Академический Документы

Профессиональный Документы

Культура Документы

CIR Vs CA

Загружено:

Gil Aldrick FernandezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

CIR Vs CA

Загружено:

Gil Aldrick FernandezАвторское право:

Доступные форматы

[G.R. No. 78953. July 31, 1991.

]

COMMISSIONER OF INTERNAL REVENUE, petitioner, vs. MELCHOR J. JAVIER, JR. and THE

COURT OF TAX APPEALS, respondents.

Facts: Victoria L. Javier, the wife of the petitioner (private respondent herein), received

from the Prudential Bank and Trust Company in Pasay City the amount of US$999,973.70

remitted by her sister, Mrs. Dolores Ventosa, through some banks in the United States,

among which is Mellon Bank, N.A.

Mellon Bank, N.A. filed a complaint with the Court of First Instance of Rizal (now Regional

Trial Court), (docketed as Civil Case No. 26899), against the petitioner (private respondent

herein), his wife and other defendants, claiming that its remittance of US$1,000,000.00 was

a clerical error and should have been US$1,000.00 only, and praying that the excess amount

of US$999,000.00 be returned on the ground that the defendants are trustees of an implied

trust for the benefit of Mellon Bank with the clear, immediate, and continuing duty to return

the said amount from the moment it was received.

The petitioner (private respondent herein) filed his Income Tax Return for the taxable year

1977 showing a gross income of P53,053.38 and a net income of P48,053.88 and stating in

the footnote of the return that "Taxpayer was recipient of some money received from

abroad which he presumed to be a gift but turned out to be an error and is now subject of

litigation."

The petitioner (private respondent herein) received a letter from the acting Commissioner

of Internal Revenue dated November 14, 1980, together with income assessment notices for

the years 1976 and 1977, demanding that petitioner (private respondent herein) pay on or

before December 15, 1980 the amount of P1,615.96 and P9,287,297.51 as deficiency

assessments for the years 1976 and 1977 respectively . .

The petitioner (private respondent herein) wrote the Bureau of Internal Revenue that he

was paying the deficiency income assessment for the year 1976 but denying that he had any

undeclared income for the year 1977 and requested that the assessment for 1977 be made

to await final court decision on the case filed against him for filing an allegedly fraudulent

return . . .

The petitioner (private respondent herein) received from Acting Commissioner of Internal

Revenue Romulo Villa a letter dated October 8, 1981 stating in reply to his December 15,

1980 letter-protest that "the amount of Mellon Bank's erroneous remittance which you

were able to dispose, is definitely taxable.". . . 5

The Commissioner also imposed a 50% fraud penalty against Javier.

Disagreeing, Javier filed an appeal before the respondent Court of Tax Appeals on

December 10, 1981.

Issue: WON there was tax evasion? No fraud. Javier had literally "laid his cards on the table."

Held:

In Aznar v. Court of Tax Appeals (L-20569, promulgated on August 23, 1974, 58 SCRA 519),

fraud in relation to the filing of income tax return, was discussed in this manner: . . . The

fraud contemplated by law is actual and not constructive. It must be intentional fraud,

consisting of deception willfully and deliberately done or resorted to in order to induce

another to give up some legal right. Negligence, whether slight or gross, is not equivalent to

the fraud with intent to evade the tax contemplated by law. It must amount to intentional

wrong-doing with the sole object of avoiding the tax. It necessarily follows that a mere

mistake cannot be considered as fraudulent intent, and if both petitioner and respondent

Commissioner of Internal Revenue committed mistakes in making entries in the returns and

in the assessment, respectively, under the inventory method of determining tax liability, it

would be unfair to treat the mistakes of the petitioner as tainted with fraud and those of the

respondent as made in good faith. Fraud is never imputed and the courts never sustain

findings of fraud upon circumstances which, at most, create only suspicion and the mere

understatement of a tax is not itself proof of fraud for the purpose of tax evasion.

In the case at bar, there was no actual and intentional fraud through willful and deliberate

misleading of the government agency concerned, the Bureau of Internal Revenue, headed by

the herein petitioner. The government was not induced to give up some legal right and place

itself at a disadvantage so as to prevent its lawful agents from proper assessment of tax

liabilities because Javier did not conceal anything. Error or mistake of law is not fraud. The

petitioner's zealousness to collect taxes from the unearned windfall to Javier is highly

commendable. Unfortunately, the imposition of the fraud penalty in this case is not justified

by the extant facts. Javier may be guilty of swindling charges, perhaps even for greed by

spending most of the money he received, but the records lack a clear showing of fraud

committed because he did not conceal the fact that he had received an amount of money

although it was a "subject of litigation."

As ruled by respondent Court of Tax Appeals, the 50% surcharge imposed as fraud penalty

by the petitioner against the private respondent in the deficiency assessment should be

deleted.

Вам также может понравиться

- Peralta Vs MathayДокумент2 страницыPeralta Vs MathayGil Aldrick FernandezОценок пока нет

- GSIS Vs City of Manila (FT)Документ12 страницGSIS Vs City of Manila (FT)Gil Aldrick FernandezОценок пока нет

- Pasengco Vs EstoyaДокумент1 страницаPasengco Vs EstoyaGil Aldrick FernandezОценок пока нет

- CIR Vs JavierДокумент3 страницыCIR Vs JavierGil Aldrick Fernandez0% (1)

- CIR Vs General Foods DigestДокумент3 страницыCIR Vs General Foods DigestGil Aldrick FernandezОценок пока нет

- Carco Vs NLRCДокумент2 страницыCarco Vs NLRCGil Aldrick FernandezОценок пока нет

- Besa Vs TrajanoДокумент1 страницаBesa Vs TrajanoGil Aldrick FernandezОценок пока нет

- ABSCBN Vs NazarenoДокумент2 страницыABSCBN Vs NazarenoGil Aldrick FernandezОценок пока нет

- CIR Vs General Foods DigestДокумент3 страницыCIR Vs General Foods DigestGil Aldrick FernandezОценок пока нет

- NGA Vs IACДокумент2 страницыNGA Vs IACGil Aldrick Fernandez0% (1)

- Naguit Vs CAДокумент9 страницNaguit Vs CAGil Aldrick FernandezОценок пока нет

- CIR Vs HawaiianДокумент1 страницаCIR Vs HawaiianGil Aldrick FernandezОценок пока нет

- Prats V CAДокумент23 страницыPrats V CAGil Aldrick FernandezОценок пока нет

- Calalas V CA DigestДокумент2 страницыCalalas V CA DigestGil Aldrick Fernandez100% (1)

- Ppl vs janjalani Elmer Andales testimony bomb busДокумент1 страницаPpl vs janjalani Elmer Andales testimony bomb busGil Aldrick Fernandez100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- 2nd ANAND SWAROOP GUPTA MEMORIAL NATIONAL MOOT COURT COMPETITIONДокумент17 страниц2nd ANAND SWAROOP GUPTA MEMORIAL NATIONAL MOOT COURT COMPETITIONhargunОценок пока нет

- In The Court of Session Judge, Amritsar.: StateДокумент12 страницIn The Court of Session Judge, Amritsar.: Statevidit mongaОценок пока нет

- Tripartite AgreementДокумент6 страницTripartite AgreementBalaji Venkat100% (1)

- United States v. James Robert Frankenberry, JR., 387 F.2d 337, 2d Cir. (1967)Документ3 страницыUnited States v. James Robert Frankenberry, JR., 387 F.2d 337, 2d Cir. (1967)Scribd Government DocsОценок пока нет

- Superior Court of The State of Washington in and For The County of KingДокумент12 страницSuperior Court of The State of Washington in and For The County of KingNathan JoyceОценок пока нет

- Nollora vs. PeopleДокумент13 страницNollora vs. PeopleHassan Nor DamacОценок пока нет

- Special Power of AttorneyДокумент2 страницыSpecial Power of AttorneyPaulo Abenio EscoberОценок пока нет

- Usa V Garcia IndictmentДокумент4 страницыUsa V Garcia Indictmentangel117mcОценок пока нет

- China Bank VS OrtegaДокумент6 страницChina Bank VS Ortegaboks9s.9escaladaОценок пока нет

- SC modifies penalty for shooting incidentДокумент41 страницаSC modifies penalty for shooting incidentJasmine Montero-GaribayОценок пока нет

- ACLU Lawsuit - Police Break Up Party at RioДокумент33 страницыACLU Lawsuit - Police Break Up Party at RioMichelle RindelsОценок пока нет

- Gainor v. Sidley, Austin, Brow - Document No. 104Документ4 страницыGainor v. Sidley, Austin, Brow - Document No. 104Justia.comОценок пока нет

- SALESBA Study Guide SalesДокумент15 страницSALESBA Study Guide SalesHikariОценок пока нет

- World War II Veterans Legionnaires - Appointment of AVA LAwДокумент2 страницыWorld War II Veterans Legionnaires - Appointment of AVA LAwArvin AtienzaОценок пока нет

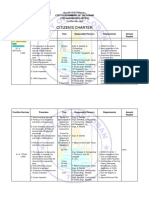

- Citizen'S Charter: Republic of The Philippines City Government of Tacloban City Assessor'S OfficeДокумент18 страницCitizen'S Charter: Republic of The Philippines City Government of Tacloban City Assessor'S OfficeChandra RashaОценок пока нет

- 3 - Documento de Apoyo - Lectura Gestion de ComprasДокумент14 страниц3 - Documento de Apoyo - Lectura Gestion de ComprasLaurence AVENDANO LOPEZ0% (1)

- Bad CandidateДокумент3 страницыBad CandidatePat PowersОценок пока нет

- Reynaldo Valdez vs. NLRC G.R. No. 125028, February 9, 1998 FactsДокумент2 страницыReynaldo Valdez vs. NLRC G.R. No. 125028, February 9, 1998 FactsJing DalaganОценок пока нет

- People V VillanuevaДокумент2 страницыPeople V Villanuevaxxyy100% (2)

- Syllabus For Civil Procedure Atty. Victor Y. Eleazar: Rule 16 To 36Документ8 страницSyllabus For Civil Procedure Atty. Victor Y. Eleazar: Rule 16 To 36Agnes GamboaОценок пока нет

- 1-4-17 Mtn. To Recuse SpencerДокумент326 страниц1-4-17 Mtn. To Recuse SpencerPeter CoulterОценок пока нет

- Case Digest: People v. NanoyДокумент2 страницыCase Digest: People v. NanoyElla Tho100% (1)

- Motion For Reconsideration RovillosДокумент3 страницыMotion For Reconsideration RovillosWaren Morales0% (1)

- Facts:: Section 7, Rule 117 ("Section 7") of The 1985 Rules On Criminal ProcedureДокумент1 страницаFacts:: Section 7, Rule 117 ("Section 7") of The 1985 Rules On Criminal ProcedureLinalyn LeeОценок пока нет

- Jurisdiction of Sandiganbayan Over Private Individual Charged with ConspiracyДокумент2 страницыJurisdiction of Sandiganbayan Over Private Individual Charged with ConspiracyCharmila Siplon100% (3)

- Moot Problem 1Документ3 страницыMoot Problem 1Vaman SharmaОценок пока нет

- Court rules on annulment of sale of propertiesДокумент10 страницCourt rules on annulment of sale of propertiesAnn ChanОценок пока нет

- Joint-Affidavit of Two Disinterested Persons: Virgie NasiadДокумент3 страницыJoint-Affidavit of Two Disinterested Persons: Virgie Nasiadoyr100% (1)

- CONTRACT OF SERVICE - RefereeДокумент6 страницCONTRACT OF SERVICE - RefereeReese OguisОценок пока нет

- Complaint Mariano V NumosДокумент5 страницComplaint Mariano V NumosSab dela RosaОценок пока нет