Академический Документы

Профессиональный Документы

Культура Документы

Revista E&P - Octubre 2011

Загружено:

jpsi6Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Revista E&P - Octubre 2011

Загружено:

jpsi6Авторское право:

Доступные форматы

E P MAG.

COM

OCT OB E R 2 0 1 1

Electromagnetics

Improving

Exploration

Success

Mature Assets

MPD/UBD

Subsea

Technology

Regional Report:

CANADA

Balancing cost and productivity

in stimulation technology

Balancing cost and productivity

in stimulation technology

WEIGHING

the opti ons

991-994 HEPcoversOCT_Layout 1 9/19/11 3:49 PM Page 991

991-994 HEPcoversOCT_991-994 HEPcoversOCT 9/19/11 3:23 PM Page 992

1

11

Tj

,

-

_

n

's?-

_

=. . .

--?"_.

.?._

?

'?

'

_

. : ,ci, ?? ,.,

- . Lr p-

- -

?.rte

.r

-

j

rj o

i i

j i

-I

7jj

j

i

fil

i i

Irv

J-

7.

Sti

10 MEW.

f

9s luSt

as-

96

REGIONAL REPORT:

CANADA

IMPROVING EXPLORATION SUCCESS

Mapping horizons leads to greater

exploration success

Banish the ghosts from marine seismic data

Three-D seismic advances improve

exploration success

ELECTROMAGNETICS

CSEM: Smoother seas ahead

Integration of seismic and CSEM data

reduces risk

MPD/UBD

Automated MPD improves drilling efficiency in

deepwater GoM

Closing the loop alleviates challenges

SUBSEA TECHNOLOGY

Dry breakaway technology delivers efficiency

MATURE ASSETS

Mature fields add to the bottom line

Perforation tunnel tool optimizes mature assets

IndustryPULSE:

Technology trends reshape

business landscape

Taking advantage of evolving technolo-

gies helps companies maintain a compet-

itive advantage.

EXPLORATION & PRODUCTION

W O R L D W I D E C O V E R A G E

OCTOBER 2011

VOLUME 84 I SSUE 10

A HART ENERGY PUBLI CATI ON www. EPmag. com

COVER STORY

32

Sleeves vs. Shots

The Debate Rages

Company preference between the two most

popular methods for stimulating horizontal

multistage completions breaks down to a

study in the economics of expediency versus

the economics of a systematic approach.

8

WorldVIEW: North Sea

operator continues to see

opportunity

Sticking with what you know can provide

a solid foundation for moving into new

frontiers.

12

Unconventional: Eagle Ford

Eagle Ford output continues

to soar

New data suggest the Eagle Ford shale may soon

become the biggest producing shale play in Texas.

42

46

50

54

58

66

68

62

80

72

84

01-6 TOC_OCT_01-4 TOC 9/20/11 8:52 AM Page 1

01-6 TOC_OCT_01-4 TOC 9/20/11 9:13 AM Page 2 01-6 TOC_OCT_01-4 TOC 9/20/11 9:13 AM Page 3

Gas production from the Norwegian Continental Shelf can supply millions of Europeans with power.

Both industry and homes are connected to a cost competitive energy source , and will remain so for decades

to come. Be enlightened goodideas.statoi l .com. There' s never been a better time for good ideas .

Statoil

M?

J

-

., .. . ' ' ' ,,._ , .

saw

???,?;?rr

`

_F? .,? _ "

ray ?. ?f, ? ...

?

4, /

r

vr*

-

4

10-

imp .

?. _

. , ' 7

'

?

,

?

.a

.?

'-

ma

y

' .

?!

,? ?

1

!!

?

/

1

%!L

AS I SEE IT

EFD program expands 5

MANAGEMENT REPORT

Collaborative tools come of age 16

DIGITAL OIL FIELD

New technology optimizes operations 20

Data environments prove viable best option for E&P customers 23

EXPLORATION TECHNOLOGY

Seismic leads the way for geothermal 27

WELL CONSTRUCTION

A new twist on an old problem 29

PRODUCTION OPTIMIZATION

Positive outlook for offshore 31

TECH WATCH

New system fills gap between PDM, rotary

steerable technologies 88

TECH TRENDS 92

INTERNATIONAL SPOTLIGHT

Nova Scotia shows promise as deepwater bright spot 95

INTERNATIONAL HIGHLIGHTS 102

ON THE MOVE/INDEX TO ADVERTISERS 106-107

LAST WORD

Reduce uncertainty, risk in drilling projects 108

E&P (ISSN 1527-4063) (PM40036185) is published monthly by Hart Energy Publishing, LP, 1616 S. Voss Road, Suite 1000, Houston, Texas 77057.

Periodicals postage paid at Houston, TX, and additional mailing offices. Subscription rates: 1 year (12 issues), US $149; 2 years (24 issues), US $279. Single

copies are US $18 (prepayment required). Advertising rates furnished upon request. POSTMASTER: Send address changes to E&P, PO Box 5020, Brentwood, TN

37024. Address all non-subscriber correspondence to E&P, 1616 S. Voss Road, Suite 1000, Houston, Texas 77057; Telephone: 713-260-6442. All subscriber

inquiries should be addressed to E&P, 1616 S Voss Road, Suite 1000, Houston, TX 77057; Telephone: 713-260-6442 Fax: 713-840-1449; custserv@hartener-

gy.com. Copyright Hart Energy Publishing, LP, 2011. Hart Energy Publishing, LP reserves all rights to editorial matter in this magazine. No article may be repro-

duced or transmitted in whole or in parts by any means without written permission of the publisher, excepting that permission to

photocopy is granted to users registered with Copyright Clearance Center/0164-8322/91 $3/$2. Indexed by Applied Science, Technology Index and Engineering Index

Inc. Federal copyright law prohibits unauthorized reproduction by any means and imposes fines of up to $25,000 for violations.

DEPARTMENTS AND COMMENTARY

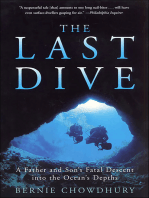

ABOUT THE COVER Companies continue to test the balance between plug

and perf (PNP) and openhole multistage (OHMS) completions, while ice remains a

challenge to Atlantic Canada operations. (Photo courtesy of Greg Locke; cover

design by Laura J. Williams)

COMING NEXT MONTH Read the November issue of E&P to find out the experts views on the

status and future of intelligent operations. See how operators are improving efficiency and take a look

at what is new in passive microseismic technology. Read the drilling feature for the latest advances in

drilling and automation control and the production feature to find out about innovations in flow assur-

ance and sand and water management. The Offshore focus for November investigates how new deep-

water interventions are being applied, while the regional report showcases the Middle East. A look at the

Woodford shale rounds out the issue. And dont forget to check out EPmag.comfor the latest news.

01-6 TOC_OCT_01-4 TOC 9/20/11 8:45 AM Page 4

The Low PRESSURE AUTOCHOKE

CONSOLE * (LPAC*) unit gives

precise bott omhole pressure

control during MPD and UBD

drilling operations - keeping you

in the pressure stability window.

Di

g

ital touch screen interf aces

located in the driller 's cabin and

ri

g

fl oor offer greater coordination

during pressure-critical operations.

With simultaneous hi

g

h-resolution

monitoring and direct pressure

control of our unique AUTOCHOKE *

unit, you gain greater operational

performance and efficiency.

During the underbalanced drilling

of a series of laterals , the system

doubled overall ROP from 15to

30 fUhr and held the required

surf ace pressure of 350 psi

during connections. As a result ,

the operator cut drilling time by

10 days, saving S1 m.

Mi SWACO

A Schlumberger Comoa ny

www.miswaco .slb.com/LPAC

i

r u

_ 4

nw.

M

qd

ry

4

`

O

ffluns;

_

!L

1

p ,

.

1

ONLINE CONTENT OCTOBER 2011

PREMIUM CONTENT Subscribe @ EPmag.com/explorationhighlights

Whiting Niobrara wildcat flows 1,061 b/d, 1.56 MMcf/d

The #16-13H Wild Horse horizontal well in the Denver-Julesburg basin

initially flowed 1,061 bbl of oil and 1.56 MMcf/d of gas for Whiting Oil

& Gas Corp.

AVAILABLE ONLY ONLINE

Next big shale play?

The Canadian Arctic

By Scott Weeden, Senior Online Editor

Onshore companies are focusing efforts

on shale formations in the central

Mackenzie Valley.

Slow recovery rate projected for

Gulf of Mexico drilling

By Mike Madere, Senior Online Editor

GoM active rig count of 20 may be

unsustainable at the current pace of

permit approvals.

New Zealand could be net oil

exporter by 2030

By Scott Weeden, Senior Online Editor

Ministry of Energy and Resources

proposes changes to how oil and gas

exploration rights are issued.

R

E

A

D

T

H

E

L

A

T

E

S

T

E

P

m

a

g

.c

o

m

IN

D

U

S

T

R

Y

N

E

W

S

Eni hits gas pay

at Kutei basin, Indonesia

Rome-based Eni encountered gas at the

#1-Jangkrik North East well in the Muara

Bakau Block located in the Kutei basin

east of Kalimantan offshore Indonesia.

WEBINARS

Unconventionals

in Michigan: The

A-1 Carbonate

and Collingwood

and Utica Shales

Unlocking The

Utica: The Next

Big Northeast

Shale Play?

The Mississippi

Lime: The

Midcontinents

Newest

Horizontal

Oil Play

Noble follows Tamar, Dalit finds

with exploration offshore Cyprus

Houston-based Noble Energy Inc. has

planned an exploration well offshore

Cyprus in the Block 12 concession in the

Eastern Mediterranean.

01-6 TOC_OCT_01-6 TOC_OCT 9/19/11 2:46 PM Page 5

PeriScope

Bring boundaries

into focus

Pradera Resources increased production

by orders of magnitude using the PeriScope*

service to place 100% of a 3,000-ft horizontal

lateral in an undulating oil reservoir in

western Canada.

PeriScope lets you continuousl y monitor

formation and fluid boundaries up to 21 ft

from the wellbore so you can

maximize production

eliminate sidetracks.

Position your wells in the best place

in less time .

www.slb .com/PeriScope

Schiumberger

,n

?

NCI

01-6 TOC_OCT_01-6 TOC_OCT 9/19/11 2:46 PM Page 6

"When your mature

wells go quiet , it pays

to know who can turn

up the volume-or turn

it off

altogether"

Reducing risk and uncertainty while efficiently

improving ultimate recovery or performing a plug

and abandonment. Meeting all HSE standards.

Addressing concerns about effectiveness , cost

and availability of equipment. Solving your mature

field challenges is what Halliburton does daily around

the world. All thanks to extensive experience,

cost-effective and challenge-specific solutions , an

how Halliburton experts work collaboratively with

operators to get it right every time.

What

'

s your mature fi el d cha l enge? For solutions,

o to halliburton .com/maturefields.

Ow

00

00,

11

,

Its

It

IP MNW

i r-

ti

_.

, Z

T

he Environmentally Friendly Drilling (EFD) program, managed by the Houston

Advanced Research Center (HARC), is funded by the US Department of Energy, the

Research Partnership to Secure Energy for America (RPSEA), industry, and environ-

mental organizations. The program focuses on technologies for developing energy

sources that can be cost effectively applied in environmentally sensitive areas.

According to Richard Haut, HARC senior research scientist, the program objective is

to identify, develop, and transfer critical, cost-effective, new technologies that can pro-

vide policy makers and industry with the ability to develop reserves in a safe and envi-

ronmentally friendly manner.

A European Chapter of the EFD program was created in September of 2010 kicked

off with a workshop held in conjunction with the 2010 SPE annual meeting in Flo-

rence, Italy. The goal was to identify and apply best practices in Europe and to identify

new innovations and applications, Haut said.

In the past two years, a new gas shale development is being initiated nearly every

week. As this new resource expands, opportunities are expanding for US companies that

have developed technologies and the wherewithal to expand internationally, he said.

The EFD management team works with Gerhard Thonhauser at the University of

Leoben, Austria, to manage the EFD European chapter and perform related research.

According to Haut, having US and European EFD programs enables all operators and

regulators to learn about technologies being developed and implemented throughout

the world, fostering relationships between Europe and the US.

Innovation knows no geographic boundaries, he said.

Although requirements in countries with strict regulatory standards possibly could

prevent the development of natural resources, Haut believes those same restrictions

also can encourage innovation and lead to the development of new technologies that

could be applied in the US as well as in Europe.

The EFD program addresses new low-impact technology that reduces the footprint

of oil and gas activities, integrates light-weight drilling rigs with reduced emission

engine packages, addresses onsite waste management, optimizes systems to fit the

needs of specific development sites, and addresses environmental issues. In addition,

the program includes industry, the public, environmental organizations, and elected

officials in a collaboration that addresses concerns on development of unconventional

natural gas resources in environmentally sensitive areas.

The EFD team has been evaluating the performance of a new low-impact drilling rig,

has participated in a number of gas shale workshops and meetings across Europe, and

has established a work scope for assisting with gas shale

development in the Ukraine.

The EFD team has briefed US and international govern-

ment agencies about unconventional gas issues, and we

have learned we all share similar goals and objectives,

Haut said.

As I

SEE IT

1616 S. VOSS ROAD, STE 1000

HOUSTON, TEXAS 77057

P: +1 713.260.6400 F: +1 713.840.0923

www.EPmag.com

EFD program expands

7

Read more commentary at

EPmag.com

JUDY MURRAY

Editor

jmurray@hartenergy.com

Editor JUDY MURRAY

jmurray@hartenergy.com

Senior Editor RHONDA DUEY

rduey@hartenergy.com

Senior Editor TAYVIS DUNNAHOE

tdunnahoe@hartenergy.com

International Editor MARK THOMAS

mthomas@hartenergy.com

Associate Editor NANCY AGIN

nagin@hartenergy.com

Corporate Art Director ALEXA SANDERS

Senior Graphic Designer LAURA J. WILLIAMS

Production Director

& Reprint Sales JO LYNNE POOL

Senior Editor/Manager,

Special Projects JO ANN DAVY

Executive Editor Online RICHARD MASON

Director of Business Development ERIC ROTH

Group Publisher RUSSELL LAAS

Editorial Advisory Board

CHRIS BARTON

Sr. VP Business Development, Oil & Gas., KBR

KEVIN BRADY

VP, Sales & Marketing,Verdande Technology Inc.

MIKE FORREST

Exploration Consultant, formerly with Shell

JOHN M. GILMORE JR.

Director of Global Industry Solutions Upstream

Oil & Gas, Invensys Operations Management

CHRIS JOHNSTON

VP & Managing Director, North America, Ensco

ULISSES T. MELLO

Manager, Petroleum & Energy Analytics, IBM

DONALD PAUL

Executive Director, University of Southern

California Energy Institute

EVE SPRUNT

Business Development Manager,

Chevron Energy Technology Co.

MANUEL TERRANOVA

Sr. VP Regional Operations & Global Sales,

Drilling & Production, GE Oil & Gas

RONNIE WITHERSPOON

Sr. VP of Marketing & Business Development,

Nabors Drilling USA LP

DENNIS A. YANCHAK

Sr. Geosciences Advisor, Apache Corp.

Vice President, Digital Media

RONS DIXON

Senior Vice President, Consulting Group

E. KRISTINE KLAVERS

Executive Vice President & CFO

KEVIN F. HIGGINS

Executive Vice President

FREDERICK L. POTTER

President & Chief Executive Officer

RICHARD A. EICHLER

07 AsISeeIt-OCT_07 AsISeeIt-OCT 9/19/11 2:46 PM Page 7

HARTENERGY

T

echnology is evolving fast. For that reason, it is

imperative that companies focus not just on the

changes happening today but also on emerging techno-

logical trends that are shaping the future of organiza-

tions and industries. The more anticipatory a company

can be with regard to technology, the more creatively it

can use that knowledge and planning to gain competi-

tive advantage.

Just-in-time training

Thanks to cloud-based technology, the world is on the

brink of a revolution in just-in-time training. This will

enable people to use their laptops, cell phones, and tablet

computers as a tool to receive training precisely when

they need it. In the current training model used by many

organizations, people often receive training before they

actually need the expertise, a practice that takes them

away from their jobs and costs the company money.

With just-in-time training, companies can keep people

in the field until they need specific training. When a

person needs a certain skill set to complete a job or do

a task, he or she can receive training in real time via

cloud-based technology.

For example, suppose a service company has new

drilling equipment that its technicians have to install and

operate in a manner different from what has been done in

the past. Rather than taking people out of work and put-

ting them in a multiday training course, the company

keeps them in the field. When it is time to install and

use the equipment, they can receive the training on

how to do so in real time via their mobile devices.

Suppose a technician has used the training module but

is still confused about a certain aspect of the machinery.

He touches the help icon on his screen, and it immedi-

ately connects him to a master trainer live on the screen.

The technician can put on a headband that has a camera

on the front, much like the headbands with lights that

people use for camping or car repair. By wearing this

digital, high-resolution camera that interfaces with the

mobile device, the field operator can show the master

trainer exactly what the issue is. The master trainer can

lead the field operator through the issue as if he were

standing right there. This approach promises dramatic

savings and increases in efficiency.

Using cloud-based technology for just-in-time services

goes far beyond installation or repair. It can be used to

train people on new software, product upgrades, and on

new policies and procedures, etc. And it is different and

better than a standard tutorial because the training can

be accessed via any device anywhere and at any time,

and it offers an option for live help. In reality, the appli-

cations for cloud-based, just-in-time services are virtually

limitless.

Processing power on demand

The increased bandwidth mobile devices now receive

enables people to connect to cloud-based technologies

easier and faster than ever before. And bandwidth will

October 2011 | EPmag.com

8

industry

PULSE

Technology trends reshape

business landscape

Taking advantage of evolving technologies helps companies maintain a

competitive advantage.

Daniel Burrus, Burrus Research

Embracing cloud computing can aid in training.

08-11 IndPULSE-OCT_08-11 IndPULSE-OCT 9/19/11 2:46 PM Page 8

08-11 IndPULSE-OCT_08-11 IndPULSE-OCT 9/19/11 2:46 PM Page 9

FLOW EQUI PMENT LEADERSHI P

r n

r-

r% n n A A K /

0

- *

Deploying a complete fleet of Flowback

and Well Testing units to major shale plays.

From the Bakken Shale and Eagle Ford Shale to the Marcellus Shale and every shale play

in between, we are putting the full force of our Flowback and Well Testing fleet to work

for you. A vital link in our comprehens ive range of integrated CAMSHALE" products and

services, our portfolio of Galaxy '" Flowback and Well Testing equipment is customized to

meet the pressure, temperature and liquid content specifications of each basin. Through our

suite of Galaxy products , you benefit from proven technology that delivers seamless flow

control from completion to production. Maximizing efficiency for the life of the fi el d.

In every shale gas environment. Vi si t us at www.carnshale .com

Iff "M

COMPLETION

FRAC SUPPORT SERVICES

FLUID MANAGEMENT

01

-1- COMPRESSION

RAI SI NG P E R F OR MA N C E . T OGE T HE R

TM

CAMERON

ELI

MW

0

continue to increase. Because of this, another emerging

trend is processing power on demand or virtualized pro-

cessing power.

So many things already have been virtualized. Data

can be stored on a cloud-based network. Many compa-

nies choose this option for data safety and ease of

backup as well as for the ability to access the data via

any device. Desktops have been virtualized to be seen

on anyone elses machine.

It only makes sense, then, that processing power will

be virtualized too. In other words, a mobile device only

has a certain amount of processing power. But by tap-

ping into additional processing power via cloud-based

technology, users can turn their mobile devices into

super computers to perform advanced simulations and

crunch different data streams together to get real-time

analytics. Suddenly the handheld device is as powerful

and advanced as a desktop. If employees had the capa-

bility to do complex work that required advanced pro-

cessing power while they were on the road, armed with

nothing more than their mobile device, the increases in

productivity would be enormous.

Creative application of technology

For these trends and others to fully emerge, business

leaders have to consider what their people would do

with the technology. It is no longer enough to deploy

technology; companies have to consider how people

can creatively apply the technology to gain competitive

advantage.

To find the answer to this question, they need to ask

their internal customers (the people using the technol-

ogy in the enterprise) what they want technologically.

The next step is to give them what they ask for with the

understanding that most of them will under-ask

because they do not know what is technically possible.

What employees are not asking for is bigger and better

capabilities the things they do not even know exist.

The key is to go to the next level and give people the

ability to do what they currently cannot do but would

want to do if they knew they could. After all, people

really did not ask for an iPhone or a Blackberry. The

hidden need was the ability to access email and the

Internet without being tied to a desktop or laptop.

The goal is to put existing technologies together and

use them in a creative way. For example, there are liter-

ally thousands of features in Microsoft Word that users

can select, but most people are using only seven to 10

features. And competitors are using the same features,

which means companies are not getting any true com-

petitive advantage.

Managers need to ask questions such as, What fea-

tures would be great for our sales group (or HR, or

accounting department, or logistics people, etc.) to

use features that are so buried in the software that no

one knows they exist? Most IT departments will not ask

those questions because they are too busy making sure

everything is connected, working well, and safe. And if

they are not asking, who is? Chances are the answer is

no one. As such, it is safe to say that all tools are

underutilized.

Companies need to implement a communication

vehicle that engages the different groups served in the

enterprise sales, logistics, purchasing, accounting, HR,

etc. and help them understand the power of the tools

to which they have access.

One suggestion is to automatically show them a feature

of the day and how it can make their lives easier. This

approach provides information in short, fun, engaging

ways rather than in a hundred-page document (which no

one will read anyway) that details all of the features.

Creating a companys future

Many business leaders will say they are too busy to address

any of these trends. But if they do not

address them, who will?

Ultimately, whoever drives these

trends within an organization will be

seen as a significant contributor to

the enterprise. That someone can

drive results to the bottom line and be

a key contributor to the organiza-

tions success.

October 2011 | EPmag.com

10

industry

PULSE

Desktops can be virtualized to be seen

on any machine.

08-11 IndPULSE-OCT_08-11 IndPULSE-OCT 9/19/11 2:46 PM Page 10

08-11 IndPULSE-OCT_08-11 IndPULSE-OCT 9/19/11 2:46 PM Page 11

I have someone retiring after 33 years on the job.

I have someone taking 33 years of experience with him.

And now someone with just

3 years has to do that job.

POSSIBLE

GARY

) 7.

use

c

Sig

,

JEFF

9P

TF.

521

I

With new Human Centered Design technologies from Emerson, it's like the experience

never left . Using our deep insights into how your people perform their roles and tasks , Emerson

is designing all of our new products based on the science of Human Centered Design. This lets us

embed the same experience and understanding that's walking through your plant into our control

and monitoring technologies - making them the easiest and most intuitive to use. Tasks are

accomplished in fewer steps, and with greater confidence, even when relying on less expertise

and specialization. It's the certainty that jobs are done right, no matter who's doing them. Find the

experience you've been missing at EmersonProcess.com/ Experience

Process Management

4-

EMERSOM

EMERSON . CONSI DER I T SOLVED' :

.

y a

North Sea operator continues to see

opportunity

Sticking with what you know can provide a solid foundation for moving into new frontiers.

H

eadquartered in Denmark, DONG Energy considers

itself to be one of the leading energy groups in

Europe. Sren Gath Hansen, DONG Energys executive

vice president in charge of Exploration & Production,

refers to DONG as an integrated energy company.

DONG is the result of a merger among several large

players in the Danish energy sector. In 2005, we had

several separate power producing companies, an E&P

and gas transmission and wholesale company, and sev-

eral distribution companies, which we merged into one

joint company, Gath said.

Today the company has more than 6,000 employees

and is continuing to grow. Danish 76% state-owned

DONG had annual revenues in 2010 equaling US $10

billion (6.3 Bn GBP) with earnings of $2.5 billion (1.6

Bn GBP). In a Danish context, DONG is among the

three largest companies in the country. On an interna-

tional level, the company is classified as small to medium

size.

According to Gath, DONG is working to expand its

portfolio both as a major European utility player and as

an E&P company. Originally, power generation was

based on coal-fired plants, he said. We are now chang-

ing that to natural gas and biomass to decrease CO

2

emissions overall. In 2006, we set a target to reduce our

CO

2

emission per MWh by 50% in 2020, and we are

already ahead of our plan to reach this target. We are

also a world leader in offshore wind energy with signifi-

cant investments in Denmark, Germany, and especially

UK, Gath said.

As DONG continues to invest in its utilities arm, the

company also plans to expand its E&P offering. The

company operates across the Danish and Norwegian

continental shelves and is the largest license holder in

the West of Shetlands, with recent discoveries including

Glenlivet, Laggan, Tormore, Edradour, Rosebank,

Cambo, and Tornado.

At the end of 2010, DONG Energy held 73 licenses in

Northern Europe: 13 production licenses, 11 under

development, and 49 exploration and appraisal licenses.

DONG Energy operates 10 licenses in Denmark, seven

in Norway, eight in the UK, and one in Greenland.

DONG is a mixture of E&P and utility, said Gath.

We have seen better results in the first half of 2011 than

the same period in 2010, which was our best year to

date, outperforming most of our peers, he added.

Of the revenue for 1H 2011, 34% of the earnings came

from DONGs E&P sector. Part of our success is because

we have changed our strategy to strengthen our E&P

efforts while increasing our focus on green energy as

well, Gath said. In coming years, DONGs E&P develop-

ment will increase in addition to adding more wind and

biomass power generation to our mix, he said. The com-

pany is heavily invested in several wind farms that will

come online within the next two to three years.

From partner to producer

DONGs energy growth strategy was marked by several sig-

nificant events in the past 12 months. The Nini East field

on the Danish shelf was put into production, followed by

the Norwegian Trym field at the beginning of 2011.

Exploration for new reserves has resulted in two discov-

eries, one in the Solsort license in the Danish sector of the

Sren Gath Hansen, DONG Energys executive vice president, E&P:

Part of our success is because we have changed our strategy to

strengthen our E&P efforts. (Image courtesy of DONG Energy)

Tayvis Dunnahoe, Senior Editor

October 2011 | EPmag.com

12

world

VIEW

12-15 WorldView-OCT_12-15 WorldView-OCT 9/19/11 2:46 PM Page 12

12-15 WorldView-OCT_12-15 WorldView-OCT 9/19/11 2:46 PM Page 13

}

`Wt L_?

?

'

L

??

U L L

' ?`t?;LL

(L

( l =

'L 1 d

C cIri kR

L'

L k L ftt Y

ere at the beginning. Here for the future.

When you think of petroleum engineering and petroleum geology programs,

the University of Oklahoma's Mewboume College of Earth & Energy migh

rst college that comes to mind, and it should be.

to the world's first school of Petroleum Geology, granting the fir

ee in 1904

ie to the world's first school of Petroleum Engineering

a mater to more petroleum engineers and petroleum geologists

any program in the world ... and to 8 past presidents of the

ociety of Petroleum Engineers

A trusted

pa

rtner of the oil and gas industry for the past 100 years

www.ou.edu/

MEWBOURNE

COLLEGE OF EARTH&ENERGY

HE CNI VFI' SI I YO -OKLAHOMA

Real education for the real world.

j

F*

k : l

IL T

r

-

_

be the fi

degr

t

?

i

It'no ev leader for the future

mcee

October 2011 | EPmag.com

14

world

VIEW

North Sea operated by DONG E&P and one in the

Edradour license in the UK sector in which DONG E&P is

partnering with Total, the operator. In 2010, DONG E&P

participated in investment decisions to develop the Lag-

gan-Tormore licenses in the UK North Sea and Marulk in

the Norwegian Sea, and it is initiating further develop-

ment of the Syd Arne field offshore Denmark. The com-

pany also has been awarded a new West Greenland

license, three in the UK, and one in Norway.

We have a well diversified portfolio comprising assets

in mature areas in the Southern Norwegian and Danish

North Sea, assets with fresh new production in Mid-Nor-

way, assets in growth areas such as West of Shetlands, and

frontier areas such as the Barents Sea and Greenland,

Gath said. The companys strategy has been to focus on

these areas: We know the political systems, we know the

business culture, and, we know the subsoil, he said.

Gath believes there is good value in partnering with

larger operators. We always play an active role in projects

because we are learning at every phase and believe that we

can contribute in a value-creating way, he said. DONG is

currently one of the largest holders in the West of Shet-

lands. We set out a long-term strategy, Gath said. In

2000, the company made the decision to get into the

West of Shetlands when few people believed in the areas

potential. We wanted to fully understand the region. We

wanted to be basin masters who understood all the plays

in the area, he said. The company has managed to break

the code in the West of Shetlands and has participated in

nine discoveries in the area since 2000.

Our primary objective for all of our operations is to

develop and understand the subsoil in a particular region

and make a difference with this applied knowledge,

Gath said.

Although some of the companys assets could be consid-

ered mature fields, many have years of production

ahead.

The Siri area, for example, was estimated to contain 50

MMbbl when production started in 1999. Weve produced

110 MMbbl and still expect to have about 10 more years of

strong production left, Gath said.

The recent Solsort North Sea discovery shows that the

Danish sector still has viable prospects to be discovered.

DONG has increased its operating potential through

a variety of successful partnerships with larger, more

experienced operators. In the mid-Norwegian North

Sea, DONG holds a 10.3% interest in the landmark

Ormen Lange development project. The field, which

is 40 km (25 miles) long field and 8 km (5 miles) wide,

showcased one of the worlds first subsea-to-beach produc-

tion facilities from such deep waters. This field is pro-

duced from the sea floor 120 km (75 miles) from shore.

Partnering in Ormen Lange gave DONG assurances

toward developing similar projects. As Totals only partner

in the Laggan-Tormore development offshore West of

Shetlands, DONG holds a 20% interest. This develop-

ment, which is being called a mini-Ormen Lange, will

exceed the record set for subsea-to-beach production by

producing through a multiphase system 143 km (89

miles) to shore.

Frontier player?

While DONG has proven its viability close to its native

Denmark, the company is not opposed to moving out fur-

ther. It is active in two frontier areas, including the Barents

Sea and offshore Greenland. We will be drilling our first

operated well in the Barents Sea in November this year,

Gath said.

In Greenland, which Gath considers to be a true fron-

tier, the company has participated in exploration activi-

ties since 2000, when it partnered with Statoil on the Fylla

well. The company now holds two licenses: one in partner-

ship with ExxonMobil and Chevron and another with

ConocoPhillips.

The companys strategy is to operate in areas where it

has an understanding and has competencies to bring to

the table such as in the North Sea. We would like to be

capable of doing anything, but our size provides some lim-

itations. Our goal and our strategy in frontier and areas

with huge challenges is to become a strong and coopera-

tive partner to larger companies that have more experi-

ence, Gath said.

DONG expects to see about 10 more years of strong production

from the Siri area, which has delivered 110 MMbbl of oil so far.

12-15 WorldView-OCT_Layout 1 9/20/11 11:21 AM Page 14

12-15 WorldView-OCT_12-15 WorldView-OCT 9/19/11 2:47 PM Page 15

Well take care of it.

it comes to w ll it t

Accommodations. Solids control .

Construction and communication services.

Lots of little things on the wellsite can

distract your crew and take focus away

from the wel l itself-and the big picture .

Stallion Oilfield Services takes care of all

these tertiary services , including:

Onshore and Offshore - Wellsite Construction Fluid Transport and Logistics

Workforce Accommodations Wellsite Communications Solids Cont rol

Rental Equipment

Read y to learn more? Call 713.528.5544 or visit Stallion at booth #478

at DUG Eag le Ford , and get firsthand information on how we can help you

Stay Well Focused"" on your next project.

staywe llfocused.co m

r

11

-1

f

l

r"1

?d

04

T

here are many factors challenging the industry today.

Domestically in the US, there are concerns with

uncertainty from Washington DC and the fallout from

the Macondo oil spill and subsequent moratorium on

offshore drilling. There is a shortage of young people

entering the oil and gas industry at a time when the

workforce is reaching retirement age. Globally, there has

been a trend toward increasing demand for oil and gas

in the face of a decline in exploration over the last 24

months. And political unrest in major producing coun-

tries in the Middle East has made countries that are

reliant on hydrocarbon imports uncomfortably aware of

their vulnerability. In the face of all of these challenges

is the demand to reduce time to deployment despite

higher-than-ever development costs.

This situation is compounded by the do more with

less mentality that is so ingrained it is hard to think

about innovative ways to tackle these issues.

The good news is that technology can help ease the

pressure. Collaboration tools have come of age and hold

the promise of addressing many of these concerns and

very cost-effectively.

Technologies, networks mature

Videoconferencing has been around for years. While it

is a well understood technology, the endpoint products

historically have been costly. Most products only liked to

talk to the same brand of equipment worldwide, and

the major expense was the cost of a quality network. In

certain parts of the world, high-speed circuits simply

were not available.

Both sides of the equation have changed dramatically

in recent years.

Conferencing equipment is largely standardized,

and pricing for endpoints have dropped significantly.

Newer products also use bandwidth much more effi-

ciently than products produced as recently as five years

ago. The spectrum of offerings is impressive, ranging

from basic, low-end offerings that are essentially free,

to complete Telepresence suites that provide lifelike

HD experiences.

In the same time frame, options for high-speed Internet

access have expanded, even in countries where it takes

years to get a telephone line. The same is true of offshore

networks high-speed Internet is now an expectation on

the rig and one can take advantage of that to collaborate

with co-workers around the world, bringing the best minds

on the planet together to make important decisions or to

solve a problem.

Baby steps

For many energy companies the first use of collabora-

tion and video tools was not initiated by the IT depart-

ment. Individuals who saw the need took matters into

their own hands and deployed webcams or handheld

video devices like Ciscos Flip camera and used free

products like Skype and Google Video Chat to share

information and collaborate. Every iPhone user can

videoconference and now expects to be able to do at

least that in the workplace.

These low-cost entry level collaboration tools are sur-

prisingly good and in many cases are free but for the

cost of a webcam (most laptops and tablets today come

equipped with at least one camera whether buyers want

it or not). When troubleshooting a problem on a rig,

this approach may not be technically pristine, but it gets

the job done. Some of these free video chat tools are

surprisingly effective, and the price is certainly right.

Another option to consider is Microsofts Lync prod-

uct, formerly known as Office Communication Services

Collaborative tools come of age

In a resource challenged industry, leading companies are using collaboration tools to bring

the best minds together to make the best decisions.

Dave Jacobs, TechKnowledge Consulting Corp.

October 2011 | EPmag.com

16

management

REPORT

Ciscos Telepresence is the market leader in the high-end video

arena. (Photo courtesy of Temple Webber Photography)

16-19 MgtReport_16-19 MgtReport 9/19/11 2:47 PM Page 16

16-19 MgtReport_16-19 MgtReport 9/19/11 2:47 PM Page 17

I

Custome

ervi,

W7:

.. i

.: .. . I I i

Portable Available Consignment)

National Oilwel l Varco" has introduced NOV RigPAC

S""

, an i nventory management

solution by Distribution Services, designed to streamline and enhance drilling

contractor support.

NOV' RigPAC is a portable warehouse unit that holds consigned inventory onsite,

resulting in increased efficiencies ,

better i nventory controls

, improved safety and

security, and lower total cost of ownership.

Improving the supply chain to address your operational and financial challenges

Maxi mum Ri g Uptime

Improved inventory control and visibility ensures critical materials are on location

Global Support and I nt ; ucture

Global inventory in more than 200+ locations worldwide

Superior Financial Returns

Reduced total cost of ownership and expense optimization

For more information visit www.nov.com/ novrigpac or contact your local Distribution Services re resentative.

11111111

Email: distrbutlon@nov.co

NOVRigPAC

L VARC

_

One Company . . . Unlimi t ed Soluti o

www.nov.

j

-

p/novrlgp

VP

P'

10

r ?

?r

t?

' i c:

'

a

s

?v ?.

?

t

SM

?oV

RigPAG

n

70.

d {

i

l

l -Ve

.`

T!d `

. .

(OCS). Most of the Lync functions are embedded in

existing Microsoft products. Many large energy compa-

nies already have some of these functions as a result of

existing enterprise license agreements. Lync includes

easy-to-deploy Instant Messaging (IM) and video chat

sessions and also can provide basic telephony services

that can be useful in settings where deploying a tradi-

tional phone system is impractical.

Many energy companies spend thousands of dollars

with third-party conferencing companies, unaware that

conferencing and collaboration servers are cost-effective

options. For any company spending more than $2,500 a

month with a third-party provider, a conferencing server

may make sense. They are available in a variety of config-

urations, but all replicate the basic bridging function

of a third-party provider, complete with controls for the

host. Many offer a collaboration tool that permits every-

one on the call to view an image or document, and some

also offer video chat. The better offerings integrate with

Outlook, providing conferencing as an option when

sending a meeting invitation. Some also

offer recording and archiving for those who

cannot participate in the real-time confer-

ence. One example is Avayas conferencing

server, which is part of the Avaya Aura prod-

uct set. Webex can be an equally effective

method of collaborating and is available for

purchase as a secure corporate server or as

an affordable pay-by-the-use service.

Cost-effective videoconferencing

With high-speed Internet access available in much of the

world, the challenge of delivering a quality video circuit

is to some degree resolved. An HD quality experience

may not be possible everywhere in the world, but even

the most basic Internet connection can provide a rea-

sonable video experience. Consider how often news cor-

respondents broadcast from a remote location using a

satellite Internet connection not the most elegant

video quality, but effective nonetheless.

While it is nice to see a persons face on the screen, in

many cases the purpose of a videoconference is not to

interact with an individual the more important aspect

of the conversation is to collaborate and review a piece

of information, a seismic image, some interesting data.

Video conferencing and collaboration tools provide the

ability to do that in HD, accomplishing most of the

objectives of a face-to-face meeting. Reduction in travel

is appreciated by both employees and employers, but

the real benefit is better decision-making and a substan-

tial reduction in the time

required to make important

choices. Mainstream

providers such as Tandberg

(recently acquired by Cisco),

Polycom, and Lifesize offer

quality products that are sur-

prisingly affordable.

When the key objective is

personal interaction, Cisco,

Hewlett Packard, and Poly-

com offer very lifelike high-

end conferencing systems.

Ciscos Telepresence is the

market leader in the high-

end video arena. The com-

pany has deployed more than

1,000 purpose-built Telepres-

ence rooms worldwide.

Each provider offers a wide array of

products, large and small, so even a

remote location can participate cost

effectively.

There is little doubt that the floodgates

are opening, and video conversations are

soon to be the norm. Although most com-

pany IT networks are not prepared to

make the leap to video anywhere/any-

time, the time to start planning and

deploying video is now.

October 2011 | EPmag.com

18

management

REPORT

RIGHT: Most laptops and tablets today come

equipped with at least one camera. BELOW:

Videoconferencing has become standard

practice in many companies.

16-19 MgtReport_Layout 1 9/20/11 11:40 AM Page 18

16-19 MgtReport_16-19 MgtReport 9/19/11 2:47 PM Page 19

GE Energy

fAi l give. NO

tQK

.

Introducing the new standard-GE's Waukesha 275GL+

-the most efficient , powerful, fuel flexible engine in its class.

No matter how you measure performance, the 275GL+ represents the

most advanced generation of high-horsepower lean-burn engines.

Witl-

the 275GL+ there are no tradeoffs-no choosing between high power and

emissions, or between fuel efficiency and fuel flexibility. Regardless of what

your application demands, the 275GL+ is your engine of choice.

Learn how we're raising the bar for the gas compression industry

by visiting www.ge-energy.com/275GL

ecomagination

a GE commitment

imagination at work

04

AN

!

Al

ou

J!

r

L'

?^

?

? i i

pp

? 1 t

. t

r

j

t

:?{i R

S

i?

,?S

'

I

TRADE OFFS

- - - - - - -

-

---

October 2011 | EPmag.com

20

B

ringing a new offshore oil field into full production

requires timely and accurate decision-making

informed by current conditions. Without proper real-

time surveillance, however, new fields can be hampered

by uncertainty especially during start-up periods,

where rapid assessment of field operations and produc-

tion conditions is critical to maximizing production.

Ensuring optimum production is not simply a matter

of building the infrastructure, installing equipment, and

flipping a switch to begin operating. New fields require

the right combination of technology and planning at

every step of the process. Without adequate means to

obtain critical information, the process can be long,

cumbersome, and ripe with the chance of error.

Potential pitfalls

Exploration and development company Ithaca Energy is

well aware of this and is taking the necessary steps to

minimize improvisation in the development of the new

Athena oil field offshore Scotland. The Athena oil field

a joint venture among Ithaca Energy, Dyas UK, EWE,

and Zeus Petroleum expected to produce approxi-

mately 22,000 b/d of oil at startup. Field operator Ithaca

Energy sought the latest monitoring technology avail-

able to help with well management and surveillance

and to ensure optimal production processes. To ensure

expedient startup and maximize production, Ithaca

Energy needed to find the right mix of technology to

help personnel spend less time gathering data and more

time meeting the organizations operational objectives.

The company needed technology that would provide

real-time insight into processes and performance to com-

bat the uncertainty and inaccuracy that often impede the

process of bringing new fields onstream. In addition, oil

fields are frequently subject to variations in well perform-

ance, artificial lift variables, topsides process conditions,

and other factors. These, in turn, can cause large fluctua-

tions in total production. Also, process data obtained

in these conditions is frequently subject to flat lines,

dropouts, and errors that require cleansing for proper

and accurate data processing.

Well rate estimations require calculations and correla-

tions using accepted first-principle methods, and these

must be adjusted and recalibrated according to field

conditions. The resulting estimations must then be pre-

sented clearly and accurately to decision-makers and

in a format that allows them to consult with their peers

and respond to situations in a timely manner.

Digital advantages

The Athena oil field required technology that would

address these factors as much as possible while ensuring

optimal production. Ithaca Energy found the answer to

its requirements in digital oil field management technol-

ogy for the flexibility and control it offered. Central to

achieving this was selection of well surveillance software

from Honeywell Well Performance Monitor (WPM)

which provides an easy-to-understand, real-time snap-

shot of key operations through one information hub,

helping key personnel and decision-makers visualize the

performance of the entire field.

For Ithaca Energy, choosing the Honeywell WPM soft-

ware was the first step in the process toward establishing

a digital oil field on Athena. The next stem was the

implementation process, which entailed determining

the proper approach as well as the appropriate phases

and structure of the system. Working with Honeywell,

Ithaca Energy took a vertical (from data sources to end-

user visualization) and phased approach to deployment,

implementing an adequate amount of functionality at

every automation/IT layer to achieve the business objec-

tives, but allowing room for growth and adaptation

based on potential new objectives and future levels of

functionality.

digital

OIL FIELD

New technology optimizes operations

The Athena field is powered for performance.

Joel Chacon, Honeywell Process Solutions

Honeywells program allows engineers to monitor ESP perform-

ance to better manage production. (Images courtesy of Honey-

well Process Solutions)

20-22 DOF-Honeywell_20-22 DOF-Honeywell 9/19/11 2:47 PM Page 20

20-22 DOF-Honeywell_20-22 DOF-Honeywell 9/19/11 2:47 PM Page 21

i

,

Expro h

_

as continuously

'

acquire accurate and reliable high quality data, allowing

me customer ioiMaKe in

ilea

effectively and qVi c

Our core

record that

_ r r

r-

integra

ervoirs.

n proven bve

ew DST tools means

across t t " xploration

mere

track

ears and

well.

vide througho

1

- J ,.f D J f 1 JI

r0group.

I

r

??ft Il ly

P

1JJ ri"Jt

c

rr r r-

?r

,:?

J??

'

M OEM

A . a

v

rina ouu ore at: xp

l ?a

R

v

u

1

i

Drill Stem Test

urlneu utiuiswns yuu;lcly,

i e

9

?J

.

JI -J!.

ME

at ase of env

om.

LE?

v

d'

Z

U

October 2011 | EPmag.com

22

From a timing perspective, the phased implemen-

tation eliminated costly uncertainty and guesswork

during the ramp-up period of the new field and

ensured Ithaca Energy would have a fully tested sys-

tem available when the field came onstream. It also

left room for future growth and improvement.

Once the field is on production, the WPM system

will enable the engineering team to monitor how

the Athena wells are performing compared to

expectations. To complement the WPM system,

Ithaca Energy also selected an out-of-the-box mod-

ule for Well Test Validation from Honeywell, further

supporting the objective of establishing optimal well

performance conditions.

Taking a three-phased approach, the operator first

established system requirements and developed a

general design for the integrated system. At its core,

the Athena field development is producing from

wells in which production is being boosted by electrical

submersible pumps (ESPs). Engineers sought to auto-

mate the well production test capture, analysis, and vali-

dation process, so Ithaca Energy formed the projects

main objectives around the set of functions as applicable

to ESP wells, and by modifying WPMs Well Test Valida-

tion module, as required, to achieve those objectives.

Honeywell helped extend the Well Test Validation

modules functionality to cover specific model-based val-

idation steps on the well. As part of this activity, the tech-

nology provides suggestions of possible well model

adjustments to match recent well tests.

Using the module, production engineers can quickly

calculate and recalculate well test results based on stable

process variable averages to capture valid well tests even

prior to creating the well test record. If the well test is

deemed valid, the system executes a match with the well

model and suggests potential adjustments. This provides

engineers with the level of detail necessary to accurately

determine which parameters actually require modifica-

tion. The engineers have the final word on what well

model adjustments require changes or if a new well test

is required to validate the results of the analysis.

Visual models will help predict what each well is capable

of producing. The WPM technology can extract summary

information and key performance indicators from real-

time process data historians, production databases, and

engineering well models, allowing operators to visualize

field performance data and manage equipment assets.

This picture shows where shortfalls in production are

occurring so engineers can take immediate steps to cor-

rect them and maximize the production potential of each

well. WPM also helps personnel manage costs associated

with surveillance by enabling engineers to identify abnor-

mal situations quickly and react rapidly to disturbances.

Because of the systems flexibility, Honeywell is help-

ing Ithaca Energy use the system to automate as many

routine actions as possible to free personnel to focus on

more complex tasks and decision-making. By enabling

greater automation, the system saves engineers time

while providing them with the detailed insight needed

to make sound, informed decisions that ultimately affect

well performance.

Fine-tuned performance

The second stage of implementation entails deploying

the software in a simulated environment, which is

enabling operations managers to test the system, train

personnel, and fine-tune processes so they can be as

fully operational as possible when the wells begin to pro-

duce. This is especially critical because the oil field is

being developed concurrently with the system.

In the third stage, Honeywell will work with Ithaca

Energy to ensure a smooth changeover to the produc-

tion environment. This involves working with the system

users and adjusting the softwares calculation and esti-

mation methods to reflect actual field conditions so

engineers can access critical real-time information to

pinpoint underperforming wells and help improve col-

laboration throughout the team. When the changeover

occurs in late 2011 and the wells start producing, Hon-

eywell and Ithaca Energy expect the preparations cou-

pled with the advanced technology capabilities will

ensure the Athena oil field is running optimally from

day one and that it continues to perform efficiently long

into its future.

digital

OIL FIELD

WPM will provide the operator with a real-time snapshot of key opera-

tions on the Athena field.

20-22 DOF-Honeywell_20-22 DOF-Honeywell 9/19/11 2:47 PM Page 22

E

&P companies today are very knowledgeable about

identifying and investigating best-in-class technology

resources that support the demanding core tasks that their

business requires. These requirements include some that

are unique to the oil and gas industry and thus extend

beyond conventional business IT requirements including

seismic interpretation, wellpath planning, and the trans-

fer/availability of extremely large data volumes that sup-

port multiple areas of exploration and mapping. All

of these are tied to improved workflow performance,

which means reducing the amount of time and resources

required to assess, deploy, and manage projects that deliver

optimal results. Efficiency and productivity are critical

requirements for the bottom line.

Inherent to optimizing workflow performance is the

ability to identify and leverage top-tier data environments

that not only support but enhance productivity and effi-

ciency while ensuring 24/7 security and reliability. Some

companies are recognizing the value of scalable, sophisti-

cated data center environments.

Petroleum Geo-Services (PGS) is one such company

that stands at the leading edge of this trend. It reposi-

tioned a significant portion of its IT infrastructure to

CyrusOnes Houston West data center several months ago.

David Baldwin, service support manager at PGS, noted

several areas of performance that convinced him and his

colleagues that a co-located environment was the best

option for the company.

Cost efficiency is paramount

The most important factor CyrusOne encounters is cost

efficiency, namely reduced power costs. Over the past half-

decade, IT teams have experienced a dramatic increase in

power requirements for data and network infrastructures.

This is because the core hardware and architecture have

evolved very rapidly toward high-density data environ-

ments in which power requirements have moved from

100 kW of power per sq ft to 300 kW/sq ft. Some high-

density environments can reach 500 kW/sq ft. Managing

power requirements and projecting budget outlays for

ever-increasing power needs becomes more difficult and

unpredictable as these requirements continue to escalate.

IT teams have three core options build a data center,

retrofit an existing center to meet current and future

requirements, or co-locate with a hosted data provider.

Build vs. buy analytics clearly indicate that co-location is

the best option in many cases.

CyrusOne reviews the various scenarios with prospective

and current customers on a regular basis. The most

underrepresented factor when IT teams conduct their

own analysis is power requirement. As previously men-

tioned, it becomes more difficult to execute this analysis

correctly when confronted with power consumption met-

rics that increase rapidly and continuously over a short

period of time. This years budget will not be next years

budget; that much is certain.

A company that wants to build its own data center must

consider the most advanced and scalable power supply

architectures to ensure the facility will adapt to future

technology, increased space, and growing electricity

requirements. This is an expensive undertaking to say the

least a high-density data center built to meet the most

advanced and most flexible specifications will exceed US

$500/sq ft for a 10,000-sq-ft build. Economies of scale

become critical at this stage of decision-making. A co-

located data center is built to house multiple customers

across a much larger and more dynamic architectural foot-

print, thus distributing and mitigating both cost and risk.

Because of the nature of data center business and opera-

tional models, top tier co-located data centers are designed

EPmag.com | October 2011

23

digital

OIL FIELD

Data environments prove viable

best option for E&P customers

Co-located centers help ease IT headaches.

Kenneth Wolverton, CyrusOne

Having several customers in one facility provides economies of

scale for power consumption. (Images courtesy of CyrusOne)

23-26 DOF-Cyrus_23-26 DOF-Cyrus 9/19/11 2:47 PM Page 23

23-26 DOF-Cyrus_23-26 DOF-Cyrus 9/19/11 2:47 PM Page 24

Change Your Shale Economics

with a Custom-fit Completion

Maximize production. Reduce operating costs. Save valuable time.

SLEEVES

MULTI FRAC ZONE

Weatherford's ZoneSelect

-

fracturing-completion system

targets each zone with a customized stimulation design to

maximize production in multizone completions.

Unlock your tight-shale production while saving significant

completion time and money.

With a selection of mechanical and swellable packers

,

high-torque-rated frac sleeves, and solid-performing

composite plugs

,

we customize the optimal isolation

and stimulation package for each zone to maximize total

production with single-trip efficiency.

Best of all, you can have a custom-fit ZoneSelect system for

about the same cost as a general-purpose system. This is

Tactical Technology

`"

at its best

,

with proven reliability and

safety over the last ten years in Nort h American shale plays.

Contact your Weatherford representative or visit

weathe rfo rd.co m/zonesel ect.

The change will do you good

-

Completion

4

Lir . :ion

1i

Openhole corm letions;

Multizone completion systems

Swellable packers

1W

Weatherford

weatherford.com

co

0

z

a.

0

v

PACKERS

?_

k

. -1

EPmag.com | October 2011

digital

OIL FIELD

with advanced 2N and N+1 architectures that deliver optimal power efficiency

and uptime reserve in addition to superior power and ambient environmental

control within the center. Because of this advanced architecture, CyrusOne is

optimally equipped to predict and manage power consumption needs across the

entire facility, accommodating power requirements on a per-customer basis from

the lower end of the scale (150 kW/sq ft) to the upper limit (500 kW/sq ft).

Reduced infrastructure management

Oil and gas companies want to focus less on managing data infrastructure,

including routine maintenance and iterative processes, and focus more on core

competency and business-facing workflows. But for many IT teams, a large pro-

portion of their workload is spent executing routine tasks in the name of quality

control and supervision.

Co-located data centers are able to offload routine maintenance and tasks

without sacrificing peace of mind. In fact, this is another area that PGS cited as a

principal factor in its decision to migrate to co-location with CyrusOne. Leverag-

ing intrinsic on-hand expertise is a fairly easy decision for many customers.

Additionally, many co-location providers offer training to further enhance the

efficiency and effectiveness of client work teams. Some clients prefer to manage

all or most workflows themselves, while others carefully choose select process

points at which to directly engage. In either scenario, on-hand training offers

valuable insight and improved techniques for managing and coordinating criti-

cal pieces of the data infrastructure puzzle.

Future-proof scalability

The third component that all customers appreciate is a forward-designed data

center environment. As requirements and architectures change, and as hardware

and network protocols change, the data center remains ahead of the curve at

every stage, and customers can scale their respective infrastructures accordingly.

Co-located customers can adapt and alter their data infrastructures as needed

without headaches or bottlenecks. This arrangement aids greatly in planning

because customers can reliably predict and anticipate next years budget with a

great degree of certainty. Like most top tier co-located data centers, CyrusOne

anticipates change based on innovation models and advances in technology and

can thus ensure seamless upgrades and modification of existing systems and com-

ponents. The technology curve is an elusive thing in many respects, but through

expertise and a deterministic approach to future needs, CyrusOne ensures its cus-

tomers are empowered to stay well ahead of this ever-shifting curve.

Another important aspect of remaining ahead of the curve is the ability to

remain fully compliant with environmental standards and/or mandates, which

can vary widely between regions. Any top-tier co-location provider should remain

fully abreast of all environmental control factors and maintain full compliance at

every required stage.

According to Baldwin, this feature of the CyrusOne value proposition gave

PGS great confidence in consolidating the bulk of its IT infrastructure within the

Houston West data center. You have to be certain that the new environment is a

better and more secure environment and that it can be

managed and adjusted as needed without complication

and with the full certainty that no interruptions, only

improved performance and efficiency, will occur. EPmag.com

READ MORE ONLINE

There is more

to the story

23-26 DOF-Cyrus_23-26 DOF-Cyrus 9/19/11 2:47 PM Page 25

W

Weatherford'

Tactical Technology

TM

in action:

ZoneSelect'" frac system

proven in tight-shale zones.

Globally, the modular ZoneSelect

frac-completion system is maximizing

production with completions

customized to each individual zone.

And, operators are saving money

with the ability to perform multizone

stimulations in a single trip.

Total design and engineering

capability from a premium completions

provider and one of the world's leading

oilfield service companies:

Detailed job planning

Torque-and-drag calculation to run

system trouble-free to bottom

CFD (computational fluid dynamics)

modeling to maximize frac gradient ,

avoid premature opening of sleeve

Discover how Weatherford's ZoneSelect

systems and Tactical Technology give

you more for your money. Contact a

Weatherford representative or visit

weatherford.com/zoneselect

The change will do you good

-

weatherford.com

4icu,W.4, 'e ptgklel:lry di %1 pa7mlW N1' .;W11i7pO tat1'nMU??.

23-26 DOF-Cyrus_23-26 DOF-Cyrus 9/19/11 2:47 PM Page 26

Ghost-free acquisition.

Iv

GeoStreamer GS

TM

Broadest bandwidth

Increased confidence

Reduced risk

Scan to learn more about

GeoStreamer GS

GeoStreamer

+

GeoSource

GeoStreamer GS is the first marine acquisition system to

eliminate both source and receiver ghosts.

The combination of the proven GeoStreamer "' dual-sensor

technology with the time and depth distributed source of

the new GeoSource

TM

offers unprecedented bandwidth.

Oslo London Houston Singapore

Tel: +47 67 526400 Tel: +441932 376000 Tel: +1 281 509 8000 Tel : +65 6735 6411

Fax:+47 67 526464 Fax:+44 1932 376100 Fax:+1 281 509 8500 Fax:+65 6735 6413

A Clearer Image

www.pgs.com/GeoStreamerGS

I

V

A

q

*??o

I

I

I'

I

O

perators in North Americas shale plays are increas-

ingly relying on microseismic information to deter-

mine fracture length and orientation during hydraulic

fracturing operations. This understanding often impacts

the location and orientation of future wells.

In a proposed geothermal project in the UK, informa-

tion from the seismic around the first well will determine

the exact location of the second well. Once again, its all

about the fractures.

The Eden Deep Geothermal Energy Project in Corn-

wall is an ambitious attempt to tap into the heat buried

beneath the granite in the area. The Cornubian

Batholith, sort of a granite spine in Western Europe,

brings geothermal heat closer to the surface and lowers

drilling costs, according to Edens website.

The idea is to drill a 4-km to 5-km (2.4-mile to 3-mile)

borehole into the granite, where it will encounter

temperatures of about 180C to 190C (356F

to 374F). Water will be pumped into this

borehole to open up natural and

induced fractures in the rock.

Borehole seismic sondes developed

by DJB instruments will be deployed

around the borehole. The sondes can

be buried to 400 m (1,300 ft) deep, do

not need a clamping mechanism, and

have large accelerometers and low-noise

amplifiers to provide a very high output

and make them sensitive to small signals.

The accelerometers, according to DJB litera-

ture, have a larger bandwidth than geophones and

seismometers, facilitating additional analytical treatment

such as source parameters.

The sensors also have very low power consumption

and can be operated from a car battery. The sondes will

be triangulated to find the exact locations where frac-

tures are opened and then slipped by a shear mecha-

nism. By imaging this location, the second borehole

can be sited.

The sondes monitor whats happening in terms of

the water and the movement of the rocks, said Paul

Hunter, managing director of DJB. Weve supplied six

sondes to the Eden Project, and they will be put around

the perimeter and keep monitoring and measuring

whats happening.

Its important to drill into these open fractures

because thats where the magic of geothermal comes

to bear. Water pumped down the first borehole will be

heated, transferred to the second borehole through

the fracture network, and sent back to the surface as

steam to provide electricity.

Eden Project participants have partnered with ESG

Energy to build the facility to generate both

heat and electricity. The site is located in a

parking lot and has been sanctioned by

the Cornwall Council.

When complete, it should have a

capacity of 3 MW to 4 MW of elec-

tricity and should be able to gener-

ate about 95% of the time. Its

expected to supply enough elec-

tricity to support 3,500 households

as well as some heating capacity.

An ESG plant is very efficient when

compared to many other systems, the

website states. Around 30% of the power

created by the plant will go back into pumping

water around the system, so it can be said to be

about 70% efficient overall.

Covering an area about the size of a rugby pitch,

the plant will run 24 hours a day, more than 345 days

per year, and is expected to come onstream in 2013.

DJB, meanwhile, is already developing its next

generation of sondes to operate at greater depths

and temperatures.

Might there be applications to oil and gas opera-

tions? Only time will tell.

But any device that can so

accurately pinpoint open

fractures is certainly worth

a look.

Seismic leads the way for geothermal

Sondes identify exact location of open fractures.

Read more commentary at

EPmag.com

RHONDA DUEY

Senior Editor

rduey@hartenergy.com

27

exploration

TECHNOLOGY

EPmag.com | October 2011

Im

a

g

e

c

o

u

rte

sy

o

f

D

J

B

In

stru

m

e

n

ts

27-28 ExpCOL-OCT_27-28 ExpCOL-OCT 9/19/11 2:48 PM Page 27

27-28 ExpCOL-OCT_27-28 ExpCOL-OCT 9/19/11 2:48 PM Page 28

EVOLVE IN

EVOLUTION

'"

Vi&

I I nICVnC/ "TCI"1 \ A/ AVC

BIGGER DOESN'T GUARANTEE SUCCESS

EARLY ADOPTERS of our Evolution high-performance water- based drilling fluid

are already enjoying the cleaner ,

fast er

,

and smart er benefits of part ner i ng

with Newpark Drilling Fluids.

USED IN MORE t han 300 wells stretching across North America

'

s most challenging

shale plays, Evolution cont i nues to provide fast er rates of penetration,

greater cost savings and easy compliance with all envi ronment al standards.

Isn

'

t it time you j oi ned the Evolution Era?

FIND CUT IIOb C CAN HELP YOU EVOLVE UNEXPECTEDLY AT

WWW. NEWPARKDF.COM/ EVOLUTI ON

THE HIGH PERFORMANCE

WATER BASED FLUIDS SYSTEM

NEWPARK

DRILLING FLUIDS

I

n

k

mmo

,

'

\

w-

.

??C

?

?

l'Y .,te

a

?...Ts ' ?' ?

dl5+f R

'

y,

.,r,o?1?.

?

,

?

/'

,g+?

?

?

;

? i

? ?

?L?1

`

?! ?

M

j

S

P

i

"9

;r

+

w

*