Академический Документы

Профессиональный Документы

Культура Документы

DSK Budget Highlights 2014-15

Загружено:

KB_mitАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

DSK Budget Highlights 2014-15

Загружено:

KB_mitАвторское право:

Доступные форматы

BUDGET 2014 HIGHLIGHTS

Table of Contents

Direct Tax es

Indi vi dual Taxati on

Corporate Taxati on

Internati onal Taxati on

Indirect Taxes

Servi ce Tax

Exci se Duty

Customs Duty

Direct Tax

Individual Taxation

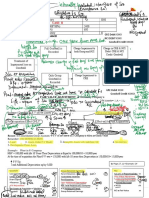

Income Tax Rates for the year ending March 31, 2015,

effective upon the enactment by the parliament:

Individuals (resident as well as non residents):

Total income Rate

Not exceeding Rs 250,000 Nil

Over Rs 250,000 but not exceeding Rs 500,000 10%

Over Rs 500,000 but not exceeding Rs 1,000,000 20%

Over Rs 1,000,000 30%

Residents above the age of sixty years but less than eighty

years:

Total income Rate

Not exceeding Rs 300,000 Nil

Over Rs 300,000 but not exceeding Rs 500,000 10%

Over Rs 500,000 but not exceeding Rs 1,000,000 20%

Over Rs 1,000,000 30%

Residents above the age of eighty years:

Total income Rate

Not exceeding Rs 500,000 Nil

Over Rs 500,000 but not exceeding Rs 1,000,000 20%

Over Rs 1,000,000 30%

Surcharge and education cess rates are the same as was in

previous year.

The investment limit for deduction under section 80C has been

increased from Rs. 100,000 to Rs. 150,000.

The deduction on account of interest paid on housing loan for

self-occupied property has been increased from Rs. 150,000 to

Rs. 200,000.

Earlier, in case, an individual or a HUF was not be liable to

capital gain tax if he/it invested the gain arising from transfer

of resident property or any other capital assets, in a residential

house. Now it has been proposed that investment can be made

only in one resident and that only in India.

Corporate Taxation:

There is no change in the corporate tax rates.

It has been clarified that expenditure incurred by the assessee

for corporate social responsibility clause of the Companies Act,

2013 shall not be allowed as deduction from business income.

Relief to FIIs: Any security held by FIIs in accordance with

SEBI regulations shall be treated as capital assets and

therefore, any gain arising from transfer of such securities shall

be liable to capital gain tax. So the profit shall be categorised

as capital gain or business income has now been resolved.

Business Income

Deduction in respect of Investment in new plant or machinery:

In order to boost the manufacturing sector, it has been

proposed to allowed additional deduction of 15% to a

manufacturing company, on the amount of actual cost of new

plant & machinery, if the investment in such new assets

exceeds Rs. twenty five crores (Indian rupees 250 million).

Earlier the limit was Rs one hundred crore (Indian rupees one

billion). The deduction is available only in the year when the

new assets have been acquired. Further, this deduction shall

be available only up to Financial Year 2016-17.

Section 35AD allows deduction in respect of the whole of

capital expenditure incurred wholly or exclusively, for the

purpose of specified business. Now the business in the nature

of laying and operating a slurry pipeline for the transportation

of iron ore and setting up and operating a semi-conductor

wafer fabrication manufacturing unit have also been proposed

to be included in the category of specified business. Besides

an additional condition regarding use of such capital assets for

a minimum period of eight years has also been proposed.

It has been proposed that the deduction under section 80IA

shall be available to an undertaking, which (i) is setup for

generation or generation and distribution of power, (ii) starts

transmission or distribution lines, or (iii) undertakes substantial

renovation and modernization of existing network of

transmission or distribution lines, on or before 31st March

2017. Earlier the dead line was 31st March 2014.

MAT: It has also been proposed that In case of MAT (as

applicable to an assessee other than a company), the

deduction allowed under Section 35AD (after reducing the

amount of allowable depreciation) shall be added back in total

income for the purpose of calculating MAT.

Transfer Pricing

It has been proposed that the advance pricing agreement

entered between the CBDT and assessee may provide for the

conditions, procedure and manner, so that it can also apply for

determining the arms length price during any period not

exceeding four previous years preceding the first previous year

for which the agreement is being effective.

Withholding Tax

Earlier, no deduction of expense was allowable while

calculating business profit, in case the assesse fails to withhold

tax while making payment of such expenses or fails to deposit

the tax so withheld. Now, it has been proposed that in case of

payment to non-resident, the payment can be made on or

before the due date for filing the income tax return. Further, in

case of payment to a resident, only 30% of such expense shall

be disallowed as deduction instead of 100% of the expense

provided earlier.

The money (including the bonus) to be received under a life

insurance policy, if not exempt from tax shall be liable to

withholding of tax at the rate of 2%. However, no withholding

shall be made if the money does not exceed Rs. one (1) lakh

(Indian rupees hundred thousand)

The Indian company is liable to withholding tax at the rate of

5% on the interest payable in respect of money borrowed in

foreign currency, under a loan agreement or long-term

infrastructure bonds, on or before 1st July 2015. Now the

benefit of lower tax has been extended to loan or long term

bonds (including infrastructure bonds) taken on or before 1st

July 2017.

Capital Gain

Earlier any transfer of shares, listed securities or units etc.,

which is held by the assessee for less than twelve (12) months

were treated as short term capital assets. Now, only the listed

securities and the units of equity oriented fund, which is held

for less than twelve (12) months were treated as short term

capital assets. In all other cases, the time period shall be thirty

six (36) months.

Earlier the long term capital gain in case of listed securities or

units or zero coupon bonds was liable to 10% capital gain tax

in case the benefit of indexation is not availed. Now, this

benefit is restricted only to listed securities (other than units)

or zero coupon bonds. It means that units (mutual funds units)

shall be liable to capital gain tax at normal rate i.e. 20%.

The transfer of capital asset, being government security

carrying periodic interest, by a non-resident to a non-resident

outside India, shall not be treated as transfer and therefore,

shall not be liable to capital gain tax.

Other Provisions

Dividend From a Foreign Company: The dividend income

received by an Indian company, up to Financial Year 2013-14,

from a foreign company in which the Indian company holds

26% or more shares was chargeable to tax at the rate of 15%

in the hands of Indian company. Now it has been proposed to

done away with this sunset date.

Dividend Distribution Tax: It has been proposed that for the

purpose of calculating DDT or the tax on distributed income to

the unit holders by a mutual fund, the tax shall be grossed up

for the purpose of calculating tax.

Forfeited Advance Money: Any money, taken as advance for

transfer of capital assets, in case forfeited, shall be treated as

income from other source. Now, this advance so forfeited

shall not be deducted from the cost of acquisition for the

purpose of calculating capital gain.

It has been proposed that every mutual fund, securitization

trust, venture capital company or venture capital fund shall be

liable to file its return of income, if its income exceeds

maximum amount which is not chargeable to tax without

giving effect to the exemption under Section 10 of the Income

Tax Act.

Business Trust

A trust registered as an infrastructure investment trust or a

real estate investment trust under the SEBI regulations and

whose units are listed on a recognized stock exchange shall be

termed as Business Trust. Such trust shall acquire the income

bearing assets by acquiring controlling or other specified assets

in an Indian SPV from the sponsor.

The units of Business Trust to be allotted to the sponsor in

exchange of shares of SPV shall not be regarded as transfer

and therefore, shall not be liable to capital gain tax.

For the purpose of calculating capital gain, at the time of

transfer of units of Business Trust by the sponsor, the time

period of holding the shares in the SPV shall be added in the

time period of holding the units in the Business Trust. Similarly,

the cost of acquisition of the Units in the Business Trust, shall

be the cost at which the shares in the SPV were acquired by

the sponsor.

In case of transfer of units of the Business Trust by the

sponsor is liable to security transaction tax (STT):

the long term capital gain shall not be exempt from tax

the short term capital gain shall be liable to normal rate of

tax (and not he reduced rate of 15%)

The income to be distributed by the Business Trust to the unit

holder shall have the pass through status. That means:

Interest Income shall be exempt in the hands of Business

Trust, but shall be liable to tax in the hands of unit holder.

The capital gain shall be chargeable in the hands of

Business Trust at the maximum marginal rate, however the

portion of capital gain (as distributed to the unit holders)

shall be exempt in the hands of unit holders.

The interest income to be distributed to unit holder by the

Business Trust shall be liable to withholding of tax at the rate

of:

5% - where the interest is distributed to a non-resident; or

10% - where the interest is distributed to a resident.

The Business Trust shall be liable to file income tax return.

The transfer of units of Business Trust by the unit holder shall

be liable to capital gain tax in the same manner as are listed

securities.

Indirect Tax

Service Tax

Rate of Service Tax has not been changed.

The basic threshold limit has not been changed.

Legislative changes

Amendments in Exemption Notification No. 25/2012

dated 20.06.2012(w.e.f. 11.07.2014):

Services provided by operators of the common Bio Medical

Waste Treatment Facility to a clinical establishment are

now exempted.

Services provided by Indian tour operator to a foreign

tourist in relation to tour conducted wholly outside India

are included in the exemption notification.

Services provided by way of technical testing or analysis of

newly developed drugs by a clinical research institute

approved by Drug Controller General of India is made

taxable.

Services provided to RBI from outside India in relation to

management of foreign exchange services.

Exemption is extended to services of accommodation for

residential purpose by any non-commercial dharamshalas

etc. which have declared tariff less than Rs. One thousand

per day.

Changes in Negative List (w.e.f. notification after

assent of president):

Service provided by radio taxis is included in the service

tax net. Service tax will be charged on abated value of

40%.

Selling of space for advertisement in any form other than

print media is brought under the service tax net. (Print

media does not include business directories, yellow pages

and trade catalogues meant for commercial purpose)

Service Tax Rule (w.e.f. 01.10.2014)

Every Service Tax assessee has to pay service tax through

internet banking.

Reverse Charge (w.e.f. 11.07.2014)

Services by a non-executive director to any company were

under reverse charge. Now the scope has been widened to

include non-executive directors of Body Corporate.

Services provided by recovery agents to banks and NBFC

are covered under reversed charge to the extent of 100%.

In respect of non-abated renting of motor vehicle for

transporting passenger, the ratio of payment of service tax

has been made 50% by service provider and 50 % by

service receiver.

Rate of Interest on Delayed Payment of Service Tax

(w.e.f. 01.10.2014)

The rate of interest on delayed payment of Service Tax has

been revised as under:

Sr. No. Period Of delay Rate of simple interest

1. Upto 6 months 18 %

2. More than 6 months

and upto 1 year

18 % for the first six

months and 24 % for the

delay beyond 6 months.

3. More than one year 18 % for the first six

months and 24 % for the

delay beyond 6 months and

30% for any delay beyond

1 year.

All pending dues (whether in litigation or not) will be

applied new interest rates after 01.10.2014. Thus, any

dues which are pending payment since one year as on

01.10.2014 will attract 30% interest rate.

3% concession to small scale service providers is retained.

Point of Taxation (w.e.f. 01.10.2014)

The point of taxation in respect of reverse charge will be

payment date or the first day after a period of three

months from the date of invoice, whichever is earlier.

(Applicable to invoices issued after 01.10.2014 only)

For the invoices issued prior to 01.10.2014, if payment is

made in 6 months, the point of taxation shall be date of

payment. Otherwise, the date of invoice shall be the point

of taxation.

Place of Provision of Service Rules (w.e.f. 01.10.2014)

Under Rule 4, a machine temporarily imported for repair in

India continues to enjoy exemption and the procedure is

further simplified.

In Rule 9(c), changes have been made to include

intermediary of goods. Thereby, commission agent or

consignment agent will now be covered under Rule 9(c)

and the place of provision of service shall be location of

such commission or consignment agent.

Services consisting of hiring of vessels & aircrafts

(excluding yachts) will be covered under general rule 3 and

place of provision shall be location of service receiver.

Determination of Value Rules, 2006 (w.e.f. 01.10.2014)

In Rule 2A, value of service portion in works contract of

repair maintenance of movable and immovable property

OR any other works contract (other than original works

contract) has been reconciled and the same shall be 70%

of the total amount.

Amendments in Act (w.e.f. notification after assent of

president):-

Under Section 80 of the Finance Act, 1994 benefit of

waiver of penalty under Section 78 has been withdrawn.

The definition of Private Limited Company has been

adopted for Service tax from Companies Act, 2013.

Similarly definition of resident has been adopted from

Income Tax Act, 1961.

Input Service Distribution

Rule 7 of the CENVAT Credit Rules has been clarified to

state that the accumulated credit can be distributed to all

the units of the assessee irrespective of fact that the

service was not used in any particular unit, subject to

compliance of other conditions.

Central Excise

Rate of Duty

Peak rate of Excise Duty has been not been changed.

Legislative changes

Section 15A has been inserted in the Act so as to empower

the Central Government to create a Nodal Agency to seek

information regarding an assessee from any other specified

Government agency/office like Income Tax Authority, VAT

Authorities, Electricity Board, Registrar of Companies etc.

in a specified time limit. It is also proposed to insert

Section 15B, which provides for imposition of penalty to

the extent of Rs. 100 for each day of default, if desired

information is not submitted.

Section 23A of the Act has been amended so as to include

the resident private limited company to apply for advance

ruling before the Advance Ruling Authority. Earlier the said

facility was available to the non-residents.

Similar amendments have been carried out in the

corresponding provisions of Customs Act.

Section 32E has been amended to allow filing of

applications before Settlement Commission subject to its

satisfaction in cases where applicant has not filed the

return. Earlier it was prohibited under the Act.

Section 35B has been amended so as to increase the

discretionary powers of the tribunal to refuse to hear the

appeal involving duty amount less than Rs. 2 Lakhs.

Earlier, the prescribed amount was Rs. 50,000.

Similar amendments have been carried out in the

corresponding provisions of Customs Act.

New Section 35F has been inserted whereby, a

requirement of mandatory pre-deposit of 7.5% of the duty

demanded or penalty imposed or both have been made for

the purpose of filing of appeal before the first appellate

authority and a deposit of 10% of the aforesaid amount for

filing before the 2nd appellate authority has been made. A

cap of Rs.10 crores has been placed on such pre-deposit.

As a result of this amendment, mechanism of filing stay

applications before Commissioner (Appeals) and Tribunal

has been done away with.

Similar amendments have been carried out in the

corresponding provisions of Customs Act.

An amendment has been made in Section 35L which

relates to filing of appeal before the Supreme Court of

India. Now it has been clarified that determination of

disputes related to taxability or excisablity of goods is

covered under the term determination of any-question

having a relation to rate of duty. The said amendment

would help in avoiding uncalled for litigation before the

High Courts on the issue related to excisability.

Other Amendments

Amendment has been made in Rule 8(1B) of Central Excise

Rules, 2002, so as to make it mandatory for every assesse

to pay duty electronically through internet banking w.e.f

October 1, 2014. The Assistant Commissioner upon

satisfaction may allow payment through any other mode.

Further amendment has been made in Rule 8(3A) to make

provisions for imposition of penalty at the rate of 1% on

duty not paid for each month or part thereof during the

default period, which has been declared as payable in the

returns.

Amendment is made in Rule 6 of Central Excise Valuation

Rules. It has been provided that in cases where the

excisable goods are sold at a price less than the

manufacturing cost and profit and no additional

consideration is flowing, the value of such goods will be

treated as the transaction value for the purpose of

payment of excise duty. Primarily, this amendment has

been made effective to get over the ruling of Supreme

Court of India in the case of Fiat India.

Rule 2 (qa) has been inserted in the CENVAT Credit Rule,

2004, in order to define place of removal.

Rule 4 of the said rules has been amended w.e.f.

September 1, 2014, so as to provide that the manufacturer

or the output service provider shall not take the CENVAT

Credit after 6 Months of the date of issue of invoice/

document. Henceforth, there will be a limitation of 6

months to avail the credit, which was not present prior to

the amendment.

Rule 4 has been further amended so as to provide that in

case of services where service recipient is liable to pay

service tax, credit shall be allowed after the service tax is

paid. Further, in cases where service tax liability is partially

on the provider and partially on the recipient, credit in

respect of such services shall be allowed on or after the

day on which payment is made of the value of input

service and the service tax paid or payable.

Impact on Industry

Automobiles

Excise duty is being exempted on parts of tractors

removed from factories of a tractor manufacturer to

another factory of the same manufacturer.

Tobacco Products

Excise duty increased from 12 percent to 16 percent on

pan masala, from 50 percent to 55 percent on

unmanufactured tobacco and from 60 percent to 70

percent on gutkha and chewing tobacco.

Agriculture/ Agro- Processing

Basic excise duty is being reduced from 10% to 6% on

machinery for the preparation of meat, poultry, fruits, nuts

and vegetables and on similar machinery used in the

manufacture of wine, cider, fruit juices and similar

beverages, etc.

Textile

Excise duty on polyester staple fibre and polyester filament

yarn manufactured from plastic waste and scrap is being

exempted retrospectively w.e.f. June 29, 2010 to May, 5,

2012 and intermediate product Toe w.e.f. June 29, 2010

to July 10, 2014. Further, excise duty at the rate of 2%

(without CENVAT) or 6% (with CENVAT) has been imposed

on PSF and PFY manufactured from plastic waste and

scrap w.e.f. July 11, 2014.

Electronics

Excise duty on recorded smart cards has been increased to

12%.

Excise duty on Metal Core PCB and LED Driver used in the

manufacture of LED Lights has been reduced from 12% to

6%.

Renewable Energy

Full exemption from excise duty has been granted in

respect of machinery/ equipment, etc. required for setting

up solar energy production projects.

Exemption from excise duty has also been provided on

machinery, equipment etc., required for setting up of

compressed biogas plant (Bio-CNG).

Miscellaneous

Optional excise duty of 2% (without CENVAT) on writing

and printing paper for printing of educational textbooks

has been withdrawn and instead a uniform excise duty of

6% has been levied.

The scope of excise duty exemption, all goods supplied

against International Competitive Bidding has been

clarified, so as to state that the said exemption is also

available to the sub-contractors for manufacture and

supply of goods to the main contractor for the execution of

said product.

Full exemption from education cess and secondary &

higher education cess/ customs component is being

exempted on goods cleared by an EOU into the DTA

Customs

Rate of Duty

Peak rate of Basic Customs Duty has been not been

changed.

Legislative Changes

Section 8B of the Customs Tariff Act, 1975 has been

amended so as to provide for levy of safeguard duty on

inputs/ raw materials imported by an EOU and cleared into

DTA as such or are used in the manufacture of final

products, which are cleared into DTA.

Baggage rules have been amended to raise the free

baggage allowance to Rs. 35000 to Rs. 45000. Further,

duty free allowance has been reduced on cigarettes from

200 to 100, of cigars from 50-25 and of tobacco from 250

gms. to 125 gms.

Impact on Industry

Textile Industry

The BCD on raw materials for manufacture of spandex

yarn has been done away with.

The list of specified goods required by handicraft

manufacturer-exporter has been expanded to include wire

rolls.

Steel Industry

BCD on stainless steel flat products has been increased

from 5%-7.5%.

BCD on ships imported for breaking up has been reduced

from 10% to 5%.

Electronics

BCD on LCD and LED TV panels of below 19 inches has

been done away with. Further, BCD on specified parts of

LCD and LED Panels of TVs has also been exempted.

BCD on specified telecommunication products not covered

under the Information Technology Agreement has been

increased to 10%.

Special Additional Duty on all inputs/ components used in

the manufacture of personal computer (laptops/ desktops)

and tablet computers has been exempted subject to actual

user components.

Renewable Energy

Full exemption from Special Additional Duty has been

provided on parts and components required for the

manufacture of wind operated electricity generators.

BCD on machinery, equipment, etc., required for setting up

of solar energy production project has been reduced to

5%.

Concessional Custom Duty of 5% has been provided on

machinery, equipment, etc., required for setting up of

compressed biogas plant (Bio-CNG).

Infrastructure

State governments concerned are being notified as

sponsoring authority for Metro Rail Projects covered under

the Project Import Regulations, 1986.

The requirement of certification Ministry of Road Transport

or National Highway Authority of India for availing custom

duty exemption on specified goods required for

construction of roads has been done away with.

Contact Details: dsklegal.knowledgecenter@dsklegal.com

abhishek.baghel@dsklegal.com

Mumbai Office

1203, One Indiabulls Centre,

Tower 2, Floor 12B,

841, Senapati Bapat Marg

Elphinstone Road

Mumbai 400 013

India

Tel: (91 - 22) 6658 8000

Fax: (91 - 22) 6658 8001

Mumbai Office (Litigation)

C-16, Dhanraj Mahal,

3rd Floor, Apollo Bunder,

Colaba, Mumbai 400 001

India

Tel: (91 - 22) 6152 6000

Fax: (91 - 22) 6152 6001

Delhi Office

4 Aradhna Enclave,

R.K. Puram Sector 13

Opposite Hotel Hyatt,

New Delhi - 110 066

India

Phone : +91 11 66616666

Fax : +91 11 66616600

Disclaimer

The update is intended for your general information only. The

information and opinions contained in this document are derived from

public sources which we believe to be reliable and accurate but which,

without further investigation, cannot be warranted as to their accuracy,

completeness or correctness. It is not intended to be nor should be

regarded as legal advice and no one should act on such information

without appropriate professional advice. DSK Legal accepts no

responsibility for any loss arising from any action taken or not taken by

anyone using this material.

Вам также может понравиться

- S. NO - House/Stat E Tenure From Tenure TO Assemb Ly Seat: Date of Poll Date of Counting Date of CompletionДокумент1 страницаS. NO - House/Stat E Tenure From Tenure TO Assemb Ly Seat: Date of Poll Date of Counting Date of CompletionKB_mitОценок пока нет

- GPH Ispat Limited PDFДокумент2 страницыGPH Ispat Limited PDFKB_mitОценок пока нет

- LehДокумент3 страницыLehKB_mitОценок пока нет

- Nit 1Документ3 страницыNit 1KB_mitОценок пока нет

- Domestic Competitive Bidding (E-tendering-Web Notice) : Page 1 of 9Документ9 страницDomestic Competitive Bidding (E-tendering-Web Notice) : Page 1 of 9KB_mitОценок пока нет

- Package-29 Vol-III Price ScheduleДокумент46 страницPackage-29 Vol-III Price ScheduleKB_mitОценок пока нет

- Tamilnadu 17cat 2013Документ24 страницыTamilnadu 17cat 2013KB_mitОценок пока нет

- Nit 1Документ9 страницNit 1KB_mitОценок пока нет

- Shareholding Pattern of The Company For The Quarter Ended 30th June 2016Документ11 страницShareholding Pattern of The Company For The Quarter Ended 30th June 2016KB_mitОценок пока нет

- Chennai Desalination PlantДокумент10 страницChennai Desalination PlantjhonnyОценок пока нет

- Ariyalur District BrochureДокумент14 страницAriyalur District BrochureKB_mitОценок пока нет

- SUBASHINIДокумент3 страницыSUBASHINIKB_mitОценок пока нет

- Basf India LimitedДокумент7 страницBasf India LimitedKB_mitОценок пока нет

- Dharmapuri District BrochureДокумент15 страницDharmapuri District BrochureKB_mitОценок пока нет

- Karur District Brochure DesignДокумент15 страницKarur District Brochure DesignKB_mitОценок пока нет

- Electronic Hardware SectorДокумент13 страницElectronic Hardware SectorKB_mitОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Payslip 2023-07-31Документ1 страницаPayslip 2023-07-31Elmarie Elize SmithОценок пока нет

- ProjectДокумент18 страницProjectpatel2431Оценок пока нет

- ACC 201 Ch5Документ7 страницACC 201 Ch5Trickster TwelveОценок пока нет

- Fin Man HeavenДокумент6 страницFin Man HeavenJoshelFlorentinoОценок пока нет

- Math-Based Quiz Questions Worked OutДокумент130 страницMath-Based Quiz Questions Worked OutJ MОценок пока нет

- Business Ethics and CSR Presentation RevisedДокумент84 страницыBusiness Ethics and CSR Presentation RevisedJuvi CruzОценок пока нет

- Ch08 Harrison 8e GE SM (Revised)Документ102 страницыCh08 Harrison 8e GE SM (Revised)Muh BilalОценок пока нет

- Applied AuditingДокумент2 страницыApplied Auditingctcasiple50% (2)

- FIN254 Assignment# 1Документ6 страницFIN254 Assignment# 1Zahidul IslamОценок пока нет

- Fire Insurance BangladeshДокумент59 страницFire Insurance BangladeshNir NishirОценок пока нет

- CPAR Deductions (Batch 89) HandoutДокумент26 страницCPAR Deductions (Batch 89) HandoutlllllОценок пока нет

- Case: Ii: Lecturer: Mr. Shakeel BaigДокумент2 страницыCase: Ii: Lecturer: Mr. Shakeel BaigKathleen De JesusОценок пока нет

- Non Marketable Financial AssetsДокумент3 страницыNon Marketable Financial AssetsSnehal JoshiОценок пока нет

- Payslip YemplateДокумент2 страницыPayslip YemplateCristine GonzalesОценок пока нет

- Briefing O Merger and ConsolidationДокумент19 страницBriefing O Merger and ConsolidationRonalynPuatuОценок пока нет

- Accounting PolicyДокумент50 страницAccounting Policynati100% (2)

- Nota Amalan Iktisas 3 C4382Документ34 страницыNota Amalan Iktisas 3 C4382Sharifah NadzehaОценок пока нет

- Audit Program For Internal Audit of Construction IndustryДокумент3 страницыAudit Program For Internal Audit of Construction IndustryMadhavi YetrintalaОценок пока нет

- Puma Financial Statements 2011 PDFДокумент105 страницPuma Financial Statements 2011 PDFApple JuiceОценок пока нет

- Coll V Batangas Case DigestДокумент1 страницаColl V Batangas Case DigestRheaParaskmklkОценок пока нет

- Ross12e - CHAPTER 2 - Mini Case - Warf Computers - SolutionДокумент3 страницыRoss12e - CHAPTER 2 - Mini Case - Warf Computers - SolutionHemil ShahОценок пока нет

- CVP AnalysisДокумент16 страницCVP AnalysisPushkar SharmaОценок пока нет

- Eagle Security v. NLRC DigestДокумент2 страницыEagle Security v. NLRC Digestada9ablaoОценок пока нет

- Forms of Business OrgДокумент14 страницForms of Business OrgNald TropelОценок пока нет

- Gayatri Sales & Services: Terms & Conditions PricesДокумент1 страницаGayatri Sales & Services: Terms & Conditions Pricesarpit85Оценок пока нет

- Assignment On Financial and Management AccountingДокумент15 страницAssignment On Financial and Management Accountingdiplococcous83% (12)

- CASE STUDY Long-Term Financial PlanningДокумент2 страницыCASE STUDY Long-Term Financial PlanningsОценок пока нет

- Math 6 - Second Quarter First Long Bus - MathДокумент8 страницMath 6 - Second Quarter First Long Bus - MathJon Jon D. MarcosОценок пока нет

- MS ASE20104 September 2018 - FINAL REVISEDДокумент17 страницMS ASE20104 September 2018 - FINAL REVISEDAung Zaw HtweОценок пока нет

- Module Acctg1Документ49 страницModule Acctg1Belle TurredaОценок пока нет