Академический Документы

Профессиональный Документы

Культура Документы

Water Insoluble Strategies

Загружено:

Shalie VhiantyАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Water Insoluble Strategies

Загружено:

Shalie VhiantyАвторское право:

Доступные форматы

Water Insoluble Drug

Development: Strategies,

Technologies, Case Studies

Kurt R. Sedo

Vice President

PharmaCircle, LLC

Encinitas, CA USA

www.pharmacircle.com

March 28, 2011

Water Insoluble Drug Development

Case Studies

TriCor/Fenofibrate

Kaletra

The Inevitable Generic Competition

The Emergence of Specialty Pharma

Approved Water Insoluble Drugs 2000-2010

Technology Selection Strategies

The Impact of Drug Delivery

Life Cycle Management

How do you study the space and your competition?

Marketed Product Attributes

Color, shape, size, form

The TriCor* Story

Date Action

1960s Fenofibrate discovered by Fournier

1975 Lipidil Capsule approved in Europe.

1993 FDA approved as Lipidil 100 mg capsule but Fournier did not market

1997 Fournier granted Abbott an exclusive license including US4895726

(fenofibrate co-micronized with a solid surfactant)

1998 Tricor-A (Lipidil Micro) 67 mg capsule approved in US (Abbott)

1999 Tricor-A 134 mg and 200 mg approved in US

1999 Novopharma (Teva) filed PIV on 726 patent

2000 Impax files PIV on 726 patent

*TriCor is a registered trademark of Abbott laboratories.

The TriCor Story

2001 Tricor-B tablet 54 mg and 160 mg approved. Abbott pulls capsule from

market. TRICOR B had an additional indication for HDL effect.

2001 TRICOR-A listed as obsolete in the National Drug Data File causing Tevas

generic TRICOR-A to be identified as a brand drug resulting in a higher co-

payment.

2002 Teva files PIV for Tricor-B 54 mg and 160 mg tablets ( US6074670,

US6277405, US6589552, US6652881)

2004 Teva and Impax receive tentative approval for generic Tricor-B

2004 Abbotts Tricor-C approved as 48 mg and 145 mg tablets using Elans

NanoCrystal technology as a new NDA. TRICOR-C precluded generic

substitution of those approved for TRICOR-B (food effect). TRICOR C has

patent protection until 2018.

The TriCor Story

2008 Abbott pays Teva/Impax $184M in Tricor anti-trust settlement. Agree to

launch date of generic 145 mg.

2008

Abbotts Trilipix (choline fenofibrate) approved. US7259186 patent on

fenofibric acid salts valid until 1/07/2025. Exclusivity Expiration

12/15/2011. (Source Orange Book)

2009 Trilipix Delayed Release Capsules launched in US in January

2010 Trilipix PIVs already filed by Watson and Impax. Litigation initiated by

Abbott.

2011/2012 Market of generic 145 mg TriCor no sooner than March 28, 2011. Launch

expected some time in 2012

Meanwhile..

The TriCor Story: Specialty Pharma Makes Its Mark

New Formulations (NDAs) of Fenofibrate Developed and Marketed

2004* Ethypharms Antara 43 mg, 87 mg, 130 mg capsules approved in

US. 2008 sales of $70 million. Marketed in US by Lupin.

2005 SkyePharmas Triglide 50 mg and 160 mg approved in US.

Marketed in US by Shionogi (First Horizon/S

2006 Galephar/Cipher Lipofen 50 mg, 100 mg 150 mg capsules

approved in US. Marketed by Kyowa in US.

2007* LifeCycle Pharmas Fenoglide 40 mg and 120 mg tablets approved

with MeltDose technology in US. Marketed in US by Shionogi

(Sciele).

2009 URLs Fibricor 35 mg and 105 mg tablets (fenofibric acid)

approved.

* Paragraph IVs filed

What Is At Stake?

Source: PharmaCircle, LLC

Case Study: Kaletra

Date Action

2000 Soft gel capsule 133.3 mg Lopinavir/33.3 Ritanovir Approved in

US as HIV protease inhibitor.

Formulation: FD&C Yellow No. 6, gelatin, glycerin, oleic acid,

polyoxyl 35 castor oil, propylene glycol, sorbitol special,

titanium dioxide and water.

Also approved as an Oral Solution

2001 Soft gel capsule/Oral Solution approved in Europe.

Recommended storage: Store KALETRA soft gelatin capsules at 36F - 46F

(2C - 8C) until dispensed. Avoid exposure to excessive heat. For patient

use, refrigerated KALETRA capsules remain stable until the expiration date

printed on the label. If stored at room temperature up to 77F (25C), capsules

should be used within 2 months.

*Kaletra is a registered trademark of Abbott laboratories

Case Study: Kaletra

2005 US approval of Kaletra Tablet 200 mg/ 50 mg and 100 mg/25

mg Lopinavir/Ritanovir using Soliqs Meltrex technology.

Reduced pill burden from 3 capsules 2X daily to 2 tablet/2X

daily.

2009 Tentative approval of generics from Mylan/Matrix, Cipla, and

Aurobindo.

2009 The United States non-composition of matter patent covering

lopinavir/ritonavir will expire in 2016. Abbott filed suit in

March 2009 alleging Mylans proposed generic products

infringe Abbott's patents. Upon Matrix's motion, the court

granted a five-year stay of the litigation unless good cause to

lift the stay is shown.

Case Study: Kaletra

Source: PharmaCircle, LLC

The Generic Effect

Products with Generic Patent Challenges

25

27

2010 PIV Filings

DDS

Non-DDS

Source: US FDA

2010: PIV Drug Delivery Filings

Solubilization

Fenoglide Jalyn/Duodart Rapamune (0.5 mg)

Oral MR

Dexilant Exalgo/Jurnista Oxycontin OTR

Biaxin XL Ranexa Focalin XR (30 mg)

Simcor (750 mg/20 mg,

500 mg/20 mg)

Mirapex ER Oleptro

IntraOral

Metozolv ODT Orapred ODT Aricept ODT

Edluar

Other

Vivelle Dot Taclonex Ointment Locoid Lipocream

Latisse Zymaxid Olux-E Foam

Pulmicort Respules

(1mg/2mL)

Protopic Retin-A Micro

Generic Competition

Increase in PIV patent challenges earlier in patent life

Increased sophistication in DD technologies

Water insoluble techs (nanoparticles, amorphous, etc.)

Drug/Device combinations

Injectable Depot

Transdermal

Several large, well funded, skilled, generic firms with global

presence

Teva

Watson

Sandoz

Mylan

Actavis

Ranbaxy

Specialty Pharma

Specialty Pharma company formations are on

the rise

Success Rates for New Formulations (NF) are

higher than NCEs.

Companies are developing complex technologies

Not just Oral CR dosage forms

Amorphous, nanoparticles, injectable depot,

transdermal, Polymer prodrugs/PEGylation.

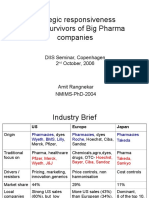

Year Founded vs. Business Models

NME vs. NF Products and Pipeline

41%

59%

US Marketed NDA

Products

NME

NF

71%

29%

Current NDA Pipeline

NME

NF

US Marketed Products: NDAs

Molecule Type Total NME NF DDS

Small Molecule 4987 1479 2316 2513

Peptide 164 71 68 93

Protein 511 212 260 204

Antibody 128 107 0 21

siRNA 0 0 0 0

Global NDA Pipeline

Molecule Type Total NME NF DDS

Small Molecule 5997 3619 1981 2597

Peptide 782 576 150 317

Protein 1185 806 279 485

Antibody 1314 1123 168 91

siRNA 186 186 0 121

Water Solubility of NMEs Approved in

US Since 2000

Water Solubility of New Formulations

(NF) Approved in US Since 2000

Practically Insoluble Drug Products

Approved in US Since 2000

0 50 100 150

NF

NME

Solubilized

What Do We Mean By Solubilization

Technology?

Solubilized

Nanoparticles

Lipid SEDDS

Amorphous, Solid

Solution/Dispersion

Cyclodextrins

Dendrimers

Micelles/Emulsions

Not Solubilized

Micronization

Standard wetting agents

Standard tablet, capsule, solution,

powder processing

Somewhat subjective

Solubilization Technology Utilization

Only 15% of practically insoluble drugs (NME or

New Formulation) utilized solubilization

technologies.

Water Insoluble Technologies Really Needed?

OR

Opportunity for improved therapies?

Approved Drugs: 2000-2010

Solubilization Technology

Brandname Approved Dosage Form Company Type Technology

ITRACONAZOLE

(Hyphanox) 2010 Tablet STIEFFEL/GSK NF Solid Disperion

NORVIR TABLET 2010 Tablet ABBOTT NF Meltrex

JALYN (DUODART) 2010 Capsule GSK NF Softgel/SEDDS

INVEGA SUSTENNA 2009

Suspension; Injectable

(Ext. Release, IM) J&J NF NanoCrystal

ZIPSOR 2009 Capsule XANODYNE NF Softgel/SEDDS

FIBRICOR 2009 Tablet URL NF Nanoburst

ALOXI 2008 Capsule HELSINN NF Softgel/SEDDS

NEXTERONE 2008 Injectable PRISM NF Captisol

CLEVIPREX 2008 Emulsion; IV MEDICINES CO NF Emulsion

INTELENCE 2008 Tablet J&J NME Amorphous

Approved Drugs: 2000-2010

Solubilization Technology

Brandname Approved Dosage Form Company Type Technology

HYCAMTIN 2007 Capsule GSK NF Softgel/SEDDS

FENOGLIDE 2007 Tablet

SHIONOGI/

LIFECYCLE NF Softgel/SEDDS

ABILIFY INJECTION 2006 Injectable OTSUKA NF Captisol

TIROSINT 2006 Capsule

INSTITUT

BIOCHIMIQUE NF Softgel/SEDDS

AMITIZA 2006 Capsule SUCAMPO NME Softgel/SEDDS

LIPOFEN 2006 Capsule CIPHER NF Softgel/SEDDS

KALETRA TABLETS 2005 Tablet ABBOTT NF Meltrex

MEGACE ES 2005 Suspension; Oral PAR NF NanoCrystal

TRIGLIDE 2005 Tablet SKYEPHARMA NF

IDD-P

Microparticle

ABRAXANE 2005 Suspension, Injectable ABRAXIS NF Nab Nanoparticle

Approved Drugs: 2000-2010

Solubilization Technology

Brandname Approved Dosage Form Company Type Technology

APTIVUS 2005 Capsule BOEHRINGER NME Softgel/SEDDS

TRICOR C 2004 Tablet ABBOTT NF NanoCrystal

ANTARA 2004 Capsule ETHYPHARM NF Other

EMEND 2003 Capsule MERCK NME NanoCrystal

VFEND INJECTION 2002

Injectable; IV

(Infusion) PFIZER NF Captisol

GEODON 2002 Injectable; IM PFIZER NF Captisol

MITOZYTREX 2002 Injectable SUPERGEN NF Cyclodextrin

AVODART 2001 Capsule GSK NME Softgel/SEDDS

RAPAMUNE 2000 Tablet WYETH NF NanoCrystal

KALETRA CAPSULE 2000 Capsule ABBOTT NME/NC Softgel/SEDDS

Top 20 Product Sales Worlwide-2010

Product Sales (M$) Molecule Type Route DDS

Lipitor 10733 Small Molecule Oral No

Plavix 9483 Small Molecule Oral No

Advair 7988 Small Molecule Inhalation Yes

Enbrel 7216 Protein Injection Yes*

Humira 6548 Antibody Injection Yes

Remicade 6445 Antibody Injection No

Avastin 6100 Antibody Injection No

Diovan 6053 Small Molecule Oral No

Rituxan 6001 Antibody Injection No

Crestor 5691 Small Molecule Oral No

Seroquel 5302 Small Molecule Oral Yes*

Herceptin 5126 Antibody Injection No

Zyprexa 5026 Small Molecule Oral, Injection Yes*

Singulair 4987 Small Molecule Oral Yes*

Nexium 4969 Small Molecule Oral, Injection Yes*

Lantus 4828 Protein Injection Yes*

Gleevec 4265 Small Molecule Oral No

Actos 4200 Small Molecule Oral No

Lovenox 3643 Carbohydrate Injection No

Aricept 3643 Small Molecule Oral Yes*

*Sales reported for franchise which includes multiple formulations

Drug Delivery in Top 20 Products

40%

60%

Top 20 Product Sales

DD

Non-DD

40% of Top 20 products have

an element of Drug Delivery

DD contributes to $51 Billion

USD in sales for Top 20

products

DD is applied to small

molecules and biologics

Drug Delivery and LCM: Risperdal

Impact of DD Technology on Products

Emend

Solubilization technology enabled product to reach market. Sales of $380 million

USD in 2010.

Megace ES

Eliminated food effect and reduced dose size. Important for patient population

that has difficulties eating/swallowing. Sales of approx. $70 million USD.

Intelence

Solubilization technology enabled product to reach market

Invega

OROS and Nanocrystal technologies created products with good safety/efficacy

profiles. May be difficult for Generics to copy. Sales of $424 millionUSD in 2010.

TriCor

Reduced dose, eliminate food effect, LCM delayed Generic introduction. Sales of

$1.6 billion USD in 2010.

Geoden

Allowed for an injectable form to reach market. Franchise sales of over $1 billion

USD in 2010

Impact of Drug Delivery: Summary

Drug delivery provides measurable value

Utilized in some capacity in 40% of Top 20

pharmaceutical products with sales of 51 billion

USD worldwide.

Drug delivery increases revenues via patent

protection and life cycle products

Delays generic introduction in some cases and

provides additional franchise revenues.

Drug delivery has to make sense

Does not provide inherent value to all programs.

Must be product/market driven.

Due Diligence and Competitive

Intelligence

Need to know Who is in the space? What are

they doing?, Where are they going?, When

do they expect to get there?, and How?

Need detailed analyses of all players to assess

your competiveness.

Analyses can come from internal resources,

external sources(i.e. consultants) or a mixture of

both.

Keeping Up with Technology

According PharmaCircle:

Over 60,000 patents published/issued in DD

2000-2010

Approximately 4,000 distinct DD technologies

identified

Approximately 1,600 companies have patented

DD technology

Large Pharma

Specialty Pharma

Generics

Drug Delivery (are there really any of these left?)

DD Patents: 2000-2010

Oral Water Insoluble Patents: 2000-2010

DD Technology Assessment

Do you need it?

How do you compare technologies?

What is your strategy?

Look at multiple technologies

Internal vs. external technology

Who do partner with?

What are key decision points?

How do you move quickly and efficiently?

DD Technology Assessment: Nanoparticles

Technology*

NanoCrystal Solumatrix NanoActive

Phase Marketed Phase 2 Preclinical (recently

validated GMP equipment

1/2011)

GMP Yes Yes Yes

Process Wet milling Dry milling Precipitation

Solvents Aqueous based Aqueous wash after

dry milling

Various

aqueous/organic

Additives/

Stabilizers

PVA, PVP, docusate

sodium, SLS, and

others.

Sodium chloride, sodium

hydrogen sulfate, sodium

carbonate, sodium

bicarbonate, or ammonium

chloride, CTB

Dextran, PVP,

Carbopol

Particle

Size

<400 nm 100-500 nm <500 nm

*Trademarks of Elan, iCeutica and NanGenex respectively

DD Technology Assessment: Nanoparticles

Technology*

NanoCrystal Solumatrix NanoActive

Special

Equipment

Yes No (ball mill) Yes

Batch Sizes 10 mg Commercial Lab to Phase II

500 mg to 2-4 kg/8 hr

Routes

Oral, injectable,

topical, inhalation and

nasal

Oral, injectable,

topical, inhalation and

nasal

Oral, injectable,

topical, inhalation and

nasal

Example IP

Multiple issued and

published US/World

patents.

US2009028948, EP1830824,

WO2008000042

WO2009133418,

WO2010146408,

WO2010146407,

WO2010146406

Partners

Multiple including

Merck, Janssen, AZ,

Pfizer, BMS

Iroko Pharmaceuticals,

Undisclosed large

pharma company

NanoForm

Therapeutics Ltd.

*Trademarks of Elan, iCeutica and NanGenex respectively

Product and Technology Deals

Need to understand past and current deal terms

Upfront Payments

Royalties

Milestones

Development Fees

Phase Deal Signed

Therapeutic Category

Route

Technologies licensed (DD, Discovery)

Product and Technology Deals

Products/Pipeline Assessment

Molecule Type (small molecule, biologic, siRNA)

Mechanism

Delivery Route (injectable, oral, transdermal)

Phase

NME, New Formulation, New Combination..

Dose (25 mg or 1000 mg)

Dose Frequency (QD, BID)

Dosage Form (shape, size, color.)

Technology and IP

Products/Pipeline Assessment

Current Pipeline Summary

Molecule

Type Total NME*

New

Formulation* DDS

Small Molecule 5997 3619 1981 2597

Peptide 782 576 150 317

Protein 1185 806 279 485

Antibody 1314 1123 168 91

siRNA 186 186 0 121

Phase 2/Phase 3 Pipeline

Water Insoluble Drugs Pipeline

Do we really know????

Water solubility of NME pipeline programs

usually not publicly available.

Technology approaches also not usually

available until later phases or until

registration/approval.

Water Solubility: Oral Products US

Water Solubility: Oral Products US

1990-2011

Top 10 Oral Products: Attributes**

Product DDS Ther. Category Form Dose (mg) Colors Shapes

Lipitor No Cardiovascular Tablet

10, 20, 40,

80

White Elliptical

Plavix No Cardiovascular Tablet 75, 300 Pink Round

Diovan*** No Cardiovascular Tablet 40, 80, 160

320

Yellow

Red

Grey-Orange

Dark Grey-Violet

Oval

Almond

Almond

Almond

Crestor No Cardiovascular Tablet 5, 10, 20, 40

Yellow

Pink

Pink

Round

Round

Oval

Seroquel XR Yes* CNS Tablet

25, 50, 150,

200, 300,

400

Peach

White

Yellow

Capsule

Capsule

Capsule

Seroquel No* CNS Tablet

25, 50, 100,

200, 300,

400

Peach

White

Yellow

White

Yellow

Round

Round

Round

Capsule

Capsule

*Sales reported for franchise which includes multiple formulations.

** For US market

***Capsule form discontinued

Top 10 Oral Products: Attributes**

Product DDS Ther. Category Form Dose (mg) Colors** Shapes**

Zyprexa No* CNS Tablet 2.5, 5, 7.5, 10,

15, 20

White

Blue

Pink

Round

Elliptical

Elliptical

Zyprexa Zydis Yes* CNS ODT 5, 10, 15, 20 Yellow Round

Singulair No* Respiratory Tablet 10 Beige Rounded square

Singulair Chewable

Yes* Respiratory Tablet 4, 5

Pink

Pink

Oval

Round

Singular Granules No* Respiratory Powder 4 White NA

NexiumDelayed

Release Capsule

Yes* GI Capsule 20, 40

Amethyst Capsule

Gleevec*** No Oncology Tablet 100, 400

Yellow/Orange

Yellow/Orange

Round

Oval

Actos No Diabetes Tablet 15, 30, 45 White Round

*Sales reported for franchise which includes multiple formulations.

** Colors/Shapes for US

***Capsule form discontinued

Oral Marketed Products Attributes

Of the Top 10 Oral Products

Cardiovascular and CNS are top therapeutic

categories

Tablets dominate oral forms

In US, many oral dosage forms are colored. Not as

many little white pills

Summary

Need to understand the market and competition

Need Data AND Analyses

Generic companies are more aggressive and

more sophisticated

Specialty Pharma is a growing sector

Drug Delivery has a large, measurable role in

successful products and franchises

A successful development strategy integrates

ALL areas: R&D, Marketing, IP, Information

Services, Licensing, Executive Management,

Вам также может понравиться

- Dissolution MethodsДокумент114 страницDissolution MethodsBusdev Catur DakwahОценок пока нет

- Drug IndexДокумент71 страницаDrug IndexDunca Ana-MariaОценок пока нет

- API Common Deficiencies - 1Документ68 страницAPI Common Deficiencies - 1wondwosseng100% (1)

- Drug Registration in ASEAN CountriesДокумент35 страницDrug Registration in ASEAN CountriesSreedhar TirunagariОценок пока нет

- Vitamin D Supplements in The Indian MarketДокумент15 страницVitamin D Supplements in The Indian Marketpartha9sarathi9ainОценок пока нет

- KetofolДокумент10 страницKetofolDr. Shivkumar Kiran AngadiОценок пока нет

- Antibiotic SlideДокумент56 страницAntibiotic SlidePhongsathorn PhlaisaithongОценок пока нет

- Top 200 Small Molecule Pharmaceuticals 2018 1568907849 PDFДокумент1 страницаTop 200 Small Molecule Pharmaceuticals 2018 1568907849 PDFvngopalОценок пока нет

- Biosimilars Market Size, Trends and Forecast, 2026Документ7 страницBiosimilars Market Size, Trends and Forecast, 2026swati kaleОценок пока нет

- Insoluble Drug Delivery StrategiesДокумент12 страницInsoluble Drug Delivery StrategiespsykhodelykОценок пока нет

- Global Pharma StrategyДокумент15 страницGlobal Pharma StrategyDr Amit RangnekarОценок пока нет

- Biopharmaceuticals Are Among The Most Sophisticated and ElegantДокумент8 страницBiopharmaceuticals Are Among The Most Sophisticated and ElegantRuza MazlanОценок пока нет

- Pharma Business Dynamics in ROW MarketsДокумент9 страницPharma Business Dynamics in ROW Marketskaushal_75Оценок пока нет

- Korean Biologics Pipeline 2015Документ31 страницаKorean Biologics Pipeline 2015Anonymous JE7uJRОценок пока нет

- Peptide DrugДокумент17 страницPeptide DrugNADIA INDAH FITRIA NINGRUM -100% (1)

- BiosimilarsДокумент22 страницыBiosimilarsMichel HalimОценок пока нет

- The Micro Sponge Delivery SystemДокумент19 страницThe Micro Sponge Delivery SystemArjun KumarОценок пока нет

- DpcoДокумент41 страницаDpcodrugdrugОценок пока нет

- Best Hospitals in Nigeria: 1. Neuro-Psychiatric Hospital, Aro, AbeokutaДокумент3 страницыBest Hospitals in Nigeria: 1. Neuro-Psychiatric Hospital, Aro, AbeokutaHussein Ibrahim GebiОценок пока нет

- West Africa Ghana Nigeria Specific Pharmaceutical Industry PDFДокумент32 страницыWest Africa Ghana Nigeria Specific Pharmaceutical Industry PDFMadisonCloeОценок пока нет

- Biosimilars ManuДокумент6 страницBiosimilars ManuIshan GhaiОценок пока нет

- 2011 The Pharmaceutical Industry and Global HealthДокумент50 страниц2011 The Pharmaceutical Industry and Global HealthAbe GuinigundoОценок пока нет

- Migraine Headache: in Partial Fulfillment of Nursing 505B by Melissa A. MakhoulДокумент26 страницMigraine Headache: in Partial Fulfillment of Nursing 505B by Melissa A. MakhoulMelissa MakhoulОценок пока нет

- List of Guidelines 1679795815Документ3 страницыList of Guidelines 1679795815Rezha AmaliaОценок пока нет

- Product Lifecycle ManagementДокумент3 страницыProduct Lifecycle ManagementkhandakeralihossainОценок пока нет

- Comparative Dossier Filling Procedure in The Asean, Cis and The GCC RegionДокумент35 страницComparative Dossier Filling Procedure in The Asean, Cis and The GCC Regionsandeepver88100% (1)

- Surfactants and Their ApplicationsДокумент46 страницSurfactants and Their ApplicationsCecilia Solar100% (4)

- Chile 09 q3 WPMДокумент80 страницChile 09 q3 WPMhormiga777Оценок пока нет

- EU-Guideline On Quality of Transdermal Patches-WC500132404Документ28 страницEU-Guideline On Quality of Transdermal Patches-WC500132404raju1559405Оценок пока нет

- L-1 Drugs and Cosmetics Act 1940 PDFДокумент7 страницL-1 Drugs and Cosmetics Act 1940 PDFAkash HalsanaОценок пока нет

- Biosimilars PathwayДокумент13 страницBiosimilars Pathwaytamara_0021Оценок пока нет

- MEU X3 SIMPO 4.3 Semaglutide ReviewДокумент40 страницMEU X3 SIMPO 4.3 Semaglutide ReviewBimo Panji KumoroОценок пока нет

- Medicine Price Surveys, Analyses and Comparisons: Evidence and Methodology GuidanceОт EverandMedicine Price Surveys, Analyses and Comparisons: Evidence and Methodology GuidanceSabine VoglerОценок пока нет

- C & D HospitalsДокумент15 страницC & D HospitalsjeedanОценок пока нет

- Kenya HRH Strategy 2014 2018Документ82 страницыKenya HRH Strategy 2014 2018Isaac SpaiderОценок пока нет

- Rybelsus Product MedicalДокумент58 страницRybelsus Product MedicalNovo NORDISK BalajiОценок пока нет

- Modified From The List Produced by The Njardarson Group (The University of Arizona)Документ1 страницаModified From The List Produced by The Njardarson Group (The University of Arizona)pili35Оценок пока нет

- Commercial Report BFT 28 April 2023 S3640279Документ11 страницCommercial Report BFT 28 April 2023 S3640279suzana krkicОценок пока нет

- Trends in Drug ResearchДокумент186 страницTrends in Drug ResearchEvsevios HadjicostasОценок пока нет

- Doxofylline IR Tablet paper-IJPSRRДокумент10 страницDoxofylline IR Tablet paper-IJPSRRMohd Bismillah AnsariОценок пока нет

- Enoxaparin FDA 2010Документ45 страницEnoxaparin FDA 2010Imam Nur Alif KhusnudinОценок пока нет

- Injection Product List HДокумент11 страницInjection Product List Halnikki25kОценок пока нет

- Ghana Medical PricesДокумент62 страницыGhana Medical PricesbobbiebogusОценок пока нет

- Guidelines For Registration of Imported Drug Products in NigeriaДокумент7 страницGuidelines For Registration of Imported Drug Products in NigeriaTueОценок пока нет

- Basilea Investor Booklet FinalДокумент47 страницBasilea Investor Booklet FinalMiguel RamosОценок пока нет

- Propofol - Injectable Injection - RLD 19627 - RC06-16 PDFДокумент3 страницыPropofol - Injectable Injection - RLD 19627 - RC06-16 PDFAhmed SalehinОценок пока нет

- Strategy of Aurobindo PharmaДокумент12 страницStrategy of Aurobindo PharmaanuragОценок пока нет

- Checklist For FSSAI License For Importer-1137words-1August2018-MBBДокумент2 страницыChecklist For FSSAI License For Importer-1137words-1August2018-MBBAbhishek PaulОценок пока нет

- Minutes of 244th Meeting of Registration BoardДокумент268 страницMinutes of 244th Meeting of Registration BoardSarfarazpk1100% (2)

- Overview of Scale-Up and Post-Approval Changes (SUPAC)Документ3 страницыOverview of Scale-Up and Post-Approval Changes (SUPAC)Ashwini DoleОценок пока нет

- Manufacturing Landscape: Clarivate Analytics NewportДокумент6 страницManufacturing Landscape: Clarivate Analytics NewportNarendra JoshiОценок пока нет

- Introduction To Genric DrugДокумент60 страницIntroduction To Genric Drugganesh_orcrdОценок пока нет

- Appendix B - Product Name Sorted by Applicant: December 2019 - Approved Drug Product ListДокумент200 страницAppendix B - Product Name Sorted by Applicant: December 2019 - Approved Drug Product ListlichenresearchОценок пока нет

- Unit Dosages Form Tablet An OverviewДокумент32 страницыUnit Dosages Form Tablet An OverviewIJHEPS JOURNALОценок пока нет

- Hep AДокумент13 страницHep ARakesh SharmaОценок пока нет

- Evaluation of The Effect of Submucosal Vaginal Administration of Ketamine On Postoperative Pain in Ivf CandidatesДокумент10 страницEvaluation of The Effect of Submucosal Vaginal Administration of Ketamine On Postoperative Pain in Ivf Candidatesindex PubОценок пока нет

- Pharmaceutical ExcipientsДокумент5 страницPharmaceutical Excipientsmads56091Оценок пока нет

- Drugs Approving AuthoritiesДокумент38 страницDrugs Approving AuthoritiesTariq HaqueОценок пока нет

- Drug Registration and Essential DrugsДокумент42 страницыDrug Registration and Essential DrugsJeyanthakumar RasarathinamОценок пока нет

- Nutra Summit Presentation For 15th MarchДокумент25 страницNutra Summit Presentation For 15th MarchGayathry RavishankarОценок пока нет

- New Drug Delivery Systems: A Global OpportunityДокумент24 страницыNew Drug Delivery Systems: A Global OpportunityRugun Clara SamosirОценок пока нет

- Efektivitas Penggunaan Jenis Pelarut Dan AsamДокумент6 страницEfektivitas Penggunaan Jenis Pelarut Dan AsamShalie VhiantyОценок пока нет

- UK-Enclosure41Документ7 страницUK-Enclosure41Shalie VhiantyОценок пока нет

- Bero 2009 2Документ33 страницыBero 2009 2Shalie VhiantyОценок пока нет

- Article Senyawa Kimia Ubi UnguДокумент10 страницArticle Senyawa Kimia Ubi UnguShalie VhiantyОценок пока нет

- Kim 26 4 8 0106 13 PDFДокумент8 страницKim 26 4 8 0106 13 PDFIif Bocah ToiliОценок пока нет

- Nutritive and Anti-Nutritive Evaluation of Sweet PotatoesДокумент3 страницыNutritive and Anti-Nutritive Evaluation of Sweet PotatoesShalie VhiantyОценок пока нет

- Jurnal Sistem Sitokin Universitas Sebelas MaretДокумент5 страницJurnal Sistem Sitokin Universitas Sebelas MaretMade Oka Heryana100% (1)

- 426 Kartika Nugraheni G2C007040 PDFДокумент38 страниц426 Kartika Nugraheni G2C007040 PDFJaime GarzaОценок пока нет

- Drug Metab Dispos-2004-Mangold-566-71 PDFДокумент6 страницDrug Metab Dispos-2004-Mangold-566-71 PDFShalie VhiantyОценок пока нет

- Antibiotics 02 00485Документ15 страницAntibiotics 02 00485Sally HerviantiОценок пока нет

- Nutritive and Anti-Nutritive Evaluation of Sweet PotatoesДокумент3 страницыNutritive and Anti-Nutritive Evaluation of Sweet PotatoesShalie VhiantyОценок пока нет

- AcetaminophenДокумент11 страницAcetaminophenShalie VhiantyОценок пока нет

- Evaluationof in Vitrocytotoxicand Antioxidantactivitiesof IpomoeaДокумент2 страницыEvaluationof in Vitrocytotoxicand Antioxidantactivitiesof IpomoeaShalie VhiantyОценок пока нет

- Etoposide JurnalДокумент6 страницEtoposide JurnalShalie VhiantyОценок пока нет

- Data Logistik Untuk SO SIHA 2.1 KabKotaДокумент34 страницыData Logistik Untuk SO SIHA 2.1 KabKotaTeti HerawatiОценок пока нет

- SHC Antiretroviral FormularyДокумент1 страницаSHC Antiretroviral FormularyMario BulaciosОценок пока нет

- JCP 29785Документ10 страницJCP 29785Wa Ode Yulianti Asrar JayaОценок пока нет

- Forbes - Ten Misleading Drug AdsДокумент8 страницForbes - Ten Misleading Drug AdsrdandapsОценок пока нет

- Patient Testimonial Videos: FDA Actions On Risk Information PresentationДокумент3 страницыPatient Testimonial Videos: FDA Actions On Risk Information PresentationDale Cooke100% (1)

- COVID 19 Science Report Therapeutics 4 May PDFДокумент41 страницаCOVID 19 Science Report Therapeutics 4 May PDFjolamo1122916Оценок пока нет

- The Latest:: Veg. Vs Non-VegДокумент44 страницыThe Latest:: Veg. Vs Non-VegedwincliffordОценок пока нет

- SPIN BindingSiteAnalysisOfPotentialДокумент6 страницSPIN BindingSiteAnalysisOfPotentialnishiОценок пока нет

- Hot Melt ExtrusionДокумент14 страницHot Melt ExtrusionMuhammadAmdadulHoqueОценок пока нет

- LopinavirДокумент2 страницыLopinavirCẩm nang Y họcОценок пока нет

- Register For Medicines 2019 Human UseДокумент320 страницRegister For Medicines 2019 Human UseLeroy LupiyaОценок пока нет

- SSHP Newsletter Spring22Документ18 страницSSHP Newsletter Spring22api-398712370Оценок пока нет

- Guidelines Unproven Therapies COVID-19Документ60 страницGuidelines Unproven Therapies COVID-19Aleksandar DimkovskiОценок пока нет

- Update Harga TW I 2023Документ28 страницUpdate Harga TW I 2023Luthfina MaulidaОценок пока нет

- TanzaniaДокумент584 страницыTanzaniaSindy Elfas0% (1)

- The Covid-19 Pandemic and Haemoglobin Disorders: Vaccinations & Therapeutic DrugsДокумент53 страницыThe Covid-19 Pandemic and Haemoglobin Disorders: Vaccinations & Therapeutic DrugsJuanGabrielVillamizarОценок пока нет

- Letter To PM, Finance Minister Over Medicine For HIV-positive ChildrenДокумент21 страницаLetter To PM, Finance Minister Over Medicine For HIV-positive ChildrenArunGОценок пока нет

- CDER Fast Track Products Approved Since 1998 Through June 1, 2010Документ5 страницCDER Fast Track Products Approved Since 1998 Through June 1, 2010dianОценок пока нет

- Water Insoluble StrategiesДокумент61 страницаWater Insoluble StrategiesShalie VhiantyОценок пока нет

- House Committee On Good Government and Public Accountability Committee Report No. 1393Документ55 страницHouse Committee On Good Government and Public Accountability Committee Report No. 1393GMA News OnlineОценок пока нет

- AI in Contact TracingДокумент7 страницAI in Contact Tracingpayal_joshi_14Оценок пока нет

- Peer Review Report (Lopinavir/Ritonavir (40mg/10mg) Oral Granules For Oral Suspension)Документ6 страницPeer Review Report (Lopinavir/Ritonavir (40mg/10mg) Oral Granules For Oral Suspension)Ranga NdhlovuОценок пока нет

- 2013 Pipeline ReportДокумент295 страниц2013 Pipeline ReportLIONtescuОценок пока нет

- Nhis Drug Price List Final (2013 Ed)Документ32 страницыNhis Drug Price List Final (2013 Ed)holuwadamilare935Оценок пока нет

- AbbVie Products & Contact Information - MIMSДокумент3 страницыAbbVie Products & Contact Information - MIMSKhoaОценок пока нет

- Infectious Diseases Society of America Guidelines On The Treatment and Management of Pa - Tients With COVID-19, 14 MARTIE 2023 PDFДокумент56 страницInfectious Diseases Society of America Guidelines On The Treatment and Management of Pa - Tients With COVID-19, 14 MARTIE 2023 PDFdavid mangaloiuОценок пока нет

- [CC-By-NC-ND 4.0 International License] Muradiye Nacak - Bioequivalence Study of Lopinavir_Ritonavir 200_50 Mg Film Tablet (World Medicine Ilac, Turkey) Under Fasting Conditions (Orvical) Clinical, Biological and GenДокумент5 страниц[CC-By-NC-ND 4.0 International License] Muradiye Nacak - Bioequivalence Study of Lopinavir_Ritonavir 200_50 Mg Film Tablet (World Medicine Ilac, Turkey) Under Fasting Conditions (Orvical) Clinical, Biological and Genstreet jobОценок пока нет

- Drug Repurposing ApproachДокумент30 страницDrug Repurposing ApproachShofi Dhia AiniОценок пока нет

- Possible Treatment and Strategies For COVID-19: Review and AssessmentДокумент16 страницPossible Treatment and Strategies For COVID-19: Review and AssessmentAni RahayuОценок пока нет

- VIRADAY Tablets (Efavirenz + Emtricitabine + Tenofovir Disoproxil Fumarate)Документ23 страницыVIRADAY Tablets (Efavirenz + Emtricitabine + Tenofovir Disoproxil Fumarate)Revina BustamiОценок пока нет

![[CC-By-NC-ND 4.0 International License] Muradiye Nacak - Bioequivalence Study of Lopinavir_Ritonavir 200_50 Mg Film Tablet (World Medicine Ilac, Turkey) Under Fasting Conditions (Orvical) Clinical, Biological and Gen](https://imgv2-2-f.scribdassets.com/img/document/544572595/149x198/597ccccac7/1638626721?v=1)