Академический Документы

Профессиональный Документы

Культура Документы

Ashiana Crisil PDF

Загружено:

Jaimin ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ashiana Crisil PDF

Загружено:

Jaimin ShahАвторское право:

Доступные форматы

Ashiana Housing

Limited

Independent Equity Research

Enhancing investment decisions

In-depth analysis of the fundamentals and valuation

Business Prospects

Financial Performance

Corporate Governance

Management Evaluation

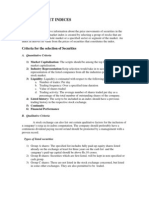

Explanation of CRISIL Fundamental and Valuation (CFV) matrix

The CFV Matrix (CRISIL Fundamental and Valuation Matrix) addresses the two important analysis of an investment making

process Analysis of Fundamentals (addressed through Fundamental Grade) and Analysis of Returns (Valuation Grade)

FundamentalGrade

CRISILs Fundamental Grade represents an overall assessment of the fundamentals of the company graded in relation to

other listed equity securities in India. The grade facilitates easy comparison of fundamentals between companies, irrespective

of the size or the industry they operate in. The grading factors in the following:

Business Prospects: Business prospects factors in Industry prospects and companys future financial performance

Management Evaluation: Factors such as track record of the management, strategy are taken into consideration

Corporate Governance: Assessment of adequacy of corporate governance structure and disclosure norms

The grade is assigned on a five-point scale from grade 5 (indicating Excellent fundamentals) to grade 1 (Poor fundamentals)

CRISILFundamentalGrade Assessment

5/5 Excellent fundamentals

4/5 Superior fundamentals

3/5 Good fundamentals

2/5 Moderate fundamentals

1/5 Poor fundamentals

ValuationGrade

CRISILs Valuation Grade represents an assessment of the potential value in the company stock for an equity investor over a

12 month period. The grade is assigned on a five-point scale from grade 5 (indicating strong upside from the current market

price (CMP)) to grade 1 (strong downside from the CMP).

CRISILValuationGrade Assessment

5/5 Strong upside (>25% from CMP)

4/5 Upside (10-25% from CMP)

3/5 Align (+-10% from CMP)

2/5 Downside (negative 10-25% from CMP)

1/5 Strong downside (<-25% from CMP)

Analyst Disclosure

Each member of the team involved in the preparation of the grading report, hereby affirms that there exists no conflict of interest that can bias

the grading recommendation of the company.

Disclaimer:

This Company-commissioned Report (Report) is based on data publicly available or from sources considered reliable. CRISIL Ltd. (CRISIL)

does not represent that it is accurate or complete and hence, it should not be relied upon as such. The data / Report are subject to change without

any prior notice. Opinions expressed herein are our current opinions as on the date of this Report. Nothing in this Report constitutes investment,

legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assumes the entire risk of any use made of this data / Report.

CRISIL especially states that it has no financial liability, whatsoever, to the subscribers / users of this Report. This Report is for the personal

information only of the authorized recipient in India only. This Report should not be reproduced or redistributed or communicated directly or

indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any purpose.

CRISIL Equities 1

Independent Research Report Ashiana Housing Limited

Good company, good story

Industry: Real Estate Management & Development

Date: November 03, 2010

Delhi-based Ashiana Housing Ltd (Ashiana) is a mid-sized real estate player focused on

affordable homes and retirement housing projects. It has developed ~9 mn sq.ft. of area

and has a healthy pipeline of ~7 mn sq.ft. over the next four-five years. However, limited

land bank inventory reduces future visibility. We assign Ashiana a fundamental grade of

3/5, indicating that its fundamentals are good relative to other listed securities in India.

Strong track record - known for quality constructi on and transparent busi ness

Ashianas past track record and a robust pipeline of projects clearly support the fact that it

is an established player in the industry. Its position is supported by superior quality of

construction, timely delivery and transparent business structure. This enables Ashiana to

sell properties at premium rates compared to its peers projects in the same location. We

expect this trend to continue in the future.

Busi ness model di fferent from peers; well positi oned to weather cycli cal ri sks

Unlike other real estate players, Ashiana builds residential projects which are generally

self-sufficient in terms of funding as against commercial projects. The company does not

build a huge land bank reserve or engage in buying expensive land parcels. This results in

comparatively lower capital requirement and consequently limited financial liabilities.

Therefore, we believe that Ashiana is well positioned to withstand cyclical risks compared

to peers; it was least affected during the economic downturn in FY09.

Cauti ous strat egy on l and bank inventory reduces fut ure visi bilit y

Although the companys strategy of holding limited land bank mitigates the downside risk,

it reduces revenue visibility beyond five-six years. Therefore, future growth will be

dependent on the companys ability to continuously acquire land bank at reasonable prices

in an increasingly competitive market. The company is looking for land parcels, but we

believe there will be challenges in a new market since real estate requires knowledge of

local business environment and customer expectation.

Revenues to grow at a t wo-year CAGR of 40%, EPS to increase t o Rs 34.3 in FY12

Revenues are expected to grow at a two-year CAGR of 40% to Rs 2.2 bn in FY12 driven

by revenue recognition in Bhiwadi, Lavasa and J aipur projects. EBITDA margins are

expected to increase to 36.8% in FY12 from 34.9% in FY10 due to increasing contribution

from high-margin residential projects. PAT is expected to increase at a CAGR of 30.7% to

Rs 0.6 bn in FY12. EPS is expected to increase to Rs 34.3 in FY12 from Rs 20.1 in FY10.

Valuati on - the current market pri ce has strong upside

We have used the NAV method to value Ashiana and arrived at a one-year fair value of Rs

220 per share. We initiate coverage on Ashiana with a valuation grade of 5/5, indicating

that the market price of Rs 166 (as on November 03, 2010) has a strong upside from the

current levels.

Key forecast (consolidat ed)

Rs (mn) FY08 FY09 FY10 FY11E FY12E

Operating income

1,271 918 1,139 1,563 2,233

EBITDA

386 222 398 556 822

Adj Net income

387 286 363 439 620

EPS-Rs

21.4 15.8 20.1 24.3 34.3

EPS growth (%)

17.3 (26.8) 29.5 19.5 41.0

P/E (x)

4.5 2.1 8.3 6.8 4.8

P/BV (x)

2.6 0.6 2.3 1.8 1.3

RoCE (%)

70.3 24.7 32.6 34.3 39.6

RoE (%)

77.3 34.9 32.1 29.3 31.3

EV/EBITDA (x)

4.4 2.1 7.3 4.9 2.5

Source: Company, CRISIL Equi ties est imate

CFV matri x

Fundamental grade of '3/5' indicates good fundamentals

Valuation grade of '5/5' indicates strong upside

1

2

3

4

5

1 2 3 4 5

Valuation Grade

F

u

n

d

a

m

e

n

t

a

l

G

r

a

d

e

Poor

Fundamentals

Excellent

Fundamentals

S

t

r

o

n

g

D

o

w

n

s

i

d

e

S

t

r

o

n

g

U

p

s

i

d

e

Key stock stati sti cs

BSE Ticker ASHIHOU

Fair value (FV Rs 10) 220

Current market price* 166

Shares outstanding (mn) 18.1

Market cap (Rs mn) 2,995

Enterprise value (Rs mn) 2,732

52-week range (Rs) (H/L) 192 / 78

P/E on EPS estimate (FY12E) 4.8

Beta 1.0

Free float (%) 32.6

Average daily volumes 26,555

*as on report date

Share price movement

0

50

100

150

200

250

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

Ashiana S&P CNX NIFTY

-Indexed to 100

Anal yti cal contact

Sudhir Nair (Head, Equities) +91 22 3342 3526

Ravi Dodhia +91 22 3342 3508

Bhaskar Bukrediwala +91 22 3342 1983

Email: clientservicing@crisil.com +91 22 3342 3561

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

2

Ashi ana: Busi ness envi ronment

Parameter Real estat e - Development of resi dential and retirement housi ng properties

Product / service off eri ng Primarily into affordable residential and retirement housing properties; has one property in retail and hospitality

Geographic presence Primary area of operations: Rajasthan (~80% of future saleable area)

Also has one ongoing project each at J amshedpur (J harkhand) and Lavasa (Pune). Plans to expand its

geographic presence to western India in the near future

Market posit ion Is a mid-sized player (ongoing development of 7.1 mn sq.ft.) in the competitive north Indian market with focus on

affordable housing. Ashiana has first-mover advantage in its area of operations known for quality construction and

timely delivery of projects. It commands a premium (10-15%) over other developers in the same area

Ashiana is also a leading player in retirement housing projects

Industry outlook North India outlook Residential market is expected to remain stable; capital values expected to rise by 5% in

2011

Sal es growth (FY07-FY10

3-yr CAGR)

30%

Sal es f orecast (FY10-

FY12 2-yr CAGR)

40%

Demand drivers Strong economic outlook driving the demand for real estate. Low interest rates and improving job prospects to

boost demand for residential properties, particularly affordable homes

There is acute shortage of houses in India in the mid-income and low-income category. Urban housing needs are

expected to increase owing to continuous migration and rise in nuclear families. CRISIL Research expects housing

shortage in urban areas to touch 21.7 mn units by the end of 2014 from ~19 mn units in 2008

Key competit ors Large players Omaxe Ltd, Mahindra Lifespace Developers Ltd, Parsvnath Developers Ltd

Comparable players Ansal Housing

Sour ce: Company, CRISI L Equi t i es

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

3

Grading Rationale

A mid-sized real estate player focused on affordable homes

Ashiana is a mid-sized real estate player in north India with a focus on affordable

housing. The company has mainly developed projects in the cities of Bhiwadi and

J aipur in Rajasthan, and J amshedpur in J harkhand. It has also pioneered the

retirement housing concept in India.

Strong execution track record; known for quality construction

Ashiana has a strong track record of execution. It has developed ~9 mn sq.ft. of area

so far; 3.5 mn sq.ft. was developed in the past five years. The company further plans to

develop ~7 mn sq.ft. of residential projects over the next four-five years. It plans to

increase the equivalent area constructed (EAC) from the current 1 mn sq.ft. per year to

2 mn sq.ft. every year by FY13.

Fi gur e 1: Geogr aphy-wi se br eak-up of ar ea devel oped Fi gur e 2: Ar ea const r uct ed and booked i n past 5 year s

Sour ce: Company, CRISI L Equi t i es Sour ce: Company, CRISI L Equi t i es

Although Ashiana is a mid-sized player, it boasts a brand known for quality construction

and timely delivery. It has an in-house construction team, which helps control quality,

costs and provides execution flexibilities. It follows a direct sales approach to the end-

users and believes in long-term commitment with clients by providing management

services to the projects built by them. This enables the company to command a

premium over other developers operating in the surrounding area. For example, its

project Ashiana Angan on the Old Alwar Highway, Bhiwadi (Rajasthan) has an

average realisation of Rs 2,150 per sq.ft. compared to the average prevailing rate of Rs

1,900 per sq.ft. in the area. Since Ashiana has built a reputation of delivering quality

products at reasonable prices, we believe its ability to sell properties at a premium

compared to its peers projects will continue in the future.

Tabl e 1: Key proj ects executed i n the past

Sl.No Project name Locati on Complet ion Sal eable area (mn sq.ft.)

1 Ashiana Gardens J amshedpur 1992 0.8

2 Ashiana Utsav Bhiwadi 2008 0.7

3 Ashiana Gardens Bhiwadi 2003 0.6

4 Ashiana Woodland J amshedpur 2009 0.4

5 Ashiana Greenhills Neemrana 2008 0.3

Sour ce: Company, CRISI L Equi t i es

Bhiwadi

69%

Neemrana

6%

Jaipur

5%

Jamshedpur

20%

0.4

0.5

0.7

0.9

1.0

0.8

0.4

0.7

0.5

0.7

-

0.2

0.4

0.6

0.8

1.0

1.2

FY06 FY07 FY08 FY09 FY10

(in mn sq.ft)

Equivalent area constructed Area booked

Ashiana i s known for quality

construction and timely delivery

Ashiana has so far developed ~9

mn sq.ft. of area

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

4

First-mover advantage i n majority of its projects in tier II and III cities

Ashiana enjoys the first-mover advantage in locations where most of its projects are

located. The company was the first organised developer in Patna, Bhiwadi,

J amshedpur and Neemrana. The strategy of entering a new market and making it a

destination puts the company in a sweet spot due to lower land cost.

Affordable housing ready for strong traction - Ashiana well positioned

India is facing an acute shortage of houses especially in the mid-income and low-

income categories. Housing supply is mainly concentrated in the premium category,

resulting in a shortage of affordable houses. CRISIL Research expects urban housing

shortage to increase further owing to continuous migration and rise in nuclear families.

Housing shortage in urban areas was ~19 mn units at the end of 2008 and is likely to

touch 21.7 mn units by the end of 2014. Looking at this huge gap, real estate

developers are increasingly planning to target this segment. We believe Ashiana, with

an understanding and experience of operating in this market, is positioned well to tap

future growth potential.

Business model different from other developers; higher ability to

withstand a downturn

Unlike other real estate players, Ashiana is only into residential projects which are

generally self-sufficient in terms of funding as against commercial and hospitality

projects. Also, the company focuses on affordable and retirement housing projects, in

tier II and tier III cities where land is a smaller component (~20-25%) of the total project

cost. This results in comparatively lower capital requirement than high-end residential

projects. The company does not focus on building huge land bank reserves and does

not engage in buying expensive land parcels.

Strategy of land bank i nventory of five-seven years reduces strain on balance

sheet

Ashiana considers land bank as a raw material and keeps an inventory of five-seven

years. The strategy of holding limited land bank is in contrast to the approach of other

real estate players, who have aggressively accumulated land over the past few years

by taking substantial debt. Since Ashianas capital requirements are funded from cash

inflows from the ongoing projects, it has a limited debt which provides strong financial

flexibility. Also, the company picks up land parcels in new markets which are relatively

cheaper, translating into per sq.ft. cost of ~Rs 80.

Tabl e 2: Ashi ana i s vi rtuall y a debt-free company

Rs mn FY07 FY08 FY09 FY10

Debt 32.4 25.8 12.0 79.6

Cash 234.2 77.7 130.1 160.6

Equity 323.4 677.7 962.8 1,297.9

Net debt-to-equi ty (x) (0.6) (0.1) (0.1) (0.1)

Sour ce: Company, CRISI L Equi t i es

Enjoys first-mover advantage in

most of its project

Focuses on projects, where land i s

a small component of the total cost

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

5

enables company to weather the downturn and hol d on to prices

Due to a low burden of debt servicing, Ashiana is well equipped to weather a cyclical

downturn. In the economic downturn in FY09, many real estate players lowered their

prices, offered attractive discounts and resorted to distress sales to meet the

burgeoning financial liabilities. Most of these companies witnessed a huge decline in

profitability (on an average ~55%). Ashiana reported a comparatively lower dip in

profitability, as it was able to hold on to prices as there was no liquidity constraint.

Fi gur e 3: PAT decl i ne i n FY09 was l ower t han most of i t s peer s

Sour ce: Company, CRISI L Equi t i es est i mat e

Partnership/JV with land owners enables company to take on large projects

Ashiana is also undertaking development of projects under the joint venture model with

land owners. The company enters into joint development where the J V partner has a

clear title to the land and the regulatory approvals are in place. This mitigates the risk

of being stuck in a project due to disputes on the land title or lack of approvals. The

company has entered into a partnership with Manglam Group to develop Rangoli

Gardens in J aipur, largest project till date with saleable area of ~2.5 mn sq.ft. It has

also entered into partnership with Miras Properties (65%) and Shubhlabh Buildhomes

(50%) for its J odhpur and J aipur projects.

Pioneer in retirement housing projects in India

Ashiana is a pioneer in retirement homes; its first project - Utsav - in Bhiwadi in 2004

(640-units retirement resort) received overwhelming response and was successfully

sold by FY09. It now aims to replicate the story of Utsav in other parts of India and has

launched two projects in J aipur and Lavasa (Pune). In India, ~9% of the population is

above 60 years of age. Owing to the growing senior citizen cohort, improved financial

independence and change in mindset, we remain upbeat about the potential market for

retirement homes in India.

Retirement housi ng concept is picki ng up i n India

The status of senior citizens in India is experiencing a sea change and contemporary

retirement homes have replaced the earlier concept of old age homes. Although a

relatively new concept in India, the demand for retirement housing is growing fast

-71.0%

-38.7%

-41.1%

-77.5% -77.4%

-52.0%

-28.2%

-35.7%

-80%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

Ansal DLF HDIL Omaxe Orbit Sobha Unitech Ashiana

Ashiana pi oneered the concept of

retirement housing by launching it s

first project - Utsav - in 2004

Ashiana was able t o hold on t o

prices during downturn in FY09

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

6

among senior citizens who seek the companionship of same-age people. According to

industry sources, the retirement housing units currently estimated at ~4,000 are

expected to jump to over 20,000 units in the next three-four years. The immense

potential of this segment, with its unique needs and promises, offers ample

opportunities to real estate developers.

Tabl e 3: Detail s of exi sti ng and upcomi ng reti rement housi ng proj ects i n Indi a

Company Name Project name Locati on

Pri ce

(Rs per sq.ft .)

Paranjpe Schemes Athashri

Tamhini in Mulshi Taluka, 40 kms

from Pune, Baner , Bhawdhan-

Pune 4,000

Classic Kuthumba Classic Kuthumba Sholinganallur, Chennai 2,600

Alternative Lifestyle Pvt Ltd Melur Meadows Coimbatore, Tamil Nadu 2,231

Ashiana Housing Utsav Bhiwadi 2,100

Ashiana Housing Utsav J aipur 1,500

Ashiana Housing Utsav Lavasa (Pune) 3,100

Sour ce: CRISI L Equi t i es

Distinguished player with unique offerings to senior ci tizens

Although other real estate developers too are focusing on the retirement housing

segment, we believe Ashiana stands distinguished with its unique offerings.

Tabl e 4: Servi ces offered at reti rement houses

Hobby clubs, swimming pool, health club, and wheel chair-friendly campus

Emergency switches, large-sized switches in red colour, in-built night lamp, smooth corners and anti-

skid tiles; bathrooms are specially equipped with grab rails and arthritis-friendly handles

Weekly/fortnightly activities including cultural events and festivals

24 X 7 availability of nurses, ambulance, doctors, taxi, drivers and maids

Sour ce: Company, CRISI L Equi t i es

The biggest USP of Utsav is that it is managed and maintained by Ashianas in-house

facility management arm, which ensures highest level of safety and comfort to the

residents.

Healthy project pipeline of five-six years: Rangoli Gardens and

Ashiana Aangan are the biggest projects

Ashiana has a healthy project pipeline entailing development of 6.8 mn sq.ft.

(Ashianas share 75%) to be completed over the next five-six years. Some of the major

ongoing projects include a group housing project in J aipur and Bhiwadi, and a

retirement housing project in Lavasa.

Retirement housing units t o grow

five-fold in next three-four years

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

7

Tabl e 5: Ongoi ng proj ects

Sl. No Project Locati on Type

Sal eable area

(mn sq.ft.)

Share i n project

(%)

1 Utsav Lavasa Retirement resort 0.69 100

2 Ashiana Brahmananda J amshedpur Residential 0.48 100

3 Ashiana Angan Bhiwadi Residential 2.06 100

4 Ashiana Amarbagh J odhpur Villas 0.34 65

5 Utsav J aipur Retirement resort 0.39 65

6 Rangoli Gardens J aipur Residential 2.50 50

7 Ashiana Greenwood J aipur Residential 0.36 50

Source: Company, CRISIL Equi ties

Pendi ng approvals to ai d project pipeli ne

Apart from 6.8 mn sq.ft. of development plans, the company is awaiting approvals for

~4 mn sq.ft. of saleable area. This will add to the project pipeline adding visibility for

another two years.

Cautious strategy on land bank inventory reduces future visibility

Ashiana, as a strategy, does not accumulate land reserves of more than five-seven

years of its current execution. Even though the companys strategy of holding limited

land bank mitigates the risk of a decline in land prices, it reduces visibility beyond five-

six years. Its future growth will be dependent on the ability to continuously acquire land

at reasonable price in an increasingly competitive market.

Looki ng for land parcels i n new geographies; understandi ng these markets a key

Ashiana is actively looking for land parcels in western markets - Pune - to enhance its

revenue visibility. It also plans to explore eastern and southern markets. However, we

believe there will be challenges in a new market since real estate requires knowledge

of local business environment, laws and customer expectation, which are critical for the

success of its projects.

Future growth prospects dependent

on abil ity to acquire land at

reasonable price

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

8

Key risks

Execution delays in ongoing projects

Ashiana has a proven track record for timely delivery of most of the projects. However,

we have factored in slight delays in the execution schedule of the ongoing projects due

to unforeseen events. More-than-anticipated delays could impact our valuations.

Real estate industry is exposed to political and legal hindrances

The real estate industry is exposed to government rules and regulations which might

stall ongoing projects. In addition, political and administrative influences may lead to

delays in project execution.

Slowdown in industry, land acquisition delays might impact growth

Although the outlook for the real estate industry remains positive, any downturn might

have an adverse impact on future prospects. Also, the recent surge in property prices

has adversely affected affordability, which may impact volumes. Since the company

does not have a significant land bank, any delays in acquisition may have a severe

impact on its growth plans.

Downturn in the industry might have

an adverse impact on future

prospects

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

9

Financial Outlook

Revenues to grow at two-year CAGR of 40% to Rs 2.2 bn in FY12

Ashianas consolidated revenues grew at a three-year CAGR of 30% to Rs 1.1 bn in

FY10 driven by revenue bookings in Utsav and Ashiana Aangan at Bhiwadi. Going

forward, we expect consolidated revenues to grow at a two-year CAGR of 40% to Rs

2.2 bn in FY12. Revenue growth will be driven by revenue bookings in projects such as

Ashiana Aangan (residential project in Bhiwadi), Utsav (residential project in Lavasa)

and Ashiana Greenwoods (residential project in Pune). The initial response in these

projects has been good. As the company scales up construction in these projects,

revenues will start getting booked on achieving a recognition threshold of 25%.

Fi gur e 4: Revenues t o r egi st er t wo-year CAGR of 40%

Source: Company, CRISIL Equi ties est imate

EBITDA margins to improve to 36.8% in FY12 from 34.9% in FY10

We expect EBITDA margins to improve from 34.9% in FY10 to 36.8% in FY12. The

improvement is due to revenue recognition in comparatively high-end projects such as

Utsav in Lavasa and Ashiana Aangan in Bhiwadi.

Fi gur e 5: EBITDA mar gi ns t o i mpr ove f r om curr ent l evel s

Source: Company, CRISIL Equi ties est imate

1,271

918

1,139

1,563

2,233

145.1%

-27.8%

24.1%

37.2%

42.9%

-50%

0%

50%

100%

150%

200%

-

500

1,000

1,500

2,000

2,500

FY08 FY09 FY10 FY11E FY12E

Rs mn

Revenue y-o-y growth (RHS)

386

222

398 556

822

30.4%

24.2%

34.9%

35.6%

36.8%

20%

25%

30%

35%

40%

0

200

400

600

800

1,000

FY08 FY09 FY10 FY11E FY12E

Rs mn

EBITDA EBITDA margin (RHS)

Revenues expected to grow at a

two-year CAGR of 40% to Rs 2.2 bn

in FY12

EBITDA margins are expected to

improve to 36.8% in FY12

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

10

PAT to grow at a two-year CAGR of 31%, EPS expected to

increase from Rs 20.1 in FY10 to Rs 34.3 in FY12

Ashianas consolidated PAT is expected to grow at a two-year CAGR of 30.7%,

primarily on account of strong growth in top line. Despite improvement in EBITDA

margins, net margin is expected to decline to 27.7% in FY12 from 31.9% in FY10 due

to lower other income. EPS is expected to increase from Rs 20.1 in FY10 to Rs 34.3 in

FY12.

Fi gur e 6: PAT and PAT mar gi ns

Source: Company, CRISIL Equi ties est imate

RoE to remain stable at 30-31%

We expect RoE to be at 30-31% in next two years, which is quiet healthy. RoCE is

expected to increase from 32.6% in FY10 to 39.6% in FY12. Although the estimated

RoE of 30-31% is healthy, it is lower than RoCE as it is tempered by lower gearing.

Fi gur e 7: RoE and RoCE

Source: Company, CRISIL Equi ties est imate

21

16

20

24

34

30.4%

31.2%

31.9%

28.1%

27.7%

24%

26%

28%

30%

32%

34%

10

20

30

40

FY08 FY09 FY10 FY11E FY12E

Rs

EPS PAT margin (RHS)

77.3%

34.9%

32.1%

29.3%

31.3%

70.3%

24.7%

32.6%

34.3%

39.6%

20%

30%

40%

50%

60%

70%

80%

20%

30%

40%

50%

60%

70%

80%

FY08 FY09 FY10 FY11E FY12E

RoE RoCE (RHS)

RoE i s expected to remain healthy

at 31.3% in FY12

EPS is expected to increase from Rs

20.1 in FY10 to Rs 34.3 in FY12

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

11

Management Overview

CRISIL's fundamental grading methodology includes a broad assessment of

management quality, apart from other key factors such as industry and business

prospects, and financial performance. Overall, we feel that the management is strong

and will drive the companys growth in the near future.

Experienced and professional management with strong track record

Ashiana has an experienced and professional management team led by three brothers

- Mr Vishal Gupta, Mr Ankur Gupta and Mr Varun Gupta. Mr Vishal Gupta (managing

director) is an MBA from FORE School of Management (Delhi) and looks after project

execution and general administration. Mr Ankur Gupta (joint managing director), MS in

real estate from New York University (USA) has focused on residential projects for

senior citizens during his research work at the university; he looks after marketing. Mr

Varun Gupta (whole time director), majored in finance and management and has

worked with Citigroup in commercial mortgage backed securities underwriting

commercial real estate. He currently looks after land and finance. Currently, the trio is

managing the business; their father, Mr Om Gupta, turned chairman emeritus in April

2010.

Pioneer in retirement housing projects

Ashiana is one of the first companies to pioneer retirement housing projects in India.

The management was quick in identifying the opportunities; its Utsav Bhiwadi project

was a great success. To replicate the story, it has announced two similar projects in

J aipur and Lavasa.

Fairly experienced second line

Although major activities are handled by three brothers, based on our interactions with

various project heads Bhiwadi, J aipur, J odhpur and Lavasa - we believe Ashiana has

a fairly experienced second line of management with an experience of 10-15 years.

Experienced and professi onal

management team led by three

brothers

Company has a fairly experienced

second l ine of management

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

12

Corporate Governance

CRISILs fundamental grading methodology includes a broad assessment of corporate

governance and management quality, apart from other key factors such as industry

and business prospects, and financial performance. In this context, CRISIL Equities

analyses shareholding structure, board composition, typical board processes,

disclosure standards and related-party transactions. Any qualifications by regulators or

auditors also serve as useful inputs while assessing a companys corporate

governance.

Overall, corporate governance at Ashiana is strong supported by fairly high disclosure

levels and transparency. Also, the current board has good and relevant experience.

Board composition

Ashiana's board comprises seven members, of whom four are independent, meeting

stipulated SEBI listing guidelines. Given the background of directors, we believe that

the board is fairly diversified.

Transparent group structure with superior disclosures

Contrary to other real estate companies, who operate through a number of joint

ventures, SPVs and group companies, Ashiana has a transparent group structure with

only one subsidiary Vatika Marketing Ltd - which undertakes facility management

services in different projects. Ashianas quality of disclosure can be considered

superior, judged by the level of information and details furnished in annual reports,

website and other publicly available data. Ashianas transparent group structure and

superior disclosures mark a new era in the accountability of the real estate companies.

Boards processes

The company has various committees audit, remuneration and investor grievance - in

place to support corporate governance practices. CRISIL Equities assesses from its

interactions with independent directors of the company that the quality of agenda

papers and the level of discussions at the board meetings are good.

We feel that the independent directors are well aware of the business of the company

and are fairly engaged in all the major decisions, reflecting well on the company's

corporate governance practices. The audit committee is chaired by an independent

director and it meets at timely and regular intervals. The board also includes other

known names like Mr Ashok Mattoo worked with major organisations like BHEL and

Tata Steel and Mr Abhishek Dalmia, CEO of Renaissance Group. However, Mr Ashok

Mattoos daughter - Ms Sonal Mattoo - is also an independent director with the

company, which we believe is not good corporate governance practice.

Similar brand can lead to confusion

Ashiana Homes, Ghaziabad-based real estate company (managed by Mr Rajkumar

Modi erstwhile founder of Ashiana Group along with Mr Om Gupta) shares a similar

brand with Ashiana. Hence, end-users may get confused between the two companies.

Board comprises seven members,

of whom four are independent

directors

High level of transparency and

superior di scl osure levels

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

13

Valuation Grade: 5/5

We have valued Ashiana using the NAV method and arrived at a valuation of Rs 3.9 bn

which translates into a one-year fair value of Rs 220 per share. Consequently, we

initiate coverage on with a valuation grade of 5/5, indicating that the market price has

strong upside from the current levels.

Aangan (Bhiwadi), Utsav (Lavasa) and Rangoli Gardens (J aipur) contribute more than

80% to the total valuation. Bookings and timely construction of these projects is a key

monitorable.

Fi gur e 8: Cont ri but i on of key pr oj ect s i n val uat i on

Source: Company, CRISIL Equi ties est imate

We have valued only those projects based on cash flows which have received

approvals and there is higher certainty in terms of execution. The following are the key

assumptions in our valuation:

We have assumed a cost of equity of 16.0%. This is lower than what we have

taken for other real estate companies since the company is not leveraged,

reducing the financial risk. Also, the business model of the company is less prone

to cyclical risks.

We have assumed a tax rate of ~20% in the initial two years as the company gets

the benefit of unutilised MAT credit. Post FY12 we have assumed a full tax rate of

34%.

We have taken the market value of land for projects which have not received

approval. Once the company gets the necessary approvals on these projects, it

could provide an upside trigger to our valuation.

Utsav (Lavasa)

27%

Brahmananda

6%

Aangan

36%

Amarbagh

4%

Utsav (Jaipur)

3%

Rangoli Gardens

20%

Greenwood

4%

We initiate coverage on Ashiana

with a valuation grade of 5/5

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

14

Ashi ana has recovered from i ts trough (outperformed BSE Realty Index and Sensex), but others are still bl eedi ng

Real t y i ndex has under perf ormed t he br oader i ndex i n

past one year

Ashi ana has out per f ormed t he r eal t y and br oader

i ndexes

DLF t r ades i n l i ne wi t h Real t y Index but has been

under per f ormi ng t he br oader mar ket

Uni t ech cont i nues t o underper f orm bot h t he i ndexes

Omaxe t oo has been under perf ormi ng bot h t he i ndexes Ansal has been under perf ormi ng t he Real t y Index

0

20

40

60

80

100

120

140

160

180

200

J

a

n

-

0

7

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

BSE Realty Index BSE Sensex

0

50

100

150

200

250

300

350

J

a

n

-

0

7

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

Ashiana BSE Realty Index BSE Sensex

0

50

100

150

200

250

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

DLF BSE Realty Index BSE Sensex

0

50

100

150

200

250

J

a

n

-

0

7

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

Unitech BSE Realty Index BSE Sensex

0

50

100

150

200

250

A

u

g

-

0

7

N

o

v

-

0

7

F

e

b

-

0

8

M

a

y

-

0

8

A

u

g

-

0

8

N

o

v

-

0

8

F

e

b

-

0

9

M

a

y

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

A

u

g

-

1

0

Omaxe BSE Realty Index BSE Sensex

0

20

40

60

80

100

120

140

160

180

200

J

a

n

-

0

7

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

Ansal BSE Realty Index BSE Sensex

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

15

Company Overview

Incorporated in 1986, Ashiana is a Delhi-based real estate developer focused on

affordable homes. It diversified into retirement housing projects in 2004, identifying a

need for such kind of projects in India. The company has a strong brand image

supported by quality construction, timely deliveries and facility management services. It

is the only Indian real estate company that boasts of being featured in Asias Best

under a Billion company list by Forbes in 2010.

Tabl e 6: Ashi ana s evol uti on

Year Events and mil est ones

1979 Established as the first organised developer in Patna

1985 Started housing projects in J amshedpur

1986 Incorporated as Ashiana Housing and Finance (India) Limited

1992 Started operations as the first organised developer in Bhiwadi, Rajasthan

1992 Came out with an IPO

1998 Launched residential project in Neemrana, Rajasthan

2006 Started operations in J aipur

2007 Commenced project in J odhpur. Completed India's first retirement resort in Bhiwadi. Also

launched hotel and club at the same location

2008 Launched 30 acres of retirement resort project at Lavasa (Pune)

2008 Issued bonus shares in the ratio of 5:2

2010 Launched Rangoli Gardens in J aipur with saleable area of 2.5 mn sq.ft., largest project till

date

2010 Got recognised under Forbes Asia's Best under a Billion' 200 list of companies

Sour ce: Company

Key ongoing projects

Ashiana Aangan Bhiwadi (Rajasthan)

Ashiana Aangan is located on Old Alwar Highway, Bhiwadi (55 kms from the

international airport, Delhi). The project will be developed in five phases totalling

saleable area of 2.1 mn sq.ft. and ~1,475 residential units. Two phases entailing total

area of 0.9 mn sq.ft. is already completed.

Utsav Lavasa (Pune)

Ashiana has planned 0.7 mn sq.ft. of saleable area with ~440 homes and villas for

retirement housing in Lavasa. Its an hour drive from Pune (around 65 kms) and around

3.5 hours from Mumbai (around 200 kms).

Rangoli Gardens Jaipur (Rajasthan)

Rangoli Gardens is a joint venture project between Ashiana (50%) and Manglam Group

(land owners 50%). It is located in J aipur, Rajasthan and has a saleable area of 2.5

mn sq.ft. and ~1,600 residential units.

Featured in Asia s Best under a

Bill i on list by Forbes in 2010

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

16

Annexure: Financials

Income St atement

(Rs Mn) FY08 FY09 FY10 FY11E FY12E

Net sales 1,245 879 1,086 1,502 2,165

Operat ing Income 1,271 918 1,139 1,563 2,233

EBITDA 386 222 398 556 822

Depreciation 14 15 15 19 22

Interest - 2 11 8 6

Other Income 31 80 25 31 45

PBT 403 285 397 560 840

PAT 387 286 363 439 620

No. of shares 18 18 18 18 18

Earni ngs per share (EPS) 21.4 15.8 20.1 24.3 34.3

Balance Sheet

(Rs Mn) FY08 FY09 FY10 FY11E FY12E

Equity capital (FV - Rs 10) 181 181 181 181 181

Reserves and surplus 497 782 1,117 1,517 2,081

Debt 26 12 80 55 35

Current Liabilities and Provisions 964 601 451 274 326

Deferred Tax Liability/(Asset) 3 5 11 11 11

Capit al Employed 1,670 1,581 1,840 2,037 2,634

Net Fixed Assets 253 281 290 342 390

Capital WIP 28 56 136 - -

Intangible assets 1 1 1 1 1

Investments 457 407 499 499 499

Loans and advances 398 106 51 51 51

Inventory 416 584 685 816 705

Receivables 39 15 17 12 15

Cash & Bank Balance 78 130 161 318 974

Appli cat ions of Funds 1,670 1,581 1,840 2,037 2,634

Sour ce: Company, CRISI L Equi t i es est i mat e

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

17

Cash Fl ow

(Rs Mn) FY08 FY09 FY10 FY11E FY12E

Pre-tax profit

403 285 397 560 840

Total tax paid

(48) (34) (70) (120) (221)

Depreciation

14 15 15 19 22

Change in working capital (222) (215) (198) (302) 161

Cash flow from operating activit ies 147 51 144 156 802

Capital expenditure (108) (71) (104) 66 (70)

Investments and others (188) 50 (92) - -

Cash flow from i nvest ing activiti es (296) (21) (195) 66 (70)

Equity raised/(repaid) 129 - - - -

Debt raised/(repaid) (7) (14) 68 (25) (20)

Dividend (incl. tax) (33) - (33) (40) (56)

Others (incl extraordinaries) (98) 37 47 - -

Cash flow from fi nanci ng activities (8) 23 82 (65) (76)

Change in cash positi on (156) 52 31 157 656

Opening Cash 234 78 130 161 318

Closing Cash 78 130 161 318 974

Ratios

FY08 FY09 FY10 FY11E FY12E

Growt h rat ios

Sales growth (%)

145.1 (27.8) 24.1 37.2 42.9

EBITDA growth (%)

418.9 (42.5) 79.2 39.6 48.0

EPS growth (%)

17.3 (26.8) 29.5 19.5 41.0

Profit abil ity Rat ios

EBITDA Margin (%)

30.4 24.2 34.9 35.6 36.8

PAT Margin (%)

30.4 31.2 31.9 28.1 27.7

Return on Capital Employed (RoCE) (%)

70.3 24.7 32.6 34.3 39.6

Return on equity (RoE) (%)

77.3 34.9 32.1 29.3 31.3

Dividend and Earnings

Dividend per share (Rs)

1.8 0.0 1.8 1.9 2.6

Dividend payout ratio (%)

8.5 0.0 8.9 7.7 7.7

Dividend yield (%)

1.9 - 1.1 1.1 1.6

Earnings Per Share (Rs)

21.4 15.8 20.1 24.3 34.3

Effici ency rat ios

Asset Turnover (Sales/GFA)

6.1x 3.1x 3.4x 4.1x 5.0x

Asset Turnover (Sales/NFA)

6.8x 3.4x 4.0x 4.9x 6.1x

Sales/Working Capital

-5.7x -329.3x 5.6x 3.4x 4.3x

Financial st ability

Net Debt-equity

-0.1 -0.1 -0.1 -0.2 -0.4

Interest Coverage

nm 116.4 36.5 64.0 143.5

Current Ratio

1.0 1.4 2.0 4.4 5.3

Valuati on Multiples

Price-earnings

4.5x 2.1x 8.3x 6.8x 4.8x

Price-book

2.6x 0.6x 2.3x 1.8x 1.3x

EV/EBITDA

4.4x 2.1x 7.3x 4.9x 2.5x

Sour ce: Company, CRISI L Equi t i es est i mat e

`

CRISIL Equities

Ashi ana Housi ng Li mit ed

18

Focus Charts

Ashi ana has out per f ormed t he Real t y Index as wel l as

br oader mar ket i n past one year

Shar ehol di ng pat t er n

Source: NSE, CRISIL Equiti es Source: NSE, CRISIL Equiti es

Geogr aphy-wi se br eak-up of area devel oped Revenues t o gr ow at a t wo-year CAGR of 40% i n FY12

Source: Company, CRISIL Equi ties Source: Company, CRISIL Equi ties est imate

Cont r i but i on of key pr oj ect s t o val uat i on Heal t hy RoCE and RoE

Source: Company, CRISIL Equi ties est imate Source: Company, CRISIL Equi ties est imate

0

50

100

150

200

250

300

350

J

a

n

-

0

7

A

p

r

-

0

7

J

u

l

-

0

7

O

c

t

-

0

7

J

a

n

-

0

8

A

p

r

-

0

8

J

u

l

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

J

u

l

-

0

9

O

c

t

-

0

9

J

a

n

-

1

0

A

p

r

-

1

0

J

u

l

-

1

0

O

c

t

-

1

0

Ashiana BSE Realty Index BSE Sensex

Promoters 67.4

FIIs 0.5

Others 32.1

Bhiwadi

69%

Neemrana

6%

Jaipur

5%

Jamshedpur

20%

1,271

918

1,139

1,563

2,233

145.1%

-27.8%

24.1%

37.2%

42.9%

-50%

0%

50%

100%

150%

200%

-

500

1,000

1,500

2,000

2,500

FY08 FY09 FY10 FY11E FY12E

Rs mn

Revenue y-o-y growth (RHS)

Utsav (Lavasa)

27%

Brahmananda

6%

Aangan

36%

Amarbagh

4%

Utsav (Jaipur)

3%

Rangoli

Gardens

20%

Greenwood

4%

77.3%

34.9%

32.1%

29.3%

31.3%

70.3%

24.7%

32.6%

34.3%

39.6%

20%

30%

40%

50%

60%

70%

80%

20%

30%

40%

50%

60%

70%

80%

FY08 FY09 FY10 FY11E FY12E

RoE RoCE (RHS)

CRISIL Independent Equity Research Team

Mukesh Agarwal magarwal@crisil.com +91 (22) 3342 3035

Director

Tarun Bhatia tbhatia@crisil.com +91 (22) 3342 3226

Director- Capital Markets

Analytical Contacts

Chetan Majithia chetanmajithia@crisil.com +91 (22) 3342 4148

Sudhir Nair snair@crisil.com +91 (22) 3342 3526

Sector Contacts

Nagarajan Narasimhan nnarasimhan@crisil.com +91 (22) 3342 3536

Ajay D'Souza adsouza@crisil.com +91 (22) 3342 3567

Manoj Mohta mmohta@crisil.com +91 (22) 3342 3554

Sachin Mathur smathur@crisil.com +91 (22) 3342 3541

Sridhar C sridharc@crisil.com +91 (22) 3342 3546

Business Development Contacts

Vinaya Dongre vdongre@crisil.com +91 99 202 25174

Sagar Sawarkar ssawarkar@crisil.com +91 98 216 38322

CRISILs Equity Offerings

TheEquityGroupatCRISILResearchprovidesawiderangeofservicesincluding:

Independent Equity Research

IPO Grading

White Labelled Research

Valuation on companies for use of Institutional Investors, Asset Managers, Corporate

OtherServicesbytheResearchgroupinclude

CRISINFAC Industry research on over 60 industries and Economic Analysis

Customised Research on Market sizing, Demand modelling and Entry strategies

Customised research content for Information Memorandum and Offer documents

For further details

or more information, please contact:

Client Servicing

CRISIL Research

CRISIL House

Central Avenue

Hiranandani Business Park

Powai, Mumbai - 400 076, India.

Phone +91 (22) 3342 3561/ 62

Fax +91 (22) 3342 3501

E-mail: clientservicing@crisil.com

E-mail: research@crisil.com

www.ier.co.in

AboutCRISILLimited

CRISIL is India's leading Ratings, Research, Risk and Policy Advisory Company

AboutCRISILResearch

CRISIL Research is India's largest independent, integrated research house. We leverage our unique,

integrated research platform and capabilities spanning the entire economy-industry-company

spectrum to deliver superior perspectives and insights to over 600 domestic and global clients,

through a range of subscription products and customised solutions.

Mumbai

CRISIL House

Central Avenue

Hiranandani Business Park

Powai, Mumbai - 400 076, India.

Phone +91 (22) 3342 8026/29/35

Fax +91 (22) 3342 8088

NewDelhi

The Mira

G-1 (FF),1st Floor, Plot No. 1&2

Ishwar Nagar, Near Okhla Crossing

New Delhi -110 065, India.

Phone +91 (11) 4250 5100, 2693 0117-21

Fax +91 (11) 2684 2212/ 13

Bengaluru

W-101, Sunrise Chambers

22, Ulsoor Road

Bengaluru - 560 042, India.

Phone +91 (80) 4117 0622

Fax +91 (80) 2559 4801

Kolkata

Horizon, Block B, 4th floor

57 Chowringhee Road

Kolkata - 700 071, India.

Phone +91 (33) 2283 0595

Fax +91 (33) 2283 0597

Chennai

Mezzanine Floor, Thappar House

43 / 44, Montieth Road

Egmore

Chennai - 600 008, India.

Phone +91 (44) 2854 6205/06, 2854 6093

Fax +91 (44) 2854 7531

Hyderabad

3rd Floor, Uma Chambers

Plot No. 9&10, Nagarjuna Hills,

(Near Punjagutta Cross Road)

Hyderabad - 500 482

Phone : 91-40-2335 8103 - 05

Fax : 91-40-2335 7507

Вам также может понравиться

- Savera HotelsДокумент21 страницаSavera HotelsMansi Raut Patil100% (1)

- CRISIL Research Ier Report Alok Industries 2012Документ38 страницCRISIL Research Ier Report Alok Industries 2012Akash MohindraОценок пока нет

- Ashiana Housing LTD: Detailed ReportДокумент24 страницыAshiana Housing LTD: Detailed ReportArchit GroverОценок пока нет

- KRBL ReportДокумент28 страницKRBL ReportHardeep Singh SohiОценок пока нет

- Dewan Housing FinanceДокумент4 страницыDewan Housing FinanceLakshminarayana SamaОценок пока нет

- PC Jeweller LTD IER InitiationReport 2Документ28 страницPC Jeweller LTD IER InitiationReport 2Himanshu JainОценок пока нет

- Sharekhan Top Picks: November 30, 2012Документ7 страницSharekhan Top Picks: November 30, 2012didwaniasОценок пока нет

- Nivesh Stock PicksДокумент13 страницNivesh Stock PicksAnonymous W7lVR9qs25Оценок пока нет

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapДокумент7 страницSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriОценок пока нет

- Feel Left Out? Join The Midcap Party With These10 Stocks: City Union BankДокумент4 страницыFeel Left Out? Join The Midcap Party With These10 Stocks: City Union BankDynamic LevelsОценок пока нет

- Independent Equity Research: Enhancing Investment DecisionДокумент0 страницIndependent Equity Research: Enhancing Investment DecisionvivekdkrpuОценок пока нет

- Initiating Coverage HDFC Bank - 170212Документ14 страницInitiating Coverage HDFC Bank - 170212Sumit JatiaОценок пока нет

- QS - Housing Finance Companies - Thematic ReportДокумент50 страницQS - Housing Finance Companies - Thematic ReportRavi KumarОценок пока нет

- Reliance Infrastructure 091113 01Документ4 страницыReliance Infrastructure 091113 01Vishakha KhannaОценок пока нет

- CRISIL Research - Ier Report Harrisons PDFДокумент22 страницыCRISIL Research - Ier Report Harrisons PDFdidwaniasОценок пока нет

- CeraДокумент32 страницыCeraRohit ThapliyalОценок пока нет

- Crisil HeroДокумент28 страницCrisil HeroSachin GuptaОценок пока нет

- Mid-Cap Marvels: RCM ResearchДокумент20 страницMid-Cap Marvels: RCM ResearchmannimanojОценок пока нет

- State Bank of India: Play On Economic Recovery Buy MaintainedДокумент4 страницыState Bank of India: Play On Economic Recovery Buy MaintainedPaul GeorgeОценок пока нет

- Crisil Report Sep 2013Документ32 страницыCrisil Report Sep 2013MLastTryОценок пока нет

- JainMatrix Investments Bajaj Finance Jan2012Документ6 страницJainMatrix Investments Bajaj Finance Jan2012Punit JainОценок пока нет

- Crisil: JBF Industries LTDДокумент14 страницCrisil: JBF Industries LTDpriyaranjanОценок пока нет

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Документ27 страницDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinОценок пока нет

- India Inc. A Look AheadДокумент20 страницIndia Inc. A Look AheadsebbatasОценок пока нет

- IEA Report: 23rd January, 2017Документ27 страницIEA Report: 23rd January, 2017narnoliaОценок пока нет

- Motilal Oswal Securities Limited: Summary of Rated Instruments Instrument Amount (In Rs. Crore) Rating ActionДокумент7 страницMotilal Oswal Securities Limited: Summary of Rated Instruments Instrument Amount (In Rs. Crore) Rating ActionsandeepОценок пока нет

- India Equity Analytics Today: Hold Rating On Prestige Estates StockДокумент25 страницIndia Equity Analytics Today: Hold Rating On Prestige Estates StockNarnolia Securities LimitedОценок пока нет

- EPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentДокумент4 страницыEPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentpriyaranjanОценок пока нет

- Wealth Management Assignment Idfc: About The CompanyДокумент2 страницыWealth Management Assignment Idfc: About The CompanyManmeet MalikОценок пока нет

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Документ2 страницыBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecОценок пока нет

- Phillips Carbon Report by CrisilДокумент12 страницPhillips Carbon Report by CrisilNaman BansalОценок пока нет

- Diwali-Picks Microsec 311013 PDFДокумент14 страницDiwali-Picks Microsec 311013 PDFZacharia VincentОценок пока нет

- Ratio Analysis of HDFC FINALДокумент10 страницRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- Investment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDДокумент23 страницыInvestment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDNarnolia Securities LimitedОценок пока нет

- BIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Документ2 страницыBIMBSec - Bumi Armada Company Update - Deeper Into Caspian Sea - 20120417Bimb SecОценок пока нет

- IDirect MuhuratPicks 2014Документ8 страницIDirect MuhuratPicks 2014Rahul SakareyОценок пока нет

- IDirect RBIActions Dec15Документ5 страницIDirect RBIActions Dec15umaganОценок пока нет

- Research: Sintex Industries LimitedДокумент4 страницыResearch: Sintex Industries LimitedMohd KaifОценок пока нет

- IEA Report 22th DecemberДокумент21 страницаIEA Report 22th DecembernarnoliaОценок пока нет

- MOSt Stocks DiwaliДокумент6 страницMOSt Stocks DiwaliSuresh Babu AОценок пока нет

- QS - Union Bank of IndiaДокумент11 страницQS - Union Bank of IndiaratithaneОценок пока нет

- RBI Policy Review Oct 2011 Highlights and RecommendationДокумент7 страницRBI Policy Review Oct 2011 Highlights and RecommendationKirthan Ψ PurechaОценок пока нет

- Sharekhan Top Picks: October 26, 2012Документ7 страницSharekhan Top Picks: October 26, 2012Soumik DasОценок пока нет

- Mid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Документ21 страницаMid Cap Ideas - Value and Growth Investing 250112 - 11 - 0602120242Chetan MaheshwariОценок пока нет

- SC Securities (PVT) LTD.: Banking SectorДокумент1 страницаSC Securities (PVT) LTD.: Banking Sectorapi-3838342Оценок пока нет

- Post Budget Impact Analysis - MF & Debt: Retail ResearchДокумент2 страницыPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyОценок пока нет

- India Equity Analytics: HCLTECH: "Retain Confidence"Документ27 страницIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedОценок пока нет

- DCB Bank Buy Emkay ResearchДокумент23 страницыDCB Bank Buy Emkay ResearchGreyFoolОценок пока нет

- Indian Hotel JPMДокумент25 страницIndian Hotel JPMViet VuОценок пока нет

- Independent Equity Research: Beardsell LimitedДокумент10 страницIndependent Equity Research: Beardsell LimitedRuchi AgarwalОценок пока нет

- Recovery FundДокумент31 страницаRecovery FundRohitOberoiОценок пока нет

- Bajaj Capital Centre For Investment Research: Buy HDFC BankДокумент9 страницBajaj Capital Centre For Investment Research: Buy HDFC BankShikhar KumarОценок пока нет

- IEA Report: 7th Dec, 2016Документ19 страницIEA Report: 7th Dec, 2016narnoliaОценок пока нет

- 15 Stocks Oct15th2018Документ4 страницы15 Stocks Oct15th2018ShanmugamОценок пока нет

- Axis Enam MergerДокумент9 страницAxis Enam MergernnsriniОценок пока нет

- June 2019 Investor LetterДокумент7 страницJune 2019 Investor LetterMohit AgarwalОценок пока нет

- Background of The Investor: Ketki Prabhat Roll No:44Документ4 страницыBackground of The Investor: Ketki Prabhat Roll No:44Santosh KardakОценок пока нет

- SBI Emerging Businesses1Документ4 страницыSBI Emerging Businesses1Ram AgarwalОценок пока нет

- FactSheet April14Документ15 страницFactSheet April14Prasad JadhavОценок пока нет

- Stock Market IndicesДокумент2 страницыStock Market IndicesbijubodheswarОценок пока нет

- Private Equity Shareholders Agreements PresentationДокумент23 страницыPrivate Equity Shareholders Agreements Presentationmayor78Оценок пока нет

- Myanmar Business Today - Vol 2, Issue 14Документ32 страницыMyanmar Business Today - Vol 2, Issue 14Myanmar Business TodayОценок пока нет

- Brand Plan FormatДокумент21 страницаBrand Plan FormatchienОценок пока нет

- Digital Future Magazine-Davos 2020 EditionДокумент24 страницыDigital Future Magazine-Davos 2020 EditionR.A.U. Juchter van Bergen QuastОценок пока нет

- Pizza Hut Case SolutionДокумент2 страницыPizza Hut Case Solutionparth2kОценок пока нет

- WEF Alternative Investments 2020 FutureДокумент59 страницWEF Alternative Investments 2020 FutureR. Mega MahmudiaОценок пока нет

- Wild Ib8 PPT 04Документ22 страницыWild Ib8 PPT 04TINОценок пока нет

- History of Banking Asian PerspectiveДокумент226 страницHistory of Banking Asian PerspectiveJohn Sutherland100% (3)

- Dynamic FX PortfoliosДокумент55 страницDynamic FX PortfolioslorenzoОценок пока нет

- WIR2013 Full Report Low ResolutionДокумент264 страницыWIR2013 Full Report Low ResolutionVishyataОценок пока нет

- Chapter 14 Sol StudentsДокумент4 страницыChapter 14 Sol StudentsAllen Grce100% (2)

- Crisil SmeДокумент60 страницCrisil SmeUtkarsh PandeyОценок пока нет

- Ws Ja 20141014Документ32 страницыWs Ja 20141014jlkdinhkОценок пока нет

- Giorgio ArmaniДокумент6 страницGiorgio Armanichetanprakash077Оценок пока нет

- Assets Hide Creditors Cook Fraudulent Transfers 2008Документ97 страницAssets Hide Creditors Cook Fraudulent Transfers 2008sbhasin1Оценок пока нет

- Chap 21-2Документ8 страницChap 21-2JackОценок пока нет

- Vietnam's TaxtationДокумент26 страницVietnam's TaxtationTrangg PhạmОценок пока нет

- Expeditious Approval CircularДокумент36 страницExpeditious Approval CircularNyl TumambingОценок пока нет

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFДокумент15 страницAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyОценок пока нет

- Dividend PolicyДокумент27 страницDividend PolicyMohammad ShibliОценок пока нет

- Sandeep Sarvade CVДокумент3 страницыSandeep Sarvade CVRahul DalmiaОценок пока нет

- Income-Taxation 5-7 ValenciaДокумент56 страницIncome-Taxation 5-7 ValenciaDevonОценок пока нет

- CHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationДокумент6 страницCHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationCatherine Rivera100% (3)

- Financial Analysis of BHEL: Section B Group 18Документ18 страницFinancial Analysis of BHEL: Section B Group 18Deenbandhu MishraОценок пока нет

- Black LittermanДокумент21 страницаBlack LittermanJoseph TanОценок пока нет

- Plastic Syring and Disposable Needle Making PlantДокумент25 страницPlastic Syring and Disposable Needle Making PlantJohnОценок пока нет

- Chapter 10Документ28 страницChapter 10YourMotherОценок пока нет

- 14 - Lord (2002) Spinning Out A StarДокумент9 страниц14 - Lord (2002) Spinning Out A StarGonzalo JimenezОценок пока нет

- Basic Accounting 1Документ33 страницыBasic Accounting 1Tejas BapnaОценок пока нет