Академический Документы

Профессиональный Документы

Культура Документы

Financial Institutions

Загружено:

Ben Dover McDuffinsАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Institutions

Загружено:

Ben Dover McDuffinsАвторское право:

Доступные форматы

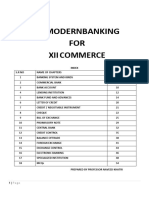

Principles of Finance

1

ST

SEMESTER AY 2013-2014

UNIVERSITY OF SANTO TOMAS

FACULTY OF ARTS AND LETTERS

Bangko Sentral ng Pilipinas

central monetary authority of the

Philippines

Enjoys fiscal and administrative

autonomy from the National

Government in the pursuit of its

mandated responsibilities.

Functions of BSP

1) Issue currency

efficient issuance of currency

geared in minimizing inflationary

and exchange rate effects

issuance of currency should occur

if these is an asset that will be

gained from it

Functions of BSP

2) Determine and implement monetary policy in the

Philippines

BSPs mandate:

To maintain price stability conducive to a balanced

sustainable growth of the economy.

Price stability:

prices do not go up or down uncontrollably

NEDA

consulting body of the BSP in projecting

macroeconomic targets such as inflation rate,

interest rate and money supply.

Functions of BSP

3) Safeguard the soundness and integrity of the financial

system

supervision and regulatory authority over banks and some

financial institutions and non-bank institutions performing

quasi-banking functions

Events that happen during financial system failure:

Bank runs: depositors simultaneously want to take out

most of their deposits from banks.

Bank losses: when it is not earning anymore maybe

because of defaulted payments from borrowers or major

losses in its investment activities.

Functions of BSP

Examples of BSP policies to banks

1) Requiring banks to offset the losses incurred through Non-

Performing Loans (NPLs)

2) Ensuring that banks comply to minimum capital

requirement

3) Monitoring the amount of its risky investments

4) Regulation of DOSRI lending (directors, officers,

stockholders and related interest lending)

5) Preventing banks to be conduits of dirty money such as

money obtained from terrorism, drug trafficking, gambling,

kidnapping, etc.

Functions of BSP

4) Banker of banks or lender of last resort of banks and financial

institutions under its charge

Banks normally borrow short term and lend long term (tenor mismatch).

If depositors withdraw and if the bank will have difficulties in providing

for the fund, this will become a liquidity problem.

5) Custodian of funds of the National Government

The BSP acts as the official depository of the national government

Cash balances are kept in the BSP

Some small balances are kept on other government banks such as DBP and

Landbank.

6) Ensures the convertibility of the Peso to other currencies

The BSP must have sufficient foreign exchange to supply the forex

market when there is an apparent shortage.

Banks

an institution whose current operations consist in

receiving deposits from the public and granting

loans to the public (Freixas and Rochet).

Functions of a bank

(aside from safekeeping money):

3) Offering access to a payment system

2) Shouldering risk of borrowers default

1) Serves as the financial intermediary between the

lender and borrower of funds

4) Processing information and monitoring of borrowers

Other policies adhered to by banks

Reserve Requirement: part of customer deposits that each

commercial bank holds as reserves. They are kept physically at

the banks vaults.

18%

(as of April 2013)

Capital Adequacy Ratio : percentage of the banks investment on

risky assets to the total stockholders equity

Risky assets: loans and investments not in Government Securities.

10%

(as of April 2013)

Commercial Banks (KBs)

represent the largest single group of financial

institution in the country in terms of assets.

Two types:

Ordinary Commercial Banks

Expanded Commercial Banks or Universal Banks

Ordinary Commercial Banks

POWERS LIMITATIONS

(with regards to investment)

1) Accept deposits specifically demand

deposits, savings and time deposits and

deposit substitutes

1) Total investment to another company

(whether financial or non-financial) shall

not exceed 35% of the net worth of the

bank

2) Lend money on a secured or unsecured

basis

3) Acquire marketable bonds or other

short-term debt securities

4) Issue promissory notes and other forms

of indebtedness

5) Buy and sell foreign currency, gold and

silver

Expanded Commercial Banks or Universal Banks

POWERS LIMITATIONS

(with regards to investment)

1) Exercise power of investment

houses

1) Invest up to 40% of a quasi bank

institution

2) Invest and own 100% of unrelated

business

3) Invest and own up to 100% of

allied financial institutions, such as

investment banks, stock brokerage,

leasing companies, credit card

companies.

Commercial Banks (KBs)

the only banks that can buy and sell foreign currency in

the Philippine Dealing System (PDS).

It is primarily a company that caters to the wholesale

buying and selling of Foreign Currencies.

Commercial Banks (KBs)

Commercial banks may also offer trust services, like handling

the funds of an investor in different kinds of financial

instruments.

Trust Funds: funds, usually taken out of an employees

salary, which is intended to provide monetary benefits to an

individual in the future.

Unit Investment Trust Fund: ready-made investments that

allow the pooling of funds from different investors with

similar investment objectives

Mutual Funds: a diversified portfolio consisting of a

collection of stocks, bonds and other securities.

Pension Funds: fund established by an employer to

facilitate and organize the investment of employees'

retirement funds contributed by the employer and

employees

Commercial Banks (KBs)

Primary Sources of Revenue

Interest Income: net amount earned from the lending of

money.

Service Fee income: Revenue taken in by financial

institutions from account-related charges to customers.

Trading Income: net income from the trading of securities

whether stocks or bonds.

Commercial Banks (KBs)

Primary Sources of Expenses:

Bad debts expense: percentage of loans that

defaulted

Interest expense: amount spent for its

accountholders or to its lenders

Operational expenditures: fund used in running a

bank such as salaries, marketing, utilities, machines

etc.

Assessing Financial Condition of Banks

Cash to total assets ratio: the percentage of cash that the bank

has to the total assets it possess

Investments to total assets ratio: the percentage of

investments that the bank has to the total assets it possess

Repossessed Assets (ROPOA) to assets: the percentage of

collateral owned by the bank to the total assets it possess

Non-Performing loans (NPL) to loans ratio: the percentage

of defaulted loans to the total loan portfolio of the bank

IMF Report

The IMF reported that the ownership of

the corporate sector is highly

concentrated to few players. The same

groups that own the major

manufacturing and service sectors also

control most of the major banks. This

led to high concentration of loans- the

top 100 corporate borrows in the

Philippines account for 30% of loans

outstanding in the banking system.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Affidavit - NeighborДокумент3 страницыAffidavit - NeighborBen Dover McDuffins100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- KNPS Loan Form 0921 PDFДокумент2 страницыKNPS Loan Form 0921 PDFcollins gatobu100% (3)

- Non-Impairment of ContractДокумент2 страницыNon-Impairment of ContractBen Dover McDuffinsОценок пока нет

- View PDFДокумент6 страницView PDFfabrikfashions171Оценок пока нет

- Marketplace PresentationДокумент189 страницMarketplace PresentationAki Minh Thu NguyenОценок пока нет

- SC RULES ON TRAVEL RIGHTSДокумент7 страницSC RULES ON TRAVEL RIGHTSBen Dover McDuffinsОценок пока нет

- Pascual RD 5Документ4 страницыPascual RD 5Ben Dover McDuffinsОценок пока нет

- Letter To East West BankДокумент3 страницыLetter To East West BankVanОценок пока нет

- Obligations and Contracts GuideДокумент145 страницObligations and Contracts GuideJonalyn Bedking100% (1)

- Lesson Plan FormatДокумент47 страницLesson Plan FormatGena Clarish Carreon100% (5)

- Why Closed-Shop Provisions Cannot Be Applied RetroactivelyДокумент2 страницыWhy Closed-Shop Provisions Cannot Be Applied RetroactivelyBen Dover McDuffins100% (1)

- Special Power of AttorneyДокумент5 страницSpecial Power of AttorneyBen Dover McDuffinsОценок пока нет

- Allied Free Workers V Compania MaritamaДокумент3 страницыAllied Free Workers V Compania MaritamaBen Dover McDuffinsОценок пока нет

- Medel vs. Court of AppealsДокумент11 страницMedel vs. Court of AppealsMary Villanueva100% (1)

- CIR vs. MitsubishiДокумент2 страницыCIR vs. MitsubishiBae IreneОценок пока нет

- Overview of FinacleДокумент6 страницOverview of FinacleShabih FatimaОценок пока нет

- ATAP Case Digests - Agency and Trust (W7-13) RevisedДокумент107 страницATAP Case Digests - Agency and Trust (W7-13) RevisedDeurod JoeОценок пока нет

- Andaya v. Rural Bank of CabadbaranДокумент8 страницAndaya v. Rural Bank of CabadbaranClara SawaliОценок пока нет

- Right To BailДокумент4 страницыRight To BailBen Dover McDuffinsОценок пока нет

- Masikip V City of PasigДокумент1 страницаMasikip V City of PasigBen Dover McDuffinsОценок пока нет

- Unreasonable Search and SeizureДокумент35 страницUnreasonable Search and SeizureBen Dover McDuffinsОценок пока нет

- Cross Witness 1Документ2 страницыCross Witness 1Ben Dover McDuffinsОценок пока нет

- Affidavit WifeДокумент3 страницыAffidavit WifeBen Dover McDuffinsОценок пока нет

- Lawyers Ethics 2 FUTUREДокумент13 страницLawyers Ethics 2 FUTUREBen Dover McDuffinsОценок пока нет

- 73 Province of Cagayan V LaraДокумент1 страница73 Province of Cagayan V LaraBen Dover McDuffinsОценок пока нет

- Main FileДокумент24 страницыMain FileBen Dover McDuffinsОценок пока нет

- Long Exam 1 DQ of JudgesДокумент35 страницLong Exam 1 DQ of JudgesBen Dover McDuffinsОценок пока нет

- Poli Outline PDFДокумент23 страницыPoli Outline PDFBen Dover McDuffinsОценок пока нет

- Elective Courses - Course Descriptions (1st Sem, AY 17-18)Документ12 страницElective Courses - Course Descriptions (1st Sem, AY 17-18)Ben Dover McDuffinsОценок пока нет

- PALE - 1. Requirements For Admission To The Bar and Continuous Practice of LawДокумент22 страницыPALE - 1. Requirements For Admission To The Bar and Continuous Practice of LawEmmagine E EyanaОценок пока нет

- PALE - Topics Outline - 2018-2019Документ1 страницаPALE - Topics Outline - 2018-2019j guevarraОценок пока нет

- Ra 10028 An Act Expanding The Promotion of BreastfeedingДокумент9 страницRa 10028 An Act Expanding The Promotion of BreastfeedingBen Dover McDuffinsОценок пока нет

- Knecht Inc V Municipality of CaintaДокумент1 страницаKnecht Inc V Municipality of CaintaBen Dover McDuffinsОценок пока нет

- CrimRev SyllabusДокумент31 страницаCrimRev SyllabusBen Dover McDuffinsОценок пока нет

- 2019 Civrev2 CasesДокумент1 страница2019 Civrev2 CasesBen Dover McDuffinsОценок пока нет

- RR 05-2001Документ0 страницRR 05-2001Peggy SalazarОценок пока нет

- Case DoctrinesДокумент3 страницыCase DoctrinesKian FajardoОценок пока нет

- 2016 Sales Class RulesДокумент1 страница2016 Sales Class RulesBen Dover McDuffinsОценок пока нет

- Labor 2 DigestДокумент3 страницыLabor 2 DigestBen Dover McDuffinsОценок пока нет

- Indian Registration Act: M. S. RAMA RAO B.SC., M.A., M.LДокумент23 страницыIndian Registration Act: M. S. RAMA RAO B.SC., M.A., M.LadhiОценок пока нет

- Spread Sheet Manual (Form 7) : Microsoft ExcelДокумент22 страницыSpread Sheet Manual (Form 7) : Microsoft ExcelSethОценок пока нет

- Question Paper - 5th SemДокумент15 страницQuestion Paper - 5th SemJnine McNamaraОценок пока нет

- FR15. Provision, Contingent Liab & Assets (Practice)Документ4 страницыFR15. Provision, Contingent Liab & Assets (Practice)duong duongОценок пока нет

- Court upholds dissolution of construction partnershipДокумент9 страницCourt upholds dissolution of construction partnershipFrancis Leo TianeroОценок пока нет

- Draft Prospectus of Trust Islami Life Insurance Limited-P-250Документ250 страницDraft Prospectus of Trust Islami Life Insurance Limited-P-250Rumana SharifОценок пока нет

- NotesДокумент9 страницNotesErika GuillermoОценок пока нет

- Auditing Mcom 2Документ49 страницAuditing Mcom 2BhavyaОценок пока нет

- Financial Management: Money, Interest Rates and Time ValueДокумент81 страницаFinancial Management: Money, Interest Rates and Time ValueAyesha GuptaОценок пока нет

- Banking AdamjeeДокумент60 страницBanking AdamjeePREMIER INSTITUTEОценок пока нет

- Barredo V LeanoДокумент15 страницBarredo V LeanoCla SaguilОценок пока нет

- Chapter II - Organizational ProfileДокумент16 страницChapter II - Organizational ProfileSudarsun sunОценок пока нет

- Update Customer Information FormДокумент2 страницыUpdate Customer Information FormAndreaОценок пока нет

- The Money Supply: M1, M2, M3Документ4 страницыThe Money Supply: M1, M2, M3Veronica GarsteaОценок пока нет

- Kitgum 22Документ64 страницыKitgum 22alfonseoОценок пока нет

- The Library System: HIT 234 - Database ConceptsДокумент14 страницThe Library System: HIT 234 - Database ConceptsJamal Al-jaziОценок пока нет

- Morganstanley Co IncДокумент47 страницMorganstanley Co IncWilliam Masterson ShahОценок пока нет

- Exercise On Introduction To Parts of A Contract 1Документ3 страницыExercise On Introduction To Parts of A Contract 1Shahnoor Ali GattuОценок пока нет

- Agricultural Loans ExplainedДокумент11 страницAgricultural Loans ExplainedSamnang ChyОценок пока нет

- VJ2Документ4 страницыVJ2Thư TrầnОценок пока нет

- Lending Scenario for Talha FarooqiДокумент2 страницыLending Scenario for Talha FarooqiTalha FarooqiОценок пока нет