Академический Документы

Профессиональный Документы

Культура Документы

256 Inquirer1

Загружено:

sgoyal89Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

256 Inquirer1

Загружено:

sgoyal89Авторское право:

Доступные форматы

COMP-XM INQUIRER

1 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Page 1 Front Page

Page 2 Stocks & Bonds

Page 3 Financial Summary

Page 4 Production Analysis

Annual Report Andrews

Page 5 Thrift Segment Analysis

Page 6 Core Segment Analysis

Page 7 Nano Segment Analysis

Page 8 Elite Segment Analysis

Annual Report Baldwin

Page 9 Market Share

Page 10 Perceptual Map

Page 11 HR/TQM Report

Annual Report Chester

Annual Report Digby

22-08-2014 10:44

COMP-XM INQUIRER

2 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

"

Round: 1

Dec. 31, 2014

Svati

Goyal

Student: Svati Goyal

Andrews

Svati Goyal

Baldwin

Chester

Digby

Selected Financial Statistics

ROS

Asset Turnover

ROA

Leverage (Assets/Equity)

ROE

Emergency Loan

Sales

EBIT

Profits

Cumulative Profit

SG&A / Sales

Contrib. Margin %

Andrews

0.8%

0.93

0.7%

1.7

1.3%

$0

$118,094,480

$7,039,083

$949,940

$949,940

14.7%

34.5%

Baldwin

4.8%

0.84

4.0%

2.4

9.6%

$0

$126,410,049

$19,301,558

$6,077,411

$6,077,411

12.1%

36.1%

Chester

9.3%

1.63

15.1%

1.8

26.6%

$0

$160,355,656

$27,396,574

$14,898,599

$14,898,599

8.2%

33.2%

Digby

4.3%

0.98

4.2%

2.6

10.8%

$0

$163,893,493

$22,475,904

$7,008,030

$7,008,030

8.5%

30.0%

22-08-2014 10:44

COMP-XM INQUIRER

3 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

COMP-XM INQUIRER

Page 1

22-08-2014 10:44

COMP-XM INQUIRER

4 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Round: 1

Stocks & Bonds

Svati Goyal

December 31 , 2014

Stock Market Summary

Company

Andrews

Baldwin

Chester

Digby

Close

$63.50

$48.29

$70.58

$41.49

Change

($32.31)

($4.44)

$15.55

($3.33)

Shares

2,071,816

2,255,661

1,880,440

2,628,743

MarketCap ($M)

$132

$109

$133

$109

Book Value

$35.89

$28.21

$29.74

$24.59

EPS

$0.46

$2.69

$7.92

$2.67

Dividend

$0.00

$0.00

$3.45

$0.00

Yield

0.0%

0.0%

4.9%

0.0%

P/E

138.2

17.9

8.9

15.6

Bond Market Summary

Company

Series#

Face

Yield

Close$

S&P

13.5S2015

11.2S2020

11.9S2021

10.9S2024

$11,300,000

$8,837,000

$7,072,000

$14,000,000

13.2%

11.2%

11.6%

11.2%

101.98

99.58

102.80

97.67

BBB

BBB

BBB

BBB

13.5S2015

11.2S2020

12.4S2021

12.0S2023

12.6S2024

$11,300,000

$8,632,724

$5,825,802

$15,610,279

$17,788,546

13.5%

12.1%

12.8%

12.7%

12.9%

100.35

92.43

96.91

94.38

97.30

CC

CC

CC

CC

CC

13.5S2015

11.1S2022

11.2S2023

11.5S2024

$11,300,000

$2,509,600

$5,662,814

$1,377,976

13.3%

11.3%

11.4%

11.5%

101.79

97.98

98.37

100.00

BB

BB

BB

BB

13.5S2015

11.3S2020

12.5S2021

12.5S2022

12.5S2023

12.9S2024

$11,300,000

$10,417,600

$14,665,611

$7,963,435

$9,569,958

$14,262,838

13.5%

12.3%

13.0%

13.1%

13.1%

13.3%

100.09

91.70

96.07

95.74

95.45

97.33

CC

CC

CC

CC

CC

CC

Andrews

Baldwin

Chester

Digby

Next Year's Prime Rate 8.50%

COMP-XM INQUIRER

Page 2

22-08-2014 10:44

COMP-XM INQUIRER

5 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Financial Summary

Cash Flow Statement Survey

Cash flows from operating activities

Net Income (Loss)

Adjustment for non-cash items:

Depreciation

Extraordinary gains/los ses/writeoffs

Changes in current as sets and liabilities:

Accounts payable

Inventory

Accounts receivable

Net cash from operations

Cash flows from investing activities

Plant improvements (net)

Cash flows from financing activities

Dividends paid

Sales of common stock

Purchase of common s tock

Cash from long term debt issued

Early retirement of long term debt

Retirement of current debt

Cash from current debt borrowing

Cash from emergency loan

Net cash from financing activities

Round: 1

December 31, 2014

Svati Goyal

Andrews

Baldwin

Chester

Digby

$950

$6,077

$14,899

$7,008

$7,619

($515)

$9,887

$0

$6,264

$0

$11,837

$0

($5,006)

$22,043

$3,749

$28,841

$787

($203)

($641)

$15,907

$1,326

$9,876

($3,339)

$29,026

$1,931

$2,822

($2,624)

$20,975

($34,433)

($40,900)

($9,580)

($34,660)

$0

$2,000

$0

$14,000

$0

($15,717)

$7,000

$0

$0

$4,365

$0

$17,789

$0

($25,523)

$21,710

$0

($6,494)

$0

($1,609)

$1,378

$0

($18,445)

$13,971

$0

$0

$2,840

$0

$14,263

$0

($29,281)

$25,277

$0

$7,283

$18,341

($11,198)

$13,098

$1,691

($6,652)

$8,248

($587)

Balance Sheet Survey

Cash

Accounts Receivable

Inventory

Total Current Ass ets

Andrews

$34,132

$9,706

$3,489

$47,328

Baldwin

$24,986

$10,390

$7,584

$42,960

Chester

$25,872

$13,180

$6,955

$46,007

Digby

$32,136

$13,471

$7,172

$52,779

Plant and equipment

Accumulated Depreciation

Total Fixed Ass ets

$129,892

($50,149)

$79,743

$165,300

($57,176)

$108,124

$93,960

($41,287)

$52,673

$177,560

($63,104)

$114,456

Total Assets

$127,071

$151,084

$98,680

$167,234

Accounts Payable

Current Debt

Long Term Debt

Total Liabilities

$4,510

$7,000

$41,209

$52,719

$6,583

$21,710

$59,157

$87,451

$7,927

$13,971

$20,850

$42,749

$9,130

$25,277

$68,179

$102,586

Common Stock

Retained Earnings

Total Equity

$14,081

$60,270

$74,351

$18,743

$44,890

$63,634

$8,799

$47,132

$55,931

$27,509

$37,139

$64,648

Total Liabilities & Owners' Equity

$127,071

$151,084

$98,680

$167,234

Income Statement Survey

Sales

Variable Costs (Labor, Material, Carry)

Depreciation

SGA (R&D, Promo, Sales, Admin)

Other (Fees, Writeoffs, TQM, Bonuses)

EBIT

Interes t (Short term, Long term)

Taxes

Profit Sharing

Net Profit

Andrews

$118,094

$77,334

$7,619

$17,316

$8,785

$7,039

$5,548

$522

$19

$950

Baldwin

$126,410

$80,806

$9,887

$15,308

$1,108

$19,302

$9,761

$3,339

$124

$6,077

Chester

$160,356

$107,158

$6,264

$13,194

$6,343

$27,397

$4,008

$8,186

$304

$14,899

Digby

$163,893

$114,760

$11,837

$13,965

$855

$22,476

$11,474

$3,851

$143

$7,008

Net change in cash position

22-08-2014 10:44

COMP-XM INQUIRER

6 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

COMP-XM INQUIRER

Page 3

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

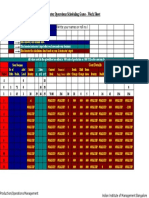

Production Analysis

Round: 1

December 31, 2014

Svati Goyal

Production Information

Name

Primary

Segment

Units

Unit

Sold Inven tory

MTBF

Pfmn

Coord

Size

Coord

Material

Price

Cost

Labor

Cost

Contr.

Marg.

2nd Shift

&

Overtime

Auto

mation Capacity

Next

Next

Round

Round

Plant

Utiliz.

Ark

Able

Acre

Awe

Anoah

As ome

Elite

Thrift

Core

Nano

759

831

1,353

756

0

0

0

221

0

0

0

0

7/19/2014

12/22/2014

7/29/2014

10/5/2014

5/21/2015

5/9/2015

1.3

3.1

1.8

1.2

0.0

0.0

26000

20000

18000

20000

0

0

13.9

6.8

8.9

11.6

0.0

0.0

8.3

13.2

11.1

6.0

0.0

0.0

$40.50

$24.50

$28.00

$38.50

$0.00

$0.00

$16.23

$8.57

$10.01

$14.48

$0.00

$0.00

$9.18

$6.56

$8.20

$9.18

$0.00

$0.00

37%

34%

33%

36%

0%

0%

0%

0%

10%

0%

0%

0%

5.0

7.5

7.0

5.0

5.0

5.0

714

1,000

1,200

728

300

300

76%

30%

109%

68%

0%

0%

Buzz

Brat

Baker

Bead

Bid

Thrift

Core

Nano

Elite

1,498

2,172

913

733

0

307

70

88

92

0

6/28/2014

12/7/2014

12/17/2014

12/18/2014

4/1/2015

2.5

1.1

1.1

1.1

0.0

14000

16000

18000

20000

0

7.0

9.4

11.3

13.7

0.0

13.2

10.8

6.8

8.8

0.0

$19.00

$21.00

$30.00

$34.00

$0.00

$6.93

$9.87

$13.41

$14.22

$0.00

$2.79

$5.67

$6.07

$6.89

$0.00

48%

28%

36%

38%

0%

80%

96%

13%

0%

0%

9.0

7.0

6.0

5.0

7.0

1,250

1,500

800

800

500

178%

194%

112%

80%

0%

Cute

Crimp

Cake

Cedar

Nano

Elite

Nano

Elite

1,211

1,051

1,157

1,109

0

31

142

119

12/1/2014

1/4/2015

10/17/2014

10/17/2014

1.6

2.9

1.1

1.1

23000

25000

23000

25000

10.5

12.6

12.0

14.0

7.8

9.8

6.2

8.2

$31.00

$35.00

$37.00

$39.00

$13.95

$14.61

$15.44

$16.04

$9.68

$8.80

$8.53

$8.00

26%

33%

35%

38%

100%

36%

24%

5%

5.0

5.0

5.5

5.5

800

700

850

950

198%

134%

122%

104%

Dug

Drat

Deal

Dell

Thrift

Thrift

Core

Core

2,308

2,529

1,324

1,522

3

124

156

141

4/11/2015

4/11/2015

11/19/2014

11/17/2014

3.8

3.6

1.2

1.2

17000

17000

18000

20000

6.8

7.0

10.2

11.0

13.4

13.2

9.4

10.0

$18.00

$18.00

$27.00

$27.00

$7.63

$7.83

$11.55

$12.25

$4.58

$4.54

$7.14

$7.36

31%

30%

31%

28%

100%

92%

50%

68%

8.5

8.5

7.8

7.8

1,050

1,250

1,050

1,250

198%

190%

149%

167%

COMP-XM INQUIRER

7 of 41

Revision Date

Age

Dec.31

Page 4

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Thrift Market Segment Analysis

Total Industry Unit Demand

Actual Industry Unit Sales

Segment % of Total Industry

Svati Goyal

Thrift Statistics

Round: 1

December 31, 2014

5,669

5,669

26.7%

Next Year's Segment Growth Rate

11.0%

Thrift Customer Buying Criteria

1.

2.

3.

4.

Expectations

$14.00 - 26.00

MTBF 14000-20000

Pfmn 7.0 Size 13.2

Ideal Age = 3.0

Price

Reliability

Ideal Position

Age

Importance

55%

20%

15%

10%

Perceptual Map for Thrift Segment

Top Products in Thrift Segment

Name

Drat

Dug

Buzz

Able

Brat

8 of 41

Market

Share

29%

28%

18%

13%

9%

Units Sold

to Seg

1,645

1,574

1,024

717

523

Revis ion

Date

Stock Out

4/11/2015

4/11/2015

6/28/2014

12/22/2014

12/7/2014

Pfmn

Coord

7.0

6.8

7.0

6.8

9.4

Size

Coord

13.2

13.4

13.2

13.2

10.8

List

Price

$18.00

$18.00

$19.00

$24.50

$21.00

MTBF

17000

17000

14000

20000

16000

Age

Dec.31

3.56

3.76

2.48

3.06

1.11

Promo Cust. AwareBudget

ness

$1,150

69%

$1,150

68%

$1,000

56%

$1,200

81%

$1,000

56%

Sales Cust. AccessBudget

ibility

$1,000

64%

$1,000

64%

$1,000

72%

$1,200

71%

$1,800

72%

Dec.

Cust.

Survey

37

36

24

26

5

22-08-2014 10:44

COMP-XM INQUIRER

9 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Acre

Deal

3%

0%

181

5

COMP-XM INQUIRER

7/29/2014

11/19/2014

YES

8.9

10.2

11.1

9.4

$28.00

$27.00

18000

18000

1.83

1.16

$1,200

$1,150

81%

68%

$1,200

$700

71%

64%

4

0

Page 5

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Core Market Segment Analysis

Total Industry Unit Demand

Actual Industry Unit Sales

Segment % of Total Industry

Svati Goyal

Core Statistics

Round: 1

December 31, 2014

7,354

7,354

34.6%

Next Year's Segment Growth Rate

10.0%

Core Customer Buying Criteria

1.

2.

3.

4.

Expectations

$20.00 - 32.00

Ideal Age = 2.0

MTBF 16000-22000

Pfmn 9.4 Size 10.8

Price

Age

Reliability

Ideal Position

Importance

46%

20%

18%

16%

Perceptual Map for Core Segment

Top Products in Core Segment

Name

Brat

Dell

Acre

Deal

Drat

10 of 41

Market

Share

22%

15%

14%

13%

12%

Units Sold

to Seg

1,650

1,110

1,035

982

884

Revis ion

Date

Stock Out

12/7/2014

11/17/2014

7/29/2014

YES

11/19/2014

4/11/2015

Pfmn

Coord

9.4

11.0

8.9

10.2

7.0

Size

Coord

10.8

10.0

11.1

9.4

13.2

List

Price

$21.00

$27.00

$28.00

$27.00

$18.00

MTBF

16000

20000

18000

18000

17000

Age

Dec.31

1.11

1.18

1.83

1.16

3.56

Promo Cust. AwareBudget

ness

$1,000

56%

$1,150

68%

$1,200

81%

$1,150

68%

$1,150

69%

Sales Cust. AccessBudget

ibility

$1,800

63%

$700

69%

$1,200

67%

$700

69%

$1,000

69%

Dec.

Cust.

Survey

39

22

28

18

15

22-08-2014 10:44

COMP-XM INQUIRER

11 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Dug

Buzz

Cute

Able

Baker

Crimp

Bead

10%

6%

5%

2%

0%

0%

0%

734

474

352

114

16

2

2

COMP-XM INQUIRER

4/11/2015

6/28/2014

12/1/2014

12/22/2014

12/17/2014

1/4/2015

12/18/2014

YES

6.8

7.0

10.5

6.8

11.3

12.6

13.7

13.4

13.2

7.8

13.2

6.8

9.8

8.8

$18.00

$19.00

$31.00

$24.50

$30.00

$35.00

$34.00

17000

14000

23000

20000

18000

25000

20000

3.76

2.48

1.63

3.06

1.05

2.91

1.07

$1,150

$1,000

$1,250

$1,200

$1,000

$1,250

$1,000

68%

56%

77%

81%

57%

77%

57%

$1,000

$1,000

$900

$1,200

$900

$900

$1,200

69%

63%

20%

67%

63%

20%

63%

11

13

2

20

0

0

0

Page 6

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Nano Market Segment Analysis

Total Industry Unit Demand

Actual Industry Unit Sales

Segment % of Total Industry

Svati Goyal

Nano Statistics

Round: 1

December 31, 2014

4,164

4,164

19.6%

Next Year's Segment Growth Rate

14.0%

Nano Customer Buying Criteria

1.

2.

3.

4.

Expectations

Pfmn 11.3 Size 6.6

$28.00 - 40.00

Ideal Age = 1.0

MTBF 18000-24000

Ideal Position

Price

Age

Reliability

Importance

35%

27%

20%

18%

Perceptual Map for Nano Segment

Top Products in Nano Segment

Name

Cake

Baker

Awe

Cute

Crimp

12 of 41

Market

Share

22%

16%

14%

13%

7%

Units Sold

to Seg

905

668

592

560

300

Revis ion

Date

Stock Out

10/17/2014

12/17/2014

10/5/2014

YES

12/1/2014

YES

1/4/2015

Pfmn

Coord

12.0

11.3

11.6

10.5

12.6

Size

Coord

6.2

6.8

6.0

7.8

9.8

List

Price

$37.00

$30.00

$38.50

$31.00

$35.00

MTBF

23000

18000

20000

23000

25000

Age

Dec.31

1.12

1.05

1.17

1.63

2.91

Promo Cust. AwareBudget

ness

$1,250

76%

$1,000

57%

$1,200

80%

$1,250

77%

$1,250

77%

Sales Cust. AccessBudget

ibility

$800

85%

$900

64%

$1,000

70%

$900

85%

$900

85%

Dec.

Cust.

Survey

46

40

34

52

13

22-08-2014 10:44

COMP-XM INQUIRER

13 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Dell

Deal

Bead

Cedar

Acre

Ark

6%

6%

6%

5%

2%

2%

261

249

232

212

95

91

COMP-XM INQUIRER

11/17/2014

11/19/2014

12/18/2014

10/17/2014

7/29/2014

7/19/2014

YES

YES

11.0

10.2

13.7

14.0

8.9

13.9

10.0

9.4

8.8

8.2

11.1

8.3

$27.00

$27.00

$34.00

$39.00

$28.00

$40.50

20000

18000

20000

25000

18000

26000

1.18

1.16

1.07

1.12

1.83

1.27

$1,150

$1,150

$1,000

$1,250

$1,200

$1,200

68%

68%

57%

76%

81%

80%

$700

$700

$1,200

$800

$1,200

$1,000

28%

28%

64%

85%

70%

70%

17

15

7

7

3

7

Page 7

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Elite Market Segment Analysis

Total Industry Unit Demand

Actual Industry Unit Sales

Segment % of Total Industry

Svati Goyal

Elite Statistics

Round: 1

December 31, 2014

4,038

4,038

19.0%

Next Year's Segment Growth Rate

16.0%

Elite Customer Buying Criteria

1.

2.

3.

4.

Expectations

Ideal Age = 0.0

$30.00 - 42.00

Pfmn 13.6 Size 8.9

MTBF 20000-26000

Age

Price

Ideal Position

Reliability

Importance

34%

24%

22%

20%

Perceptual Map for Elite Segment

Top Products in Elite Segment

Name

Cedar

Crimp

Ark

Bead

Cute

14 of 41

Market

Share

22%

19%

17%

12%

7%

Units Sold

to Seg

896

749

667

499

299

Revis ion

Date

Stock Out

10/17/2014

1/4/2015

7/19/2014

YES

12/18/2014

12/1/2014

YES

Pfmn

Coord

14.0

12.6

13.9

13.7

10.5

Size

Coord

8.2

9.8

8.3

8.8

7.8

List

Price

$39.00

$35.00

$40.50

$34.00

$31.00

MTBF

25000

25000

26000

20000

23000

Age

Dec.31

1.12

2.91

1.27

1.07

1.63

Promo Cust. AwareBudget

ness

$1,250

76%

$1,250

77%

$1,200

80%

$1,000

57%

$1,250

77%

Sales Cust. AccessBudget

ibility

$800

85%

$900

85%

$1,000

76%

$1,200

55%

$900

85%

Dec.

Cust.

Survey

40

26

40

28

23

22-08-2014 10:44

COMP-XM INQUIRER

15 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Cake

Baker

Awe

Dell

Deal

Acre

6%

6%

4%

4%

2%

1%

252

230

165

150

88

42

COMP-XM INQUIRER

10/17/2014

12/17/2014

10/5/2014

11/17/2014

11/19/2014

7/29/2014

YES

YES

12.0

11.3

11.6

11.0

10.2

8.9

6.2

6.8

6.0

10.0

9.4

11.1

$37.00

$30.00

$38.50

$27.00

$27.00

$28.00

23000

18000

20000

20000

18000

18000

1.12

1.05

1.17

1.18

1.16

1.83

$1,250

$1,000

$1,200

$1,150

$1,150

$1,200

76%

57%

80%

68%

68%

81%

$800

$900

$1,000

$700

$700

$1,200

85%

55%

76%

15%

15%

76%

7

8

2

8

5

1

Page 8

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Market Share Report

Actual Market Share in Units

Thrift

Industry Unit

Sales

% of Market

Ark

Able

Acre

Awe

Total

Buzz

Brat

Baker

Bead

Total

Dug

Drat

Deal

Dell

Total

7,354

34.6%

12.7%

3.2%

1.6%

14.1%

15.8%

15.6%

18.1%

9.2%

6.5%

22.4%

0.2%

0.0%

29.1%

27.3%

4.8%

0.0%

4.8%

27.8%

29.0%

0.1%

0.0%

56.9%

COMP-XM INQUIRER

16 of 41

Core

5,669

26.7%

Cute

Crimp

Cake

Cedar

Total

Round: 1

December 31, 2014

Svati Goyal

10.0%

12.0%

13.3%

15.1%

50.4%

Nano

Elite

Potential Market Share in Units

Total

Units

Demanded

% of Market

4,164

19.6%

4,038

19.0%

21,226

100.0%

2.2%

16.5%

2.3%

14.2%

18.7%

1.1%

4.1%

21.7%

3.6%

3.9%

6.4%

3.6%

17.4%

Ark

Able

Acre

Awe

Total

16.0%

5.6%

21.6%

5.7%

12.4%

18.1%

7.1%

10.2%

4.3%

3.5%

25.1%

Buzz

Brat

Baker

Bead

Total

13.4%

7.2%

21.7%

5.1%

47.5%

7.4%

18.6%

6.2%

22.2%

54.4%

5.7%

5.0%

5.5%

5.2%

21.3%

Cute

Crimp

Cake

Cedar

Total

2.2%

3.7%

5.9%

10.9%

11.9%

6.2%

7.2%

36.2%

Dug

Drat

Deal

Dell

Total

6.0%

6.3%

12.3%

Thrift

Core

Nano

Elite

Total

5,669

26.7%

7,354

34.6%

4,164

19.6%

4,038

19.0%

21,226

100.0%

12.4%

4.2%

1.5%

18.0%

16.6%

19.5%

17.6%

9.0%

6.1%

21.2%

0.2%

26.6%

2.7%

21.2%

2.8%

18.1%

23.6%

1.3%

5.1%

27.6%

4.5%

3.8%

8.2%

4.5%

21.1%

14.7%

5.1%

19.8%

5.2%

11.3%

16.5%

6.8%

9.7%

3.9%

3.2%

23.7%

4.9%

14.3%

6.6%

19.9%

4.7%

45.4%

7.9%

16.9%

5.7%

20.1%

50.6%

6.0%

4.5%

5.0%

4.7%

20.2%

9.9%

11.3%

12.6%

14.3%

48.0%

5.5%

5.8%

11.3%

2.0%

3.4%

5.3%

27.5%

4.9%

28.4%

28.3%

0.1%

56.8%

11.0%

11.5%

5.8%

6.7%

35.0%

Page 9

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Perceptual Map

Round: 1

December 31, 2014

Svati Goyal

Perceptual Map for All Segments

Andrews

Name

Ark

Able

Acre

Awe

17 of 41

Pfmn

13.9

6.8

8.9

11.6

Size

8.3

13.2

11.1

6.0

Baldwin

Revised

7/19/2014

12/22/2014

7/29/2014

10/5/2014

Name

Buzz

Brat

Baker

Bead

Pfmn

7.0

9.4

11.3

13.7

Size

13.2

10.8

6.8

8.8

Chester

Revised

6/28/2014

12/7/2014

12/17/2014

12/18/2014

Name

Cute

Crimp

Cake

Cedar

Pfmn

10.5

12.6

12.0

14.0

Size

7.8

9.8

6.2

8.2

Revised

12/1/2014

1/4/2015

10/17/2014

10/17/2014

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Digby

Name

Dug

Drat

Deal

Dell

Pfmn

6.8

7.0

10.2

11.0

Size

13.4

13.2

9.4

10.0

COMP-XM INQUIRER

18 of 41

Revised

4/11/2015

4/11/2015

11/19/2014

11/17/2014

Page 10

22-08-2014 10:44

COMP-XM INQUIRER

19 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

HR/TQM Report

Svati Goyal

Round: 1

December 31, 2014

HUMAN RESOURCES SUMMARY

Andrews

397

385

379

6

Baldwin

441

441

303

138

Chester

576

576

427

149

Digby

632

632

361

271

3.1%

0.0%

9.4%

36

419

$2,000

6.5%

71

0

$5,000

0.0%

10.0%

136

0

$0

0.0%

8.1%

150

0

$2,500

25

100.0%

80

121.3%

0

100.0%

40

110.9%

Recruiting Cost

Separation Cost

Training Cos t

Total HR Admin Cost

$108

$2,095

$193

$2,396

$425

$0

$705

$1,130

$136

$0

$0

$136

$524

$0

$505

$1,030

Labor Contract Next Year

Wages

Benefits

Profit Sharing

$26.81

2,500

2.0%

$26.81

2,500

2.0%

$26.81

2,500

2.0%

$26.81

2,500

2.0%

5.0%

5.0%

5.0%

5.0%

Needed Complement

Complement

1st Shift Complement

2nd Shift Complement

Overtime%

Turnover Rate

New Employees

Separated Employees

Recruiting Spend

Training Hours

Productivity Index

Annual Raise

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Process Mgt Budgets Last Year

CPI Systems

Vendor/JIT

Quality Initiative Training

Channel Support Systems

Concurrent Engineering

UNEP Green Programs

Andrews

Baldwin

Chester

Digby

$1,000

$0

$1,200

$1,500

$1,200

$1,200

$0

$0

$0

$0

$0

$0

$0

$0

$1,250

$1,250

$1,250

$0

$0

$0

$0

$0

$0

$0

22-08-2014 10:44

COMP-XM INQUIRER

20 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

TQM Budgets Last Year

Benchmarking

Quality Function Deployment Effort

CCE/6 Sigma Training

GEMI TQEM Sustainability Initiatives

Total Expenditures

Cumulative Impacts

Material Cos t Reduction

Labor Cost Reduction

Reduction R&D Cycle Time

Reduction Admin Costs

Demand Increase

COMP-XM INQUIRER

$0

$1,200

$1,200

$0

$8,500

$0

$0

$0

$0

$0

$0

$0

$1,250

$1,250

$6,250

$0

$0

$0

$0

$0

0.69%

2.92%

20.19%

0.00%

5.44%

0.00%

0.00%

0.00%

0.00%

0.00%

0.58%

3.47%

9.91%

0.00%

0.94%

0.00%

0.00%

0.00%

0.00%

0.00%

Page 11

22-08-2014 10:44

COMP-XM INQUIRER

21 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Andrews

Round: 1

Dec. 31, 2014

C59559

Balance Sheet

DEFINITIONS: Common Size: The common s ize column

simply represents each item as a percentage of total

ass ets for that year. Cash: Your end-of-year cash position.

Accounts Receivable: Reflects the lag between delivery

and payment of your products. Inventories: The current

value of your inventory acros s all products. A zero indicates

your company stocked out. Unmet demand would, of

course, fall to your competitors. Plant & Equipment: The

current value of your plant. Accum Deprec: The total

accumulated depreciation from your plant. Accts Payable:

What the company currently owes suppliers for materials

and services. Current Debt: The debt the company is

obligated to pay during the next year of operations. It

includes emergency loans used to keep your company

solvent should you run out of cash during the year. Long

Term Debt: The company's long term debt is in the form of

bonds, and this represents the total value of your bonds .

Common Stock: The amount of capital inves ted by

shareholders in the company. Retained Earnings: The

profits that the company chose to keep instead of paying to

shareholders as dividends .

ASSETS

Cash

Accounts Receivable

Inventory

2014

Common

Size

26.9%

7.6%

2.7%

$34,132

$9,706

$3,489

Total Current Assets

$47,327

Plant & Equipment

Accumulated Depreciation

$32,442

$13,456

$25,532

37.2%

$71,430

102.2%

-39.5%

$96,824

($44,409)

$79,743

62.8%

$52,415

$127,071

100.0%

$123,844

3.5%

5.5%

32.4%

$9,516

$15,717

$27,209

41.5%

$52,442

11.1%

47.4%

$12,081

$59,320

$129,892

($50,149)

Total Fixed Assets

Total As sets

2013

LIABILITIES & OWNERS'

EQUITY

Accounts Payable

Current Debt

Long Term Debt

$4,510

$7,000

$41,209

Total Liabilities

Common Stock

Retained Earnings

$52,719

$14,081

$60,270

Total Equity

Total Liab. & O. Equity

$74,351

58.5%

$71,401

$127,071

100.0%

$123,844

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account during the

year. Cash injections appear as positive numbers and cash withdrawals as negative

numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans.

When negative cash flows exceed positives , you are forced to seek emergency funding.

For example, if sales are bad and you find yours elf carrying an abundance of excess

inventory, the report would show the increase in inventory as a huge negative cas h flow.

Too much unexpected inventory could outstrip your inflows, exhaust your s tarting cash

and force you to beg for money to keep your company afloat.

Cash Flows from Operating Activities:

Net Income (Loss )

Depreciation

Extraordinary gains/losses /writeoffs

Accounts Payable

Inventory

Accounts Receivable

Net cash from operations

Cash Flows from Investing Activities:

Plant Improvements

Cash Flows from Financing Activities:

Dividends Paid

Sales of Common Stock

Purchase of Common Stock

Cash from long term debt

Retirement of long term debt

Change in current debt (net)

Net cash from financing activities

Net change in cash position

Closing cash position

22 of 41

2014

$950

$7,619

($515)

($5,006)

$22,043

$3,749

2013

$20,238

$6,455

$0

$735

($11,075)

$5

$28,841

$16,358

($34,433)

($3,520)

$0

$2,000

$0

$14,000

$0

($8,717)

($13,331)

$0

($1,935)

$0

($7,533)

$9,992

$7,283

$1,691

$34,132

($12,807)

$31

$32,442

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Annual Report

23 of 41

Page 1

22-08-2014 10:44

COMP-XM INQUIRER

24 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

22-08-2014 10:44

COMP-XM INQUIRER

25 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Andrews

Round: 1

Dec. 31, 2014

C59559

2014

Income

Statement

Acre

Awe

Anoah

Asome

$37,878

$29,123

$0

$0

NA

$0

NA

$0

2014

Total

$118,094

Common

Size

100.0%

$6,251

$6,856

$419

$13,526

$11,120

$14,456

$0

$25,576

$7,219

$11,565

$0

$18,784

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$31,700

$45,216

$419

$77,334

26.8%

38.3%

0.4%

65.5%

$11,275

$6,844

$12,302

$10,339

$0

$0

$0

$0

$40,760

34.5%

Period Costs:

Depreciation

SG&A: R&D

Promotions

Sales

Admin

Total Period

$1,238

$554

$1,200

$1,000

$838

$4,830

$2,400

$988

$1,200

$1,200

$556

$6,344

$2,720

$581

$1,200

$1,200

$1,034

$6,735

$1,262

$770

$1,200

$1,000

$795

$5,027

$0

$1,000

$0

$0

$0

$1,000

$0

$1,000

$0

$0

$0

$1,000

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$7,619

$4,894

$4,800

$4,400

$3,222

$24,936

6.5%

4.1%

4.1%

3.7%

2.7%

21.1%

Net Margin

$6,445

$500

$5,567

$5,312

($1,000)

($1,000)

$0

$0

$15,824

13.4%

$8,785

$7,039

$665

$4,883

$522

$19

$950

7.4%

6.0%

0.6%

4.1%

0.4%

0.0%

0.8%

(Product Name:)

Sales

Ark

$30,724

Able

$20,370

Variable Costs:

Direct Labor

Direct Material

Inventory Carry

Total Variable

$7,110

$12,339

$0

$19,449

Contribution Margin

Definitions: Sales: Unit sales times list price. Direct Labor: Labor cos ts incurred to produce the product that was sold.

Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year

depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration

overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force

budget for each product. Other: Charges not included in other categories such as Fees, Write Offs, and TQM. The fees

include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees

your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate

inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually

made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interes t and Taxes . Short Term Interest:

Interest expense bas ed on last year's current debt, including short term debt, long term notes that have become due,

and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35%

tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes,

and profit s haring.

Other

EBIT

Short Term Interes t

LongTerm Interest

Taxes

Profit Sharing

Net Profit

22-08-2014 10:44

COMP-XM INQUIRER

26 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Page 2

Annual Report

22-08-2014 10:44

COMP-XM INQUIRER

27 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Baldwin

Round: 1

Dec. 31, 2014

C59559

Balance Sheet

DEFINITIONS: Common Size: The common s ize column

simply represents each item as a percentage of total

ass ets for that year. Cash: Your end-of-year cash position.

Accounts Receivable: Reflects the lag between delivery

and payment of your products. Inventories: The current

value of your inventory acros s all products. A zero indicates

your company stocked out. Unmet demand would, of

course, fall to your competitors. Plant & Equipment: The

current value of your plant. Accum Deprec: The total

accumulated depreciation from your plant. Accts Payable:

What the company currently owes suppliers for materials

and services. Current Debt: The debt the company is

obligated to pay during the next year of operations. It

includes emergency loans used to keep your company

solvent should you run out of cash during the year. Long

Term Debt: The company's long term debt is in the form of

bonds, and this represents the total value of your bonds .

Common Stock: The amount of capital inves ted by

shareholders in the company. Retained Earnings: The

profits that the company chose to keep instead of paying to

shareholders as dividends .

ASSETS

Cash

Accounts Receivable

Inventory

2014

Common

Size

16.5%

6.9%

5.0%

$24,986

$10,390

$7,584

Total Current Assets

$42,960

Plant & Equipment

Accumulated Depreciation

$165,300

($57,176)

2013

$31,638

$9,749

$7,381

28.4%

$48,768

109.4%

-37.8%

$124,400

($47,289)

Total Fixed Assets

$108,124

71.6%

$77,111

Total As sets

$151,084

100.0%

$125,879

4.4%

14.4%

39.2%

$5,797

$25,523

$41,369

57.9%

$72,689

12.4%

29.7%

$14,378

$38,813

LIABILITIES & OWNERS'

EQUITY

Accounts Payable

Current Debt

Long Term Debt

$6,583

$21,710

$59,157

Total Liabilities

Common Stock

Retained Earnings

$87,450

$18,743

$44,890

Total Equity

Total Liab. & O. Equity

$63,633

42.1%

$53,191

$151,084

100.0%

$125,879

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account during the

year. Cash injections appear as positive numbers and cash withdrawals as negative

numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans.

When negative cash flows exceed positives , you are forced to seek emergency funding.

For example, if sales are bad and you find yours elf carrying an abundance of excess

inventory, the report would show the increase in inventory as a huge negative cas h flow.

Too much unexpected inventory could outstrip your inflows, exhaust your s tarting cash

and force you to beg for money to keep your company afloat.

Cash Flows from Operating Activities:

Net Income (Loss )

Depreciation

Extraordinary gains/losses /writeoffs

Accounts Payable

Inventory

Accounts Receivable

Net cash from operations

Cash Flows from Investing Activities:

Plant Improvements

Cash Flows from Financing Activities:

Dividends Paid

Sales of Common Stock

Purchase of Common Stock

Cash from long term debt

Retirement of long term debt

Change in current debt (net)

Net cash from financing activities

Net change in cash position

Closing cash position

2014

$6,077

$9,887

$0

$787

($203)

($641)

2013

$10,046

$8,293

$0

$510

$1,341

($928)

$15,907

$19,262

($40,900)

($26,642)

$0

$4,365

$0

$17,789

$0

($3,812)

($5,966)

$0

$0

$15,610

($5,880)

$9,642

$18,341

($6,652)

$24,986

$13,406

$6,026

$31,638

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Annual Report

28 of 41

Page 1

22-08-2014 10:44

COMP-XM INQUIRER

29 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

22-08-2014 10:44

COMP-XM INQUIRER

30 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Baldwin

Round: 1

Dec. 31, 2014

C59559

2014

Income

Statement

Baker

Bead

Bid

Na

$27,404

$24,933

$0

$0

Na

$0

Na

$0

2014

Total

$126,410

Common

Size

100.0%

$12,310

$20,611

$127

$33,048

$5,576

$11,854

$201

$17,631

$5,107

$10,070

$230

$15,407

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$27,166

$52,730

$910

$80,806

21.5%

41.7%

0.7%

63.9%

$13,739

$12,566

$9,772

$9,526

$0

$0

$0

$0

$45,604

36.1%

Period Costs:

Depreciation

SG&A: R&D

Promotions

Sales

Admin

Total Period

$3,500

$496

$1,000

$1,000

$454

$6,450

$3,400

$947

$1,000

$1,800

$727

$7,874

$1,600

$973

$1,000

$900

$437

$4,910

$1,387

$977

$1,000

$1,200

$397

$4,961

$0

$1,000

$0

$0

$0

$1,000

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$9,887

$4,393

$4,000

$4,900

$2,015

$25,195

7.8%

3.5%

3.2%

3.9%

1.6%

19.9%

Net Margin

$7,290

$4,692

$4,862

$4,566

($1,000)

$0

$0

$0

$20,409

16.1%

$1,108

$19,302

$2,432

$7,329

$3,339

$124

$6,077

0.9%

15.3%

1.9%

5.8%

2.6%

0.1%

4.8%

(Product Name:)

Sales

Buzz

$28,460

Brat

$45,614

Variable Costs:

Direct Labor

Direct Material

Inventory Carry

Total Variable

$4,173

$10,195

$353

$14,720

Contribution Margin

Definitions: Sales: Unit sales times list price. Direct Labor: Labor cos ts incurred to produce the product that was sold.

Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year

depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration

overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force

budget for each product. Other: Charges not included in other categories such as Fees, Write Offs, and TQM. The fees

include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees

your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate

inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually

made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interes t and Taxes . Short Term Interest:

Interest expense bas ed on last year's current debt, including short term debt, long term notes that have become due,

and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35%

tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes,

and profit s haring.

Other

EBIT

Short Term Interes t

LongTerm Interest

Taxes

Profit Sharing

Net Profit

22-08-2014 10:44

COMP-XM INQUIRER

31 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Page 2

Annual Report

22-08-2014 10:44

COMP-XM INQUIRER

32 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Chester

Round: 1

Dec. 31, 2014

C59559

Balance Sheet

DEFINITIONS: Common Size: The common s ize column

simply represents each item as a percentage of total

ass ets for that year. Cash: Your end-of-year cash position.

Accounts Receivable: Reflects the lag between delivery

and payment of your products. Inventories: The current

value of your inventory acros s all products. A zero indicates

your company stocked out. Unmet demand would, of

course, fall to your competitors. Plant & Equipment: The

current value of your plant. Accum Deprec: The total

accumulated depreciation from your plant. Accts Payable:

What the company currently owes suppliers for materials

and services. Current Debt: The debt the company is

obligated to pay during the next year of operations. It

includes emergency loans used to keep your company

solvent should you run out of cash during the year. Long

Term Debt: The company's long term debt is in the form of

bonds, and this represents the total value of your bonds .

Common Stock: The amount of capital inves ted by

shareholders in the company. Retained Earnings: The

profits that the company chose to keep instead of paying to

shareholders as dividends .

ASSETS

Cash

Accounts Receivable

Inventory

$25,872

$13,180

$6,955

Total Current Assets

$46,007

Plant & Equipment

Accumulated Depreciation

$93,960

($41,287)

2014

Common

Size

26.2%

13.4%

7.0%

2013

$17,624

$9,841

$16,831

46.6%

$44,296

95.2%

-41.8%

$84,380

($35,023)

Total Fixed Assets

$52,673

53.4%

$49,357

Total As sets

$98,680

100.0%

$93,653

8.0%

14.2%

21.1%

$6,601

$18,445

$19,472

43.3%

$44,518

8.9%

47.8%

$9,097

$40,038

LIABILITIES & OWNERS'

EQUITY

Accounts Payable

Current Debt

Long Term Debt

$7,927

$13,971

$20,850

Total Liabilities

Common Stock

Retained Earnings

$42,748

$8,799

$47,132

Total Equity

$55,931

56.7%

$49,135

Total Liab. & O. Equity

$98,680

100.0%

$93,653

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account during the

year. Cash injections appear as positive numbers and cash withdrawals as negative

numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans.

When negative cash flows exceed positives , you are forced to seek emergency funding.

For example, if sales are bad and you find yours elf carrying an abundance of excess

inventory, the report would show the increase in inventory as a huge negative cas h flow.

Too much unexpected inventory could outstrip your inflows, exhaust your s tarting cash

and force you to beg for money to keep your company afloat.

Cash Flows from Operating Activities:

Net Income (Loss )

Depreciation

Extraordinary gains/losses /writeoffs

Accounts Payable

Inventory

Accounts Receivable

Net cash from operations

Cash Flows from Investing Activities:

Plant Improvements

Cash Flows from Financing Activities:

Dividends Paid

Sales of Common Stock

Purchase of Common Stock

Cash from long term debt

Retirement of long term debt

Change in current debt (net)

Net cash from financing activities

Net change in cash position

Closing cash position

2014

$14,899

$6,264

$0

$1,326

$9,876

($3,339)

2013

$10,745

$5,625

$0

$1,216

($1,967)

($1,780)

$29,026

$13,840

($9,580)

($6,500)

($6,494)

$0

($1,609)

$1,378

$0

($4,473)

($4,506)

$0

($1,840)

$5,663

($6,317)

$7,930

($11,198)

$8,248

$25,872

$931

$8,271

$17,624

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Annual Report

33 of 41

Page 1

22-08-2014 10:44

COMP-XM INQUIRER

34 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

22-08-2014 10:44

COMP-XM INQUIRER

35 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Chester

Round: 1

Dec. 31, 2014

C59559

2014

Income

Statement

Cake

Cedar

Na

Na

$42,794

$43,234

$0

$0

Na

$0

Na

$0

2014

Total

$160,356

Common

Size

100.0%

$9,102

$15,643

$89

$24,833

$9,912

$17,512

$405

$27,828

$8,926

$17,460

$341

$26,727

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$39,633

$66,690

$835

$107,158

24.7%

41.6%

0.5%

66.8%

$9,771

$11,954

$14,966

$16,507

$0

$0

$0

$0

$53,198

33.2%

Period Costs:

Depreciation

SG&A: R&D

Promotions

Sales

Admin

Total Period

$1,691

$928

$1,250

$900

$295

$5,063

$1,213

$1,000

$1,250

$900

$289

$4,652

$1,587

$804

$1,250

$800

$336

$4,776

$1,773

$804

$1,250

$800

$339

$4,966

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$6,264

$3,535

$5,000

$3,400

$1,259

$19,458

3.9%

2.2%

3.1%

2.1%

0.8%

12.1%

Net Margin

$4,708

$7,302

$10,189

$11,541

$0

$0

$0

$0

$33,740

21.0%

$6,343

$27,397

$1,411

$2,597

$8,186

$304

$14,899

4.0%

17.1%

0.9%

1.6%

5.1%

0.2%

9.3%

(Product Name:)

Sales

Cute

$37,540

Crimp

$36,787

Variable Costs:

Direct Labor

Direct Material

Inventory Carry

Total Variable

$11,694

$16,075

$0

$27,769

Contribution Margin

Definitions: Sales: Unit sales times list price. Direct Labor: Labor cos ts incurred to produce the product that was sold.

Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year

depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration

overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force

budget for each product. Other: Charges not included in other categories such as Fees, Write Offs, and TQM. The fees

include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees

your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate

inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually

made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interes t and Taxes . Short Term Interest:

Interest expense bas ed on last year's current debt, including short term debt, long term notes that have become due,

and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35%

tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes,

and profit s haring.

Other

EBIT

Short Term Interes t

LongTerm Interest

Taxes

Profit Sharing

Net Profit

22-08-2014 10:44

COMP-XM INQUIRER

36 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Page 2

Annual Report

22-08-2014 10:44

COMP-XM INQUIRER

37 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Digby

Round: 1

Dec. 31, 2014

C59559

Balance Sheet

DEFINITIONS: Common Size: The common s ize column

simply represents each item as a percentage of total

ass ets for that year. Cash: Your end-of-year cash position.

Accounts Receivable: Reflects the lag between delivery

and payment of your products. Inventories: The current

value of your inventory acros s all products. A zero indicates

your company stocked out. Unmet demand would, of

course, fall to your competitors. Plant & Equipment: The

current value of your plant. Accum Deprec: The total

accumulated depreciation from your plant. Accts Payable:

What the company currently owes suppliers for materials

and services. Current Debt: The debt the company is

obligated to pay during the next year of operations. It

includes emergency loans used to keep your company

solvent should you run out of cash during the year. Long

Term Debt: The company's long term debt is in the form of

bonds, and this represents the total value of your bonds .

Common Stock: The amount of capital inves ted by

shareholders in the company. Retained Earnings: The

profits that the company chose to keep instead of paying to

shareholders as dividends .

ASSETS

Cash

Accounts Receivable

Inventory

2014

Common

Size

19.2%

8.1%

4.3%

$32,136

$13,471

$7,172

Total Current Assets

$52,779

Plant & Equipment

Accumulated Depreciation

$177,560

($63,104)

2013

$32,723

$10,847

$9,993

31.6%

$53,563

106.2%

-37.7%

$142,900

($51,267)

Total Fixed Assets

$114,456

68.4%

$91,633

Total As sets

$167,234

100.0%

$145,197

5.5%

15.1%

40.8%

$7,198

$29,281

$53,917

61.3%

$90,396

16.4%

22.2%

$24,669

$30,131

LIABILITIES & OWNERS'

EQUITY

Accounts Payable

Current Debt

Long Term Debt

$9,130

$25,277

$68,179

Total Liabilities

Common Stock

Retained Earnings

$102,586

$27,509

$37,139

Total Equity

Total Liab. & O. Equity

$64,648

38.7%

$54,800

$167,234

100.0%

$145,197

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account during the

year. Cash injections appear as positive numbers and cash withdrawals as negative

numbers. The Cash Flow Statement is an excellent tool for diagnosing emergency loans.

When negative cash flows exceed positives , you are forced to seek emergency funding.

For example, if sales are bad and you find yours elf carrying an abundance of excess

inventory, the report would show the increase in inventory as a huge negative cas h flow.

Too much unexpected inventory could outstrip your inflows, exhaust your s tarting cash

and force you to beg for money to keep your company afloat.

Cash Flows from Operating Activities:

Net Income (Loss )

Depreciation

Extraordinary gains/losses /writeoffs

Accounts Payable

Inventory

Accounts Receivable

Net cash from operations

Cash Flows from Investing Activities:

Plant Improvements

Cash Flows from Financing Activities:

Dividends Paid

Sales of Common Stock

Purchase of Common Stock

Cash from long term debt

Retirement of long term debt

Change in current debt (net)

Net cash from financing activities

Net change in cash position

Closing cash position

2014

$7,008

$11,837

$0

$1,931

$2,822

($2,624)

2013

$7,607

$9,527

$0

$1,273

($1,389)

($1,055)

$20,975

$15,964

($34,660)

($15,800)

$0

$2,840

$0

$14,263

$0

($4,005)

($12,582)

$0

$0

$9,570

($7,533)

$7,083

$13,098

($587)

$32,136

($3,463)

($3,299)

$32,723

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Annual Report

38 of 41

Page 1

22-08-2014 10:44

COMP-XM INQUIRER

39 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

22-08-2014 10:44

COMP-XM INQUIRER

40 of 41

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Top

Annual Report

Digby

Round: 1

Dec. 31, 2014

C59559

2014

Income

Statement

Deal

Dell

Na

Na

$35,747

$41,087

$0

$0

Na

$0

Na

$0

2014

Total

$163,893

Common

Size

100.0%

$11,411

$20,381

$187

$31,979

$9,487

$14,797

$343

$24,628

$11,208

$18,090

$326

$29,623

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$42,552

$71,347

$861

$114,760

26.0%

43.5%

0.5%

70.0%

$13,009

$13,541

$11,119

$11,464

$0

$0

$0

$0

$49,133

30.0%

Period Costs:

Depreciation

SG&A: R&D

Promotions

Sales

Admin

Total Period

$2,800

$1,000

$1,150

$1,000

$552

$6,502

$3,333

$1,000

$1,150

$1,000

$605

$7,088

$2,604

$896

$1,150

$700

$475

$5,825

$3,100

$891

$1,150

$700

$546

$6,387

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$11,837

$3,788

$4,600

$3,400

$2,177

$25,802

7.2%

2.3%

2.8%

2.1%

1.3%

15.7%

Net Margin

$6,507

$6,453

$5,294

$5,077

$0

$0

$0

$0

$23,331

14.2%

$855

$22,476

$2,907

$8,567

$3,851

$143

$7,008

0.5%

13.7%

1.8%

5.2%

2.3%

0.1%

4.3%

(Product Name:)

Sales

Dug

$41,538

Drat

$45,521

Variable Costs:

Direct Labor

Direct Material

Inventory Carry

Total Variable

$10,446

$18,079

$4

$28,529

Contribution Margin

Definitions: Sales: Unit sales times list price. Direct Labor: Labor cos ts incurred to produce the product that was sold.

Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year

depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration

overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force

budget for each product. Other: Charges not included in other categories such as Fees, Write Offs, and TQM. The fees

include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees

your instructor might assess. Write-offs include the loss you might experience when you sell capacity or liquidate

inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually

made money on the liquidation of capacity or inventory. EBIT: Earnings Before Interes t and Taxes . Short Term Interest:

Interest expense bas ed on last year's current debt, including short term debt, long term notes that have become due,

and emergency loans. Long Term Interest: Interest paid on outstanding bonds. Taxes: Income tax based upon a 35%

tax rate. Profit Sharing: Profits shared with employees under the labor contract. Net Profit: EBIT minus interest, taxes,

and profit s haring.

Other

EBIT

Short Term Interes t

LongTerm Interest

Taxes

Profit Sharing

Net Profit

22-08-2014 10:44

COMP-XM INQUIRER

http://ww2.capsim.com/cgi-bin/CpCGIReports2011.exe?XM=1&studentkey=1084324&simid=C59...

Annual Report

41 of 41

Page 2

22-08-2014 10:44

Вам также может понравиться

- Courier C58866 Rounds 1-6 (With Scores)Документ78 страницCourier C58866 Rounds 1-6 (With Scores)jackmooreausОценок пока нет

- Comp-Xm® Inquirer WordДокумент37 страницComp-Xm® Inquirer WordAnonymous TAV9RvОценок пока нет

- Round: 2 Dec. 31, 2022: Selected Financial StatisticsДокумент15 страницRound: 2 Dec. 31, 2022: Selected Financial StatisticsAshesh DasОценок пока нет

- COMP-XM® INQUIRER - Round 2Документ24 страницыCOMP-XM® INQUIRER - Round 2Gaurav KulkarniОценок пока нет

- 268ebirch Paper CompanyДокумент14 страниц268ebirch Paper CompanySumit Singh GorayaОценок пока нет

- CapstoneДокумент3 306 страницCapstoneVan Sj TYnОценок пока нет

- CAPSIM Course Assignment 1Документ1 страницаCAPSIM Course Assignment 1Anup DhanukaОценок пока нет

- Report 2Документ28 страницReport 2Jordan McKinleyОценок пока нет

- Round: 7 Dec. 31, 2019: Selected Financial StatisticsДокумент15 страницRound: 7 Dec. 31, 2019: Selected Financial StatisticsShubham UpadhyayОценок пока нет

- Capxm Final RoundДокумент21 страницаCapxm Final RoundManoj KuchipudiОценок пока нет

- FAS 20 - T2 - Session 18 - Cityside Financial ServiceДокумент3 страницыFAS 20 - T2 - Session 18 - Cityside Financial ServiceDwai100% (1)

- Capstone Courier Round 5Документ13 страницCapstone Courier Round 5AkashОценок пока нет

- MOS GameДокумент1 страницаMOS GameRajesh1 SrinivasanОценок пока нет

- Super Project AnalysisДокумент6 страницSuper Project AnalysisDHRUV SONAGARAОценок пока нет

- Capsim Simulation: Team Eerie (Group 5)Документ4 страницыCapsim Simulation: Team Eerie (Group 5)Dhruv KumbhareОценок пока нет

- Godrej AgrovetДокумент37 страницGodrej AgrovetBandaru NarendrababuОценок пока нет

- ZomatoДокумент56 страницZomatopreethishОценок пока нет

- CapsimДокумент15 страницCapsimDamanpreet Singh100% (1)

- Capsimstrategy Blogspot Com AuДокумент5 страницCapsimstrategy Blogspot Com AuCahyo EdiОценок пока нет

- ITBO - Class AssignmentДокумент3 страницыITBO - Class Assignmentaishwarya anandОценок пока нет

- GILLETTEДокумент18 страницGILLETTEAnirban Das67% (3)

- Courier 4Документ14 страницCourier 4vivek singhОценок пока нет

- CapsimДокумент7 страницCapsimakarsh jainОценок пока нет

- Courier C102348 R6 TDK0 CAДокумент15 страницCourier C102348 R6 TDK0 CAOscar Gabriel FernándezОценок пока нет

- Collabrys Group 5Документ12 страницCollabrys Group 5Adil100% (1)

- Capst Courier 7 RoundДокумент15 страницCapst Courier 7 Roundkuala singhОценок пока нет

- ACC Cement Research Report and Equity ValuationДокумент12 страницACC Cement Research Report and Equity ValuationSougata RoyОценок пока нет

- Mindtree Model ReferenceДокумент66 страницMindtree Model Referencesaidutt sharma100% (1)

- Digby PresentationДокумент24 страницыDigby Presentationnaga25french100% (1)

- Success MeasuresДокумент4 страницыSuccess MeasuresRachel YoungОценок пока нет

- Comp-Xm® Inquirer0Документ21 страницаComp-Xm® Inquirer0Jasleen Kaur (Ms)Оценок пока нет

- FBE 529 Lecture 1 PDFДокумент26 страницFBE 529 Lecture 1 PDFJIAYUN SHENОценок пока нет

- POV - Balance in Balanced Scorecard - Service DeskДокумент11 страницPOV - Balance in Balanced Scorecard - Service DeskAnsuman PradhanОценок пока нет

- Base of Capstone StrategyДокумент2 страницыBase of Capstone StrategySagar SabnisОценок пока нет

- GSRTC Presentation BY RAHESH - BKMIBA-HLBBAДокумент49 страницGSRTC Presentation BY RAHESH - BKMIBA-HLBBArahesh sutariyaОценок пока нет

- Capsim Success MeasuresДокумент10 страницCapsim Success MeasuresalyrОценок пока нет

- GDNA Managers Guide v.1.4Документ84 страницыGDNA Managers Guide v.1.4Sebastian FigueroaОценок пока нет

- Capstone Round 3 CourierДокумент15 страницCapstone Round 3 CourierKitarpОценок пока нет

- CAPSIM Capstone Strategy 2016Документ21 страницаCAPSIM Capstone Strategy 2016Khanh MaiОценок пока нет

- Nestle and Alcon - The Value of AДокумент33 страницыNestle and Alcon - The Value of Akjpcs120% (1)

- Nestlé and Alcon-The Value of A ListingДокумент6 страницNestlé and Alcon-The Value of A ListingRahul KumarОценок пока нет

- Basic Capsim StrategiesДокумент8 страницBasic Capsim StrategiesRachel YoungОценок пока нет

- CapstoneДокумент772 страницыCapstonePradeep KavangalОценок пока нет

- DollaramaДокумент2 страницыDollaramaKenton ParrottОценок пока нет

- Caterpillar Case StudyДокумент6 страницCaterpillar Case StudykhanОценок пока нет

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaДокумент1 страницаWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993Оценок пока нет

- BEA Associates - Enhanced Equity Index FundДокумент17 страницBEA Associates - Enhanced Equity Index FundKunal MehtaОценок пока нет

- Chestnut FoodsДокумент2 страницыChestnut FoodsDebanu MahapatraОценок пока нет

- Chapter 7: International Production Networks (Ipns) and Global Value Chains (GVCS)Документ39 страницChapter 7: International Production Networks (Ipns) and Global Value Chains (GVCS)PARUL SINGH MBA 2019-21 (Delhi)Оценок пока нет

- Case 18-3Документ15 страницCase 18-3Amy HazelwoodОценок пока нет

- Assignment: Littlefield Simulation - Game 2Документ8 страницAssignment: Littlefield Simulation - Game 2Sumit SinghОценок пока нет

- Atlantic Computer:: A Bundle of Pricing OptionsДокумент6 страницAtlantic Computer:: A Bundle of Pricing OptionsApoorva SonthaliaОценок пока нет

- Does IT Payoff Strategies of Two Banking GiantsДокумент10 страницDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Оценок пока нет

- LoeaДокумент21 страницаLoeahddankerОценок пока нет

- 12 Marriott Corporation - The Cost of Capital (Abridged)Документ9 страниц12 Marriott Corporation - The Cost of Capital (Abridged)jk kumarОценок пока нет

- Vois: Team Zoozoo Team ZoozooДокумент7 страницVois: Team Zoozoo Team ZoozooAnu SahithiОценок пока нет

- Titanium Dioxide and Super Project Prof. Joshy JacobДокумент3 страницыTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHОценок пока нет

- CV Midterm Exam 1 - Solution GuideДокумент11 страницCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- 61 10 Shares Dividends AfterДокумент10 страниц61 10 Shares Dividends Aftermerag76668Оценок пока нет

- January Meeting InfoДокумент7 страницJanuary Meeting InfoBrendaBrowningОценок пока нет

- BCP Group 30 Conceptual FrameworkДокумент3 страницыBCP Group 30 Conceptual Frameworksgoyal89Оценок пока нет

- IFAssignment Group1Документ4 страницыIFAssignment Group1sgoyal89Оценок пока нет

- The Hidden Gem The Hidden Gem The Hidden Gem: Eureka - Eximius EXIMIUS 2014Документ3 страницыThe Hidden Gem The Hidden Gem The Hidden Gem: Eureka - Eximius EXIMIUS 2014sgoyal89Оценок пока нет

- Group Assignments 2015Документ1 страницаGroup Assignments 2015sgoyal89Оценок пока нет

- BCP - Group 30 - E1 Submission - Assessing The Market Potential For IBДокумент2 страницыBCP - Group 30 - E1 Submission - Assessing The Market Potential For IBsgoyal89Оценок пока нет

- Paper 3Документ17 страницPaper 3sgoyal89Оценок пока нет

- Respect It. Conserve ItДокумент5 страницRespect It. Conserve Itsgoyal89Оценок пока нет

- Questions SOLVEDДокумент10 страницQuestions SOLVEDNafisul AbrarОценок пока нет

- Buscom Summary NotesДокумент14 страницBuscom Summary Notesaaaaa aaaaaОценок пока нет