Академический Документы

Профессиональный Документы

Культура Документы

2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDF

Загружено:

joe26050 оценок0% нашли этот документ полезным (0 голосов)

47 просмотров8 страницThis case will take you back to a classic McKinsey study, similar to one you could do in your first year at the Firm. You are part of a high-profile engagement team tasked with reversing the recent profit erosions of PIONEER Bank's retail operations. The project team is internally headed by peggy Holland, EVP of service operations.

Исходное описание:

Оригинальное название

2012 Pioneer Bank Pre-Reading 1_LOP v2.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis case will take you back to a classic McKinsey study, similar to one you could do in your first year at the Firm. You are part of a high-profile engagement team tasked with reversing the recent profit erosions of PIONEER Bank's retail operations. The project team is internally headed by peggy Holland, EVP of service operations.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

47 просмотров8 страниц2012 Pioneer Bank Pre-Reading 1 - LOP v2 PDF

Загружено:

joe2605This case will take you back to a classic McKinsey study, similar to one you could do in your first year at the Firm. You are part of a high-profile engagement team tasked with reversing the recent profit erosions of PIONEER Bank's retail operations. The project team is internally headed by peggy Holland, EVP of service operations.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 8

About this SBT pre-reading:

The following page will set the scene for

the case that we will be using during

Summer Basics Training (SBT)

The memo is representative of a Letter of

Proposal (LOP) that a Partner leading a

McKinsey engagement team would send

to the Senior Client Sponsor to propose a

solution around the clients current issue

The structure of the LOP allows you to get

a sense of how we would initiate work with

our clients

This case will take you back in time!

but its a great example of a classic

McKinsey study, similar to one you could

do in your first year at the Firm. Its also a

topic thats relevant across a variety of

industries

Welcome to PIONEER Bank

You are part of a high-profile engagement

team tasked with reversing the recent

profit erosions of PIONEER Banks retail

operations

The project team is internally headed by

Peggy Holland, EVP of Service

Operations

Peggy is part of the Executive Leadership

team and reports directly to Tim Bolden,

CEO of PIONEER Bank

McKinsey & Company

Memorandum

To: Tim Bolden, CEO, PIONEER BANK

Cc: Executive Leadership Team, Peggy Holland, EVP Service Operations,

PIONEER BANK

From: Partner, McKinsey & Company

Date: J une 3, 2003

Letter of Proposal (LOP)

Addressing Recent Profit Erosion in PIONEER Banks

Retail Operations

In our last Executive Leadership meeting you asked our team to assist you in

reversing the recent profit erosion of PIONEER Banks retail operations.

Although PIONEER achieved overall profits (before taxes) of approximately $85

million in 1999, this sum was less than 20% of the banks profits in 1996 and

comes after three years of successive declines. By your own estimates,

PIONEER will face a $100 million loss in 2001, unless the bank can reverse this

trend. This increased profit pressure comes despite steps taken to address twin

challenges of increasing competition from traditional and nontraditional banking

players and changing customer needs and expectations.

Our engagement team will come up with recommendations for reversing the

recent profit erosion in the retail operations areas.

The remainder of this memo describes our perspectives on the issues at hand

and discusses how we plan to approach them. This memo is organized into

three sections:

Background and objectives

Issues to address

Proposed approach

BACKGROUND AND OBJECTIVES

As you have acknowledged, PIONEER Bank is in a precarious position. The

market seems to believe that most banks, including PIONEER, have relatively

less attractive long-term prospects and are valuing them accordingly. Investing

heavily in long-term growth initiatives, however, increases the risk that PIONEER

will miss another short term earnings target. Falling short of market expectations

carries an outsized penalty at this time: a recent industry report observed that

missing targets by 5% can provoke a 20% price decline, while exceeding them

by 5% may yield only a 1 or 2% price rise.

As we look to improve profitability and the banks long-term prospects

PIONEER is faced with significant external and internal challenges.

Externally, and increasingly difficult environment for

Incumbent regional banks

Changes in the banking environment have made the competition landscape more

difficult for PIONEER. The bank faces greater competition and increasingly

demanding and sophisticated consumers.

Increased competition. PIONEER appears to be at risk of getting caught in the

no-mans land of the evolving financial service landscape. Traditional and non-

traditional players in the banking arena are challenging incumbent regional banks

like PIONEER with scale advantages and new propositions.

The repeal of the Glass-Steagall Act is only the latest event in two decades of

change. The emergence of Citigroup represents a new breed of large-scale,

cross-industry financial holding companies with the potential to transform

financial services the way The Home Depot and Walmart have transformed

retailing in the U.S. The industry may be moving towards an era of 8 to 10

super-regional or even nationwide behemoths that will compete aggressively

using their scale advantages in operations or marketing.

At the same time, the heavier regulatory cost burdens that traditional banks

continue to bear are creating opportunities for non-traditional players. Charles

Schwab and others are competing on new propositions or on price. Your

Executive Leadership team has observed and our studies have shown this as

well that emerging internet banks like Sycamore Bank, can have as much as a

50% operating advantage over PIONEER, with a significantly higher level of per-

employee productivity.

More sophisticated customers. Over this period, consumers have grown

increasingly willing to take advantage of the offers from nationally branded

entrants or niche players, such as Charles Schwab. These more sophisticated

customers are showing greater price sensitivity and are increasingly diversifying

assets, moving savings to asset managers and mutual funds. The impact on

PIONEER has been a persistent decline in profits per household.

Internally, declining profitability at PIONEER

The Executive Leadership team has taken significant steps to increase the

PIONEER franchise during this period of change. The unintended consequence

of these moves has been a declining profitability mainly due to a strong increase

in the cost base, a declining sales force effectiveness, rapidly declining balances

per customer, slowed decision making, and change fatigue.

Strong increase in cost base. The cost base at PIONEER has risen

dramatically due in large measure to a greater number of channels

(branches, mail, ATMs, Points of Sale, telephone, and internet), greater

transaction volume, and persistent difficulty in optimizing the physical

channel assets. Customer service levels have risen, as witnessed by the

doubling of transactions per household from 1979 through 1999, but the

bank has not been able to improve its cost base, or clearly define how

each channel serves which segments in what way. As a consequence the

cost-income ration went up from 70% to 90%: In 1999, PIONEER thus

incurred 90 cents of cost for each dollar in revenues. This indicates that

the bank has a problem both in operating and non-operating expenses.

Organizational complexity and declining sales force effectiveness.

The organization at PIONEER has grown more complex over the years,

and may be impeding the banks flexibility and responsiveness. In the

marketing area alone, defining 12 customer segments has resulted in 12

segment managers and organizations. The number of sales people has

roughly stayed constant (around 3000 over the past years) while the

number of customers has grown. However, both the balance per sales

person (loan and deposit volume) and net income per sales person have

declined by 14% and 80% respectively. This could indicate a sales force

that is too small to absorb the additional customers or a lack of skills or

tools to effectively cross-sell products.

Rapidly declining average balance per customer. With 7% growth

since 1996, PIONEER Bank has been able to attract a lot of new

customers to its bank. However, the loan and deposit volume (balance)

per customer has declined by 19% from $27.291 to $21.995. This could

be due to the acquisition of less attractive customer segments or the

withdrawal of assets and transformation into mutual funds, for example.

Slowed decision making. In the 1980s, PIONEER made numerous

acquisitions, requiring repeated efforts to integrate and blend multiple

organizational cultures. One outcome of this process appears to be a

decision-making culture characterized by consensus. While this

preference can produce strong results when there is time to align

everyones interests, it can result in decisions being deferred too long or

never made when consensus is hard to reach.

Change fatigue. Over the past few years, PIONEER has undergone a

series of reorganizations to respond to maker conditions. Switching from

a product and geography focused organization to a customer-segment

orientation alone represents a major shift. The result of non-organic

growth and of major change efforts can be significant change fatigue,

which PIONEER Banks leadership has detected.

In this context, we propose that the objectives for our special initiative be two

fold:

Identify revenue enhancements and efficiency improvements that will

enable PIONEER to close its $100 million profitability gap by 2001.

Define, at a high level, the strategic, organizational, and operational steps

necessary for PIONEER to create a sustainable economic platform for the

future.

ISSUES TO ADDRESS

Closing the profitability gap and building a sustainable platform for the future will

require PIONEER to address a number of difficult, but important issues in the

course of this engagement. Our focus will be on internal improvements, which

can and should be addressed, regardless of the Executive Leadership teams

decisions on the long-term direction of the bank:

Is $100 million the right target for PIONEER? This amount will be close to

the gap expected in 2001, but it may not be sufficiently ambitious to

support the long-term growth of the bank. Our team will need to confirm:

State of core earnings and trajectory of the bank on a business-as-

usual basis, given current trends, margins, and costs.

Amount of funding PIONEER will need for growth, given

expectations and possible initiatives to enhance long-term

prospects.

What are PIONEERs highest priority opportunities to improve revenues

and reduce costs, within the current lines of business and geographies?

What set of initiatives will be most appropriate for PIONEER to close this

performance gap? In collaboration with you and the Executive Leadership

team, we will define what initiative(s) PIONEER should take in each of the

following areas:

Sales quota initiatives

Pricing

Networking and distribution

Operations and IT

Overhead and purchasing management

Credit and collections.

How should the initiatives be sequenced in an overall performance

improvement program, based on potential impact, ease of implementation,

and possible role as a precursor to a later initiative? We will need to

assess:

Organizational capacity to manage several initiatives at once

Linkages and interdependencies between these initiatives

Level of decision making authority needed for which sorts of

decisions

Coordinating mechanisms needed to ensure integration across the

initiatives

Appropriate measures to track and lock in full capture of the

benefits

What to communicate when and how, to:

- Various parts of the organization, to build awareness of the

need for change, foster conviction that these changes will

close the gap, instill the courage to act decisively in the face

of potential lack of consensus, and ensure that actions are

taken and adhered to

- Market analysts, shareholders, and other external parties, to

begin the process of changing expectations about

PIONEERs long-term growth prospects.

PROPOSED APPROACH

We propose to address these issues in three phases, recognizing that multiple

waves of initiatives may have to be launched.

Phase 1: Diagnostic to identify and prioritize key profitability levers

Phase 2: Develop implementation plan, including choosing pilots in key

representative markets

Phase 3: Pilot the recommended changes and refine in preparation for roll

out

NEXT STEPS

Discuss project approach in next Executive Leadership meeting

Schedule an offsite meeting where our McKinsey engagement team can

present its initial findings and discuss possible implications

My team and I are excited about the opportunity to work closely with you and the

rest of the Executive Leadership team at PIONEER to design a profit

improvement program that will strengthen the banks performance and create a

sustainable economic platform for the future.

Вам также может понравиться

- FIN571 Working Capital Simulation WK6Документ7 страницFIN571 Working Capital Simulation WK6Dina100% (3)

- National Geographic SocietyДокумент3 страницыNational Geographic SocietyallanОценок пока нет

- Turnaround Plan For Linens N ThingsДокумент15 страницTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- Working Capital Simulation - Managing Growth AssignmentДокумент9 страницWorking Capital Simulation - Managing Growth AssignmentMySpam100% (1)

- Barc - Citi - 500.4Документ2 страницыBarc - Citi - 500.4Benjamin Benji Bonilla Cocoma100% (1)

- WESCOДокумент15 страницWESCOPuneet Arora100% (1)

- Walker & CompanyДокумент9 страницWalker & Companyer4sallОценок пока нет

- Embezzlement at Koss Over 12 Years!Документ8 страницEmbezzlement at Koss Over 12 Years!kengsheongtehОценок пока нет

- ch16 KeyДокумент5 страницch16 Keyrocksartha100% (1)

- Beyond Survival: Eight Key Imperatives For Financial Services in The Post-Crisis EraДокумент8 страницBeyond Survival: Eight Key Imperatives For Financial Services in The Post-Crisis EraBrazil offshore jobsОценок пока нет

- Arlington Value's 2013 LetterДокумент7 страницArlington Value's 2013 LetterValueWalk100% (7)

- Avon Products Inc - 2009Документ22 страницыAvon Products Inc - 2009Charisse L. SarateОценок пока нет

- BAIN BRIEF The Return-Of-corporate Strategy in BankingДокумент12 страницBAIN BRIEF The Return-Of-corporate Strategy in BankingMBA MBAОценок пока нет

- Sample Consulting Firm B PlanДокумент18 страницSample Consulting Firm B PlanmskrierОценок пока нет

- 2012 Financial Services - Retail Banking Industry Perspective2012Документ4 страницы2012 Financial Services - Retail Banking Industry Perspective2012Brazil offshore jobsОценок пока нет

- Reflection Paper I (Costco, Financial Health, Jones)Документ3 страницыReflection Paper I (Costco, Financial Health, Jones)xsimplyxjesssОценок пока нет

- BAIN Brief - Divide and Conquer - A Guide To Winning SME Banking StrategiesДокумент12 страницBAIN Brief - Divide and Conquer - A Guide To Winning SME Banking Strategiesapritul3539Оценок пока нет

- Harvard CasesДокумент66 страницHarvard CasesAyush Singhal100% (2)

- Customer Retention Practices A Case of Cal BankДокумент88 страницCustomer Retention Practices A Case of Cal BankCollins Brobbey50% (2)

- Problem StatementДокумент3 страницыProblem StatementLeo Pratama GaniОценок пока нет

- Harvard CasesДокумент66 страницHarvard CasesAkshay Goel100% (1)

- Eastboro Case Write Up For Presentation1Документ4 страницыEastboro Case Write Up For Presentation1Paula Elaine ThorpeОценок пока нет

- Research Company IN Strategic ManagementДокумент9 страницResearch Company IN Strategic ManagementVincent SarmientoОценок пока нет

- Swot AnalysisДокумент3 страницыSwot AnalysisSayali DiwateОценок пока нет

- Groupon Inc Case AnalysisДокумент8 страницGroupon Inc Case Analysispatrick wafulaОценок пока нет

- High Performance: GrowthДокумент11 страницHigh Performance: GrowthL.T. (Tom) HallОценок пока нет

- Research Papers On Finance and Investments Special TopicsДокумент5 страницResearch Papers On Finance and Investments Special TopicsadgecibkfОценок пока нет

- Costco SwotДокумент13 страницCostco SwotHolly SantanaОценок пока нет

- 2014BankingIndustryOutlook DeloitteДокумент20 страниц2014BankingIndustryOutlook DeloittelapogkОценок пока нет

- SWOT Analysis of IndustryДокумент12 страницSWOT Analysis of IndustryZahidur RezaОценок пока нет

- GPCC 07 Case-ReportДокумент5 страницGPCC 07 Case-ReportJames Ryan AlzonaОценок пока нет

- Marks and Spencer PLCДокумент8 страницMarks and Spencer PLCoptimus457Оценок пока нет

- Customer Relationship Management: Safe MethodsДокумент10 страницCustomer Relationship Management: Safe Methodsjason tatumОценок пока нет

- 2011 Annual ReportДокумент162 страницы2011 Annual ReportNooreza PeerooОценок пока нет

- Letter ShareholdersДокумент7 страницLetter ShareholdersRich0087Оценок пока нет

- Research Paper Topics in Banking and FinanceДокумент7 страницResearch Paper Topics in Banking and Finances0l1nawymym3100% (1)

- Chapter 12-14 A FixedДокумент162 страницыChapter 12-14 A FixedDaniel Luke Higgins0% (2)

- Goldman Sachs 2012 Annual ReportДокумент244 страницыGoldman Sachs 2012 Annual ReportddubyaОценок пока нет

- GoldmanДокумент244 страницыGoldmanC.Оценок пока нет

- A New Era of Customer Expectation - Global Consumer Banking SurveyДокумент56 страницA New Era of Customer Expectation - Global Consumer Banking SurveyRahul RajputОценок пока нет

- WESCOДокумент5 страницWESCOGargi VermaОценок пока нет

- Module in Financial Management - 03Документ17 страницModule in Financial Management - 03Angelo DomingoОценок пока нет

- Content of The Strategic PlanДокумент14 страницContent of The Strategic PlanMarjorie MercadoОценок пока нет

- Financial Evaluation Report With SampleДокумент12 страницFinancial Evaluation Report With SamplemaidangphapОценок пока нет

- Oh So LocalДокумент40 страницOh So LocalfredgalleyОценок пока нет

- MC Moelis InitiatingДокумент27 страницMC Moelis InitiatingRCОценок пока нет

- Managing GrowthДокумент7 страницManaging GrowthChitrakalpa SenОценок пока нет

- FNSACC501 Assessment 2Документ6 страницFNSACC501 Assessment 2Daranee TrakanchanОценок пока нет

- Factors Influencing Customer'S Satisfaction Towards Beverages of PepsicoДокумент32 страницыFactors Influencing Customer'S Satisfaction Towards Beverages of PepsicoBeverlie Tabañag100% (1)

- Corporate Communication PlanДокумент13 страницCorporate Communication Planapi-401128290Оценок пока нет

- ENG TranslationДокумент3 страницыENG TranslationTamar PkhakadzeОценок пока нет

- Final ProjectДокумент10 страницFinal ProjectAmna AhmedОценок пока нет

- Swot AnalysisДокумент4 страницыSwot AnalysisAhmad ShahОценок пока нет

- Stuck in NeutralДокумент8 страницStuck in NeutralMike KarlinsОценок пока нет

- Financing A New Venture Trough and Initial Public Offering (IPO)Документ32 страницыFinancing A New Venture Trough and Initial Public Offering (IPO)Manthan LalanОценок пока нет

- Dec 2012 NewsletterpdfДокумент4 страницыDec 2012 NewsletterpdfRich PirrottaОценок пока нет

- Being The Best Thriving Not Just SurvivingДокумент8 страницBeing The Best Thriving Not Just SurvivingBrazil offshore jobsОценок пока нет

- DividendsДокумент5 страницDividendsMinettaLaneОценок пока нет

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)От EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Оценок пока нет

- Implementing Beyond Budgeting: Unlocking the Performance PotentialОт EverandImplementing Beyond Budgeting: Unlocking the Performance PotentialРейтинг: 5 из 5 звезд5/5 (1)

- Financial Literacy for Managers: Finance and Accounting for Better Decision-MakingОт EverandFinancial Literacy for Managers: Finance and Accounting for Better Decision-MakingРейтинг: 5 из 5 звезд5/5 (1)

- A Complete Pool Supply Store Business Plan: A Key Part Of How To Start A Pool & Spa Supply BusinessОт EverandA Complete Pool Supply Store Business Plan: A Key Part Of How To Start A Pool & Spa Supply BusinessОценок пока нет

- Online Payment SystemДокумент27 страницOnline Payment SystemVijetha bhat100% (1)

- Study On Customer Perception Towards E-Banking Services: A Summer Training Project ReportДокумент56 страницStudy On Customer Perception Towards E-Banking Services: A Summer Training Project ReportahenmakkОценок пока нет

- Questionnaire: Brand Loyalty and Relationship Marketing in State Bank of India's Banking System. IДокумент6 страницQuestionnaire: Brand Loyalty and Relationship Marketing in State Bank of India's Banking System. IAanand SharmaОценок пока нет

- Letter To All Member Banks of SLBC (UP)Документ1 страницаLetter To All Member Banks of SLBC (UP)dadan vishwakarmaОценок пока нет

- PldtbillДокумент4 страницыPldtbilljen marquesОценок пока нет

- FY19 Global MNC Plan FinalДокумент21 страницаFY19 Global MNC Plan FinalMARTHA HDEZОценок пока нет

- Demat Acount TradebullsДокумент23 страницыDemat Acount TradebullsMihir SenОценок пока нет

- Mozambique Tourist Visa ApplicationДокумент5 страницMozambique Tourist Visa ApplicationMaria José Andrade PadillaОценок пока нет

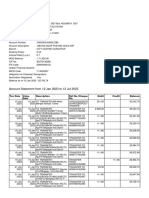

- Account Statement From 12 Jan 2023 To 12 Jul 2023Документ10 страницAccount Statement From 12 Jan 2023 To 12 Jul 2023SouravDeyОценок пока нет

- A Cheque Is A DocumentДокумент15 страницA Cheque Is A Documentmi06bba030Оценок пока нет

- Comparative Financial Statement Analysis of The Big Three Banks Operating in Finland 2015-2016Документ49 страницComparative Financial Statement Analysis of The Big Three Banks Operating in Finland 2015-2016Eugene Rugo AОценок пока нет

- CA2 Group Assignment CompleteДокумент14 страницCA2 Group Assignment CompleteCatherine Yapp100% (1)

- Credit CardДокумент15 страницCredit Cardsrdagpnt100% (1)

- SBI Investment ProductsДокумент20 страницSBI Investment ProductssaravananОценок пока нет

- Yared vs. LBPДокумент2 страницыYared vs. LBPRobОценок пока нет

- Gross Income NotesДокумент20 страницGross Income NotesCheng OlayvarОценок пока нет

- Import Form 2018Документ6 страницImport Form 2018tejasg82100% (2)

- Green Banking in Asia + 3: Edi SetijawanДокумент12 страницGreen Banking in Asia + 3: Edi SetijawanArief MizanОценок пока нет

- RBA APU PPT - OJK 16 April 2018 PDFДокумент46 страницRBA APU PPT - OJK 16 April 2018 PDFBunnyОценок пока нет

- Generated Leads For State FarmДокумент12 страницGenerated Leads For State Farmapi-19783206Оценок пока нет

- Executive Director Senior Center in Tallahassee FL Resume Rodney BigelowДокумент2 страницыExecutive Director Senior Center in Tallahassee FL Resume Rodney BigelowRodneyBigelowОценок пока нет

- Company LawДокумент15 страницCompany Lawpreetibajaj100% (2)

- 72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Документ7 страниц72-Finman Assurance Corporation vs. Court of Appeals, 361 SCRA 514 (2001)Jopan SJОценок пока нет

- Kai Green Chest 2.0Документ12 страницKai Green Chest 2.0Gaurav MalikОценок пока нет

- Confirmation and Acknowledgment - OfW Signing The Docs v2.0Документ1 страницаConfirmation and Acknowledgment - OfW Signing The Docs v2.0Carlo Josef TabulogОценок пока нет

- SBI Savings Account Opening Form For Resident IndividualsДокумент8 страницSBI Savings Account Opening Form For Resident Individualsssbaidya75% (12)

- 997SДокумент404 страницы997SZeeshan AhmedОценок пока нет