Академический Документы

Профессиональный Документы

Культура Документы

Monthly 25 Stocks For October 2014

Загружено:

Stephen Castellano0 оценок0% нашли этот документ полезным (0 голосов)

89 просмотров10 страницModel Portfolio Monthly Update: September 30, 2014

There are limitations inherent in our theoretical model results, particularly with the fact that such results do not represent actual trading and they may not reflect the impact material economic and market factors might have had on our decision making if we were actually managing client money. Please see additional disclaimers and disclosures at the back of this report.

We highlight stocks that demonstrate solid growth at a reasonable price (GARP). Stocks selected for our model portfolio strategies all rank highly for the following metrics, with an emphasis on proxies for cash flow growth and ROIC:

Relative Value

Operating Momentum

Analyst Revision Momentum

Fundamental Quality

Page 2 contains rebalancing actions for our long-only model portfolio.

Page 3 contains rebalancing actions for our short-only model portfolio.

Target and stop prices, as well as updated return data, to be provided in our daily reports that will follow.

Оригинальное название

Monthly 25 Stocks for October 2014

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документModel Portfolio Monthly Update: September 30, 2014

There are limitations inherent in our theoretical model results, particularly with the fact that such results do not represent actual trading and they may not reflect the impact material economic and market factors might have had on our decision making if we were actually managing client money. Please see additional disclaimers and disclosures at the back of this report.

We highlight stocks that demonstrate solid growth at a reasonable price (GARP). Stocks selected for our model portfolio strategies all rank highly for the following metrics, with an emphasis on proxies for cash flow growth and ROIC:

Relative Value

Operating Momentum

Analyst Revision Momentum

Fundamental Quality

Page 2 contains rebalancing actions for our long-only model portfolio.

Page 3 contains rebalancing actions for our short-only model portfolio.

Target and stop prices, as well as updated return data, to be provided in our daily reports that will follow.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

89 просмотров10 страницMonthly 25 Stocks For October 2014

Загружено:

Stephen CastellanoModel Portfolio Monthly Update: September 30, 2014

There are limitations inherent in our theoretical model results, particularly with the fact that such results do not represent actual trading and they may not reflect the impact material economic and market factors might have had on our decision making if we were actually managing client money. Please see additional disclaimers and disclosures at the back of this report.

We highlight stocks that demonstrate solid growth at a reasonable price (GARP). Stocks selected for our model portfolio strategies all rank highly for the following metrics, with an emphasis on proxies for cash flow growth and ROIC:

Relative Value

Operating Momentum

Analyst Revision Momentum

Fundamental Quality

Page 2 contains rebalancing actions for our long-only model portfolio.

Page 3 contains rebalancing actions for our short-only model portfolio.

Target and stop prices, as well as updated return data, to be provided in our daily reports that will follow.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 10

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 1 steve@ascenderellc.com

Ascendere Associates LLC Innovative Long/Short Equity Research

Model Portfolio Monthly Update: September 30, 2014

There are limitations inherent in our theoretical model results, particularly with the fact that such results do not represent actual trading and

they may not reflect the impact material economic and market factors might have had on our decision making if we were actually managing

client money. Please see additional disclaimers and disclosures at the back of this report.

We highlight stocks that demonstrate solid growth at a reasonable price (GARP). Stocks selected for our model portfolio strategies all rank highly

for the following metrics, with an emphasis on proxies for cash flow growth and ROIC:

Relative Value

Operating Momentum

Analyst Revision Momentum

Fundamental Quality

Page 2 contains rebalancing actions for our long-only model portfolio.

Page 3 contains rebalancing actions for our short-only model portfolio.

Target and stop prices, as well as updated return data, to be provided in our daily reports that will follow.

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 2 steve@ascenderellc.com

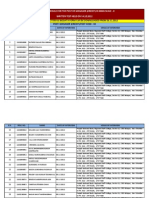

Long Model Portfolio -- Rebalancing Actions

9/30/2014 Rebalancing

Core and Opportunistic Long Portfolio:

25 stocks in the model portfolio = 4.00% weight per position

Close Position Hold/Rebalance Open Position

Omnicom Group Inc. OMC GameStop Corp. GME Magna International Inc. MGA

FMC Technologies, Inc. FTI The Home Depot, Inc. HD Foot Locker, Inc. FL

AllianceBernstein Holding L.P. AB Tata Motors Limited TTM Pilgrim's Pride Corporation PPC

Biogen Idec Inc. BIIB Halliburton Company HAL CVS Health Corporation CVS

Paychex, Inc. PAYX The Blackstone Group L.P. BX Anixter International Inc. AXE

The Sherwin-Williams Company SHW Lazard Ltd. LAZ

Affiliated Managers Group Inc. AMG

Primerica, Inc. PRI

Protective Life Corporation PL

Gilead Sciences Inc. GILD

Align Technology Inc. ALGN

VCA Inc. WOOF

Allergan Inc. AGN

Huntington Ingalls Industries, Inc. HII

Trinity Industries Inc. TRN

Robert Half International Inc. RHI

ManpowerGroup Inc. MAN

Snap-on Incorporated SNA

Brocade Communications Systems, Inc. BRCD

Source: Ascendere Associates LLC Skyworks Solutions Inc. SWKS

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 3 steve@ascenderellc.com

Short Model Portfolio -- Rebalancing Actions

When the market anticipates an improving economy from low price levels, low-quality stocks will at times out-perform high-quality stocks as the

expected improvements in fundamentals are discounted from a relatively more depressed price level.

9/30/2014 Rebalancing

Core and Opportunistic Short Portfolio:

21 stocks in the model portfolio = 4.76% weight per position

Close Position Hold/Rebalance Open Short Sale

Allscripts Healthcare Solutions, Inc. MDRX General Motors Company GM Pioneer Natural Resources Co. PXD

Cepheid CPHD Dresser-Rand Group Inc. DRC Williams Companies, Inc. WMB

CoreLogic, Inc. CLGX Golar LNG Ltd. GLNG ING Groep N.V. ING

JDS Uniphase Corporation JDSU Memorial Resource Development Corp. MRD Popular, Inc. BPOP

Yahoo! Inc. YHOO Credit Suisse Group AG CS Joy Global, Inc. JOY

Carpenter Technology Corp. CRS Deutsche Bank AG DB

Cubist Pharmaceuticals Inc. CBST

Alkermes plc ALKS

Jacobs Engineering Group Inc. JEC

Kennametal Inc. KMT

Eaton Corporation plc ETN

KBR, Inc. KBR

3D Systems Corporation DDD

SunEdison, Inc. SUNE

CRH plc CRH

Source: Ascendere Associates LLC Allegheny Technologies Inc. ATI

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 4 steve@ascenderellc.com

Return Data

Core & Opportunistic Long Model MTD Theoretical Longs Stopped Out on 8/4/2011 close for a -12.33% loss

8/31/2014 to 9/30/2014

Target/ Date+1

Sector Company Ticker 8/31/2014 9/30/2014 Performance Stop Date Sell Price Return

Health Care Allergan Inc. AGN 163.68 178.19 8.86%

Information Technology Paychex Inc. PAYX 41.65 44.20 6.12%

Information Technology Brocade Communications Systems, Inc. BRCD 10.55 10.87 3.03%

Information Technology Skyworks Solutions Inc. SWKS 56.66 58.05 2.45%

Industrials Huntington Ingalls Industries, Inc. HII 102.11 104.21 2.06%

Consumer Discretionary Sherwin-Williams Co. SHW 218.11 218.99 0.40%

Financials Protective Life Corp. PL 69.40 69.41 0.01%

Health Care Gilead Sciences Inc. GILD 107.56 106.45 -1.03%

Consumer Discretionary The Home Depot, Inc HD 93.50 91.74 -1.88%

Consumer Discretionary GameStop Corp. GME 42.20 41.20 -2.37%

Industrials Robert Half International Inc. RHI 50.21 49.00 -2.41%

Consumer Discretionary Snap-on Inc. SNA 124.95 121.08 -3.10%

Industrials Trinity Industries Inc. TRN 48.38 46.72 -3.43%

Health Care VCA Antech Inc. WOOF 40.75 39.33 -3.48%

Health Care Biogen Idec Inc. BIIB 343.04 330.81 -3.57%

Financials Primerica, Inc. PRI 50.33 48.22 -4.19%

Consumer Discretionary Omnicom Group Inc. OMC 72.01 68.86 -4.37%

Energy Halliburton Company HAL 67.61 64.51 -4.59%

Health Care Align Technology Inc. ALGN 54.46 51.68 -5.10%

Financials Affiliated Managers Group Inc. AMG 211.15 200.36 -5.11%

Financials AllianceBernstein Holding L.P. AB 27.66 26.01 -5.97%

Financials The Blackstone Group BX 33.53 31.48 -6.11%

Financials Lazard Ltd. LAZ 54.66 50.70 -7.24%

Industrials Tata Motors Ltd. TTM 48.19 43.71 -9.30%

Industrials Manpower Inc. MAN 77.58 70.10 -9.64%

Energy FMC Technologies, Inc. FTI 61.84 54.31 -12.18%

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 5 steve@ascenderellc.com

Core & Opportunistic Short Model MTD Theoretical shorts hit target 8/4/2011 for 14.84% gain

8/31/2014 to 9/30/2014

Target/ Date+1

Sector Company Ticker 8/31/2014 9/30/2014 Performance Stop Date Sell Price Return

Materials Carpenter Technology Corp. CRS 54.73 45.15 -17.50% 9/15/2014 52.02 $ -4.95%

Industrials KBR, Inc. KBR 22.02 18.83 -14.49% 9/19/2014 20.10 $ -8.72%

Information Technology SunEdison, Inc. SUNE 22.03 18.88 -14.30% 9/23/2014 20.28 $ -7.94%

Information Technology 3D Systems Corp. DDD 53.51 46.37 -13.34% 9/29/2014 46.37 $ -13.34%

Materials Allegheny Technologies Inc. ATI 42.17 37.10 -12.02% 9/25/2014 39.01 $ -7.49%

Industrials Jacobs Engineering Group, Inc. JEC 53.91 48.82 -9.44% 9/23/2014 50.34 $ -6.62%

Industrials Eaton Corp. ETN 69.81 63.37 -9.23% 9/22/2014 65.14 $ -6.69%

Healthcare Allscripts Healthcare Solutions, Inc. MDRX 14.78 13.42 -9.20% 9/25/2014 13.54 $ -8.36%

Consumer Discretionary General Motors Company GM 34.80 31.94 -8.22% 9/25/2014 33.17 $ -4.68%

Energy Memorial Resource Development Corp. MRD 29.47 27.11 -8.01% 9/25/2014 26.72 $ -9.33%

Industrials Kennametal Inc. KMT 44.81 41.31 -7.81% 9/22/2014 42.27 $ -5.67%

Information Technology CoreLogic, Inc. CLGX 28.27 27.07 -4.24%

Health Care Alkermes, Inc. ALKS 44.73 42.87 -4.16%

Health Care Cubist Pharmaceuticals Inc. CBST 69.03 66.34 -3.90%

Financials Credit Suisse Group CS 28.24 27.64 -2.12%

Materials CRH plc CRH 23.24 22.81 -1.85%

Financials Deutsche Bank AG DB 34.31 34.86 1.60%

Energy Golar LNG Ltd. GLNG 63.00 66.40 5.40% 9/16/2014 71.25 $ 13.10%

Information Technology Yahoo! Inc. YHOO 38.51 40.75 5.82% 9/8/2014 40.78 $ 5.89%

Health Care Cepheid CPHD 40.03 44.03 9.99% 9/10/2014 43.67 $ 9.09%

Information Technology JDS Uniphase Corp. JDSU 11.55 12.80 10.82% 9/11/2014 13.43 $ 16.28%

Energy Dresser-Rand Group Inc. DRC 69.30 82.26 18.70% 9/19/2014 81.97 $ 18.28%

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 6 steve@ascenderellc.com

* Return figures are calculated using cumulative simple returns. This table represents returns of several theoretical portfolios that do not assume any costs. This table is not to

be construed as advertising for any investment service. Real portfolios that attempt to exactly replicate these theoretical strategies will generate lower returns relative to these

models due to slippage, transaction costs, tax expenses and other costs. There are limitations inherent in our theoretical results, particularly with the fact that such results do

not represent actual trading and they may not reflect the impact material economic and market factors might have had on our decision making if we were actually managing

client money. We do our best to provide accurate information, but do not guarantee this. Please see additional disclosures and disclaimers.

Theoretical Model Portfolio* 09/30/14 MTD YTD

Since

03/31/09 Sharpe

Simple Returns (No Compounding)

Stock Targets Core Model

Long -0.44% -2.75% 6.92% 145.6% 1.04

Short 0.12% -1.82% 2.16% 88.1% 0.71

Core Long/Short -0.56% -0.94% 4.76% 57.4% 0.57

Stock Targets and Opportunistic Model

Portfolio Targets Long -0.44% -2.51% -0.08% 129.7% 1.21

Short 0.00% -1.82% 1.84% 39.3% 0.30

Opportunistic Long/Short -0.44% -0.70% -1.92% 90.4% 1.01

Stock Targets and Opportunistic Model III

Portfolio Targets Long Stocks -0.44% -2.51% -0.08% 129.7% 1.21

Long Inverse ETF ^SH 0.00% 1.30% -7.85% -73.3% (1.04)

Opportunistic Long/Short III -0.44% -1.21% -7.93% 56.5% 0.67

S&P 500 Index -0.60% -1.53% 6.88% 98.21% 1.06

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 7 steve@ascenderellc.com

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 8 steve@ascenderellc.com

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 9 steve@ascenderellc.com

DISCLOSURES

Ascendere is in the business of providing equity research and related consulting services to investors and their advisors. The equity research it provides includes basic

quantitative model portfolios and more detailed fundamental research with respect to individual stocks. In addition, the firm manages stock portfolios for itself and clients.

Ascendere does not rate stocks on any scale, but does offer individual stock commentary and valuation opinions. With regard to Ascendere's portfolio strategies, "long" or

"high-quality" baskets should generally be considered buys, unless otherwise noted. Stocks in our "short" or "low-quality" baskets should generally be considered sells, unless

otherwise noted. While exceptions may occasionally occur, typically stocks in the high-quality basket are expected to outperform the S&P 500 over a month's time and stocks in

the low-quality basket are expected to underperform. A more relevant benchmark would comprise of all stocks and ADRs that trade on major U.S. stock exchanges with a

market cap above $2 billion.

Ascendere adheres to professional standards and abides by codes of ethics that put the interests of clients ahead of its own. The following are specific disclosures made by

Ascendere:

1) Ascendere may have a financial interest in the companies referred to in this report ("the Companies"). The research analyst covering the Companies and members

of the analyst's immediate family have a financial interest in one or more of the Companies.

2) Ascendere generates revenue from research subscription revenue and portfolio management fees. At any given time it may be long or short any of the Companies.

3) Ascendere does not make a market in the securities of any of the Companies.

4) Ascendere has not received compensation from the Companies.

5) Ascendere has not managed or co-managed a public offering for any of the Companies.

6) Neither Ascendere nor any of its officers or any family member of the covering analyst serve as an officer, director or advisory board member of any of the

Companies.

7) Neither Ascendere nor any of its officers or any family member of the covering analyst beneficially own 1% or more of any class of securities of any of the Companies.

DISCLAIMERS

This report is intended for informational purposes only and does not constitute a recommendation, or an offer, to buy or sell any securities or related financial instruments. The

report is not intended to be in furtherance of the specific investment objectives, financial situation, or particular needs of any individual recipient. Investment decisions should

be based on an individual's own goals, time horizon and tolerance for risk. The information contained herein accurately reflects the opinion of Ascendere at the time the report

was released. The opinions of Ascendere are subject to change at any time without notice and without obligation or notification. The officers, affiliates or family members of

Ascendere Associates may hold positions in the securities of the Companies. No warranty is made as to the accuracy of the information contained herein. The views and

opinions expressed in the market commentary reflect the opinions of the author and may be based upon information obtained from third-party sources believed to be reliable

but not guaranteed. These opinions are subject to change at any time based upon market or other conditions. Ascendere disclaims any responsibility to update such views.

This information is intended for the sole use of clients of Ascendere. Any other use, distribution or reproduction is strictly prohibited. Investing in stocks includes a high degree

of risk, including the risk of total loss. This is for informational purposes only and is not intended to constitute a current or past recommendation, investment advice of any kind,

or a solicitation of an offer to buy or sell any securities or investment services. All information, opinions and estimates are current as of original distribution by author and are

subject to change at any time without notice. Any companies, securities and/or markets referenced are solely for illustrative purposes. Past performance is not indicative of

future performance, and no representation or warranty, express or implied, is made regarding future performance.

For Investment Professional use only. NOT FOR FURTHER DISTRIBUTION. Any dissemination or copying of this commentary is strictly prohibited.

Ascendere Associates LLC September 30, 2014

J. Stephen Castellano Page 10 steve@ascenderellc.com

J. Stephen Castellano founded Ascendere Associates LLC to provide innovative equity research

and investment advisory services that blends fundamental and quantitative approaches.

In general, our approach is quite simple -- we believe that return on invested capital and long-term

earnings growth are key to stock valuation. More specifically, we use powerful and unique financial

models that combine publicly available data, consensus estimates and our own inputs to generate

consistent and actionable stock recommendations.

Among the services that Ascendere provides are: 1) detailed custom equity research analysis; 2) valuation scenario analysis

studies; 3) supply /demand studies; 4) long and short stock idea generation; 5) portfolio feedback; 6) detailed fundamental

financial modeling services; and 7) additional analytical consulting services. Additional information is available at

www.ascenderellc.com.

Mr. Castellano has over 15 years of experience in equity research and related consulting work. At PaineWebber, Warburg

Dillon Read and Credit Lyonnais Securities he developed fundamental equity valuation models and conducted in-depth

research on the steel and telecom services industries. At Boston Private Value Investors, he developed quantitative models

for stock idea generation and also provided general fundamental equity research coverage. Steve received a MBA from the F.

W. Olin School of Business at Babson College (2005) and a BA from Oberlin College (1993).

Mr. Castellano's career history is highlighted below:

Startup Ecommerce Company (2013-Present)

Ascendere Associates, LLC (2009-Present)

Boston Private Value Investors , Equity Research, Equity Research Analyst (2005-2009)

Pyramid Research, Contract Consultant, Telecom Services (2002-2003)

Credit Lyonnais Securities (USA), Equity Research, Telecom Services, Vice President (2000-2001)

Warburg Dillon Read, Equity Research, Telecom Services, Research Associate (1999-2000)

PaineWebber, Equity Research, Steel and Nonferrous Metals, Research Associate, Editor (1995-1999)

Вам также может понравиться

- Guidelines for the Management of Change for Process SafetyОт EverandGuidelines for the Management of Change for Process SafetyОценок пока нет

- Ascendere Associates LLC Innovative Long/Short Equity ResearchДокумент10 страницAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoОценок пока нет

- Ascendere Associates LLC Innovative Long/Short Equity ResearchДокумент10 страницAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoОценок пока нет

- Ascendere Associates LLC Innovative Long/Short Equity ResearchДокумент10 страницAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoОценок пока нет

- Ascendere Associates LLC Innovative Long/Short Equity ResearchДокумент10 страницAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoОценок пока нет

- S&P Midcap 400Документ7 страницS&P Midcap 400amitalwarОценок пока нет

- Tutorial 5 FAT Solution (Unimelb)Документ25 страницTutorial 5 FAT Solution (Unimelb)Ahmad FarisОценок пока нет

- ValuEngine Weekly Newsletter March 30, 2010Документ15 страницValuEngine Weekly Newsletter March 30, 2010ValuEngine.comОценок пока нет

- As A Bonus To Our Free Weekly Newsletter Subscribers, We Are Now Offering A FREE DOWNLOAD of One of Our $ 25.00 Detailed Valuation ReportsДокумент9 страницAs A Bonus To Our Free Weekly Newsletter Subscribers, We Are Now Offering A FREE DOWNLOAD of One of Our $ 25.00 Detailed Valuation ReportsValuEngine.comОценок пока нет

- ValuEngine Weekly Newsletter February 17, 2012Документ10 страницValuEngine Weekly Newsletter February 17, 2012ValuEngine.comОценок пока нет

- ValuEngine Weekly Newsletter January 20, 2012Документ11 страницValuEngine Weekly Newsletter January 20, 2012ValuEngine.comОценок пока нет

- 25 Stocks For July 2015Документ11 страниц25 Stocks For July 2015Stephen CastellanoОценок пока нет

- VE Weekly 100326Документ9 страницVE Weekly 100326ValuEngine.comОценок пока нет

- Free Weekly Newsletter June 18, 2010Документ12 страницFree Weekly Newsletter June 18, 2010ValuEngine.comОценок пока нет

- Ascendere Price Targets For Feb 28, 2014 ModelДокумент8 страницAscendere Price Targets For Feb 28, 2014 ModelStephen CastellanoОценок пока нет

- Ops Assesment 2Документ12 страницOps Assesment 2greatlakes100% (1)

- BetterInvesting Weekly - Stock Screen - 3-5-12Документ1 страницаBetterInvesting Weekly - Stock Screen - 3-5-12BetterInvestingОценок пока нет

- ValuEngine Weekly Newsletter January 28, 2011Документ8 страницValuEngine Weekly Newsletter January 28, 2011ValuEngine.comОценок пока нет

- BetterInvesting Weekly Stock Screen 6-11-12Документ1 страницаBetterInvesting Weekly Stock Screen 6-11-12BetterInvestingОценок пока нет

- Brighton PresentationДокумент27 страницBrighton Presentationsharmaharsh30Оценок пока нет

- ValuEngine Weekly Newsletter April 1, 2010Документ9 страницValuEngine Weekly Newsletter April 1, 2010ValuEngine.comОценок пока нет

- VE Weekly 101126Документ6 страницVE Weekly 101126ValuEngine.comОценок пока нет

- WeeK - 2 - Reading BДокумент9 страницWeeK - 2 - Reading BSheraz AhmadОценок пока нет

- ValuEngine Weekly Newsletter July 2, 2010Документ10 страницValuEngine Weekly Newsletter July 2, 2010ValuEngine.comОценок пока нет

- ValuEngine Weekly Newsletter April 22, 2011Документ11 страницValuEngine Weekly Newsletter April 22, 2011ValuEngine.comОценок пока нет

- BetterInvesting Weekly Stock Screen 4-30-12Документ1 страницаBetterInvesting Weekly Stock Screen 4-30-12BetterInvestingОценок пока нет

- BA 2023 - 2024 T04 Descriptive StatisticsДокумент115 страницBA 2023 - 2024 T04 Descriptive StatisticsjhkkpmynkgОценок пока нет

- BetterInvesting Weekly Stock Screen 091012Документ6 страницBetterInvesting Weekly Stock Screen 091012BetterInvestingОценок пока нет

- Copia de GAS Module - 4 Years of Financial DataДокумент53 страницыCopia de GAS Module - 4 Years of Financial Dataadrian5pgОценок пока нет

- ValuEngine Weekly NewsletterДокумент13 страницValuEngine Weekly NewsletterValuEngine.comОценок пока нет

- ValuEngine Weekly December 10, 2010Документ9 страницValuEngine Weekly December 10, 2010ValuEngine.comОценок пока нет

- BetterInvesting Weekly Stock-Screen 9-22-14Документ1 страницаBetterInvesting Weekly Stock-Screen 9-22-14BetterInvestingОценок пока нет

- Intellectual Capital and Corporate Performance of Indian PharmaceuticalДокумент19 страницIntellectual Capital and Corporate Performance of Indian Pharmaceuticalkuldeep_0405Оценок пока нет

- ValuEngine Weekly Newsletter February 18, 2011Документ10 страницValuEngine Weekly Newsletter February 18, 2011ValuEngine.comОценок пока нет

- KM ManufacturingДокумент54 страницыKM Manufacturingakrajaraj100% (1)

- ValuEngine Weekly Newsletter July 23, 2010Документ15 страницValuEngine Weekly Newsletter July 23, 2010ValuEngine.comОценок пока нет

- Birlasoft LTD: Research ReportsДокумент14 страницBirlasoft LTD: Research ReportsShilpi KumariОценок пока нет

- Future of CMC Regulatory SubmissionsДокумент33 страницыFuture of CMC Regulatory Submissionsraja manikumarОценок пока нет

- ValuEngine Weekly Newsletter February 25, 2011Документ11 страницValuEngine Weekly Newsletter February 25, 2011ValuEngine.comОценок пока нет

- Playbook HCPSerialization Opt V10Документ182 страницыPlaybook HCPSerialization Opt V10Kapil Dev SaggiОценок пока нет

- CS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesДокумент220 страницCS US Multi-Industrial Analyst Presentation - July 2014 - Part 1 End Market SlidesVictor CheungОценок пока нет

- 8 Digital Knowledge Use Cases For Accelerating Oil & Gas ProfitabilityДокумент16 страниц8 Digital Knowledge Use Cases For Accelerating Oil & Gas ProfitabilityPrasad SreedheranОценок пока нет

- Express Scripts: (Nasdaq: Esrx)Документ21 страницаExpress Scripts: (Nasdaq: Esrx)nikolasbourbakiОценок пока нет

- Marketing Audit, Marketing ManagementДокумент32 страницыMarketing Audit, Marketing ManagementmajusidОценок пока нет

- Global FundsДокумент74 страницыGlobal FundsArmstrong CapitalОценок пока нет

- Case 44 Arcadian Microarray Technologies IncДокумент17 страницCase 44 Arcadian Microarray Technologies Inckoeliedonder67% (3)

- Buying Utility Assets - Failure Should Not Be An OptionДокумент8 страницBuying Utility Assets - Failure Should Not Be An OptionAmin BisharaОценок пока нет

- 2012 MBA/IMBA Salary Survey: Career Development CentreДокумент9 страниц2012 MBA/IMBA Salary Survey: Career Development CentreLaura MontgomeryОценок пока нет

- BetterInvesting Weekly Stock Screen 4-28-14Документ1 страницаBetterInvesting Weekly Stock Screen 4-28-14BetterInvestingОценок пока нет

- Procter & Gamble-Gillette Merger: By: Christine Cruell Kamika Hemphill Antjuan Seawright Jonathan ToneyДокумент33 страницыProcter & Gamble-Gillette Merger: By: Christine Cruell Kamika Hemphill Antjuan Seawright Jonathan ToneythorndykОценок пока нет

- ValuEngine Weekly Newsletter September 21, 2012Документ10 страницValuEngine Weekly Newsletter September 21, 2012ValuEngine.comОценок пока нет

- Company Specific Risks - Business, Industry & ManagementДокумент18 страницCompany Specific Risks - Business, Industry & ManagementJorge NAОценок пока нет

- Magadh Dairy Project (Sudha) : Financial Analysis of Comfed Presented by Shambhu Nath FMR-2022 PGDFMДокумент30 страницMagadh Dairy Project (Sudha) : Financial Analysis of Comfed Presented by Shambhu Nath FMR-2022 PGDFMAbhishek Kumar50% (2)

- DR Reddy's LabДокумент10 страницDR Reddy's LabTarun GuptaОценок пока нет

- ValuEngine Weekly Newsletter May 27, 2011Документ10 страницValuEngine Weekly Newsletter May 27, 2011ValuEngine.comОценок пока нет

- IPO Underpricing in USДокумент7 страницIPO Underpricing in USBalan NicolaeОценок пока нет

- Barings To Miami Pension PlanДокумент25 страницBarings To Miami Pension Planturnbj75Оценок пока нет

- Barclays Multi-Industry Poster 2014Документ2 страницыBarclays Multi-Industry Poster 2014athompson14Оценок пока нет

- Csol 520 Assignment 1Документ7 страницCsol 520 Assignment 1api-615679676Оценок пока нет

- Astrological Trade Recommendations For The Components of The S&P100 IndexДокумент2 страницыAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491Оценок пока нет

- 32 Stocks For May 2015Документ11 страниц32 Stocks For May 2015Stephen CastellanoОценок пока нет

- Ascendere Associates LLC Actionable Long/Short Equity ResearchДокумент12 страницAscendere Associates LLC Actionable Long/Short Equity ResearchStephen CastellanoОценок пока нет

- 25 Stocks For July 2015Документ11 страниц25 Stocks For July 2015Stephen CastellanoОценок пока нет

- 27 Stocks For August 2015Документ14 страниц27 Stocks For August 2015Stephen CastellanoОценок пока нет

- 25 Stocks For June 2015Документ12 страниц25 Stocks For June 2015Stephen CastellanoОценок пока нет

- Income Statement Model - NuVasive, Inc. (NUVA)Документ8 страницIncome Statement Model - NuVasive, Inc. (NUVA)Stephen CastellanoОценок пока нет

- The Best 25 Stocks For 2015Документ13 страницThe Best 25 Stocks For 2015Stephen CastellanoОценок пока нет

- Financial Statement Model Example Stephen CastellanoДокумент11 страницFinancial Statement Model Example Stephen CastellanoStephen CastellanoОценок пока нет

- 26 Stocks For November 2014Документ10 страниц26 Stocks For November 2014Stephen CastellanoОценок пока нет

- Westlake Chemical - Sell Off Based On Industry Peak Fears PrematureДокумент9 страницWestlake Chemical - Sell Off Based On Industry Peak Fears PrematureStephen CastellanoОценок пока нет

- 23 Stocks For March 2015Документ11 страниц23 Stocks For March 2015Stephen CastellanoОценок пока нет

- The Best 26 Stocks For 2014Документ13 страницThe Best 26 Stocks For 2014Stephen CastellanoОценок пока нет

- 24 Stocks For June 2014Документ10 страниц24 Stocks For June 2014Stephen CastellanoОценок пока нет

- 24 Stocks For March 2014Документ12 страниц24 Stocks For March 2014Stephen CastellanoОценок пока нет

- Ascendere Price Targets For Feb 28, 2014 ModelДокумент8 страницAscendere Price Targets For Feb 28, 2014 ModelStephen CastellanoОценок пока нет

- 27 GARP Stocks For April 2014Документ11 страниц27 GARP Stocks For April 2014Stephen CastellanoОценок пока нет

- Yahoo! Cash Flow and ROIC Analysis - September 9, 2011Документ11 страницYahoo! Cash Flow and ROIC Analysis - September 9, 2011Stephen CastellanoОценок пока нет

- 22 Stocks For February 2014Документ13 страниц22 Stocks For February 2014Stephen CastellanoОценок пока нет

- 24 Stocks For May 2014Документ11 страниц24 Stocks For May 2014Stephen CastellanoОценок пока нет

- Detailed Scenario Analysis of Microsoft's Acquisition of SkypeДокумент42 страницыDetailed Scenario Analysis of Microsoft's Acquisition of SkypeStephen Castellano67% (3)

- Analyst Revision Trends - June 3, 2011Документ18 страницAnalyst Revision Trends - June 3, 2011Stephen CastellanoОценок пока нет

- The Best Bank Stocks in The KBW IndexДокумент14 страницThe Best Bank Stocks in The KBW IndexStephen CastellanoОценок пока нет

- Ascendere Daily Update - January 27, 2011 - Companies With Expanding ROIC Tend To Surprise To The UpsideДокумент16 страницAscendere Daily Update - January 27, 2011 - Companies With Expanding ROIC Tend To Surprise To The UpsideStephen CastellanoОценок пока нет

- Ascendere Daily Update - January 31, 2011 - Our Record of Presaging 45 Sell Side Upgrades With A 25-Stock Model Portfolio in January 2011Документ17 страницAscendere Daily Update - January 31, 2011 - Our Record of Presaging 45 Sell Side Upgrades With A 25-Stock Model Portfolio in January 2011Stephen CastellanoОценок пока нет

- M.B.A. (Full - Time) : Bharathidasan University, Tiruchirappalli - 24Документ42 страницыM.B.A. (Full - Time) : Bharathidasan University, Tiruchirappalli - 24Gowthami PapaОценок пока нет

- The Vedanta Limited Delisting Fiasco: IBS Center For Management ResearchДокумент13 страницThe Vedanta Limited Delisting Fiasco: IBS Center For Management ResearchDivyanshi GuptaОценок пока нет

- Tradecap Managed Account ServicesДокумент4 страницыTradecap Managed Account ServicesRajesh ThangarajОценок пока нет

- Chap 017Документ6 страницChap 017ZoebairОценок пока нет

- S 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceДокумент174 страницыS 1 - Introduction To Private Equity and Venture Capital: B B Chakrabarti Professor of FinanceSiddhantSinghОценок пока нет

- Call OI Strike Put OI Call Value Put Value Total StrikeДокумент4 страницыCall OI Strike Put OI Call Value Put Value Total Striked_narnoliaОценок пока нет

- Both Statements Are TrueДокумент30 страницBoth Statements Are TrueSaeym SegoviaОценок пока нет

- Isb656 (Islamic Capital Market) Lesson Plan (SEPT 2016 - DEC 2016)Документ3 страницыIsb656 (Islamic Capital Market) Lesson Plan (SEPT 2016 - DEC 2016)Roslina IbrahimОценок пока нет

- Postds PDFДокумент37 страницPostds PDFYongky AОценок пока нет

- Valuation of Bonds and StocksДокумент71 страницаValuation of Bonds and Stocksnaag1000Оценок пока нет

- CH 1 Why Study Money, BankingДокумент15 страницCH 1 Why Study Money, BankingLoving GamesОценок пока нет

- Sonnemann Camerer Fox Langer 2013 - Behavioral FinanceДокумент6 страницSonnemann Camerer Fox Langer 2013 - Behavioral FinancevalleОценок пока нет

- 3-Risk Return (Recent Data)Документ3 страницы3-Risk Return (Recent Data)Yash AgarwalОценок пока нет

- FIN - Chapter 6 - Cost of Capital - PDFДокумент14 страницFIN - Chapter 6 - Cost of Capital - PDFUtpal BaruaОценок пока нет

- 6931 - Basic Earnings Per ShareДокумент2 страницы6931 - Basic Earnings Per ShareJennifer RueloОценок пока нет

- Equity Analysis at Ventura SecuritiesДокумент63 страницыEquity Analysis at Ventura SecuritiesManishKumarОценок пока нет

- TLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENДокумент1 страницаTLV - 20191216165648 - Raport Curent Extindere Program de Rascumparare Actiuni ENAndrei NitaОценок пока нет

- ID Analisis Reaksi Pasar Modal Setelah Pengumuman Initial Public Offering Ipo PadaДокумент14 страницID Analisis Reaksi Pasar Modal Setelah Pengumuman Initial Public Offering Ipo PadaChindy Orinda SilalahiОценок пока нет

- Summer Internship Project Report ON Demat AccountДокумент77 страницSummer Internship Project Report ON Demat AccountRudraksh Bhardwaj50% (2)

- Practice Question For Midterm Test - FA - 28.03Документ4 страницыPractice Question For Midterm Test - FA - 28.03TRANG NGUYỄN THỊ HÀОценок пока нет

- Mergers, Acquisitions and Corporate Restructuring: Amity Business SchoolДокумент23 страницыMergers, Acquisitions and Corporate Restructuring: Amity Business Schoolankit varunОценок пока нет

- Stock Valuation: Stock Features and Valuation Components of Required ReturnДокумент24 страницыStock Valuation: Stock Features and Valuation Components of Required ReturnnabihaОценок пока нет

- Toxic Trading - SaluzziДокумент5 страницToxic Trading - SaluzziZerohedge100% (6)

- Praxis Home Retail LimitedДокумент45 страницPraxis Home Retail LimitedContra Value BetsОценок пока нет

- Interview Call Letters & Biodata Form Can Be Downloaded From 26.11.2012 Post: Manager (Credit) Post Code - 02Документ73 страницыInterview Call Letters & Biodata Form Can Be Downloaded From 26.11.2012 Post: Manager (Credit) Post Code - 02Ankit YadavОценок пока нет

- Practice Question For Weighted Average Cost of CapitalДокумент2 страницыPractice Question For Weighted Average Cost of CapitalNirmal ThapaОценок пока нет

- Financial Statement Analysis: Charles H. GibsonДокумент47 страницFinancial Statement Analysis: Charles H. Gibsonmohamed100% (2)

- Coronavirus Impact On Stock Prices and Growth ExpectationsДокумент27 страницCoronavirus Impact On Stock Prices and Growth ExpectationsSouheil LahmerОценок пока нет

- On Buy Back Shares - NikhilДокумент8 страницOn Buy Back Shares - Nikhilnikhilgirhepunje100% (3)

- Business Com Chapter 23Документ5 страницBusiness Com Chapter 23Nino Joycelee TuboОценок пока нет