Академический Документы

Профессиональный Документы

Культура Документы

Business Environment - 3 Prezentacije 1 Parciajla

Загружено:

Amra MutilovićИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Business Environment - 3 Prezentacije 1 Parciajla

Загружено:

Amra MutilovićАвторское право:

Доступные форматы

Business Environment Sabina Silajdzic, PhD

(prezentacije) Leila L.

Business and its Environment

CONTENTS

1. Business and its environment- the main characterisitcs

2. Conceptualisation of BE differing concepts and contextualisation of BE

3. BE- framework of analysis

4. BE differing approaches to BE analysis

5. Conclusion?

What is Business?

the organised effort by individuals to produce goods and services, to sell these

goods and services in a market place and to reap some reward for this effort.

those human activities which involves production or purchase of goods with the

object of selling them at a profit margin.

What is Business Environment?

All those factors external to business that either inhibit or favour their

development no unanimity about what exactly should be included in the definition of the

term.

Business Climate/Investment Climate/Enabling Environment

I Business and its Environment: main characteristics

Diversity Business is a diverse category. It does not refer only to private sector, privately

owned profit making companies. Businesses vary in a number of ways, such as legal structure,

industry, size and market power, or geographical reach. Public org. may also be regarded as

business.

External/Internal BE mainly focuses on the external environment the surrounding conditions

outside the organisation. It is however useful to think of the environment as also having internal

dimension organisation as a highly differentiated and complex system.

Complexity economic conditions are of primary importance (competitors customers), but

business operates in more complex environment incl. political-legal, social-cultural,

environmental and technological aspects.

Spatial Levels refers to the geogprahical or territorial unit of anylsis that we use to

conceptualise business environment, local-national-reg.-intl.

I Business and its Environment:

main characteristics-2

Dynamic a fast changing environment. Dynamics of changes is directly in relation to

globalsation forces incl. tehnological progress and innovation. In the context of TE it is directly in

relation to the pace, scale and scope of economic restructuring and social transformation.

Interaction there is a two way interaction b/w business org. and their environment. Business

org. are not passive entities but seek to affect BE

Stakeholder public and business decisions are incresingly made in a context of multiple

stakeholder interests and demands- public trust is at stake. Stakeholder is an individual/group that

is affected by the decision.

Values there are competing perspectives and values concerning the nature and purpose of

business, public sector or the government. These debates mostly relate to power, responsibilities,

performance and ethics.

II Business Environment conceptualisation

BE usually refers to.. all those factors external to businesses that either inhibit or favour their

development. (Simon White)

According to Barry M. Richman and Melvyn Copen

Environment factors of constraints are largely if not totally external and beyond the control of

individual industrial enterprises and their arrangements. These are essentially the givers within

which firms and their managements must operate in a specific country and they vary, often greatly

from country to country.

II Business Environment conceptualisation

External Business Environment determines the LOCATIONAL QUALITY

Locational advantage may derive from factors such as:

1. The availability of skilled labour

2. The cost of labour

3. Favourable tax or regulatory environment

4. The quality of infrastructure

5. the proximity of suppliers/consumers, technological availability

What do we mean by locational quality?

Simply LQ refers to the range of factors that make location attractive or otherwise for busines:

tangible and intangible

Why study BE? .. All businesses operate in a changng and in some way unique environment that

affects its performance. The environment can be regarded as the source of both threats and

opportunities. Business decisions are concerned with countering threats and exploiting

opportunities.

Examples? (change in market conditions affecting demand, bahaviour of competitors, change in

govt policy affecting level of taxes, interest rates...)

BE context free market economy is characterised by a continutal pressure of economic entities

to increase efficiency. Profit motive and competittion work out in this direction ending up in

greater product diversity, lower costs of production, higher quality and chaper products. Firms

that fall behind in the efficiency race end up pricing them selves out of the market. The BE

context, however, goes well beyond simple free market logic!!!!

BE is characterised with increasing Complexity - The BE context goes well beyond simple free

market logic.

a) In reality there is no such a thing as a FREE MARKET in the sense of business being left

entirely free to make decisions for them selves.

b) In all market systems the law is used extensively to regulate various aspects of business

decisions and behaviour. This law constitutes a key element of regulatory and/or political

environment of business.

BE is not only characterisited with complexity but also with contraversy. The contraversial

context of BE mostly has to do with questions related to debate:

Free market vs. Regulation

The rationale behind government intervention/regulation:

First market efficiency and the profit motive may well be, and it often are at odds with other

wider societal interests:

a) Profit motive may result in a poor quality or even harmeful products, discrimination, child

labour, exploatation, environmental degradation, overpricing ..........

i.e. Competition vs. market power the importance of distinctive market structures

b) Persuasive advertising may be at odds with coustomer wants and needs.

i.e. Proft vs. Social responsibility business ethics & Corporate Social Responsibility

Second, and in view of the assigned greater responsibility of business in todays world, BE is

getting more complex such that govtt regulation not only attempts to protect wider social

interests and provide incentives, but also government regulation often attempts to direct bussiness

perspectives and development prospects.

III BE- Framework of analysis

ENVIRONMENTAL INFLUENCES ON BUSINESS

The term Environmental analysis may be defined as the process by which strategists monitor

the economic, governmental, legal, market, competitive, supplier, technological, geographic, and

social cultural settings to determine opportunities

Environment has a far reaching impact on business

Environment impact presents an essential focus of strategist who analyse and study changes

within a business environment with an aim to take appropriate decisions at appropriate time. If

strategist neglect to or fail to adequatly respond to these changes at the right time this may have

far-reaching implications on the organisations survival, stability, growth, profitability. The

development of organisation depends critically on micro and macro factors of the business

environment which reflect threats and opportunities to their firms/company/organisation.

In the process of Environmental analysis a successful business enterprise has to identify,

appraise and respond to the new dimensions of changing business environment, the process which

requires to identify threats in its internal and external environment and search for various

opportunities in the market.

It involves continuous monitoring and accumulation of adaptation capabilities related to the

changes in the environment (think for instance about the impact of environmental regulation on

businesses)

BE analysis presents a helpful tool to survival and prosper of the business activities. Environment

diagnosis principally consists of managerial decisions which attempt to foresee and identify

strategic competitive forces of their business related to external factors of influences. Having said

this, however, internal environment of the organisation related to its organisational, managerial

and technological capabilities is a quite essential and important from the point of view of the

environment analysis. It is the cornerstone of the new and exiting business opportunity analysis

too.

III BE- Framework of analysis- Business analysis and interrelatedness b/w business and environment

Relationship b/w organisation and its environment

A. Exchange of Information-It refers to data or information is exchanged with business

enterprise and its interna and external environment . Exchange of information occurs in the

following ways:

Business organisation scans the external environment and internal environment components and

their behavior, changes and thereby generates important information and valuable uses for

business and make proper planning, decision making and control of environment variables in the

organisation.

Business organisation structure and functions are adjusted towards the external environment

information.

Generation of external environment information is complex and it is one of the major problem and

it involves uncertainty to business organisation.

A business project look for current information and future information which are relating to

demography, competition, technical, legal, political and government policies and procedures.

B. Exchange of Resource- Exchange resource is the second and dominate relationship with the

business enterprise and its environment. Exchange of resources occures in the following ways:

Business enterprise receives inputs like finance, materials, manpower, equipment and labor force

from the external and internal environment via contractual and other arrangements.

Availability and disposal of resources, products and services are influenced by the forces of

external environment, and assume the interaction process with the external environment for

perceiving the needs of business as well as the external environment, in this way satisfying the

expectations and demands of clients, customers, employees, shareholders, creditors, suppliers,

local community.

THE IMPORTANCE OF ENVIRONMENTAL ANALYSIS

..... processes of analysing and evaluating micro (immediate) and macro (general)

environment of business to determine opportunities and threats.....

Need to constantly engage in auditing and screening the environment that influence business;

concern over effective utilization of scarce resources and capabilities, survival and competition,

business performance improvements.

Anticipate future developments and firm/organisation prospects strategic planning, interest

grouping, lobbying, collective bargaining, advocacy and negotiation.......

III BE- Framework of analysis -3

Components of Business Environment and its analysis

Economic environment- economic conditions, economic polices, and the economic system

Political and legal political system, stability and ideology, legal aspects of business regulation

legal extensiveness and efficiency the rule of law, business regulation

Socio-economic: Cultural- social values, customs and tradition, Demographic population size,

structure, growth, education

Natural Environment geographical and ecological factors

Technological the level of technological development and technological circumstances including

technological availability, complementarities/interdependencies, changing patterns.

Framework of analysis BE from the intl institutions (donors) perspective

Although generally perceived as important and reflecting locational quality of a particular

destination, BE still suffers from serious not only terminological but also conceptual disarray,

particularly among international institutions. Principally, there are number of key factors that, for

instance, donor agencies include in their definitions.

These are governance, policy frameworks, macroeconomic policies and strategies, legal and

regulatory frameworks, organisational frameworks, organisational capacity, access to

infrastructure, cost of infrastructure, access to finance, cost of finance, social conditions &

services, cultural & attitudinal influences and support services.

It is also useful to reflect on conceptual differences in terms of different approaches to BE among

international institutions, and specifically the issues they cover, and elements these conceptual

frameworks include.

BE in the context of emerging market economies

Donors and govts in developing and transition countries (TE) have been paying growing attention

to improving the environment for business as a means of promoting enterprise development,

economic growth, increasing employment, improving welfare and reducing poverty.

The focus on the business environment (BE) is a response to disappointing experiences with direct

support measures to firms, including finance and business development services (BDS), and the

finding that the positive effects of direct support measures, where they occur, are undermined if

the wider environment is characterised by burdensome regulations, poor service delivery,

corruption and a weak entrepreneurial culture.

IV Differing approaches to BE

The concept of business climate, as used by donor agencies, refers to the laws and regulations

that directly impact companies. A Business Climate Survey (BCS) primarily looks at laws and

regulations and the extent to which they do or do not discourage business activities.

In RIA, the term regulationover time acquired a broader meaning- an RIA would take a close

look at, for instance, how the particular market or industry is regulated, and what impact does it

have on business.

An Investment Climate Survey (ICS) takes a yet wider perspective and also investigates service

provision from government in areas like physical infrastructure.

So what then is the business environment? BCS, RIA and ICS or something else.....each give

a different answer. The common denominator, though, is their focus on government. They are all

based on the assumption that government intervention is the problem, not the solution, and that the

most promising approach to creating a favourable business environment is to get government out

of the way as far as possible.

Note that government service delivery in developmental activities is not addressed by any of the

intl agency approaches mentioned so far. According to the orthodox view in donor agencies, this

is the world of business development services (BDS), i.e. an area where government should not

directly deliver services to companies in the first place.

Conclusion

So what then is the business environment? BCS, RIA and ICS or something else.....Looking

more closely at the BE Framework of analysis by international institution we may conclude that

each give a different answer as to what factors constitute BE, or which of those are of importance

in understanding their influences on business, and private sector growth in particular.

The aim of the lectures to follow is to disentangle the meaning, the scope and the pace of BE

analysis.

To debunk to myths associated with the controversial aspects of business environment.

To learn about important and specific components of BE, how they interact with business and why

it is important to study those.

Economic environment refers to all those economic factors which have a bearing on the

functioning of a business unit. It is difficult to be precise about the factors which constitute the

economic environment of a country.

Still there are conventional factors which have considerable influence.

The economic environment is generally divided into the

microeconomic environment, which affects business decision-making such as individual actions

of firms and consumers, and the

macroeconomic environment, which affects an entire economy and all of its participants,

while the primary conceptualization of economic environment reveals the following components:

economic systems,

economic conditions,

and economic policy.

Content part 1

The Conceptual framework of EEB explores the conceptual nature of the macroeconomic

environment in which business operates. What are the key macro-economic determinants of

business performance.

The Mechanism of influence: how macroeconomic policy instruments influence business

operations and business performance?

Empirical study? The effect of economic recession on companies in the UK.

What is economic environment of business and why is it important?

Outside influences that can impact a business include various external factors, among which

economic factors are of predominant importance as these can impact the ability of a business or

investment to achieve its strategic goals and objectives.

EE refers to all those economic factors, which have a bearing on the functioning of a business.

Business depends on the economic environment for all the needed inputs. It also depends on the

economic environment to sell the finished goods.

Naturally, the dependence of business on the economic environment is total and is not surprising

because, as it is rightly said, business is one unit of the total economy.

Many economic factors act as external constraints or opportunities on business entities, over

which they have little, if any, control or infulence.

As noted earlier, the economic environment consists of external factors in a business' market and

the broader economy that can influence a business.

Generally, EE refers to all those economic factors which affect the functioning of a business unit.

It refers to the totality of economic factors, such as employment, income, inflation, interest rates,

productivity, and wealth, that influence the buying behavior of consumers, access to factor

resources and production factors and institutions.

Principally, EE is composed of:

economic system,

economic policy,

economic conditions, and

other specific economic factors.

Importantly, these features of EE are interdependent and interrelated and determine the character

and the nature of economic environment of business.

Lets focus more closely on these features and their interdependence.

i) Economic systems, what are they? The way a society decides to use and distribute its resources

within the economy.

There are three principal questions of relevance here:

Who determines the prices and the quantities produced in this system? (i.e. government

authorities vs. free markets)

Who controls resource allocation and the distribution of resources in this system? (i.e.

Government authorities vs. Businesses, or both)

Who can own property in this system? (i.e. anyone or govt solely, or ?)

Theoretically there are three basic economic systems:

captalism (assuming private ownership, free-market and competition mechanism

underpinned by profit maximisation motive to determine the prices and resource allocation

within the economy),

communism/socialism (assuming command economy revealing prevasive govt role in

production and distribution of economic resources and control of resource distribution,

prohibits/restricts private ownership),

mixed economy/welfare economies (capitalist systems in principle, implying also public

ownership where appropriate (i.e. provision of essential/merit public goods, ensuring

equity and welllbeing of society).

BE CAUTIOUSS in interpreting economic systems

However, in today's world it is quite difficult to draw definite boundaries between these basic

economic systems, think of China for instance, or try to point at a single strictly capitalist

economic system as defined ???

Unlike rigorous definitions of economic systems as such, most capitalist societies reveal mixed

economic systems, principally in line with the objectives of the welfare state. These states

function based on essential capitalist premises related to economic principles of efficient and

perfect markets, private ownership and incentives... However, they also resume public ownership

and management in particular instances (e.g. provision of public goods and services), active

government role in promoting positive externalities, correcting market failures, as well as rely on

extensive regulatory role of govt attempting to promote not only economic efficiency but also

equity and societal wellbeing.

HENCE REMEBER that the context of the topic examined in this course focuses on market-based

economies or economic systems, so features and specificities of business environment associated

with command/socialist economies is of no principal interest to us.

Given the problems related to the common rigid clasification of econimic systems, it seems more

appropriate to clasiffy economic systems into:

capitalism - also known as free enterprise economy and market economy. Where two

types of capitalism may be distinguished:

The old, laissez-fair capitalism, where government intervention in the economy is

absent or negligible; and

The modern, regulated or mixed capitalism, where there is a substantial amount of

government intervention.

socialism/communism where the tools of production are to be organized, managed and

owned by the government, with the benefits occurring to the public. Socialism does not

involve an equal division of existing wealth among the people, but advocates the

egalitarian principle.

ii) Economic conditions is generally referred to as the state of the economy in a country related

to economic and business cycles.

In other words, economic conditions change depending on whether the economy is expanding

positively affecting businesses or contracting which is adversely affecting economic activities

over time.

A country's economic conditions are influenced by numerous macroeconomic and microeconomic

factors, including monetary and fiscal policy, the state of the global economy, unemployment

levels, productivity, exchange rates and inflation.

iii) Economic policy generally refers to the actions that governments take in the economic field,

with an attempt to promote wellbeing of the society.

Economic policy alter economic system and conditions, determine and influence economic factors

(e.g. Interest rate, taxes) and attempt to create an environment conducive to growth and

development.

Notwithstanding the importance of understanding the aforementioned essential components

encompassing economic environment, it is useful to divide the economic environment into:

a) the macroeconomic environment, which affects an entire economy and all of its participants.

These factors include among others, Interest rates,Taxes, Inflation, Currency exchange rates,

Consumer discretionary income, Savings rates , Consumer confidence levels, Unemployment rate,

Recession, Depression.

b) the microeconomic environment, which affects business decision-making such as individual

actions of firms and consumers. Unlike macroeconomic factors, these factors are far less broad in

scope and do not necessarily affect the entire economy as a whole. Microeconomic factors

influencing a business include: Market size, Demand, Supply, Competitors, Suppliers,

Distribution chain.

Let's examine the mechanisms of influence associated with macroeconomic environment while

referring to few examples:

If interest rates are too high, the cost of borrowing may not permit a business to expand, or may

even adversely affect ongoing investments.

On the other hand, if unemployment rate is high, businesses can obtain labor at cheaper costs.

However, if unemployment is too high, this may result in a recession and less discretionary

consumer spending resulting in insufficient sales to keep the business going.

Tax rates will take a chunk of your income; labour-related taxes will influence companys labour

costs, employment levels and policy.

Currency exchange rates can either help or hurt the exporting of your products to specific foreign

markets, hence high exchange rate volatility impose a great risk to viability and sustainability of

intl ecc. transactions.

Now, let's turn our attention to microeconomic factors and consider the mechanism of influence

on business, similalry refering to few examples:

Market size may determine the viability of entering into a new market. If a market is too small,

there may not be sufficient demand and profit potential. This leads us to the concept of demand

and supply. If your product is in high demand but there is a low supply of it, you are going to

make a tidy profit, but if your product is in low demand and the market is flooded with similar

products, you may be facing bankruptcy.

The quality and quantity of your competition will affect how well you do in winning customers in

the marketplace.

Suppliers are the arteries pumping vital supplies and resources to you for production. If you have

problems with suppliers, it can clog up those arteries and cause serious problems.

Likewise, the type of relationship you have with your distributors, such as retail stores, may

influence how quickly your products leave their shelves.

The role of Economic policy

Beginning with macro-economic factors, we examine the importanc of macroeconomic policy in

shaping the business environment.

Economic expansion is of outmost importance in that it infulences businesses growth prospects. It

can be seen that there is a clear conceptual link between macro economic policy reform and

economic growth.

Let us first consider the following question:

What are the targets of macroeconomic policy?

Macroeconomic stability, Economic growth, Control of inflation, Full employment, External

balanceLet us now examine more closely individual macroeconomic policy targets.

1. What is macroeconomic stability and why is it important?

The logic is simple: most investors seek relative stability and predictability in making an

investment. In the absence of such stability investors face risk associated with business strategic

decesions and forecasts, most investors will withhold their investment or seek other opportunities

in more stable environments.

Econometric studies show that macroeconomic stability is essential for economic growth. For

example, Easterly and Kraay (1999) using cross-country analysis show that growth is positively

related to macro economic stability.

2. Why is economic growth important?

Growth is condicio sin e qua non for the improvements of living standards of the population.

While some capital accumulation can be contributed to the public sector, it is mostly the private

sector that drives capital accumulation and therefore growth. It accounts for most increases in

employment and improvements in living standards.

This is why economic or macroeconomic reforms are targeted to benefit and spur private sector

growth and development.

3. What govt policies are there to achieve the Policy Targets?

A Fiscal Policy decisions and policy options related to taxation and public expenditures.

B Monetary Policy -decisions and policy options related to the rate of interest and the supply of

money to the economy.

C Exchange Rate Policy decision on exchange rate regime

D Competition and Industrial Policy decisions and policy options that attempt to ensure fair

market competition; policies to promote growth of selective industrial sectors.

Conflict and disarray of government policies trade policy, distributional policies income

distribution, disposable income

What are key Fiscal policy instruments and actions?

Fiscal approaches (balanced budget, budget deficit/surplus)

STOP & THINK key questions to be explored

What effect will a Budget Deficit and a Budget Surplus have on the Growth of an Economy?

What effect will a Budget Deficit and a Budget Surplus have on Inflation?

What effect will a Budget Deficit and a Budget Surplus have on Employment?

What effect will a Budget Deficit and a Budget Surplus have on the Balance of Payments?

What are key Monetary policy instruments and actions?

Monetary approches (expansionary, restrictive/ austerity)

STOP & THINK key questions to be explored

What effect will lowering interest rates have on the economy?

How can Government increase or decrease the money supply in the economy?

What relationship is there between the interest rates and the money supply?

What relationship is there between the interest rates and the inflation?

What are key Exchange rate policies? Fixed ERR (Currency Board, Currency Pag); Floating ERR (Free

float, Managed float)

What do we mean by Competition policy policy objectives?

To ensure that there are no monopoly providers who tend to maximise profits by charging prices

that are higher than a competitive market and do not respond to consumers preferences

To ensure that the competitive forces operate to optimise the allocation of resources and a

responsiveness to the choice of the consumer

To ensure that the full social costs of productions and distribution are reflected in the price

charged to consumers (e.g. environmental tax)

What do we mean by Industrial policy? In principle these are policies which excercise

selectivity principle (non-neutrality) with an aim to promote growth and build competitive

advantage of selected industires.

How do macroeconomic policies affect business?

Economic growth (supply & demand, business cycle)

In principle the fundamental mechanism of influence is through economic growth patterns. If

Government policies increase the economic growth then it is likely the companys sales will grow.

Supply and demand impacts a nation's GDP. If Government policies increase the level of demand

in the economy then it is very likely that the companys product will sell.

At what stage of the business cycle is the economy? If the economy is going through a recession it

is obvious that businesses generally will not be doing well due to low aggregate demand in the

economy. On the other hand, a boom period will lead to higher business profits and revenue for

most of the businesses in the economy.

How do macroeconomic policies affect business-continued?

Inflation mechanism

If the level of inflation rises because of Government policies this would make it easier for the

company to raise its prices but the costs will also increase. If wages don't rise at the same rate of

inflation, people actually lose money- this affect the demand pattern. When inflation rises, the

value of the local currency decreases which affects imports.

How do macroeconomic policies affect business-continued?

Interest rate mechanism

Interest rates increasing make borrowing expensive thus pushing up the cost of any overdrafts and

also the cost of borrowing for major investments which affects supply-side capacities. Also,

Fluctuation in interest rates can have an impact on consumer purchasing; when interest rates are

high, consumers may be less inclined to borrow money to buy a new home or car- whihc affects

demand pattern.

People who have adjustable-rate home mortgages can face financial hardship or even lose their

homes when interest rates spike.

How do macroeconomic policies affect business-continued?

Exchange rate policy

Transactions between different countries around the world create a need for money exchange.

Each country has its own currency system. As a result, companies need to convert currencies by

buying or selling the currency of one country to another.

These transactions are associated risks of ERR fluctuations. If the foreign currency exchange rate

is increasing local companies will struggle to compete overseas because their overseas prices will

be high.

At this stage, the success of an international company is relative to the currency of the country

where it operates ERR directly affects countries levels of imports and exports ( J-curve?)

These risks are usually mitigated by using the exchange rate of different available markets such as

the spot market, forward market and the future market depending on the ultimate goals. If the

currency of that country is soft which means it is not easily convertible, this may present a

problem.

How do macroeconomic policies affect business-continued?

Unemployment level

The rate of unemployment can have a major effect on the economy. An economy that is near to

full employment will pose a problem for companies because good workers will be hard to find and

expensive to employ.

The more people who are out of work, the less money that is circulated into the economy through

the purchase of goods and services. Even the threat of unemployment has an impact, as workers

who fear losing their jobs are less inclined to spend or invest their money.

Interaction pause BE Analysis in Practice

Consider and Discuss

(Macro)-economic business environment analysis:

an example of UNICREDIT-GROUP

Given the precedant importance of the economic environment the business operates in Economic

analysits supply business entities with the Macro economic forecast and research considered of

relevance

These BE analysis are found not only in major companies in manufacturing, commerce and

finance, but all accountable business entities.

These confirm the importance of economic environment in business.

III Empirical Study- Example of how economic environment affects business

Research Study: The impact of economic recession on business strategy planning in UK

companies (CIMA, 2012)

The key findings from this research were:

There is very little optimism about the prospects for the UK economy in the short to medium-

term.

There is quite a degree of optimism from companies about their own commercial future based on a

combination of factors such as: accessing overseas markets, improving the way they do things,

better customer relations, product innovation etc.

Businesses recognise the importance of having a robust business strategy to guide them through a

recessionary period. However, what was done in response to the recession largely conforms to the

emergent theory of strategy formulation.

Content part 2

The Importance of Investment Climate for Business growth and development: associated with

Private sector Development Policy which is a multidimensional approach to improve BE.

The meaning and the scope of Business Enabeling Environment (BEE) from international donnor

community perspective

The intersection between economic and other aspects of business environment within BEE

approach

Cross-cutting issues and the key economic factors within BEE apporach

Financial markets as key economic factor of doing business, characterists within emerging market

economies and developed market economies.

I The concept of Business Enabling Environment

The business enabling environment (BEE) is now widely recognised within major intl institutions

and donor community as a mechanism through which greater development outcomes can be

achieved.

The World Development Report (WDR) 2005, which is based on an extensive array of data

sources including Investment Climate Surveys and the Banks Doing Business reports, defines a

sound enabling environment for private sector led growth as critical.

The WDR 2005 establishes that, while private firms are at the heart of the development process,

their contribution to these processes is largely determined by the investment climate.

The investment climate shapes the costs and risks of doing business, as well as barriers to

competition, all of which strongly influence the role of the private sector in social and economic

development.

Empirical evidence in support of the hypothesis are numerous and growing- in case of India, for

instance, improvments in BEE can incrase GDP by up to 2% per annum (ceteris paribus).

According to the OECD Development Assistance Comitte, effective BEE requires the creation of:

strong incentives for domestic and foreign private investment; the fostering of international

economic linkages; access to new assets and markets; and the need for competition to spur

innovation and raise productivity.

Research into the enabling environment and country investment climate assessments have

invariably found that developing countries are challenged by poor public governance, weak

infrastructure, and policy and legal frameworks that are inconsistent, unstable, and unpredictable.

The cross-cutting nature of the enabling environment has led to an increasing awareness of the

interrelationships between different aspects of BE; private sector development generally; financial

services; the provision and maintenance of infrastructure; trade and investment; and agriculture

and rural development.

I Differing approaches to BEE policy area focus

Private sector development work is increasingly adopting a multidisciplinary approach involving

enterprise, economic, governance, livelihoods and infrastructure perspectives

Key policy area supported by intl community include:

Support to productive dialogue and the development of trust between government and

business.

Support to Legal and regulatory reform: because over-regulation of business stifles

enterprises, reducing incentives to invest and grow, the simplification and improvement of

business laws and regulations and the development of more accessible commercial justice

systems is key priority.

Support to Privatisation: reform and privatisation of state-owned enterprise and banks to

reduce the fiscal pressure on govts and to facilitate private sector development by

unblocking sectors of economy dominated by inefficient public enterprise.

Making markets work for the poor; and (v) Competition policy

I Creating an enabling environment for investment: Economic factors

Donors implement a range of activities and programmes at both central and country levels aimed

at promoting a more conducive enabling environment for both domestic and foreign investment,

highlighting the policies, regulatory frameworks and institutions that businesses need to grow, for

instance, we extract those strictly related to economic policy:

Identify and remove barriers to foreign and domestic investment, especially promote effective

FDI-related policies and institutions,

Identify the barriers related to the taxation policy (indirect taxes, direct taxes e.g. labour

taxation), assess the impact of country credit ratings and taxation regimes on private investment

Creating an enabling environment for financial services has traditionally focused on the design,

creation and development of specialised institutions (e.g., microfinance institutions) to deliver

financial services. The emphasis now is on how improvements to the policy, legal and institutional

framework for financial systems development can widen and deepen access to financial markets

generally.

Economic factors of business: financial markets and access to finances in emerging economies

Access to financing presents one of major constraints for business growth in emerging market

economies

The reasons are multiple, but the predominant are often found to be amongst the following:

Underdeveloped financial markets and instruments

Poor supply side capacity inefficient enterprises, lack of FM knowledge and capacity,

structure of private sector with dominant SME.

Cost of capital too high, mostly has to do with low levels of domestic capital accumulation

and savings

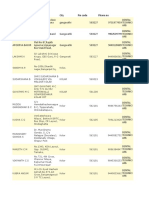

Example A: Survey Results WB (2004) Country-Level: Reported Constraints and

Impediments to financing

Unprofitable projects (e.g., too risky, insufficient profitability & scale, high upfront expense)

Inadequate legal and regulatory frameworks (especially at regional and subsovereign levels;

issue with local banking provisions for guarantees)

Unacceptable cross-border risk & insufficient access to local funding (government crowding

out, pension funds restrictions, government fiscal constraints)

Weak local partners (e.g., operators, government)

Difficulty/expense coordinating with multiple official donors

Example B: Survey Results from the Study by Ayyagari et al. (2006)

The tittle of the study: How Important Are Financing Constraints? The role of finance in the

business environment

The principal question of the study: What role does the business environment play in

promoting and restraining firm growth? Recent literature points to a number of factors as

obstacles to growth. Inefficient functioning of financial markets, inadequate security and

enforcement of property rights, poor provision of infrastructure, inefficient regulation and

taxation, and broader governance features such as corruption and macroeconomic stability.

The study uses firm level survey data to present evidence on the relative importance of

different features of the business environment. They find that only obstacles related to finance,

crime and political instability directly affect the growth rate of firms, with obstacles to

financing exhibiting greatest adverse impact on firms growth performance.

Examining the Financing obstacle in more detail, they find that although firms perceive many

specific financing obstacles, such as lack of access to long-term capital and collateral

requirements, only the cost of borrowing (i.e. interst rates) directly affects firm growth.

The study hilights the importance of access to finances as key economic factor of BE

Economic policies to promote financial market development in DC

Most common policy solutions to foster financial market development in DC:

Financial and capital market liberalisation lifiting of capital movement controls

Privatisation of banking sector principally associated with attracking foreign banks

Establish prudent financial supervisory regulation and institutions, with an explict aim to

secure individual depositors, and promote prudent and stable banking sector

BEE: financial services as key economic factor for business growht in industrialised countries

Developed financial markets are prerequisite of business development and growth.

However, access to favorable financing is of key importance and is not guaranteed per se by

the mere existence of developed financial markets due to prevalent market failures inherent in

financial sector:

Even in industrialized countries, characterized by the developed financial markets there are

pervasive market failures related to financing (e.g. innovation)

Growth in modern economies is based on efforts to increase productivity through innovation,

and innovation is an essential precondition for technological and structural changes, as well as

a contributor to growth and competitiveness.

A fundamental component of strategic innovation management is the long-term decision to

innovate, which is accompanied by the need to establish structures and resources for the

acquisition of technology.

Financing restrictions hamper innovation The latest Community Innovation Survey shows

that in the EU27, 52% of enterprises in industry and services reported innovation activity

(between 2006 and 2008). The highest levels of reported innovation were in Germany (80%)

and Luxembourg (65%), and the lowest in Latvia (24%) and Poland (28%). Often, firms

reported having ideas for technically feasible and customer-demanded innovation but that they

lacked the resources to implement them; hence, financing restrictions are reducing

innovation activities at the firm level.

This is also confirmed by empirical studies. For example, the European Commission (EC) in

2009 consulted more than 1,000 enterprises and 430 innovation intermediaries with the result

that two main factors were seen as hampering innovation activities in enterprises: (1) lack of

access to financing (70%); and (2) innovation costs that are too high (65%). As a consequence,

many firms have to rely on internal funding.

What explains the presence of financing restrictions, or generally access to financing related

to innovation and technological progress.

J-curve cash flow and business risk require seed-stage firms to rely on internal funds or

venture capital investing in innovation and new technology typically follows a negative

cash flows during the seed and startup stages, with cash flows becoming positive at the early

growth stage. Debt financing, which requires guaranteed regular repayments, is often not

suitable for small or even medium sized firms let alone young, innovate enterprises.

Instead, such enterprises, at least in their early, seed stage, have tended to rely on financing

from the founders own funds, and funds from family and friend

This tends to be provided in the form of venture capital (VC) either formally by seed funds

or venture capital funds, or informally by business angels.

Responsive and accountable govt attempts to intervene to restore or remove market failures.

In this specific context EU govts provide excessive and special financing instruments to

compensate for lack of financing of technological and innovative activities.

Public funds in EU for instance have assumed increased importance in the early-stage sector

during the current economic climate. Government agencies (including the European

Investment Fund) provided more than 30% of the funds raised by VC funds (from identifiable

sources in Europe) during 2009 and 2010.

The overall increase is partly the result of declining overall fundraising; however, the absolute

contribution of government agencies has increased by almost 80% over the past three years .

EC provides comprehensive financial assistance for innovation-collaboration and green

investment activities.

Concluding remarks

STOP & THINK

What are the obvious implications for business related to the differencies in the development

of financial markets and instruments between developing and developed countries?

a) what are the implications for local companies being fully exposed to intl competition on

domestic markets assuming presistent constraints to access (favourable) finances by local

companies in DC?

Вам также может понравиться

- Primjeri Za PrezentacijuДокумент2 страницыPrimjeri Za PrezentacijuAmra MutilovićОценок пока нет

- Chap 011Документ13 страницChap 011Amra MutilovićОценок пока нет

- Chap 012Документ13 страницChap 012Amra MutilovićОценок пока нет

- Chap 014Документ13 страницChap 014Amra MutilovićОценок пока нет

- Chap 010Документ13 страницChap 010Amra MutilovićОценок пока нет

- Chap 006Документ14 страницChap 006Amra MutilovićОценок пока нет

- Chap 013Документ14 страницChap 013Amra MutilovićОценок пока нет

- Chap 009Документ14 страницChap 009Amra MutilovićОценок пока нет

- Chap 003Документ11 страницChap 003Amra MutilovićОценок пока нет

- Chap 008Документ13 страницChap 008Amra MutilovićОценок пока нет

- Chap 002Документ14 страницChap 002Amra MutilovićОценок пока нет

- Chap 005Документ13 страницChap 005Amra MutilovićОценок пока нет

- Chap 004Документ14 страницChap 004Amra MutilovićОценок пока нет

- Chap 007Документ12 страницChap 007Amra MutilovićОценок пока нет

- Accompanying Material For Lecture 1Документ3 страницыAccompanying Material For Lecture 1Amra MutilovićОценок пока нет

- Business EnvironmentДокумент11 страницBusiness EnvironmentAmra MutilovićОценок пока нет

- Chap 015Документ14 страницChap 015Amra MutilovićОценок пока нет

- Chap 001Документ14 страницChap 001Amra MutilovićОценок пока нет

- Corporate FinanceДокумент9 страницCorporate FinanceZerina PačarizОценок пока нет

- Strategic ManagementДокумент9 страницStrategic ManagementAmra MutilovićОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- سلفات بحري كومنز PDFДокумент8 страницسلفات بحري كومنز PDFSami KahtaniОценок пока нет

- Introducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingДокумент35 страницIntroducing HR Measurement and Reporting: Ensuring Executive Alignment and UnderstandingkoralbiruОценок пока нет

- Nature of Vat RefundДокумент7 страницNature of Vat RefundRoselyn NaronОценок пока нет

- SAHANA Disaster Management System and Tracking Disaster VictimsДокумент30 страницSAHANA Disaster Management System and Tracking Disaster VictimsAmalkrishnaОценок пока нет

- IDM Sem 6 Jury WorkДокумент13 страницIDM Sem 6 Jury WorkRabi KantОценок пока нет

- Risk Management ProcessДокумент17 страницRisk Management ProcessUntuk Kegiatan100% (1)

- Criticism of DAT SutherlandДокумент2 страницыCriticism of DAT SutherlandBabarОценок пока нет

- Cover LetterДокумент2 страницыCover LetterAditya Singh0% (1)

- GAAR Slide Deck 13072019Документ38 страницGAAR Slide Deck 13072019Sandeep GolaniОценок пока нет

- Tesco Vs Asda - EditedДокумент15 страницTesco Vs Asda - EditedAshley WoodОценок пока нет

- CRM AssignmentДокумент43 страницыCRM Assignmentharshdeep mehta100% (2)

- KTP Leng: Rawngbawl Leh A That Dan BerДокумент4 страницыKTP Leng: Rawngbawl Leh A That Dan Berlaltea2677Оценок пока нет

- PrecedentialДокумент41 страницаPrecedentialScribd Government DocsОценок пока нет

- Course Code: EDU15104DCE Course Title: Population Education: Unit 1Документ7 страницCourse Code: EDU15104DCE Course Title: Population Education: Unit 1Danielle Joyce NaesaОценок пока нет

- Dentapdf-Free1 1-524 1-200Документ200 страницDentapdf-Free1 1-524 1-200Shivam SОценок пока нет

- Puyat vs. Arco Amusement Co (Gaspar)Документ2 страницыPuyat vs. Arco Amusement Co (Gaspar)Maria Angela GasparОценок пока нет

- The History of Sewing MachinesДокумент5 страницThe History of Sewing Machinesizza_joen143100% (2)

- Fundamentals of Accounting I Accounting For Manufacturing BusinessДокумент14 страницFundamentals of Accounting I Accounting For Manufacturing BusinessBenedict rivera100% (2)

- Summary (SDL: Continuing The Evolution)Документ2 страницыSummary (SDL: Continuing The Evolution)ahsanlone100% (2)

- HSEMS PresentationДокумент21 страницаHSEMS PresentationVeera RagavanОценок пока нет

- HANA Presented SlidesДокумент102 страницыHANA Presented SlidesRao VedulaОценок пока нет

- Utilitarianism and The Ethical Foundations of Cost-Effectiveness Analysis in Resource Allocation For Global HealthДокумент7 страницUtilitarianism and The Ethical Foundations of Cost-Effectiveness Analysis in Resource Allocation For Global HealthZainab AbbasОценок пока нет

- The Ethiopian Electoral and Political Parties Proclamation PDFДокумент65 страницThe Ethiopian Electoral and Political Parties Proclamation PDFAlebel BelayОценок пока нет

- Profile - Sudip SahaДокумент2 страницыProfile - Sudip Sahasudipsinthee1Оценок пока нет

- H-05Документ11 страницH-05lincoln9003198Оценок пока нет

- Ch02 Choice in World of ScarcityДокумент14 страницCh02 Choice in World of ScarcitydankОценок пока нет

- RA 9072 (National Cave Act)Документ4 страницыRA 9072 (National Cave Act)Lorelain ImperialОценок пока нет

- The Role of Business in Social and Economic DevelopmentДокумент26 страницThe Role of Business in Social and Economic Developmentmichelle80% (5)

- India's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsДокумент11 страницIndia's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsMAHANTESH GОценок пока нет

- Name: Joselle A. Gaco Btled-He3A: THE 303-School Foodservice ManagementДокумент3 страницыName: Joselle A. Gaco Btled-He3A: THE 303-School Foodservice ManagementJoselle GacoОценок пока нет