Академический Документы

Профессиональный Документы

Культура Документы

Sharekhan Top Picks: CMP As On September 01, 2014 Under Review

Загружено:

rohitkhanna1180Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sharekhan Top Picks: CMP As On September 01, 2014 Under Review

Загружено:

rohitkhanna1180Авторское право:

Доступные форматы

100

150

200

250

300

350

400

450

M

a

y

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

A

u

g

-

1

0

N

o

v

-

1

0

F

e

b

-

1

1

M

a

y

-

1

1

A

u

g

-

1

1

N

o

v

-

1

1

F

e

b

-

1

2

M

a

y

-

1

2

A

u

g

-

1

2

N

o

v

-

1

2

F

e

b

-

1

3

M

a

y

-

1

3

A

u

g

-

1

3

N

o

v

-

1

3

F

e

b

-

1

4

M

a

y

-

1

4

A

u

g

-

1

4

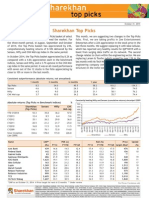

Sharekhan Sensex Nif ty

Sharekhan Top Picks

After taking a breather in July, the equity market surged ahead

again in August to scale new heights. As highlighted by us in

the last months editorial of ValueGuide, it is not the right

strategy to wait for corrections to enter the market. It is better

to start investing in a systematic and phased manner especially

if one is looking to play the rally that is expected in the

domestic equity market over the next two to three years.

The benchmark indices, Nifty and Sensex, have appreciated

by 5.1% and 5.3% respectively since our revision in the Top

Picks basket last month whereas the CNX Mid-cap Index has

also moved up by 5.3% in the same period. The Top Picks basket

has comfortably outperformed the benchmark indices with

superlative returns of 10.6% in the same period.

Two stocks added during the last revision, PTC India Financial

Services and TVS Motor Company, have appreciated by well over

25% each in the past one month. The only underperformer has

been Zee Entertainment Enterprises (down 1.5% in the same

period) where the sentiment was dented by the further extension

of the deadline for phases III and IV of the digitisation of cable

television services. However, we believe it is only a temporary

setback and Zee Entertainment Enterprises is our preferred pick

in the media sector. It is slated to get inducted in the Nifty in the

forthcoming round of changes in the index composition.

September 01, 2014 Visit us at www.sharekhan.com

For Private Circulation only

Name CMP* PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs)# (%)

Apollo Tyres 179 8.7 8.7 7.7 26.4 20.7 19.3 210 17

Axis Bank 406 15.3 13.4 11.5 17.4 17.3 17.5 476 17

Federal Bank 124 12.7 10.9 9.0 12.6 13.3 14.5 142 14

Gateway Distriparks 260 19.9 18.2 15.8 17.5 18.1 20.0 310 19

ICICI Bank 1,599 18.8 16.8 14.1 14.0 14.5 15.7 1,723 8

Larsen & Toubro 1,578 29.8 26.3 21.7 15.6 15.6 17.1 1,840 17

Lupin 1,289 31.4 22.7 19.8 26.5 27.7 24.4 ** -

Maruti Suzuki 2,916 31.6 25.3 19.1 14.1 15.5 17.8 3,500 20

Persistent Systems 1,301 20.9 16.8 14.3 22.3 23.1 22.7 1,400 8

Reliance Industries 1,014 14.6 13.7 12.3 11.3 10.9 11.0 1,190 17

Salzer Electronics 137 16.7 10.6 7.4 9.0 13.1 16.7 175 28

Zee Entertainment Enterprises 285 30.6 28.8 21.9 20.6 19.1 22.3 367 29

*CMP as on September 01, 2014 # Price target for next 6-12 months ** Under review

Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East),

Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Fax: 67481899; E-mail: publishing@sharekhan.com; Website: www.sharekhan.com; CIN:

U99999MH1995PLC087498. Sharekhan Ltd.: SEBI Regn. Nos. BSE- INB/INF011073351 ; CD-INE011073351; NSE INB/INF231073330 ; CD-INE231073330; MCX

Stock Exchange- INB/INF261073333 ; CD-INE261073330; DP-NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN

20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX-00132 ; (NCDEX/TCM/CORP/0142) ;

NCDEX SPOT-NCDEXSPOT/116/CO/11/20626; For any complaints email at igc@sharekhan.com ; Disclaimer: Client should read the Risk Disclosure Document

issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com before investing.

This month, we are making three changes and adding another

stock to the portfolio. We are booking profit in TVS Motor

Company (a gain of 27% in a month) and PTC India Financial

Services (a return of 31.4% in a month); and replacing these

with Maruti Suzuki and Axis Bank as part of the churn within

the auto and financial sectors respectively.

The third change in the Top Picks folio is the proposed

replacement of UltraTech Cement with Reliance Industries

Ltd (RIL). The bellwether RIL has underperformed in the past

few months and could catch up with the benchmark indices

on the back of some favourable policy announcement and the

commissioning of its expansion project in both the refining

and the petrochemical business. We see scope for the doubling

of its earnings over the next four years if the petrochemical

cycle improves in line with our expectations and the

realisations in its upstream business are revised upwards after

the deliberations by the new government at the centre. Lastly,

we are adding an engineering company, Salzer Electronics

(which is under our soft coverage) to the Top Picks folio. It is

a well managed company (26% stake held by Larsen and Toubro

[L&T]) with a wide product portfolio and marquee clients like

L&T, Schneider Electric and General Electric among others

and could be an early gainer of an improving macro scenario

along with its increased focus on the overseas business.

Constantly beating Nifty and Sensex (cumulative returns) since April 2009

Absolute returns (Top Picks Vs Benchmark indices) %

Sharekhan Sensex Nifty CNX

(Top Picks) MIDCAP

CY2014 38.1 27.1 26.9 39.7

CY2013 12.4 8.5 6.4 -5.6

CY2012 35.1 26.2 29.0 36.0

CY2011 -20.5 -21.2 -21.7 -25.0

CY2010 16.8 11.5 12.9 11.5

CY2009 116.1 76.1 72.0 114.0

Since Inception 287.7 168.2 163.3 212.9

(Jan 2009) Index to 100

2

September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Apollo Tyres 179 8.7 8.7 7.7 26.4 20.7 19.3 210 17

Remarks: Apollo Tyres is a leading player in the domestic passenger car and truck tyre segments. The tyre industrys volume

has been subdued given the weak macro environment. We expect the demand to improve in H2FY2015 with a

pick-up in the economy.

The profitability of the tyre companies has improved given the soft natural rubber prices and this benefit is

expected to continue in FY2015-16 as global supply of natural rubber is expected to outstrip demand.

Its European operations too have reported a strong performance with a strong volume growth and high profitability.

The company will be investing EUR200 million for setting up a greenfield facility in Eastern Europe which will

start production in Q4FY2017 and cater to the long-term growth in Europe. Additionally, it will invest Rs2,000

crore in its Indian operations for capacity expansion.

We like the stock for its consistent performance and long-term growth prospects (expansion in Europe and Chennai).

We have a Buy recommendation on the stock with a price target of Rs210.

Axis Bank 406 15.3 13.4 11.5 17.4 17.3 17.5 476 17

Remarks: Axis Bank continues to report a strong growth in profits led by an improved operating performance. With a strong

focus on raising the CASA ratio and reducing dependence on wholesale funds, the bank has been able to narrow

the gap vis--vis its peers (ICICI Bank, HDFC Bank) in terms of liability franchise. This should help sustain the net

interest margin at healthy levels going ahead.

With gross NPAs of 1.3%, the asset quality of the bank remains among the best in the system. The provision

coverage of about 80% further adds to the comfort on the banks asset quality. The strategy of diversifying the

loan book in favour of the retail segment is shaping well as retail loans constitute over 30% of its loan book.

Axis Bank is among the best capitalised bank and is likely to benefit from a recovery in the economy. An increase

in investment activity will boost its fee income and add to its profitability. Considering high visibility of the

earnings growth and the healthy asset quality, the stock trades at a reasonable valuation (1.9x FY2016E book

value [BV]). We have a Buy rating on it with a price target of Rs476.

3 September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Federal Bank 124 12.7 10.9 9.0 12.6 13.3 14.5 142 14

Remarks: Federal Bank undertook structural changes in the balance sheet, viz increasing the proportion of the better rated

assets and improving the retail deposit base, and is thus better prepared to ride the recovery cycle. As the

economy is gradually showing signs of a revival, the bank is much better capitalised (tier-1 capital adequacy ratio

of ~15%) compared with its peer banks to expand the balance sheet.

The a sset quality has improved substantially over the past three to four quarters and is likely to improve further

in the coming period. Higher provision coverage of over 80% and a possibility of recovery from one large-ticket

account (likely in the next two to three quarters) would further increase the comfort on asset quality.

The valuation of 1.3x FY2016E BV is attractive when compared with the regional banks and other old private

banks. The expansion in the return on equity (RoE) led by a better than industry growth (FY2014-16) will lead to

an expansion in the valuation multiple. We have a Buy rating on the stock with a price target of Rs142.

Gateway Distriparks 260 19.9 18.2 15.8 17.5 18.1 20.0 310 19

Remarks: An improvement in exim trade along with a rise in port traffic at the major ports signals an improving business

environment for the logistic companies. Gateway Distriparks being a major player in the CFS and rail logistic

segments is expected to witness an improvement in the volumes of its CFS and rail divisions going ahead.

The improving trend in the rail freight and cold chain subsidiaries would sustain on account of the recent efforts

to control costs and improve utilisation.

We continue to have faith in the companys long-term growth story based on the expansion of each of its three

business segments, ie CFS, rail transportation and cold storage infrastructure segments. First, we believe the

listing of Snowman Logistics will unlock the inherent value and the potential of the cold chain operations.

Second, the coming on stream of the Faridabad facility and the strong operational performance will further

enhance the performance of the rail operations. Third, the expected turnaround in the global trade should have

a positive impact on the CFS operations. We maintain our Buy rating on the stock.

4

September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

ICICI Bank 1,599 18.8 16.8 14.1 14.0 14.5 15.7 1,723 8

Remarks: With an improvement in the liability profile, ICICI Bank is better positioned to expand its market share especially

in the retail segment. We expect its advances to grow at ~19% compound annual growth rate (CAGR) over FY2014-

16 leading to a CAGR of 17.0% in the net interest income.

ICICI Banks asset quality has stabilised and fresh non-performing asset (NPA) additions are within manageable

limits. We believe the strong operating profits should help the bank to absorb the stress which anyway is expected

to recede due to an uptick in the economy.

Led by a pick-up in the advance growth and a significant improvement in the margin, the RoE is likely to expand

to ~16% by FY2016 while the return on assets (RoA) is likely to improve to 1.8%. This would be driven by a 15.3%

growth (CAGR) in the profit over FY2014-16.

The stock trades at 2.1x FY2016E BV. Moreover, given the improvement in the profitability led by lower NPA

provisions, a healthy growth in the core income and improved operating metrics, we recommend a Buy with a

price target of Rs1,723.

Larsen & Toubro 1,578 29.8 26.3 21.7 15.6 15.6 17.1 1,840 17

Remarks: Larsen & Toubro (L&T), the largest engineering and construction company in India, is a direct beneficiary of the

strong domestic infrastructure development and industrial capital expenditure (capex) revival now.

L&T continues to impress us with its order inflow growth achievement and good execution skills even in a slowdown.

Now it is looking at better days ahead with the domestic environment improving. We believe in such a situation,

L&T would be a major beneficiary as it is placed much ahead of its peers with a strong balance sheet. Moreover,

monetisation of various assets (including listing of subsidiary) would help the company to improve the RoE.

Owing to poor results in its hydrocarbon subsidiary, L&T reported weak Q1FY2015 results and the stock corrected

significantly. We recommend investors to consider this as an opportunity of lower entry point as L&T is one of the

best bets to play the cyclical (revival benefit yet to reflect in numbers) and as the management expects the

performance of hydrocarbon business to improve in future.

5 September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Lupin 1,289 31.4 22.7 19.8 26.5 27.7 24.4 ** -

Remarks: A vast geographical presence, focus on niche segments like oral contraceptives, ophthalmic products, para-IV

filings and branded business in the USA are the key elements of growth for Lupin. The company has remarkably

improved its brand equity in the domestic and international generic markets to occupy a significant position in

the branded formulation business. Its inorganic growth strategy has seen a stupendous success in the past. The

company is now debt-free and that enhances the scope for inorganic initiatives.

The company has shown a sharp improvement in the base business margin in Q1FY2015 on the back of cost

rationalisation measures and better product mix. The management has given a guidance to sustain the operating

profit margin (OPM) at 27% to 28% in FY2015 (vs 25% in FY2014), which especially impress us.

The company is expected to see stronger traction in the US business on the back of the key generic launches in

recent months and a strong pipeline in the US generic business (over 97 abbreviated new drug approvals pending

approval including 86 first-to-files) to ensure the future growth. The key products that are going to provide a

lucrative generic opportunity for the company include Nexium (market size of $2.2 billion), Lunesta (market size

of $800 million) and Namenda (market size of $1.75 billion) that will be going out of patent protection in FY2015.

We expect revenue and profit CAGR of 21% and 26% respectively over FY2014-16.

Maruti Suzuki 2,916 31.6 25.3 19.1 14.1 15.5 17.8 3,500 20

Remarks: Maruti Suzuki India Ltd (MSIL) is the market leader in the domestic passenger vehicle industry. In FY2014, as

against an industry decline of 6.6%, MSIL was able to retain volumes at the previous years levels and in the

process expanded market share by 270BPS to 42.1%.

It has further strengthened its sales and service network. Additionally, the drive by the companys management

to tap the potential in rural areas paid rich dividends in difficult times for the industry and against rising competitive

intensity; this reaffirms the resilience of MSILs positioning and business model.

The recent launch of Celerio has been well received by the market and the new automatic manual transmission

facility has especially enthused the market. MSIL has a pipeline of new launches over the next few years with the

most important being the entry into the compact utility vehicle and light commercial vehicle segments.

We expect customer sentiment to improve on the back of a strong government at the centre. Additionally, the

passenger vehicle segment is expected to benefit from the pent-up demand over the past two years due to

deferred purchases. MSIL will benefit the most due to its high market share in the entry-level segment. We

remain positive on the stock with a price target of Rs3,500.

6

September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Persistent Systems 1,301 20.9 16.8 14.3 22.3 23.1 22.7 1,400 8

Remarks: Persistent Systems Ltd (PSL) has proven expertise and an early movers advantage in the digital technologies

(Social, Mobile Analytics and Cloud; SMAC). Additionally, strength to improve its IP base and the best-in-the-class

margin profile set it apart from the other mid-cap IT companies.

The distinctive advantage of PSLs lies in its SMAC-oriented business model (a big growth area), strong balance

sheet (Rs663 crore, at 41% of the balance sheet size) and good corporate governance.

Despite trading at a valuation (trading at 14.3x FY2016E earnings) that is closer to that of the large-cap IT

companies after a steep re-rating in the last six months, PSL continues to attract investors interest (FIIs have

increased the stake in the company from 20.6% in March 2014 to 27.4% in June 2014). Given the huge potential in

the SMAC space, we see PSL as a long-term value creator for investors.

Reliance Industries 1,014 14.6 13.7 12.3 11.3 10.9 11.0 1,190 17

Remarks: Reliance Industries Ltd (RIL) has a strong presence in the refining, petrochemical and upstream exploration

businesses. The refining division of the company is the highest contributor to its earnings and is operating efficiently

with a better gross refining margin (GRM) compared with its peers in the domestic market due to the ability of its

plant to refine more of heavier crude. However, the gas production from the Krishna-Godavari-D6 (KG-D6) field

has fallen significantly in the last two years. With the government approval for additional capex in its allocated

gas fields, we believe, the production will improve going ahead.

Though there is uncertainty prevailing on gas production and pricing of gas from the KG-D6 field, but the traction

in volume from shale gas assets is playing positively for the company. Moreover, the upcoming incremental

capacities in the petrochemical and refinery businesses are going to drive the future earnings growth as the

downstream businesses are on the driving seat and contributing the lions share of the profitability and cash flow.

Hence, the uncertainty related to the domestic gas production and pricing is having a limited material impact.

In recent past there have been signs of improvement in the benchmark GRM which suggests that there could be

a healthy improvement in the GRM of RIL too. The stock is available at a price/earnings of 12.3x its FY2016E

earnings per share, which is attractive considering the size, strong balance sheet and cash flow generating ability

of the company.

7 September 2014

Sharekhan

sharekhan top picks

Name CMP PER (x) RoE (%) Price Upside

(Rs) FY14 FY15E FY16E FY14 FY15E FY16E target (Rs) (%)

Salzer Electronics 137 16.7 10.6 7.4 9.0 13.1 16.7 175 28

Remarks: Salzer Electronics Ltd (SEL) was established in 1985 as an electrical installation product manufacturer having

more than 15 different products. SEL is a market leader in rotary switches, toroidal transformers and wire ducts.

Larsen and Tuobro (L&T) is the single largest shareholder of the company with a 26% stake and two directors on

the companys board. Further, SEL has a marketing tie-up with L&T and derives around 40% of its total revenues

through the L&T channel. The other big clients of the company include General Electric and Schneider Electric.

With a gradual revival in the domestic capex cycle in the key industries and improvement in project spending, the

management expects a strong growth (a CAGR of over 20%) in the earnings in the next two to three years. Apart

from the top line growth, we expect the margin to expand as well as the operating leverage to kick in over the

coming years. After stagnant earnings during FY2012-14, the company is well poised to deliver around 50% CAGR

over FY2014-16.

At the current market price of Rs137, the stock trades at 10.6x and 7.4x FY2015E and FY2016E based on our quick

earnings estimates. SEL is a consistent dividend paying company with a pay-out of around 20% (the company

maintained the pay-out ratio even when the earnings growth was muted). Given the significant improvement in

the earnings and the fact that L&T is its the largest shareholder and marketing partner, we believe SEL deserves

a better valuation multiple.

Zee Entertainment 285 30.6 28.8 21.9 20.6 19.1 22.3 367 29

Remarks: Among the key stakeholders of the domestic TV industry, we expect the broadcasters to be the prime beneficiary

of the mandatory digitisation process initiated by the government. The broadcasters would benefit from higher

subscription revenues at the least incremental capex as the subscriber declaration improves in the cable industry.

The management maintains that the advertisement spending will continue to grow in double digits going ahead

and ZEEL will be able to outperform the same. The growth in the advertisement spending will be driven by an

improvement in the macro-economic factors and the fact the ZEEL is well placed to capture the emerging

opportunities being a leader in terms of market share.

ZEEL is well placed to benefit from the ongoing digitisation theme and the overall recovery in the macro economy.

Also, the phase-wise rate hikes in the channel rates would augur well for the subscription revenues. We maintain

our Buy rating on the stock with a price target of Rs367.

Disclaimer

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain

confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for

the purchase or sale of any financial instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its

subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or

other reasons that may prevent SHAREKHAN and affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is

prepared for assistance only and is not intended to be and must not alone betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this

document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described

herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such

restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities

mentioned or related securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no

event shall SHAREKHAN, any of its affiliates or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made

herein are those of the analyst and do not necessarily reflect those of SHAREKHAN.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Вам также может понравиться

- Steering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryОт EverandSteering & Steering Parts (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryОценок пока нет

- TopPicks 020820141Документ7 страницTopPicks 020820141Anonymous W7lVR9qs25Оценок пока нет

- Freight Forwarding Revenues World Summary: Market Values & Financials by CountryОт EverandFreight Forwarding Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapДокумент7 страницSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaОценок пока нет

- Sharekhan Top PicksДокумент7 страницSharekhan Top PicksLaharii MerugumallaОценок пока нет

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapДокумент7 страницSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriОценок пока нет

- SharekhanTopPicks 31082016Документ7 страницSharekhanTopPicks 31082016Jigar ShahОценок пока нет

- Sharekhan Top Picks: October 01, 2011Документ7 страницSharekhan Top Picks: October 01, 2011harsha_iitmОценок пока нет

- Stock Market Today Tips - Book Profit On The Stock CMCДокумент21 страницаStock Market Today Tips - Book Profit On The Stock CMCNarnolia Securities LimitedОценок пока нет

- Sharekhan Top Picks: October 26, 2012Документ7 страницSharekhan Top Picks: October 26, 2012Soumik DasОценок пока нет

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapДокумент7 страницSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapchetanjecОценок пока нет

- 4QFY14E Results Preview: Institutional ResearchДокумент22 страницы4QFY14E Results Preview: Institutional ResearchGunjan ShethОценок пока нет

- Top PicksДокумент7 страницTop PicksKarthik KoutharapuОценок пока нет

- Finolex Cables-Initiating Coverage 22 Apr 2014Документ9 страницFinolex Cables-Initiating Coverage 22 Apr 2014sanjeevpandaОценок пока нет

- Fresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Документ10 страницFresh Capacities To Drive Growth Buy: Rating: Buy Target Price: 1,310 Share Price: 970Vidhi MehtaОценок пока нет

- JK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97Документ4 страницыJK Lakshmi Cement: Capacity Expansion With Favourable Macro Environment To Drive Earnings CMP: Rs97ajd.nanthakumarОценок пока нет

- Sharekhan Top Picks: January 01, 2013Документ7 страницSharekhan Top Picks: January 01, 2013Rajiv MahajanОценок пока нет

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesДокумент20 страницIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedОценок пока нет

- Top Picks: Research TeamДокумент30 страницTop Picks: Research TeamPooja AgarwalОценок пока нет

- Smart Gains 42 PDFДокумент4 страницыSmart Gains 42 PDF476Оценок пока нет

- Zee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Документ3 страницыZee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Marutisinh RajОценок пока нет

- Sharekhan Top Picks: April 03, 2010Документ6 страницSharekhan Top Picks: April 03, 2010Kripansh GroverОценок пока нет

- SBI Securities Morning Update - 13-01-2023Документ7 страницSBI Securities Morning Update - 13-01-2023deepaksinghbishtОценок пока нет

- Stock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Документ20 страницStock Investment Tips Recommendation - Buy Stocks of Shree Cement With Target Price Rs.4791Narnolia Securities LimitedОценок пока нет

- Investment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysДокумент25 страницInvestment Funds Advisory Today - Buy Stock of UltraTech Cement LTD, DB Corp and InfosysNarnolia Securities LimitedОценок пока нет

- EPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentДокумент4 страницыEPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentpriyaranjanОценок пока нет

- Sharekhan Top Picks: February 02, 2013Документ7 страницSharekhan Top Picks: February 02, 2013nit111Оценок пока нет

- Investor Update (Company Update)Документ34 страницыInvestor Update (Company Update)Shyam SunderОценок пока нет

- India Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Документ23 страницыIndia Equity Analytics For Today - Buy Stocks of CMC With Target Price From Rs 1490 To Rs 1690.Narnolia Securities LimitedОценок пока нет

- Amara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Документ8 страницAmara Raja Batteries: CMP: INR861 TP: INR1,100 (+28%)Harshal ShahОценок пока нет

- Rambling Souls - Axis Bank - Equity ReportДокумент11 страницRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriОценок пока нет

- Research Scorecard: December 2015Документ46 страницResearch Scorecard: December 2015senkum812002Оценок пока нет

- India Equity Analytics Today: Buy Stock of KPIT TechДокумент24 страницыIndia Equity Analytics Today: Buy Stock of KPIT TechNarnolia Securities LimitedОценок пока нет

- IEA Report 13th DecemberДокумент23 страницыIEA Report 13th DecembernarnoliaОценок пока нет

- 10 MidcapsДокумент1 страница10 MidcapspuneetdubeyОценок пока нет

- La Opala RG - Initiating Coverage - Centrum 30062014Документ21 страницаLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaОценок пока нет

- Sinindus 20110913Документ9 страницSinindus 20110913red cornerОценок пока нет

- Sharekhan Top Picks: November 30, 2012Документ7 страницSharekhan Top Picks: November 30, 2012didwaniasОценок пока нет

- 1 - 0 - 08072011fullerton Escorts 7th July 2011Документ5 страниц1 - 0 - 08072011fullerton Escorts 7th July 2011nit111Оценок пока нет

- Infosys Tech - HSBC - Buy - Oct 2010Документ8 страницInfosys Tech - HSBC - Buy - Oct 2010bob7878Оценок пока нет

- Top Picks Sep 2012Документ15 страницTop Picks Sep 2012kulvir singОценок пока нет

- Market Outlook 11th October 2011Документ5 страницMarket Outlook 11th October 2011Angel BrokingОценок пока нет

- IEA Report 31st JanuaryДокумент24 страницыIEA Report 31st JanuarynarnoliaОценок пока нет

- IDirect MuhuratPicks 2014Документ8 страницIDirect MuhuratPicks 2014Rahul SakareyОценок пока нет

- IT Sector Update 24-09-12Документ20 страницIT Sector Update 24-09-12Pritam WarudkarОценок пока нет

- Wealth Creator StocksДокумент18 страницWealth Creator Stocksshishir_ghatgeОценок пока нет

- Opening Bell: Market Outlook Today's HighlightsДокумент7 страницOpening Bell: Market Outlook Today's HighlightsBharatОценок пока нет

- NCL Industries (NCLIND: Poised For GrowthДокумент5 страницNCL Industries (NCLIND: Poised For GrowthDinesh ChoudharyОценок пока нет

- SharekhanTopPicks 070511Документ7 страницSharekhanTopPicks 070511Avinash KowkuntlaОценок пока нет

- AnandRathi Relaxo 05oct2012Документ13 страницAnandRathi Relaxo 05oct2012equityanalystinvestorОценок пока нет

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsДокумент9 страницMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaОценок пока нет

- Axis Enam MergerДокумент9 страницAxis Enam MergernnsriniОценок пока нет

- RHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Документ4 страницыRHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Rhb InvestОценок пока нет

- RHB Equity 360° - 02/03/2010Документ4 страницыRHB Equity 360° - 02/03/2010Rhb InvestОценок пока нет

- RHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Документ5 страницRHB Equity 360°: (Parkson, KLK, AirAsia, Tan Chong, APM, Carlsberg, Hunza Technical: KLK, AFG) - 19/08/2010Rhb InvestОценок пока нет

- Two-Wheelers Update 27aug2014Документ12 страницTwo-Wheelers Update 27aug2014Chandreyee MannaОценок пока нет

- RHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Документ4 страницыRHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Rhb InvestОценок пока нет

- Top Recommendation - 140911Документ51 страницаTop Recommendation - 140911chaltrikОценок пока нет

- IEA Report 19th JanuaryДокумент28 страницIEA Report 19th JanuarynarnoliaОценок пока нет

- Investors' Presentation (Company Update)Документ28 страницInvestors' Presentation (Company Update)Shyam SunderОценок пока нет

- UG To 2002 ISDA Master AgreementДокумент104 страницыUG To 2002 ISDA Master Agreementrohitkhanna1180Оценок пока нет

- Gail (India) Firstcall 150914Документ14 страницGail (India) Firstcall 150914rohitkhanna1180Оценок пока нет

- Indian Automotive Industry: Expectation Survey 2014Документ32 страницыIndian Automotive Industry: Expectation Survey 2014Sandeep MauriyaОценок пока нет

- CCL Products Initiating Coverage Sep 14 EDEL PDFДокумент35 страницCCL Products Initiating Coverage Sep 14 EDEL PDFrohitkhanna1180Оценок пока нет

- BUY BUY BUY BUY: Aditya Birla Nuvo LTDДокумент12 страницBUY BUY BUY BUY: Aditya Birla Nuvo LTDrohitkhanna1180Оценок пока нет

- A-Z of Plastics Manufacturing ProcessesДокумент3 страницыA-Z of Plastics Manufacturing Processesrohitkhanna1180Оценок пока нет

- Crompton Greaves: Riding A New MustangДокумент14 страницCrompton Greaves: Riding A New Mustangrohitkhanna1180Оценок пока нет

- MetalsMagazine 2 2018 PDFДокумент116 страницMetalsMagazine 2 2018 PDFJack 123Оценок пока нет

- Motorola Droid 2Документ11 страницMotorola Droid 2Likith MОценок пока нет

- FBL ManualДокумент12 страницFBL Manualaurumstar2000Оценок пока нет

- IEC947-5-1 Contactor Relay Utilization CategoryДокумент1 страницаIEC947-5-1 Contactor Relay Utilization CategoryipitwowoОценок пока нет

- 2.1 Article On Reasonable Compensation Job Aid 4-15-2015Документ3 страницы2.1 Article On Reasonable Compensation Job Aid 4-15-2015Michael GregoryОценок пока нет

- Diodat PDFДокумент4 страницыDiodat PDFFatmir KelmendiОценок пока нет

- Chapter 1. GOVERNMENT SUPPORT FOR INVENTIONSДокумент26 страницChapter 1. GOVERNMENT SUPPORT FOR INVENTIONSKlifford GaliciaОценок пока нет

- Strategic Issues of Information TechnologyДокумент23 страницыStrategic Issues of Information TechnologySamiksha SainiОценок пока нет

- U90 Ladder Tutorial PDFДокумент72 страницыU90 Ladder Tutorial PDFMarlon CalixОценок пока нет

- Business and Finance TerminologyДокумент15 страницBusiness and Finance TerminologyKat KatОценок пока нет

- HSTE User GuideДокумент26 страницHSTE User GuideAnca ToleaОценок пока нет

- 3-DatAdvantage Advanced Installation For NAS and Linux Platforms 8.6Документ47 страниц3-DatAdvantage Advanced Installation For NAS and Linux Platforms 8.6yaritzaОценок пока нет

- Moot Problem FinalДокумент2 страницыMoot Problem FinalHimanshi SaraiyaОценок пока нет

- PV1800VPM SEREIS (1-5KW) : Pure Sine Wave High Frequency Solar Inverter With MPPT InsideДокумент4 страницыPV1800VPM SEREIS (1-5KW) : Pure Sine Wave High Frequency Solar Inverter With MPPT InsideHuber CallataОценок пока нет

- Allama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Документ2 страницыAllama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Tehmina HanifОценок пока нет

- Ultrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedДокумент2 страницыUltrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedhaujesОценок пока нет

- LTE Radio Network Design Guideline (FDD)Документ33 страницыLTE Radio Network Design Guideline (FDD)Tri Frida NingrumОценок пока нет

- Hydraulic Power Unit: RE 51057, Edition: 2020-11, Bosch Rexroth AGДокумент20 страницHydraulic Power Unit: RE 51057, Edition: 2020-11, Bosch Rexroth AGHanzil HakeemОценок пока нет

- 6 Elements of A Healthy ChurchДокумент2 страницы6 Elements of A Healthy ChurchJayhia Malaga JarlegaОценок пока нет

- Depreciation Is A Term Used Reference To TheДокумент14 страницDepreciation Is A Term Used Reference To TheMuzammil IqbalОценок пока нет

- L11 Single Phase Half Controlled Bridge ConverterДокумент19 страницL11 Single Phase Half Controlled Bridge Converterapi-19951707Оценок пока нет

- PepsiCo Strategic Plan Design PDFДокумент71 страницаPepsiCo Strategic Plan Design PDFdemereОценок пока нет

- PF2579EN00EMДокумент2 страницыPF2579EN00EMVinoth KumarОценок пока нет

- Auto Setting DataДокумент6 страницAuto Setting Datahalo91Оценок пока нет

- Catalog Electrical Products en - 339 - 1Документ20 страницCatalog Electrical Products en - 339 - 1H 8CОценок пока нет

- GFCO Certification ManualДокумент72 страницыGFCO Certification Manualatila117Оценок пока нет

- Procter & Gamble Global Geothermal Screening Study FINAL 9 Feb 2023Документ56 страницProcter & Gamble Global Geothermal Screening Study FINAL 9 Feb 2023Mohammad Syahir JamaluddinОценок пока нет

- HP Training Diagnostics 75 Usage and AdministrationДокумент2 страницыHP Training Diagnostics 75 Usage and AdministrationraviskskskОценок пока нет

- Electronics World 1962 11Документ114 страницElectronics World 1962 11meisterwantОценок пока нет

- Basic Principles of Immunology: Seminar OnДокумент43 страницыBasic Principles of Immunology: Seminar OnDr. Shiny KajalОценок пока нет

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesОт EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesРейтинг: 5 из 5 звезд5/5 (1636)

- Summary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityОт EverandSummary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityОценок пока нет

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsОт EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsРейтинг: 4.5 из 5 звезд4.5/5 (386)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessОт EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessРейтинг: 5 из 5 звезд5/5 (456)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesОт EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesРейтинг: 4.5 из 5 звезд4.5/5 (274)

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsОт EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsРейтинг: 4.5 из 5 звезд4.5/5 (709)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessОт EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessОценок пока нет

- Summary of 12 Rules for Life: An Antidote to ChaosОт EverandSummary of 12 Rules for Life: An Antidote to ChaosРейтинг: 4.5 из 5 звезд4.5/5 (294)

- Summary of Eat to Beat Disease by Dr. William LiОт EverandSummary of Eat to Beat Disease by Dr. William LiРейтинг: 5 из 5 звезд5/5 (52)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursОт EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursОценок пока нет

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaОт EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Summary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsОт EverandSummary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsОценок пока нет

- Chaos: Charles Manson, the CIA, and the Secret History of the Sixties by Tom O'Neill: Conversation StartersОт EverandChaos: Charles Manson, the CIA, and the Secret History of the Sixties by Tom O'Neill: Conversation StartersРейтинг: 2.5 из 5 звезд2.5/5 (3)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeОт EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeРейтинг: 4.5 из 5 звезд4.5/5 (128)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindОт EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindРейтинг: 4.5 из 5 звезд4.5/5 (57)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryОт EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryРейтинг: 5 из 5 звезд5/5 (557)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningОт EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningРейтинг: 4.5 из 5 звезд4.5/5 (55)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessОт EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessРейтинг: 4.5 из 5 звезд4.5/5 (328)

- Summary of The Algebra of Wealth: A Simple Formula for Financial SecurityОт EverandSummary of The Algebra of Wealth: A Simple Formula for Financial SecurityРейтинг: 4 из 5 звезд4/5 (1)

- Extreme Ownership by Jocko Willink and Leif Babin - Book Summary: How U.S. Navy SEALS Lead And WinОт EverandExtreme Ownership by Jocko Willink and Leif Babin - Book Summary: How U.S. Navy SEALS Lead And WinРейтинг: 4.5 из 5 звезд4.5/5 (75)

- The 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageОт EverandThe 5 Second Rule by Mel Robbins - Book Summary: Transform Your Life, Work, and Confidence with Everyday CourageРейтинг: 4.5 из 5 звезд4.5/5 (329)

- Summary of Atomic Habits by James ClearОт EverandSummary of Atomic Habits by James ClearРейтинг: 5 из 5 звезд5/5 (170)

- Summary of Miracle Morning Millionaires: What the Wealthy Do Before 8AM That Will Make You Rich by Hal Elrod and David OsbornОт EverandSummary of Miracle Morning Millionaires: What the Wealthy Do Before 8AM That Will Make You Rich by Hal Elrod and David OsbornРейтинг: 5 из 5 звезд5/5 (201)

- Blink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingОт EverandBlink by Malcolm Gladwell - Book Summary: The Power of Thinking Without ThinkingРейтинг: 4.5 из 5 звезд4.5/5 (114)

- Summary of "Measure What Matters" by John Doerr: How Google, Bono, and the Gates Foundation Rock the World with OKRs — Finish Entire Book in 15 MinutesОт EverandSummary of "Measure What Matters" by John Doerr: How Google, Bono, and the Gates Foundation Rock the World with OKRs — Finish Entire Book in 15 MinutesРейтинг: 4.5 из 5 звезд4.5/5 (62)

- Summary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsОт EverandSummary of The Galveston Diet by Mary Claire Haver MD: The Doctor-Developed, Patient-Proven Plan to Burn Fat and Tame Your Hormonal SymptomsОценок пока нет

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryОт EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryРейтинг: 4.5 из 5 звезд4.5/5 (91)

- The Effective Executive by Peter Drucker - Book Summary: The Definitive Guide to Getting the Right Things DoneОт EverandThe Effective Executive by Peter Drucker - Book Summary: The Definitive Guide to Getting the Right Things DoneРейтинг: 4.5 из 5 звезд4.5/5 (19)