Академический Документы

Профессиональный Документы

Культура Документы

Mepp

Загружено:

Hemant Kumar0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров6 страницpoject

Оригинальное название

mepp

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документpoject

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров6 страницMepp

Загружено:

Hemant Kumarpoject

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

GLOBAL FINANCIAL CRISIS:

Global Financial Crisis: the root cause

The reason behind the global financial crisis is the subprime crisis, epicentre of which is

US. What happened was that many corporations awarded to loans to debtors classified as sub

prime. These investments appeared to be very lucrative as the returns expected were higher as

these were lend at higher rates. But the flip side of these was the high credit risk involved. Due to

their lucrative offers, these investments were made at a very big scale. The creditworthiness of

the debtors was ignored. For a number of years prior to the crisis, declining lending standards, an

increase in loan incentives such as easy initial terms, and a long-term trend of rising housing

prices had encouraged borrowers to assume difficult mortgages in the belief they would be able

to quickly refinance at more favourable terms. However, once interest rates began to rise and

housing prices started to drop moderately in 20062007 in many parts of the U.S., refinancing

became more difficult. This led to drastic increase in the number of defaulters leading to the

major financial crisis of the century.

I mpact on I ndia

Indian economy was also hit by Global Financial crisis but to a limited extent. Indices of

Stock Markets (Nifty, Sensex etc) plummeted but not because of loss of confidence of

domestic investors significantly. The major reason for downward trend in these indices is

the excessive outflow by FIIs as they are facing liquidity crunch in other countries as well

as they are hit by panic. Indian Stock Exchanges saw year to date (YTD) FII outflow of

$9.2 bn. With US bailout package in place, pressure on liquidity will ease and stability to

the Indian market.

Indian economy being a domestic consumption driven economy with exports constituting

a very small portion of GDP is insulated from global crisis to great extent. GDP is

expected to grow at 7-8%.

Barring domestic brokerages, this meltdown has not affected any domestic BFSI

(Banking, Financial Services & Insurance) business significantly. Public sector banks are

safe. Apart from reasonable exposure that some Indian private sector banks have, rest of

the business is as usual. Indian regulators (RBI & SEBI) have done a good job by putting

caps and regulations on foreign investments. RBI, for instance, had used ECB, Repo

Rates, CRR & LAF (Liquidity Adjustment Facility) to good effect.

Moreover, Indian economy is undergoing real economic growth (infrastructure, services

etc) unlike the developed countries experiencing financial growth (excessive lending

etc.). Hence, Indian economys growth is not so much impacted by the financial turmoil

when compared with countries like US and UK which are epicentres for this crisis.

. FIIs pulling out

The FIIs, who have been in exit mode since January, have liquidated shares worth Rs 8,739,

only in the first fortnight of September. The net sales, since the beginning of 2008 are estimated

at over Rs 37,000 crores. This means that corporates access to overseas funds will be limited

and more expensive going forward. Lenders will now look more closely at who is the counter-

party and make a careful assessment before taking on additional risks. This could mean a

tightening of liquidity with further rise in interest rates. And industry, which is already in a tight

spot, will be squeezed further. The concerted intervention by central banks of developed

countries in injecting liquidity is expected to reduce the unwinding of India investments held by

foreign entities, but fresh investment flows into India are in doubt.

Other areas where the Indian economy has been effected areas are as follows:-

1. Effect on Dalal Street

2. Effect on employment level

3. Effect on insurance sector

4. Impact on other sectors

6. Effect on Indian Banks

Macro-economical aspects

Impact of this financial turmoil on the macro-economic factors are summarized in the following

points-

1. Borrowing costs up

RBI had announced measures to salvage the falling Rupee, which had crossed Rs48 to

the Dollar. It said it would continue to sell Dollars through agent banks or intervene

directly to meet any supply-demand gaps.

While the RBI steps did have a salutary affect on the sliding Rupees vis--vis the dollar,

it will be a while before credit starts flowing as before. Promoters of companies would be

hit by depreciation in value of their equity holdings, which are normally leveraged to

provide additional capital sought by way of preferential issues or for shoring up their

holdings in the company. Promoters who have already borrowed against their holdings

would have to meet the additional margin call requirements following the erosion in the

value of their assets and also pay higher risk premium in volatile time for additional

borrowings.

While big companies will be hit, it is the small and medium companies that will find it

extremely difficult to raise funds. During troubled times, quality lenders are loathe to take

exposure from small borrowers having inadequate collateral. The worst hit will be SMEs. While

issues form the big houses or PSUs divestments may still evoke a good response irrespective of

conditions, the market for mid-size companies is virtually dead.

2. Adverse effect on M&As

What would hurt companies even more will be their inability to grow through M&As despite the

fact that overseas assets are available at bargain rates. This inability to fund acquisitions from

overseas borrowings will slow down the overseas growth plans of Indian companies. Even

private investors who were otherwise gung-ho on funding these acquisitions will now turn wary.

Only respite is that times like this offer opportunities for private equity investors to acquire

assets which could be capable of providing super-normal profits.

Source: RBI website

3. Depreciation of Rupee

The Indian rupee has several negative factors - a current account deficit, high inflation and high

fiscal deficit, all of which tend to weaken the currency. The one positive factor is a still high

growth rate of 7-8% that attracts foreign funds and hence capital inflows. But these are fickle

since they depend on factors not in our control. Major factors for rupee fall are external

commercial borrowings (ECB) repayments and FII outflows from the equity market. Also, the

dollar has been strong against major currencies like the Euro, British Pound & Swiss Franc. As

oil futures started falling rapidly from May onwards, speculators turned to other asset classes

such as the Dollar and gold which resulted in the unwinding of oil futures into dollars.

Meanwhile, there is an upside to be considered as well. The falling rupee (against the dollar,

more than against other currencies) will mean that exporters who felt squeezed by the earlier rise

of the currency can breathe easy again, though buyers overseas may now become more scarce.

Indirect effect of other countries reform policy on India

As other countries plan to handle the current financial crisis by adopting various reforms and

policies the Indian economy may get affected because of that in the adverse manner possible.

CHINA one of the developing economies plan to spend $586 billion in order to get out of the

current recession the amount spent is much bigger than what INDIA can spent which may attract

the FII from every part of world as they are looking strong economies who can handle

themselves in the best manner possible, therefore the FII which were till now coming to INDIA

in context of investment in the stock market as a result of which the stock market had reached a

historical high of more than 20,000 points and Mr. Anil Ambani had become the richest man in

the world for a day may stop. The falling stock prices will reduce the liquidity and credit power

of the companies which till now because of the following factor were enjoying a good and

healthy stock positioning. The lack of FII wills surely effects the development of INDIAN

infrastructure up to a particular extends.

Conclusion

Today, there is a consensus that the FIIS will not return to emerging markets like India in

a hurry. That will probably see the markets remain in tight range band of 12000-16000. There

are, of course, a few naysayers who see a gloomier scenario, predicting that the markets could

even test even the 10000 levels before March 2008.

But financing the India growth story would not be that much of an issue given the

buoyancy in deposits, high savings and levers available with the RBI to inject liquidity. Recent

steps taken such as increasing the attractiveness of NRI deposits, and providing additional

liquidity support via the LAF window to alleviate the liquidity shortage are encouraging. The

immediate issue is how long will it take for the Indian markets to recover? Despite strong

fundamentals, some views are that it will not be before mid-2009, perhaps even 2010. But with

the emergence of desi players during the crisis periods, the Indian markets may chart out a new

course, independent of the global markets.

References

1. http://economictimes.indiatimes.com/ET_Debates/Will_financial_crisis_derail_Indias_ec

onomy/articleshow/3515559.cms

2. http://economictimes.indiatimes.com/articleshow/3574867.cms

Вам также может понравиться

- The Effect of Sales Promotion On Consumer Buying Behavior in An FMCG IndustryДокумент4 страницыThe Effect of Sales Promotion On Consumer Buying Behavior in An FMCG IndustryHemant KumarОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Final BeДокумент8 страницFinal BeHemant KumarОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Excel OutputДокумент143 страницыExcel OutputHemant KumarОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Final Report - International Marketing: Institute of Management Technology Nagpur Trimester V / PGDM (2008-10) / IMДокумент6 страницFinal Report - International Marketing: Institute of Management Technology Nagpur Trimester V / PGDM (2008-10) / IMHemant KumarОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- IMT Nagpur PGDM 2008-2010: Financial MeltdownДокумент35 страницIMT Nagpur PGDM 2008-2010: Financial MeltdownHemant KumarОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- MIS ReportДокумент1 страницаMIS ReportHemant KumarОценок пока нет

- Quantitative Methods: Commodity Excel Macro ModelingДокумент2 страницыQuantitative Methods: Commodity Excel Macro ModelingHemant KumarОценок пока нет

- UPSC CSE PRLIMS-Paper-I-2020-Answer-KeyДокумент1 страницаUPSC CSE PRLIMS-Paper-I-2020-Answer-Keyprg302Оценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- BankДокумент79 страницBankvivek1313Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- SBI Clerk Mains Exam PDF February 2024 1Документ223 страницыSBI Clerk Mains Exam PDF February 2024 1Unique SolutionОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Global Financial Crisis and Its Impact On IndiaДокумент23 страницыThe Global Financial Crisis and Its Impact On IndiagdОценок пока нет

- Developer List-9.6.21Документ8 страницDeveloper List-9.6.21Dhananjayan GopinathanОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Quarterly Update - June 2021Документ5 страницQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Gate ScorecardДокумент1 страницаGate ScorecardRishabh Tripathi100% (1)

- Total BCs-1Документ360 страницTotal BCs-1naina saxenaОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- India Top500Companies2016Документ624 страницыIndia Top500Companies2016Sandeep ElluubhollОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Step by Step Guide: Online Process of APEDA RegistrationДокумент6 страницStep by Step Guide: Online Process of APEDA RegistrationNandaniОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Agra Database Sallery ClassДокумент9 страницAgra Database Sallery ClassvishalОценок пока нет

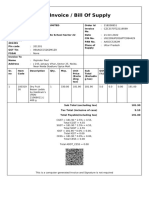

- Tax Invoice / Bill of SupplyДокумент1 страницаTax Invoice / Bill of SupplyCruise Films ProductionsОценок пока нет

- Good Service Tax (GST) Exam Week 3Документ2 страницыGood Service Tax (GST) Exam Week 3M Daiko S PОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Tourism in IndiaДокумент18 страницTourism in IndiaAishОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- My Final ProjectДокумент68 страницMy Final ProjectSAIОценок пока нет

- Jute Industry AnalysisДокумент56 страницJute Industry AnalysisShaj Han100% (5)

- Hra Cca RuleДокумент5 страницHra Cca Rulebinod12340% (1)

- Fundamental Analysis OfwiproДокумент35 страницFundamental Analysis OfwiproLavina Chandalia100% (3)

- Simone TataДокумент5 страницSimone TataHarry Khanna100% (1)

- Identifying and Addressing Social ProblemsДокумент26 страницIdentifying and Addressing Social ProblemsAniaОценок пока нет

- No 50 - 99 00Документ175 страницNo 50 - 99 00chaudharyaastik93Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Sri Shankara Matt: Cummulative Statement 2017Документ28 страницSri Shankara Matt: Cummulative Statement 2017Vijaya BhaskarОценок пока нет

- Nse 20121009Документ33 страницыNse 20121009Dhawan SandeepОценок пока нет

- Ankleshwar ListДокумент11 страницAnkleshwar ListMeghayu AdhvaryuОценок пока нет

- Royal Sundaram Alliance Insurance Company LimitedДокумент2 страницыRoyal Sundaram Alliance Insurance Company Limitedtplinklg1Оценок пока нет

- Coal Industry in Present Scenario in India (Coal Scam)Документ11 страницCoal Industry in Present Scenario in India (Coal Scam)Anoop MishraОценок пока нет

- Henex New Letter 19 NOv 2022Документ21 страницаHenex New Letter 19 NOv 2022Vivek AgОценок пока нет

- Industrial Development in India Since IndependenceДокумент19 страницIndustrial Development in India Since IndependenceRupali RamtekeОценок пока нет

- A Study of Gems and Jewellery ExportДокумент64 страницыA Study of Gems and Jewellery ExportAjay Yadav80% (5)

- Chapter 2 Indian Economy 1950-1990Документ27 страницChapter 2 Indian Economy 1950-1990Ajay pandeyОценок пока нет