Академический Документы

Профессиональный Документы

Культура Документы

Eco Commentary 2 Final

Загружено:

Yo_YO_MaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Eco Commentary 2 Final

Загружено:

Yo_YO_MaАвторское право:

Доступные форматы

Rishad Kabar Economics HL Commentary 1 (draft)

1

HL ECONOMICS COMMENTARY NUMBER:

TITLE OF EXTRACT:

SOURCE OF EXTRACT: INVESTOR'S BUSINESS DAILY

DATE OF EXTRACT: March 30, 2010

WORD COUNT: 749 words

DATE COMMENTARY WAS WRITTEN: March 30, 2010

SECTION(S) OF SYLLABUS WHICH COMMENTARY RELATES: 3

CANDIDATE NAME: Rishad Kabar

CANDIDATE NUMBER:

2

Home Prices, Consumer Mood Improve

Rishad Kabar Economics HL Commentary 1 (draft)

2

The article written by Scott Stoddard reports how the American economy is showing

increasing signs of an upturn after the recent recession as the Prices of homes appeared to

stabilize after they posted their smallest decline in three years, and consumer confidence, as

per the consumer confidence index, or measure of how people feel about the future of the

economy and their own current financial situation, obtained through polling

1

, rose to higher

than anticipated levels in March.

Both these factors, i.e. property prices and consumer confidence, are determinants of

(aspects that could lead to a change in) consumption (C), which is defined as the total

spending by consumers on domestic goods and services

2

, which together with Investment

and Net Exports happen to be the components of Aggregate Demand, or the total

spending on goods and services in a period of time at a given price level

3

As the article writes, home prices were placed at -0.7% in January, a 0.3% increase from

December, as illustrated below.

This increase in house pricing is largely due to the government stimulus or offering of

incentives to homebuyers by giving tax credits (lower tax rates). The decrease in tax rates

would leave the consumers with more disposable income, or:

Income that remains available for spending after deductions for taxes

4

1

(Microsoft Encarta Encyclopedia, 2009), consumer confidence index

2

(Blink.J. & Dorton.I., 2008), consumption

3

(Blink.J. & Dorton.I., 2008), Aggregate Demand

4

(Microsoft Encarta Encyclopedia, 2009), Disposable Income

Scott Stoddard, 30

th

March 2010, Home Prices, Consumer Mood Improve, INVESTOR'S BUSINESS DAILY

Diagram 1 - Graph of Case-Shiller 20-city home price index

Rishad Kabar Economics HL Commentary 1 (draft)

3

Demand for these homes would rise as more people would be able to afford them than

before.

In terms of Aggregate demand, the increase in prices of homes will result in property owners

feeling more wealthy as the value of their property increases.

This increase in wealth could likely result in increased borrowing and spending by the

consumers, thus increasing consumption in the economy and resulting in a shift of the

aggregate demand curve, as illustrated in diagram 1 below.

The diagram above illustrates how an increase in consumption, a component of aggregate

demand, will result in a shift in the aggregate demand curve (AD) to the right (AD

1

), a new

level of output demanded (Y to Y

1

), and an increase in general price levels from (P to P

1

)

Another determinant is the general increase in consumer confidence.

When people are confident of their economic future, they are likely to increase their

consumption.

Increase in consumption and consumer confidence are indicators that the USA is heading

towards economic recovery, or

Return of an economy to normal levels of production and employment after recession

5

5

"Recovery (economics)." Microsoft Encarta 2009 [DVD]. Redmond, WA: Microsoft Corporation, 2008

SRAS

Diagram 2: Increase in aggregate Demand due to increase in consumption in the economy

AD AD

1

0

Average Price level ($)

Real Output (Y)

Y

Y

1

P

1

Rishad Kabar Economics HL Commentary 1 (draft)

4

Here, business firms will exhibit optimism about the economic outlook by investing in facilities,

hiring more laborers and producing more goods and services. More so, consumers will reflect

this optimism by increasing their purchases, typically by resorting to additional borrowing to

finance these acquisitions.

Currently, the consumer confidence index level is still below the pre-recession level;

however, the Government could further boost consumer confidence by:

Firstly, adopting an Expansionary Monetary Policy, or a monetary policy that

seeks to increase the money supply

6

.

This would be done mainly by decreasing of interest rates, as it would discourage saving as

there would be less returns, and encourage borrowing to spend from consumers and

investment from firms.

This coupled with an expansionary monetary policy, i.e. lowering tax rates would also

provide incentives for consumers to spend more as their real/disposable incomes will

increase.

The disadvantage of adopting these policies is that firstly it takes a while for the effects of

the fiscal policy to be felt, and that the government will earn a considerably lesser amount of

fiscal revenue by lowering tax rates, meaning that it has a smaller budget to spend on

important public services such as educational and infrastructure development that will

increase the economys potential output.

However the government can operate on a budget deficit by borrowing money from the

private industry thus enabling it to sustain its expenses in these services, which will

increase demand for output from businesses related to these services, aiding economic

growth.

In the short run, consumers will see an increase in their disposable income whereas

governments will see an increase in consumption & investment.

In the long run, the economy will benefit from an increase in aggregate demand and

potential output.

6

(Wikipedia,2010), Expansionary monetary policy

Rishad Kabar Economics HL Commentary 1 (draft)

5

References

"Consumer Confidence." Microsoft Encarta 2009 [DVD]. Redmond, WA: Microsoft

Corporation, 2008.

Disposable income: Microsoft Encarta 2009. 1993-2008 Microsoft Corporation.

All rights reserved.

Expansionary Monetary Policy:

http://en.wikipedia.org/wiki/Expansionary_monetary_policy

Aggregate Demand: Blink, J. & Dorton, I. (2007). Aggregate Demand

Economics Course Companion. Great Clarendon Street, Oxford OX2 6DP: Oxford

University Press 2007

Consumption : Blink, J. & Dorton, I. (2007). Aggregate Demand Economics

Course Companion. Great Clarendon Street, Oxford OX2 6DP: Oxford University Press

2007

Вам также может понравиться

- Finance For DevelopmentДокумент6 страницFinance For Developmentsyeda maryemОценок пока нет

- Module 2-Case Economic Indicators BUS305 - Competitive Analysis and Business Cycles August 18, 2012Документ13 страницModule 2-Case Economic Indicators BUS305 - Competitive Analysis and Business Cycles August 18, 2012cnrose4229Оценок пока нет

- Economics AssignmentДокумент6 страницEconomics Assignmentsolo_sudhanОценок пока нет

- Technical Questions 1 and 3 On P. 414. in Our Textbook Pg. No. 444Документ4 страницыTechnical Questions 1 and 3 On P. 414. in Our Textbook Pg. No. 444Ehab ShabanОценок пока нет

- Government Spending, Trade Openness and Economic Growth in India: A Time Series AnalysisДокумент38 страницGovernment Spending, Trade Openness and Economic Growth in India: A Time Series AnalysisMuhammad Najit Bin SukemiОценок пока нет

- Macroeconomic - UlangkajiДокумент12 страницMacroeconomic - UlangkajiAnanthi BaluОценок пока нет

- 38 Impact and Problems of Macroeconomic PoliciesДокумент2 страницы38 Impact and Problems of Macroeconomic PoliciesLeah BrocklebankОценок пока нет

- Economics Analysis Paper Three - 2Документ12 страницEconomics Analysis Paper Three - 2INNOBUNo7Оценок пока нет

- Module-Lecture 5-Macro Economic PerspectiveДокумент20 страницModule-Lecture 5-Macro Economic PerspectiveGela ValesОценок пока нет

- AGGREGATE DEMAND and SUPPLYДокумент10 страницAGGREGATE DEMAND and SUPPLYSonali TiwariОценок пока нет

- Econ5223 Week 6Документ5 страницEcon5223 Week 6Skariah ManjithОценок пока нет

- Why Has Consumption Remained ModerateДокумент64 страницыWhy Has Consumption Remained ModerateTasnim MahinОценок пока нет

- What Is Aggregate DemandДокумент10 страницWhat Is Aggregate DemandAnshita SinghОценок пока нет

- EC1009 May ExamДокумент10 страницEC1009 May ExamFabioОценок пока нет

- CIA4U Final Exam ReviewДокумент15 страницCIA4U Final Exam ReviewkolaowlejoshuaОценок пока нет

- Economics Essay TaskДокумент11 страницEconomics Essay TaskHaris ZaheerОценок пока нет

- Order 5121077 Read Instructions - EditedДокумент7 страницOrder 5121077 Read Instructions - EditedJimmi WОценок пока нет

- Economic Warfare and Weaponization of Trade Impacts US EconomyДокумент21 страницаEconomic Warfare and Weaponization of Trade Impacts US EconomysupriyaОценок пока нет

- Luigi PistaferriДокумент63 страницыLuigi PistaferriTBP_Think_TankОценок пока нет

- Research Paper American EconomyДокумент4 страницыResearch Paper American Economygvyztm2f100% (1)

- CHAP 33 - Group3Документ15 страницCHAP 33 - Group3thaothuvg2004Оценок пока нет

- Aggrigate Demand and SupplyДокумент7 страницAggrigate Demand and Supplyarslan shahОценок пока нет

- Effect of Public ExpenditureДокумент5 страницEffect of Public ExpenditureSantosh ChhetriОценок пока нет

- ¿Qué Hacen Los Déficits Presupuestarios¿ - MankiwДокумент26 страниц¿Qué Hacen Los Déficits Presupuestarios¿ - Mankiwpandita86Оценок пока нет

- Financialization of The US Economy PDFДокумент26 страницFinancialization of The US Economy PDFSaran BaskarОценок пока нет

- Ec1420 NotesДокумент18 страницEc1420 NotesChelsea ZhuОценок пока нет

- Weekly Economic Commentary 01-30-12Документ4 страницыWeekly Economic Commentary 01-30-12monarchadvisorygroupОценок пока нет

- Fiscal Policy A Tool To Beat RecessionДокумент8 страницFiscal Policy A Tool To Beat RecessionNadeem YousufОценок пока нет

- Loanable Funds Market (F)Документ4 страницыLoanable Funds Market (F)Rishav SОценок пока нет

- Stimulus vs Austerity: India Needs Fiscal StimulusДокумент6 страницStimulus vs Austerity: India Needs Fiscal StimulusSiddharth DewalwarОценок пока нет

- Complex economics for entrepreneursДокумент13 страницComplex economics for entrepreneursYidong ZhangОценок пока нет

- U.S. National Debt and the F-Cubed I.T. PrincipleДокумент16 страницU.S. National Debt and the F-Cubed I.T. PrincipleJay FlottmannОценок пока нет

- Macro Economics FinalДокумент9 страницMacro Economics FinalDeepa RaghuОценок пока нет

- Case Study The Great Depression and The Global Financial CrisisДокумент9 страницCase Study The Great Depression and The Global Financial CrisisBurak NaldökenОценок пока нет

- AD shifts explainedДокумент32 страницыAD shifts explainedGeorge EscribanoОценок пока нет

- Changes in Economic GrowthДокумент6 страницChanges in Economic GrowthMmapontsho TshabalalaОценок пока нет

- #ADI086Документ8 страниц#ADI086Shreya NaithaniОценок пока нет

- Newton KuNe Neg 01 - Blue Valley Southwest OctasДокумент27 страницNewton KuNe Neg 01 - Blue Valley Southwest OctasEmronОценок пока нет

- Inflation and RecessionДокумент16 страницInflation and RecessionHenrielene LontocОценок пока нет

- The University of Chicago PressДокумент55 страницThe University of Chicago PresscaggiatoОценок пока нет

- Factors Affecting Economic Development and GrowthДокумент74 страницыFactors Affecting Economic Development and GrowthAnonymous MPVl949TgОценок пока нет

- Enlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansОт EverandEnlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansОценок пока нет

- Chapter 7 Aggregate Demand and Aggregate Supply: Start Up: The Great WarningДокумент50 страницChapter 7 Aggregate Demand and Aggregate Supply: Start Up: The Great WarningRyan CholoОценок пока нет

- Infalation and Interest RateДокумент7 страницInfalation and Interest Rateadarsh_kushwaha_pgp11Оценок пока нет

- Eco NewДокумент30 страницEco NewTauseef AhmedОценок пока нет

- U S Economic Recession & Its Impact On Indian EconomyДокумент32 страницыU S Economic Recession & Its Impact On Indian EconomysinghsanjОценок пока нет

- Economic Growth & Development StructureДокумент33 страницыEconomic Growth & Development Structuremusinguzi francisОценок пока нет

- Inflation, Unemployment and The Fed: Real GDPДокумент5 страницInflation, Unemployment and The Fed: Real GDPKaterina McCrimmonОценок пока нет

- EconomicsДокумент3 страницыEconomicsdominic oyaroОценок пока нет

- Case StudyДокумент16 страницCase StudyDisha PuriОценок пока нет

- Q& A 1Документ6 страницQ& A 1Mohannad HijaziОценок пока нет

- Economics AQA A2 Un 4 Workbook AnswersДокумент28 страницEconomics AQA A2 Un 4 Workbook AnswersJEFFREYОценок пока нет

- Aggregate Demand and Aggregate SupplyДокумент3 страницыAggregate Demand and Aggregate SupplysafinaОценок пока нет

- Research Paper Economic CrisisДокумент5 страницResearch Paper Economic Crisisafmcqeqeq100% (1)

- Week 12 - Tutorial QuestionsДокумент9 страницWeek 12 - Tutorial Questionsqueeen of the kingdomОценок пока нет

- Investment and Tax Planning Strategies For Uncertain Economic TimesДокумент16 страницInvestment and Tax Planning Strategies For Uncertain Economic TimesMihaela NicoaraОценок пока нет

- PRODUCTДокумент82 страницыPRODUCTSrishti AggarwalОценок пока нет

- Honda Wave Parts Manual enДокумент61 страницаHonda Wave Parts Manual enMurat Kaykun86% (94)

- Catalogoclevite PDFДокумент6 страницCatalogoclevite PDFDomingo YañezОценок пока нет

- MBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorДокумент20 страницMBO, Management by Objectives, Pooja Godiyal, Assistant ProfessorPooja GodiyalОценок пока нет

- Resume of Deliagonzalez34 - 1Документ2 страницыResume of Deliagonzalez34 - 1api-24443855Оценок пока нет

- Cushman Wakefield - PDS India Capability Profile.Документ37 страницCushman Wakefield - PDS India Capability Profile.nafis haiderОценок пока нет

- Google Dorks For PentestingДокумент11 страницGoogle Dorks For PentestingClara Elizabeth Ochoa VicenteОценок пока нет

- Prof Ram Charan Awards Brochure2020 PDFДокумент5 страницProf Ram Charan Awards Brochure2020 PDFSubindu HalderОценок пока нет

- Music 7: Music of Lowlands of LuzonДокумент14 страницMusic 7: Music of Lowlands of LuzonGhia Cressida HernandezОценок пока нет

- Quality Management in Digital ImagingДокумент71 страницаQuality Management in Digital ImagingKampus Atro Bali0% (1)

- India Today 11-02-2019 PDFДокумент85 страницIndia Today 11-02-2019 PDFGОценок пока нет

- Book Networks An Introduction by Mark NewmanДокумент394 страницыBook Networks An Introduction by Mark NewmanKhondokar Al MominОценок пока нет

- Resume Template & Cover Letter Bu YoДокумент4 страницыResume Template & Cover Letter Bu YoRifqi MuttaqinОценок пока нет

- Lecture Ready 01 With Keys and TapescriptsДокумент157 страницLecture Ready 01 With Keys and TapescriptsBảo Châu VươngОценок пока нет

- Case Study Hotel The OrchidДокумент5 страницCase Study Hotel The Orchidkkarankapoor100% (4)

- Mission Ac Saad Test - 01 QP FinalДокумент12 страницMission Ac Saad Test - 01 QP FinalarunОценок пока нет

- Gas Dehydration (ENGINEERING DESIGN GUIDELINE)Документ23 страницыGas Dehydration (ENGINEERING DESIGN GUIDELINE)Tu Dang TrongОценок пока нет

- Wasserman Chest 1997Документ13 страницWasserman Chest 1997Filip BreskvarОценок пока нет

- Sentinel 2 Products Specification DocumentДокумент510 страницSentinel 2 Products Specification DocumentSherly BhengeОценок пока нет

- TDS Sibelite M3000 M4000 M6000 PDFДокумент2 страницыTDS Sibelite M3000 M4000 M6000 PDFLe PhongОценок пока нет

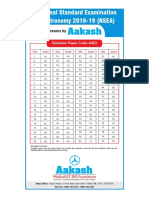

- National Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423Документ1 страницаNational Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423VASU JAINОценок пока нет

- Books of AccountsДокумент18 страницBooks of AccountsFrances Marie TemporalОценок пока нет

- Main Research PaperДокумент11 страницMain Research PaperBharat DedhiaОценок пока нет

- Postgraduate Notes in OrthodonticsДокумент257 страницPostgraduate Notes in OrthodonticsSabrina Nitulescu100% (4)

- Krok2 - Medicine - 2010Документ27 страницKrok2 - Medicine - 2010Badriya YussufОценок пока нет

- Zelev 1Документ2 страницыZelev 1evansparrowОценок пока нет

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsДокумент3 страницыAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CОценок пока нет

- Inside Animator PDFДокумент484 страницыInside Animator PDFdonkey slapОценок пока нет

- Nama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Документ3 страницыNama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Yetri MulizaОценок пока нет

- Electronics Ecommerce Website: 1) Background/ Problem StatementДокумент7 страницElectronics Ecommerce Website: 1) Background/ Problem StatementdesalegnОценок пока нет