Академический Документы

Профессиональный Документы

Культура Документы

Opera + Adcolony

Загружено:

carlyblack20060 оценок0% нашли этот документ полезным (0 голосов)

23 просмотров12 страницOpera has chosen to boost its efforts in the Mobile Video Space with the acquisition of AdColony. Video is the single largest medium for ad spend globally TV $300B Global Market Digital is around $120B, of which approximately $18B in mobile (15%) video will move from TV to mobile much faster than TV to desktop.

Исходное описание:

Оригинальное название

Presentation

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документOpera has chosen to boost its efforts in the Mobile Video Space with the acquisition of AdColony. Video is the single largest medium for ad spend globally TV $300B Global Market Digital is around $120B, of which approximately $18B in mobile (15%) video will move from TV to mobile much faster than TV to desktop.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

23 просмотров12 страницOpera + Adcolony

Загружено:

carlyblack2006Opera has chosen to boost its efforts in the Mobile Video Space with the acquisition of AdColony. Video is the single largest medium for ad spend globally TV $300B Global Market Digital is around $120B, of which approximately $18B in mobile (15%) video will move from TV to mobile much faster than TV to desktop.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

Opera + AdColony

Opera has chosen to boost its efforts in the mobile

video space with the acquisition of AdColony

Video is the single largest medium for ad spend globally

TV $300B Global Market

Digital is around $120B, of which approximately $18B in Mobile (15%)

Video will move from TV to mobile much faster than TV to desktop

Tablets have re-defined how consumers watch video content

Full screen, TV-like experiences + interactivity

Largely immune to PVR effect

Advertisers will follow the eyeballs

February study from Millward Brown More time spent on mobile screen than TV screen

(155 minutes/day vs. 147 minutes/day) in U.S.

The advertiser spend has yet to catch up

Video is the #1 mobile content format consumed globally, including emerging markets

Video is the fastest growing mobile advertising

segment and is highly effective

Source: eMarketer, Aug 2013

0% 20% 40% 60% 80% 100%

Purchase intent

Ad favorability

Message recall

Brand recall

General recall

Ad effectiveness

(% of exposed respondents)

Online video TV Mobile video

Video engagement

rates are 3-5% (10-

15x static banner

ads)

0.2

0.6

1.0

1.6

2.3

3.0

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

2012 2013 2014 2015 2016 2017

U

S

D

b

i

l

l

i

o

n

s

US mobile video ad spend

CAGR:

51%

Compared to search, banner,

rich media CAGR of 37%

Growth rates for mobile video ad spending will be far

greater than for any other related channeltelevision,

online or total digital

eMarketer

AdColony: Quick Facts

Scale: A Leading Player in the Mobile Video Space

2013 revenues of $53 million with strong growth and

profitability

Audience reach of more than 340 million consumers

Technology: Market-leading Instant-Play HD video ads

Full-screen HD TV-like experience

Video ads shown anywhere not only as part of video

content

Engagement: Dynamic End Cards that drive post-viewing

interaction with consumers

Deliver immersive brand experiences, location, social

media sharing, app installs

Strong traction with both brand advertisers and

performance advertisers

Team: Strong management and 100-person team

Leadership from Apple, Yahoo!, AT&T, Activision etc.

Based in LA, other offices in SF, NYC, Seattle, Chicago,

Detroit and London

AdColony delivers a video advertising product with

massive traction among both advertisers and publishers

Razor sharp quality

Lightning fast speed; never buffers

Full-screen experience

Superior audio quality

Instant-Play HD Video

AdColony: Featured Advertising Partners

AdColony: Featured Publishing Partners

AdColony combines the power of TV with the

engagement of digital, at scale

User engaged in a native app

on their smartphone or tablet

typically long session-time

apps where users are highly

engaged and in a state of

want (vs. need)

entertainment, news, music,

games and social

Superior-quality HD video ad

plays at normal breaks in the

experience, full screen with no

buffering

Video resolves to completely

customizable Dynamic End

Card to accomplish multiple

calls-to-action

In-App Environment

Full-Screen Instant-Play

HD Video ad

Customizable

Dynamic End Card

AdColony is an excellent strategic fit for Opera

Establishes Opera as the leader in mobile video advertising

Highly differentiated combined platform leading the innovation curve

Addresses huge demand for mobile video inventory from our brand advertisers

Very attractive market with strong underlying growth

Industry Leader in

Mobile Video

Advertising

Expands Publisher

Base

Strong Brand &

Performance

Offering

Global Opportunity

Highly complementary addition of a broad range of top-tier mobile publishers

Attractive new inventory for rich media and banner ads

Strengthens Operas portfolio in high growth mobile ad market

Opera can take AdColony beyond U.S. footprint and expand to international

markets (starting with a solid foothold in the U.K., Germany, Brazil and Mexico)

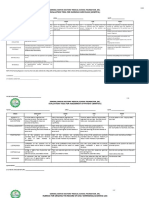

Overview of transaction terms

Component

Upfront

consideration

Performance

based

consideration

Total

$75m, plus payment for excess cash

Escrow: $25m total, both revenue

and adj. EBITDA targets, of which

2014: $10m total escrow pool

2015: $15m total escrow pool

2014 earn-out: $75m total pool

30% revenue

1

, 70% adj. EBITDA

2015 earn-out: $135m total pool

22% revenue

1

, 78% adj. EBITDA

2016 earn-out: $40m total pool

19% revenue

1

, 81% adj. EBITDA

$350m

Maximum consideration and

earn-out drivers

Cash

Escrow: Cash

Earn-outs: Cash or stock,

largely at Operas

discretion

Up to $15m of the

potential EBITDA-driven

earn-out payments are

dedicated to employees,

$7.5m in each of 2015

and 2016, and will be paid

in cash

Form of consideration

Total estimated

purchase price at

expected performance

$75m, plus payment for

excess cash

Escrow: $25m

2014 earn-out: $50m

2015 earn-out: $75m

2016 earn-out: $20m

$245m

1 Revenue targets also include minimum adj. EBITDA targets

Updated 2014 Financial Guidance and 2015 Financial

Aspirations in light of the AdColony acquisition

1: AdColony represents 15 August 31 December in 2014

2: Marketing and R&D

2014 guidance

Existing guidance

Opera AdColony

expectation

1

Addtl investments

2

in Consumer and

Operator

businesses

Updated guidance

Revenue Adj. EBITDA

$390-410m $108-116m

$45-50m $7-9m

($5m)

$435-460m $110-120m

2015 Financial Aspirations

Existing Aspirations

Opera AdColony

estimate

Updated aspirations

Revenue Adj. EBITDA

$500m $150m

$170m $30m

$670m $180m

2013 Opera Software ASA. All rights reserved.

Вам также может понравиться

- Focus Media Hong KongДокумент31 страницаFocus Media Hong KongbibrahimОценок пока нет

- Display AdДокумент33 страницыDisplay AdsohailpanezaiОценок пока нет

- GoogleДокумент49 страницGoogleBhargavi DoddaОценок пока нет

- Google PPT 1227880622128341 8Документ49 страницGoogle PPT 1227880622128341 8Dina ErtoleuОценок пока нет

- Technology New Product Development Development: Mamatha SenДокумент14 страницTechnology New Product Development Development: Mamatha SenShadman KibriaОценок пока нет

- Mobisummer SDK Monetization Plan PDFДокумент21 страницаMobisummer SDK Monetization Plan PDFMahmud HassanОценок пока нет

- Mastering and Marketing Online-Video-Made-Simple: Changing technologies have sourced paradigm shifts in the way companies used to do their business. Gone are the days when print media, radio and television were considered the only ways of reaching the masses.От EverandMastering and Marketing Online-Video-Made-Simple: Changing technologies have sourced paradigm shifts in the way companies used to do their business. Gone are the days when print media, radio and television were considered the only ways of reaching the masses.Оценок пока нет

- Media EconomicsДокумент30 страницMedia EconomicsSukaran ThakurОценок пока нет

- Group 9: Advertising's Reach and Efficacy & Traditional Media's EvaluationДокумент25 страницGroup 9: Advertising's Reach and Efficacy & Traditional Media's EvaluationDARSHANA JHAОценок пока нет

- Project Report On "Comparative Analysis On Television Regarding The Brand Preference of Consumers and Dealers"Документ47 страницProject Report On "Comparative Analysis On Television Regarding The Brand Preference of Consumers and Dealers"Konark GuptaОценок пока нет

- Quantcast - ReachingTheRightAudience REPORT 2 PDFДокумент20 страницQuantcast - ReachingTheRightAudience REPORT 2 PDFAnonymous 2Yd4GgОценок пока нет

- Appia: Case StudyДокумент11 страницAppia: Case Studygargashish11Оценок пока нет

- Smart Digital Signage: Prepared Exclusively ForДокумент55 страницSmart Digital Signage: Prepared Exclusively ForIndigo CorpОценок пока нет

- Advanced Mobile Marketing - Section 5 SlidesДокумент100 страницAdvanced Mobile Marketing - Section 5 SlidesSAURABH BHANDARIОценок пока нет

- Market Strategy Stakeholders FinancialsДокумент5 страницMarket Strategy Stakeholders Financialsthu trang nguyễnОценок пока нет

- Sales Presentation - Consumer DurablesДокумент50 страницSales Presentation - Consumer DurablesdrifterdriverОценок пока нет

- This Study Is Brought To You Courtesy ofДокумент25 страницThis Study Is Brought To You Courtesy ofAl KaoОценок пока нет

- q2 12 Rhythm Insights WebsiteДокумент21 страницаq2 12 Rhythm Insights WebsiteMobileLeadersОценок пока нет

- 2011 Letter To StockholdersДокумент0 страниц2011 Letter To Stockholdersapi-241575924Оценок пока нет

- Investor Pres Mar2011Документ29 страницInvestor Pres Mar2011Steve DavisОценок пока нет

- OTT Industry AnalysisДокумент32 страницыOTT Industry AnalysisRohit Raj100% (1)

- Competences With The Aim ofДокумент145 страницCompetences With The Aim ofSita RamОценок пока нет

- Competences With The Aim ofДокумент183 страницыCompetences With The Aim ofSita RamОценок пока нет

- Ooyala Driving Quality in Online TV AdvertisingДокумент3 страницыOoyala Driving Quality in Online TV AdvertisingJuanalverto Ladron de GuevaraОценок пока нет

- Branding The World: Vodafone Brand OverviewДокумент81 страницаBranding The World: Vodafone Brand OverviewPunit BhattОценок пока нет

- Cap 2013-mcДокумент1 страницаCap 2013-mcapi-255163238Оценок пока нет

- Marketing Quiz ReviewДокумент5 страницMarketing Quiz ReviewJasmine GiápОценок пока нет

- Media Donuts Advertising AgencyДокумент24 страницыMedia Donuts Advertising Agencyquaintrelle joy100% (1)

- Global Advertising EffectivenessДокумент21 страницаGlobal Advertising EffectivenessMunish Nagar100% (1)

- Job DeskДокумент19 страницJob DeskPandi IndraОценок пока нет

- Google PPT 1227880622128341 8Документ49 страницGoogle PPT 1227880622128341 8Rohit BhattОценок пока нет

- When Are We Going To Walk The Talk in Mobile Marketing?: 4th Conference On Digital MarketingДокумент12 страницWhen Are We Going To Walk The Talk in Mobile Marketing?: 4th Conference On Digital Marketinga_d425Оценок пока нет

- Akamai Tech Pub Video Ads EffectivenessДокумент15 страницAkamai Tech Pub Video Ads EffectivenessAnca FoiaОценок пока нет

- Brand Marketer's Guide To Video - May2011Документ16 страницBrand Marketer's Guide To Video - May2011Alexandre Lobo FilhoОценок пока нет

- Presentation 2Документ19 страницPresentation 2kjjjsОценок пока нет

- Advertising Sector: Service ManagementДокумент35 страницAdvertising Sector: Service ManagementPrithish GhoshОценок пока нет

- GoogleДокумент28 страницGoogleAnonymous Ht0MIJ75% (4)

- Introduction - Players - Content - BrandsДокумент34 страницыIntroduction - Players - Content - BrandsAnuth SiddharthОценок пока нет

- Digital Marketing and PandemicДокумент1 страницаDigital Marketing and PandemicNeeraj GargОценок пока нет

- Digital Marketing and Pandemic PDFДокумент1 страницаDigital Marketing and Pandemic PDFNeeraj GargОценок пока нет

- How To Build A Live Soccer Streaming AppДокумент7 страницHow To Build A Live Soccer Streaming AppLekha KoshtaОценок пока нет

- MoPub - Publisher Deck Q4 2011Документ21 страницаMoPub - Publisher Deck Q4 2011Dan SackОценок пока нет

- Five Reasons To Launch A Subscription ServiceДокумент9 страницFive Reasons To Launch A Subscription ServiceDistant AnimalsОценок пока нет

- Online Video Monetization Strategies: Yahoo! - Summer Internship ProjectДокумент42 страницыOnline Video Monetization Strategies: Yahoo! - Summer Internship Projectpachori83Оценок пока нет

- Q1 14 Fact SheetL - v2 - 050514Документ2 страницыQ1 14 Fact SheetL - v2 - 050514Benj LucioОценок пока нет

- Case Analysis: Marketing Analysis: 3 C'SДокумент12 страницCase Analysis: Marketing Analysis: 3 C'SParth Singla100% (1)

- Samba Tech at Chin ICTДокумент10 страницSamba Tech at Chin ICTIT DecisionsОценок пока нет

- About NetflixДокумент8 страницAbout Netflixraj chopdaОценок пока нет

- Case AnalysisДокумент7 страницCase Analysissanthu_bhoomi9673Оценок пока нет

- DemoДокумент15 страницDemoJayaKhemaniОценок пока нет

- BM Assignment - MukundДокумент14 страницBM Assignment - MukundDivya HindujaОценок пока нет

- Videocon Industries LTDДокумент10 страницVideocon Industries LTDnamitmalhotra21Оценок пока нет

- YouTube For Brands GRP10Документ8 страницYouTube For Brands GRP10ritam chakrabortyОценок пока нет

- AashutoshSaini DirectiДокумент11 страницAashutoshSaini Directiasmita196Оценок пока нет

- Adobe Q12023 ResultsДокумент2 страницыAdobe Q12023 ResultsSampath KumarОценок пока нет

- Say It, Sell It, Buy ItДокумент11 страницSay It, Sell It, Buy Itasmita196Оценок пока нет

- Aztec GodsДокумент3 страницыAztec Godscarlyblack20060% (1)

- ATFCapacityДокумент10 страницATFCapacitypaulpassmore998100% (1)

- Cray x1 AssemblyДокумент308 страницCray x1 Assemblycarlyblack2006Оценок пока нет

- Adobe Server ListДокумент1 страницаAdobe Server Listcarlyblack2006Оценок пока нет

- PCB Design Guidelines For Reduced EMIДокумент23 страницыPCB Design Guidelines For Reduced EMIEdgar Eduardo Medina CastañedaОценок пока нет

- Software Basics ExplainedДокумент6 страницSoftware Basics Explainedcarlyblack2006Оценок пока нет

- Pick It 2 Clone Part ListДокумент2 страницыPick It 2 Clone Part Listcarlyblack2006Оценок пока нет

- Small ACDC ConverterДокумент1 страницаSmall ACDC Convertercarlyblack2006Оценок пока нет

- 1/24/2009 4:40:06 PM C:/Documents and Settings/Papa/My Documents/eagle/PWM Control/PWM Controller - SCH (Sheet: 1/1)Документ1 страница1/24/2009 4:40:06 PM C:/Documents and Settings/Papa/My Documents/eagle/PWM Control/PWM Controller - SCH (Sheet: 1/1)carlyblack2006Оценок пока нет

- Fake Ids A National Security ProblemДокумент8 страницFake Ids A National Security Problemcarlyblack2006100% (1)

- Why Warren Buffett Stayed Far Away From The Facebook IPO - Business InsiderДокумент5 страницWhy Warren Buffett Stayed Far Away From The Facebook IPO - Business Insidercarlyblack2006Оценок пока нет

- Baofeng Uv-3r 2 Way Radio Hacked To 3 Way RadioДокумент3 страницыBaofeng Uv-3r 2 Way Radio Hacked To 3 Way Radiocarlyblack2006Оценок пока нет

- Army War College PDFДокумент282 страницыArmy War College PDFWill100% (1)

- GMAT Sentence Correction Practice Test 03Документ5 страницGMAT Sentence Correction Practice Test 03krishnachivukulaОценок пока нет

- Evolution Epidemiology and Etiology of Temporomandibular Joint DisordersДокумент6 страницEvolution Epidemiology and Etiology of Temporomandibular Joint DisordersCM Panda CedeesОценок пока нет

- Music 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Документ4 страницыMusic 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Kate Mary50% (2)

- PEDIA OPD RubricsДокумент11 страницPEDIA OPD RubricsKylle AlimosaОценок пока нет

- How To Use The ActionДокумент3 страницыHow To Use The Actioncizgiaz cizgiОценок пока нет

- 755th RSBДокумент32 страницы755th RSBNancy CunninghamОценок пока нет

- BUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Документ55 страницBUS 301 - Hospitality Industry Vietnam - Nguyễn Thị Thanh Thuý - 1632300205Nguyễn Thị Thanh ThúyОценок пока нет

- IsaiahДокумент7 страницIsaiahJett Rovee Navarro100% (1)

- Corelation & Multiple Regression AnalysisДокумент28 страницCorelation & Multiple Regression AnalysisSaad Bin Tariq100% (1)

- Referensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFДокумент6 страницReferensi PUR - Urethane Surface coating-BlockedISO (Baxenden) - 20160802 PDFFahmi Januar AnugrahОценок пока нет

- College PrepДокумент2 страницыCollege Prepapi-322377992Оценок пока нет

- Guidebook On Mutual Funds KredentMoney 201911 PDFДокумент80 страницGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarОценок пока нет

- Ancient Egyptian TimelineДокумент5 страницAncient Egyptian TimelineMariz Miho100% (2)

- Google Chrome OSДокумент47 страницGoogle Chrome OSnitin07sharmaОценок пока нет

- Detailed Award Sheet Government College University, FaisalabadДокумент1 страницаDetailed Award Sheet Government College University, FaisalabadAnayat KhetranОценок пока нет

- Prestressed ConcreteДокумент66 страницPrestressed ConcreteTech BisuОценок пока нет

- Mae (256F) - HW3 PDFДокумент2 страницыMae (256F) - HW3 PDFClaireОценок пока нет

- ESS Revision Session 2 - Topics 5-8 & P1 - 2Документ54 страницыESS Revision Session 2 - Topics 5-8 & P1 - 2jinLОценок пока нет

- Rata-Blanca-La Danza Del FuegoДокумент14 страницRata-Blanca-La Danza Del FuegoWalter AcevedoОценок пока нет

- Value Chain AnalaysisДокумент100 страницValue Chain AnalaysisDaguale Melaku AyeleОценок пока нет

- RPS Manajemen Keuangan IIДокумент2 страницыRPS Manajemen Keuangan IIaulia endiniОценок пока нет

- Air Microbiology 2018 - IswДокумент26 страницAir Microbiology 2018 - IswOktalia Suci AnggraeniОценок пока нет

- Baybay - Quiz 1 Code of EthicsДокумент2 страницыBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.Оценок пока нет

- Peptic UlcerДокумент48 страницPeptic Ulcerscribd225Оценок пока нет

- Pudlo CWP TDS 2Документ4 страницыPudlo CWP TDS 2azharОценок пока нет

- Peacekeepers: First Term ExamДокумент2 страницыPeacekeepers: First Term ExamNoOry foOT DZ & iNT100% (1)

- God Made Your BodyДокумент8 страницGod Made Your BodyBethany House Publishers56% (9)

- Agrarian ReformДокумент40 страницAgrarian ReformYannel Villaber100% (2)

- March FOMC: Tighter Credit Conditions Substituting For Rate HikesДокумент8 страницMarch FOMC: Tighter Credit Conditions Substituting For Rate HikeshaginileОценок пока нет