Академический Документы

Профессиональный Документы

Культура Документы

Companies Act 2013 Raising The Bar On Governance - KPMG

Загружено:

Manjunath Shettigar0 оценок0% нашли этот документ полезным (0 голосов)

104 просмотров49 страницGovernment Policy India

M Manjunath Shettigar

Оригинальное название

Companies Act 2013 Raising the Bar on Governance - KPMG

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGovernment Policy India

M Manjunath Shettigar

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

104 просмотров49 страницCompanies Act 2013 Raising The Bar On Governance - KPMG

Загружено:

Manjunath ShettigarGovernment Policy India

M Manjunath Shettigar

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 49

Companies Act 2013

Raising the bar on Governance

Focus on 6 critical themes

Inclusive CSR Agenda

Increased Reporting Framework

Wider Director and management responsibility

Higher Auditor Accountability

Easier restructuring

Emphasis on Investor Protection

The recently enacted Companies Act, 2013 (the New Act) is a landmark piece of

legislation and likely to have far reaching consequences on all companies incorporated in India.

The erstwhile Companies Act, 1956 was in existence for well over fifty years and was lately

seeming quite ineffective at handling present day challenges of a growing industry and the

complexities related with the growing stakeholders interests.

The New Act promises to substantively raise the bar on governance and in a

comprehensive form purports to deal with some very relevant themes. On the flip side, it appears

to be quite pervasive and thrusts greater responsibility and obligation on the Board of Directors

and Management in Indian companies.

The KPMG in India team takes a closer look at the important changes and developments to

help companies assess the impact and develop a clear strategy on compliance and governance.

Theme 1: Increased Reporting Framework

New definition of subsidiary, associate, Joint Venture company [sections 2(6) and 2(87)]

Holding company

1. Owns/controls > 50% total share capital or exercises control of board subsidiary

company

2. Owns/controls at least 20% total share capital or business decisions under an agreement

associate company

Financial year to be uniform

a. All companies to follow uniform FYE 31 March

b. Exemptions (subject to conditions and approval process) if a company is:

- A holding/subsidiary of a company incorporated outside India; and

- Required to follow a different FYE for consolidation of its accounts outside India

c. Transitional compliance phase: Two years

Mandatory requirement for Consolidated Financial Statement (CFS) [section 129]

a. In addition to standalone financial statements, every company to prepare CFS if it has a:

- Subsidiary; or

- Associate; or

- Joint Venture company

b. No exemption for intermediate holding companies for preparing CFS

Penalty for violation:

Officer in default:

Imprisonment one year;

Fine between INR 50,000 500,000

Revision in Financial Statement [sections 130 and 131]

a. Pursuant to an order made by a court or Tribunal on an application for revision of financial statements made

as under:by the Central Government, Income-Tax, SEBI etc. in the following casesFraudulent financial reporting; or

Mismanaged affairs casting doubt on financial statements; or

by the Directors of a company only in the following cases:Financial statements and Board Report are

non-compliant; and

Voluntary restatement by Directors possible only for the past three years

Changes in Depreciation regulation [section 123(2) and Schedule II]

a. Concept of Useful Life takes prominence over standard mandated rates

b. Justification required where Useful Life Schedule II for prescribed companies. Other cases Useful Life < Schedule

II

c. Applicability of Component Accounting

d. Transitional provision: Depreciate carrying value less residual value over balance life. Adjust net worth if useful life

has been exhausted

Mandatory Internal Audit and reporting on Internal Financial Controls [section 138]

a. Assurance on adequacy and effectiveness of Internal Financial Controls (which includes orderly and

efficient conduct of business, and prevention and detection of frauds and errors) to be given: in Directors and Auditors

report for all listed entities; and

only in Auditors report for all other entities

b. Internal Audit made mandatory for:all listed companies; and

public limited companies with: loans/deposits INR 250 mn ; or

paid up capital INR 100 mn

c. Internal audit to be done only by CAs; or CWAs; or other professionals decided by the Board

Penalty for violation:

1. Company: Fine between INR 50,000 2,500,000

2. Officer in default: Imprisonment up to three years; fine between INR 50,000 500,000

Theme 2: Higher Auditor Accountability

Auditor Appointment and Rotation

a. Maximum 20 audits permitted per individual Auditor/Partner of a firm

b. Instead of reappointment at each AGM, Auditor to be appointed for a block of five years:

- Individual Auditor eligible for appointment of single block of five years; and partnership audit firms to be eligible for

appointment of additional consecutive block of five years

- Auditor to be subject to a five-year cooling period post completion of his previous term

- Incoming Auditor cannot be an associate or a network firm in relation to the outgoing Auditor

- Transitional compliance phase: Three years

- As per draft rules, pre-commencement term to retrospectively apply for computing balance validity of current Auditors

tenure prior to rotation

c. Significant restrictions on non-audit services that can be provided by Auditors. All non-audit services to be

pre-approved by the Board or Audit Committee

d. National Financial Reporting Authority (NFRA) to be the new regulator for Auditors and will have powers to

recommend, enforce and monitor compliance of accounting and auditing standards

Auditors Reporting Responsibility

a. Audit report to cover

1. Observations, comments on financial transactions and adverse matters

2. Qualification or adverse remark on maintenance of accounts

3. Adequacy of internal financial control system and effectiveness

4. Disclosure of effect of pending litigation on financial position

5. Provisions for foreseeable losses on long term/derivative contracts

6. Delays in depositing money into IEPF

b. Report to Audit Committee or Board on fraud committed against company by officers or employees and escalate to

Central Government if:

- happening frequently; or

- amount is material at 5 percent of net profits or 2 percent of turnover; or

- if dissatisfied with action by audit committee or Board on immaterial frauds

Theme 3 Easier Restructuring

Rationalizing Multilayered Structures

a. Maximum of only two Investment SPV company levels permitted between investor company and investee company

Penalty for violation:

1. Company: Fine of INR 25,000 5,00,000

2. Office in default: Imprisonment upto two years; fine INR 25,000 1,00,000

b. Exemption:

- Acquisition of overseas subsidiary with existing multiple layers allowed under foreign law; or

- Multi-layering required under any law in force

Simplifying Procedures for Merger [section 232]

a. National Company Law Tribunal (NCLT) to approve schemes of restructuring companies in place of High Court

b. Auditor to certify that accounting treatment specified in the Scheme conforms with Accounting Standard for listed,

unlisted and private companies

c. Consent of majority Members/ Creditors >75 percent (in value)

d. Merger of listed company into unlisted company allowed subject to:

- Exit opportunity being provided to public shareholders; and

- Valuation is done as per SEBI guidelines

Minority buy-out [section 236]

a. Acquirer holding 90 percent share capital (in value) may notify intent to buy-out balance equity shares

b. Exit valuation to be done by Registered Valuer [section 247]

c. No opportunity provided for minority to dissent

Cross-border Merger [section 234]

a. Merger of Indian company with foreign company and vice-versa now permitted

b. Central Government to make necessary Rules in consultation with RBI and notify permitted jurisdictions

c. Merger to be approved by NCLT

d. Consideration only in cash or Depositary Receipts

Fast-track Merger [section 233]

a. Merger between the following entities possible without NCLT approval:

- Two or more small companies; or

- Holding and wholly owned subsidiary; or

- Prescribed types of companies (list awaited)

b. Declaration of Solvency required to be submitted

c. Consent required from:

- Members owning > 90 percent of total number of shares

- Majority creditors owning 90 percent in value

Share capital reduction [section 66]

a. No share capital reduction permitted in companies that have overdue deposit /interest

b. No buy-back permitted until after three years from remediation of defaults on deposits; preference shares; or term

loans

c. Multiple buy-back within a year not permitted

d. Schemes of arrangement involving buy-back/capital reduction to require Auditors certificate and comply with

conditions of section 66/68

Theme 4: Emphasis on Investor Protection

Related Party Transactions [section 188]

a. Transactions in ordinary course of business on arms-length basis permissible. Central Government approval not

required anymore

b. Board approval required where transactions are either not in the ordinary course of business /not at arms length:

c. Special resolution, where no related party can vote, required for non-arms length transactions or transactions not in

the ordinary course of business where

- Share capital > INR 10 mn; or where

- Sale, purchase of goods, services, leasing of property transaction value exceeds 5% of annual turnover or 20 percent

of net worth

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

- Appointment to any office or place of profit in company, subsidiary or associate

monthly reummuneration > INR 100,000

- Remuneration for underwriting subscription of any securities or derivatives remuneration >INR 1 mn

Insider Trading [sections 125, 194, 195]

a. Director/Key Managerial Personnel (KMP) to refrain from forward dealing/ buy options in shares or debentures of

company/ holding company/ subsidiary/ associate

b. No company person (incl. any Director/KMP) with access to non-public price sensitive information to indulge in any

form of insider trading/counseling.

Penalty for violation:

i. imprisonment up to five years; or

ii. fine up to INR 250 mn or three times profits made, whichever is higher; or

iii. both of the above

Oppression and Mismanagement

a. Members or Depositors may notify Tribunal if company conduct is prejudicial to their interests

b. For fraudulent, unlawful or wrongful act; or improper or misleading statements, Class Action Suit can be filed on:

- Company or its Directors; or

- Auditor/audit firm; or

- Expert/advisor/consultant

c. Who can file Class Action Suit:

- 100 or 10 percent of total number of members

- 100 or 10 percent of total number of depositors

- Member(s) holding 10 percent of issued share capital

- Depositor(s) holding 10 percent of outstanding value of deposits

Fraud Risk Mitigation

a. Fraud defined/referred to under various sections and includes:

- Act; or

- Omission; or

- Concealment of fact; or

- Abuse of position

- Considered fraud whether or not there is any wrongful gain or loss

b. Senior Fraud Investigation Officer (SFIO) made statutory body with significant powers

c. Mandatory establishment of vigil-mechanism for directors/ employees to report concerns

Penalty for violation

Imprisonment [3-10 years]; cognizable offence without bail

Theme 5: Wider Director and Management Responsibility

Additional Responsibility on Independent Directors [section 149]

a. Code of Professional Conduct imposing stringent responsibility and accountability

b. Maximum term of five years extendable by another five years subject to a special resolution

c. Retirement by rotation not applicable

d. Liable only for acts with knowledge of and attributable through Board Process and with his consent or connivance or

not having acted diligently

e. Direct/indirect pecuniary/other relationships through relatives not permitted

f. Declaration of Independence mandatory each year.

g. Stock options not permitted. Only sitting fees and profit related commission.

h. Independent directors to hold one annual meeting where no non-independent director, KMP or Senior Management

can attend.

Audit Committee

a. Composition:

- Mandatory for prescribed companies to constitute an Audit Committee

- three directors (majority should be Independent Directors)

b. The Chairperson and majority of the Audit Committee members should have the ability to read and understand

financial statements

c. Responsibilities:

- Recommend appointment, remuneration of auditors and monitor their independence and effectiveness

- Examine financial statements and auditors report thereon

- Approve related party transactions

- Scrutiny of inter-corporate loans and investments

- Undertake asset valuation

- Evaluate internal financial controls and risk management systems

- Monitor end use of funds raised through public offers

Penalty for violation

i. Company: Fine between INR 100,000 500,000

ii. Officer in default: Imprisonment upto one year; fine between INR 25,000 100,000

Content of Directors Report [section 134]

a. All companies to, inter-alia, state:

- Devised proper systems to ensure proper compliance with all applicable laws in India and that this system is operating

effectively.

- Taken proper and sufficient care for maintenance of adequate accounting records for safeguarding assets and

preventing and detecting fraud and other irregularities.

- On development and implementation of a risk management policy

b. Listed and prescribed companies to state:

- Internal financial controls have been laid down and they are operating effectively.

- Manner in which performance evaluation of the Board members have been conducted

Penalty for violation

i. Company: Fine between INR 50,000 2,500,000

ii. Officer in default: Imprisonment upto three years and /or fine between INR 50,000 to INR 500,000

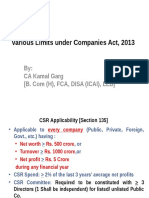

Theme 6: Inclusive CSR Agenda

Obligation Trigger and Calculation

a. Covers all companies in India meeting any one or more of the following conditions:

- Turnover INR10 bn

- Networth NR 5 bn

- Net Profit INR 50 mn

b. CSR contribution to be 2 percent of average net profit before tax for last three financial years

c. Contributions to be made towards causes listed under Schedule VII

Administration and Reporting

a. Board to appoint a three-member CSR committee including one Independent Director

- Committee responsibility:

- Formulate CSR policy;

- Recommend CSR activities;

- Monitor CSR expenditure

b. Mandatory reporting on CSR under section 135

c. Even where companies are not required to appoint Independent Directors under

Penalty for violation

i. Company: Fine between INR 50,000 2,500,000

ii. Officer in default: Imprisonment upto 3 years and / or Fine between INR 50,000 to INR 2,500,000

Impact on various stakeholders

Board of Directors

Accountability to stakeholders well beyond only shareholders

Reporting beyond traditional SOX coverage

Liability on Class Action Suits

Significant penalties on Insider Trading and restatements

Public scrutiny on CSR

Compliance on Related Party Transactions

Mandatory roll-out of whistle-blower vigil mechanism

Mandate on gender diversity

Promoters

Multi-layered structures to be collapsed

Cross-border transactions allowed

Mandatory CSR contribution will affect cash flows

Wider definition of Related Party Transactions

Heavy penalties introduced on Insider Trading

Lower consolidation threshold may invite greater scrutiny [PE Firms to be impacted]

New depreciation rules may affect profitability

CXO and Key Management Personnel

Ease of restructuring

Reporting beyond traditional SOX coverage

Wider definition of Related Party Transactions

Lower consolidation threshold may invite greater scrutiny

New depreciation rules may affect profitability

Liability for Class Action Suits

Significant penalties on Insider Trading and restatements

Independent Directors

Oversee implementation of best corporate governance practices

Safeguard interests of all stakeholders

Ensure adequate and functional vigil mechanism

Determine appropriate levels of remuneration for Directors and KMP

Compliance on Related Party Transactions

Prime accountability on CSR compliance

Liability on Class Action Suits

Audit Committee

Additional rigour on financial reporting

Mandatory internal audit

Reporting beyond traditional SOX coverage

Significant penalties on Insider Trading and restatements

Compliance on Related Party Transactions

Monitoring inter-corporate loans and investments

Evaluation of internal financial controls

Multi National Corporation

Lower thresholds for financial consolidation

Mandatory contribution to local CSR

Wider definition of Related Party Transactions

Ease in cross-border restructuring

Facility of minority buy-out

Liability for Class Action Suits

Board meetings through video conference

One Resident Director mandatory

Additional reporting responsibilities in Boards Report

Penalty for violation:

Penalty for violation:

Penalty for violation:

Imprisonment [3-10 years]; cognizable offence without bail

Oppression and Mismanagement [section 241-246]

Oppression and Mismanagement [section 241-246]

Oppression and Mismanagement [section 241-246]

Oppression and Mismanagement [section 241-246]

a. Members or Depositors may notify Tribunal if company conduct is prejudicial to their interests

b. For fraudulent, unlawful or wrongful act; or improper or misleading statements, Class Action Suit can be filed

on:Company or its Directors; or

Oppression and Mismanagement [section 241-246]

a. Members or Depositors may notify Tribunal if company conduct is prejudicial to their interests

b. For fraudulent, unlawful or wrongful act; or improper or misleading statements, Class Action Suit can be filed

on:Company or its Directors; or

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

Penalty for violation:

i. Contract may be rendered as void

ii. Directors concerned to indemnify the loss

iii. Director / employee involved can be fined and imprisoned (in case of a listed company)

As per draft rules, pre-commencement term to retrospectively apply for computing balance validity of current

Auditors tenure prior to rotation

c. Significant restrictions on non-audit services that can be provided by Auditors. All non-audit services to be

pre-approved by the Board or Audit Committee

d. National Financial Reporting Authority (NFRA) to be the new regulator for Auditors and will have powers to

recommend, enforce and monitor compliance of accounting and auditing standards

Auditors Reporting Responsibility

a. Audit report to cover:

3. Company: Fine between INR 50,000 2,500,000

4. Officer in default: Imprisonment up to three years; fine between INR 50,000 500,000

d. Transitional provision: Depreciate carrying value less residual value over balance life. Adjust net worth if useful life

has been exhausted

Mandatory Internal Audit and reporting on Internal Financial Controls [section 138]

a. Assurance on adequacy and effectiveness of Internal Financial Controls (which includes orderly and

efficient conduct of business, and prevention and detection of frauds and errors) to be given: in Directors and Auditors

report for all listed entities; and

only in Auditors report for all other entities

b. Internal Audit made mandatory for:all listed companies; and

public limited companies with: loans/deposits INR 250 mn ; or

paid up capital INR 100 mn

c. Internal audit to be done only by CAs; or CWAs; or ot

a. Pursuant to an order made by a court or Tribunal on an application for revision of financial statements made

as under:by the Central Government, Income-Tax, SEBI etc. in the following casesFraudulent financial reporting; or

Mismanaged affairs casting doubt on financial statements; or

by the Directors of a company only in the following cases:Financial statements and Board Report are

non-compliant; and

Voluntary restatement by Directors possible only for the past three years

Changes in Depreciation regulation [section 123(2) and Schedule II]

a. Concept of Useful Life takes prominence over standard mandated rates

b. Justification required where Useful Life Schedule II for prescribed companies. Other cases Useful Life < Schedule

II

c. Applicability of Component Accounting

Theme 5: Wider Director and Management Responsibility

Theme 6: Inclusive CSR Agenda

Mandatory Director Appointment

Obligation Trigger and Calculation Administration and Reporting

section 149, in case a company does

a. Covers all companies in India meeting a. Board to appoint a three-member CSR

meet the criteria under section 135, it Company parameters

1 Director

1

1/3rd

Audit

Nomination and

Penalty for violation:

New definition of subsidiary, associate, d. Transitional provision: Depreciate carrying

Resident in

Woman

Independent

Committee

remuneration

Penalty for violation:

i. Company: Fine between

Joint Venture company [sections 2(6) value less residual value over balance life.

any one or more of the following

committee including one Independent

will have to mandatorily appoint one India 182 days

Director

Director

committee

Officer in default:

INR 100,000 500,000

and 2(87)]

conditions:

Director

Independent Director on the Board

Imprisonment one year; Fine between

Adjust net worth if useful life has been Listed

ii. Officer in default: Imprisonment INR 50,000 500,000

exhausted

Turnover INR10 bn

Committee responsibility:

d. In case of failure to spend, reasons to be upto one year; fine between

Holding company

Networth NR 5 bn

Formulate CSR policy;

disclosed. Penalties for non disclosure Unlisted (All)

INR 25,000 100,000

Mandatory Internal Audit and reportingRevision in Financial Statement [sections

Net Profit INR 50 mn

Recommend CSR activities;

Share Capital INR 1 bn

Owns/controls at least

on Internal Financial Controls [sectionContent of Directors Report

Owns/controls >50%

b. CSR contribution to be 2 percent of

Monitor CSR expenditure

Penalty for violation:

20% total share capital or 130 and 131]

total share capital or

138]

i. Company: Fine between

Turnover INR 3 bn

[section 134]

average net profit before tax for last b. Mandatory reporting on CSR under

exercises control of board

business decisions under

a. Pursuant to an order made by a court or an agreement

INR 50,000 2,500,000

a. All companies to, inter-alia, state: a. Assurance on adequacy and

three financial years

section 135

ii. Officer in default: Imprisonment Loan/Debentures/

Tribunal on an application for revision of

Devised proper systems to ensure

effectiveness of Internal Financial

c. Contributions to be made towards

c. Even where companies are not required upto 3 years and / or Fine between

Deposits INR 2 bn

Subsidiary company

Associate company

financial statements made as under:

INR 50,000 to INR 2,500,000

proper compliance with all applicable

Controls (which includes orderly and causes listed under Schedule VII

to appoint Independent Directors under

by the Central Government, Income-

Additional Responsibility on IndependentAudit Committee [section 177]

laws in India and that this system is Financial Year to be uniform

efficient conduct of business, and

Tax, SEBI etc. in the following cases Directors [section 149]

a. Composition:

operating effectively.

prevention and detection of frauds and a. All companies to follow uniform FYE

Fraudulent financial reporting; or errors) to be given:

31 March

Mismanaged affairs casting doubt

6

a. Code of Professional Conduct imposing

Mandatory for prescribed companies to

Taken proper and sufficient care for stringent responsibility and accountability constitute

an Audit Committee

maintenance of adequate accounting

in Directors and Auditors report for all Increased

Inclusive

b. Exemptions (subject to conditions and b. Maximum term of five years extendable

three directors (majority should be records for safeguarding assets and

on financial statements; or

Reporting

listed entities; and

CSR Agenda

approval process) if a company is:

Framework

by another five years subject to a special Independent Directors)

preventing and detecting fraud and

by the Directors of a company only in

only in Auditors report for all other

A holding/ subsidiary of a company Focus on

5

resolution

b. The Chairperson and majority of the Audit other irregularities.

the following cases:

entities

incorporated outside India; and

Financial statements and Board

b. Internal Audit made mandatory for: 1

c. Retirement by rotation not applicable Committee members should have the ability

On development and implementation

d. Liable only for acts with knowledge of and to read and understand financial statements

of a risk management policy

Required to follow a different FYE for Report are non-compliant; and

Wider

all listed companies; and

attributable through Board Process and with c. Responsibilities: b. Listed and prescribed

companies to consolidation of its accounts outside Director

Voluntary restatement by Directors Higher

and

his consent or connivance or not having

Recommend appointment, remuneration

public limited companies with:

state:

India

Auditor

Management

possible only for the past three

acted diligently

of auditors and monitor their

Internal financial controls have been

loans/deposits INR 250 mn ; or Accountability

Responsibility

c. Transitional compliance phase: Two years years

Mandatory requirement for Consolidated

paid up capital INR 100 mn

Changes in Depreciation regulationFinancial Statement (CFS) [section 129]

c. Internal audit to be done only by CAs; or

[section 123(2) and Schedule II]

a. In addition to standalone financial CWAs; or other professionals decided by 6

e. Direct/indirect pecuniary/other relationships independence and effectiveness

laid down and they are operating

through relatives not permitted

Examine financial statements and

effectively.

f. Declaration of Independence mandatory auditors report thereon

critical Themes

Manner in which performance

a. Concept of Useful Life takes prominence statements, every company to prepare the

Board

2

4

each year.

Approve related party transactions evaluation of the Board members

g. Stock options not permitted. Only sitting

Scrutiny of inter-corporate loans and have been conducted.

over standard mandated rates

Emphasis on

CFS if it has a:

Easier

fees and profit related commission.

investments

Investor

b. Justification required where Useful Life Penalty for violation:

Restructuring

Protection

Subsidiary; or

h. Independent directors to hold one annual

Undertake asset valuation

Penalty for violation:

1. Company: Fine between

Associate; or

Schedule II for prescribed companies.

INR 50,000 2,500,000

Other cases Useful Life < Schedule II 3

meeting where no non-independent

Evaluate internal financial controls and i. Company: Fine between

INR 50,000 2,500,000

Joint Venture company

2. Officer in default: Imprisonment

director, KMP or Senior Management can risk management systems

ii. Officer in default: Imprisonment b. No exemption for intermediate holding c.

Applicability of Component Accounting up to three years; fine between

attend.

Monitor end use of funds raised through upto three years and /or fine

between INR 50,000 to INR 500,000

companies for preparing CFS

INR 50,000 500,000

public offers

3

Theme 3: Easier Restructuring

Rationalizing Multilayered Structures d. Merger of listed company into unlisted

Holding and wholly owned subsidiary; 4

a. Maximum of only two Investment SPV

company allowed subject to:

or

Theme 4: Emphasis on Investor Protection 2

company levels permitted between

Exit opportunity being provided to

Prescribed types of companies (list Related Party Transactions [section 188]

Remuneration for underwriting

Auditor/audit firm; or

Theme 2: Higher Auditor Accountability investor company and investee company

public shareholders; and

awaited)

a. Transactions in ordinary course of business subscription of any securities or

Expert/advisor/consultant

Valuation is done as per SEBI

b. Declaration of Solvency required to be on arms-length basis permissible. Central

derivatives remuneration >INR 1 mn c. Who can file Class Action Suit:

Penalty for violation:

Auditor Appointment and Rotation

As per draft rules, pre-commencement guidelines

submitted

Government approval not required anymore

100 or 10 percent of total number of 1. Company: Fine of INR 25,000

Insider Trading [sections 125, 194, 195]

a. Maximum 20 audits permitted per

term to retrospectively apply for

3. Adequacy of internal

4. Disclosure of effect

5,00,000

Minority buy-out [section 236]

c. Consent required from:

b. Board approval required where transactions members

financial control system

of pending litigation on

a. Director/Key Managerial Personnel (KMP) to individual Auditor/Partner of a firm

computing balance validity of current 2. Office in default: Imprisonment

Members owning > 90 percent of total and effectiveness

financial position

a. Acquirer holding 90 percent share are either not in the ordinary course of

100 or 10 percent of total number of upto two years; fine INR 25,000

refrain from forward dealing/ buy options in b. Instead of reappointment at each AGM,

Auditors tenure prior to rotation

business /not at arms length:

depositors

1,00,000

capital (in value) may notify intent to buy-number of shares

shares or debentures of company/ holding Auditor to be appointed for a block of five c.

Significant restrictions on non-audit

Majority creditors owning 90 percent c. Special resolution, where no related party

Member(s) holding 10 percent of issued 5. Provisions for

out balance equity shares

company/ subsidiary/ associate

years:

services that can be provided by Auditors.

foreseeable losses on

6. Delays in depositing

b. Exemption:

b. Exit valuation to be done by Registered in value

can vote, required for non-arms length share capital

b. No company person (incl. any Director/KMP)

Individual Auditor eligible for

All non-audit services to be pre-approved long term/derivative

money into IEPF

Acquisition of overseas subsidiary Share capital reduction [section 66]

transactions or transactions not in the

Depositor(s) holding 10 percent of contracts

Valuer [section 247]

with access to non-public price sensitive appointment of single block of five

by the Board or Audit Committee

with existing multiple layers allowed c. No opportunity provided for minority to a. No

share capital reduction permitted in ordinary course of business where

outstanding value of deposits

information to indulge in any form of insider years; and partnership audit firms

d. National Financial Reporting Authority under foreign law; or

dissent

companies that have overdue deposit /

Share capital > INR 10 mn; or where trading/counseling.

Fraud Risk Mitigation

to be eligible for appointment of

(NFRA) to be the new regulator for

b. Report to Audit Committee or Board on

Multi-layering required under any law Cross-border Merger [section 234]

interest

Sale, purchase of goods, services, leasing a. Fraud defined/referred to under various

additional consecutive block of five Auditors and will have powers to

fraud committed against company by

in force

a. Merger of Indian company with foreign b. No buy-back permitted until after three of

property transaction value exceeds Penalty for violation:

sections and includes:

years

recommend, enforce and monitor

officers or employees and escalate to Simplifying Procedures for Merger i.

imprisonment up to five years; or company and vice-versa now permitted years from remediation

of defaults on 5% of annual turnover or 20 percent of

Act; or

ii. fine up to INR 250 mn or three times

Auditor to be subject to a five-year compliance of accounting and auditing Central

Government if:

[section 232]

b. Central Government to make necessary deposits; preference shares; or term networth

profits made, whichever is higher; or

Omission; or

cooling period post completion of his standards

happening frequently; or

a. National Company Law Tribunal (NCLT) Rules in consultation with RBI and notify

loans

Penalty for violation:

iii. both of the above

Concealment of fact; or

previous term

c. Multiple buy-back within a year not Auditors Reporting Responsibility

amount is material at 5 percent of net to approve schemes of restructuring

permitted jurisdictions

i. Contract may be rendered as void Oppression and Mismanagement

Abuse of position

Incoming Auditor cannot be an

permitted

ii. Directors concerned to indemnify a. Audit report to cover:

profits or 2 percent of turnover; or companies in place of High Court

c. Merger to be approved by NCLT

the loss

[section 241-246]

Considered fraud whether or not there is associate or a network firm in relation

if dissatisfied with action by audit b. Auditor to certify that accounting d. Consideration

only in cash or Depositary d. Schemes of arrangement involving buy-iii. Director / employee

involved can be a. Members or Depositors may notify Tribunal any wrongful gain or loss

to the outgoing Auditor

1. Observations,

2. Qualification or

committee or Board on immaterial

treatment specified in the Scheme

Receipts

back/capital reduction to require Auditors fined and imprisoned (in case of a

if company conduct is prejudicial to their b. Senior Fraud Investigation Officer (SFIO)

Transitional compliance phase: Three comments on financial

adverse remark on

frauds

certificate and comply with conditions of listed company)

transactions and

maintenance of

conforms with Accounting Standard for interests

made statutory body with significant powers years

adverse matters

accounts

listed, unlisted and private companies Fast-track Merger [section 233]

section 66/68

Appointment to any office or place of b. For fraudulent, unlawful or wrongful act; or c.

Mandatory establishment of vigil-mechanism c. Consent of majority Members/ Creditors a.

Merger between the following entities profit in company, subsidiary or associate improper or

misleading statements, Class for directors/ employees to report concerns

>75 percent (in value)

possible without NCLT approval:

Penalty for violation:

Two or more small companies; or

monthly reummuneration > INR 100,000

Action Suit can be filed on:

Imprisonment [3-10 years]; cognizable

Company or its Directors; or

offence without bail

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative (KPMG

International), a Swiss entity. All rights reserved.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative (KPMG

International), a Swiss entity. All rights reserved.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative (KPMG

International), a Swiss entity. All rights reserved.

Board of Directors

Accountability to stakeholders well beyond only Promoters

shareholders

Multi-layered structures to be collapsed

Reporting beyond traditional SOX coverage

Cross-border transactions allowed KPMG in India

Liability on Class Action Suits

Mandatory CSR contribution will affect cash flows

Significant penalties on Insider Trading and

Wider definition of Related Party Transactions restatements

Heavy penalties introduced on Insider Trading Ahmedabad

Hyderabad

Public scrutiny on CSR

Lower consolidation threshold may invite greater Safal Profitaire

8-2-618/2

Compliance on Related Party Transactions scrutiny [PE Firms to be impacted]

B4 3rd Floor, Corporate Road,

Reliance Humsafar, 4th Floor

Mandatory roll-out of whistle-blower vigil

New depreciation rules may affect profitability Opp. Auda Garden, Prahlad Nagar

Road No.11, Banjara Hills

mechanism

Ahmedabad 380 015

Hyderabad 500 034

Tel: +91 79 4040 2200

Tel: +91 40 3046 5000

Mandate on gender diversity

Fax: +91 79 4040 2244

Fax: +91 40 3046 5299

Bangalore

Kochi

CXO and Key Management Personnel

Maruthi Info-Tech Centre

4/F, Palal Towers

Ease of restructuring

11-12/1, Inner Ring Road

M. G. Road, Ravipuram,

Reporting beyond traditional SOX coverage Koramangala, Bangalore 560 071

Kochi 682 016

Independent Directors

Wider definition of Related Party Tel: +91 80 3980 6000

Tel: +91 484 302 7000

Oversee implementation of best corporate Fax: +91 80 3980 6999

Fax: +91 484 302 7001

Transactions

governance practices

Lower consolidation threshold may invite Chandigarh

Kolkata

Safeguard interests of all stakeholders greater scrutiny

SCO 22-23 (Ist Floor)

Infinity Benchmark, Plot No. G-1

Ensure adequate and functional vigil Impact on various

New depreciation rules may affect Sector 8C, Madhya Marg

10th Floor, Block EP & GP, Sector V

mechanism

profitability

Chandigarh 160 009

Salt Lake City, Kolkata 700 091

Determine appropriate levels of

stakeholders

Tel: +91 172 393 5777/781

Tel: +91 33 44034000

Liability for Class Action Suits

remuneration for Directors and KMP

Fax: +91 172 393 5780

Fax: +91 33 44034199

Significant penalties on Insider Trading and

Compliance on Related Party Transactions restatements

Chennai

Mumbai

Prime accountability on CSR compliance No.10, Mahatma Gandhi Road

Lodha Excelus, Apollo Mills

Liability on Class Action Suits

Nungambakkam

N. M. Joshi Marg

Chennai 600 034

Mahalaxmi, Mumbai 400 011

Tel: +91 44 3914 5000

Tel: +91 22 3989 6000

Fax: +91 44 3914 5999

Fax: +91 22 3983 6000

Multi National Corporation

Delhi

Pune

Audit Committee

Lower thresholds for financial consolidation Building No.10, 8th Floor

703, Godrej Castlemaine

Additional rigour on financial reporting

Mandatory contribution to local CSR

DLF Cyber City, Phase II

Bund Garden

Gurgaon, Haryana 122 002

Pune 411 001

Mandatory internal audit

Wider definition of Related Party Transactions Tel: +91 124 307 4000

Tel: +91 20 3058 5764/65

Reporting beyond traditional SOX coverage

Ease in cross-border restructuring Fax: +91 124 254 9101

Fax: +91 20 3058 5775

Significant penalties on Insider Trading and

Facility of minority buy-out

restatements

Liability for Class Action Suits

Compliance on Related Party Transactions

Board meetings through video conference

Monitoring inter-corporate loans and

One Resident Director mandatory

investments

Additional reporting responsibilities in Boards Report

Evaluation of internal financial controls Key contact

The information contained herein is of a general nature and is not intended to address the

Sai Venkateshwaran

circumstances of any particular individual or entity. Although we endeavour to provide

accurate Partner and Head

and timely information, there can be no guarantee that such information is accurate as of

the date it is received or that it will continue to be accurate in the future. No one should act on such

Accounting Advisory

information without appropriate professional advice after a thorough examination of the

particular T: +91 22 3090 2020

situation. The views and opinions expressed herein as a part of the Survey are those of the

survey respondents and do not necessarily represent the views and opinions of M: +91 98203

45741

KPMG in India.

E: saiv@kpmg.com

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative (KPMG

International), a Swiss entity. All rights reserved.

The KPMG name, logo and cutting through complexity are registered trademarks or

trademarks of KPMG International.

kpmg.com/in

Printed in India.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG

network of independent member firms affiliated with KPMG International Cooperative (KPMG

International), a Swiss entity. All rights reserved.

Вам также может понравиться

- Russell3000 Membership List 2011Документ38 страницRussell3000 Membership List 2011trgnicoleОценок пока нет

- Rogoff - Foundations of International Macroeconomics PDFДокумент380 страницRogoff - Foundations of International Macroeconomics PDFhetsudoyaguiuОценок пока нет

- Audit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFДокумент113 страницAudit Icap Chapterwise Past Paper With Solution Prepared by Fahad Irfan PDFShaheryar Shahid100% (1)

- A3 ReportsДокумент6 страницA3 Reportswayneseal1Оценок пока нет

- My Courses: Home FM Internal Tests Assessment 1 Excel Test-NewДокумент4 страницыMy Courses: Home FM Internal Tests Assessment 1 Excel Test-NewTanu Singh 1584Оценок пока нет

- Companies Act 2013Документ6 страницCompanies Act 2013brightlight1989Оценок пока нет

- IIBF Monthly ColumnДокумент3 страницыIIBF Monthly ColumnNavneet PatelОценок пока нет

- Expressin of Interest - Document PDFДокумент12 страницExpressin of Interest - Document PDFSoumyaranjan SinghОценок пока нет

- Comparative Table - New Act and Old ActДокумент5 страницComparative Table - New Act and Old Actsanil_pОценок пока нет

- Intro Slides - Company Act 2013Документ57 страницIntro Slides - Company Act 2013Hafis ShaharОценок пока нет

- Comprimise, Arrangement and Amalgamation NotesДокумент6 страницComprimise, Arrangement and Amalgamation Notesitishaagrawal41Оценок пока нет

- Financial Statements Disclosures, Related Party Transactions, Auditor's Liabilities, Dividends & CARO, Under Companies Act, 2013Документ47 страницFinancial Statements Disclosures, Related Party Transactions, Auditor's Liabilities, Dividends & CARO, Under Companies Act, 2013Raman SapraОценок пока нет

- Amendment - CA Final - Nov'22Документ6 страницAmendment - CA Final - Nov'22Vrinda KОценок пока нет

- NewCompaniesAct bySKДокумент35 страницNewCompaniesAct bySKPraveena RajaОценок пока нет

- CoverДокумент98 страницCoverVelayudham ThiyagarajanОценок пока нет

- Corporate Law 2017Документ100 страницCorporate Law 2017behroz khanОценок пока нет

- Structural Comparison: Companies Act 1956 Companies Act 2013Документ52 страницыStructural Comparison: Companies Act 1956 Companies Act 2013Sudhaker PandeyОценок пока нет

- Meetings and ProceedingsДокумент4 страницыMeetings and ProceedingsArslan QadirОценок пока нет

- Company Act SlideДокумент101 страницаCompany Act SlideKrishna ShankarОценок пока нет

- Corporate Governance and FinanceДокумент9 страницCorporate Governance and FinancePratyasha DasguptaОценок пока нет

- SEBI (LODR) Regulation 2015Документ20 страницSEBI (LODR) Regulation 2015prasadzinjurdeОценок пока нет

- REANDA HZ CO Summary of Companies Act 2017 Slide Deck Corporate AdvisoryДокумент100 страницREANDA HZ CO Summary of Companies Act 2017 Slide Deck Corporate AdvisoryAli ArslanОценок пока нет

- Brief Note On Annual Report PDFДокумент4 страницыBrief Note On Annual Report PDFMaruko ChanОценок пока нет

- Managerial Remuneration Checklist FinalДокумент4 страницыManagerial Remuneration Checklist FinaldhuvadpratikОценок пока нет

- Various Limits Under Companies Act, 2013 (CA Final)Документ61 страницаVarious Limits Under Companies Act, 2013 (CA Final)Asim JavedОценок пока нет

- Countdown To Companies Act 2013 Impact On Transactions and Corporate RestructuringДокумент18 страницCountdown To Companies Act 2013 Impact On Transactions and Corporate Restructuringeqbal.sayed@exensys.comОценок пока нет

- Companies Act, 2013: Govind Pareek, +91-9950132400Документ2 страницыCompanies Act, 2013: Govind Pareek, +91-9950132400Ted MosbyОценок пока нет

- Audit ExemptionДокумент6 страницAudit ExemptionerikbaratОценок пока нет

- An Overview of The Companies (Amendment) Bill, 2017: As Passed by The ParliamentДокумент30 страницAn Overview of The Companies (Amendment) Bill, 2017: As Passed by The ParliamentPayal AggarwalОценок пока нет

- Company Law: List Any Fifteen Privileges Available To A Private Company Under The Companies Act, 1956Документ18 страницCompany Law: List Any Fifteen Privileges Available To A Private Company Under The Companies Act, 1956hiren_zalaОценок пока нет

- RULE68-2005 (Audited Financial Statements)Документ17 страницRULE68-2005 (Audited Financial Statements)Michael AlinaoОценок пока нет

- Declaration and Distribution of Dividends by A Company Under Indian LawДокумент8 страницDeclaration and Distribution of Dividends by A Company Under Indian LawHarimohan NamdevОценок пока нет

- Corporate Governance Through Audit Committees: Corporate and Allied LawsДокумент10 страницCorporate Governance Through Audit Committees: Corporate and Allied LawsRidhi ChoudharyОценок пока нет

- Summary Due To Law ChangeДокумент35 страницSummary Due To Law ChangeAayush NigamОценок пока нет

- Preparation of Balance Sheet and Profit and Loss Account: TotalДокумент7 страницPreparation of Balance Sheet and Profit and Loss Account: TotalAnil ChauhanОценок пока нет

- Indian Are SH Chandra Execs UmДокумент28 страницIndian Are SH Chandra Execs UmAshutosh SinghОценок пока нет

- The Companies Act 2012 Salient Features DBR 2015Документ4 страницыThe Companies Act 2012 Salient Features DBR 2015Day VidОценок пока нет

- Aoc 4Документ20 страницAoc 4Sameer DhumaleОценок пока нет

- Advance Audit and Professional Ethics Amendment NotesДокумент38 страницAdvance Audit and Professional Ethics Amendment NotesSnehaОценок пока нет

- SebiДокумент7 страницSebiAbhijeit BhosaleОценок пока нет

- Week 4Документ5 страницWeek 4Anonymous rkhiSdОценок пока нет

- CRVI Suggested AnswersДокумент12 страницCRVI Suggested AnswersCma SankaraiahОценок пока нет

- Companies Bill 2012Документ8 страницCompanies Bill 2012sidharthmalikОценок пока нет

- Certificate Course For Women DirectorsДокумент36 страницCertificate Course For Women DirectorsJhilik PradhanОценок пока нет

- SRC Rule 68Документ15 страницSRC Rule 68chua_arlene256189Оценок пока нет

- Naresh Chandra Committee Report On Corporate Audit andДокумент20 страницNaresh Chandra Committee Report On Corporate Audit andHOD CommerceОценок пока нет

- Paper 4 - LawДокумент21 страницаPaper 4 - LawManish ChawlaОценок пока нет

- CLGSP - Short NotesДокумент64 страницыCLGSP - Short NotesAmin HoqОценок пока нет

- Accounting Alert SEC Amended SRC Rule 68Документ10 страницAccounting Alert SEC Amended SRC Rule 68blackphoenix303Оценок пока нет

- Cos Bill - Enhanced Disclosures - Jan 11, 2013 - d1Документ17 страницCos Bill - Enhanced Disclosures - Jan 11, 2013 - d1Geetika AnandОценок пока нет

- Companies Bill 2012: Presented by Ca Pratik AroraДокумент40 страницCompanies Bill 2012: Presented by Ca Pratik Arorababy0310Оценок пока нет

- Previleges of Small CompaniesДокумент9 страницPrevileges of Small CompaniesRahul ShahОценок пока нет

- Advance AccountsДокумент25 страницAdvance Accountsashish.jhaa756Оценок пока нет

- Comapny QuestionsДокумент36 страницComapny QuestionsvinodОценок пока нет

- Companies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROДокумент28 страницCompanies (Auditors' Report) Order, 2015 (CARO) : Requirements of Sec 143 Requirements of CAROCA Rishabh DaiyaОценок пока нет

- Lesson 2Документ11 страницLesson 2wambualucas74Оценок пока нет

- Check List – Revised Schedule III of Companies Act For F.Y 2021-22 - Taxguru - inДокумент6 страницCheck List – Revised Schedule III of Companies Act For F.Y 2021-22 - Taxguru - inTony VargheseОценок пока нет

- Corporate AdministrationДокумент7 страницCorporate AdministrationaliyahnicoleeeeОценок пока нет

- Group Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaДокумент11 страницGroup Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaANKITA GOOMERОценок пока нет

- UNIT 5 Audit1-InsuranceДокумент30 страницUNIT 5 Audit1-InsuranceJawahar KumarОценок пока нет

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОт EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОценок пока нет

- CEO Perspectives 2018 PDFДокумент36 страницCEO Perspectives 2018 PDFManjunath ShettigarОценок пока нет

- CSR - in India - Under Companies ActДокумент8 страницCSR - in India - Under Companies ActManjunath ShettigarОценок пока нет

- How To Give Academic Job TalksДокумент14 страницHow To Give Academic Job Talkscharles_j_gomezОценок пока нет

- Effective Teaching PDFДокумент105 страницEffective Teaching PDFManjunath ShettigarОценок пока нет

- How To Give Academic Job TalksДокумент14 страницHow To Give Academic Job Talkscharles_j_gomezОценок пока нет

- How To Talk - Academic TalkДокумент60 страницHow To Talk - Academic TalkManjunath ShettigarОценок пока нет

- Mergers, Acquisitions & AlliancesДокумент28 страницMergers, Acquisitions & AlliancesManjunath ShettigarОценок пока нет

- (-) Marketing Management (BookFi)Документ5 страниц(-) Marketing Management (BookFi)Manjunath ShettigarОценок пока нет

- (-) Marketing Management (BookFi)Документ5 страниц(-) Marketing Management (BookFi)Manjunath ShettigarОценок пока нет

- (-) Marketing Management (BookFi) PDFДокумент3 страницы(-) Marketing Management (BookFi) PDFManjunath ShettigarОценок пока нет

- Educational Leadership: DR M Manjunath ShettigarДокумент31 страницаEducational Leadership: DR M Manjunath ShettigarManjunath ShettigarОценок пока нет

- Resume FormatДокумент5 страницResume FormatManjunath ShettigarОценок пока нет

- Implementing CSR in India - Issues ND ChallengesДокумент12 страницImplementing CSR in India - Issues ND ChallengesManjunath ShettigarОценок пока нет

- Market Equilibrium & Govt InterventionДокумент25 страницMarket Equilibrium & Govt InterventionManjunath ShettigarОценок пока нет

- Corporate Governance TheoriesДокумент12 страницCorporate Governance TheoriesManjunath ShettigarОценок пока нет

- A Monetary Policy PrimerДокумент96 страницA Monetary Policy PrimerManjunath ShettigarОценок пока нет

- Self-Esteem: Dr. M Manjunath ShettigarДокумент23 страницыSelf-Esteem: Dr. M Manjunath ShettigarManjunath ShettigarОценок пока нет

- Market EQUILIBRIUM & Govt InterventionДокумент25 страницMarket EQUILIBRIUM & Govt InterventionManjunath ShettigarОценок пока нет

- ECONOMICS - Consumer Surplus & Producer SurplusДокумент12 страницECONOMICS - Consumer Surplus & Producer SurplusManjunath ShettigarОценок пока нет

- International Product Life CycleДокумент4 страницыInternational Product Life CycleManjunath Shettigar67% (3)

- Corporate Governance - An OverviewДокумент95 страницCorporate Governance - An OverviewManjunath ShettigarОценок пока нет

- Educational Leadership: DR M Manjunath ShettigarДокумент31 страницаEducational Leadership: DR M Manjunath ShettigarManjunath ShettigarОценок пока нет

- Macreconomics Shcools of ThoughtДокумент16 страницMacreconomics Shcools of ThoughtManjunath ShettigarОценок пока нет

- ECONOMICS - Consumer Surplus & Producer SurplusДокумент12 страницECONOMICS - Consumer Surplus & Producer SurplusManjunath Shettigar100% (1)

- Money and Money Supply - Class1Документ84 страницыMoney and Money Supply - Class1Manjunath ShettigarОценок пока нет

- Attitude, Behavior & Job Satisfaction - ClassДокумент29 страницAttitude, Behavior & Job Satisfaction - ClassManjunath Shettigar100% (1)

- Types of DemandДокумент34 страницыTypes of DemandManjunath ShettigarОценок пока нет

- C H A P T E R 8: Developing An Effective Ethics ProgramДокумент11 страницC H A P T E R 8: Developing An Effective Ethics ProgramManjunath ShettigarОценок пока нет

- Production PossibilityДокумент33 страницыProduction PossibilityManjunath ShettigarОценок пока нет

- Bmy S4CLD2111 BPD en FRДокумент45 страницBmy S4CLD2111 BPD en FRjihanemkaОценок пока нет

- 0 0 0 15000 0 15000 SGST (0006)Документ2 страницы0 0 0 15000 0 15000 SGST (0006)Pruthiv RajОценок пока нет

- CM1Документ61 страницаCM1somapala88Оценок пока нет

- VDA 4985 Just in Time JIT Delivery Instructions V3p0 2022 03Документ15 страницVDA 4985 Just in Time JIT Delivery Instructions V3p0 2022 03Diego PottОценок пока нет

- RA 7916 - The Special Economic Zone Act of 1995 (IRR)Документ23 страницыRA 7916 - The Special Economic Zone Act of 1995 (IRR)Jen AnchetaОценок пока нет

- Exchange of Immovable PropertyДокумент3 страницыExchange of Immovable PropertyCharran saОценок пока нет

- Operations On Functions Worksheet 6Документ4 страницыOperations On Functions Worksheet 6Johnmar FortesОценок пока нет

- Scribd Upload 6Документ22 страницыScribd Upload 6AnirudhОценок пока нет

- ASUG84069 - The Fashion Solution Portfolio From SAP and What You Need To KnowДокумент82 страницыASUG84069 - The Fashion Solution Portfolio From SAP and What You Need To KnowCharith WeerasekaraОценок пока нет

- Family Entertainment Center Business PlanДокумент51 страницаFamily Entertainment Center Business PlanJoseph QuillОценок пока нет

- Simple Business Plan (Principle of Management)Документ11 страницSimple Business Plan (Principle of Management)ahyong81Оценок пока нет

- Assignment Advance Strategic ManagementДокумент5 страницAssignment Advance Strategic ManagementSanjay BhattacharyaОценок пока нет

- Engleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFДокумент384 страницыEngleski In%C5%BEenjerski%20menad%C5%BEment%20 (OAS) PDFHarini SreedharanОценок пока нет

- Section3 2Документ80 страницSection3 2aОценок пока нет

- REVISED CORPO-Board of Directors Trustees Officers 2020Документ24 страницыREVISED CORPO-Board of Directors Trustees Officers 2020Prince Carl Lepiten SilvaОценок пока нет

- KYC - FormatДокумент3 страницыKYC - FormatTalented India YUASОценок пока нет

- Market Research & Marketting ResearchДокумент2 страницыMarket Research & Marketting ResearchGurprasad SinghОценок пока нет

- CIN 502 TUTORIAL 1 - 2014123399 - Adi Salote LewatuДокумент3 страницыCIN 502 TUTORIAL 1 - 2014123399 - Adi Salote LewatuLote LewatuОценок пока нет

- Full Question Bank by Ravi Taori 201025122739Документ345 страницFull Question Bank by Ravi Taori 201025122739Mr. RetrospectorОценок пока нет

- Chapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Документ8 страницChapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Arvind KumarОценок пока нет

- Unilever Un-Chained Case Study: Format Surf Excel Liquids White Magic Liquid PowderДокумент7 страницUnilever Un-Chained Case Study: Format Surf Excel Liquids White Magic Liquid PowderSwathi PatibandlaОценок пока нет

- Questions - Financial ReportingДокумент4 страницыQuestions - Financial ReportingMo HachimОценок пока нет

- Solution Cost and Management Nov 2010Документ7 страницSolution Cost and Management Nov 2010Samuel DwumfourОценок пока нет

- Media StudiesДокумент9 страницMedia StudiesRingle JobОценок пока нет

- Reviewer RESA LAWДокумент34 страницыReviewer RESA LAWMadonna P. EsperaОценок пока нет

- "Advanced": Business Model Canvas: TemplateДокумент9 страниц"Advanced": Business Model Canvas: TemplateWahid HasimОценок пока нет

- Insurance Companies 2022Документ5 страницInsurance Companies 2022Mujo TiОценок пока нет