Академический Документы

Профессиональный Документы

Культура Документы

Jones Reply Brief

Загружено:

Statesman JournalАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Jones Reply Brief

Загружено:

Statesman JournalАвторское право:

Доступные форматы

rified Correct Copyof th1 Original 9/23/2014

~ V

STATF

C~Ec~lOi~e

IN THE SUPREME COURT OF THE STATE OF OREGONSEp 0~

22

? 0 1 4

~ Cp~~T

viE' (;C

uHT

~ CEP CF~P

~ EVERICE MORO; TERRI DOMENIGONI; CHARLES CUSTER; JO~

~ HAWKINS; MICHAEL ARKEN; EUGENE DITTER; JOHN O'KIEF;

~ MICHAEL SMITH; LANE JOHNSON; GREG CLOUSER;

~ BRANDON SILENCE; ALISON VICKERY; and JIN VOEK,

Petitioners,

V .

w

STATE OF OREGON; STATE OF OREGON, by and through the

~ Department of Corrections; LINN COUNTY; CITY OF PORTLAND;

~ CITY OF SALEM; TUALATIN VALLEY FIRE & RESCUE; ESTACADA

` SCHOOL DISTRICT; OREGON CITY SCHOOL DISTRICT; ONTARIO

SCHOOL DISTRICT; BEAVERTON SCHOOL DISTRICT; WEST LINN

~ SCHOOL DISTRICT; BEND SCHOOL DISTRICT; and PUBLIC

r

EMPLOYEES RETIREMENT BOARD,

~

Resporidents,

~

and

LEAGUE OF OREGON CITIES, OREGON SCHOOL BOARDS

ASSOCIATION; and ASSOCIATION OF OREGON COUNTIES,

Intervenors,

a n d

CENTRAL OREGON IRRIGATION DISTRICT

Intervenor below

S061452 (Control)

WAYNE STANLEY JONES,

Petitioner,

V .

PUBLIC EMPLOYEES RETIREMENT BOARD, ELLEN ROSENBLUM,

Attorney General, and JOHN A. KITZHABER, Governor,

Respondents.

S061431

WAYNE STANLEY JONES' EXTENDED REPLY BRIEF SEPTEMBER 2014

, - MICHAEL D:. REYNOLDS,

Petitioner,

V .

PUBLIC EMPLOYEES RETIREMENT BOARD, ~State of Oregon; and

JOHN A. .KITZHABER, Governor, State of Oregon,

: Respondents.

S061454

. . .GEORGE A. RIEMER,

. . ; ..

Petitioner,

.

. ;

V .

STATE OF OREGON; OREGON GOVERNOR JOHN A. KITZHABER;

OREGON ATTOR. NEY GENERAI< ELLEN ROSENBLUM; OREGON

PUBLIC EMPLOYEES RETIREMENT BOARD; and OREGON PUBLIC

EMPLOYEES RETIREMENT SYSTEM,

Respondents.

S061475

GEORGE A. RIEMER,

Petitioner,

V .

STATE OF OREGON; OREGON GOVERNOR JOHN A. KITZHABER;

OREGON ATTORNEY GENERAL ELLEN ROSENBLUM; PUBLIC

EMPLOYEES RETIREMENT BOARD; and PUBLIC EMPLOYEES

RETIREMENT SYSTEM,

Respondents.

S061860

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY

BRIEF

for Direct Judicial Review based on Senate Bill 822,

77th Oregon Legislative Assembly, 2013 Regular Session, and

Senate Bill 861, 77th Oregon Legislative Assembly, 2013 Special Session

WAYNE STANLEY JONES' EXTENDED~REPLY BRIEF SEPTEMBER 2014

AG Ellen Rosenblum #753239

SG Anna M. Joyce #013112

AAG Keith L. Kutler #852626

AAG Matthew J. Merritt # 122206

AAG Michael A. Casper #062000

Oregon Department of Justice

1162 Court Street.NE.

Salem, OR 97301-4096

Telephone: 503-37-8-4402

Facsimile: 503-378-6306

anna.ioyce@doj. state. or.us

keith. kutler@doj . state. or. us

matthew. merritt(~ a,doi . state. or.us

michael.casper@doj.-state.or.us

Attorneys for State. Respondents

Harry Auerbach #821830

Kenneth A. McGair #990148

Office of the City Attorney

1221 SW 4`'' Avenue, Ste 430

Portland, OR 97204

Telephone: 503-823-4047

Facsimile: 503-823-3089

harry. auerbachgportlandoregon. gov

ken.McGair(~ a,portlaindoregon. gov

Attorney for Respondent City of

Portland

Eugene J. Karandy II #972987 .

Ofrice of County Attorney

Linn County Courthouse

104 SW Fourth Avenue, Room 123

Albany, OR 97321

Telephone : 541-967-3 840

F acsimile : 541-928-5424

gkarandyA co. linn. or. us

Attorney for Respondent Linn County

William F. Gary #770325,

william.f.g_ ary@harran . g com

Sharon A. Rudnick#830835

sharon.rudnick@haffang.com

Harrang Long'Gary Rudnick PC

360 E. 10`'' Ave., suite 300

Eugene, OR .97401

Telephone: -503-242-00.00:

Facsimile: 541-686=6564

Attorneys for Respondents Linn

County, Estacada, Oregon City,

Ontario, West Linn School Districts

and Beaverton School Districts; and

Intervenors Oregon School Boards

Association and Association of

Oregon Counties

DanieJ B. Atchison #040424

Kenneth Scott Montoya #064467

Office of City Attorney

555 Liberry Street SE Rm 205

Salem, OR 97301

Telephone: 503-588-6003

Facsimile: 503-361-2202

datchison(~ a,cityofsalem.net

kmontoya@cityofsalem.net

Attorney for Respondent City of

Salem

Edward F. Trompke #843653

Jordan Ramis PC

Two Centerpointe Drive, 6`h Floor

Lake Oswego, OR 97035

Telephone: 503-598-5532

Facsimile: 503-598-7373

ed. trompke(a~ ~j ordanramis. com

Attorney for Respondent Tualatin

Valley Fire and Rescue

WAYNE STANLEY JONES''EXTENDED REPLY BRIEF SEPTEMBER 2014

Lisa M. Frieley #912763

Oregon School Boards Association

PO Box 1068

Salem, OR 97308

Telephone: 503-588-2800

Facsimile: 503-588-2813

lfreiley@osba.org

Attorney for Respondents Estacada,

Oregon City, Ontario, and West Linn

School Districts and Intervenor

Oregon School Boards Association

Rob Bovett #910267

Association of Oregon Counties

1201 Court St. NE Ste 300

Salem, OR 97301

Telephone: 971-218-0945

rbovett e aocweb.org

Attorney for Linn County

1Vlichael D. Reynolds (Petitioner Pro

Se)

8012 Sunnyside Avenue N.

Seattle, WA 98103

Telephone: 206-910-6568

mreynoldsl4@comcast.net

Petitioner pro se

Sara K. Drescher #042762

Tedesco Law Group

3021 NE Broadway

Portland, OR 97232

Telephone: 866-697-6015

sara@miketlaw.com

Attorney for Amicus Curiae IAFF

W. Michael Gillette #660458

Leora Coleman-Fire #113581

Sara Kobak#023495

William B. Crow #610180

Schwabe Williamson & Wyatt PC

1211 SW 5`h Ave Suite 1900

Portland, OR 97204

Telephone: 503 -222-9981

Facsimile: 503-796-2900

wm il g lette@schwabe.com

Attorneys for Intervenor League of

Oregon Cities

George A. Riemer (Petitioner Pro

Se)

23206 N. Pedregosa Drive

Sun City West, AZ 85375

Telephone: 623-238-5039

cortebella@gmail.com

Petitioner pro se

Gregory A. Hartman #741.283

HartmanGgbennettthartman. com

Aruna A. Masih #973241

MasihA@bennetthartinan.com

Bennett Hartman Morris

210 SW Morrison Street, Suite 500

Portland, OR 97204

Telephone: 5 03 -546-9601

Attorneys for Petitioners Moro,

Domenigoni, Custer, Hawkins,

Arken, Ditter, O'Kief, Smith,

Johnson, Clouseer, Silence,

Veckery, and Voek

Craig A. Crispin #82485

Crispin Employment Lawyers

1834 SW 58th Avenue, Suite 200

Portland, OR 97221

Telephone: 503-293-5759

crispin@employmentlaw-nw.com

Attorney for Amicus Curiae AARP

WAYNE STANLEY JONES' EXTENDED REPLY BRIEF SEPTEMBER 2014

Thomas A. Woodley

taw@wmlaborlaw.com

Douglas L. Steele

dls@wmlaborlaw.com

Woodley & McGillivary

1101 Vermont Ave., NW, Suite 1000

Washington, DC 20005

Telephone: 202-697-6015

Attorneys for Amicus Curiae IAFF

The Honorable Stephen K. Bushong

Multnomah County Circuit Court

1021 S.W. 4t ' Avenue

Portland, OR 97204

Telephone: 503-988-3546

stephen.k.bushong~a~,ojd. state.or.us

WAYNE STANLEY JONES' EXTENDED REPLY BRIEF SEPTEMBER 2014

TABLE OF CONTENTS

Page(s)

TABLE OF AUTHORITIES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . iii

Introduction .................................................... 1

ASSIGNMENT OF ERROR NO. 1 In an effort to undermine clear case

precedent which favors Petitioners' position, Respondents and Intervenors urge

this Court to "disavow" or "reject" all or part of its prior decisions which hold

PERS members have a contractual right to their PERS benefits, including the

COLA.........................................................l

A. Respondents' and Intervenors' request to overturn prior settled Oregon

case law, runs roughshod over the principle of stare decisis .......... 1

B. Respondents and Intervenors have failed to prove error in prior Oregon

Supreme Court holdings; and their assertion attempts to undermine the

Court's careful review in these prior cases . . . . . . . . . . . . . . . . . . . . . . . 3

C. The Respondents' and Intervenors' allegations that this Court provided

only a"superficial" analysis in prior decisions is inaccurate and demeans

the careful analysis provided by prior Courts . . . . . . . . . . . . . . . . . . . . . . 6

Assignment of Error No. 2 The 2013 COLA changes to Petitioner Jones'

contractual retirement benefit are not a`betterment' as claimed by Respondents

and Intervenors, but instead constitute a substantial impairment to his contract

withPERS ......................................................7

Assignment of Error No. 3 State Respondents' allegations that any

impairment to Petitioner Jones from SB 822 and SB 861 is "insubstantial" is

factually wrong; Petitioner Jones' will suffer a substantial impairment if SB 822

and SB 861 are upheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Assignment of Error No. 4 Respondents and Intervenors are in error in

asserting that the Oregon Legislature may remove that part of Petitioner Jones'

PERS contractual retirement benefits provided in SB 656 and HB 3349, solely

because he lives out of state, as that action would violate Ragsdale, the

principles of intergovernmental tax immunity, and the legislative intent in

enacting these two bills . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

11

Assignment of Error No. 5 Petitioner Jones' contractual right to his full PERS

retirement benefit, including the pre-2013 COLA, was fulfilled when he retired;

they are not a"windfall," a"gratuity", or an"ad hoc COLA" as erroneously

alleged by Respondents and Intervenors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

A. Oregon case law affirms that Petitioner Jones' gave consideration for his

pre-20131egislation retirement benefits . . . . . . : . . . . . . . . . : . . . . . . . . 20

B. Intervenor League mischaraeterizes the COLA which predates the 2013

legislation as `adhoc ...................................... . . . . . 22

C. Respondents and Intervenors erroneous characterization of Petitioner

Jones' pre-2013 contractual retirement benefits as a`windfall' or a

`gratuity' fails to recognize that upon his retirement, Petitioner Jones'

right to his PERS contractual retirement benef ts were fully vested, and

the 2013 legislation resulted in a substantial iinpairment of those

rights................................ ....................... 23

Assignment of Error No. 6 State Respondent misstates the facts in minimizing

the substantial impact of the removal of SB 656 and HB- 3349 from Petitioner

Jones......................................................... 24

Assignment of Error No. 7 Respondents and Intervenors are in error in

alleging Petitioner Jones must satisfy the criteria for a facial challenge ...... 26

Conclusion..................................................... 26

Certificate of Compliance with Brief Length and Type Size

Requirements

Certificate of Service and Certificate of Filing

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

iii

TABLE OF AUTHORITIES

Page(s)

CASES

Adams v. Schrunk, 6 Or.App. 580,

488 P.2d831, rev. denied(Novernber16, 1971) . . . . . . . . . . . . . . . . . . . . 5

Booth v. Sims, 193 W. Va. 323 456 S.E. 2d 167 (W. Va. 1995) ............14

Crawfordv. Teachers' Ret. FundAss'n.

164 Or. 77, 99 P.2d729 (1940) . . . . . . . . . . . . . . . . . . . . . . . . . . 5, 14-15

Davis v. Michigan, 49 U.S. 803 (1989) . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,25

Ellis v. Utah State Retirement Board, 752 P.2d 882 (Utah App. 1988) ....... 9

Hart v. Washington Co. Rural Fire Protection Dist.,

52 Or. App. 1005, 630 P.2d390 (Or.App. 198 1) . . . . . . . . . . . . . . . . . . 24

Hughes v. State of Oregon, 314, Or.l, 838 P.2d 1018 (1992) ....:. 3-4, 6-7, 23

Marbury v. Madison, 5 U.S. 137 (1803) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Nicholas v. Nevada, 116 Nev. 40, 992 P.2d262 (Nev. 2000) . . . . . . . . . . . . . 15

Oregon State Police Officers Association v. State of Oregon,

323 Or.356(1996) ..........................................4

Ragsdale v. Department of Revenue, 321Or. 216,

895 P.2d1348 (1995) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16-20

Rose City Transit v. City of Portland, 271 Or. 588 (Or. 1975) ........ 8, 20-21

Sheehy v. Public Employees Retirement Division, 262 Mont. 129,

864 P.2d762 reh. den. (1993) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17-18

Strunk v. Public Employees Retirement Board,

338, OR 145 (2005) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3, 6-7, 11-13, 15

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

iv

Taylor v. Multnomah County Deputy Sheriff's Retirement Board,

265 Or. 445 (1973) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5, 20-21

UnitedFirefighters of Los Angeles City v. City of Los Angeles,

210 Cal. App. 3 d 1095 (1984) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

UnitedStates v. Washington, .872 F.2d 874 (9th Cir. 1989) . . . . . . . . . . . . . . . 2

Vogl v. Department of Revenue, 327 Or: 193 (1998) . . . . . . . . . . . . . . . . . 19-20

CONSTITUTIONS, STATUTES, AND RULES

ORS 238.360(1) (2001) . . . . . . . . . . . . . : . . . . . . . . . . . . . . . . . . . . . . . . 3, 7, 13

Or. Laws 1971, ch. 738 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8, 10, 20, 22

Or. Laws 1973, ch. 695 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3, 8, 14, 20-22, 24

Or. Laws 1995, ch. 569 (HB 3349) . . . . . . . . . . . . . . . . . . . . . . 16, 19-21, 24-25

Or. Laws 1991, ch. 796, (SB 656) . . . . . . . . . . . . . .. . . . . . . . . . . 5, 16-21, 24-25

Or. Laws 2013, ch. 53 (SB 822) . . . . . . . . . . .' . . . . . ". . . . . . 7-13, 15, 22-23, 26

Or. Laws 2013, ch 2(Special Session) (SB 861). ......... 7-13, 15, 22-23, 26

4 U.S.C. section 111 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

TREATISES AND OTHER AUTHORITIES

Black's Law Dictionary, 6`h Edition, www.foavc.org . . . . . . . . . . . . . . . . . . . . . 2

Consumer Price Index, 1913--,The Federal Reserve Bank

of Minneapolis; minneapolisfed.org . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Glossary in the Guide to Implementation of GAS'B Statement 67

on Financial Reporting for Pension Plans, by the

Governmental Accounting Standards Board (June 2013) . . . . . . . . . . . 22

SPECIAL MASTER'S FINAL REPORT AND RECONIlVIENDED

FINDINGS OF FACT, April 30, 2014 (SMR) . . . . . . . . . . . . . 12-14

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

EXTENDED REPLY BRIEF

Introduction

Petitioner Jones, in this consolidated reply brief, will correct a number

of errors of fact and/or errors of law contained in the Answering Briefs filed

by State Respondents, County/School District Respondents, and Intervenor

League [collectively hereinafter referred to as `Respondents and

Intervenors'].

ASSIGNMENT OF ERROR NO. 1 In an effort to undermine clear

precedent which favors Petitioner Jones' position, Respondents and

Intervenors urge this Court to "disavow" or "reject" all or part of its

prior decisions which hold PERS members have a contractual right to

their PERS benefits, including the COLA.

Respondents and Intervenors insist this Court should "disavow" or

"reject" a whole line of Oregon Supreme Court cases which establish that

PERS members have a contractual right to their PERS benefits, alleging

these decisions are "superficial," are full of "errors," and did not contain

"strict and methodical inquiry."

A. Respondents' and Intervenors' request to overturn prior settled

Oregon case law, runs roughshod over the principle of stare

decisis.

1

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

2

Among America's three branches of government, "It 'is emphatically the -

province and duty of.the judicial department to say what the law.is."

Marbury v. Madison,.5 U.S. 137,177 (1803). Once the Court has

determined what the law is, the principle of stare decisis provides that courts

are obliged to abide by their precedents and not disturb settled matters.

Stare decisis means:

"Doctrine that; when court has once laid down a principle of

law as applicable to a certain state of facts, it will adhere to that

principle; and- apply it to all future case, where facts are

substantially the same. ... The doctrine is not ordinarily

departedfrom where decision is of long-standing andrights

have been acquiredunder it, unless considerations of public

policy demand it."

Black's Law Dictionary, 6h Edition, www.foavc.org. (emphasis in original).

Clearly, Petitioner Jones, in retiring in 1998, relied on the contractual riature

of his full PERS retirement benefit, including his 2% COLA. Since the -

1940s, this right has been repeatedly upheld in Oregon case law, and is

entitled to p'rotection.under the principle of stare decisis.

The Ninth Circuit Court affirmed the principle of stare decisis in United

States v. Washington. The Ninth Circuit refused defendant's request that it

overrule its prior decision, saying: "We are bound by decisions of prior

panels unless an en banc decision, Supreme Court decision, or subsequent

legislation undermines those decisions." UnitedStates v. Washington, 872

F.2d 874, 880 (9th Cir. 1989). The Ninth Circuit reviewed the statutory

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLYBRIEF

3

language and legislative history of the challenged case and rejected the

suggested need for further clarification. This is exactly the situation here.

B. Respondents and Intervenors have failed to prove error in prior

Oregon Supreme Court holdings; and their assertion attempts to

undermine the Court's careful review in these prior cases.

Respondents and Intervenors have alleged, but failed to give any

substantive evidence that proves any errors in this Court's prior judgments.

The Oregon Supreme Court has repeatedly reviewed and consistently

afftrmed the contractual nature of PERS retirement benefits and of PERS

members' right to these benefits, including the 1973 COLA. The case

history on this point is clear.

Strunk v. Public Employees Retirement Board, 338 Or. 145, 108 P.3d

1058 (Or. 2005) is determinative on this issue. The Court held that the ORS

238.360(1)(2001) COLA was part of the contractual PERS retirement

benefit.

"Like the tax provision analyzed in Hughes, the text of ORS

238.360(1)(2001) evinces a clear legislative intent to provide

retired members with annual COLAs on their service retirement

allowances, whenever the CPI warrants such COLAs. We

therefore conclude that the general promise embodied in ORS

238.360(1)(2001) was part ofthe statutory PERS contract

applicable to the group of retired members affected by the 2003

provisions at issue here."

Id. at 221.

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

4

The Court determined that the promise of annual COLAs did not extend to

erroneous overpayments. "However, the promise does extend to properly

calculated service retirement allowances." Id. at 222.

The Court affirmed the principle of the contractual nature of PERS

retirement benefits in Oregon State Police Officers Association v. State of

Oregon, 323 Or. 356 (1996), stating:

"the state may undertake binding contractual obligations with ,

its employees, including benefits that may accrue in the future

for work not yet performed. Mor.eover, the cases recognize that

the PERS pension plan is an offer for a unilateral contract

which can be accepted 'by the , tende"r of part performance by the

employee. The Oregon line of cases is consistent with the

majority of jurisdictions that have considered the issue and also

is consistent with the modern view of the nature of pensions."

OSPOA at 371 (emphasis added).

Likewise, the Court in Hughes v. State of Oregon, 314 Or. 1(1992),

held that PERS statutes were part of a unilateral contract extended by the

state to its employees; and the 1991 law subjecting PERS benefits to Oregon

state income taxation breached that contract. The Hughes court, citing to

frve previous Oregon cases, held that upon employment:

"Oregon is in line with the theory of pensions which holds that

pensions are a form of compensation and that employees '

acquire vested contractual rights in pension benefits. ... An

employee's contract right to pension benefits become vested at

the time of his or her acceptance of employment. ... On vesting,

an employee's contractual interest in a pension plan may not be

substantially impaired by subsequent legislation.

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

5

Id. at 20.

The Court spent several pages detailing the legislative history which

justified its decision. The Court then stated: "Thus, by virtue of the terms of

the statutes, the legislative history, andour holdings that PERS is acontract,

the contrdctual intent of the legislature in this case has been decided." Id. at

21 (emphasis added).

Reaching back further into Oregon's case law history, the Oregon

Supreme Court in Taylor v. Multnomah County Deputy Sherifs Retirement

Board, 265 Or. 445 (1973), found "that plaintiff established a contractual

right to participate in the pension plan. The adoption of the pension plan

was an offer for a unilateral contract. Such an offer can be accepted by the

tender of part performance." Id. at 455. In reaching its conclusion, the Court

stated: "Oregon has joined the ranks of those rejecting the gratuity theory of

pensions and has held that contractual rights to a pension can be created

between the employee and employer." Id. at 450. Taylor recited Oregon's

prior adherence to this principle in two earlier Oregon cases of Crawfordv.

Teachers' Ret. FundAss'n. 164 Or. 77, 99 P.2d 729 (1940), and also in

Adams v. Schrunk, 6 Or.App. 580, 488 P.2d 831, rev. denied(November 16,

1971). The Taylor court said: "We conclude from the above authorities that

Oregon has adopted not only the contractual concept of pensions; but, also,

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

6

the concept that contractual rights can arise prior to the completion of the,

service necessary to a pension."- Id.

`This overview of Oregon Supreme Court cases evidences this Court or

the Oregon Court of Appeals has reviewed the issue of the contractual

retirement rights of PERS mcmbers at least six times,-that its review of the

legislative history and statutory context has been thorough;.and that the

Court has consistently held that contract rights in PERS benefits exist

between the state and PERS members.

Respondents and Intervenors have failed to provide any evidence

showing these six Oregon. opinions (Intervenor League cites to 8 Oregon

decisions) were'all made in error. Their request to "reject" -or "disavow" the

Hughes and Strunk decisions necessarily undermines all the case law

underlying those decisions, and is unsupported by fact or law.

C. The Respondents' and Intervenors' allegations that this Court

provided only a"superficial" analysis in prior decisions is

inaccurate and demeans the careful analysis provided by prior

Courts.

Respondents and Intervenors challenges to both the 121-page Strunk

opinion and the 72-page Hughes. opinion as "superficial" defies logic. A

court's written opinion often reveals only the tip of the iceberg as to how the

court came to its holding. But the Strunk and Hughes decisions are not

cryptic opinions. They are full-bodied, well reasoned decisions.

PETITIONER WAYNE STANLEY JONES'EXTENDED REPLY BRIEF

7

The Strunk Court examined three amendments to members' PERS

benefits using the test of `whether the text of legislation and its statutory

context clearly and unambiguously promised PERS members a benefit that

would continue. in the future.' As to the COLA, the Strunk Court held: "[I]t

is indisputable that the promise set out in ORS 238.360(1)(2001) respecting

annual COLAs remains part of the PERS statutory scheme applicable to the

affected group of retirement members." Strunk at 224.

Although Respondents and Intervenors cite with approval the test used in

Strunk, since they did not like the conclusions reached by the Court on the

COLA, they criticize the opinion as `superficial' and assert the Court did not

actually use the test they set out. These criticisms of the Court are illogical

and demean the lengthy analysis of the Strunk and Hughes opinions and the

consistency of the prior Oregon cases that affirm the contractual nature of

PERS retirement benefits.

Assignment of Error No. 2 The 2013 COLA changes to Petitioner

Jones' contractual retirement benefit are not a`betterment' as claimed

by Respondents and Intervenors, but instead constitute a substantial

impairment to his contract with PERS.

Taken together, Oregon Laws 2013, chapter 53 ("SB 822') as

amended by Oregon Laws 2013, chapter 2(Special Session)("SB 861")

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

~ 8

~ (hereafter sometimes referred to as "the.2013 legislation"), provide a

formula for a reduced annual cost of living adjustment, dubbed "COLA,"

~ that is actually no longer based on the Consumer Price Index (CPI). The

~ original 1971 COLA required an annual adjustment, based on the CPI for

~

Portland, Oregon, of up to 1.5 percent in the monthly allowance paid to

~ retirees. Oregon Laws 1971, chapter 738. This COLA `cap' was increased

~ from 1.5 to 2.0 percent in 1973. Oregon Laws 1973, chapter 695. This 1973

~ change was an enhancement from the 1971 COLA. This change was

~ accepted by the employees as a function of their continued employment and

~

was accepted by new hires when they joined the work force. In Rose City

~ Transit v. City of Portland, 271Or. 588 (Or. 1975), the Oregon Supreme

Court held that "This court has held that the adoption of a pension plan is an

~ offer for a unilateral contract." Id. at 592. And it noted that "an employee

~

pension or disability plan may be viewed as an offer to the employee which

~ may be accepted by the employee's coiitinued employment, and such

~ employment constitutes the underlying consideration for the promise." Id.

~ at 593. Because the legislature in 1973 provided for a permanent 0.5%

~ benefit increase for employees, there would be no reason to expect

~

employees to object to the change. An employer is always free under

~ contract law to unilaterally offer its employees increased compensation

which the employees effectively accept by continued employment. However,

~

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

~

9 ~

an employer cannot unilaterally decrease and substantially impair an ~

~

employee's compensation under an employment contract without providing ~

~

a substantial substitute. See Ellis v. Utah State Retirement Board, 752 P.2d ~

~

882 (Utah App. 1988), which held: "Once the retirement benefits have ~

~ vested, however, the Legislature can modify the plan only upon a showing

~

that a vital state interest will be protected ... and only where asubstantial ~

~

substitute is providedfor in lieu of the loss of benefits sustained. Id. at 886 ~

~

(emphasis added). The Respondents and Intervenors have failed on both of ~

~

these counts. No vital state interest has been demonstrated, nor has a ~

substantial substitute been provided to compensate Petitioner Jones for his ~

~

loss of benefits under the 2013 legislation. ~

~

The County/School District Respondents erroneously assert "if the ~

~

CPI remains unchanged for a sustained period, retirees will generally earn ~

~ more in COLA benefits under the 2013 legislation than they would have.

~

under the prior law". County/School District Respondents' Answering Brief ~

at 52-53. Respondents also suggest that if Oregon were to experience a ~

~

sustained economic turndown, that justifies their `betterment' speculation ~

~

because the COLA in the 2013 legislation is given annually, regardless of ~

~ the CPI. (This assertion of a`betterment' even in an economic turndown,

.

~

fails to account for the fact that some retirees have a"banked" positive ~

~

adjustment from prior years that would extend their annual adjustment if M

, PETITIONER WAYNE' STANLEY IONES' EXTENDED REPLY BRIEF

~

~

1

10

there is a negative CPI in any given year. Id. at 53, footnote 11.)

Respondents' arguments are misleading and inaccurate.

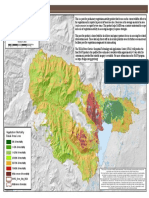

As evidenced by the CPI from 1913 thru the first quarter of 2014, the

history of the CPI for-the last 100 years demonstratesthat Respondents'

speculation is not supported by historical fact. Consumer Price Index, 1913--,

The Federal Reserve Bank of Minneapolis, minneapolisfed.org. Appendix 1.

Beginning in,'1913, and including the turbulent years of the late .1920's and

1930's, the CPI' has been positive 87% of the time. In fact, since 1971 (in the

last 42 years) when the COLA statute was enacted, there has only been one

year in which the national average CPI was negative (2009) and no other

year when the CPI was less than 1:5%. The actual history of the CPI does ,

not support Respondents' assertion of a`betterment'- in the 2013 legislation

COLA, nor does history support their speculation of a sustained unchanged

or a sustained negative CPI. This assertion is also in conflict with the Special

Master's Report on:the projected4ossto Petitioner Jones because of-the 2013

legislation COLA change. SMR at 75:

The County/School District Respondents claim that "...as to the vast

majority of retirees, the 2013 legislation causes no substantial teduction in

COLA benefits =- and in some circumstances it increases those benefits."

County/School District Respondents Answering Brief at 51. The

Respondents then make the unsupported assertion that ..."nine out of 10

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

11

PERS employees will earn more under the 2013 legislation than under the

prior law". Id. at 53-54. Respondents failed to establish facts in the Special

Master's Report evidencing any PERS retiree whose situation is financially

improved by this change, so we are left with unsupported hypotheticals.

In contrast, the Special Master's Report, Page 35, says "Taken

together, SB 822 and SB 861, reduced the PERS UAL because the

legislation reduced the amount of benefits projected to be paid to members

in the future. Those liability reductions were estimated to total about $5.3

billion, stated on a system-wide, present value basis." Id. So, if the state

estimates it will save $5.3 billion, obviously, the projected savings is

substantial. But if, as the Respondents cJaim, the COLA changes are a

`betterment' for the majority of retirees, then the state and County/School

District Respondents would not be saving $5.3 billion.

The faulty reasoning on the part of the Respondents is incomprehensible.

The County/School District Respondents' assert that Strunk holds that

a substantial impairment is measured by percentage reduction, and "a

reduction in benefits of between ' 12% to 20% per month' is 'illustrative of a

substantial impairment' ...." County/School District Respondents

Answering Brief at 49. The Strunk court did not decide, define, or state what

percentage constitutes a substantial reduction, but only that in this particular

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

12

instance, reductions of 12% to 20% are illustrative of a substantial

impairment of a PERS contract. Strunk at 206.

The 2013 legislation reduced the PERS retirees COLA from 2% to a

fixed annual increase of 1.25%. Applying the Strunk percentage reduction

illustration to Petitioner Jones, it is clear that there has been substantial

impairment to his PERS retirement contract. For Petitioner Jones, whose

PERS retirement benefit is, greater than $60,000 per year, the 2013

legislation reduced his COLA by 50%. (This reduction was determined by

comparing the August 1, 2014 actual COLA adjustment for Petitioner Jones,

which was a$64.98 per month increase or a plus 0.977% increase from 2013

under the 20131egislation, with the COLA betnefit he would have received

under the pre-20131egislation, in which case the COLA would have

increased by 2.0%): Using the Strunk illustration of a 12% to 20% reduction

in PERS benefits as a substantial impairment, the 50% reduction in

Petitioner Jones' COLA benefits under the 2013 legislation, satisfies the

substantial impairment test. Compounded over-Petitioner Jones' life

expectancy of 21.3 years; (SMR at 74) this 50% annual reduction in his

COLA retirement benefits will continue to exponentially decrease his COLA

retirement benefits over his projected lifetime, resulting in a projected

lifetime decrease of $314;507. ($398,823 {total reduction if 2013 legislation

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

13

is upheld} minus $84,316 {elimination of SB656/HB3349 benefits}.) SMR

at 75 and Petitioner Jones' Brief at 44-45.)

Strunk is dispositive as to the unconstitutional impairment of the

COLA in the 20131egislation. Strunk specifically held the "text of ORS

238.360(1) (2001) evinces a clear legislative intent to provide retired

members with annual COLAs on their service retirement allowances,

whenever the CPI warrants such COLAs. We therefore conclude that the

general promise embodied in ORS 238.360(1)(2001) was part of the

statutory PERS contract applicable to the group of retired members affected

by the 2003 provisions at issue here." Id. at 221. The Strunk holding

validated the PERS retirees' right to an annual ORS 238.360(1) (2001),

COLA that is based on the CPI. The 20131egislation, in establishing a

minimal, fixed, annual increase, is no longer a true cost of living adjustment.

It does not refer to or rely on the CPI at all.

Petitioner Jones has qualified for and satisfied all the prerequisites to

having fully vested contractual rights in his PERS retirement benefits

existing at the time of his retirement in 1998, including the COLA existing

prior to the 2013 legislation.

Petitioner Jones' COLA benefits and their method of calculation is

part of his PERS contract, and his contract rights may not be reduced after

retirement. In UnitedFirefighters of Los Angeles City v. City of Los

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

14

Angeles, the court held that where -firefighters' rights to pension benefits had

vested under a pension statute that provided uncapped post-retirement

COLAs, the later imposition of a 3% cap on the COLAs violated the .

contract clause. 210 Cal. App. 3d 1095 (1984). Similarly; in Booth v. Sims,

193 W. Va. 323,328, 456 S.E. 2d 167 (W. Va.- 1995); the West Virginia

Supreme Court struck down a law reducing the pension COLAs from 3.75%.

to 2% for active State Troopers whose benefits had previously vested and

who were eligible for retirement.

Petitioner Jones began working for a PERS employer in 1967 and he

contributed to PERS pension system from 1967 until his retirement, 30 years

and 8 months later, in 1998. From 19734hrough 1998, which encompassed

the overwhelming majority of his career; the- effective COLA rate was 2%

for PERS retirees. To reduce Petitioner Jones' COLA after his 1998

retirement under Option 2 Annuity (SMR at 73), amounts to a retroactive

decrease in the value of these contributions that were promised to Petitioner

Jones as an employee and upon which he relied in planning for and taking

his retirement, and constitutes a substantial impairment of his contract with

the State. The Oregon Crawfordcase affirmed that when Plaintiff Crawford

retired, "there had been full performance on the part of the plaintiff, in

compliance with the by-laws then governing the association, [and] her rights

became vested and no subsequent change in the by-laws could interfere with

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

15

or impair such rights. Any other rule would utterly destroy all stability and

security in the retirement fund plan under consideration." Crawfordat 733.

See also Nicholas v. Nevada, 116 Nev. 40, 992 P.2d 262, 265 (Nev. 2000),

which held: "Public employees perform their duties in reliance on the state

paying retirement benefits when certain conditions are met. When those

rights become absolutely vested, a contract exists between the employee and

the state which cannot be modified by unilateral action on the part of the

legislature."

Assignment of Error No. 3 State Respondents' allegations that any

impairment to Petitioner Jones from SB 822 and SB 861 is

"insubstantial" is factually wrong; Petitioner Jones will suffer a

substantial impairment if SB 822 and SB 861 are upheld.

State Respondents' allegations that any impairment to Petitioner Jones

from SB 822 and SB 861 is "insubstantial" is false. If both SB 822 and SB

861 are upheld, Petitioner Jones will suffer a 17.55% reduction in his PERS

retirement pension, which is a substantial impairment using the Strunk

analysis. Petitioner Jones' Brief on the Merits at 45 provides greater detail

regarding this reduction.

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

16

Assignment of Error No: 4 Respondents and Intervenors are in error

in asserting that the Oregony Legislature may remove that part of

Petitioner Jones' PERS contractual retirement benefits provided in SB

656 and HB 3349, solely because he lives out of state, as that action

would violate Ragsdale; the principles of intergovernmental tax

immunity, and the legislative intent in enacting these two bills.

Ragsdale made it clear that Petitioner Jones' retirement compensation

includes the benefits provided, in SB 656, and that the Oregon Legislature

intended those benefits to apply 'equally to, in state and out of state Oregon

retirees.

SB 656 (Oregon Laws 1991, chapter 796) was challenged by a federal

retiree in Ragsdale v. Department of Revenue, 321Or. 216, 895 P.2d 1348

(Or. 1995), on the basis that the benefit given to Oregon state employees in

SB 656 discriminated in taxation between state and federal retirees in

violation of federal constitutional and statutory doctrine of

intergovernmental tax immunity. The Appellant asserted the increased

benefit given to state retirees amounted to a tax refund aind that federal

retirees were entitled to that same refund. The Court gave five reasons why

the SB 656 benefits given to state PERS retirees were not a tax rebate or a

tax beneft. Tlie last of these is particularly instructive to the current case:

"Fifth and last, we'find no correlation, either direct or indirect,

between state retirees' state tax obligations and the amount of

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

17

increased PERS retirement benefits, if any, to which they may

be entitled under the provisions of Oregon Laws, 1991, chapter

796. As noted, the amounts of increased retirement benefits are

based on the PERS members' years of service, not on their state

income tax obligations. All eligible PERS retirees receive

those benefits. .. . Indeed, taxpayer's claim for a ta.z refund

measured by the increased benefit paid to state retirees -

incorrectly assumes that every state retiree who receives an

increase in benefits paid state income taxes, but it is

conceivable that many state retirees paid little or no state

income tax for 1991.... In sum, taxpayer's argument lacks

both a factual and a legal predicate. The system of state

taxation is not implicated by the 1991 increase in retirement

benefits to some state retirees and the principle of

intergovernmental tax immunity does not apply, because there

is no discrimination in taxation on account of the source of the

compensation."

Id. at 228-229 (italics added).

Ragsdale confirms that the Court and the Legislature knew that not all state

retirees were paying Oregon income tax, but they were all still receiving the

SB 656 benefit.

The Ragsdale challenge relied on Sheehy v. Public Employees

Retirement Division, 262 Mont. 129, 864 P.2d 762 reh. den. (1993), which

held that the Montana legislative adjustment to Montana state retirement

benefits in response to the Davis decision was a partial tax rebate for state

retirees, though named otherwise, and therefore violated federal law as

discriminatory taxation of federal retirees who do not receive the same

benefits. "Before Davis, Montana, like Oregon, taxed federal retirement

benefits but exempted state retirement benefits." Id. at 764. Appellant

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

18

Ragsdale argued Oregon's SB 656 should- fail for those same reasons. The

Court disagreed and upheld SB 656, saying:

"The Sheehy court's conclusion that the Montana adjustment is

a partial tax rebate that violated federal law relied heavily on

two features of the Montana enactment: (1) that only retirees

who are Montana residents will receive the benefit, and (2) that

the retirement benefits at issue are funded solely by the .

Montana general fund." Id. The Court went on to find: "In

contrast, under. Oregon Laws 1991, chapter 796, every state

retiree who qualifies for benefits (based on years of service)

will receive the benef ts, regardless of the state retiree 's .. -

residency. Moreover, the challenged provisions of Oregon

Laws 1991, chapter 796, do not appropriate money from the

Oregon general fund. Rather, the increased PERS retirement

benefits are funded by contributions from all PERS employers

to the PERS retirement trust fund."

Id. (emphasis added). The Court held the benefits paid to Oregon state

retirees did not violate 4 U.S.C. section 111 and the constitutional principle

of intergovernmental tax immunity.

Ragsdale upheld the constitutionality of SB 656 because, "every state

retiree who qualifies for the benefits (based on years of service) will receive

the benefits, regardless of the state retiree's residency." Id. at 230. Ragsdale

also confirmed that the benefits provided in SB 656 are `compensation' to

state retirees. Id. at 231. As compensation, the benefits provided under SB

656 became part of the compensation base within the overall PERS

retirement system, which Petitioner Jones is contractually entitled to receive.

Ragsdale makes it clear that SB 656 benefits may not be confined only to

PETITIONER WAYNE STANLEY JONES'.EXTENDED REPLY BRIEF

19

retirees living in Oregon. The 2013 legislation is unconstitutional under

Ragsdale.

In Vogl v. Department of Revenue, 327 Or. 193, 960 P.2d 373 (1998),

a federal retiree challenged HB 3349, the 1995 law that gave a pension

benefit to state retirees based on their total years of service before 1991.

Federal retirees asserted HB 3349 violated the equal tax treatment required

by the federal doctrine, of intergovernmental tax immunity. The Court

noted: "as with the 1991 increase, entitlement to the 1995 increase is not

conditioned on actual liability for an equivalent amount in state taxes.

PERS recipients receive the inct-ease even if they pay little or no state

income tax on their PERS benefits. " Id. at 380 (emphasis added).

However, unlike Ragsdale, the Court found the benefit increase was, in

substance, a tax rebate. The Court said two facts countered that conclusion:

"There is relatively little in the statute to pit against that

suggestion only the facts that the increase is to be funded by

employer contributions, ... and that it applies without regard

to individual tax circumstances. Although those latter factors

were deemed sufficient in Ragsdale to counteract the relatively

weak evidence that the 1991 increase was a tax rebate, they

cannot carry the day against the stronger circumstances in the

present context."

Id. at 381(emphasis added.)

The Vogl Court held that the federal retirees are entitled to an

equivalent tax benefit. The Court then addressed the potential ripple of its

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

20

decision and held: "We-emphasize that our holding necessarily is confined

to the 1995 statute. We- do not overrule Ragsdale or its 'analysis of the 1991

law.. Id. (emphasis added).

The Court made it clear in Ragsdale and Vogl that the Oregon

Legislature, in enacting SB 656 and HB 3349, intended to avoid potential

constitutional challenges under federal intergovernmental tax immunity by

providing that every state retiree who qualifies for benefits (based on years

of service), will receive the benefits; regardless of the state retiree's

residency.

Assignment of Error No. 5 Petitioner Jones' contractual right to his

full PERS retirement benefit, including the pre-2013 COLA, was

fulfilled when he retired; they are not a"windfall," a"gratuity", or an

"ad hoc COLA" as erroneously alleged by Respondents and Intervenors.

A. Oregon case law affirms that Petitioner Jones gave consideration

for his pre-20131egislation retirement benefits.

Allegations that Petitioner Jones' retirement benefits are a"windfall"

or "gratuity,'.' as erroneously alleged by State Respondents and

County/School District Respondents, fails to account for this Court's

holding in Taylor and Rose City Transit. Petitioner Jones', continued

employment affter the enactment of the COLA in 1971 and enhancement in

1973, and the enactment of SB 656 in 1991 and HB 3349 in 1995 constitutes

PETITIONER WAYNE STANLEY ]ONES' EXTENDED REPLY BRIEF

21

his acceptance of these terms. These legislative changes were included as

integral parts of PERS retirement benefits when Petitioner Jones retired in

1998. Petitioner Jones is contractually entitled to his full retirement benefit,

which includes the pre-2013 COLA, and those benefits provided in SB 656

and HB 3349.

Taylor v. Multnomah County Deputy Sheriff's Retirement Board, 265

Or. 445 (1973), settles the matter that retirement.benefits are not a`windfall'.

or a`gratuity'. In Taylor, the Oregon Supreme Court reviewed the history of

contract theory, which looks upon a pension as part of the employee's

promised but delayed compensation for the performance of his job. The

Court held: "Oregon has joined the ranks of those rejecting the gratuity

theory of pensions and has held that contractual rights to a pension can be

created between the employee and employer. " Id. at 450 (emphasis added).

The benefits payable to Petitioner Jones under SB 656 and HB 3349

and the 1973 COLA are clearly accrued, earned benefits that Petitioner

Jones has given consideration for and is fully entitled to receive as a retired

employee. Petitioner Jones' right to his contractual PERS retirement

benefits was entirely fulfilled when he retired. In Rose City Transit v. City

of Portland, 271 Or. 588 (Or. 1975), the Oregon Supreme Court noted that

"an employee pension or disability plan may be viewed as an offer to the

employee which may be accepted by the employee's continued employment,

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

22

and such employment constitutes the underlying consideration for the

promise." Id. at 593,.Y:~ -: - '

B. Intervenor League mischaracterizes the COLA which predates

the 2013 -legislation as `ad hoc.'

The legislative history of Oregon's .1971 and 1973 COLA evidences

these are automatic cost of living adjustments, not `ad hoc' cost of living

adjustments as asserted by Intervenor League. The definitions in the

Glossary in the Guide to Implementation of GASB Statement 67 on Financial

Reporting for Pension Plans, by the Governmental Accounting Standards

Board (June 2013), provide clarity to this question:

"Ad hoc cost of living adjustments (ad hoc COLAs)" [are]

"Cost-of-living adjustrrients that require a decision to grant by

the authority responsible for making such decisions.". ..

"Automatic cost of living adjustments (automatic COLAs)"

[are] "Cost-of-living adjustments that occur without a

requirement for a decision to grant by a responsible authority,

including those for which the amounts are determined by

reference to a specified experience factor (such as the earnings

experience of the pension plan) or to another

,

variable ,(such as

the increase in the consumer price index)."

Id. at 29. Appendix 2.

Clearly, given the factors listed above, 'Oregon's 1971 and 1973

COLAs were both automatic COLAs. They occurred without any further

action on the part of the Oregon Legislatu`re when the consumer price index

showed an increase or .decrease. Intervenor League's reference to Oregon's

1971 and 1973 COLAs as `ad hoc' is in error.

PETITIONER WAYNE STANLEY lONES' EXTENDED REPLY BRIEF

23

C. Respondents and Intervenors erroneous characterization of

Petitioner Jones' pre-2013 contractual retirement benefits as a

`windfall' or a`gratuity' fails to recognize that upon his

retirement, Petitioner Jones' right to his PERS contractual

retirement benefits were fully vested, and the 20131egislation

resulted in a substantial impairment of those rights.

Petitioner Jones, upon his retirement in 1998, having contributed as a

member of the PERS pension system for over 30 years, had fulfilled all the

obligations of the PERS retirement pension plan; and his benefits could not

thereafter be substantially impaired. Oregon courts have affirmed this

principle.

In Hughes, the Oregon Supreme Court stated:

"Oregon is in line with the theory of pensions which holds that

pensions are a form of compensation and that employees

acquire vested contractual rights in pension benefits. ... An

employee's contract right to pension benefits becomes vested at

the time of his or her acceptance of employment. ... On vesting,

an employee's contractual interest in a pension may not be

substantially impaired by subsequent legislation."

Hughes v. State of Oregon, 838 P.2d 1018, 1029 (Or. 1992). The Court also

determined that:

"a pension right `is an integral part of contemplated

compensation', and ... public employment gives rise to certain

obligations which are protected by the contract clause of the

Constitution, including the right to payment of salary which has

been earned.' Therefore, in making any change in retirement

benefits, it is essential to adhere to the principle that an

employe's [sic] right to retirement benefits can not be destroyed

`by a repeal of a statute without the enactment of a substitute'."

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

24

Id. at 1028.

In Hart v. Washington County Rural Fire Protection District No. 1,

52 Or. App. 1- 005, 630 P.2d 390 (Or.App. 198 1), plaintiffs retired under a

1973 pension plan of the defendant. Defendant modified its pension plan in

1976 and began paying the plaintiff decreased pension amounts. The

Oregon Court of Appeals determined this change impaired plaintiffs'

contractual pension rights:

"Once the employe [sic] has fulfilled all of his obligations

under the plan and has retired, rights under the pension plan

become vested, and those rights may not be impaired by the

subsequent action of the employer. ... Plaintiffs here all knew

of the original plan adopted by defendant, fulfilJed their

employment obligations under that plan and retired while the

original planwas in effect. Their rights in the original plan

vested when they retired and may not now be impaired."

Id. at 392, n.2, n.3 The Court held that "Plaintiffs, upon retirement, were

entitled to rely upon the benefits provided in the original plan." Id. at 393.

(As a side note, W. Michael Gillette participated as the presiding judge in

this unanimous decision.)

Assignment of Error No. 6 State Respondent misstates the facts in

minimizing the substantial impact of the removal.of SB 656 and HB ~

3349 from Petitioner Jones.

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

25

State Respondents' argument that removing SB 656 and HB 3349,

`tax remedy' change, does not rise to the level of a substantial impairment,

misstates the facts and minimizes the substantial impairment wrought by

removing these contractual retirement benefits from Petitioner Jones.

The numbers and percentage reduction attributed to Petitioner Jones by the

State Respondents Answering Brief at 76-77 are invalid and understate the

substantial impact of SB 656 and HB 3349, for three reasons: First, State

Respondents' take into account only SB 656, the first of the two bills

providing a remedy for PERS members after the Davis decision; Second,

Petitioner Jones actually receives the benefits provided under HB 3349,

which bill authorized an increase in his employee refund of accumulated

employee contributions under either SB 656 or HB 3349, whichever

provides the greater percentage increase to him. And for Petitioner Jones,

his benefits under HB 3349 are approXimately twice as much as under SB

656. And third, Petitioner Jones' retirement benefits are paid to him over his

lifetime, but State Respondents show his "present value" only. The true

value of Petitioner Jones' total reduction and its attributable percentage are

substantially greater than those given in the State Respondents' figures. The

measurement tools used by the State are intended to substantially understate

the actual impact of Petitioner's loss.

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

26

Assignment of Error No. 7.The Respondents and Intervenors are in

error in alleging Petitioner Jones must satisfy the criteria for a facial

challenge.

The Oregon Legislature statutorily outlined the process for any person

who is or may be adversely impacted by the 20131egislation. That process

is to file a petition with the Oregon Supreme Court, alleging the basis for the

challenge and a statement showing how the individual petitioner was

adversely affected by either or both of these acts. Section 19, Senate Bill

822, and Section 11, Senate Bi11861. Petitioner Jones followed that process ,

and has satisfied all the statutory requirements to qualify for this Court's

review. Respondents and Intervenors are in error in asserting that the 2013

legislation required Petitioner Jones to mount a facial challenge.

Conclusion

Respondents and Intervenors have failed to meet their burden of proof

in responding to Petitioner Jones' Brief on the Merits. Petitioner Jones asks

this Court to hold SB 822 and SB 861 unconstitutional as applied to him.

PETITIONER WAYNE STANLEY IONES' EXTENDED REPLY BRIEF

Respectfully submitted this 18th day of September, 2014.

Wayne Stanley Jones, Pro Se

18 North Foxhill Road

North Salt Lake, Utah 84054

Telephone: 801-296-1552

Email: wstanm~-tggrnail.com

27

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

HUME

. . . . . . . . . . . . . . . . . . . _ . . . . .

SEARCH GO !

~ . . . . . . _ . . . . _ . . . ~

iOther Federsl Respne 8fiea v

Latest

ppening Remarks

Narrayana Kochertakote, Helena,

Montana, Seplwpber 46 2014

Banking Condibom in tfie Ninth

distrir. t, Second OuarW 2014

Results ... .

Ron Fekfi>Ian, Exocutive Yice

PreaiderK, 8aptembar 4, 2Q14

The Current arx! FtAure Stide of

Community Bardang

Narayana Kochwiakota, August

15, 2014

Paychecks or ?

Lessans from dfse Death Spiraf ot

detroit

Economic Policy PaPer, August

7,2014

A minimalist pictu re

fed,gazette, July 2014

Reiated Links

What is a t}oHar 7

Calculator

Wtroat is a Dottar ?

Background Intofmabon

Ezteznal Links

Bureau ot Labor S tW i sti es

fedmi rewve

mbmLwg

AfiN%IT TNE FEO BANKSNG COMMUNITY 8 EDUCAt1tMi RESEARCI4 TME EGCnOMY NEVi1S 8 EYEl+ITS PU9LJCATIONS 8 PAFE.RS

CONSUMER PRICE INDEX, 1913-

CPI-U

Base year is chained;

1982-1984 = 100

Year Annual

Average

Annual Percent

Change

(rate of in8ation)

1913 9. 9

1914 10. 0 1. 3%

1915 10. 1 0. 9%

1916 10. 9 7. 7%

1917 12. 8 17_ 8%

1918 15. 0 17. 3%

1919 17. 3 15. 2%

1920 20. 0 15. 6%

1921 17. 9 -10. 9%

1922 16. 8 -6. 2%

1923 17. 1 1. 8%

1924 17. 1 0. 4%

1925 17. 5 2_ 4%

1926 17. 7 0. 9%

1927 17. 4 -1. 9%

1928 17. 2 -1. 2%

1929 17. 2 0. 0%

1930 16. 7 -2. 7%

1931 15. 2 -8. 9%

1932 13. 6 -10. 3%

1933 12. 9 -5. 2%

1934 13. 4 3. 5%

1935 13. 7 2. 6%

1936 13. 9 1. 0%

1937 14. 4 3. 7%

1938 14. 1 -2. 0%

1939 13. 9 -1. 3%

1940 14. 0 0. 7%

1941 14. 7 5. 1%

1942 16. 3 10. 9%

1943 17. 3 6. 0%

1944 17. 6 1. 6%

1945 18. 0 2. 3%

1946 19. 5 8. 5%

1947 22. 3 14. 4%

1948 24. 0 7. 7%

1949 23. 8 -1. 0%

1950 24. 1 1. 1%

1951 26. 0 7. 9%

+ Community Development

~~Student Resaurrres

. Teaching Aids

Articles and Class

Supplements

Economic Education for

Teachers

Our Nioney Teaching Unit

CPl Calculator Information

t Financial Leaming for the

Pul}liC

1952 26. 6 2. 3%

1953 26. 8 0. 8%

1954 26. 9 0. 3%

1955 26. 8 -0. 3%

1956 27. 2 1. 5%

1957 28. 1 3. 3%

1958 28. 9. 2. 7%

1959 29. 2 1. 08%

1960 29. 6 1. 5%

1961 29. 9 1. 1%

1962 30. 3 1. 2%

1963 30. 6 1. 2%

1964 31. 0 1. 3%

1965 31. 5 1. 6%

1966 32. 5 3. 0%

1967 33. 4 2. 8%

1968 34. 8 4. 3%

1969 36. 7 5. 5%

1970 38. 8 5. 8%

1971 40. 5 4. 3%

1972 41. 8 3. 3%

1973 44. 4 6. 2%

1974 49. 3 11. 1%

1975 53. 8 9. 1%

1976 56. 9 5. 7%

1977 60. 6 6. 5%

1978 65. 2 7. 6%

1979 72. 6 11. 3%

1980 82. 4 13. 5%

1981 90. 9 10. 3%

1982 96. 5 6. 1%

1983 99. 6 3. 2%

1984 103. 9 4. 3%

1985 107. 6 3. 5%

1986 109. 6 1. 9%

1987 113. 6 3. 7%

1988 118. 3 4. 1%

1989 124. 0 4. 8%

1990 130. 7 5. 4%

1991 136. 2 4. 2%

1992 140. 3 3. 0%

1993 144. 5 3. 0%

1994 148. 2 2. 6%

1995 152. 4 2. 8%

1996 156. 9 2. 9%

1997 160. 5 2. 3%

1998 163. 0 1. 6%

1999 166. 6 2. 2%

2000 172. 2 3. 4%

2001 177. 1 2. 8%

2002 179. 9 1. 6%

2003 184. 0 2. 3%

2004 188. 9 2. 7%

2005 195. 3 3. 4%

2006 201. 6 3. 2%

2007 207. 3 2. 9%

2008 215. 3 3. 8%

2009 214. 5 -0. 4%

2010 218. 1 1. 6%

2011 224. 9 3. 2%

2012 229. 6 2. 1%

2013 233. 0 1. 5%

2014' 236. 2 1. 4%

An estimate for 2014is based on the change in the CPI from

first quarter 2013 tofirst quarter 2014.

PRIVACY 8 TERMS ! DISCLAIMER ; , ACCESSIBILITY GLOSSARY i SITE MAP ' MOBILE SITE TWITTER j FACEBOOK . RSS

Appendix 2

Appendix 1

GLOSSARY

This appendix contains definitions of certain terms as they are used in Statement 67, the terms may have different

meanings in other contexts.

Actuarial present value of projected benefit payments

Projected benefit payments discounted to reflect the expected effects of the time value (present value) of money

and the probabilities of payment.

Actuarial valuation

The determination, as of a point in time (the actuarial valuation date), of the service cost, total pension iiability, and

related actuarial present value of projected benefit payments for pensions performed in conformity with Actuarial

Standards of Practice unless otherwise specified by the GASB.

Actuarial valuation date

The date as of which an actuarial vaivation is performed.

Actuarially determined contribution

A target or recommended contribution to a defined benefit pension plan for the reporting period, determined in

conformity with Actuarial Standards of Practice based on the most recent measurement avaitable when the

contribution for the reporting period was adopted.

Ad hoc cost-of-living adjustments (ad hoc COLAs)

Cost-of-living adjustments that require a decision to grant by the authority responsible for making such decisions.

Ad hoc postempioyment benefit changes

Postemployment benefit changes that require a decision to grant by the authority responsible for making such

decisions.

Agent multiple-employer defined benefit pension plan (agent pension pian)

A multiple-employer defined benefit pension plan in which pension plan assets are pooled for investment purposes

but separate accounts are maintained for each individual employer so that each employer's share of the pooied

assets is legally available to pay the benefits of only its employees.

Allocated insurance contracts

Contracts with an insurance company under which related payments to the insurance company are currently used

to purchase immediate or deferred annuities for individual plan members. Also may be referred to as annuity

contracts.

Automatic cost-of-living adjustments (automatic COLAs)

Cost-of-living adjustments that occur without a requirement for a decision to grant by a responsible authority,

including those for which the amounts are determined by reference to a specified experience factor (such as the

earnings experience of the pension plan) or to another variable (such as an increase in the consumer price index).

29

CERTIFICATE OF COMPLIANCE

WITH EXTENDED REPLY BRIEF LENGTH AND

TYPE SIZE REQUIREMENTS

Reply Brief length

I certify that:

(1) this EXTENDED REPLY BRIEF complies with the word-count

limitation in the ORDER GRANTING MOTION FOR EXTENSIONS OF

TIME TO FILE BRIEFS AND TO FILE EXTENDED BRIEFS;' dated

August 15, 2014, which order provided a word count limitation 'to Pro Se

Petitioner Jones of 6,000 words; and

(2) the word count of this EXTENDED REPLY BRIEF is 5992 words

Type size

I certify that the size' of the type in this brief is not smaller than 14 point for

both the text of the brief and footnotes as required by ORAP 5:05(4)(f). :

Waynt Stanley

PETITIONER WAYNE STANLEY-JONES' REP.LY BRIEF

CERTIFICATE OF FILING

I certify that on September 18, 2014, I filed the original and 7 copies of the

WAYNE STANLEY JONES' EXTENDED REPLY BRIEF with the

Appellate Court Administrator by United States Postal Service, first class,

priority mail, certified mail, return receipt requested at this address:

Appellate Court Administrator

Appellate Court Records Section

1163 State Street -

Salem, OR 97301-2563

gppealsclerk@oj d. state. or.us

CERTIFICATE OF SERVICE

I certify that on September 18, 2014, I served two copies of the foregoing

WAYNE STANLEY JONES' EXTENDED REPLY BRIEF by United

States Postal Service, first class mail, and also emailed an electronic copy to:

AG Ellen Rosenblum 4753239

SG Anna M. Joyce #013112

AAG Keith L. Kutler #852626

AAG Matthew J. Merritt # 122206

AAG Michael A. Casper #062000

Oregon Department of Justice

1162 Court Street NE

Salem, OR 97301-4096

Telephone: 503-378-4402

F acs imile : 5 03 -3 78-63 06

anna. j oyce(~ ae,doj . state. or. us

keith.kutler(~ a,doi . state. or.us

matthew.merritt c (~ o,doj.state.or.us

michael. casper@ doj . state. or. us

Attorneys for State Respondents

William F. Gary #770325

william.f.g_ ary@harran . g com

Sharon A. Rudnick#830835

sharon.rudnick@harran . g com

Harrang Long Gary Rudnick PC

360 E. 10`h Ave., suite 300

Eugene, OR 97401

Telephone: 503 -242-0000

F acsimile : 541-686-6564

Attorneys for Respondents Linn

County, Estacada, Oregon City,

Ontario, West Linn School Districts

and Beaverton School Districts, and

Intervenors Oregon School Boards

Association and Association of

Oregon Counties

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

Harry Auerbach #821830

Kenneth A. McGair #990148

Office of the City Attomey .

1221 SW 4th Avenue, Ste 430

Portland, OR 97204

Telephone: 503-823-4047

Facsimile: 503-823-3089

hqn.auerbach@portlandoregon.gov

kmontoya@cityofsalem.net

Attorney for Respondent City of.

Portland

Eugene J. Karandy II #972987

Office of County Attorney

Linn County Courthouse

104 SW Fourth Avenue, Room 123

Albany, OR 97321

Telephone: 541-967-3 840 .

F acs imile : 541-92 8-5 424

g,karandyna,co. linn. or. us

Attorney for Respondent Linn Count,

Lisa M. Frieley #912763

Oregon School Boards Association

PO Box 1068

Salem, OR 97308

Telephone: 503-5 88-2800

Facsimile: 503-588-2813

lfreiley@osba.org

Attorney for Respondents Estacada,

Oregon City, Ontario, and West Linn

School Districts and Intervenor

Oregon School Boards Association

Rob Bovett #910267

Association of Oregon Counties

1201 Court St. NE Ste 300

Salem, OR 97301

Telephone: 971-218-0945

rbovett(~ a,aocweb.org

Attorney for Linn County

Daniel B. Atchison #040424

Kenneth Scott Montoya #064467

Office of City Attorney ..

555 Liberty Street SE Rm 205

Salem, OR 97301

Telephone : 5 03 -5 8 8-6003

Facsimile: 503-361-2202

datchison@cityofsalem.net

kmontoya@cityofsalem.net

Attorney for Respondent City of

Salem

Edward F. Trompke #843653

Jordan Ramis PC

Two Centerpointe Drive, 6t'' Floor

Lake Oswego, OR 97035

Telephone: 503-598-5532

Facsimile: 503-598-7373

ed.trompke@jordanramis.com

Attorney for Respondent Tualatin

Valley Fire and Rescue

W. Michael Gillette #660458

Leora Coleman-Fire .#113581

Sara Kobak#023495

William B. Crow #610180

Schwabe Williamson & Wyatt PC

1211 SW 5`h Ave Suite 1900

Portland, OR 97204

Telephone: .503-222-9981

Facsimile: 503-796-2900

wmgillette@schwabe.com

Attorneys for Intervenor League of

Oregon Cities

George A. Riemer (Petitioner Pro

Se)

23206 N. Pedregosa Drive

Sun City West, AZ 85375

Telephone: 623 -23 8-503 9

cortebella@gmail.com

Petitioner pro se

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

Michael D. Reynolds (Petitioner Pro

Se)

8012 Sunnyside Avenue N.

Seattle, WA 98103

Telephone: 206-910-6568

mreynoldsl4@comcast.net

Petitioner pro se

Sara K. Drescher #042762

Tedesco Law Group

3021 NE Broadway

Portland, OR 97232

Telephone: 866-697-6015

sara@miketlaw.com

Attorney for Amicus Curiae IAFF

Thomas A. Woodley

tawAwmlaborlaw. com

Douglas L. Steele

dls@wmlaborlaw.com

Woodley & McGillivary

1101 Vermont Ave., NW, Suite 1000

Washington, DC 20005

Telephone: 202-697-6015

Attorneys for Amicus Curiae IAFF

d l . . S 4.L'

Wayni Stanley Jon s

Petitioner, Pro Se

Gregory A. Hartman #741283

HartmanG(~ a,bennettthartman. com

Aruna A. Masih #973241

MasihA@bennetthartman.com

Bennett Hartman Morris

210 SW Morrison Street, Suite 500

Portland, OR 97204

Telephone: 503-546-9601

Attorneys for Petitioners Moro,

Domenigoni, Custer, Hawkins,

Arken, Ditter, O'Kief, Smith,

Johnson, Clouseer, Silence,

Veckery, and Voek

Craig A. Crispin #82485

Crispin Employment Lawyers

1834 SW 58th Avenue, Suite 200

Portland, OR 97221

Telephone: 503-293-5759

crispin@employmentlaw-nw.com

Attorney for Amicus Curiae AARP

The Honorable Stephen K. Bushong

Multnomah County Circuit Court

1021 S.W. 4h Avenue

Portland, OR 97204

Telephone: 503-988-3546

stephen.k. bushong@oi d. state. or.us

PETITIONER WAYNE STANLEY JONES' EXTENDED REPLY BRIEF

Вам также может понравиться

- Moro Reply BriefДокумент79 страницMoro Reply BriefStatesman JournalОценок пока нет

- STATE OF OREGON Answer BriefДокумент123 страницыSTATE OF OREGON Answer BriefStatesman JournalОценок пока нет

- In The Supreme Court of California: Ristin Erry Ity and Ounty of AN RanciscoДокумент17 страницIn The Supreme Court of California: Ristin Erry Ity and Ounty of AN RanciscoEquality Case FilesОценок пока нет

- Plug and Abandon Report of Century Exploration 7-5-13 PDFДокумент5 страницPlug and Abandon Report of Century Exploration 7-5-13 PDFlonghorn4lifОценок пока нет

- S Upteme of Tbe: QintttbДокумент22 страницыS Upteme of Tbe: QintttbEquality Case FilesОценок пока нет

- Reynolds Reply BriefДокумент40 страницReynolds Reply BriefStatesman JournalОценок пока нет

- FirstEnergy Motion To DismissДокумент87 страницFirstEnergy Motion To DismissJessie BalmertОценок пока нет

- Rosenblum v. Trump and Does 1-10 Oregon AG Files For TRO Against Black-Ops Detentions of Peaceful ProtestersДокумент22 страницыRosenblum v. Trump and Does 1-10 Oregon AG Files For TRO Against Black-Ops Detentions of Peaceful Protesterschristopher kingОценок пока нет

- State V Cody Anthony Dupre - Fecr012240Документ65 страницState V Cody Anthony Dupre - Fecr012240thesacnewsОценок пока нет

- JP Morgan Chase V US Dept of TreasuryДокумент11 страницJP Morgan Chase V US Dept of TreasuryForeclosure Fraud100% (1)

- Randy Wolfe Death Documents (Skidmore v. Led Zeppelin "Stairway To Heaven" Lawsuit)Документ34 страницыRandy Wolfe Death Documents (Skidmore v. Led Zeppelin "Stairway To Heaven" Lawsuit)James CookОценок пока нет

- G048303 (Opposition Brief - Anaheim) Modiano v. City of Anaheim (California Disabled Persons Act) Opposition Brief - City of AnaheimДокумент80 страницG048303 (Opposition Brief - Anaheim) Modiano v. City of Anaheim (California Disabled Persons Act) Opposition Brief - City of Anaheimwilliam_e_pappasОценок пока нет

- Geiger v. Kitzhaber: Plaintiffs Amended Memorandum in Support of Summary JudgmentДокумент153 страницыGeiger v. Kitzhaber: Plaintiffs Amended Memorandum in Support of Summary JudgmentLaw Works LLCОценок пока нет

- Judgment Against Sac City Couple in The Amount $1,137.60Документ22 страницыJudgment Against Sac City Couple in The Amount $1,137.60thesacnewsОценок пока нет

- 37 - Motion To SealДокумент122 страницы37 - Motion To SealSarah BursteinОценок пока нет

- Appellants' Opening Brief - Ca10 - 21-6139Документ47 страницAppellants' Opening Brief - Ca10 - 21-6139dillon-richards100% (2)

- Hassan v. NYC - 3rd Circuit Appeal - 07-03-2014Документ63 страницыHassan v. NYC - 3rd Circuit Appeal - 07-03-2014The DeclarationОценок пока нет

- Supreme Court of The United States: Petitioners Pro SeДокумент72 страницыSupreme Court of The United States: Petitioners Pro SeNye LavalleОценок пока нет

- United States District Court Northern District of CaliforniaДокумент39 страницUnited States District Court Northern District of CaliforniaEquality Case FilesОценок пока нет

- Brief For The Appellant, Violet Dock Port, Inc., LLC v. Heaphy, No. 19-30993 (5th Cir. Feb. 3, 2020)Документ72 страницыBrief For The Appellant, Violet Dock Port, Inc., LLC v. Heaphy, No. 19-30993 (5th Cir. Feb. 3, 2020)RHTОценок пока нет

- IVAN ANTONYUK COREY JOHNSON ALFRED TERRILLE JOSEPH MANN LESLIE LEMAN and LAWRENCE SLOANE V. NEW YORK STATEДокумент53 страницыIVAN ANTONYUK COREY JOHNSON ALFRED TERRILLE JOSEPH MANN LESLIE LEMAN and LAWRENCE SLOANE V. NEW YORK STATEJillian SmithОценок пока нет

- Arnold Emergency Motion 22cv41008 Joseph Et AlДокумент13 страницArnold Emergency Motion 22cv41008 Joseph Et AlKaitlin AthertonОценок пока нет

- Evr'k Huvriro11: B/ F/KL By: T-FДокумент5 страницEvr'k Huvriro11: B/ F/KL By: T-FChapter 11 DocketsОценок пока нет

- Warren Initial Appellate Brief March 2023Документ66 страницWarren Initial Appellate Brief March 2023SeanWMNFОценок пока нет

- Brandon Trosclair Case Petition For ReviewДокумент8 страницBrandon Trosclair Case Petition For ReviewMary Margaret OlohanОценок пока нет

- South Bay United Pentecostal ChurchДокумент101 страницаSouth Bay United Pentecostal ChurchLaw&Crime0% (1)

- Gibson's Bakery v. Oberlin College - Plaintiffs Motion For Prejudgment InterestДокумент4 страницыGibson's Bakery v. Oberlin College - Plaintiffs Motion For Prejudgment InterestLegal InsurrectionОценок пока нет

- Former FirstEnergy CEO Chuck Jones' Motion To DismissДокумент42 страницыFormer FirstEnergy CEO Chuck Jones' Motion To DismissJessie BalmertОценок пока нет

- Filed & Entered: SBN 143271 SBN 165797 SBN 259014Документ8 страницFiled & Entered: SBN 143271 SBN 165797 SBN 259014Chapter 11 DocketsОценок пока нет

- Todd Giffen v. Oregon Habeas CorpusДокумент26 страницTodd Giffen v. Oregon Habeas Corpusmary engОценок пока нет

- C N - 10-16696 United States Court of Appeals For The Ninth CircuitДокумент36 страницC N - 10-16696 United States Court of Appeals For The Ninth CircuitKathleen PerrinОценок пока нет

- TRO Application and Memo FinalДокумент37 страницTRO Application and Memo FinalSinclair Broadcast Group - EugeneОценок пока нет

- BP Oil Spill: BP's Motion For Restitution and Injunctive ReliefДокумент49 страницBP Oil Spill: BP's Motion For Restitution and Injunctive ReliefTheDonovanLawGroupОценок пока нет

- Motion For Indefinite Continuance While Deal Is Work Out Sustained in The Matter of State Vs Cody Anthony DupreДокумент62 страницыMotion For Indefinite Continuance While Deal Is Work Out Sustained in The Matter of State Vs Cody Anthony DuprethesacnewsОценок пока нет

- Clayton Appeal BriefДокумент115 страницClayton Appeal BriefReutersLegalОценок пока нет