2 E2/$*A/ED A2 06''6&2:

F. , . @ ,@, . ,

+, . +++ I

+, I

+, . +++ I

. +,, -I + . ,

)

D

k

p

p

p

= = = = =

76/E -+. /8A/ 2$7#E )9E0E99ED D$L$DE7D2 A9E 76/ /AP DED(#/$'E /6 /8E

$22(E9, /8E9E $2 76 7EED 069 A /AP ADQ(2/*E7/, A7D -4. /8A/ &E #6('D

8ALE E2/$*A/ED /8E E00E#/$LE A77(A' #62/ 60 /8E )9E0E99ED, (/ A2 $7

/8E #A2E 60 DE/, /8E 76*$7A' #62/ $2 ME7E9A''5 (2ED.

C. 2. COLEMANS PREFERRED STOC IS RISIER TO INVESTORS THAN ITS DEBT, YET

THE PREFERREDS YIELD TO INVESTORS IS LOWER THAN THE YIELD TO MATURITY

ON THE DEBT. DOES THIS SUGGEST THAT YOU HAVE MADE A MISTAE, (HINT!

THIN ABOUT TAXES.)

ANSWER! J286& 2+,"+A /896(M8 2+,"+E 8E9E.K #69)69A/E $7LE2/692 6&7 *62/

)9E0E99ED 2/6#N, E#A(2E H, )E9#E7/ 60 )9E0E99ED D$L$DE7D2 9E#E$LED 5

#69)69A/$672 A9E 767/APA'E. /8E9E069E, )9E0E99ED 60/E7 8A2 A '6&E9

E069E"/AP 5$E'D /8A7 /8E E069E"/AP 5$E'D 67 DE/ $22(ED 5 /8E 2A*E

#6*)A75. 76/E, /86(M8, /8A/ /8E A0/E9"/AP 5$E'D /6 A #69)69A/E

$7LE2/69 A7D /8E A0/E9"/AP #62/ /6 /8E $22(E9 A9E 8$M8E9 67 )9E0E99ED

2/6#N /8A7 67 DE/.

D. 1. WHY IS THERE A COST ASSOCIATED WITH RETAINED EARNINGS,

ANSWER! J286& 2+,"+H /896(M8 2+,"+@ 8E9E.K #6'E*A72 EA97$7M2 #A7 E$/8E9 E

9E/A$7ED A7D 9E$7LE2/ED $7 /8E (2$7E22 69 )A$D 6(/ A2 D$L$DE7D2. $0

EA97$7M2 A9E 9E/A$7ED, #6'E*A72 28A9E86'DE92 069M6 /8E 6))69/(7$/5 /6

9E#E$LE #A28 A7D /6 9E$7LE2/ $/ $7 2/6#N2, 67D2, 9EA' E2/A/E, A7D /8E

'$NE. /8(2, #6'E*A7 286('D EA97 67 $/2 9E/A$7ED EA97$7M2 A/ 'EA2/ A2

*(#8 A2 $/2 2/6#N86'DE92 /8E*2E'LE2 #6('D EA97 67 A'/E97A/$LE

$7LE2/*E7/2 60 EO($LA'E7/ 9$2N. 0(9/8E9, /8E #6*)A752 2/6#N86'DE92

#6('D $7LE2/ $7 #6'E*A72 6&7 #6**67 2/6#N, &8E9E /8E5 #6('D EP)E#/ /6

EA97 k

s

. &E #67#'(DE /8A/ 9E/A$7ED EA97$7M2 8ALE A7 6))69/(7$/5 #62/

/8A/ $2 EO(A' /6 k

s

, /8E 9A/E 60 9E/(97 $7LE2/692 EP)E#/ 67 /8E 0$9*2

#6**67 2/6#N.

Harcourt, Inc. Integrated Case: 10 - 1(

D. 2. WHAT IS COLEMANS ESTIMATED COST OF COMMON E'UITY USING THE CAPM

APPROACH,

ANSWER! J286& 2+,"4, A7D 2+,"4+ 8E9E.K /8E #A)* E2/$*A/E 069 #6'E*A72 #62/

60 #6**67 EO($/5 $2 +A.4 )E9#E7/:

k

s

C k

90

= -k

*

" k

90

.b C H.,F = -E.,F.+.4 C H.,F = H.4F C +A.4F.

E. WHAT IS THE ESTIMATED COST OF COMMON E'UITY USING THE DISCOUNTED CASH

FLOW (DCF) APPROACH,

ANSWER! J286& 2+,"44 /896(M8 2+,"4; 8E9E.K 2$7#E #6'E*A7 $2 A #672/A7/ M96&/8

2/6#N, /8E #672/A7/ M96&/8 *6DE' #A7 E (2ED:

s

k C

s

k

S

C ,; . ,

;, I

. ,; . + - +@ . A I

)

. g + - D

g

)

D

,

,

,

+

+ +

+

= +

C F. < . +: F , . ; F < . < ,; . , ,<< . , ,; . ,

;, I

A, . A I

= + = + = +

F. WHAT IS THE BOND-YIELD-PLUS-RIS-PREMIUM ESTIMATE FOR COLEMANS COST

OF COMMON E'UITY,

ANSWER! J286& 2+,"4E 8E9E.K /8E 67D"5$E'D")'(2"9$2N")9E*$(* E2/$*A/E $2

+A )E9#E7/:

k

s

C 67D 5$E'D = 9$2N )9E*$(* C +,.,F = A.,F C +A.,F.

76/E /8A/ /8E 9$2N )9E*$(* 9EO($9ED $7 /8$2 *E/86D $2 D$00$#('/ /6

E2/$*A/E, 26 /8$2 A))96A#8 67'5 )96L$DE2 A A'')A9N E2/$*A/E 60 k

s

.

$/ $2 (2E0(', /86(M8, A2 A #8E#N 67 /8E D#0 A7D #A)* E2/$*A/E2, &8$#8

#A7, (7DE9 #E9/A$7 #$9#(*2/A7#E2, )96D(#E (79EA267A'E E2/$*A/E2.

G. WHAT IS YOUR FINAL ESTIMATE FOR -

.

,

ANSWER! J286& 2+,"4H 8E9E.K /8E 06''6&$7M /A'E 2(**A9$TE2 /8E k

s

E2/$*A/E2:

*E/86D E2/$*A/E

#A)* +A.4F

D#0 +:.<

Integrated Case: 10 - 1* Harcourt, Inc.

k

d

= 9) +A.,

ALE9AME +A.,F

A/ /8$2 )6$7/, #672$DE9A'E Q(DM*E7/ $2 9EO($9ED. $0 A *E/86D $2

DEE*ED /6 E $70E9$69 D(E /6 /8E 1O(A'$/53 60 $/2 $7)(/2, /8E7 $/

*$M8/ E M$LE7 '$//'E &E$M8/ 69 ELE7 D$29EMA9DED. $7 6(9 EPA*)'E,

/86(M8, /8E /89EE *E/86D2 )96D(#ED 9E'A/$LE'5 #'62E 9E2('/2, 26 &E

DE#$DED /6 (2E /8E ALE9AME, +A )E9#E7/, A2 6(9 E2/$*A/E 069 #6'E*A72

#62/ 60 #6**67 EO($/5.

H. EXPLAIN IN WORDS WHY NEW COMMON STOC HAS A HIGHER PERCENTAGE COST

THAN RETAINED EARNINGS.

ANSWER! J286& 2+,"4< 8E9E.K /8E #6*)A75 $2 9A$2$7M *67E5 $7 69DE9 /6 *ANE A7

$7LE2/*E7/. /8E *67E5 8A2 A #62/, A7D /8$2 #62/ $2 A2ED )9$*A9$'5 67

/8E $7LE2/692 9EO($9ED 9A/E 60 9E/(97, #672$DE9$7M 9$2N A7D A'/E97"

A/$LE $7LE2/*E7/ 6))69/(7$/$E2. 26, /8E 7E& $7LE2/*E7/ *(2/ )96L$DE A

9E/(97 A/ 'EA2/ EO(A' /6 /8E $7LE2/692 6))69/(7$/5 #62/.

$0 /8E #6*)A75 9A$2E2 #A)$/A' 5 2E''$7M 2/6#N, /8E #6*)A75 D6E27/

ME/ A'' 60 /8E *67E5 /8A/ $7LE2/692 )(/ (). 069 EPA*)'E, $0 $7LE2/692

)(/ () I+,,,,,,, A7D $0 /8E5 EP)E#/ A +; )E9#E7/ 9E/(97 67 /8A/

I+,,,,,,, /8E7 I+;,,,, 60 )960$/2 *(2/ E ME7E9A/ED. (/ $0 0'6/A/$67

#62/2 A9E 4, )E9#E7/ -I4,,,,,., /8E7 /8E #6*)A75 &$'' 9E#E$LE 67'5

I<,,,,, 60 /8E I+,,,,,, $7LE2/692 )(/ (). /8A/ I<,,,,, *(2/ /8E7

)96D(#E A I+;,,,, )960$/, 69 A I+;?I<, C +<.H;F 9A/E 60 9E/(97 LE92(2

A +; )E9#E7/ 9E/(97 67 EO($/5 9A$2ED A2 9E/A$7ED EA97$7M2.

I. 1. WHAT ARE TWO APPROACHES THAT CAN BE USED TO ACCOUNT FOR FLOTATION

COSTS,

ANSWER! J286& 2+,"4@ 8E9E.K /8E 0$92/ A))96A#8 $2 /6 $7#'(DE /8E 0'6/A/$67

#62/2 A2 )A9/ 60 /8E )96QE#/ 2 ()"0967/ #62/. /8$2 9ED(#E2 /8E

)96QE#/ 2 E2/$*A/ED 9E/(97. /8E 2E#67D A))96A#8 $2 /6 ADQ(2/ /8E #62/

60 #A)$/A' /6 $7#'(DE 0'6/A/$67 #62/2. /8$2 $2 *62/ #6**67'5 D67E 5

$7#69)69A/$7M 0'6/A/$67 #62/2 $7 /8E D#0 *6DE'.

I. 2. COLEMAN ESTIMATES THAT IF IT ISSUES NEW COMMON STOC, THE FLOTATION

COST WILL BE 1# PERCENT. COLEMAN INCORPORATES THE FLOTATION COSTS

Harcourt, Inc. Integrated Case: 10 - 11

INTO THE DCF APPROACH. WHAT IS THE ESTIMATED COST OF NEWLY ISSUED

COMMON STOC, TAING INTO ACCOUNT THE FLOTATION COST,

ANSWER! J286& 2+,":, A7D 2+,":+ 8E9E.K

+;.AF. C ;.,F =

IA4.;,

IA.A,

C

;.,F =

,.+;. " I;,-+

. IA.+@-+.,;

C

g =

0. " -+

)

g. = -+

D

C

k

,

,

e

J. WHAT IS COLEMANS OVERALL, OR WEIGHTED AVERAGE, COST OF CAPITAL

(WACC), IGNORE FLOTATION COSTS.

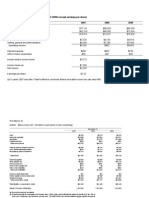

ANSWER! J286& 2+,":4 8E9E.K #6'E*A72 &A## $2 ++.+ )E9#E7/.

#A)$/A' 2/9(#/(9E #6*)67E7/

&E$M8/2 #62/2 C )96D(#/

,.: EF +.<F

,.+ @ ,.@

,.E +A <.A

+., &A## C ++.+F

&A## C w

d

k

d

-+ " /. = w

p

k

p

= w

c

k

s

C ,.:-+,F.-,.E. = ,.+-@F. = ,.E-+AF. C +.<F = ,.@F = <.AF C

++.+F.

. WHAT FACTORS INFLUENCE COLEMAN S COMPOSITE WACC,

ANSWER! J286& 2+,":: A7D 2+,":A 8E9E.K /8E9E A9E 0A#/692 /8A/ /8E 0$9* #A776/

#67/96' A7D /862E /8A/ /8E5 #A7 #67/96' /8A/ $70'(E7#E &A##.

0A#/692 /8E 0$9* #A776/ #67/96':

'ELE' 60 $7/E9E2/ 9A/E2

/AP 9A/E2

0A#/692 /8E 0$9* #A7 #67/96':

#A)$/A' 2/9(#/(9E )6'$#5

D$L$DE7D )6'$#5

Integrated Case: 10 - 12 Harcourt, Inc.

*A9NE/ #67D$/$672

$7LE2/*E7/ )6'$#5

L. SHOULD THE COMPANY USE THE COMPOSITE WACC AS THE HURDLE RATE FOR EACH

OF ITS PROJECTS,

ANSWER! J286& 2+,":; /896(M8 2+,":H 8E9E.K 76. /8E #6*)62$/E &A## 9E0'E#/2

/8E 9$2N 60 A7 ALE9AME )96QE#/ (7DE9/ANE7 5 /8E 0$9*. /8E9E069E, /8E

&A## 67'5 9E)9E2E7/2 /8E 18(9D'E 9A/E3 069 A /5)$#A' )96QE#/ &$/8

ALE9AME 9$2N. D$00E9E7/ )96QE#/2 8ALE D$00E9E7/ 9$2N2. /8E )96QE#/2

&A## 286('D E ADQ(2/ED /6 9E0'E#/ /8E )96QE#/2 9$2N.

Harcourt, Inc. Integrated Case: 10 - 13

M. WHAT ARE THREE TYPES OF PROJECT RIS, HOW IS EACH TYPE OF RIS USED,

ANSWER! J286& 2+,":< A7D 2+,":@ 8E9E.K /8E /89EE /5)E2 60 )96QE#/ 9$2N A9E:

2/A7D"A'67E 9$2N

#69)69A/E 9$2N

*A9NE/ 9$2N

*A9NE/ 9$2N $2 /8E69E/$#A''5 E2/ $7 *62/ 2$/(A/$672. 86&ELE9,

#9ED$/692, #(2/6*E92, 2())'$E92, A7D E*)'65EE2 A9E *69E A00E#/ED 5

#69)69A/E 9$2N. /8E9E069E, #69)69A/E 9$2N $2 A'26 9E'ELA7/. 2/A7D"

A'67E 9$2N $2 /8E EA2$E2/ /5)E 60 9$2N /6 *EA2(9E.

/AN$7M 67 A )96QE#/ &$/8 A 8$M8 DEM9EE 60 E$/8E9 2/A7D"A'67E 69

#69)69A/E 9$2N &$'' 76/ 7E#E22A9$'5 A00E#/ /8E 0$9*2 *A9NE/ 9$2N.

86&ELE9, $0 /8E )96QE#/ 8A2 8$M8'5 (7#E9/A$7 9E/(972, A7D $0 /862E

9E/(972 A9E 8$M8'5 #699E'A/ED &$/8 9E/(972 67 /8E 0$9*2 6/8E9 A22E/2

A7D &$/8 *62/ 6/8E9 A22E/2 $7 /8E E#676*5, /8E )96QE#/ &$'' 8ALE A

8$M8 DEM9EE 60 A'' /5)E2 60 9$2N.

N. WHAT PROCEDURES ARE USED TO DETERMINE THE RIS-ADJUSTED COST OF

CAPITAL FOR A PARTICULAR PROJECT OR DIVISION, WHAT APPROACHES ARE

USED TO MEASURE A PROJECTS BETA,

ANSWER! J286& 2+,"A, /896(M8 2+,"A4 8E9E.K /8E 06''6&$7M )96#ED(9E2 #A7 E

(2ED /6 DE/E9*$7E A )96QE#/2 9$2N"ADQ(2/ED #62/ 60 #A)$/A':

2(QE#/$LE ADQ(2/*E7/2 /6 /8E 0$9*2 #6*)62$/E &A##.

A//E*)/ /6 E2/$*A/E &8A/ /8E #62/ 60 #A)$/A' &6('D E $0 /8E

)96QE#/?D$L$2$67 &E9E A 2/A7D"A'67E 0$9*. /8$2 9EO($9E2 E2/$*A/$7M

/8E )96QE#/2 E/A.

/8E 06''6&$7M A))96A#8E2 #A7 E (2ED /6 *EA2(9E A )96QE#/2 E/A:

)(9E )'A5 A))96A#8. 0$7D 2ELE9A' )('$#'5 /9ADED #6*)A7$E2

EP#'(2$LE'5 $7 /8E )96QE#/2 (2$7E22. /8E7, (2E /8E ALE9AME 60

/8E$9 E/A2 A2 A )96P5 069 /8E )96QE#/2 E/A. -$/2 8A9D /6 0$7D

2(#8 #6*)A7$E2..

Integrated Case: 10 - 20 Harcourt, Inc.

A##6(7/$7M E/A A))96A#8. 9(7 A 9EM9E22$67 E/&EE7 /8E )96QE#/2

96A A7D /8E 2U) $7DEP 96A. A##6(7/$7M E/A2 A9E #699E'A/ED -,.; "

,.E. &$/8 *A9NE/ E/A2. 86&ELE9, 56( 769*A''5 #A7/ ME/ DA/A 67

7E& )96QE#/ 96As E069E /8E #A)$/A' (DME/$7M DE#$2$67 8A2 EE7

*ADE.

O. COLEMAN IS INTERESTED IN ESTABLISHING A NEW DIVISION, WHICH WILL FOCUS

PRIMARILY ON DEVELOPING NEW INTERNET-BASED PROJECTS. IN TRYING TO

DETERMINE THE COST OF CAPITAL FOR THIS NEW DIVISION, YOU DISCOVER THAT

STAND-ALONE FIRMS INVOLVED IN SIMILAR PROJECTS HAVE ON AVERAGE THE

FOLLOWING CHARACTERISTICS!

THEIR CAPITAL STRUCTURE IS "0 PERCENT DEBT AND +0 PERCENT COMMON

E'UITY.

THEIR COST OF DEBT IS TYPICALLY 12 PERCENT.

THE BETA IS 1.&.

GIVEN THIS INFORMATION, WHAT WOULD YOUR ESTIMATE BE FOR THE DIVISIONS

COST OF CAPITAL,

ANSWER! J286& 2+,"A: /896(M8 2+,"A; 8E9E.K

k

s D$L.

C k

90

= -k

*

" k

90

.b

D$L.

C HF = -EF.+.H C +H.4F.

&A##

D$L.

C &

d

k

d

-+ " /. = &

c

k

s

C ,.A-+4F.-,.E. = ,.E-+H.4F.

C +:.4F.

/8E D$L$2$672 &A## C +:.4F L2. /8E #69)69A/E &A## C ++.+F. /8E

D$L$2$672 *A9NE/ 9$2N $2 M9EA/E9 /8A7 /8E 0$9*2 ALE9AME )96QE#/2.

/5)$#A' )96QE#/2 &$/8$7 /8$2 D$L$2$67 &6('D E A##E)/ED $0 /8E$9

9E/(972 &E9E A6LE +:.4 )E9#E7/.

Harcourt, Inc. Integrated Case: 10 - 21

Вам также может понравиться

- Chapter 10Документ22 страницыChapter 10hoalongkiemОценок пока нет

- Testbank - Chapter 15Документ4 страницыTestbank - Chapter 15naztig_0170% (1)

- A Few Practice Questions From Chapters 1-5: D) Capital StructureДокумент4 страницыA Few Practice Questions From Chapters 1-5: D) Capital StructureMichaelFraserОценок пока нет

- Definition of 'Ratio Analysis'Документ12 страницDefinition of 'Ratio Analysis'VikasDoshiОценок пока нет

- Case of Cost of Capital - PrasannachandraДокумент13 страницCase of Cost of Capital - PrasannachandraJyotiGhanchiОценок пока нет

- BEC 0809 AICPA Newly Released QuestionsДокумент22 страницыBEC 0809 AICPA Newly Released Questionsrajkrishna03Оценок пока нет

- Assignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsДокумент3 страницыAssignment No. - 3: Ans 1: A Condition Where A Company Cannot Meet or Has Difficulty Paying Off ItsashishthecoolОценок пока нет

- Solution 2011Документ16 страницSolution 2011Krutika MehtaОценок пока нет

- 6F:117 Corporate Finance: Course ObjectivesДокумент6 страниц6F:117 Corporate Finance: Course ObjectivesblasgadasОценок пока нет

- Risk and Rates of Return: Learning ObjectivesДокумент36 страницRisk and Rates of Return: Learning Objectivesssregens82Оценок пока нет

- Chapter 18 International Capital BudgetingДокумент26 страницChapter 18 International Capital BudgetingBharat NayyarОценок пока нет

- Capital BudgetingДокумент34 страницыCapital BudgetingHija S YangeОценок пока нет

- Weighted Average Cost of CapitalДокумент13 страницWeighted Average Cost of CapitalAkhil RupaniОценок пока нет

- Concept Questions: NPV and Capital BudgetingДокумент23 страницыConcept Questions: NPV and Capital BudgetingGianni Stifano P.Оценок пока нет

- C 3 A F S: Hapter Nalysis of Inancial TatementsДокумент27 страницC 3 A F S: Hapter Nalysis of Inancial TatementskheymiОценок пока нет

- PDF EvaДокумент36 страницPDF EvaShrey GoelОценок пока нет

- Answers To Practice Questions: Capital Budgeting and RiskДокумент9 страницAnswers To Practice Questions: Capital Budgeting and RiskAndrea RobinsonОценок пока нет

- Prashant ResumeДокумент7 страницPrashant ResumePrashantAlavandiОценок пока нет

- Chapter 1Документ29 страницChapter 1Chitose HarukiОценок пока нет

- Hotelogix Product Presentation 11Документ46 страницHotelogix Product Presentation 11Lester HerreraОценок пока нет

- Chapter 1-The Scope of Corporate Finance: Multiple ChoiceДокумент7 страницChapter 1-The Scope of Corporate Finance: Multiple ChoiceEuxine AlbisОценок пока нет

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesДокумент17 страницChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourОценок пока нет

- Paper 1akkxbДокумент3 страницыPaper 1akkxbhinagarg373Оценок пока нет

- LeverageДокумент8 страницLeverageamol_more37Оценок пока нет

- FM StudyguideДокумент18 страницFM StudyguideVipul SinghОценок пока нет

- Risk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionДокумент27 страницRisk, Return and Capital Budgeting: For 9.220, Term 1, 2002/03 02 - Lecture15.ppt Student VersionZee ZioaОценок пока нет

- The Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnДокумент12 страницThe Cost of Capital Cost of Capital, Discounts Rates, and The Required Rate of ReturnAveek ChatterjeeОценок пока нет

- Chapter 1Документ9 страницChapter 1craig52292Оценок пока нет

- WACC Project Instructions FinalДокумент6 страницWACC Project Instructions FinalMandaviОценок пока нет

- WACC Project Instructions FinalДокумент6 страницWACC Project Instructions FinalMandaviОценок пока нет

- WACC Project Instructions FinalДокумент6 страницWACC Project Instructions FinalMandaviОценок пока нет

- WACC Project Instructions FinalДокумент6 страницWACC Project Instructions FinalMandaviОценок пока нет

- 04dpp415 PDFДокумент124 страницы04dpp415 PDFZic ZacОценок пока нет

- Fin 635 Project FinalДокумент54 страницыFin 635 Project FinalCarbon_AdilОценок пока нет

- Discuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Документ24 страницыDiscuss Whether The Dividend Growth Model or The Capital Asset Pricing Model Offers The Better Estimate of Cost of Equity of A Company3Henry PanОценок пока нет

- Shapiro CHAPTER 2 SolutionsДокумент14 страницShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Socio Economic FactorsДокумент48 страницSocio Economic FactorsMarionchester Ladia OlarteОценок пока нет

- Chapter 18: Accounting and Engineering EconomyДокумент6 страницChapter 18: Accounting and Engineering EconomyKamОценок пока нет

- Liquid Chemical CaseДокумент2 страницыLiquid Chemical CaseArvind KumarОценок пока нет

- Financial Statements, Cash Flows, and Taxes: Homework ForДокумент9 страницFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1Оценок пока нет

- Master of Business Administration: Project Report Optimization of Portfolio Risk and ReturnДокумент55 страницMaster of Business Administration: Project Report Optimization of Portfolio Risk and ReturnpiusadrienОценок пока нет

- Chap 014Документ87 страницChap 014limed1100% (1)

- Takeover CodeДокумент25 страницTakeover CodejoshitejasОценок пока нет

- Consolidated Financial Statements After Acquisition: Complete Equity Method On Books of InvestorДокумент5 страницConsolidated Financial Statements After Acquisition: Complete Equity Method On Books of Investorsalehin1969Оценок пока нет

- Cost of Capital Unit 4 FMДокумент16 страницCost of Capital Unit 4 FMSHIVANSH ARORAОценок пока нет

- Chapter 04Документ32 страницыChapter 04Phuong TrangОценок пока нет

- 2010-11-13 225355 StarДокумент3 страницы2010-11-13 225355 Starjcool6780% (1)

- CH 10 IMДокумент46 страницCH 10 IMAditya Achmad Narendra WhindracayaОценок пока нет

- Balance Sheet and Income StatementДокумент11 страницBalance Sheet and Income StatementAmelia Butan50% (2)

- Solutions Class Examples AFM2015Документ36 страницSolutions Class Examples AFM2015SherelleJiaxinLiОценок пока нет

- Finman Chap3Документ66 страницFinman Chap3Jollybelleann MarcosОценок пока нет

- 11 LasherIM Ch11Документ26 страниц11 LasherIM Ch11jimmy_chou1314100% (1)

- Case 04 (Old) - Can One Size Fit All - SolutiondsfsdДокумент4 страницыCase 04 (Old) - Can One Size Fit All - SolutiondsfsdFitria Hasanah100% (4)

- Can One Size Fit All?Документ21 страницаCan One Size Fit All?Abhimanyu ChoudharyОценок пока нет

- Advanced MGT Accounting Paper 3.2Документ242 страницыAdvanced MGT Accounting Paper 3.2Noah Mzyece DhlaminiОценок пока нет

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationОт EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationОценок пока нет

- Final FMДокумент53 страницыFinal FMSourabh Arora80% (5)

- The FGM Initiative Final Report 2013Документ61 страницаThe FGM Initiative Final Report 2013jamn1979Оценок пока нет

- Flash Memory Inc Student Spreadsheet SupplementДокумент5 страницFlash Memory Inc Student Spreadsheet Supplementjamn1979Оценок пока нет

- Case - Flash Memory, Inc. - SolutionДокумент11 страницCase - Flash Memory, Inc. - SolutionBryan Meza71% (38)

- Blaine Kitchenware Inc.Документ13 страницBlaine Kitchenware Inc.vishitj100% (4)

- Flash Inc Financial StatementsДокумент14 страницFlash Inc Financial Statementsdummy306075% (4)

- Finc5880 Lo Wk1Документ9 страницFinc5880 Lo Wk1jamn1979Оценок пока нет

- Fie443 2015Документ8 страницFie443 2015jamn1979Оценок пока нет

- MarriottДокумент22 страницыMarriottjamn1979Оценок пока нет

- Case 5 Tom - Com GuidelinesДокумент2 страницыCase 5 Tom - Com Guidelinesjamn1979Оценок пока нет

- MonmouthДокумент16 страницMonmouthjamn1979100% (1)

- Capital Budgeting: Estimating Cash Flows and Analyzing RiskДокумент30 страницCapital Budgeting: Estimating Cash Flows and Analyzing Riskjamn1979Оценок пока нет

- Capital BudgetingДокумент16 страницCapital Budgetingjamn1979Оценок пока нет

- Journalists Safety Indicators InternationalДокумент13 страницJournalists Safety Indicators Internationaljamn1979Оценок пока нет

- Chap 006Документ23 страницыChap 006jamn1979Оценок пока нет

- Decision Modeling SEДокумент13 страницDecision Modeling SEjamn1979Оценок пока нет

- Solutions Manual To Accompany FAPF - Ch13Документ20 страницSolutions Manual To Accompany FAPF - Ch13jamn1979Оценок пока нет

- Topics: Corporate Valuation: A Company Owns Two Types of AssetsДокумент4 страницыTopics: Corporate Valuation: A Company Owns Two Types of AssetsSebastian GarciaОценок пока нет

- STRATEGY Lecture 1Документ14 страницSTRATEGY Lecture 1jamn1979Оценок пока нет

- Solution NigeriaДокумент41 страницаSolution Nigeriajamn1979Оценок пока нет

- Porter - What Is Strategy - HBRДокумент21 страницаPorter - What Is Strategy - HBRmkkaran900% (1)

- Chapter 11 Cash Flow Estimation and Risk AnalysisДокумент80 страницChapter 11 Cash Flow Estimation and Risk AnalysisFaye Alonzo86% (7)

- Journalists Resolution DraftДокумент4 страницыJournalists Resolution Draftjamn1979Оценок пока нет

- Dividends and Dividend Policy: Mcgraw-Hill/IrwinДокумент24 страницыDividends and Dividend Policy: Mcgraw-Hill/IrwinKafil MahmoodОценок пока нет

- Chap 15Документ66 страницChap 15jamn1979Оценок пока нет

- CH 12Документ60 страницCH 12jamn1979Оценок пока нет

- CH 10Документ81 страницаCH 10jamn1979Оценок пока нет

- Presentation Sample 3.Документ14 страницPresentation Sample 3.jamn1979Оценок пока нет

- Valacich Esad5e PP Ch08Документ42 страницыValacich Esad5e PP Ch08jamn1979Оценок пока нет

- S.N o Name of Stock Quantit y Purchas e Price Last Traded Price Sale S Pric e Gain Realized/UnrealizedДокумент8 страницS.N o Name of Stock Quantit y Purchas e Price Last Traded Price Sale S Pric e Gain Realized/UnrealizedShreya ChitrakarОценок пока нет

- Chapter 2 - Financial Statements, Cash Flow, and TaxesДокумент4 страницыChapter 2 - Financial Statements, Cash Flow, and TaxesJean EliaОценок пока нет

- Ma'am MaconДокумент7 страницMa'am MaconKim Nicole Reyes100% (1)

- Session 7 and 7a SupplemenДокумент10 страницSession 7 and 7a Supplemenkhadija arifОценок пока нет

- Bitcoin RoughДокумент19 страницBitcoin RoughSaloni Jain 1820343Оценок пока нет

- Income From SalaryДокумент60 страницIncome From SalaryroopamОценок пока нет

- Credit Counseling For Responsible Retail BankingДокумент12 страницCredit Counseling For Responsible Retail BankingSubhanan SahooОценок пока нет

- Basic Concepts of Open EconomyДокумент44 страницыBasic Concepts of Open EconomyIvy Amistad Dela Cruz-CabalzaОценок пока нет

- Milton Friedman (1975) There's No Such Thing As A Free LunchДокумент340 страницMilton Friedman (1975) There's No Such Thing As A Free Lunchislasoy100% (1)

- Narrative ReportДокумент3 страницыNarrative ReportKrissie Jane MorinОценок пока нет

- Quality InvestingДокумент4 страницыQuality InvestingKhaled FatnassiОценок пока нет

- VCE Summer Internship Program 2021: Their CharacterДокумент5 страницVCE Summer Internship Program 2021: Their CharacterKetan PandeyОценок пока нет

- Statement 36823447Документ7 страницStatement 36823447Robert SchumannОценок пока нет

- Training Lecture Sheet Mostafa KamalДокумент19 страницTraining Lecture Sheet Mostafa KamalArif Uz ZamanОценок пока нет

- Application Form - Vuka (Form 1 A)Документ7 страницApplication Form - Vuka (Form 1 A)Derrick KimaniОценок пока нет

- 4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFДокумент21 страница4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFMohan DОценок пока нет

- Review QuestionsДокумент4 страницыReview QuestionsValentina NotarnicolaОценок пока нет

- National Income New PDFДокумент25 страницNational Income New PDFLaksh SahniОценок пока нет

- Foreign Currency TransactionsДокумент14 страницForeign Currency TransactionsXavier AresОценок пока нет

- 1.false 2. True 3. False 4. True 5. False 6. False 7. True 8. False 9. False 10. FALSEДокумент9 страниц1.false 2. True 3. False 4. True 5. False 6. False 7. True 8. False 9. False 10. FALSEHazel Kaye EspelitaОценок пока нет

- Hybrid SecurityДокумент3 страницыHybrid SecurityTahmidul HaqueОценок пока нет

- FFM D20 Examiner's ReportДокумент7 страницFFM D20 Examiner's ReportQuỳnhОценок пока нет

- Customer Service: Problem Solving: Informing A Customer That An Ordered Item Isn't AvailableДокумент10 страницCustomer Service: Problem Solving: Informing A Customer That An Ordered Item Isn't AvailableDefri Reflia RefliaОценок пока нет

- CH 1 FAcc I @2015Документ21 страницаCH 1 FAcc I @2015Gedion FeredeОценок пока нет

- BBA Internship ProjectДокумент40 страницBBA Internship Project68Rohan Chopra100% (1)

- Project Report of Bank of KathmanduДокумент30 страницProject Report of Bank of Kathmandushyamranger85% (27)

- To The Chief Executive Officer Bank of America N.A. (India Branches)Документ53 страницыTo The Chief Executive Officer Bank of America N.A. (India Branches)aditya tripathiОценок пока нет

- Briefing Guide July Week2&3 Metrobank EMVCardsДокумент3 страницыBriefing Guide July Week2&3 Metrobank EMVCardsRafael-Cheryl Tupas-LimboОценок пока нет

- Basel-III Norms and Indian Financial SystemДокумент3 страницыBasel-III Norms and Indian Financial SystemNavneet MayankОценок пока нет

- Contemporary Financial Management 14th Edition Moyer Solutions ManualДокумент7 страницContemporary Financial Management 14th Edition Moyer Solutions Manualbenjaminnelsonijmekzfdos100% (13)