Академический Документы

Профессиональный Документы

Культура Документы

Cash Flow Analysis Itc LTD: Sayon Das 1421328 Mbal

Загружено:

Sayon DasОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cash Flow Analysis Itc LTD: Sayon Das 1421328 Mbal

Загружено:

Sayon DasАвторское право:

Доступные форматы

CASH FLOW ANALYSIS

ITC LTD

BSEId :500875 NSE Id :ITC

ISIN Id :INE154A0102

Sayon das

1421328

MBAL

Introduction

Key Result Activities of ITC are FMCG, Agri business, Paperboards and packaging, Information technology and

hotels. FMCG includes branded packaged foods, education & stationery, lifestyle retailing, personal care products,

safety matches & incense sticks and cigarettes and nicotine gums. Agri-Business includes leaf tobacco, wheat, soya

bean etc. ITC ltd net profit for FY2013 is Rs 8785.21 cr which is higher comparison to previous year which was Rs

7418 cr in FY2012.

ITC is listed in BSE and NSE. BSEId :500875 NSE Id :ITC. Last traded price as on 1 Aug 16:00 is 349.75

decresed Rs 6.45 which opened at 356.20.

Cash flow highlights

Operating profit before working capital changes Rs 13172.42 cr in FY2013 which were Rs 11218 cr in

FY2012.

Net cash from operating activities are Rs 7343.58 in FY2013 crore which increased from FY 2012

7101.83 crore.

Net cash used in investing activities are Rs3254.08 cr which decreased from FY2013 which were rs

3881.35 cr in FY2012.

Net cash used financial activities are Rs 4121.54 cr which increased from Rs 3310.01cr.

Net decrease in cash and cash equivalents are 32.04 cr which decreased from FY 2012 which were 89.53

cr.

Opening cash and cash equivalents are Rs308.52 cr which which were 398.05 in FY2012.

Closing cash and cash equivalents were Rs 276.48 cr which is less than FY2012 that were Rs 308.52.

Note: Cash and Bank balance are Rs 3490.19 cr in FY2013 which were Rs 3828.30 cr.

Gross revenue from sale of products and services

Rs(in cr)

Cigarettes 29076.48

Branded Packaged Food products 5717.32

Others(apparel, education stationery, personal care, etc) 2394.66

Hotels 2394.66

Agri-business

Unmanufactured tobacco 1780.97

Others(wheat, soya, spices etc) 3349.12

Paperboards and paper 2843.97

Printed material 428.65

Sale of products 45591.17

Sale of services 1121.45

Cash flow from operating activities analysis ( FY2013 & FY2012)

Depreciation and amortisation expenses have increased significantly by Rs 87.81 cr in FY2013 which

signifies that there has been greater utilisation of machinery and assets.

Finance costs have decreased hugely from 87 cr to 6cr.

Dividend income has increased both in long term investment and current investment.

Loss on sale of fixed asset has decreased to an extent of 20 cr from FY2012 to FY2013, thus company

should sell its fixed assets by trying to sell at a greater value or retain the asset till it gets higher value.

There has been a huge loss on Net sale of current investments amounting to Rs 182cr which is not a good

sign for the company. Investments should be made with thorough analysis on ROI and resale value. This

loss will create a burden for the company.

Whereas loss on sale of long term investment is only Rs 0.89 cr compared to Rs 121.62 cr which is a good

sign as company has vastly decreased its losses in long term investments.

Thus, company should make investments with greater analysis and research on both ROI and resale value. This

incurring of huge losses is a burden for the company.

Bad and doubtful debts have increased significantly from Rs 9.72 cr to 20.34cr

Provisions of long term investments have been created amounting to Rs 20.67 cr

Thus, ITC should give credit with in-depth credibility analysis of their analysis. This provision would have

been avoided if there was less bad and doubtful debts and cash could have been used for productive purposes.

There has been an decrease of cost of current investments over fair value by Rs 25cr, whereas there is

excess of carrying cost over fair value over current investments by Rs 8cr.

As analysed earlier there should be comprehensive investment analysis conducted by ITC before investments.

Adjustments for trade receivables, loans and advances, other assets are Rs 1546.05 cr, increase in

inventories at Rs 754cr and increase in trade payables other liabilities and provisions are Rs 456.26cr.

There has been significant increase in trade payables and other liabilities and provision which is not a good

sign but there has also been increase in trade receivables, loans and advances and other asset. Inventories are

very high and company should try to dispose greater inventory by manufacturing finish goods.

Cash generated from operations is higher at Rs 11328.06 cr from 10117 cr which is a good sign as it

signifies healthy operational activity.

Cash flow from investing activity

There has been increase in purchase of fixed assets by Rs 243cr and there has been greater sale of fixed

asset by Rs 29 cr.

Purchase of current investments has been increased drastically amounting to Rs 18557 cr which is greater

than the cash generated from operating activity. Yet, ITC is incurring losses on its net sale of current

investment as shown in operating activity.

Purchase of long term investments has decreased nearly 50%. Sale of long term investments has also

decreased which signifies ITC is retaining its long term fixed investments and getting good return on its

investments.

Dividends from current and long term investment have decreased which poses a threat as company has

significantly increased current investments.

There has been maturity of deposit of financial institutions and bank deposits which increase cash inwards

substantially.

Thus, cash used in investing in investing activity has reduced from previous fiscal year amounting to Rs 627 cr.

Cash outwards are mostly due to purchase of current investments and inwards due to maturity of deposits.

Cash flow from financial activity

Proceeds from issue of share capital is lower than previous fiscal year by Rs 231 cr. The company may

have issued lower no. of shares as last year the price of share was approximately equal to current market

price.

Proceeds from long term borrowing have increased and also repayment of long term borrowing has been

greater than previous year.

Dividends paid is higher as there is an increase in Net profit of the company which sends a good sign to

shareholder as company is financially sound and has a positive outlook.

Cash utilized in financial activity has increased primarily due to greater dividend paid.

Thus, cash and cash equivalents has decreased in the company mostly accounting to higher investments, and

payment of dividends, loss on sale on investments, increase in trade payables and other liabilities.

The company is using cash in productive activities which will give return on investment and thus increasing

in Net profit.

Вам также может понравиться

- Allahabad BankДокумент103 страницыAllahabad BankPiyush Gehlot0% (1)

- Financial Statement Analysis: Key Metrics and TrendsДокумент15 страницFinancial Statement Analysis: Key Metrics and TrendsManeet SinghОценок пока нет

- Customer Satisfaction Study at Big BazaarДокумент46 страницCustomer Satisfaction Study at Big BazaarsathvikaОценок пока нет

- Ratio Analysis of L&T InfotechДокумент36 страницRatio Analysis of L&T Infotechrajwindernijjar1100% (1)

- Sales Promotion Presentation V4 - FinalДокумент23 страницыSales Promotion Presentation V4 - FinalAditya MishraОценок пока нет

- Empployee Welfare MPSEBДокумент48 страницEmpployee Welfare MPSEBAmit PasiОценок пока нет

- Service Quality and Customer Satisfaction of Maruti Service StationДокумент66 страницService Quality and Customer Satisfaction of Maruti Service StationSahil Maini0% (1)

- Amul Company PresentationДокумент31 страницаAmul Company PresentationshifashaikhОценок пока нет

- Next ShowroomДокумент3 страницыNext ShowroomVRajamanikandanОценок пока нет

- Health and Hygiene in IndiaДокумент19 страницHealth and Hygiene in IndiaSOHEL BANGIОценок пока нет

- A-Project-Report-on-EMPLOYEE-WELFARE-MEASURES-for-AXIS BANK J RAIPURДокумент46 страницA-Project-Report-on-EMPLOYEE-WELFARE-MEASURES-for-AXIS BANK J RAIPURPurva tawri0% (1)

- Boney Hector D Cruz Am Ar U3com08013 Final ProjectДокумент63 страницыBoney Hector D Cruz Am Ar U3com08013 Final ProjectthinckollamОценок пока нет

- Working Capital at SbiДокумент65 страницWorking Capital at SbiRahul ShrivastavaОценок пока нет

- Advertising, Sales, Promotion, and Public RelationsДокумент24 страницыAdvertising, Sales, Promotion, and Public RelationsShaukat Ali KhanОценок пока нет

- 103 - Aarogya Registration For Hospital and DayCare - UseCaseДокумент11 страниц103 - Aarogya Registration For Hospital and DayCare - UseCasePrabhu Ch100% (1)

- HCL Company Analysis - Udit GurnaniДокумент7 страницHCL Company Analysis - Udit GurnaniUdit GurnaniОценок пока нет

- Capital Budget Impact in Banking SectorДокумент85 страницCapital Budget Impact in Banking SectorVickram JainОценок пока нет

- Satish Bajaj FinservДокумент71 страницаSatish Bajaj FinservAnjaliОценок пока нет

- By SUMEET DOLHE - THE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIAДокумент48 страницBy SUMEET DOLHE - THE IMPACT OF GLOBAL RECESSION ON INFORMATION TECHNOLOGY SECTOR IN INDIASumeet DolheОценок пока нет

- Project Report On PepsicoДокумент101 страницаProject Report On Pepsico18UCOM040 Saravanakumar AОценок пока нет

- Quality of Work Life of Employees in An Organization by Namita and Kritika WaliaДокумент11 страницQuality of Work Life of Employees in An Organization by Namita and Kritika Waliaijr_journalОценок пока нет

- Working Capital ProjectДокумент48 страницWorking Capital ProjectkunjapОценок пока нет

- 90Документ70 страниц90tariquewali11Оценок пока нет

- Role of Commercial Banks in The Economic Development of A Country:-An Indian PerspectiveДокумент10 страницRole of Commercial Banks in The Economic Development of A Country:-An Indian Perspectivepinky kumariОценок пока нет

- A Paper On CSR of Kia Motors PhilippinesДокумент17 страницA Paper On CSR of Kia Motors PhilippinesJayson S. VerdeflorОценок пока нет

- Concept of NetworkingДокумент71 страницаConcept of NetworkingAmit PasiОценок пока нет

- Inventory Management System DriplexДокумент104 страницыInventory Management System DriplexAnil Kumar SinghОценок пока нет

- 384 A Study of Recruitment and Selection Process On HCLДокумент101 страница384 A Study of Recruitment and Selection Process On HCLKalpita MandavaleОценок пока нет

- A Study of Perception of Customers Towards Sharekhan and Comparison With Five Other Brokring FirmsДокумент90 страницA Study of Perception of Customers Towards Sharekhan and Comparison With Five Other Brokring Firmsmaazabdullah9694100% (1)

- Understanding the qualitative and quantitative aspects of hospital kitchen servicesДокумент31 страницаUnderstanding the qualitative and quantitative aspects of hospital kitchen servicesashna javedОценок пока нет

- Work Life BalanceДокумент15 страницWork Life BalanceTHIMMAIAH BAYAVANDA CHINNAPPAОценок пока нет

- Summer Internship Project ReportДокумент46 страницSummer Internship Project Reportanup_agarwal100% (1)

- Mba ProjectДокумент51 страницаMba ProjectHarpreet SinghОценок пока нет

- Ignou Assignment Front PageДокумент4 страницыIgnou Assignment Front PageSumitKumarОценок пока нет

- Salary and Wages AdministrationДокумент52 страницыSalary and Wages AdministrationLokesh YadevОценок пока нет

- National Stock Exchange of India (NSE)Документ16 страницNational Stock Exchange of India (NSE)Mohit SuranaОценок пока нет

- Name: Sangeeta Kumari ROLL NO:1051-15-407-085 T0Pic: Compartatives Study On Ulip'S in The Insurance MarketДокумент68 страницName: Sangeeta Kumari ROLL NO:1051-15-407-085 T0Pic: Compartatives Study On Ulip'S in The Insurance Marketkavya srivastavaОценок пока нет

- Difference Between Cash Flow and Fund Flow StatementДокумент3 страницыDifference Between Cash Flow and Fund Flow StatementAtul ManiОценок пока нет

- Shriram Institute OF Management Technology: A Project ON 4P'S IN FlexituffДокумент68 страницShriram Institute OF Management Technology: A Project ON 4P'S IN Flexituffcafe customercareОценок пока нет

- A Study On The Importance of Cross Cultural Training For Employees of Various OrganizationsДокумент11 страницA Study On The Importance of Cross Cultural Training For Employees of Various OrganizationsanitikaОценок пока нет

- Equal Employment Opportunities and Affirmative ActionДокумент25 страницEqual Employment Opportunities and Affirmative Actionmhegan flor zafeОценок пока нет

- Measuring Customer Satisfaction at Reliance FreshДокумент88 страницMeasuring Customer Satisfaction at Reliance FreshFaheem QaziОценок пока нет

- Project Report ON Market Penetration Strategies of HCLДокумент66 страницProject Report ON Market Penetration Strategies of HCLSangha Toy100% (1)

- TCS CompanyProfileДокумент11 страницTCS CompanyProfileSwetha EvergreenОценок пока нет

- Job Satisfaction Factors at SBIДокумент51 страницаJob Satisfaction Factors at SBIAshish NavalОценок пока нет

- Ratio Analysis in Business Decisions@ Bec DomsДокумент85 страницRatio Analysis in Business Decisions@ Bec DomsBabasab Patil (Karrisatte)Оценок пока нет

- Customer Satisfaction Insurance Products of ICICI PrudentialДокумент71 страницаCustomer Satisfaction Insurance Products of ICICI Prudentialkarthik_shabby15Оценок пока нет

- Gurpyar (MAIN PROJECT)Документ54 страницыGurpyar (MAIN PROJECT)jellymaniОценок пока нет

- A Study On Effectiveness of Cost Benefit Analysis in Dharani Sugars and Chemicals LTD., VasudevanallurДокумент85 страницA Study On Effectiveness of Cost Benefit Analysis in Dharani Sugars and Chemicals LTD., VasudevanallurJanagar Raja SОценок пока нет

- NRI Banking StudyДокумент55 страницNRI Banking StudyJayanti KappalОценок пока нет

- A Study On Customer Preference Towards Lenskart Online ShoppingДокумент27 страницA Study On Customer Preference Towards Lenskart Online Shoppingv maheshОценок пока нет

- A Study On Hiring Process at PayTM (A Subsidiary of One97 Communications)Документ22 страницыA Study On Hiring Process at PayTM (A Subsidiary of One97 Communications)Abhishek DasОценок пока нет

- Mark and Spencer and H&MДокумент4 страницыMark and Spencer and H&MsanuОценок пока нет

- Employee Satisfaction at NALCOДокумент50 страницEmployee Satisfaction at NALCOConnect Net cafeОценок пока нет

- Financial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDДокумент4 страницыFinancial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDishant7890Оценок пока нет

- Analysis of Financial StatementsДокумент3 страницыAnalysis of Financial StatementsVatsal ChangoiwalaОценок пока нет

- Cash Flow Analysis For Nestle India LTDДокумент2 страницыCash Flow Analysis For Nestle India LTDVinayak Arun SahiОценок пока нет

- Financial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedДокумент6 страницFinancial Accounting and Reporting Analysis-Term 1: Godrej Consumer Products LimitedNamit BaserОценок пока нет

- BLUESTAR ANNUAL REPORT ANALYSISДокумент16 страницBLUESTAR ANNUAL REPORT ANALYSISKunal NegiОценок пока нет

- E - Business, SMEs and Risks: Towards A Research AgendaДокумент3 страницыE - Business, SMEs and Risks: Towards A Research AgendaSayon DasОценок пока нет

- Business Model-Financial Service CompanyДокумент8 страницBusiness Model-Financial Service CompanySayon DasОценок пока нет

- Securitization & Bankruptcy RemoteДокумент1 страницаSecuritization & Bankruptcy RemoteSayon DasОценок пока нет

- Notes - Primary Market ConceptsДокумент15 страницNotes - Primary Market ConceptsSayon DasОценок пока нет

- The Nature of Credit Risk in Project FinanceДокумент4 страницыThe Nature of Credit Risk in Project FinanceSayon DasОценок пока нет

- Business Ethics CIA-3: Submitted To M. Abraham MathewДокумент4 страницыBusiness Ethics CIA-3: Submitted To M. Abraham MathewSayon DasОценок пока нет

- Will Reverse Book-Building Ensure Fair Play?Документ1 страницаWill Reverse Book-Building Ensure Fair Play?Sayon DasОценок пока нет

- UltraTech Cement LTD Financial AnalysisДокумент26 страницUltraTech Cement LTD Financial AnalysisSayon DasОценок пока нет

- Terms To Learn - Chapter 1Документ2 страницыTerms To Learn - Chapter 1Sayon DasОценок пока нет

- UNIFIED REGULATOR - A PerspectiveДокумент3 страницыUNIFIED REGULATOR - A PerspectiveSayon DasОценок пока нет

- Reverse Book Building - NoteДокумент2 страницыReverse Book Building - NoteSayon DasОценок пока нет

- Safety Net For Retail InvestorsДокумент1 страницаSafety Net For Retail InvestorsSayon DasОценок пока нет

- Entrepreneurship in IndiaДокумент9 страницEntrepreneurship in IndiaSayon DasОценок пока нет

- Econometric TopicДокумент20 страницEconometric TopicSayon DasОценок пока нет

- Econometric TopicДокумент20 страницEconometric TopicSayon DasОценок пока нет

- United Spirits Financial Management AnalysisДокумент10 страницUnited Spirits Financial Management AnalysisSayon DasОценок пока нет

- Entrepreneurship in IndiaДокумент9 страницEntrepreneurship in IndiaSayon DasОценок пока нет

- Financial Risk ManagementДокумент5 страницFinancial Risk ManagementSayon DasОценок пока нет

- Can The Same Income Be Taxed Twice in Two Countries?Документ4 страницыCan The Same Income Be Taxed Twice in Two Countries?Sayon DasОценок пока нет

- The Nature of Credit Risk in Project FinanceДокумент4 страницыThe Nature of Credit Risk in Project FinanceSayon DasОценок пока нет

- Finance Xcel FSAДокумент19 страницFinance Xcel FSASayon DasОценок пока нет

- Foreign Exchange Market StructureДокумент3 страницыForeign Exchange Market StructureSayon DasОценок пока нет

- Rebirth of The Eagle MOTIVATIONДокумент13 страницRebirth of The Eagle MOTIVATIONSayon DasОценок пока нет

- UltraTech Cement LTD Financial AnalysisДокумент26 страницUltraTech Cement LTD Financial AnalysisSayon DasОценок пока нет

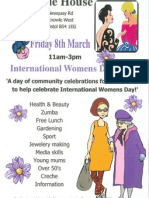

- Women's DayДокумент1 страницаWomen's DayFilwood WardОценок пока нет

- List of Institute of PGDM With AddressДокумент6 страницList of Institute of PGDM With AddressSayon DasОценок пока нет

- Pharma Industry ReportДокумент24 страницыPharma Industry ReportSayon DasОценок пока нет

- MOTIVATIONДокумент59 страницMOTIVATIONSayon DasОценок пока нет

- MotivationДокумент11 страницMotivationSayon DasОценок пока нет

- EIRA v0.8.1 Beta OverviewДокумент33 страницыEIRA v0.8.1 Beta OverviewAlexQuiñonesNietoОценок пока нет

- Problem Set SolutionsДокумент16 страницProblem Set SolutionsKunal SharmaОценок пока нет

- Critical Methodology Analysis: 360' Degree Feedback: Its Role in Employee DevelopmentДокумент3 страницыCritical Methodology Analysis: 360' Degree Feedback: Its Role in Employee DevelopmentJatin KaushikОценок пока нет

- Empanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)Документ6 страницEmpanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)HARSHITRAJ KOTIYAОценок пока нет

- Mosfet 101Документ15 страницMosfet 101Victor TolentinoОценок пока нет

- United-nations-Organization-uno Solved MCQs (Set-4)Документ8 страницUnited-nations-Organization-uno Solved MCQs (Set-4)SãñÂt SûRÿá MishraОценок пока нет

- H I ĐĂNG Assigment 3 1641Документ17 страницH I ĐĂNG Assigment 3 1641Huynh Ngoc Hai Dang (FGW DN)Оценок пока нет

- Special Power of Attorney: Benedict Joseph M. CruzДокумент1 страницаSpecial Power of Attorney: Benedict Joseph M. CruzJson GalvezОценок пока нет

- Product Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966Документ1 страницаProduct Data Sheet For CP 680-P and CP 680-M Cast-In Firestop Devices Technical Information ASSET DOC LOC 1540966shama093Оценок пока нет

- 2010 HD Part Cat. LBBДокумент466 страниц2010 HD Part Cat. LBBBuddy ButlerОценок пока нет

- Week 15 - Rams vs. VikingsДокумент175 страницWeek 15 - Rams vs. VikingsJMOTTUTNОценок пока нет

- Embryology-Nervous System DevelopmentДокумент157 страницEmbryology-Nervous System DevelopmentGheavita Chandra DewiОценок пока нет

- AVR Instruction Set Addressing ModesДокумент4 страницыAVR Instruction Set Addressing ModesSundari Devi BodasinghОценок пока нет

- Pasadena Nursery Roses Inventory ReportДокумент2 страницыPasadena Nursery Roses Inventory ReportHeng SrunОценок пока нет

- EN 12449 CuNi Pipe-2012Документ47 страницEN 12449 CuNi Pipe-2012DARYONO sudaryonoОценок пока нет

- 02 Slide Pengenalan Dasar MapinfoДокумент24 страницы02 Slide Pengenalan Dasar MapinfoRizky 'manda' AmaliaОценок пока нет

- Navistar O & M ManualДокумент56 страницNavistar O & M ManualMushtaq Hasan95% (20)

- Human Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsДокумент3 страницыHuman Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsHuman Rights Alert - NGO (RA)Оценок пока нет

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Документ10 страницMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasОценок пока нет

- Meet Joe Black (1998) : A Metaphor of LifeДокумент10 страницMeet Joe Black (1998) : A Metaphor of LifeSara OrsenoОценок пока нет

- CS210 Lecture 32 Magical Application Binary Tree IIIДокумент38 страницCS210 Lecture 32 Magical Application Binary Tree IIIOshoОценок пока нет

- Mutual Fund PDFДокумент22 страницыMutual Fund PDFRajОценок пока нет

- Oxgen Sensor Cat WEBДокумент184 страницыOxgen Sensor Cat WEBBuddy Davis100% (2)

- Reading and Writing Q1 - M13Документ13 страницReading and Writing Q1 - M13Joshua Lander Soquita Cadayona100% (1)

- Anti Jamming of CdmaДокумент10 страницAnti Jamming of CdmaVishnupriya_Ma_4804Оценок пока нет

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFДокумент1 страницаKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYОценок пока нет

- Damcos Mas2600 Installation UsermanualДокумент26 страницDamcos Mas2600 Installation Usermanualair1111Оценок пока нет

- Essential Rendering BookДокумент314 страницEssential Rendering BookHelton OliveiraОценок пока нет