Академический Документы

Профессиональный Документы

Культура Документы

Derivatives

Загружено:

deepakmaru92Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Derivatives

Загружено:

deepakmaru92Авторское право:

Доступные форматы

A

PROJECT REPORT

ON

AN ANALYTICL STUDY OF DERIVATIVES IN FUTURES

WITH REFERENCE TO

UNICON SECURITIES

Submitted in partia !u!iment !"r t#e a$ard "! t#e

%a&ter "! 'u&ine&& Admini&trati"n

I( under &i)ned #ere b* de+are t#at t#e pr",e+t rep"rt entited -AN

ANALYTICAL STUDY OF DERIVATIVES IN FUTURES WITH

REFERENCE TO UNICON SECURITIES.( and t#i& pr",e+t i&

&ubmitted t" //////( a!!iiated t" ////( i& dra!ted b* me and i&

"ri)ina $"r0 "! m* "$n1

1

2

TA'LE OF CONTENTS

CHAPTER PA2E NU%'ER

1. INTRODUCTION3333333333333333111317

Introduction

Objectives of the Study

Imort!nce of Study

"ethodo#o$y

2. R%&I%' O( )IT%R*TUR%33333313333333112

(utures

Tr!din$

+. INDUSTR, -RO(I)% 33333333333313331.+

.. CO"-*N, -RO(I)%1111111111111111111111111111111111111111111111111111111111111111/2

/1 D*T* *N*),SIS 0 -R%S%NT*TION11133333311311//

-resent!tion !nd *n!#ysis

(indin$s of "!r1et

2. CONC)USIONS 0 SU33%STIONS333333331311112/

Summ!ry 0 conc#usions

)imit!tions of Study

*--%NDI4 333333333333333333111125

6I6)IO3R*-7,333113333333333331137.

C#apter 4 5

Intr"du+ti"n

+

Intr"du+ti"n

* Deriv!tive is ! fin!nci!# instrument th!t derives its v!#ue from !n under#yin$ !sset.

Deriv!tive is !n fin!nci!# contr!ct 8hose rice9v!#ue is deendent uon rice of one or more

b!sic under#yin$ !sset: these contr!cts !re #e$!##y bindin$ !$reements m!de on tr!din$ screens of

stoc1 e;ch!n$es to buy or se## !n !sset in the future. The most common#y used deriv!tives

contr!cts !re for8!rds: futures !nd otions: 8hich 8e sh!## discuss in det!i# #!ter.

The m!in objective of the study is to !n!#y<e the deriv!tives m!r1et in Indi! !nd to !n!#y<e the

oer!tions of futures !nd otions. *n!#ysis is to ev!#u!te the rofit9#oss osition futures !nd

otions. Deriv!tes m!r1et is !n innov!tion to c!sh m!r1et. *ro;im!te#y its d!i#y turnover

re!ches to the e=u!# st!$e of c!sh m!r1et

In c!sh m!r1et the rofit9#oss of the investor deend the m!r1et rice of the under#yin$

!sset. Deriv!tives !re most#y used for hed$in$ urose. In bu##ish m!r1et the c!## otion 8riter

incurs more #osses so the investor is su$$ested to $o for ! c!## otion to ho#d: 8here !s the ut

otion ho#der suffers in ! bu##ish m!r1et: so he is su$$ested to 8rite ! ut otion. In be!rish

m!r1et the c!## otion ho#der 8i## incur more #osses so the investor is su$$ested to $o for ! c!##

otion to 8rite: 8here !s the ut otion 8riter 8i## $et more #osses: so he is su$$ested to ho#d !

ut otion.

.

O'JECTIVES

To study the v!rious trends in deriv!tives m!r1et.

To study the ro#e of deriv!tives in Indi! fin!nci!# m!r1et

To study in det!i# the ro#e of futures !nd otions.

To study the ro#e of stoc1 e;ch!n$e 8ith emh!sis on 7S%.

To find out rofit9#oss osition of the otion 8riter !nd otion ho#der.

I%PORTANCE OF THE STUDY

The resent study on futures !nd otions is very much !reci!b#e on the $rounds th!t it

$ives dee insi$hts !bout the (0O m!r1et. It 8ou#d be essenti!# for the erfect 8!y of tr!din$ in

(0O. *n investor c!n choose the fi$ht under#yin$ or ortfo#io for investment +8hich is ris1 free.

The study 8ou#d e;#!in the v!rious 8!ys to minimi<e the #osses !nd m!;imi<e the rofits. The

study 8ou#d he# the investors ho8 their rofit9#oss is rec1oned. The study 8ou#d !ssist in

underst!ndin$ the (0O se$ments. The study !ssists in 1no8in$ the different f!ctors th!t c!use

for the f#uctu!tions in the (0O m!r1et. The study rovides inform!tion re#!ted to the bye#!8s of

(0O tr!din$. The studies e#ucid!te the ro#e of (0O in Indi! (in!nci!# "!r1ets.

%ETHODOLO2Y

The d!t! h!d been co##ected throu$h rim!ry !nd second!ry source.

Primar* data6

The d!t! h!d been co##ected throu$h UNICON st!ff: -roject $uide !nd Stoc1 bro1ers.

Se+"ndar* data6

The d!t! h!d been co##ected throu$h >ourn!#s: Ne8s !ers: !nd Internet.

/

Ch!ter ? 2

REVIEW OF

LITERATURE

2

Deriv!tive

The emer$ence of the m!r1et for deriv!tive roducts: most not!b#y for8!rds: futures !nd

otions: c!n be tr!ced b!c1 to the 8i##in$ness of ris1?!verse economic !$ents to $u!rd

themse#ves !$!inst uncert!inties !risin$ out of f#uctu!tions in !sset rices. 6y their very n!ture:

the fin!nci!# m!r1ets !re m!r1ed by ! very hi$h de$ree of vo#!ti#ity. Throu$h the use of

deriv!tive roducts: it is ossib#e to !rti!##y or fu##y tr!nsfer rice ris1s by #oc1in$@in !sset

rices. *s instruments of ris1 m!n!$ement: these $ener!##y do not inf#uence the f#uctu!tions in

the under#yin$ !sset rices. 7o8ever: by #oc1in$?in !sset rices: deriv!tive roducts minimi<e

the im!ct of f#uctu!tions in !sset rices on the rofit!bi#ity !nd c!sh f#o8 situ!tion of ris1?

!verse investors.

Deriv!tives !re ris1 m!n!$ement instruments: 8hich derive their v!#ue from !n under#yin$ !sset.

The under#yin$ !sset c!n be bu##ion: inde;: sh!re: bonds: currency: interest etc. 6!n1s: securities

firms: com!nies !nd investors to hed$e ris1s: to $!in !ccess to che!er money !nd to m!1e

rofit: use deriv!tives. Deriv!tives !re #i1e#y to $ro8 even !t ! f!ster r!te in future.

DEFINITION6

Deriv!tive is ! roduct 8hose v!#ue is derived from the v!#ue of !n under#yin$ !sset in !

contr!ctu!# m!nner. The under#yin$ !sset c!n be e=uity: fore;: commodity or !ny other !sset.

Securities Contr!cts ARe$u#!tionB *ct: 15/2 ASCARB *B defines Cderiv!tiveD to inc#ude @

1. * security derived from ! debt instrument: sh!re: #o!n 8hether secured or unsecured:

ris1 instrument or contr!ct for differences or !ny other form of security.

2. * contr!ct 8hich derives its v!#ue from the rices: or inde; of rices: of under#yin$

securities.

PARTICIPANTS6

The fo##o8in$ three bro!d c!te$ories of !rtici!nts in the deriv!tives m!r1et.

HED2ERS6

7

7ed$ers f!ce ris1 !ssoci!ted 8ith the rice of !n !sset. They use futures or otions

m!r1ets to reduce or e#imin!te this ris1.

SPECULATORS6

Secu#!tors 8ish to bet on future movements in the rice of !n !sset. (utures !nd otions

contr!cts c!n $ive them !n e;tr! #ever!$eE th!t is: they c!n incre!se both the otenti!# $!ins !nd

otenti!# #osses in ! secu#!tive venture.

AR'ITRA2EURS6

*rbitr!$eurs !re in business to t!1e !dv!nt!$e of ! discre!ncy bet8een rices in t8o

different m!r1ets. If: for e;!m#e: they see the futures rice of !n !sset $ettin$ out of #ine 8ith

the c!sh rice: they 8i## t!1e offsettin$ ositions in the t8o m!r1ets to #oc1 in ! rofit.

FUNCTIONS OF DERIVATIVES %AR7ET6

The fo##o8in$ !re the v!rious functions th!t !re erformed by the deriv!tives m!r1ets. They !reF

-rices in !n or$!ni<ed deriv!tives m!r1et ref#ect the ercetion of m!r1et !rtici!nts !bout

the future !nd #e!d the rices of under#yin$ to the erceived future #eve#.

Deriv!tives m!r1et he#s to tr!nsfer ris1s from those 8ho h!ve them but m!y not #i1e them to

those 8ho h!ve !n !etite for them.

Deriv!tive tr!din$ !cts !s ! c!t!#yst for ne8 entrereneuri!# !ctivity.

Deriv!tives m!r1ets he# incre!se s!vin$s !nd investment in the #on$ run.

TYPES OF DERIVATIVES6

The fo##o8in$ !re the v!rious tyes of deriv!tives. They !reF

FORWARDS6

* for8!rd contr!ct is ! customi<ed contr!ct bet8een t8o entities: 8here sett#ement t!1es

#!ce on ! secific d!te in the future !t tod!yGs re?!$reed rice

FUTURES F

H

* futures contr!ct is !n !$reement bet8een t8o !rties to buy or se## !n !sset !t ! cert!in

time in the future !t ! cert!in rice.

OPTIONS F

Otions !re of t8o tyes ? c!##s !nd uts. C!##s $ive the buyer the ri$ht but not the

ob#i$!tion to buy ! $iven =u!ntity of the under#yin$ !sset: !t ! $iven rice on or before ! $iven

future d!te. -uts $ive the buyer the ri$ht: but not the ob#i$!tion to se## ! $iven =u!ntity of the

under#yin$ !sset !t ! $iven rice on or before ! $iven d!te.

WARRANTS F

Otions $ener!##y h!ve #ives of u to one ye!rE the m!jority of otions tr!ded on otions

e;ch!n$es h!vin$ ! m!;imum m!turity of nine months. )on$er?d!ted otions !re c!##ed 8!rr!nts

!nd !re $ener!##y tr!ded over?the?counter.

LEAPS F

The !cronym )%*-S me!ns )on$?Term %=uity *ntici!tion Securities. These !re

otions h!vin$ ! m!turity of u to three ye!rs.

'AS7ETS F

6!s1et otions !re otions on ortfo#ios of under#yin$ !ssets. The under#yin$ !sset is

usu!##y ! movin$ !ver!$e of ! b!s1et of !ssets. %=uity inde; otions !re ! form of b!s1et

otions.

SWAPS F

S8!s !re riv!te !$reements bet8een t8o !rties to e;ch!n$e c!sh f#o8s in the future

!ccordin$ to ! re!rr!n$ed formu#!. They c!n be re$!rded !s ortfo#ios of for8!rd contr!cts. The

t8o common#y used s8!s !re

Intere&t rate &$ap&6

These ent!i# s8!in$ on#y the interest re#!ted c!sh f#o8s bet8een the

-!rties in the s!me currency.

5

Curren+* &$ap&6

These ent!i# s8!in$ both rinci!# !nd interest bet8een the !rties: 8ith the c!sh f#o8s in one

direction bein$ in ! different currency th!n those in the oosite Direction.

S$apti"n&6

S8!tions !re otions to buy or se## ! s8! th!t 8i## become oer!tive !t the e;iry of

the otions. Thus ! S8!tions is !n otion on ! for8!rd s8!.

RATIONALE 'EHIND THE DEVELOP%ENT OF DERIVATIVES6

7o#din$ ortfo#io of securities is !ssoci!ted 8ith the ris1 of the ossibi#ity th!t the investor m!y

re!#i<e his returns: 8hich 8ou#d be much #esser th!n 8h!t he e;ected to $et. There !re v!rious

f!ctors: 8hich !ffect the returnsF

1. -rice or dividend AinterestB.

2. Some !re intern!# to the firm #i1e @

Industri!# o#icy

"!n!$ement c!!bi#ities

ConsumerGs reference

)!bor stri1e: etc.

These forces !re to ! #!r$e e;tent contro##!b#e !nd !re termed !s non System!tic ris1s. *n

investor c!n e!si#y m!n!$e such non?system!tic by h!vin$ ! 8e## @ diversified ortfo#io sre!d

!cross the com!nies: industries !nd $rous so th!t ! #oss in one m!y e!si#y be comens!ted 8ith

! $!in in other.

There !re yet other tyes of inf#uences 8hich !re e;tern!# to the firm: c!nnot be contro##ed

!nd !ffect #!r$e number of securities. They !re termed !s system!tic ris1. They !reF

1. %conomic

2. -o#itic!#

+. Socio#o$ic!# ch!n$es !re sources of system!tic ris1.

1I

(or inst!nce: inf#!tion: interest r!te: etc. their effect is to c!use rices of ne!r#y !##

individu!# stoc1s to move to$ether in the s!me m!nner. 'e therefore =uite often find stoc1

rices f!##in$ from time to time in site of com!nyGs e!rnin$s risin$ !nd vice vers!.

R!tion!#e behind the deve#oment of deriv!tives m!r1et is to m!n!$e this system!tic ris1:

#i=uidity !nd #i=uidity in the sense of bein$ !b#e to buy !nd se## re#!tive#y #!r$e !mounts =uic1#y

8ithout subst!nti!# rice concessions.

In debt m!r1et: ! #!r$e osition of the tot!# ris1 of securities is system!tic. Debt instruments !re

!#so finite #ife securities 8ith #imited m!r1et!bi#ity due to their sm!## si<e re#!tive to m!ny

common stoc1s. Those f!ctors f!vor for the

urose of both ortfo#io hed$in$ !nd secu#!tion: the introduction of ! deriv!tive security th!t is

on some bro!der m!r1et r!ther th!n !n individu!# security.

Indi! h!s vibr!nt securities m!r1et 8ith stron$ ret!i# !rtici!tion th!t h!s ro##ed over the ye!rs.

It 8!s unti# recent#y b!sic!##y c!sh m!r1et 8ith ! f!ci#ity to c!rry for8!rd ositions in !ctive#y

tr!ded J*G $rou scris from one sett#ement to !nother by !yin$ the re=uired m!r$ins !nd

borro8in$ some money !nd securities in ! se!r!te c!rry for8!rd session he#d for this urose.

7o8ever: ! need 8!s fe#t to introduce fin!nci!# roducts #i1e in other fin!nci!# m!r1ets 8or#d

over 8hich !re ch!r!cteri<ed 8ith hi$h de$ree of deriv!tive roducts in Indi!.

Deriv!tive roducts !##o8 the user to tr!nsfer this rice ris1 by #oo1in$ in the !sset rice there by

minimi<in$ the im!ct of f#uctu!tions in the !sset rice on his b!#!nce sheet !nd h!ve !ssured

c!sh f#o8s.

Deriv!tives !re ris1 m!n!$ement instruments: 8hich derive their v!#ue from !n under#yin$ !sset.

The under#yin$ !sset c!n be bu##ion: inde;: sh!res: bonds: currency etc.

11

ANY E/CHAN2E FULFILLIN2 THE DERIVATIVE SE2%ENT AT NATIONAL

STOC7 E/CHAN2E6

The deriv!tives se$ment on the e;ch!n$e commenced 8ith S0- CN4 Nifty Inde; futures on

>une 12: 2III. The (0O se$ment of NS% rovides tr!din$ f!ci#ities for the fo##o8in$ deriv!tive

se$mentF

1. Inde; 6!sed (utures

2. Inde; 6!sed Otions

+. Individu!# Stoc1 Otions

.. Individu!# Stoc1 (utures

RE2ULATORY FRA%EWOR76

The tr!din$ of deriv!tives is $overned by the rovisions cont!ined in the SC ARB *: the S%6I *ct

!nd the re$u#!tions fr!med there under the ru#es !nd bye#!8s of stoc1 e;ch!n$es.

Re)uati"n !"r Deri8ati8e Tradin)6

S%6I set u ! 2. member committed under Ch!irm!nshi of Dr.).C.3ut! deve#o the

!rori!te re$u#!tory fr!me8or1 for deriv!tive tr!din$ in Indi!. The committee submitted its

reort in "!rch 155H. On "!y 11: 155H S%6I !cceted the recommend!tions of the committee

!nd !roved the h!sed introduction of Deriv!tives tr!din$ in Indi! be$innin$ 8ith Stoc1 Inde;

(utures. S%6I !#so !roved he CSu$$estive bye?#!8sD recommended by the committee for

re$u#!tion !nd contro# of tr!din$ !nd sett#ement of Deriv!tives contr!cts.

The rovisions in the SC ARB * $overn the tr!din$ in the securities. The !mendment of the SC

ARB * to inc#ude CD%RI&*TI&%SD 8ithin the !mbit of JSecuritiesG in the SC AR B * m!de tr!din$

in Deriv!tives ossib#e 8ithin the fr!me8or1 of the *ct.

1. %#i$ibi#ity criteri! !s rescribed in the ).C. 3ut! committee reort m!y !#y to S%6I

for $r!nt of reco$nition under Section . of the SC A R B *: 15/2 to st!rt Deriv!tives

Tr!din$. The deriv!tives e;ch!n$e9se$ment shou#d h!ve ! se!r!te $overnin$ counci#

!nd reresent!tion of tr!din$ 9 c#e!rin$ members sh!## be #imited to m!;imum of .IK of

12

the tot!# members of the $overnin$ counci#. The e;ch!n$e sh!## re$u#!te the s!#es

r!ctices of its members !nd 8i## obt!in !rov!# of S%6I before st!rt of Tr!din$ in !ny

deriv!tive contr!ct.

2. The e;ch!n$e sh!## h!ve minimum /I members.

+. The members of !n e;istin$ se$ment of the e;ch!n$e 8i## not !utom!tic!##y become the

members of the deriv!tive se$ment. The members of the deriv!tive se$ment need to

fu#fi## the e#i$ibi#ity conditions !s #!y do8n by the ).C.3ut! Committee.

.. The c#e!rin$ !nd sett#ement of deriv!tes tr!des sh!## be throu$h ! S%6I

!roved C#e!rin$ Coror!tion 9 C#e!rin$ house. C#e!rin$ Coror!tion 9

C#e!rin$ 7ouse com#yin$ 8ith the e#i$ibi#ity conditions !s #!y do8n

6y the committee h!ve to !#y to S%6I for $r!nt of !rov!#.

/. Deriv!tives bro1er9de!#ers !nd C#e!rin$ members !re re=uired to see1 re$istr!tion from

S%6I.

2. The "inimum contr!ct v!#ue sh!## not be #ess th!n Rs.2 )!1h. %;ch!n$es shou#d !#so

submit det!i#s of the futures contr!ct they urose to introduce.

7. The tr!din$ members !re re=uired to h!ve =u!#ified !roved user !nd s!#es erson 8ho

h!ve !ssed ! certific!tion ro$r!mmed !roved by S%6I.

1+

Future&

DEFINITION

* (utures contr!ct is !n !$reement bet8een t8o !rties to buy or se## !n !sset !t ! cert!in time in

the future !t ! cert!in rice. To f!ci#it!te #i=uidity in the futures contr!ct: the e;ch!n$e secifies

cert!in st!nd!rd fe!tures of the contr!ct. The st!nd!rdi<ed items on ! futures contr!ct !reF

Lu!ntity of the under#yin$

Lu!#ity of the under#yin$

The d!te !nd the month of de#ivery

The units of rice =uot!tions !nd minimum rice ch!n$e

)oc!tions of sett#ement

T*pe& "! !uture&6

On the b!sis of the under#yin$ !sset they derive: the futures !re divided into t8o tyesF

St"+0 !uture&6

The stoc1 futures !re the futures th!t h!ve the under#yin$ !sset !s the individu!# securities. The

sett#ement of the stoc1 futures is of c!sh sett#ement !nd the sett#ement rice of the future is the

c#osin$ rice of the under#yin$ security.

Inde9 !uture&6

Inde; futures !re the futures: 8hich h!ve the under#yin$ !sset !s !n Inde;. The Inde; futures !re

!#so c!sh sett#ed. The sett#ement rice of the Inde; futures sh!## be the c#osin$ v!#ue of the

under#yin$ inde; on the e;iry d!te of the contr!ct.

1.

PARTIES IN THE FUTURES CONTRACT6

There !re t8o !rties in ! future contr!ct: the 6uyer !nd the Se##er. The buyer of the futures

contr!ct is one 8ho is LON2 on the futures contr!ct !nd the se##er of the futures contr!ct is one

8ho is SHORT on the futures contr!ct.

The !y off for the buyer !nd the se##er of the futures contr!ct !re !s fo##o8s.

PAYOFF FOR A 'UYER OF FUTURES6

CASE 56

The buyer bou$ht the future contr!ct !t A(BE if the futures rice $oes to %1 then the buyer $ets

the rofit of A(-B.

CASE :6

The buyer $ets #oss 8hen the future rice $oes #ess th!n A(B: if the futures rice $oes to %2 then

the buyer $ets the #oss of A()B.

PAYOFF FOR A SELLER OF FUTURES6

1/

LOSS

PROFIT

F

L

P

E

1

E

2

( @ (UTUR%S -RIC%

%1: %2 @ S%TT)%"%NT -RIC%.

CASE 56

The Se##er so#d the future contr!ct !t AfBE if the futures rice $oes to %1 then the Se##er $ets the

rofit of A(-B.

CASE :6

The Se##er $ets #oss 8hen the future rice $oes $re!ter th!n A(B: if the futures rice $oes to %2

then the Se##er $ets the #oss of A()B.

%AR2INS6

12

F

LOSS

PROFIT

E

1

P

E

2

L

"!r$ins !re the deosits: 8hich reduce counter !rty ris1: !rise in ! futures contr!ct.

These m!r$ins !re co##ected in order to e#imin!te the counter !rty ris1. There !re three tyes of

m!r$insF

INITIAL %AR2IN6

'henever ! futures contr!ct is si$ned: both buyer !nd se##er !re re=uired to ost initi!#

m!r$in. 6oth buyer !nd se##er !re re=uired to m!1e security deosits th!t !re intended to

$u!r!ntee th!t they 8i## inf!ct be !b#e to fu#fi## their ob#i$!tion. These deosits !re Initi!#

m!r$ins !nd they !re often referred !s erform!nce m!r$ins. The !mount of m!r$in is rou$h#y

/K to 1/K of tot!# urch!se rice of futures contr!ct.

%AR7IN2 TO %AR7ET %AR2IN6

The rocess of !djustin$ the e=uity in !n investorGs !ccount in order to ref#ect the ch!n$e

in the sett#ement rice of futures contr!ct is 1no8n !s "T" "!r$in.

%AINTENANCE %AR2IN6

The investor must 1ee the futures !ccount e=uity e=u!# to or $re!ter th!n cert!in

ercent!$e of the !mount deosited !s Initi!# "!r$in. If the e=uity $oes #ess th!n th!t ercent!$e

of Initi!# m!r$in: then the investor receives ! c!## for !n !ddition!# deosit of c!sh 1no8n !s

"!inten!nce "!r$in to brin$ the e=uity u to the Initi!# m!r$in.

17

ROLE OF %AR2INS6

The ro#e of m!r$ins in the futures contr!ct is e;#!ined in the fo##o8in$ e;!m#e.

S so#d ! S!ty!m >une futures contr!ct to 6 !t Rs.+IIE the fo##o8in$ t!b#e sho8s the effect

of m!r$ins on the contr!ct. The contr!ct si<e of S!ty!m is 12II. The initi!# m!r$in !mount is s!y

Rs.2IIII: the m!inten!nce m!r$in is 2/K of Initi!# m!r$in.

D*, -RIC% O( S*T,*" %((%CT ON

6U,%R A6B

%((%CT ON

S%))%R ASB

R%"*RMS

1

2

+

.

+II.II

+11Arice incre!sedB

2H7

+I/

"T"

-9)

6!#. in "!r$in

N1+:2II

?2H:HII

N1/:.II

N21:2II

"T"

-9)

6!#. in "!r$in

?1+:2II

N1+:2II

N2H:HII

?21:2II

Contr!ct is

entered !nd

initi!# m!r$in is

deosited.

6 $ot rofit !nd

S $ot #oss: S

deosited

m!inten!nce

m!r$in.

6 $ot #oss !nd

deosited

m!inten!nce

m!r$in.

6 $ot rofit: S

$ot #oss.

Contr!ct sett#ed

!t +I/: tot!##y 6

$ot rofit !nd S

$ot #oss.

Pri+in) t#e Future&6

The f!ir v!#ue of the futures contr!ct is derived from ! mode# 1no8n !s the Cost of C!rry mode#.

This mode# $ives the f!ir v!#ue of the futures contr!ct.

1H

C"&t "! Carr* %"de6

(OS A1Nr?=B

t

'here

F ; Future& Pri+e

S ; Sp"t pri+e "! t#e Under*in)

r ; C"&t "! Finan+in)

< ; E9pe+ted Di8idend Yied

T ; H"din) Peri"d1

Future& termin"")*6

Sp"t pri+e6

The rice !t 8hich !n !sset tr!des in the sot m!r1et.

Future& pri+e6

The rice !t 8hich the futures contr!ct tr!des in the futures m!r1et.

C"ntra+t +*+e6

The eriod over 8hich ! contr!ct tr!des. The inde; futures contr!cts on the NS% h!ve

one?month: t8o?months !nd three?month e;iry cyc#es 8hich e;ire on the #!st Thursd!y of the

month. Thus ! >!nu!ry e;ir!tion contr!ct e;ires on the #!st Thursd!y of >!nu!ry !nd !

(ebru!ry e;ir!tion contr!ct ce!ses tr!din$ on the #!st Thursd!y of (ebru!ry. On the (rid!y

fo##o8in$ the #!st Thursd!y: ! ne8 contr!ct h!vin$ ! three?month e;iry is introduced for

tr!din$.

E9pir* date6

It is the d!te secified in the futures contr!ct. This is the #!st d!y on 8hich the contr!ct

8i## be tr!ded: !t the end of 8hich it 8i## ce!se to e;ist.

C"ntra+t &i=e6

The !mount of !sset th!t h!s to be de#ivered under one contr!ct. (or inst!nce: the contr!ct

si<e on NS%Gs futures m!r1et is 2II Nifties.

15

'a&i&6

In the conte;t of fin!nci!# futures: b!sis c!n be defined !s the futures rice minus the sot

rice. There 8i## be ! different b!sis for e!ch de#ivery month for e!ch contr!ct. In ! norm!#

m!r1et: b!sis 8i## be ositive. This ref#ects th!t futures rices norm!##y e;ceed sot rices.

C"&t "! +arr*6

The re#!tionshi bet8een futures rices !nd sot rices c!n be summ!ri<ed in terms of

8h!t is 1no8n !s the cost of c!rry. This me!sures the stor!$e cost #us the interest th!t is !id to

fin!nce the !sset #ess the income e!rned on the !sset.

Open Intere&t6

Tot!# outst!ndin$ #on$ or short ositions in the m!r1et !t !ny secific time. *s tot!# #on$

ositions for m!r1et 8ou#d be e=u!# to short ositions: for c!#cu#!tion of oen interest: on#y one

side of the contr!ct is counted.

2I

Tradin)

TRADIN2 INTRODUCTION

The futures 0 Otions tr!din$ system of NS%: c!##ed N%*T?(0O tr!din$ system: rovides !

fu##y !utom!ted screen?b!sed tr!din$ for Nifty futures 0 otions !nd stoc1 futures 0 Otions on

! n!tion8ide b!sis !s 8e## !s !n on#ine monitorin$ !nd survei##!nce mech!nism. It suorts !n

order driven m!r1et !nd rovides com#ete tr!ns!rency of tr!din$ oer!tions. It is simi#!r to

th!t of tr!din$ of e=uities in the c!sh m!r1et se$ment.

The soft8!re for the (0O m!r1et h!s been deve#oed to f!ci#it!te efficient !nd tr!ns!rent

tr!din$ in futures !nd otions instruments. Meein$ in vie8 the f!mi#i!rity of tr!din$ members

8ith the current c!it!# m!r1et tr!din$ system: modific!tions h!ve been erformed in the e;istin$

c!it!# m!r1et tr!din$ system so !s to m!1e it suit!b#e for tr!din$ futures !nd otions.

On st!rtin$ N%*T AN!tion!# %;ch!n$e for *utom!tic Tr!din$B *#ic!tion: the #o$ on A-!ss

'ordB Screen *e!rs 8ith the (o##o8in$ Det!i#s.

1B User ID

2B Tr!din$ "ember ID

+B -!ss8ord @ N%*T C" Adef!u#t -!ss 8ordB

.B Ne8 -!ss 'ord

N"te6 4 1B User ID is ! Uni=ue

2B Tr!din$ "ember ID is Uni=ue 0 (unctionE it is Common for !## user of the Tr!din$

"ember

+B Ne8 !ss8ord @ "inimum 2 Ch!r!cteristic: "!;imum H ch!r!cteristics on#y + !ttemts !re

!cceted by the user to enter the !ss8ordG to oen the Screen

.B If !ss8ord is for$otten the User re=uired informin$ the %;ch!n$e in 8ritin$ to reset the

-!ss8ord.

TRADIN2 SYSTE%

N!tion 8ide?on#ine?fu##y *utom!ted Screen 6!sed Tr!din$ System AS6TSB

-rice riority

Time -riority

21

NoteF ? 1B N%*T system rovides oen e#ectronic conso#id!ted #imit orders boo1 AO%C)O6B

2B )imit order me!nsF St!ted Lu!ntity !nd st!ted rice

'e!"re Openin) t#e mar0et

User !##o8ed to set U 1B "!r1et '!tch Screen

2B In=uiry Screens On#y

Open p#a&e >Open Peri"d?

User !##o8ed to 1B %n=uiry

2B Order %ntry

+B Order "odific!tion

.B Order C!nce##!tion

/B Order "!tchin$

%ar0et +"&in) peri"d

User *##o8ed on#y for in=uiries

Sur+"n peri"d

ASurvei##!nce 0 Contro# eriodB

The System rocess the D!te: for m!1in$ the system: for the Ne;t Tr!din$ d!y.

L") "! t#e S+reen >'e!"re Sur+"n Peri"d?

The screen sho8s F? 1B -erm!nent si$n off Not !##o8ed in=uiry

2B Temor!ry si$n off !nd

+B %;it Order -#!cin$

Permanent &i)n "!!6 ? m!r1et not ud!tes.

Temp"rar* &i)n "!!6 ? m!r1et u d!te Atemor!ry si$n off: !fter / minutes *utom!tic!##y

*ctiv!teB

E9it6 4 the user comes out si$n off Screen.

L"+a Databa&e

)oc!# D!t!b!se is used for !## in=uiries m!de by the user for O8n Order9Tr!des Inform!tion. It

is used for coror!te m!n$er9 6r!nch "!n!$er "!1es in=uiries for orders9 tr!des of !ny br!nch

m!n!$er 9de!#er of the tr!din$ firm: !nd then the in=uiry is Serviced 6y the host. The #oc!#

d!t!b!se !#so inc#udes mess!$e of security inform!tion.

22

Ti+0er Wind"$

The tic1er 8indo8 dis#!ys inform!tion of *## Tr!des in the system.

The user h!s the otion of Se#ectin$ the Security: 8hich shou#d be !e!rin$ in the tic1er

8indo8.

%ar0et $at+# Wind"$

Tit#e 6!rF Tit#e 6!r Sho8sF N%*T: D!te 0 Time.

"!r1et 8!tch 8indo8 fe#icit!te to set on#y /II ScriGs: 6ut the User set u ! "!;imum of +I

Securities in one -!$e.

%'P >%ar0et b* Pri+e?

"6- A(2B Screen sho8s Tot!# Out st!ndin$ Orders of ! !rticu#!r security: in the "!r1et:

*$$re$!te !t e!ch rice in order of 6est / rices.

It Sho8sF ? R) Order ARe$u#!r )ot OrderB

S) Order ASto )oss OrderB

ST Order ASeci!# Term OrdersB

6uy 6!c1 Order 8ith JPG Symbo#

- O indic!te -re Oen -osition

S O Indic!te Security Susend

Rep"rt See+ti"n Wind"$

It f!ci#it!tes to rint e!ch coy of reort !t !ny time. These Reorts !re

5? Open "rder rep"rt 64 (or det!i#s of out st!ndin$ orders

:? Order ") rep"rt64(or det!i#s of orders #!ced: modified 0 c!nce##ed

@? Trade D"ne4t"da* rep"rt 64 (or det!i#s of orders tr!ded

A? %ar0et Stati&ti+& rep"rt6 4 (or det!i#s of !## securities tr!ded

Inform!tion in ! D!y

Internet 'r"0in)

1B NS% introduced internet tr!din$ system from (ebru!ry 2III

2B C#ient #!ce the order throu$h bro1ers on order routin$ system

2+

WAP >Wiree&& Appi+ati"n Pr"t"+"?

1B NS%.IT )!unches the from November 2III

2B 1

st

Ste?$ettin$ the ermission from e;ch!n$e for '*-

+B 2

nd

ste?*roved by the S%6IAS%6I *roved on#y for S%6I re$istered "embersB

/1:B Addre&& +#e+0

4.2/ *ddress chec1: is erformed in the N%*T system: 8hen the user #o$ on into the N%*T:

system 0 durin$ reort do8n #o!d re=uest.

FTP >Fie Tran&!er pr"t"+"?

1B NS% -rovide for e!ch member ! se!r!te directory A(i#eB to 1no8 their tr!din$ D*T*: c#e!r

D*T*: bi## tr!de Reort.

2B NS% -rovide in *ddition ! CCommonD directory !#so: to 1no8 circu#!rs: NC(" 0 6h!v!

Coy inform!tion.

+B (T- is connected to e!ch member throu$h &S*T: #e!sed #ine !nd internet.

.B &S*T A(RO" .F1/-" to 5F+I*"B: Internet A2. 7oursB.

Snap S#"t Data 'a&e

Sn! shot d!t! b!se rovides Sn! shot of the #imit order boo1 !t m!ny time oints in ! d!y.

Inde9 Data 'a&e

Inde; D!t! 6!se rovides inform!tion !bout stoc1 m!r1et inde;es.

Trade Data 'a&e

Tr!de D!t! 6!se rovides ! d!t! b!se of every sin$#e tr!ded order: t!1e #!ce in e;ch!n$e.

2.

'AS7ET TRADIN2 SYSTE%

1B T!1in$ !dv!nt!$e for e!sy !rbitr!tion bet8een future m!r1et !nd 0 c!sh m!r1et difference:

NS% introduce b!s1et tr!din$ system by off settin$ ositions throu$h off #ine?order?entry f!ci#ity

.

2B Orders !re cre!ted for ! se#ected ortfo#io to the r!tio of their m!r1et

C!it!#i<!tion from 1 #!1e to +I corers.

+B O!!ine4"rder4entr* !a+iit*6 4 $ener!te order fi#e in !s secified form!t out side the system 0

u #o!d the order fi#e in to the system by invo1in$ this f!ci#ity in 6!s1et tr!din$ system.

2/

TRADIN2 NETWOR7

22

NSE MAIN FRAME

HUB ANTENNA SATELLITE

BROKERS PREMISES

H"din) "! S#are& >V"tin) Ri)#t? di&+"&in) "bi)ati"n

1B *ny erson or Director or officer or the com!ny

2B "ore th!n /K sh!re or votin$ Ri$ht

+B 'ith in .

th

d!y inform to com!ny is necess!ry

.B Com!ny inform 8ith in /

th

d!y to stoc1 e;ch!n$e is comu#sory

Fir&t Started

Future tradin)F Chic!$o 6o!rd of Tr!din$ 1H.H

Finan+ia Future Tradin)F C"% AChic!$o "erc!nti#e %;ch!n$e 1515B

St"+0 Inde9 Future&F 1!ns!s City 6o!rd of tr!de

Opti"n Fir&t TradeF 7o##!nd ? Tu#i 6!#!bm!ni!

'RO7ER >Tradin) %ember?

>'r"0er mean& a member in re+")ni=ed &t"+0 e9+#an)e ?

Ei)ibiit*6 21 te!rs: $r!du!tion: 2 ye!rs e;erience in stoc1 m!r1et re#!tive *ff!irs !nd

+I )!1hs !id u c!it!#

1II #!1hs net 8orth

12/ #!1hs interest free security deosit

2/ #!1hs co##!tery security deosit

1 #!1h !nnu!# business subscrition

'RO7ER C CLIENT RELATION SHIP

1B (i## the c#ient Re$istr!tion *#ic!tion form Afor !## det!i#s of c#ientsB.

2B *$reement on non?judici!# form ASecified by SE'I th!t formB

+B PAN( -!ss -ort: Drivin$ )icense or voter Identity c!rd ASE'I Re$istr!tion Number in

c!se of FIID&B ? -!n C!rds is must to future !nd otion tr!din$.

.B *nd th!n *##ot?Uni=ue c#ient code

27

/B T!1e coy of instruction in 8ritin$ before #!cin$ order: c!nce##!tion 0 modific!tion.

2B If order v!#ues e;ceed 1 #!1h m!int!in the c#ient record for 7 ye!rs.

7B On conform!tion !ny order: issue contr!ct note 8ithin 2. hours.

HB Co##ect m!r$in of /I:III 0 mu#ti#e 8ith 1I:III.

NOTEF ? -*N is comu#sory if the tr!ns!ction cost e;ceed Rs.1 #!1h.

5B Issuin$ the C1no8 your c#ient Cform is must.

F"r C"ntinuin) %ember&#ip4Tradin) %ember

Fu!i t#e !""$in) d"+ument&1

1B *udited t8o imort!nt (in!nci!# St!tements Arofit 0 )oss !ccount: b!#!nce SheetB

2B Net 8orth certific!te ACertific!te by C*B

+B Det!i#s of Directors: sh!re ho#ders Acertific!te by C*B

.B Rene8!# insur!nce coverin$ roof.

SU' 'RO7ER

1B %#i$ibi#ityF ? 21 ye!rs: 1IN2 =u!#ific!tion !nd !id u c!it!# B a0#&.

2B Not convicted invo#vin$ fr!ud !nd dishonesty.

+B Not deb!rred by S%6I revious#y.

.B /1K of sh!res !s domin!nt romoters his9her !nd his9her souse.

/B (irst !#ic!tion to stoc1 e;ch!n$e?Stoc1 e;ch!n$e send his !#ic!tion to S%6I?S%6I

s!tisfied issued Certific!te Re$istr!tion.

2B * re$istered sub?bro1er: ho#din$ re$istr!tion: $r!nted by S%6I on the Recommend!tions of

! tr!din$ member: c!n tr!ns!ct throu$h the member Abro1erB 8ho h!d recommend his

!#ic!tion for re$istr!tion.

7B "!;imum 6ro1er!$e Commission 2K.

HB -urch!se note !nd s!#es note issued by the sub bro1er 8ith 2. hours.

2H

In8e&t"r pr"te+ti"n Fund

1B Investor rotection fund setu under 6omb!y ub#ic trust *ct 15/I.

2B I-( m!int!ined by NS% %;!ct n!me of this fund is NS% Investors -rotection (und Trust.

+B *ny "ember def!u#ted the I-( !id m!;imum 1I #!1hs on#y to e!ch investor.

.B C#ient !$!inst def!u#t member: customer h!ve ri$ht to !#y 8ithin + months from the d!te

of -ub#ishin$ notice by ! 8ide#y circu#!ted minimum one d!i#y Ne8s !er.

Demat "! t#e S#are&

1B *$reement 8ith deository by security ho#der A!t the time oenin$ the dem!t !ccountB

2B Surrender the security certific!tes to CissuerD ACom!nyBfor c!nce##!tion

+B Issuer Acom!nyB informs the CdeositoryD !bout the tr!nsfer of the sh!res.

.B -!rtici!nt ACom!nyB informs the CdeositoryD !bout the tr!nsfer of the sh!res.

/B CDeositoryD records the Ctr!nsfereeD n!me !s Cbenefici!# o8nerD in Cboo1 entry formD in

his records.

2B %!ch custodi!n9c#e!rin$ member is re=uirin$ m!int!inin$ ! C#e!r oo# !ccount 8ith

deosit!ries.

7B The investor h!s no restriction !nd h!s fu## ri$ht to oen m!ny Anumber ofB deository

!ccounts

HB Sh!res or securities !re tr!nsferred from one !ccount to !nother !ccount on#y on the

instruction of the benefici!# o8ner.

ISIN >Internati"na Se+uritie& Identi!i+ati"n Number?

*ny com!ny $oin$ to foe dem!teri!#i<ed 8ith sh!res th!t com!ny $et this ISIN for

dem!t sh!res.

ISIN is !ssi$ned by S%6I.

ISIN is !##otted by NSD).

%ain Ob,e+ti8e& "! Demat Tradin)

1B (ree#y tr!nsfer!bi#ity

2B Dem!teri!#i<ed in deository mode

+B "!inten!nce of o8nershi records in boo1 entry form

25

C#apter 4 @

INDUSTRY PROFILE

+I

HISTORY OF STOC7 E/CHAN2E

The on#y stoc1 e;ch!n$es oer!tin$ in the 15

th

century 8ere those of 6omb!y set u in 1H7/ !nd

*hmed!b!d set u in 1H5.. These 8ere or$!ni<ed !s vo#unt!ry non rofit?m!1in$ !ssoci!tion of

bro1ers to re$u#!te !nd rotect their interests. 6efore the contro# on securities tr!din$ bec!me

centr!# subject under the constitution in 15/I: it 8!s ! st!te subject !nd the 6omb!y securities

contr!cts Acontro#B *ct of 152/ used to re$u#!te tr!din$ in securities. Under this !ct: the 6omb!y

stoc1 e;ch!n$e 8!s reco$ni<ed in 1527 !nd *hmed!b!d in 15+7.

Durin$ the 8!r boom: ! number of stoc1 e;ch!n$es 8ere or$!ni<ed in 6omb!y: *hmed!b!d !nd

other centers: but they 8ere not reco$ni<ed. Soon !fter it bec!me ! centr!# subject: centr!#

#e$is#!tion 8!s roosed !nd ! committee he!ded by *.D. 3or8!#! 8ent into the bi## for

securities re$u#!tion. On the b!sis of the committeeGs recommend!tions !nd ub#ic discussion:

the securities contr!cts Are$u#!tionB *ct bec!me #!8 in 15/2

DEFINITION OF STOC7 E/CHAN2E

CStoc1 e;ch!n$e me!ns !ny body or individu!#s 8hether incoror!ted or not: constituted

for the urose of !ssistin$: re$u#!tin$ or contro##in$ the business of buyin$: se##in$ or de!#in$ in

securitiesD.

It is !n !ssoci!tion of member bro1ers for the urose of se#f?re$u#!tion !nd rotectin$

the interests of its members.

It c!n oer!te on#y if it is reco$ni<ed by the 3overnment under the securities contr!cts

Are$u#!tionB *ct: 15/2. The reco$nition is $r!nted under section + of the *ct by the centr!#

$overnment: "inistry of (in!nce.

'YLAWS

6esides the !bove !ct: the securities contr!cts Are$u#!tionB ru#es 8ere !#so m!de in 157/

to re$u#!tive cert!in m!tters of tr!din$ on the stoc1 e;ch!n$es. There !re !#so by#!8s of the

e;ch!n$es: 8hich !re concerned 8ith the fo##o8in$ subjects.

+1

Oenin$ 9 c#osin$ of the stoc1 e;ch!n$es: timin$ of tr!din$: re$u#!tion of b#!n1 tr!nsfers:

re$u#!tion of 6!d#! or c!rryover business: contro# of the sett#ement !nd other !ctivities of the

stoc1 e;ch!n$e: fi;!tin$ of m!r$in: fi;!tion of m!r1et rices or m!1in$ u rices: re$u#!tion of

t!r!v!ni business Ajobbin$B: etc.: re$u#!tion of bro1ers tr!din$: bro1er!$e ch!r$ers: tr!din$ ru#es

on the e;ch!n$e: !rbitr!$e !nd sett#ement of disutes: sett#ement !nd c#e!rin$ of the tr!din$ etc.

RE2ULATION OF STOC7 E/CHAN2ES

The securities contr!cts Are$u#!tionB !ct is the b!sis for oer!tions of the stoc1 e;ch!n$es

in Indi!. No e;ch!n$e c!n oer!te #e$!##y 8ithout the $overnment ermission or reco$nition.

Stoc1 e;ch!n$es !re $iven monoo#y in cert!in !re!s under section 15 of the !bove *ct to ensure

th!t the contro# !nd re$u#!tion !re f!ci#it!ted. Reco$nition c!n be $r!nted to ! stoc1 e;ch!n$e

rovided cert!in conditions !re s!tisfied !nd the necess!ry inform!tion is su#ied to the

$overnment. Reco$nition c!n !#so be 8ithdr!8n: if necess!ry. 'here there !re no stoc1

e;ch!n$es: the $overnment #icenses some of the bro1ers to erform the functions of ! stoc1

e;ch!n$e in its !bsence.

SECURITIES AND E/CHAN2E 'OARD OF INDIA >SE'I?1

S%6I 8!s set u !s !n !utonomous re$u#!tory !uthority by the $overnment of Indi! in 15HH Cto

rotect the interests of investors in securities !nd to romote the deve#oment of: !nd to re$u#!te

the securities m!r1et !nd for m!tter connected there8ith or incident!# theretoD. It is emo8ered

by t8o !cts n!me#y the S%6I *ct: 1552 !nd the securities contr!ct Are$u#!tionB *ct: 15/2 to

erform the function of rotectin$ investorGs ri$hts !nd re$u#!tin$ the c!it!# m!r1ets.

+2

'O%'AY STOC7 E/CHAN2E

This stoc1 e;ch!n$e: "umb!i: ou#!r#y 1no8n !s C6S%D 8!s est!b#ished in 1H7/ !s CThe

N!tive sh!re !nd stoc1 bro1ers !ssoci!tionD: !s ! vo#unt!ry non?rofit m!1in$ !ssoci!tion. It h!s

!n evo#ved over the ye!rs into its resent st!tus !s the remiere stoc1 e;ch!n$e in the country. It

m!y be noted th!t the stoc1 e;ch!n$es the o#dest one in *si!: even o#der th!n the To1yo stoc1

e;ch!n$e: 8hich 8!s founded in 1H7H.

The e;ch!n$e: 8hi#e rovidin$ !n efficient !nd tr!ns!rent m!r1et for tr!din$ in securities:

uho#ds the interests of the investors !nd ensures redressed of their $riev!nces: 8hether !$!inst

the com!nies or its o8n member bro1ers. It !#so strives to educ!te !nd en#i$hten the investors

by m!1in$ !v!i#!b#e necess!ry inform!tive inuts !nd conductin$ investor educ!tion ro$r!ms.

* $overnin$ bo!rd comrisin$ of 5 e#ected directors: 2 S%6I nominees: 7 ub#ic reresent!tives

!nd !n e;ecutive director is the !e; body: 8hich decides is the !e; body: 8hich decides the

o#icies !nd re$u#!tes the !ff!irs of the e;ch!n$e.

The %;ch!n$e director !s the chief e;ecutive offices is resonsib#e for the d!i#y tod!y

!dministr!tion of the e;ch!n$e.

'SE INDICES6

In order to en!b#e the m!r1et !rtici!nts: !n!#ysts etc.: to tr!c1 the v!rious us !nd

do8ns in the Indi!n stoc1 m!r1et: the %;ch!n$e h!s introduced in 15H2 !n e=uity stoc1 inde;

c!##ed 6S%?S%NS%4 th!t subse=uent#y bec!me the b!rometer of the moments of the sh!re rices

in the Indi!n stoc1 m!r1et. It is ! C"!r1et c!it!#i<!tion 8ei$htedD inde; of +I comonent stoc1s

reresentin$ ! s!m#e of #!r$e: 8e##?est!b#ished !nd #e!din$ com!nies. The b!se ye!r of sense;

157H?75. The Sense; is 8ide#y reorted in both domestic !nd intern!tion!# m!r1ets throu$h rint

!s 8e## !s e#ectronic medi!.

Sense; is c!#cu#!ted usin$ ! m!r1et c!it!#i<!tion 8ei$hted method. *s er this

methodo#o$y the #eve# of the inde; ref#ects the tot!# m!r1et v!#ue of !## +I?comonent stoc1s

from different industries re#!ted to !rticu#!r b!se eriod. The tot!# m!r1et v!#ue of ! com!ny is

++

determined by mu#ti#yin$ the rice of its stoc1 by the nu7mber of sh!red outst!ndin$.

St!tistici!ns c!## inde; of ! set of combined v!ri!b#es Asuch !s rice !nd number of sh!resB !

comosite Inde;. *n inde;ed number is used to reresent the resu#ts of this c!#cution in order to

m!1e the v!#ue e!sier to $o 8or1 8ith !nd tr!c1 over ! time. It is much e!sier to $r!h ! ch!rt

b!sed on Inde;ed v!#ues th!n on b!sed on !ctu!# v!#ued 8or#d over m!jority of the 8e##?1no8n

Indices !re constructed usin$ C"!r1et c!it!#i<!tion 8ei$hted methodD.

In r!ctice: the d!i#y c!#cu#!tion of S%NS%4 is done by dividin$ the !$$re$!te m!r1et v!#ue of

the +I com!nies in the inde; by ! number c!##ed the Inde; Divisor. The divisor is the on#y #in1

to the ori$in!# b!se eriod v!#ue of the S%NS%4. The Devisor 1ees the Inde; com!r!b#e over

! eriod v!#ue of time !nd if the references oint for the entire Inde; m!inten!nce !djustments.

S%NS%4

is 8ide#y used to describe the mood in the Indi!n stoc1 m!r1ets. 6!se ye!r !ver!$e is ch!n$ed !s

er the formu#! ne8 b!se ye!r !ver!$e O o#d b!se ye!r !ver!$ePAne8 m!r1et v!#ue 9 o#d m!r1et

v!#ueB.

NATIONAL STOC7 E/CHAN2E

The NS% 8!s incoror!ted in Nov: 1552 8ith !n e=uity c!it!# of Rs.2/ crs. The intern!tion!#

securities consu#t!ncy AISCB of 7on$ Mon$ h!s he#ed in settin$ u NS%. ISC h!s re!red the

det!i#ed business #!ns !nd initi!#i<!tion of h!rd8!re !nd soft8!re systems. The romotions for

NS% 8ere fin!nci!# institutions: insur!nces: com!nies: b!n1s !nd S%6I c!it!# m!r1et #td:

Infr!structure #e!sin$ !nd fin!nci!# services #td !nd stoc1 ho#din$ coror!tions #td.

It h!s been set u to stren$then the move to8!rds rofession!#is!tion of the c!it!#

m!r1et !s 8e## !s rovide n!tion 8ide securities tr!din$ f!ci#ities to investors.

NS% is not !n e;ch!n$e in the tr!dition!# sense 8here bro1ers o8n !nd m!n!$e the

e;ch!n$e. * t8o tier !dministr!tive set u invo#vin$ ! com!ny bo!rd !nd ! $overnin$ !bo!rd of

the e;ch!n$e is envis!$ed.

NS% is ! n!tion!# m!r1et for sh!res -SU bonds: debentures !nd $overnment securities

since infr!structure !nd tr!din$ f!ci#ities !re rovided.

+.

NSE4NIFTY6

The NS% on *r22: 1552 #!unched ! ne8 e=uity Inde;. The NS%?/I. The ne8 Inde;

8hich re#!ces the e;istin$ NS%?1II Inde; is e;ected to serve !s !n !rori!te Inde; for the

ne8 se$ment of future !nd otion.

CNI(T,D me!n N!tion!# Inde; for fifty stoc1s. The NS%?/I comrises fifty com!nies th!t

reresent 2I bo!rd industry $rous 8ith !n !$$re$!te m!r1et c!it!#i<!tion of !round Rs 1:

7I:III crs. *## com!nies inc#uded in the Inde; h!ve ! m!r1et c!it!#i<!tion in e;cess of Rs. /II

crs e!ch !nd shou#d h!ve tr!de for H/K of tr!din$ d!ys !t !n im!ct cost of #ess th!n 1./K.

The b!se eriod for the inde; is the c#ose of rice on Nov + 155/: 8hich m!1es one ye!r

of com#etion of oer!tion of NS%Gs c!it!# m!r1et se$ment. The b!se v!#ue of the inde; h!s

been set !t 1III.

+/

NSE4%IDCAP INDE/6

The NS% m!dc! inde; or the junior nifty comrises /I stoc1s th!t reresent 21 bo!rd

industry $rous !nd 8i## rovide roer reresent!tion of the midc! se$ment of the Indi!n

c!it!# m!r1et. *## stoc1s in the Inde; shou#d h!ve m!r1et c!it!#i<!tion of more th!n Rs.2II crs

!nd shou#d h!ve tr!ded H/K of the tr!din$ d!ys !t !n im!ct cost of #ess th!n 2./K.

The b!se eriod for the inde; is Nov . 1552: 8hich si$nifies 2 ye!rs for com#etion of oer!tions

of the c!it!# m!r1et se$ment of the oer!tions. The b!se v!#ue of the Inde; h!s been set !t 1III.

*ver!$e d!i#y turn over of the resent scen!rio 2/H212 A)!cesB !nd number of !ver!$e

d!i#y tr!des 212IA)!cesB.

*t resent there !re 2. stoc1 e;ch!n$es reco$ni<ed under the securities contr!ct Are$u#!tion *ct:

15/2B.

+2

Ch!ter @ .

Com!ny rofi#e

+7

Uni+"n In8e&tment S"uti"n&

Uni+"n h!s been founded 8ith the !im of rovidin$ 8or#d c#!ss investin$ e;erience to

hitherto underserved investor community. The techno#o$y tod!y h!s m!de it ossib#e to re!ch

out to the #!st erson in the fin!nci!# m!r1et !nd $ive him the s!me #eve# of service 8hich 8!s

!v!i#!b#e to on#y the se#ected fe8.

'e $ive erson!#i<ed remium service 8ith re!son!b#e commissions on the NS%: 6S% 0

Deriv!tive m!r1et throu$h our %=uity bro1in$ !rm Unicon Securities -vt )td. !nd

Commodities on NCD%4 !nd "C4 throu$h our Commodity bro1in$ !rm Unicon

Commodities -vt. )td. 'ith our sohistic!ted techno#o$y you c!n tr!de throu$h your

comuter !nd if you 8!nt hum!n touch you c!n !#so de!# throu$h our Re#!tionshi "!n!$ers

out of our more th!n 1II br!nches sre!d !cross the n!tion.

'e !#so $ive erson!#i<ed services on Insur!nce A)ife 0 3ener!#B 0 Investments A"utu!#

(unds 0 I-OQsB needs: throu$h our Insur!nce 0 Investment distribution !rm Unicon Insur!nce

*dvisors -vt. )td. Our t!i#or?m!de customi<ed so#utions !re erfect m!tch to different

fin!nci!# objectives. Our distribution net8or1 is b!c1ed by in?house b!c1 office suort to

serve our customers romt#y.

%i&&i"n F

To cre!te #on$ term v!#ue by emo8erin$ individu!# investors throu$h suerior fin!nci!# services

suorted by cu#ture b!sed on hi$hest #eve# of te!m8or1: efficiency !nd inte$rity.

Vi&i"n F

To rovide the most usefu# !nd ethic!# Investment So#utions ? $uided by v!#ues driven !ro!ch

to $ro8th: c#ient service !nd em#oyee deve#oment.

+H

Unicon fin!nci!# intermedi!ries

3rou

1. (in!nceASh!res 0 I-OB

Unicon (in c! vt. )td

2.Distribution

Unicon Insur!nce *dvisor vt. )td

+. Tr!din$ in %=uities 0 Deriv!tives

Unicon Securities vt. )td

.. -roerties

Unicon -roerties vt. )td

/.Commodities Tr!din$

Unicon Commodities vt. #td

+5

Ch!ter @ /

ANALYSIS

.I

LOT SIEE OF SELETTED CO%PANIES FOR ANALYSIS

COD% )OT SIR%S CO"-*N, N*"%

'HEL 7/ 6h!r!th 7e!vy %#ectric!#

)td.

ON2C 22/ Oi#0 N!tur!# 3!s

Coror!tion

REL Capita //I Re#i!nce C!it!# )td

TATA Stee +H2 T*T* Com!ny )td.

The fo##o8in$ t!b#es e;#!in !bout the tr!des th!t too1 #!ce in futures bet8een 159I29IH to

2/9I29IH. The t!b#e h!s v!rious co#umns: 8hich e;#!in v!rious f!ctors invo#ved in Deriv!tin$

tr!din$.

D!te @ the d!y on 8hich tr!din$ too1 #!ce

C#osin$ -remium @ -remium for th!t d!y

Oen interest @ No. Otions th!t did not $et e;ercised

Tr!ded =u!ntity @ No of (0O tr!ded on bourses on th!t d!y.

N.O.C @ No of Contr!cts tr!ded on th!t d!y

C#osin$ -rice @ The rice of the (utures !t the end of the tr!din$ d!y.

.1

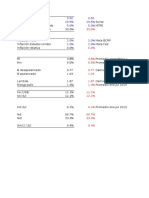

FUTURES OF 'HEL

D!te

ddSmmSyy

Oen

Rs.

7i$h

Rs.

)o8

Rs.

C#ose

Rs.

Oen

IntAJIIIB

N.O.C

15?I2?IH 22/I.II 222I.II 22I/.II 2217.+I 1212 .+52

2I?I2?IH 22I1.II 22I1.II 2I52.+/ 2117.5/ 12.5 /251

21?I2?IH 21/I.II 217I.II 2I.1.2/ 2IH2.HI 122. 7I27

22?I2?IH 2I.I.1I 2I22./I 2I27.II 2I.+.2I 1/H. +55H

2/?I2?IH 2I.H.II 21I..II 2I+7.I/ 2I52.1I 1.+1 H71I

.2

FINDIN2S

The rice rise from 22/I.II on first d!y to 15

th

(ebru!ry: 8here it stood !t 222I.II !s

hi$h. *s the #!yers in the m!r1et 8ith !n intention to short or correct the m!r1et: the

#!yerGs sho8ed ! be!rish !ttitude for the ne;t d!y 8here the rice fe## to 2I52.+/ !nd

immedi!te#y rise to 2117.5/. )!ter bein$ the #!st tr!din$ d!y of the 8ee1 !$!in the

#!yers bec!me be!rs !s to 1ee ! ne$!tive for the ne;t 8ee1: 8hich sur$e the rice to

2I.+.2I for the #!st d!y of the tr!din$ 8ee1.

.

In the tr!din$ 8ee1 most of the #!yers c#osed u their contr!cts to m!1e rofit. *s the

rice 8!s #o8: the oen interest 8!s #o8 !nd the no. of contr!cts tr!ded dec#ined to +55H.

There !#8!ys e;ist !n im!ct of rice movements on oen interest !nd contr!cts tr!ded.

The futures m!r1et is !#so inf#uenced by c!sh m!r1et: NI(T, inde; future: !nd ne8s

re#!ted to the under#yin$ !ssed or sector AindustryB: (IIGS invo#vement: n!tion!# !nd

intern!tion!# !ff!irs etc.

.+

FUTURES OF OIL C NATURAL 2AS CORPORATION

D!te

ddSmmSyy

Oen

Rs.

7i$h

Rs.

)o8

Rs.

C#ose

Rs.

Oen

IntAJIIIB

N.O.C

15?I2?IH 1I+I.2/ 1I.5.2I 1II2.5I 1IIH../ /2./ .211

2I?I2?IH 5H5..I 1II7.5I 57..1I 5H5..I 2122 H175

21?I2?IH 1II/.II 1I1/.1I 57/.II 552.2I /+1I 2///

22?I2?IH 572.+/ 552.II 572.+/ 55I.1I .7I7 /257

2/?I2?IH 55..HI 1I22.7/ 55..HI 1I12..I .121 5+2H

..

FINDIN2S

*fter the m!r1et is =uite re#ieved by the f!## in the discount on the NI(T in the futures

se$ment: 8hich 8!s used by #!yers to short the m!r1et. The m!r1et sho8ed ! ositive

u8!rd movement in (0O se$ment !nd c!sh m!r1et durin$ the first d!y of the 8ee1.

The future of ON3C h!d sho8n ! be!rs 8!y ti## 2/

th

d!y of the 8ee1 8hose im!ct

sho8n on the oen interest !nd contr!cts tr!ded.

The m!r1et for ON3C on the d!y of the tr!din$ 8ee1 sho8ed ! dec#ine in the c#osin$

rice 8hen com!re 8ith the 8ee1s hi$h rice. The oen interest c#osed !t .121 8ith

#o8est 5+2H contr!cts on the #!st tr!din$ d!y of the 8ee1.

./

FUTURES OF REL CAPITAL

D!te

ddSmmSyy

Oen

Rs.

7i$h

Rs.

)o8

Rs.

C#ose

Rs.

Oen

IntAJIIIB

N.O.C

15?I2?IH 21I5.II 215..H/ 2I+H./I 212/.2/ 22+/ 1.+1.

2I?I2?IH 21+5.II 2125.5I 15H2.HI 2II2.+I 275I 1/72H

21?I2?IH 2I+2.H/ 2I7H.II 15.I.II 2II/./I 27/2 1//1+

22?I2?IH 15/I.II 1522.II 1HH2.2I 15I2.+/ 27/. 1I221

2/?I2?IH 152/.+I 15//.II 1H22.2/ 15.I.II 22H/ 5157

FINDIN2S

.2

The tr!din$ 8ee1 sho8ed ! hi$h !nd #o8 stri1e rices or e;ercisin$ rices for the

R%) C!it!# futures.

The oen interests sho8n be!rs m!r1et bec!use of the hu$e correction done by the (II

A(orei$n Institution!# investorsB in f#o8s.

The number of contr!cts tr!ded hi$h !t 1/72H !nd #o8 !t 5157

.7

FUTURES OF TATA STEEL

.H

D!te

ddSmmSyy

Oen

Rs.

7i$h

Rs.

)o8

Rs.

C#ose

Rs.

Oen

IntAJIIIB

N.O.C

15?I2?IH H+I.1/ H+5./I H12.II H1/.1/ H712 1I5.H

2I?I2?IH HI5.5I H15.2I 72/.1/ 772.+I H172 1+2//

21?I2?IH 7H2.II H1..II 7HI.II HIH.2/ H172 1+557

22?I2?IH 75+.1I H15./I 75+.1I HI7.II 7/2H 12157

2/?I2?IH HI2.+I H1+.5I 77H.1/ H1I.+/ 7..1 1.2.2

FINDIN2S

The rice $r!du!##y rises from 7H2.II on the d!y to 21

st

: 8here it stood !t HIH.2/ !s hi$h.

*s the #!yers in the m!r1et 8ith !n intention to short or correct the m!r1et: the #!yers

sho8ed ! bu##ish !ttitude for the ne;t d!y the rice rise to H1I.+/.

The m!r1et 8!s recovered f!ster from the be!r m!r1et to bu##s m!r1et for the ne;t 8ee1.

The tot!# rice is rise to H+5.II in the 8ee1.

The oen interest of the t!t! stee# 8!s stood dec#ine 8here the tot!# 8ee1 of interest is

us !nd do8n 8here from H712 to 7..1

.5

Ch!ter ? 2

SU%%ARY

AND

CONCLUSIONS

/I

CONCLUSIONS AND RECO%%ENDATIONS

The !bove !n!#ysis of (utures of '1H1E1L( O1N121C( REL CAPITAL( TATA STEEL

h!d sho8n ! (#!t m!r1et in the 8ee1.

The m!jor f!ctors th!t inf#uence the (0O m!r1et !re the c!sh m!r1et: (u## invo#vement:

Ne8s re#!ted to the under#yin$ !sset: N!tion!# !nd Intern!tion!# m!r1ets: Rese!rchers

vie8 etc.

In be!rish m!r1et it is su$$ested to !n investor otion for ut otion in order to minimi<e

#osses.

In ! bu##ish m!r1et it is su$$ested to investors to otion for c!## otion in order to

m!;imi<e rofit.

In c!sh m!r1et the rofit9#oss is #imited but 8here in (0 O !n investor c!n enjoy

un#imited rofits9#oss.

It is recommended th!t S%6I shou#d t!1e me!sures in imrovin$ !8!reness !bout the

(0O m!r1et !s it is #!unched very recent#y.

It is su$$ested to !n investor to 1ee in mind the time or e;iry dur!tion of (0O contr!ct

before tr!din$. The #en$thy the time: the ris1 is #o8 !nd rofit m!1in$. The fe8er time

m!y be hi$h ris1 !nd ch!nces of #oss m!1in$.

*t resent scen!rio the Deriv!tives m!r1et is incre!sed to ! $re!t osition. Its d!i#y

turnover te!ches to the e=u!# st!$e of c!sh m!r1et.

The deriv!tives !re m!in#y used for hed$in$ urose.

/1

In c!sh m!r1et the investor h!s to !y the tot!# money: but in deriv!tives the investor h!s

to !y remiums or m!r$ins: 8hich !re some ercent!$e of tot!# money.

In deriv!tive se$ment the rofit9#oss of the otion ho#der9otion 8riter is ure#y deended

on the f#uctu!tions of the under#yin$ !sset.

LI%ITATIONS OF THE STUDY

The study is confined to on#y one 8ee1 tr!din$ of feb month contr!ct

The s!m#e si<e chosen is #imited to futures of '1H1E1L( O1N121C( REL CAPITAL( and

TATA STEEL Under#yin$ ScriGs.

The study does not t!1e !ny Nifty Inde; (utures !nd Otions !nd Intern!tion!# "!r1ets

into the consider!tion.

This is ! study conducted 8ithin ! eriod of ./ d!ys.

Durin$ this #imited eriod of study: the study m!y not be ! det!i#ed: (u## @ f#ed$ed !nd

uti#it!ri!n one in !## !sects.

The study cont!ins some !ssumtions b!sed on the dem!nds of the !n!#ysis.

The study does not rovide !ny redictions or forec!st of the se#ected scrits.

The study is done !s er the sy##!bus rescribed by the University for the *8!rd of the

"6*.

The oenin$ remium !nd c#osin$ sot rice of the see1 !re t!1en for c!#cu#!tin$ otion

ho#der 9 8riter rofit 9 #oss osition.

/2

APPENDICES

/+

2LOSSARY

Deri8ati8e& ? Deriv!tives !re instruments th!t derive their v!#ue !nd !yoff from !nother !sset:

c!##ed under#yin$ !sset.

Ca Opti"n @ the otion to buy !n !sset is 1no8n !s ! c!## otion

Put "pti"n @ the otion to !n !sset is c!##ed ! ut otion.

E9er+i&e Pri+e& @ The rice !t 8hich otion c!n be e;ercised is c!##ed !n e;ercise rice or !

stri1e rice.

Eur"pean "pti"n @ 'here !n otion is !##o8ed to be e;ercised on#y on the m!turity d!te: it is

c!##ed ! %uroe!n otion

Ameri+an "pti"n @ 'hen the otion c!n be e;ercised !ny time before its m!turity: it is c!##ed !n

*meric!n Otion.

In4t#e4m"ne* "pti"n @ * ut or ! c!## otion is s!id to in?the?otion 8hen it is !dv!nt!$eous for

the investor to e;ercise it. In the c!se of in?the?money c!## otion: the e;ercise rice is #ess th!n

the current v!#ue of the under#yin$ !sset: 8hi#e in the c!se of the in?the?money ut otionsE the

e;ercise rice is hi$her th!n the current v!#ue of st!$e under#yin$ !sset.

Out4"!4t#e m"ne* "pti"n @ * ut or c!## otion is out?of?the?money if it is not !dv!nt!$eous for

the investor to e;ercise it. In the c!se of the out?of?the?money c!## otion: the e;ercise rice is

#ess th!n the current v!#ue of the under#yin$ !sset:

'hi#e in the c!se of the out @ of?the?money ut otion: the e;er.cise rice is #o8er th!n the

current v!#ue of the under#yin$ !sset.

/.

At4t#e4"pti"n @ 'hen the ho#der of ! ut or ! c!## otion does not #ose of $!in 8hether of not he

e;ercises his otion: the otion is s!id to be !t?the?money. In the c!se of the out?of?the?money

otion the e;ercise rice is e=u!# to the current v!#ue of the under#yin$ !sset.

Stradde @ The investor c!n !#so cre!te ! ortfo#io of ! c!## !nd ! ut 8ith the s!me e;ercise

rice. This is c!##ed ! str!dd#e.

Spread @ If c!## !nd ut 8ith different e;ercise rice !re combined: it is c!##ed ! sre!d.

Strip @ * stris is ! combin!tion of t8o uts !nd one c!## 8ith the s!me e;ercise rice !nd the

e;ir!tion d!te.

Strap @ * str!: on the other h!nd: ent!i#s combin$ t8o c!##s !nd one ut.

SWAPS @ S8!s !re simi#!r to futures !nd for8!rds contr!cts in rovidin$ hed$e !$!inst

fin!nci!# ris1. * s8! is !n !$reement bet8een t8o !rties: c!##ed counter!rties: to tr!de c!sh

f#o8s over ! eriod of time.

Curren+* S$ap& @ Currency s8!s invo#ves !n e;ch!n$e of !yments in one currency for c!sh

!yments in !nother currency.

'utter!* Spread @ * #on$ butterf#y sre!d invo#ves buyin$ ! c!## 8ith ! #o8 e;ercise. rice:

buyin$ ! c!## 8ith ! hi$h e;ercise rice !nd se##in$ to8 c!##s 8ith !n e;ercise rice in bet8een

the t8o. * short butterf#y sre!d invo#ves the oosite ositionE th!t is se##in$ c!## 8ith #o8

e;ercise rice: se##in$ ! c!## 8ith ! hi$h e;ercise rice !nd buyin$ t8o c!##s 8ith !n e;ercise

rice in bet8een the t8o.

C"ar& @ * co##!rs invo#ves ! str!te$y of #imitin$ ! ortfo#ioGs v!#ue bet8een to bounds.

'ui&# &pread @ *n investor m!y be e;ectin$ the rice of !n under#yin$ sh!re to rise. 6ut he

m!y not #i1e to t!1e hi$her ris1.

//

'eari&# Spread @ *n investor: 8ho is e;ectin$ ! sh!re of inde; toI f!##: m!y se## the hi$her?

Priced otion !nd buy the #o8er?rice otion.

Inde9 "pti"n& @ Inde; otions !re c!## or ut otions on the stoc1 m!r1ets indices. In Indi!: there

!re otions on the 6omb!y Stoc1 %;ch!n$e: Sense; !nd the n!tion!# Stoc1 %;ch!n$e:Nifty.

Premium @ The rice of !n otion contr!ct: determined on the e;ch!n$e 8hich the buyer of the

otion !ys to the otions 8riter for the fi$hts to the otion contr!ct.

Future& @ (utures is ! fin!nci!# contr!ct 8hich derives its v!#ue for the under#yin$ !sset.

Finan+ia Future& @ (utures !re tr!ded in ! 8ide v!riety of commoditiesF 8he!t: su$!r: $o#d:

si#ver: coer: or!n$es: coco: oi# soybe!n etc.

F"r$ard @ In ! for8!rd contr!ct: t8o !rties !$ree to buy or se## some under#yin$ !sset on

some future d!te !t ! st!ted rice !nd =u!ntity.

Inde9 !uture& @ Inde; futures is one of the most successfu# fin!nci!# innov!tion of the fin!nci!#

m!r1et. In 15H2: the stoc1 inde; future 8!s introduced.

%ar)in @ Deendin$ uon the n!ture of the buyer !nd se##er the m!r$in re=uirement to deosit

8ith the stoc1 e;ch!n$e is fi;ed.

%ar0et t" %ar0et @ * rocess of v!#uin$ !n oen osition on ! futures m!r1et !$!inst the

ru#in$ rice of the contr!ct !t th!t time: in order to determine the si<e of the m!r$in c!##.

'ada @ 6!d#! is ! !rt of the c!sh m!r1et. It rovided the f!ci#ity of borro8in$ !nd #endin$ of

sh!res !nd funds.

Hed)in) @ 7ed$in$ is the term used for reducin$ ris1 by usin$ deriv!tives.

/2

Ni!t* @ Nifty h!s been se#ected !s the b!se for the stoc1 inde; futures. Nifty cont!ins ! 8e##?

diversified ortfo#io of /I stoc1s.

'I'LIO2RAPHY

/7

.6I6)O3R*-7,

'""0&64

Deriv!tives De!#ers "odu#e 'or1 6oo1 ? NC("

(in!nci!# (eb1et !nd Services ? 3ORD*N 0 N*TR*>*N

(in!nci!# "!n!$ement ? -R*S*NN* C7*NDR*

Ne$& Paper&64

T7% (IN*NCI*) %4-R%SS

6USIN%SS'OR)D

%CONO"IC TI"%S

WE' SITES64

WWW1uni+"nindia1in

WWW1#&eindia1"r)

WWW1n&eindia1+"m

WWW1b&eindia1C"m

WWW1deri8ati8e&1+"m

/H

/5

Вам также может понравиться

- Final Outsource Bpo SameerДокумент36 страницFinal Outsource Bpo Sameerdeepakmaru92Оценок пока нет

- Index: SR No TopicsДокумент30 страницIndex: SR No Topicsdeepakmaru92Оценок пока нет

- Guide To Par Syndicated LoansДокумент10 страницGuide To Par Syndicated LoansBagus Deddy AndriОценок пока нет

- Eurocurrency MarketДокумент42 страницыEurocurrency Marketsweeta333100% (8)

- Tata DocomoДокумент49 страницTata Docomodeepakmaru920% (1)

- Final Ifs SameerДокумент42 страницыFinal Ifs Sameerdeepakmaru92Оценок пока нет

- SecuritisationДокумент78 страницSecuritisationAshita DoshiОценок пока нет

- Final Ifs SameerДокумент42 страницыFinal Ifs Sameerdeepakmaru92Оценок пока нет

- Final Ifs SameerДокумент42 страницыFinal Ifs Sameerdeepakmaru92Оценок пока нет

- Money MarketДокумент36 страницMoney MarketSiddharth KumarОценок пока нет

- The Foreign Exchange MarketДокумент34 страницыThe Foreign Exchange Marketparassuri00760% (5)

- DeepakДокумент26 страницDeepakdeepakmaru92Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Module14 Version 2Документ47 страницModule14 Version 2prins kyla SaboyОценок пока нет

- GlaxoSmithKline FimДокумент8 страницGlaxoSmithKline FimEesha TurraziaОценок пока нет

- Risk ReturnДокумент17 страницRisk ReturnNikhil TurkarОценок пока нет

- Shirkah Partnership by Shoayb JoosubДокумент20 страницShirkah Partnership by Shoayb JoosubRidhwan-ulHaqueОценок пока нет

- Accounting RatiosДокумент11 страницAccounting RatiosatifОценок пока нет

- Coir Spinning Unit AutomaticДокумент3 страницыCoir Spinning Unit AutomaticSenthil KumarОценок пока нет

- Chapter 15 - Test BankДокумент27 страницChapter 15 - Test Bankjuan50% (2)

- 3g-Income-Statement FinalДокумент13 страниц3g-Income-Statement FinalPERCIVAL DOMINGOОценок пока нет

- Investment Analysis and Portfolio Management 2010Документ166 страницInvestment Analysis and Portfolio Management 2010johnsm2010Оценок пока нет

- Chapter 17 Questions V1Документ4 страницыChapter 17 Questions V1KaRin MerRoОценок пока нет

- Internship Report FinalДокумент51 страницаInternship Report FinalImtahanul IslamОценок пока нет

- Final ProjectДокумент31 страницаFinal ProjectLipun baiОценок пока нет

- Problem #10 Two Sole Proprietorship Form A PartnershipДокумент2 страницыProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Macroeconomics AssignmentsДокумент15 страницMacroeconomics Assignmentsapi-3712367Оценок пока нет

- IDBIДокумент10 страницIDBIArun ElanghoОценок пока нет

- Partnership Agreement On Investment and Financial Co-OPERATION No.: RZC/CHI /500M/161120202020Документ11 страницPartnership Agreement On Investment and Financial Co-OPERATION No.: RZC/CHI /500M/161120202020Мухаммед Али100% (2)

- Marketing AnalyticsДокумент9 страницMarketing AnalyticsNeha PalОценок пока нет

- Case Digest Gamboa Vs TevesДокумент4 страницыCase Digest Gamboa Vs TevesHazel Joy Galamay - Garduque100% (4)

- SAMANA Mykonos SignatureДокумент16 страницSAMANA Mykonos Signatureengineeryasirahmed1Оценок пока нет

- Solucionario - PC1 2019-02 EF71Документ37 страницSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeОценок пока нет

- Balance Sheet ParleДокумент2 страницыBalance Sheet ParleDhruvi PatelОценок пока нет

- Presentation - Guenter Faschang, Vontobel Asset Management - Vilnius, Lithuania - March 22, 2002Документ35 страницPresentation - Guenter Faschang, Vontobel Asset Management - Vilnius, Lithuania - March 22, 2002cgs005Оценок пока нет

- Adani PowerДокумент10 страницAdani PowerMontu AdaniОценок пока нет

- 2019-09-21T173710.854Документ2 страницы2019-09-21T173710.854Mikey MadRatОценок пока нет

- Simplified Perspective of Markowitz Portfolio TheoryДокумент13 страницSimplified Perspective of Markowitz Portfolio TheoryPertenceaofutebolОценок пока нет

- Client Account Agreement Windsor BrokersДокумент40 страницClient Account Agreement Windsor BrokersAngel Ramonez100% (1)

- OLFM Contract RevisionsДокумент20 страницOLFM Contract Revisionsutkarh100% (1)

- Kumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeДокумент3 страницыKumar Mangalam Birla Committee - Docxkumar Mangalam Birla CommitteeVanessa HernandezОценок пока нет

- Adro 2018Документ3 страницыAdro 2018meilindaОценок пока нет

- Ventura, Mary Mickaella R Chapter 4 - MinicaseДокумент5 страницVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)