Академический Документы

Профессиональный Документы

Культура Документы

BDV

Загружено:

ravivarmahyd8173Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BDV

Загружено:

ravivarmahyd8173Авторское право:

Доступные форматы

Direct links

*Types of customs duties

*Rules of the Agreement on Customs Valuation

*Determining customs value: permitted adjustments to the price paid for goods

*Instances when customs can reject the transaction value declared by the importer

CHAPTER 3

Valuation of goods for customs purposes

Summary

When customs duties are levied on an ad valorem basis (e.g. 10 % of the value of

imported goods), the actual incidence of duty depends on how Customs determines

dutiable value. The Agreement on Customs Valuation requires Customs to determine

the value on the basis of the price paid or payable by the importer in the transaction

that is being valued. As a result of a Decision adopted in the Uruguay Round,

Customs can reject transaction values when it has reasons to doubt the truth or

accuracy of the value declared by importers or of the documents submitted by them. In

order to protect the interests of importers in such situations, Customs is required to

provide them with an opportunity to justify their price. Where Customs is not

satisfied with the justifications given, it is obliged to give to these importers in writing

its reasons for not accepting the transaction value they have declared.

When the transaction value is not accepted by Customs, the Agreement lays down five

methods for establishing value. In determining value on the basis of these methods,

Customs is required to consult the importers and take their views into account.

A number of developing countries currently use valuation systems based on the

Brussels Definition of Value, developed by the World Customs Organization

(WCO). These countries will have to modify their systems to bring them in

conformity with the rules of the Agreement on Customs Valuation within the

transitional period of five years (i.e. up to 1 January 2000) that has been accorded to

developing countries for changing over to the system established by the Agreement.

Types of customs duties

Customs duties are levied on an ad valorem basis (e.g. 20% of the value of the

imported product) or as specific duties (e.g. $2 per kilogram or per litre).

Combined or mixed duties containing both ad valorem and specific rates are also

levied (10% of the value + $2 per kilogram) on some products.

With a few exceptions, most countries levy ad valorem duties. Governments

prefer to levy such duties for three broad reasons. First, it is easier for the

authorities to estimate collectable revenue from ad valorem duties, which are

assessed on the basis of value, than revenue from specific duties, which are

levied on the basis of volume or weight. Second, ad valorem duties are more

equitable than specific duties as their incidence is lower on cheaper products

and higher on more expensive goods. For instance, a specific duty of $2 per litre

would have an incidence of 50% on a bottle of wine costing $4, and 10% on a

higher-priced wine costing $20 a bottle. An ad valorem duty of 10% would have

an incidence of $0.20 on the cheaper bottle and $2 on the more expensive

66

Chapter 3 Valuation of goods for customs purposes

bottle. Third, in international negotiations for reductions in tariffs it is far

easier to compare the level of tariffs and negotiate reductions if the duties are

ad valorem.

Back to the top

However, the incidence of ad valorem duties depends to a large extent on the

methods used to determine dutiable value. Thus, if Customs determines the

dutiable value at $1,000, an ad valorem duty of 10% will result in a duty of $100.

If, on the other hand, it determines value at $1,200, the importer will have to

pay an import duty of $120 for the same goods. The benefits to the trade arising

from tariff bindings could fall considerably if Customs uses prices other than

invoice prices for determining values for customs purposes. The rules that are

applied for the valuation of goods are therefore of crucial importance in

ensuring that the incidence of duties as perceived by the importer is not higher

than that indicated by the nominal rates shown in the importing countrys tariff

schedules.

Rules of the Agreement on Customs Valuation

Agreement on Customs

Valuation, Preamble

The detailed WTO rules on the valuation of goods for customs purposes are

contained in the Agreement on Customs Valuation (full title: Agreement on

Implementation of Article VII of GATT 1994). The Agreements valuation

system is based on simple and equitable criteria that take commercial practices

into account. By requiring all member countries to harmonize their national

legislation on the basis of the Agreements rules, it seeks to ensure uniformity in

the application of the rules so that importers can assess with certainty in

advance the amounts of duties payable on imports.

The main standard: transaction value

Agreement on Customs

Valuation, Article 1:1

Agreement on Customs

Valuation, Article 8:1

The basic rule of the Agreement is that the value for customs purposes should

be based on the price actually paid or payable when sold for export to the

country of importation (e.g. the invoice price), adjusted, where appropriate, to

include certain payments made by buyers such as the costs of packing and

containers, assists, royalties and license fees (see box 10). The rules exclude

buying commissions and special discounts obtained by sole agents and sole

concessionaires from being taken into account in arriving at dutiable value.

The Tokyo Round Agreement strictly limited the discretion available to

Customs to reject transaction value to the small number of cases listed in

box 11. This was a matter of concern to numerous developing countries. They

considered that the rule unduly inhibited the ability of their customs

administrations to deal with the traders practice of undervaluing imported

goods in order to reduce incidence on duties. This was one reason for the

reluctance of a large number of developing countries to accede to the

Agreement in the pre-WTO period.

Decision on Shifting the

Burden of Proof, 1

The Decision Regarding Cases where Customs Administrations Have Reasons

to Doubt the Truth or Accuracy of the Declared Value (also known as the

Decision on Shifting the Burden of Proof), adopted as a result of the initiative

taken by developing countries during the Uruguay Round, corrects this lacuna.

The Tokyo Round Agreement placed the burden of proof on Customs if it

rejected the transaction value declared by the importer. The Uruguay Round

decision shifts the burden of proof on to the importers when Customs, on the

basis of the information on prices and other data available to it, has reason to

doubt the truth or accuracy of the particulars or of documents produced in

support of declarations made by the importers.

Chapter 3 Valuation of goods for customs purposes

Box 10

Determining customs value: permitted adjustments to the price

paid for goods

(Agreement on Customs Valuation, Article 8)

In order to arrive at the transaction value, Article 8 of the Agreement on Customs

Valuation provides that payments made for the following elements can be added to the

price actually paid or payable (i.e. the invoice price) by the importer for the imported

goods:

q

Commissions and brokerage, except buying commissions;

Costs of, and charges for, packing and containers;

Assists, i.e. goods (materials, components, tools, dies, etc.) or services (designs,

plans, etc.) supplied free or at reduced cost by the buyer for use in the production of

the imported goods;

Royalties and license fees;

Subsequent proceeds of any sale accruing to the seller as a result of the resale or use

of imported goods;

The cost of transport, insurance and related charges to the place of importation, if

the country bases its valuation on CIF prices.

The Article further clarifies that no additions other than for the elements mentioned

above shall be made to the price paid or payable in order to arrive at the transaction

value. The Article, in addition, enumerates charges or costs that should not be added

to customs value, if they can be distinguished from the price actually paid or payable.

These are:

Back to the top

Freight after importation into the customs territory of the importing country;

Cost of construction, erection, assembly, maintenance or technical assistance

occurring after importation;

Duties and taxes of the importing country.

Box 11

Instances when customs can reject the transaction value declared by

the importer

1. When there is no sale.

2. When there are restrictions on the disposition or use of the goods by the buyer. The

transaction value need not be accepted if the sales contract imposes some restrictions on

the use or disposition of goods except where:

The restriction is imposed by law (e.g. packaging requirements);

The restrictions limit the geographical area in which the goods may be sold

(e.g. distribution contract which limits sales to European countries);

The restrictions do not affect the value of goods (e.g. the new model imported

should not be sold before a particular date).

3. When the sale or price is subject to some conditions for which the value cannot be

determined (e.g. the seller establishes the price of the imported goods on condition that

the buyer also buys other goods in specified quantities).

4. When part of the proceeds of any subsequent resale by the buyer accrues to the

seller.

Back to the top

5. Where the buyer and seller are related and if the price is influenced by the

relationship.

67

68

Chapter 3 Valuation of goods for customs purposes

In order to ensure that the transaction value is rejected by Customs in such

cases on an objective basis, the Agreement on Customs Valuation stipulates

that national legislation should provide certain rights to importers. First, where

Customs expresses doubts as to the truth or accuracy of a declared value,

importers should have a right to provide an explanation, including documents

or other evidence to prove that the value declared by them reflects the correct

value of the imported goods. Second, where Customs is not satisfied with the

explanations given, importers should have a right to ask Customs to

communicate to them in writing its reasons for doubting the truth or accuracy

of the declared value. This provision is intended to safeguard the interests of

importers, by giving them the right to appeal against the decision to higher

authorities and, if necessary, to a tribunal or other independent body, within

the customs administration.

Agreement on Customs

Valuation, Article 2(a)

Agreement on Customs

Valuation, Article 2(b)

The rule that transaction values declared by importers should be used for

valuation of goods applies not only to arms-length transactions but also to

transactions between related parties. In the latter transactions, which generally

take place among transnational corporations and their subsidiaries or affiliates,

prices are charged on the basis of transfer pricing which may not always reflect

the correct or true value of the imported goods. Even in such cases, the

Agreement requires Customs to enter into consultations with the importer, in

order to ascertain the type of relationship, the circumstances surrounding the

transaction and whether the relationship has influenced the price. If Customs

after such examination finds that the relationship has not influenced the declared

prices, the transaction value is to be determined on the basis of those prices.

Further, in order to ensure that in practice the transaction value is not rejected

simply on the grounds that the parties are related, the Agreement gives importers

the right to demand that the value should be accepted when they demonstrate

that the value approximates the test values arrived at on the basis of:

q Customs value determined in past import transactions occurring at about

the same time between unrelated buyers and sellers of identical or similar

goods, or

q Deductive or computed values calculated for identical or similar goods (see

below).

Five other standards

Agreement on Customs

Valuation, Annex I:

General Note

How should Customs determine dutiable value when it decides to reject the

transaction value declared by the importer? In order to protect the interests of

importers and to ensure that the value in such cases is determined on a fair and

neutral basis, the Agreement limits the discretion available to Customs to using

the five standards it lays down. The Agreement further insists that these

standards should be used in the sequence in which they appear in the text, and

only if Customs finds that the first standard cannot be used should the value be

determined on the basis of the succeeding standards.

The standards, presented in the sequence in which they are to be used, are

discussed below.

Agreement on Customs

Valuation, Article 2

The transaction value of identical goods

Agreement on Customs

Valuation, Article 3

The transaction value of similar goods

Where value cannot be determined on the basis of the transaction value, it

should be established by using an already determined transaction value for

identical goods.

Where it is not possible to determine value on the basis of the above method, it

should be determined on the basis of the transaction value of similar goods.

Chapter 3 Valuation of goods for customs purposes

69

Under both these methods, the transactions selected must relate to imported

goods that were sold for export to the country of importation and at about the

same time as the goods being exported.

Box 12 describes the rules to be followed in determining whether the goods that

are used for determining dutiable value are identical or similar to imported

goods.

Box 12

Rules for determining whether goods are identical or similar

(Agreement on Customs Valuation, Article 15:2)

Whether the goods are identical or similar to those in the transaction to be valued is

determined by taking into account the characteristics described below.

Goods are identical if they:

Goods are similar if they:

Are the same in all respects

including physical characteristics,

quality and reputation.

Closely resemble the goods being valued in

terms of components, materials and

characteristics;

Are capable of performing the same

functions and are commercially

interchangeable with the goods being

valued.

In addition, in order to be treated as identical or similar, the goods must have been

produced:

in the same country

and by the same producer

as the goods being valued.

Where, however, import transactions involving identical or similar goods produced by

the same producer in the country of production of the goods being valued do not exist,

goods produced by a different producer in the same country must be taken into account.

Deductive value

The next two methods are the deductive method and the computed value

method.

Agreement on Customs

Valuation, Article 5

Deductive value is determined on the basis of the unit sales price in the

domestic market of the imported goods being valued or of identical or similar

goods after making deductions for such elements as profits, customs duties and

taxes, transport and insurance, and other expenses incurred in the country of

importation.

Agreement on Customs

Valuation, Article 6

Computed value

Agreement on Customs

Valuation, Article 7

Fall-back method

The computed value is determined by adding to the cost of producing the goods

being valued an amount for profit and general expenses equal to that usually

reflected in sales of goods of the same class or kind as the goods being valued

which are made by producers in the country of exportation for export to the

country of importation.

Where customs value cannot be determined by any of the four methods

described above, it can be determined by using any of the previous methods in a

70

Chapter 3 Valuation of goods for customs purposes

flexible manner, provided that the criteria employed are consistent with Article

VII of the General Agreement. The value so fixed should not, however, be based

on the following factors, among others:

q The price of goods for export to a third country market,

q Minimum customs values,

q Arbitrary or fictitious values.

Agreement on Customs

Valuation, Article 6; Note

to Article 6

As a general rule, the Agreement visualizes that where a transaction value is not

accepted, the value should be determined by using the above standards on the

basis of the information available within the country of importation. However,

it recognizes that in order to determine a computed value, it may be necessary

to examine the costs of producing the goods being valued and other information

which has to be obtained from outside the country of importation. The

Agreement therefore suggests, in order to ensure that the importer is not

subjected to unnecessary burdens, that the computed value standard should be

used only when buyer and seller are related and the producer is prepared to

provide to the customs authorities in the importing country the necessary cost

data and facilities for their subsequent verification.

Developing countries and the Agreement

Agreement on Customs

Valuation, Article 20:1

Prior to 1 January 1995, only 11 countries were applying the Agreements

valuation system. When the Agreement was being negotiated, it was recognized

that the majority of developing countries (which based their valuation systems

on the Brussels Definition of Value7, a definition entirely different from that

followed by the Agreement) would need some time to adopt the legislative and

institutional framework and train the officials required for its implementation.

The Agreement therefore gave a delay period of five years to developing

countries which considered that an immediate change to the new system would

be difficult for them.

A number of developing countries have now become members of the

Agreement. However, about 50 countries (including some LDCs) have invoked

the provisions on the delay period. This period will expire for all countries by

early or mid 2000. In order to facilitate adoption of the system by the target

date, the WTO and WCO Secretariats have stepped up their technical

assistance in training officials in the methods of the Agreement.

Back to the top

A request to extend the delay period of five years may be made to the

Committee on Customs Valuation, which has been established under the

Agreement. The developing country making the request must demonstrate the

difficulties it is encountering in adopting the system. Any extension must be

approved by the Committee.

Business implications

The basic aim of the Agreement is to protect the interests of honest traders by

requiring that Customs should accept for determining dutiable value the price

actually paid by the importer in a particular transaction. This applies to both

arms-length and related-party transactions. The Agreement recognizes that the

prices obtained by different importers for the same products may vary. The

mere fact that the price obtained by a particular importer is lower than that at

which other importers have imported the product cannot be used as a ground

A system developed by the Customs Co-operation Council, now the World Customs

Organization (WCO).

Chapter 3 Valuation of goods for customs purposes

71

for rejecting the transaction value. Customs can reject the transaction value in

such situations only if it has reasons to doubt the truth or accuracy of the

declared price of the imported goods. Even in such cases, it has to give importers

an opportunity to justify their price and if this justification is not accepted, to

give them in writing the reasons for rejecting the transaction value and for

determining the dutiable value by using other methods. Furthermore, by

providing importers the right to be consulted throughout all stages of the

determination of value, the Agreement ensures that the discretion available to

Customs for scrutinizing declared value is used objectively.

In addition to the right of importers to be consulted at all stages of the

determination of dutiable value, the Agreement requires national legislation on

the valuation of goods to provide the following rights to importers:

Agreement on Customs

Valuation, Article 13

q The right to withdraw imported goods from Customs, when there is likely to

be a delay in the determination of customs value, provided they leave a

sufficient guarantee in the form of a surety or deposit to cover the payment

of customs duties for which goods may be liable.

Agreement on Customs

Valuation, Article 10

q The right to expect that any information of a confidential nature that is

made available to Customs shall be treated as confidential.

Agreement on Customs

Valuation, Article 11

q The right to appeal, without fear of penalty, to an independent body within

the customs administration and to a judicial authority against decisions

taken by Customs.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- IncomeTax Banggawan2019 Ch2Документ10 страницIncomeTax Banggawan2019 Ch2Noreen LeddaОценок пока нет

- Stamp DutyДокумент5 страницStamp DutyBrij NandanОценок пока нет

- Land Registration ProcedureДокумент6 страницLand Registration ProcedureNaveen MadirajuОценок пока нет

- Part 1 General PrincipleДокумент26 страницPart 1 General PrincipleRhea Joy OrcioОценок пока нет

- Reviewer (Book) Chapter 1-3Документ41 страницаReviewer (Book) Chapter 1-3Noeme Lansang50% (2)

- Malaysian Tax System and AdministrationДокумент75 страницMalaysian Tax System and AdministrationfazrinbusirinОценок пока нет

- Chapter 2 Multiple ChoiceДокумент4 страницыChapter 2 Multiple ChoiceLess Balesoro100% (1)

- Domtar Kingsport PILOT AgreementДокумент18 страницDomtar Kingsport PILOT AgreementBrit StackОценок пока нет

- 2 Division: Taxation I Case Digest CompilationДокумент2 страницы2 Division: Taxation I Case Digest CompilationPraisah Marjorey Picot100% (1)

- True or False: Documentary Stamp TaxДокумент6 страницTrue or False: Documentary Stamp Taxjanelle asiong50% (2)

- Asta Analytical MethodsДокумент4 страницыAsta Analytical Methodsravivarmahyd8173Оценок пока нет

- Cap As Aici NoidsДокумент1 страницаCap As Aici Noidsravivarmahyd8173Оценок пока нет

- Spice List 20121Документ2 страницыSpice List 20121ravivarmahyd8173Оценок пока нет

- Quality Criteria and Tests: Milling WheatДокумент2 страницыQuality Criteria and Tests: Milling Wheatravivarmahyd8173Оценок пока нет

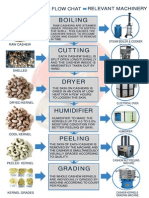

- Boiling: Cashew Process Flow Chat Relevant MachineryДокумент1 страницаBoiling: Cashew Process Flow Chat Relevant Machineryravivarmahyd8173Оценок пока нет

- Contract Farming DatabaseДокумент2 страницыContract Farming Databaseravivarmahyd8173Оценок пока нет

- Developmental Plan Template: Short Term ObjectivesДокумент3 страницыDevelopmental Plan Template: Short Term Objectivesravivarmahyd8173Оценок пока нет

- CIR Vs Republic CementДокумент22 страницыCIR Vs Republic Cementzatarra_12Оценок пока нет

- Complainant: United States Respondent: Argentina Facts: On 4 October 1996, The US Requested Consultations With Argentina ConcerningДокумент6 страницComplainant: United States Respondent: Argentina Facts: On 4 October 1996, The US Requested Consultations With Argentina ConcerningQuang NguyễnОценок пока нет

- PC Day 07 HandoutДокумент3 страницыPC Day 07 HandoutAsnifah AlinorОценок пока нет

- CAO-08-2019-Policies On Admission Movement and Re-Exportation of Containers at The Seaports Up1Документ2 страницыCAO-08-2019-Policies On Admission Movement and Re-Exportation of Containers at The Seaports Up1Romeo JepeОценок пока нет

- Public Hearing and Tax Exemption Request (Mojack Holdings, LLC/Mojack Distributors, LLC)Документ14 страницPublic Hearing and Tax Exemption Request (Mojack Holdings, LLC/Mojack Distributors, LLC)Bob WeeksОценок пока нет

- Automobile Excise Technical PPT 08142017 PDFДокумент181 страницаAutomobile Excise Technical PPT 08142017 PDFCuayo JuicoОценок пока нет

- Taxfinalquiz 3Документ115 страницTaxfinalquiz 3Mary DenizeОценок пока нет

- Marketing EfficiencyДокумент11 страницMarketing EfficiencyS.Subhasmita RoutОценок пока нет

- Research Paper No. 2005/67: The Tax Reform Experience of KenyaДокумент25 страницResearch Paper No. 2005/67: The Tax Reform Experience of KenyaNaveen Tharanga GunarathnaОценок пока нет

- Quix 2 Tax-Key 2Документ13 страницQuix 2 Tax-Key 2shaira may padorОценок пока нет

- Final Glossary CmtaДокумент8 страницFinal Glossary CmtaTyroneОценок пока нет

- Malaysia: Country M&A Team Country Leader Frances Po Khoo Chuan Keat Lim Yiek LeeДокумент18 страницMalaysia: Country M&A Team Country Leader Frances Po Khoo Chuan Keat Lim Yiek LeeNabila SurayaОценок пока нет

- 2 Quimpo v. Mendoza, GR No. 33052, 31 August 1981Документ20 страниц2 Quimpo v. Mendoza, GR No. 33052, 31 August 1981Karren QuilangОценок пока нет

- Classification of TaxesДокумент2 страницыClassification of TaxesJoliza CalingacionОценок пока нет

- Prices and Taxes of Locally-Manufactured Distilled Spirits 2013Документ3 страницыPrices and Taxes of Locally-Manufactured Distilled Spirits 2013Imperator Furiosa100% (2)

- IRAC Question Assessment Task 2 - Sem 1 2022Документ1 страницаIRAC Question Assessment Task 2 - Sem 1 2022Lương Nguyễn Khánh Bảo100% (1)

- Sec.1600-Sec.1611 & Sec.800 (Outlined)Документ7 страницSec.1600-Sec.1611 & Sec.800 (Outlined)Michaeljohn RullodaОценок пока нет

- Excise Tax On AutomobileДокумент5 страницExcise Tax On Automobilejoanna reignОценок пока нет

- CIR V Fortune Tobacco EscraДокумент69 страницCIR V Fortune Tobacco Escrasmtm06Оценок пока нет

- Estate & Donors TaxationДокумент7 страницEstate & Donors TaxationDaphnie BoloОценок пока нет