Академический Документы

Профессиональный Документы

Культура Документы

Portfolio Management

Загружено:

goodwynjИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Portfolio Management

Загружено:

goodwynjАвторское право:

Доступные форматы

1

2

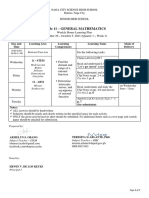

CHAPTER

NO.

TOPIC

PAGE

NO

1

INTRODUCTION 3

1.1

DEFINITION OF PORTFOLIO MANAGEMENT 6

1.2

MEANING OF PORTFOLIO MANAGEMENT 7

1.3

TYPES OF PORTFOLIO MANAGEMENT 8

1.4

TECHNIQUE OF PORTFOLIO MANAGEMENT 11

2

BASIC CONCEPTS AND COMPONENTS 12

2.1

PORTFOLIO MANAGEMENT GOVERNANCE

INVOLVES MULTIPLE DIMENSIONS INCLUDING

14

2.2

OBJECTIVES OF PORTFOLIO MANAGEMENT 16

2.3

OTHER OBJECTIVES 18

3

FUNCTION OF PORTFOLIO MANAGEMENT 19

3.1

STEPS OF PORTFOLIO MANAGEMENT 20

3.2

FORMULATION OF PORTFOLIO STRATEGY 21

3.3

SELECTION OF ASSET MIX 22

3.4

PORTFOLIO EXECUTION 23

3.5

PORTFOLIO REVISION 24

3.6

PORTFOLIO PERFORMANCE EVALUATION 25

4

EQUITY PORTFOLIO MANAGEMENT 26

5

BONDS PORTFOLIO MANAGEMENT 27

6

BENEFITS

6.1

ADVANTAGES OF PORTFOLIO MANAGEMENT 28

6.2

OTHER POTENTIAL BENEFITS 29

7

FACTORS AFFECTING THE INVESTOR 31

8

SECURITIES AND EXCHANGE BOARD OF INDIA

REGULATIONS, 1993

33

9

CASE STUDY

3

INTRODUCTION

From The Rational Edge: The first in a new series of articles on portfolio management, this

introduction expresses IBMs viewpoint about the foundations and essentials of portfolio

management, and discusses ideas and assets that support and enable effective portfolio management

practices.

A good way to begin understanding what portfolio management is (and is not) may be to define the

term portfolio. In a business context, we can look to the mutual fund industry to explain the term's

origins. Morgan Stanley's Dictionary of Financial Terms offers the following explanation: If you own

more than one security, you have an investment portfolio. You build the portfolio by buying

additional stocks, bonds, mutual funds, or other investments. Your goal is to increase the portfolio's

value by selecting investments that you believe will go up in price.

According to modern portfolio theory, you can reduce your investment risk by creating a diversified

portfolio that includes enough different types, or classes, of securities so that at least some of them

may produce strong returns in any economic climate.

When we talk about our investing portfolios, very few people are confused by the term. An

investment portfolio is a collection of income-producing assets that have been bought to meet a

financial goal. If you went back 50 years in a time machine, however, no one would have the slightest

clue what you were talking about. It is amazing that something as fundamental as an investment

portfolio didn't exist until the late 1960s. The idea of investment portfolios has become so ingrained

that we can't imagine a world without them, but it wasn't always this way.

4

Note that this explanation contains a number of important ideas:

A portfolio contains many investment vehicles.

Owning a portfolio involves making choices -- that is, deciding what additional stocks, bonds,

or other financial instruments to buy; when to buy; what and when to sell; and so forth. Making

such decisions is a form of management.

The management of a portfolio is goal-driven. For an investment portfolio, the specific goal is to

increase the value.

Managing a portfolio involves inherent risks.

Over time, other industry sectors have adapted and applied these ideas to other types of

"investments".

IMPLICATIONS FOR INVESTORS

Markowitz's work formalized the investor trade-off. On one end of the investing teeter-totter, there

are investment vehicles like stocks that are high-risk with high returns. On the other end, there are

debt issues like short-term T-bills that are low-risk investments with low returns. Trying to balance in

the middle are all the investors who want the most gain with the least risk. Markowitz created a way

to mathematically match an investor's risk tolerance and reward expectations to create an ideal

portfolio.

He chose the Greek letter beta to represent the volatility of a stock portfolio as compared to a broad

market index. If a portfolio has a low beta, it means it moves with the market. Most passive investing

5

and couch-potato portfolios have low betas. If a portfolio has a high beta, it means it is more volatile

than the market.

Despite the connotations of the word volatile, this is not necessarily a bad thing. When the market

gains, a more volatile portfolio may gain significantly more, when the market falls, the same volatile

portfolio may lose more. This style is neither good nor bad, it is just prey to more fluctuation.

Investors were given the power to demand a portfolio that fit their risk/reward profile rather than

having to take whatever their broker gave them. Bulls could choose more risk; bears could choose

less. As a result of these demands, the Capital Assets Pricing Model (CAPM) became an important

tool for the creation of balanced portfolios.

6

DEFINITION OF PORTFOLIO MANAGEMENT

1) Investorswords.com

The process of managing the assets of a mutual fund, including choosing and monitoring appropriate

investments and allocating funds accordingly.

2) Investor Glossary

Determining the mix of assets to hold in a portfolio is referred to as portfolio management. A

fundamental aspect of portfolio management is choosing assets which are consistent with the

portfolio holder's investment objectives and risk tolerance. The ultimate goal of portfolio

management is to achieve the optimum return for a given level of risk. Investors must balance risk

and performance in making portfolio management decisions. Portfolio management strategies may be

either active or passive. An investor who prefers passive portfolio management will likely choose to

invest in low cost index funds with the goal of mirroring the market's performance. An investor who

prefers active portfolio management will choose managed funds which have the potential to

outperform the market. Investors are generally charged higher initial fees and annual management

fees for active portfolio management.

3) Financial Dictionary

Managing a large single portfolio or being employed by its owner to do so. Portfolio managers have

the knowledge and skill which encourage people to put their investment decisions in the hands of a

professional (for a fee).

7

MEANING OF PORTFOLIO MANAGEMENT

Portfolio is a collection of asset

The asset may be physical or financial like Shares Bonds, Debentures, and Preference Shares

etc.

The individual investor or a fund manager would not like to put all his money in the shares of

one company, for that would amount to great risk.

Main objective is to maximize portfolio return and at the same time minimizing the portfolio

risk by diversification.

Portfolio management is the management of various financial assets, which comprise the

portfolio.

According to Securities and Exchange Board of India (Portfolio manager) Rules, 1993;

portfolio means the total holding of securities belonging to any person.

Designing portfolios to suit investor requirement often involves making several projections

regarding the future, based on the current information.

When the actual situation is at variance from the projections portfolio composition needs to be

changed.

One of the key inputs in portfolio building is the risk bearing ability of the investor.

Portfolio management can be having institutional, for example, Unit Trust, Mutual Funds,

Pension Provident and Insurance Funds, Investment Companies and non- Investment

Companies.

Institutional e.g. individual, Hindu undivided families, Non- investment Companys etc.

The large institutional investors avail services of professionals.

A professional, who manages other peoples or institutions investment portfolio with the

object of profitability, growth and risk minimization, is known as a portfolio manager.

The portfolio manager performs the job of security analyst.

In case of medium and large sized organization, job function of portfolio manager and

security analyst are separate.

Portfolios are built to suit the return expectations and the risk appetite of the investor.

8

TYPES OF PORTFOLIO MANAGEMENT

There are various types of portfolio management:

Investment Management

It Portfolio Management

Project Portfolio Management

1. INVESMENT MANAGEMENT:

Investment management is the professional management of various securities (shares, bonds etc.) and

assets (e.g., real estate), to meet specified investment goals for the benefit of the investors. Investors

may be institutions (insurance companies, pension funds, corporations etc.) or private investors (both

directly via investment contracts and more commonly via collective investment schemes e.g. mutual

funds or Exchange Traded Funds).

The term asset management is often used to refer to the investment management of collective

investments,(not necessarily) whilst the more generic fund management may refer to all forms of

institutional investment as well as investment management for private investors. Investment

managers who specialize in advisory or discretionary management on behalf of (normally wealthy)

private investors may often refer to their services as wealth management or portfolio management

often within the context of so-called "private banking".

Portfolio theory is an investment approach developed by University of Chicago economist Harry M.

Markowitz (1927 - ), who won a Nobel Prize in economics in 1990. Portfolio theory allows investors

to estimate both the expected risks and returns, as measured statistically, for their investment

portfolios.

Markowitz described how to combine assets into efficiently diversified portfolios. It was his position

that a portfolio's risk could be reduced and the expected rate of return could be improved if

9

investments having dissimilar price movements were combined. In other words, Markowitz explained

how to best assemble a diversified portfolio and proved that such a portfolio would likely do well.

There are two types of Portfolio Strategies:

A. Passive Portfolio Strategy

A strategy that involves minimal expectation input, and instead relies on diversification to match the

performance of some market index.

B. Active Portfolio Strategy

A strategy that uses available information and forecasting techniques to seek a better performance

than a portfolio that is simply diversified broadly

IT portfolio management

IT portfolio management is the application of systematic management to large classes of items

managed by enterprise Information Technology (IT) capabilities. Examples of IT portfolios would be

planned initiatives, projects, and ongoing IT services (such as application support). The promise of IT

portfolio management is the quantification of previously mysterious IT efforts, enabling measurement

and objective evaluation of investment scenarios.

The concept is analogous to financial portfolio management, but there are significant differences. IT

investments are not liquid, like stocks and bonds (although investment portfolios may also include

illiquid assets), and are measured using both financial and non-financial yardsticks (for example, a

balanced scorecard approach); a purely financial view is not sufficient.

At its most mature, IT Portfolio management is accomplished through the creation of two portfolios:

(i) Application Portfolio - Management of this portfolio focuses on comparing spending on

established systems based upon their relative value to the organization. The comparison can be based

upon the level of contribution in terms of IT investments profitability. Additionally, this comparison

can also be based upon the non-tangible factors such as organizations level of experience with a

certain technology, users familiarity with the applications and infrastructure, and external forces such

as emergence of new technologies and obsolesce of old ones.

10

(ii) Project Portfolio - This type of portfolio management specially address the issues with

spending on the development of innovative capabilities in terms of potential ROI and reducing

investment overlaps in situations where reorganization or acquisition occurs. The management issues

with the second type of portfolio management can be judged in terms of data cleanliness,

maintenance savings, suitability of resulting solution and the relative value of new investments to

replace these projects.

Project portfolio management

Project portfolio management organizes a series of projects into a single portfolio consisting of

reports that capture project objectives, costs, timelines, accomplishments, resources, risks and other

critical factors. Executives can then regularly review entire portfolios, spread resources appropriately

and adjust projects to produce the highest departmental returns.

Project management is the discipline of planning, organizing and managing resources to bring about

the successful completion of specific project goals and objectives.

A project is a finite endeavor (having specific start and completion dates) undertaken to create a

unique product or service which brings about beneficial change or added value. This finite

characteristic of projects stands in contrast to processes, or operations, which are permanent or semi-

permanent functional work to repetitively produce the same product or service. In practice, the

management of these two systems is often found to be quite different, and as such requires the

development of distinct technical skills and the adoption of separate management.

11

TECHNIQUE OF PORTFOLIO MANAGEMENT

As of now the under noted technique of portfolio management: are in vogue in our country.

1) Equity Portfolio: It is influenced by internal and external factors the internal factors affect the

inner working of the companys growth plans are analyzed with referenced to Balance sheet, profit &

loss a/c (account) of the company.

Among the external factor are changes in the government policies, Trade cycles, Political stability

etc.

2) Equity Stock Analysis : Under this method the probable future value of a share of a company is

determined it can be done by ratios of earning per share of the company and price earnings ratio

EARNING PER SHARE = PROFIT AFTER TAX

NO. OF EQUITY SHARES

PRICE EARNING RATIO = MARKET PRICE (PER SHARE)

EARNING PER SHARE

One can estimate trend of earning by EPS, which reflects trends of earning quality of company,

dividend policy, and quality of management.

Price Earnings ratio indicate a confidence of market about the company future, a high rating is

preferable.

12

BASIC CONCEPTS AND COMPONENTS FOR

PORTFOLIO MANAGEMENT

Now that we understand some of the basic dynamics and inherent challenges organizations face in

executing a business strategy via supporting initiatives, let's look at some basic concepts and

components of portfolio management practices.

1. The Portfolio

First, we can now introduce a definition of portfolio that relates more directly to the context of our

preceding discussion. In the IBM view, a portfolio is: One of a number of mechanisms, constructed to

actualize significant elements in the Enterprise Business Strategy.

It contains a selected, approved, and continuously evolving, collection of Initiatives which are aligned

with the organizing element of the Portfolio, and, which contribute to the achievement of goals or

goal components identified in the Enterprise Business Strategy. The basis for constructing a portfolio

should reflect the enterprise's particular needs. For example, you might choose to build a portfolio

around initiatives for a specific product, business segment, or separate business unit within a

multinational organization.

2. The Portfolio Structure

As we noted earlier, a portfolio structure identifies and contains a number of portfolios. This

structure, like the portfolios within it, should align with significant planning and results boundaries,

and with business components. If you have a product-oriented portfolio structure, for example, then

you would have a separate portfolio for each major product or product group. Each portfolio would

contain all the initiatives that help that particular product or product group contribute to the success of

the enterprise business strategy.

3. The Portfolio Manager

This is a new role for organizations that embrace a portfolio management approach. A portfolio

manager is responsible for continuing oversight of the contents within a portfolio. If you have several

13

portfolios within your portfolio structure, then you will likely need a portfolio manager for each one.

The exact range of responsibilities (and authority) will vary from one organization to another,1 but

the basics are as follows:

One portfolio manager oversees one portfolio.

The portfolio manager provides day-to-day oversight.

The portfolio manager periodically reviews the performance of, and conformance to expectations

for, initiatives within the portfolio.

The portfolio manager ensures that data is collected and analyzed about each of the initiatives in the

portfolio.

The portfolio manager enables periodic decision making about the future direction of individual

initiatives.

4. Portfolio Reviews and Decision Making

As initiatives are executed, the organization should conduct periodic reviews of actual (versus

planned) performance and conformance to original expectations. Typically, organization managers

specify the frequency and contents for these periodic reviews, and individual portfolio managers

oversee their planning and execution. The reviews should be multi-dimensional, including both

tactical elements (e.g., adherence to plan, budget, and resource allocation) and strategic elements

(e.g., support for business strategy goals and delivery of expected organizational benefits).

A significant aspect of oversight is setting multiple decision points for each initiative, so that

managers can periodically evaluate data and decide whether to continue the work. These

"continue/change/discontinue" decisions should be driven by an understanding (developed via the

periodic reviews) of a given initiative's continuing value, expected benefits, and strategic

contribution, Making these decisions at multiple points in the initiative's lifecycle helps to ensure that

managers will continually examine and assess changing internal and external circumstances, needs,

and performance.

14

5. Governance

Implementing portfolio management practices in an organization is a transformation effort that

typically involves developing new capabilities to address new work efforts, defining (and filling) new

roles to identify portfolios (collections of work to be done), and delineating boundaries among work

efforts and collections. Implementing portfolio management also requires creating a structure to

provide planning, continuing direction, and oversight and control for all portfolios and the initiatives

they encompass. That is where the notion of governance comes into play. The IBM view of

governance is:

An abstract, collective term that defines and contains a framework for organization, exercise of

control and oversight, and decision-making authority, and within which actions and activities are

legitimately and properly executed; together with the definition of the functions, the roles, and the

responsibilities of those who exercise this oversight and decision-making.

Portfolio management governance involves multiple dimensions including:

Defining and maintaining an enterprise business strategy.

Defining and maintaining a portfolio structure containing all of the organization's initiatives

(programs, projects, etc.).

Reviewing and approving business cases that propose the creation of new initiatives.

Providing oversight, control, and decision-making for all ongoing initiatives.

Ownership of portfolios and their contents.

Each of these dimensions requires an owner -- either an individual or a collective -- to develop and

approve plans, continuously adjust direction, and exercise control through periodic assessment and

review of conformance to expectations.

A good governance structure decomposes both the types of work and the authority to plan and

oversee work. It defines individual and collective roles, and links them to an authority scheme.

Policies that are collectively developed and agreed upon provide a framework for the exercise of

governance. The complexities of governance structures extend well beyond the scope of this article.

Many organizations turn to experts for help in this area because it is so critical to the success of any

15

business transformation effort that encompasses portfolio management. For now, suffice it to say that

it is worth investing time and effort to create a sound and flexible governance structure before you

attempt to implement portfolio management practices.

6.Portfolio management essentials

Every practical discipline is based on a collection of fundamental concepts that people have identified

and proven (and sometimes refined or discarded) through continuous application. These concepts are

useful until they become obsolete, supplanted by newer and more effective ideas.

For example, in Roman times, engineers discovered that if the upstream supports of a bridge were

shaped to offer little resistance to the current of a stream or river, they would last longer. They

applied this principle all across the Roman Empire. Then, in the Middle Ages, engineers discovered

that such supports would last even longer if their downstream side was also shaped to offer little

resistance to the current. So that became the new standard for bridge construction.

Portfolio management, like bridge-building, is a discipline, and a number of authors and practitioners

have documented fundamental ideas about its exercise. Recently, based on our experiences with

clients who have implemented portfolio management practices and on our research into the

discipline, we have started to shape an IBM view of fundamental ideas around portfolio management.

We are beginning to express this view as a collection of "essentials" that are, in turn, grouped around

a small collection of portfolio management themes.

For example:

One of these themes is initiative value contribution. It suggests that the value of an initiative

(i.e., a program or project) should be estimated and approved in order to start work, and then assessed

periodically on the basis of the initiative's contribution to the goals and goal components in the

enterprise business strategy. These assessments determine (in part) whether the initiative warrants

continued support.

16

OBJECTIVES OF PORTFOLIO MANAGEMENT

The basic objective of Portfolio Management is to maximize yield and minimize risk. The other

objectives are as follows:

Security of Principal Investment : Investment safety or minimization of risks is one of the

most important objectives of portfolio management. Portfolio management not only involves

keeping the investment intact but also contributes towards the growth of its purchasing power

over the period. The motive of a financial portfolio management is to ensure that the

investment is absolutely safe. Other factors such as income, growth, etc., are considered only

after the safety of investment is ensured.

Consistency of Returns : Portfolio management also ensures to provide the stability of

returns by reinvesting the same earned returns in profitable and good portfolios. The portfolio

helps to yield steady returns. The earned returns should compensate the opportunity cost of

the funds invested.

Capital Growth : Portfolio management guarantees the growth of capital by reinvesting in

growth securities or by the purchase of the growth securities. A portfolio shall appreciate in

17

value, in order to safeguard the investor from any erosion in purchasing power due to inflation

and other economic factors. A portfolio must consist of those investments, which tend to

appreciate in real value after adjusting for inflation.

Marketability : Portfolio management ensures the flexibility to the investment portfolio. A

portfolio consists of such investment, which can be marketed and traded. Suppose, if your

portfolio contains too many unlisted or inactive shares, then there would be problems to do

trading like switching from one investment to another. It is always recommended to invest

only in those shares and securities which are listed on major stock exchanges, and also, which

are actively traded.

Liquidity : Portfolio management is planned in such a way that it facilitates to take maximum

advantage of various good opportunities upcoming in the market. The portfolio should always

ensure that there are enough funds available at short notice to take care of the investors

liquidity requirements.

Diversification of Portfolio : Portfolio management is purposely designed to reduce the risk

of loss of capital and/or income by investing in different types of securities available in a wide

range of industries. The investors shall be aware of the fact that there is no such thing as a

zero risk investment. More over relatively low risk investment give correspondingly a lower

return to their financial portfolio.

Favorable Tax Status : Portfolio management is planned in such a way to increase the

effective yield an investor gets from his surplus invested funds. By minimizing the tax burden,

yield can be effectively improved. A good portfolio should give a favorable tax shelter to the

investors. The portfolio should be evaluated after considering income tax, capital gains tax,

and other taxes.

The objectives of portfolio management are applicable to all financial portfolios. These

objectives, if considered, results in a proper analytical approach towards the growth of the portfolio.

Furthermore, overall risk needs to be maintained at the acceptable level by developing a balanced and

efficient portfolio. Finally, a good portfolio of growth stocks often satisfies all objectives of portfolio

management.

18

OTHER OBJECTIVES OF PORTFOLIO MANAGEMENT

a) Stability of Income: An investor considers stability of income from his investment. He also

considers the stability of purchasing power of income.

b) Capital Growth: Capital appreciation has become an important investment principle. Investors

seek growth stocks which provide a very large capital appreciation by way of rights, bonus and

appreciation in the market price of a share.

c) Liquidity: An investment is a liquid asset. It can be converted into cash with the help of a stock

exchange. Investment should be liquid as well as marketable. The portfolio should contain a planned

proportion of high-grade and readily salable investment.

d) Safety: safety means protection for investment against loss under reasonably variations. In order

to provide safety, a careful review of economic and industry trends is necessary. In other words,

errors in portfolio are unavoidable and it requires extensive diversification.

e) Tax Incentives: Investors try to minimize their tax liabilities from the investments. The portfolio

manager has to keep a list of such investment avenues along with the return risk, profile, tax

implications, yields and other returns.

There are three goals of portfolio management:

Maximize the value of the portfolio

Seek balance in the portfolio

Keep portfolio projects strategically aligned

It provides a set of portfolio management tools to help achieve these goals. With multiple business

units, product lines or types of development, we recommend a strategic allocation process based on

the business plan. The Master Project Schedule provides a summary of all-active as well as proposed

projects and classifies them by status (active, proposed, on-hold) and by business unit/product line to

align projects with the strategic allocation. The Master Project Schedule also provides additional

portfolio information to prioritize projects using either a scorecard method or the development

productivity index (DPI *). In addition to this prioritization, PD-Trek provides a Risk-Reward Bubble

Chart and a Project Type Pie Chart to assure balance. A Product or Technology Roadmap template is

provided to help visualize platform and technology relationships to assure critical project

19

relationships are not overlooked with this prioritization. This will allow management to develop a

balanced approach to selecting and continuing with the appropriate mix of projects to satisfy the three

goals.

FUNCTIONS OF PORTFOLIO MANAGEMENT

The basic purpose of portfolio management is to maximize yield and minimize risk. Every investor is

risk averse. In order to diversify the risk by investing into various securities following functions are

required to be performed.

The functions undertaken by the portfolio management are as follows:

1. To frame the investment strategy and select an investment mix to achieve the desired investment

objective;

2. To provide a balanced portfolio which not only can hedge against the inflation but can also

optimize returns with the associated degree of risk;

3. To make timely buying and selling of securities;

4. To maximize the after-tax return by investing in various taxes saving investment instruments.

20

STEPS IN PORTFOSTLIO MANGEMENT STEPS IN PORTFOLIO MANAGEMENT

Portfolio Management Steps

21

IDENTIFICATION OF THE OBJECTIVES

The starting point in this process is to determine the characteristics of the various investments and

then matching them with the individuals need and preferences.

All the personal investing is designed in order to achieve certain objectives.

These objectives may be tangible such as buying a car, house etc. and intangible objectives such as

social status, security etc.

Similarly, these objectives may be classified as financial or personal objectives.

Financial objectives are safety, profitability and liquidity.

Personal or individual objectives may be related to personal characteristics of individuals such as

family commitments, status, depends, educational requirements, income, consumption and provision

for retirement etc.

FORMULATION OF PORTFOLIO STRATEGY

The aspect of Portfolio Management is the most important element of proper portfolio

investment and speculation.

While planning, a careful review should be conducted about the financial situation and current

capital market conditions.

This will suggest a set of investment and speculation policies to be followed.

The statement of investment policies includes the portfolio objectives, strategies and

constraints.

Portfolio strategy means plan or policy to be followed while investing in different types of

assets.

There are different investment strategies.

They require changes as time passes, investors wealth changes, security price change,

investors knowledge expands.

Therefore, the optional strategic asset allocation also changes.

22

The strategic asset allocation policy would call for broad diversification through an indexed holding

of virtually all securities in the asset class.

SELECTION OF ASSET MIX

The most important decision in portfolio management is selection of asset mix.

It means spreading out portfolio investment into different asset classes like bonds, stocks,

mutual funds etc.

In other words selection of asset mix means investing in different kinds of assets and reduces

risk and volatility and maximizes returns in investment portfolio.

Selection of asset mix refers to the percentage to the invested in various security classes.

The security classes are simply the type of securities as under:

MONEY MARKET INSTRUMENT fixed income security equity shares real estate

investment international securities

Once the objective of the portfolio is determined the securities to be included in the portfolio

must be selected.

Normally the portfolio is selected from a list of high-quality bonds that the portfolio manager

has at hand.

The portfolio manager has to decide the goals before selecting the common stock.

The goal may be to achieve pure growth, growth with some income or income only. Once the

goal has been selected, the portfolio manager can select the common stocks.

23

PORTFOLIO EXECUTION

The process of portfolio management involves a logical set of steps common to any

decision, plan, implementation and monitor.

Applying this process to actual portfolios can be complex.

Therefore, in the execution stage, three decisions need to be made, if the percentage

holdings of various asset classes are currently different from desired holdings.

The portfolio than, should be rebalanced. If the statement of investment policy requires

pure investment strategy, this is only thing, which is done in the execution stage.

However, many portfolio managers engage in the speculative transactions in the belief that

such transactions will generate excess risk-adjusted returns.

Such speculative transactions are usually classified as timing or selection decisions.

Timing decisions over or under weight various asset classes, industries or economic

sectors from the strategic asset allocation.

Such timing decisions are known as tactical asset allocation and selection decision deals

with securities within a given asset class, industry group or economic sector.

The investor has to begin with periodically adjusting the asset mix to the desired mix,

which is known as strategic asset allocation.

Then the investor or portfolio manager can make any tactical asset allocation or security

selection decision.

PORTFOLIO REVISION

Portfolio management would be an incomplete exercise without periodic review.

The portfolio, which is once selected, has to be continuously reviewed over a period of time

and if necessary revised depending on the objectives of investor.

Thus, portfolio revision means changing the asset allocation of a portfolio.

Investment portfolio management involves maintaining proper combination of securities,

which comprise the investors portfolio in a manner that they give maximum return with

minimum risk.

24

For this purpose, investor should have continuous review and scrutiny of his investment

portfolio.

Whenever adverse conditions develop, he can dispose of the securities, which are not worth.

However, the frequency of review depends upon the size of the portfolio, the sum involved,

the kind of securities held and the time available to the investor.

The review should include a careful examination of investment objectives, targets for

portfolio performance, actual results obtained and analysis of reason for variations.

The review should be followed by suitable and timely action.

There are techniques of portfolio revision.

Investors buy stock according to their objectives and return-risk framework.

These fluctuations may be related to economic activity or due to other factors.

Ideally investors should buy when prices are low and sell when prices rise to levels higher

than their normal fluctuations.

The investor should decide how often the portfolio should be revised.

If revision occurs to often, transaction and analysis costs may be high.

If revision is attempted too infrequently the benefits of timing may be foregone.

The important factor to take into consideration is, thus, timing for revision of portfolio.

PORTFOLIO PERFORMANCE EVALUATION

Portfolio management involves maintaining a proper combination of securities, which

comprise the investors portfolio in a manner that they give maximum return with minimum

risk.

The investor should have continues review and scrutiny of his investment portfolio.

These rates of return should be based on the market value of the assets of the fund.

25

Complete evaluation of the portfolio performance must include examining a measure of the

degree of risk taken by the fund.

A portfolio manager, by evaluating his own performance can identify sources of strength or

weakness.

It can be viewed as a feedback and control mechanism that can make the investment

management process more effective.

Good performance in the past might have resulted from good luck, in which case such

performance may not be expected to continue in the future.

On the other hand, poor performance in the past might have been result of bad luck.

Therefore, the first task in performance evaluation is to determine whether past performance

was good or poor.

Then the second task is to determine whether such performance was due to skill or luck.

Good performance in the past may have resulted from the actions of a highly skilled portfolio

manager.

The performance of portfolio should be measured periodically, preferably once in a month or

a quarter.

The performance of an individual stock should be compared with the overall performance of

the market.

26

EQUITY PORTFOLIO MANAGEMENT

It is logical that the expected return of a portfolio should depend on the expected return of the

security contained in it.

There are two approaches to the selection of equity portfolio.

One is technical analysis and the other is fundamental analysis.

Technical analysis assumes that the price of a stock depends on supply and demand in the

stock market.

All financial and market information of given security is already reflected in the market price.

Charts are drawn to identify price movements of a given security over a period of time.

These charts enable the investors to predict the future movement of the price of security.

Equity portfolio is a risky portfolio, but at the same time the return is also higher.

Equity portfolio provides highest returns.

An efficient portfolio manager can obviously give more weight age to fundamental analysis

than the technical analysis.

The fundamental analysis includes the study of ratio analysis, past and present track record of

the company, quality of management, government policies etc.

There may be several combinations of investment portfolio.

Allocation of funds for equity portfolio is a question of top most importance to any portfolio

manager.

Among all risky investments, selection of the best possible combination and allocation of

funds among these selected investment groups are of great importance.

27

BONDS PORTFOLIO MANAGEMENT

The individual investors can invest in bond portfolio.

The portfolio can be spared over variety of securities.

Investment in bond is less risky and safe as compared to equity investment.

However, the return on bond is very low.

There are no much fluctuations in bond prices.

Therefore, there is no capital appreciation in this case.

Some bonds are tax saving which help the investor to reduce his tax liability.

There is no much liquidity in bonds, investment in bond portfolio is less risky and safe but,

return is reasonable, low liquidity and tax saving are some of the more important features of

bond portfolio investment.

However, it is suitable for normal investors for getting average return over their investment.

Bond portfolio includes different types of bond, tax free bonds and taxable bonds.

Tax free bonds are issued by public sector undertaking or Government on which interest s

compounded half yearly and payable accordingly.

They have a maturity of 7 to 10 years with the facility for buyback.

The tax free bonds means the interest income on these bonds is not taxable.

Therefore, the interest rates on these bonds are very low.

However, taxable bonds yield higher interest compounded half yearly and also payable half

yearly.

They also have buy back facilities similar to taxable bonds.

28

ADVANTAGES OF PORTFOLIO MANAGEMENT

Individuals will benefits immensely by taking portfolio management services for the following

reason: -

Balancing the Risks posed by Projects

The portfolio management involves the balancing of the risks posed by the projects in the portfolio.

The companies should evaluate and balance the projects risks in their portfolios for minimizing the

risks and maximizing the returns by diversifying portfolio holdings.

A traditional portfolio may minimize the risk and protect principal; however it also limits the

prospective returns. On the contrary, the hard-line project portfolio may provide greater chances of

good returns however it also poses considerably higher risk of failure or loss. PPM balances the risks

with potential returns by diversifying the project portfolio of the companies.

Optimal Allocation of Resources

The resources are optimally allocated among various projects of the portfolio. As the resources are

really limited, all the projects should compete with each other for resources. PPM involves

measuring, comparing, and prioritizing the projects in order to classify and implement the most

valuable projects only. The conflicts between the projects for resources are resolved by the high level

management. The skill sets required for each project and ideal source of these resources are

determined by incorporating formal sourcing strategies.

29

Correction of Performance problems

The performance problems are corrected prior to their development in major issues. Although, PPM

cannot completely get rid of performance crisis, however it assists in addressing the performance

issues early. The PPM involves identification, escalation and addressing of any issues related to

execution and helps in keeping the progress of projects on track.

Aligning projects according to business goals

PPM ensures that projects remain aligned to the business goals during their execution by performing

following activities.

Management oversight and monitoring throughout the project

Standard communication and coordination

Regular course correction for checking the project drifts

Redirecting projects for maintaining alignment and changing business objectives

Executive level Project Oversight

Executives are involved for prioritizing and oversighting the project responsibilities. This ensures that

projects receive the required support and they can be completed successfully. Executives have the

required business acumen and they can align project by using various business strategies.

30

OTHER POTENTIAL BENEFITS

Whatever may be the status of the capital market; over the long period capital markets have

given an excellent return when compared to other forms of investment. The return from bank

deposits, units etc., is much less than from stock market.

The Indian stock markets are very complicated. Though there are thousands of companies that

are listed only a few hundred, which have the necessary liquidity. It is impossible for any

individual whishing to invest and sit down and analyses all these intricacies of the market

unless he does nothing else.

Even if an investor is able to visualize the market, it is difficult to investor to trade in all the

major exchanges of India, look after his deliveries and payments. This is further complicated

by the volatile nature of our markets, which demands constant reshuffling of port

31

FACTORS AFFECTING THE INVESTOR

There may be many reasons why the portfolio of an investor may have to be changed. The portfolio

manager always remains alert and sensitive to the changes in the requirements of the investor. The

following are the some factors affecting the investor, which make it necessary to change the portfolio

composition.

1. Change in Wealth

According to the utility theory, the risk taking ability of the investor increases with

increase in wealth.

It says that people can afford to take more risk as they grow rich and benefit from its

reward.

But, in practice, while they can afford, they may not be willing.

As people get rich, they become more concerned about losing the newly got riches

than getting richer.

So they may become conservative and vary risk- averse.

The fund manager should observe the changes in the attitude of the investor towards

risk and try to understand them in proper perspective.

If the investor turns to be conservative after making huge gains, the portfolio manager

should modify the portfolio accordingly.

2. Change in the Time Horizon

As time passes, some events take place that may have an impact on the time horizon of

the investor.

Births, deaths, marriages, and divorces all have their own impact on the investment

horizon.

There are, of course, many other important events in the persons life that may force a

change in the investment horizon.

The happening or the non-happening of the events will naturally have its effect.

For example :

A person may have planned for an early retirement, considering his delicate

health.But, after turning 55 years of age, if his health improves, he may not take retirement.

32

3.Change in Liquidity Needs

Investors very often ask the portfolio manager to keep enough scope in the portfolio to

get some cash as and they want.

This forces portfolio manager to increase the weight of liquid investments in the asset

mix.

Due to this, the amounts available for investment in the fixed income or growth

securities that actually help in achieving the goal of the investor get reduced.

That is, the money taken out today from the portfolio means that the amount and the

return that would have been earned on it are no longer available for achievement of the

investors goals.

4. Changes in Taxes

It is said that there are only two things certain in this world- death and taxes.

The only uncertainties regarding them relate to the date, time, place and mode.

Portfolio manager have to constantly look out for changes in the tax structure and

make suitable changes in the portfolio composition.

The rate of tax under long- term capital gains is usually lower than the rate applicable

for income. If there is a change in the minimum holding period for long-term capital

gains, it may lead to revision. The specifics of the planning depend on the nature of the

investments.

5. Others

There can be many of other reasons for which clients may ask for a change in the asset

mix in the portfolio.

For example, there may be change in the return available on the investments that have

to be compulsorily made with the government say, in the form of provident fund.

This may call for a change in the return required from the other investments.

33

SECURITIES AND EXCHANGE BOARD OF INDIA REGULATIONS, 1993

Registration of Portfolio Managers:

1. Application for grant of certificate

An application by a portfolio manager for grant of a certificate shall be made to the board on FormA.

Notwithstanding anything contained in sub regulation (1), any application made by a portfolio

manager prior to coming into force of these regulations containing such particulars or as near thereto

as mentioned in form A shall be treated as an application made in pursuance of sub-regulation and

dealt with accordingly.

2. Application of confirm to the requirements

Subject to the provisions of sub-regulation (2) of regulation 3, any application, which is not

complete in all respects and does not confirm to the instructions specified in the form, shall be

rejected:

Provided that, before rejecting any such application, the applicant shall be given an opportunity to

remove within the time specified such objections as may be indicated by the board.

3. Furnishing of further information, clarification and personal representation.

The Board may require the applicant to furnish further information or clarification regarding matters

relevant to his activity of a portfolio manager for the purposes of disposal of the application.

The applicant or, its principal officer shall, if so required, appear before the Board for personal

representation.

4. Consideration of application.

The Board shall take into account for considering the grant of certificate, all matters which are

relevant to the activities relating to portfolio manager and in particular whether the applicant complies

with the following requirements namely.

The applicant has the necessary infrastructure like to adequate office space, equipments and

manpower to effectively discharge his activities.

The applicant has his employment minimum of two persons who have the experience to conduct the

business of portfolio manager.

34

CONCLUSION

With the help of given project I got an in-depth knowledge about the working of portfolio

management. Also I got an insight as too how to invest in portfolio management, which scheme

provide better return as compared to other and who are the portfolio management players in the

Indian market.

It can be concluded from the project that future of portfolio management is bright provided proper

regulations prevail and investors needs are satisfied by providing variety of schemes. The interest of

investors is protected by SEBI. Portfolio management is governed by SEBI Act.

Due to the benefits available to the individuals such as reduction in risk, expert professional

management, diversified portfolios, tax benefits etc. young generation (i.e. age group bet. 18-30) is

willing to invest in different investment avenues through portfolio manager or through mutual funds

which are again managed by portfolio managers. On the other hand, age group of 60 & above are

least interested in making investment in different avenues through portfolio managers. They believe

in investing and managing their portfolio on their own.

However, it can be said that the future of portfolio management is bright in years to come.

35

BIBLIOGRAPHY

REFERENCE BOOKS:

Security Analysis and Portfolio Management - Dr. P.K.BANDGAR

Investment Analysis and Portfolio Management

http://en.wikipedia.org/wiki/Portfolio_management

http://www.technologyevaluation.com/search/for/what-is-the-function-of-portfolio-manager.html

http://www.portfoliomanagement.in/benefits-of-portfolio-management.html

http://epmlive.com/portfolio-management/gain-a-competitive-advantage-5-benefits-of-project-portfolio-

management-ppm/

http://www.technologyevaluation.com/search/for/function-of-portfolio-management-system.html

36

37

38

39

40

Вам также может понравиться

- Time UntimeДокумент10 страницTime UntimeMacmillan Publishers11% (27)

- Portfolio ManagementДокумент75 страницPortfolio Managementsheemankhan82% (17)

- Project Report On Portfolio ManagementДокумент115 страницProject Report On Portfolio Managementsaurav86% (14)

- Investors Perception On Portfolio Management ServicesДокумент64 страницыInvestors Perception On Portfolio Management ServicesSaroj Kumar Pinto80% (5)

- Group 4 CariCRIS Case SubmissionДокумент6 страницGroup 4 CariCRIS Case SubmissionKingsuk MaityОценок пока нет

- Convert 2.0 - Frank Kern Official Full Download + FREEДокумент127 страницConvert 2.0 - Frank Kern Official Full Download + FREETwo Comma Club100% (1)

- Introduction To The Study: Aim of Doing The ProjectДокумент64 страницыIntroduction To The Study: Aim of Doing The ProjectBeing Sumit Sharma100% (1)

- Arbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectДокумент86 страницArbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectNipul Bafna100% (3)

- Security Analysis and Portfolio ManagementДокумент71 страницаSecurity Analysis and Portfolio ManagementRaghavendra yadav KM80% (15)

- Report On Wealth ManagementДокумент68 страницReport On Wealth ManagementSANDEEP ARORA69% (13)

- Port Folio ManagementДокумент90 страницPort Folio Managementnaga0017100% (1)

- Project Report On Portfolio ConstructionДокумент37 страницProject Report On Portfolio ConstructionMazhar Zaman67% (3)

- Financial Management Term PaperДокумент29 страницFinancial Management Term PaperOmar Faruk100% (1)

- Delta Robot KinematicsДокумент11 страницDelta Robot KinematicssekinОценок пока нет

- Objectives & Scope of Portfolio ManagementДокумент4 страницыObjectives & Scope of Portfolio ManagementGourav BaidОценок пока нет

- Portfolio ManagementДокумент65 страницPortfolio ManagementAasthaОценок пока нет

- Introduction To Portfolio ManagementДокумент13 страницIntroduction To Portfolio ManagementAbdul Lathif100% (2)

- Portfolio Management - ResearchДокумент20 страницPortfolio Management - ResearchHarsh Thakker100% (1)

- Portfolio ManagementДокумент31 страницаPortfolio Managementharjot singhОценок пока нет

- Portfolio ManagementДокумент103 страницыPortfolio ManagementAnil Kumar100% (1)

- Wealth ManagementДокумент31 страницаWealth Management16july1994Оценок пока нет

- Portfolio Management Roll No.06Документ88 страницPortfolio Management Roll No.06ninad ghadigaonkar50% (4)

- Portfolio Management India InfolineДокумент93 страницыPortfolio Management India InfolineVasavi Daram0% (1)

- Wealth ManagementДокумент65 страницWealth ManagementVinay Vasani100% (2)

- Portfolio Management NetworthДокумент87 страницPortfolio Management NetworthAdiseshu ChowdaryОценок пока нет

- Project On Derivative MarketДокумент87 страницProject On Derivative Marketmuralib4u587% (30)

- A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanДокумент19 страницA Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal KhanVandita KhudiaОценок пока нет

- Research Methodology - Portfolio Management ServicesДокумент24 страницыResearch Methodology - Portfolio Management Servicespranav_mulay100% (1)

- Portfolio Management ServicesДокумент19 страницPortfolio Management Serviceschawan_nikitaОценок пока нет

- Portfolio AnalysisДокумент18 страницPortfolio Analysissubscription accountОценок пока нет

- Financial DerivativesДокумент23 страницыFinancial Derivativespurushoth100% (1)

- Investment PatternДокумент74 страницыInvestment PatternAshish KhatterОценок пока нет

- Risk Management in BankingДокумент105 страницRisk Management in BankingNasir UddinОценок пока нет

- Executive Summary RaviДокумент2 страницыExecutive Summary RaviAditya Verma0% (1)

- 123 Review of LiteratureДокумент31 страница123 Review of LiteratureHari PriyaОценок пока нет

- Portfolio MGMT SynopsisДокумент3 страницыPortfolio MGMT Synopsiskhushbookhetan0% (1)

- Investment Pattern of Salaried Individual PDFДокумент62 страницыInvestment Pattern of Salaried Individual PDFVighnesh Kurup100% (1)

- A Study of Investors Attitude Towards Mutual Funds in DelhiДокумент14 страницA Study of Investors Attitude Towards Mutual Funds in DelhiarcherselevatorsОценок пока нет

- Bhavesh Sawant Bhuvan DalviДокумент8 страницBhavesh Sawant Bhuvan DalviBhuvan DalviОценок пока нет

- Dessertation Mutual Funds in IndiaДокумент81 страницаDessertation Mutual Funds in IndiaPratiksha GaikwadОценок пока нет

- Analysis of Investment Strategie1Документ51 страницаAnalysis of Investment Strategie1Kalinga MahalikОценок пока нет

- 16 BibliographyДокумент10 страниц16 BibliographyBinayKPОценок пока нет

- "Investment Banking": HSBC Bank (Hyderabad)Документ10 страниц"Investment Banking": HSBC Bank (Hyderabad)Balakrishna Chakali0% (2)

- Investment Analysis and Portfolio Management Practice Book SampleДокумент21 страницаInvestment Analysis and Portfolio Management Practice Book SampleMeenakshi86% (7)

- Mutual Fund Project OutlineДокумент6 страницMutual Fund Project OutlineAnto PremОценок пока нет

- Mutual Funds in India: Structure, Performance and UndercurrentsОт EverandMutual Funds in India: Structure, Performance and UndercurrentsОценок пока нет

- Portfolio ManagementДокумент40 страницPortfolio ManagementTOXIC GAMINGОценок пока нет

- A Study On Portfolio ManagementДокумент21 страницаA Study On Portfolio ManagementRajendra NishadОценок пока нет

- Portfolio ManagementДокумент40 страницPortfolio ManagementSayaliRewaleОценок пока нет

- Portfolio Management PDFДокумент47 страницPortfolio Management PDFbhaumiksawant25Оценок пока нет

- Portfolio ManagementДокумент11 страницPortfolio ManagementRameez100% (1)

- Porfolio ManagementДокумент89 страницPorfolio ManagementTeddy DavisОценок пока нет

- Portfolio Evaluation and RevisionДокумент32 страницыPortfolio Evaluation and RevisionHarshit Gandhi100% (1)

- Aditya Kadam Portfolio Management of Investments NewwwwwwДокумент56 страницAditya Kadam Portfolio Management of Investments Newwwwwwchirag kararaОценок пока нет

- What Is Portfolio ManagementДокумент4 страницыWhat Is Portfolio Managementsakpal_smitaОценок пока нет

- 1.1 Introduction To The StudyДокумент68 страниц1.1 Introduction To The Studyrajesh bathulaОценок пока нет

- Project Report On Portfolio Management MGT 727Документ35 страницProject Report On Portfolio Management MGT 727Delta XeroxОценок пока нет

- What Is Portfolio and Portfolio Management (Definition) ?Документ6 страницWhat Is Portfolio and Portfolio Management (Definition) ?isha aggarwalОценок пока нет

- Chapter-2 Portfolio Analysis and SelectionДокумент14 страницChapter-2 Portfolio Analysis and Selection8008 Aman GuptaОценок пока нет

- International Portfolio Management Unit 2Документ12 страницInternational Portfolio Management Unit 2Omar Ansar Ali100% (1)

- Chapter - IДокумент75 страницChapter - IsathulurisambashivaОценок пока нет

- Portfolio AssignmentДокумент6 страницPortfolio AssignmentfkkfoxОценок пока нет

- Portfolio ManagementДокумент45 страницPortfolio ManagementSukesh Nair100% (1)

- Strategic ManagementДокумент6 страницStrategic ManagementgoodwynjОценок пока нет

- Flexible Exchange RateДокумент38 страницFlexible Exchange RategoodwynjОценок пока нет

- Financial Service Promotional (Strategy Icici Bank)Документ51 страницаFinancial Service Promotional (Strategy Icici Bank)goodwynj100% (2)

- Customer Relationship ManagementДокумент41 страницаCustomer Relationship Managementgoodwynj100% (1)

- 4.36 M.com Banking & FinanceДокумент18 страниц4.36 M.com Banking & FinancegoodwynjОценок пока нет

- Suggested End of Chapter 5 SolutionsДокумент8 страницSuggested End of Chapter 5 SolutionsgoodwynjОценок пока нет

- Monetary Policy of RBIДокумент42 страницыMonetary Policy of RBITejas SanghaviОценок пока нет

- Daftar Pustaka 7689Документ20 страницDaftar Pustaka 7689Rivani KurniawanОценок пока нет

- Bar Graphs and HistogramsДокумент9 страницBar Graphs and HistogramsLeon FouroneОценок пока нет

- Calderon de La Barca - Life Is A DreamДокумент121 страницаCalderon de La Barca - Life Is A DreamAlexandra PopoviciОценок пока нет

- Noli Me Tangere CharactersДокумент4 страницыNoli Me Tangere CharactersDiemОценок пока нет

- AVERY, Adoratio PurpuraeДокумент16 страницAVERY, Adoratio PurpuraeDejan MitreaОценок пока нет

- CA IPCC Accounting Guideline Answers May 2015Документ24 страницыCA IPCC Accounting Guideline Answers May 2015Prashant PandeyОценок пока нет

- Share Cognitive Notes Doc-1Документ15 страницShare Cognitive Notes Doc-1GinniОценок пока нет

- Case KohortДокумент37 страницCase KohortNasir AhmadОценок пока нет

- Revised Market Making Agreement 31.03Документ13 страницRevised Market Making Agreement 31.03Bhavin SagarОценок пока нет

- Javier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Документ4 страницыJavier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Scribd Government DocsОценок пока нет

- Notification On Deemed Examination Result NoticeДокумент2 страницыNotification On Deemed Examination Result Noticesteelage11Оценок пока нет

- NIA Foundation PLI Proposal Template (Repaired)Документ23 страницыNIA Foundation PLI Proposal Template (Repaired)lama dasuОценок пока нет

- Learning Objectives: Understanding The Self Module 1 - Sexual SelfДокумент11 страницLearning Objectives: Understanding The Self Module 1 - Sexual SelfMiss MegzzОценок пока нет

- The Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentДокумент4 страницыThe Effectiveness of Peppermint Oil (Mentha X Pepipirita) As Mosquito RepellentKester PlaydaОценок пока нет

- (Essential Histories) Waldemar Heckel - The Wars of Alexander The Great-Osprey PDFДокумент97 страниц(Essential Histories) Waldemar Heckel - The Wars of Alexander The Great-Osprey PDFJorel Fex100% (3)

- General Mathematics - Module #3Документ7 страницGeneral Mathematics - Module #3Archie Artemis NoblezaОценок пока нет

- BangaloreДокумент1 229 страницBangaloreVikas RanjanОценок пока нет

- Adv Tariq Writ of Land Survey Tribunal (Alomgir ALo) Final 05.06.2023Документ18 страницAdv Tariq Writ of Land Survey Tribunal (Alomgir ALo) Final 05.06.2023senorislamОценок пока нет

- DLL - English 4 - Q2 - W8Документ4 страницыDLL - English 4 - Q2 - W8BenjОценок пока нет

- The University of Southern Mindanao VisionДокумент9 страницThe University of Southern Mindanao VisionNorhainie GuimbalananОценок пока нет

- GBS210099-Nguyen Manh Quan - 1004B - As01Документ33 страницыGBS210099-Nguyen Manh Quan - 1004B - As01quannmgbs210099Оценок пока нет

- Aqeedah TahawiyyahДокумент151 страницаAqeedah Tahawiyyahguyii86100% (1)

- Skills For Developing Yourself As A LeaderДокумент26 страницSkills For Developing Yourself As A LeaderhIgh QuaLIty SVTОценок пока нет

- Constitutional Law Sem 5Документ5 страницConstitutional Law Sem 5Ichchhit SrivastavaОценок пока нет

- Astro ExamДокумент7 страницAstro ExamRitu DuaОценок пока нет

- A Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalДокумент6 страницA Clinico-Microbiological Study of Diabetic Foot Ulcers in An Indian Tertiary Care HospitalJoko Cahyo BaskoroОценок пока нет