Академический Документы

Профессиональный Документы

Культура Документы

Bachrach

Загружено:

LawstudentArellano0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров2 страницыfdsaf

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документfdsaf

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

16 просмотров2 страницыBachrach

Загружено:

LawstudentArellanofdsaf

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

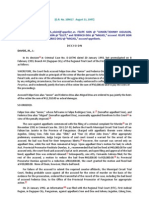

aBachrach v.

Seifeort and Elianoff

G.R. No. L-2659, October 12, 1950, 87 Phil. 483

Ozaeta, J .

FACTS: The deceased E. M. Bachrach, who left no forced heir except his widow Mary

McDonald Bachrach, in his last will and testament made various legacies in cash and

willed the remainder of his estate. The estate of E. M. Bachrach, as owner of 108,000

shares of stock of the Atok-Big Wedge Mining Co., Inc., received from the latter 54,000

shares representing 50 per cent stock dividend on the said 108,000 shares. On June

10, 1948, Mary McDonald Bachrach, as usufructuary or life tenant of the estate,

petitioned the lower court to authorize the Peoples Bank and Trust Company, as

administrator of the estate of E. M. Bachrach, to transfer to her the said 54,000 shares

of stock dividend by indorsing and delivering to her the corresponding certificate of

stock, claiming that said dividend, although paid out in the form of stock, is fruit or

income and therefore belonged to her as usufructuary or life tenant. Sophie Seifert and

Elisa Elianoff, legal heirs of the deceased, opposed said petition on the ground that the

stock dividend in question was not income but formed part of the capital and therefore

belonged not to the usufructuary but to the remainderman. While appellants admit that a

cash dividend is an income, they contend that a stock dividend is not, but merely

represents an addition to the invested capital.

ISSUE: Whether or not a dividend is an income and whether it should go to the

usufructuary.

HELD: Yes. The usufructuary shall be entitled to receive all the natural, industrial, and

civil fruits of the property in usufruct. The 108,000 shares of stock are part of the

property in usufruct. The 54,000 shares of stock dividend are civil fruits of the original

investment. They represent profits, and the delivery of the certificate of stock covering

said dividend is equivalent to the payment of said profits. Said shares may be sold

independently of the original shares, just as the offspring of a domestic animal may be

sold independently of its mother. If the dividend be in fact a profit, although declared in

stock, it should be held to be income. A dividend, whether in the form of cash or stock,

is income and, consequently, should go to the usufructuary, taking into consideration

that a stock dividend as well as a cash dividend can be declared only out of profits of

the corporation, for if it were declared out of the capital it would be a serious violation of

the law.

Under the Massachusetts rule, a stock dividend is considered part of the capital and

belongs to the remainderman; while under the Pennsylvania rule, all earnings of a

corporation, when declared as dividends in whatever form, made during the lifetime of

the usufructuary, belong to the latter. The Pennsylvania rule is more in accord with our

statutory laws than the Massachusetts rule.

Bachrach Motor Co., Inc. v. Talisay Silay Milling Co.

G.R. No. 35223, September 17, 1931, 56 Phil. 117

Romualdez, J .

FACTS: On December 22, 1923, the Talisay-Silay Milling Co., Inc., was indebted to the

Philippine National Bank. To secure the payment of its debt, it succeeded in inducing its

planters, among whom, was Mariano Lacson Ledesma, to mortgage their land to the

creditor bank. And in order to compensate those planters for the risk they were running

with their property under the mortgage, the aforesaid central, by a resolution passed on

that same date, i.e., December 22, 1923, undertook to credit the owners of the

plantation thus mortgaged every year with a sum equal to two per centum of the debt

secured according to yearly balance, the payment of the bonus being made at once, or

in part from time to time, as soon as the central became free of its obligations to the

aforesaid bank, and of those contracted by virtue of the contract of supervision, and had

funds which might be so used, or as soon as it obtained from said bank authority to

make such payment.

Bachrach Motor Co., Inc. filed a complaint against the Talisay-Silay Milling Co., Inc., for

the delivery of the amount P13,850 or promissory notes or other instruments or credit

for that sum payable on June 30, 1930, as bonus in favor of Mariano Lacson Ledesma.

The Philippine National Bank filed a third party claim alleging a preferential right to

receive any amount which Mariano Lacson Ledesma might be entitled to from the

Talisay-Silay Milling Co. as bonus, because that would be civil fruits of the land

mortgaged to said bank by said debtor for the benefit of the central referred to, and by

virtue of a deed of assignment, and praying that said central be ordered to delivered

directly to the intervening bank said sum on account of the latter's credit against the

aforesaid Mariano Lacson Ledesma.

ISSUE: Whether or not the bonus in question is civil fruits

HELD: No. The said bonus bears no immediate, but only a remote accidental relation to

the land mentioned, having been granted as compensation for the risk of having

subjected one's land to a lien in favor of the bank, for the benefit of the entity granting

said bonus. If this bonus be income or civil fruits of anything, it is income arising from

said risk, or, if one chooses, from Mariano Lacson Ledesma's generosity in facing the

danger for the protection of the central, but certainly it is not civil fruits or income from

the mortgaged property. Hence, the amount of the bonus, according to the resolution of

the central granting it, is not based upon the value, importance or any other

circumstance of the mortgaged property, but upon the total value of the debt thereby

secured, according to the annual balance, which is something quite distinct from and

independent of the property referred to.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Prudente V DayritДокумент1 страницаPrudente V DayritLawstudentArellanoОценок пока нет

- Political Law Case DigestsДокумент96 страницPolitical Law Case DigestsLawstudentArellanoОценок пока нет

- People V SionДокумент11 страницPeople V SionLawstudentArellanoОценок пока нет

- Prudente v. Judge DayritДокумент6 страницPrudente v. Judge DayritLawstudentArellanoОценок пока нет

- People V FerrerДокумент2 страницыPeople V FerrerLawstudentArellanoОценок пока нет

- Naval V CaДокумент2 страницыNaval V CaLawstudentArellanoОценок пока нет

- People V CaprizoДокумент2 страницыPeople V CaprizoLawstudentArellanoОценок пока нет

- Industrial Textile Manufacturing Company of The Philippines, Inc., FactsДокумент2 страницыIndustrial Textile Manufacturing Company of The Philippines, Inc., FactsLawstudentArellanoОценок пока нет

- People V SionДокумент11 страницPeople V SionLawstudentArellanoОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Tarpley ReportДокумент12 страницTarpley ReportPeggy W SatterfieldОценок пока нет

- Deposit Scheme Analysis of Exim BankДокумент16 страницDeposit Scheme Analysis of Exim Bankmamun khanОценок пока нет

- Commerce Lesson PlanДокумент6 страницCommerce Lesson PlanPrince Victor0% (1)

- Study Guide 1Документ11 страницStudy Guide 1ambitchous19Оценок пока нет

- Bank of America V Associated Citizens BankДокумент4 страницыBank of America V Associated Citizens BankJuhainah Lanto TanogОценок пока нет

- Advanced Banking Law Nov 2010 Main PaperДокумент4 страницыAdvanced Banking Law Nov 2010 Main PaperBasilio MaliwangaОценок пока нет

- PM Lecture 7Документ12 страницPM Lecture 7Atharva BanarseОценок пока нет

- BOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchДокумент17 страницBOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchPardeep KumarОценок пока нет

- Globalization and Sovereignty Beyond The Territorial Trap by John AgnewДокумент291 страницаGlobalization and Sovereignty Beyond The Territorial Trap by John AgnewLunargalaxyYT223 MoonlightОценок пока нет

- 400KV Substation Tender Document Part 01 of 02Документ674 страницы400KV Substation Tender Document Part 01 of 02Pranoy BaruaОценок пока нет

- Oceanis Q3 Market ReportДокумент12 страницOceanis Q3 Market ReportIneffAble MeloDyОценок пока нет

- Banking Regulation ACT, 1949: Presentation By: Kajal BansalДокумент33 страницыBanking Regulation ACT, 1949: Presentation By: Kajal BansalAman MehtaОценок пока нет

- Low Interest RatesДокумент2 страницыLow Interest RatesAmogh SahuОценок пока нет

- Campos vs. PeopleДокумент4 страницыCampos vs. PeopleannelyseОценок пока нет

- Draft Memorandum of AssociationДокумент11 страницDraft Memorandum of AssociationEthan HuntОценок пока нет

- MB20202 Corporate Finance Unit V Study MaterialsДокумент33 страницыMB20202 Corporate Finance Unit V Study MaterialsSarath kumar CОценок пока нет

- Case of ICICI and Bank of Madura MergerДокумент6 страницCase of ICICI and Bank of Madura MergerAkash SinghОценок пока нет

- Auditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Документ4 страницыAuditing & Assurance Principles - Specialized Industries (Module 5, 8 & Banking)Joana Lyn BuqueronОценок пока нет

- Signed MOUДокумент3 страницыSigned MOUSheila MaОценок пока нет

- A Research On Understanding and Exploring Job Description in Standard Chartered BankДокумент59 страницA Research On Understanding and Exploring Job Description in Standard Chartered BankMd Saimum HossainОценок пока нет

- Deposits: Private Liited CompanyДокумент6 страницDeposits: Private Liited CompanyGautam BanthiaОценок пока нет

- Annual Report 2011Документ41 страницаAnnual Report 2011Moinul HasanОценок пока нет

- Ethiopia Permits Mobile Banking and Money ServicesДокумент1 страницаEthiopia Permits Mobile Banking and Money ServicesWellik SouzaОценок пока нет

- 2 (F) and 12 (B) Colleges - Proforma For Soliciting Xii Plan Requirements of The CollegeДокумент15 страниц2 (F) and 12 (B) Colleges - Proforma For Soliciting Xii Plan Requirements of The CollegeSenthil KumarОценок пока нет

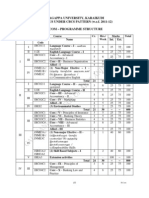

- Alagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Документ26 страницAlagappa University, Karaikudi SYLLABUS UNDER CBCS PATTERN (W.e.f. 2011-12)Mathan NaganОценок пока нет

- Small Industries Development Bank of India (SIDBI) WWW - Edutap.co - inДокумент16 страницSmall Industries Development Bank of India (SIDBI) WWW - Edutap.co - injashuramuОценок пока нет

- FAR Pre-Week Part 1Документ24 страницыFAR Pre-Week Part 1John DoeОценок пока нет

- Newzen Mba Finance 2023Документ11 страницNewzen Mba Finance 2023New Zen InfotechОценок пока нет

- (VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Документ14 страниц(VIII) Chapter 3 (Financial Analysis and SWOT Analysis)Swami Yog BirendraОценок пока нет

- Preethi Rao: Chit Funds - A Boon To The Small EnterprisesДокумент19 страницPreethi Rao: Chit Funds - A Boon To The Small EnterprisesNisha UchilОценок пока нет