Академический Документы

Профессиональный Документы

Культура Документы

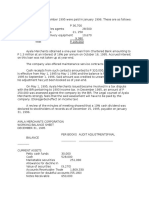

Movie Rags Unadjusted Trial Balance November 30, 2013

Загружено:

Helpline0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров24 страницыAccounting

Оригинальное название

Juile

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAccounting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров24 страницыMovie Rags Unadjusted Trial Balance November 30, 2013

Загружено:

HelplineAccounting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 24

Acc. No.

Account Title Debit Credit

101 Cash $20,400

105 Accounts Receivable $32,000

110 Raw Materials Control $2,300

112 Work-In-Process Control $6,825

114 Finished Goods Control $0

120 Prepaid Rent $2,400

140 Equipment $24,850

141 Accumulated Depreciation Equipment $7,100

201 Accounts Payable $11,800

205 Wages Payable $18,940

210 Income Taxes Payable $0

300 Common Stock $20,000

305 Retained Earnings $12,079

400 Sales $273,500

500 Cost of Goods Sold $206,310

600 Selling & Administrative Expenses $49,204

610 Depreciation Expense Selling & Administrative $0

620 Income Tax Expense $0

801 Manufacturing OH Cost Control $76,630

802 Manufacturing OH Allocated $77,500

805 Income Summary

Total $420,919 $420,919

Movie Rags

Unadjusted trial balance

November 30, 2013

Page No.

Date Account Titles and Explanation PR Debit Credit

Dec 05 Cash 27,400

Accounts Receivable 27,400

Dec 10 Wages Payable 18,940

Cash 18,940

Dec 11 Manufacturing OH Cost Control 3,250

Cash 3,250

Dec 14 Raw Materials Control 13,582

Accounts Payable 13,582

Dec 23 Accounts Payable 11,800

Cash 11,800

Dec 29 Work In Process 39,706

Raw Materials Control 13,422

Wages Payable 18,772

Manufacturing OH Allocated 7,512

Dec 31 Manufacturing OH Cost Control 3,090

Depreciation Expense Selling & Administrative 460

Accumulated Depreciation - Equipment 3,550

Dec 31 Manufacturing OH Cost Control 5,800

Wages Payable 5,800

Dec 31 Selling & Administrative Expenses 800

Prepaid Rent 800

Dec 31 Finished Goods 43,626

Work In Porcess 43,626

Dec 31 Accounts Receivable 52,340

Sales 52,340

Dec 31 Cost of goods sold 33,325

Finished Goods 33,325

Dec 31 Selling & Administrative Expenses 8,400

Cash 3,600

Accounts Payable 4,800

GENERAL JOURNAL

Dec 31 Cost of goods sold 3,758

Manufacturing OH Allocated 3,758

Dec 31 Income Tax Expenses 7,075

Income Tax Payable 7,075

Closing Entries

Dec 31 Sales 325,840

Income Summary 325,840

Dec 31 Income Summary 309,332

Cost of Goods Sold 243,393

Selling & Administrative Expenses 58,404

Depreciation Expense Selling & Administrative 460

Income Tax Expense 7,075

Dec 31 Income Summary 16,508

Retained Earnings 16,508

3,550 / 24,850 x 21630

3,550 / 24,850 x 3220

(24,850 / 7)

(4,800 / 6 )

Movie Rags

Schedule of cost of goods manufactured

For the monthe ended December 31, 2013

Work in process as on Jan 01 , 2013 4,623

Direct Material used:

Material on Jan 01, 2013 1,120

Add: Material Purchase (42,816 + 13,582) 56,398

Material available for use 57,518

Less: Material on Dec 31, 2013 (2,460)

Raw Material Used 55,058

Add: Direct Labor (77,320 + 18,772) 96,092

Add: Manufacturing OH Allocated 85,012

Total Manufacturing Cost 236,162

Cost of goods available for use 240,785

Less: Work in process as on Dec 31, 2013 (2,905)

Cost of goods manufactured 237,880

Movie Rags

Income Statement

For the monthe ended December 31, 2013

Sales Revenue 325,840

Less: Cost of goods sold

Finished Goods as on 1-1-2013 12,056

Add: Cost of goods manufactured 237,880

Cost of goods available for sale 249,936

Less: Finished Goods 31-12-2013 (10,301)

Cost of goods sold 239,635

Add: Underallocated MOH Cost 3,758

Adjusted Cost of goods sold 243,393

Gross Profit 82,447

Less: Operating Expenses:

Selling & Administrative Expenses $58,404

Depreciation Expense Selling & Administrative $460

58,864

Earnings before tax 23,583

Less: Income Taxes (7,075)

Net Income 16,508

Movie Rags

Balance Sheet

December 31, 2013

Assets:

Cash 10,210

Accounts Receivable 56,940

Prepaid Rent 1,600

Raw Materials Inventory 2,460

Work-in-Process Inventory 2,905

Finished Goods Inventory 10,301

Office Equipment 24,850

Accumulated Depreciation (10,650)

Total Assets 98,616

Liabilities:

Accounts Payable 18,382

Wages Payable 24,572

Income Taxes Payable 7,075

Total Liabilities 50,029

Equity:

Capital Stock 20,000

Retained Earnings (12,079 + 16,508) 28,587

Total Equity 48,587

Total Liabilities & Equity 98,616

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 5 From receivables 27400

Dec 10 Payment of wages 18940

Dec 11 Utilities expenses paid in cash 3250

Dec 23 Cash payment for accounts payable 11800

Dec 31 For supplies & misc. expenses 3600

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 5 Cash recovery 27400

Dec 31 Sale for Dec 52340

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 14 Purchase of Raw material on account 13582

Dec 29 Manufacturing cost added 13422

Account Title Cash Account No. 101

Date

Account Title Raw Materials Control Account No. 110

Date

Date

Account Title Accounts Receivable Account No. 105

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 29 Manufacturing cost added 39706

Dec 31 Completion of jobs 43626

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Completion of jobs 43626

Dec 31 Cost for the Dec sale 33325

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Rent expired 800

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Account Title Work-In-Process Control Account No. 112

Date

Date

Account Title Prepaid Rent Account No. 120

Account Title Finished Goods Control Account No. 114

Date

Date

Account Title Equipment Account No. 140

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Depreciation charged for the equipment 3550

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 14 Purchase of Raw material on account 13582

Dec 23 Cash payment for accounts payable 11800

Dec 31 For supplies & misc. expenses 4800

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 10 Payment of wages 18940

Dec 29 Manufacturing cost added 18772

Dec 31 Indirect labor charged 5800

Account Title Accounts Payable Account No. 201

Date

Account Title Accumulated Depreciation Equipment Account No. 141

Account Title Income Taxes Payable Account No. 210

Date

Date

Account Title Wages Payable Account No. 205

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Income tax for the year 7075

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Income Summary 16508

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Sale for Dec 52340

Dec 31 Income Summary 325840

Date

Account Title Common Stock Account No. 300

Date

Date

Account Title Sales Account No. 400

Account Title Retained Earnings Account No. 305

Date

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Cost for the Dec sale 33325

Dec 31 Adjustment of underallocated OH 3758

Dec 31 Income Summary 243393

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Rent expired 800

Dec 31 For supplies & misc. expenses 8400

Dec 31 Income Summary 58404

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Depreciation charged for the equipment 460

Dec 31 Income Summary 460

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Income tax for the year 7075

Dec 31 Income Summary 7075

Account Title Depreciation Expense Selling & Administrative Account No. 610

Date

Date

Account Title Selling & Administrative Expenses Account No. 600

Account Title Cost of Goods Sold Account No. 500

Date

Date

Account Title Income Tax Expense Account No. 620

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 11 Utilities expenses paid in cash 3,250

Dec 31 Depreciation charged for the equipment 3090

Dec 31 Indirect labor charged 5800

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 29 Manufacturing cost added 7512

Dec 31 Underallocated MOH 3758

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec 31 Sales 325840

Dec 31 Cost of Goods Sold 243393

Dec 31 Selling & Administrative Expenses 58404

Dec 31 Depreciation Expense Selling & Administrative 460

Dec 31 Income Tax Expense 7075

Dec 31 Retained Earnings 16508

Date

Account Title Manufacturing OH Allocated Account No. 802

Account Title Manufacturing OH Cost Control Account No. 801

Date

Account Title Income Summary Account No. 805

Date

WORK-IN-PROCESS

SUBSIDIARY LEDGER ACCOUNTS

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec. 29 Direct Material 1400

Dec. 29 Direct Labor 2000

Dec. 29 MOH 1540

Dec. 31 Finished Goods 8045

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec. 29 Direct Material 1590

Dec. 29 Direct Labor 3290

Dec. 29 MOH 1230

Dec. 31 Finished Goods 7860

Explanation PR Debit Credit

Nov. 30 Beginning Balance

Dec. 29 Direct Material 6040

Dec. 29 Direct Labor 6530

Dec. 29 MOH 2880

Dec. 31 Finished Goods 17420

Date

Job Number 10-3

Date

Date

Job Number 11-2

Job Number 11-1

Explanation PR Debit Credit

Dec. 29 Direct Material 4152

Dec. 29 Direct Labor 4820

Dec. 29 MOH 1329

Dec. 31 Finished Goods 10301

Explanation PR Debit Credit

Dec. 29 Direct Material 240

Dec. 29 Direct Labor 2132

Dec. 29 MOH 533

FINISHED GOODS

SUBSIDIARY LEDGER ACCOUNTS

Explanation PR Debit Credit

Dec 31 WIP 8045

Job Number 12-1

Date

Job Number 10-3

Date

Date

Job Number 12-2

Dec 31 Cost of goods sold 8045

Explanation PR Debit Credit

Dec 31 WIP 7860

Dec 31 Cost of goods sold 7860

Explanation PR Debit Credit

Dec 31 WIP 17420

Dec 31 Cost of goods sold 17420

Explanation PR Debit Credit

Dec 31 WIP 10301

Job Number 11-1

Date

Date

Job Number 12-1

Job Number 11-2

Date

Balance

20400

47800

28860

25610

13810

10210

10210

10210

10210

10210

10210

10210

10210

10210

Balance

32000

4600

56940

56940

56940

56940

56940

Balance

2300

15882

2460

2460

2460

2460

2460

2460

Account No. 101

Account No. 110

Account No. 105

2460

2460

Balance

6825

46531

2905

2905

2905

2905

2905

2905

2905

Balance

0

43626

10301

10301

10301

10301

10301

10301

Balance

2400

1600

1600

Balance

24850

24850

24850

Account No. 112

Account No. 120

Account No. 114

Account No. 140

24850

24850

24850

Balance

7100

10650

10650

10650

10650

Balance

11800

25382

13582

18382

18382

18382

18382

18382

Balance

18940

0

18772

24572

24572

24572

24572

24572

Account No. 201

Account No. 141

Account No. 210

Account No. 205

Balance

0

7075

7075

7075

7075

7075

7075

7075

Balance

20000

20000

20000

20000

20000

Balance

12079

28587

28587

28587

28587

28587

28587

Balance

273500

325840

0

0

0

0

0

0

Account No. 300

Account No. 400

Account No. 305

Balance

206310

239635

243393

0

0

0

0

0

Balance

49204

50004

58404

0

0

0

Balance

0

460

0

0

0

0

Balance

0

7075

0

0

0

0

0

Account No. 610

Account No. 600

Account No. 500

Account No. 620

0

Balance

76630

79880

82970

88770

88770

88770

88770

88770

Balance

77500

85012

88770

88770

88770

88770

88770

88770

Balance

0

325840

82447

24043

23583

16508

33016

33016

33016

33016

33016

33016

33016

Account No. 802

Account No. 801

Account No. 805

33016

Balance

3105

4505

6505

8045 (1,400 x $1.1)

0

0

0

0

Balance

1750

3340

6630

7860

0

0

0

0

0

0

Balance

1970

8010

14540

17420

0

0

0

0

0

0

Balance

4152

8972

10301

0

0

0

0

0

0

0

Balance

240

2372

2905

2905

2905

2905

2905

2905

2905

2905

Balance

8045

0

0

0

0

0

Balance

7860

0

0

0

0

0

Balance

17420

0

0

0

0

0

Balance

10301

10301

10301

10301

10301

10301

Вам также может понравиться

- Abc Company Trial Balance For The Year End: December 31, 2010Документ8 страницAbc Company Trial Balance For The Year End: December 31, 2010JT GalОценок пока нет

- Hampton MachineДокумент7 страницHampton MachineMurali SubramaniamОценок пока нет

- GRACE CORP BookДокумент815 страницGRACE CORP Booklifeware0471% (7)

- P3-2B IFRS 2ndДокумент5 страницP3-2B IFRS 2ndAfrishalPriyandhanaОценок пока нет

- P5-3a Pa1Документ10 страницP5-3a Pa1Agnes Eviyany50% (6)

- Module 5 Cash Flow Test Solution Posted Fall 2011Документ6 страницModule 5 Cash Flow Test Solution Posted Fall 2011sonic763Оценок пока нет

- Contract CostingДокумент10 страницContract CostingSreekanth DogiparthiОценок пока нет

- Computer Project EsaystwДокумент18 страницComputer Project Esaystwspectrum_48Оценок пока нет

- ACC1002 Team 8Документ11 страницACC1002 Team 8Yvonne Ng Ming HuiОценок пока нет

- Financial Accounting 3 Chapter 10Документ36 страницFinancial Accounting 3 Chapter 10Cloyd Angel C. YamutОценок пока нет

- ADJUSTING JOURNALSДокумент27 страницADJUSTING JOURNALSHasan TarekОценок пока нет

- Hoos Got Game, Inc. Statement of Income and Retained Earnings For The Year Ended December 31, 2X02Документ3 страницыHoos Got Game, Inc. Statement of Income and Retained Earnings For The Year Ended December 31, 2X02foreverjessx3Оценок пока нет

- CCC 4 - AnsДокумент31 страницаCCC 4 - AnsPramod Dubey100% (1)

- Fa 2 - Vertical Financial StatementsДокумент7 страницFa 2 - Vertical Financial StatementsEduwiz Mänagemënt EdücatîonОценок пока нет

- Accounting Cycle IДокумент21 страницаAccounting Cycle IChristine PeregrinoОценок пока нет

- Accounting JournalДокумент6 страницAccounting JournalJhon Salvatierra TОценок пока нет

- Cash and Accrual BasisДокумент36 страницCash and Accrual BasisHoney LimОценок пока нет

- Principles of Accounting Simulation - Student's Answer - Excel FileДокумент55 страницPrinciples of Accounting Simulation - Student's Answer - Excel FilekoopamonsterОценок пока нет

- Exercises On Cash Flow StatementsДокумент3 страницыExercises On Cash Flow StatementsSam ChinthaОценок пока нет

- Classwork HorizontalVertical BusFinДокумент3 страницыClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURAОценок пока нет

- Classwork HorizontalVertical BusFinДокумент3 страницыClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURAОценок пока нет

- Accounting Cycle Illustrated JDCДокумент90 страницAccounting Cycle Illustrated JDCjiiОценок пока нет

- Rolito DionelaДокумент40 страницRolito DionelaRolito Dionela50% (2)

- Week 6 - Solutions (Some Revision Questions)Документ13 страницWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- Martel Law OfficeДокумент6 страницMartel Law Officechrisguamos69% (16)

- MAC 102 201905 Foundations of Accounting II.Документ6 страницMAC 102 201905 Foundations of Accounting II.Angellah Batiraishe MoyoОценок пока нет

- Gutierrez Construction Company journal entriesДокумент3 страницыGutierrez Construction Company journal entriesAj GuanzonОценок пока нет

- 1P91+F2012+Midterm Final+Draft+SolutionsДокумент10 страниц1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyОценок пока нет

- ACTBAS1 - Lecture 9 (Adjusting Entries) RevisedДокумент44 страницыACTBAS1 - Lecture 9 (Adjusting Entries) RevisedAlejandra MigallosОценок пока нет

- ACC 201 Problem 23Документ4 страницыACC 201 Problem 23Myzz AjaОценок пока нет

- Introduction To Accounting - Fall 2011 Example - Merchandising Recording TransactionsДокумент4 страницыIntroduction To Accounting - Fall 2011 Example - Merchandising Recording Transactionsq0% (1)

- Auditing ProblemsДокумент9 страницAuditing ProblemsJillОценок пока нет

- Exercises in MerchandisingДокумент10 страницExercises in MerchandisingJhon Robert BelandoОценок пока нет

- Acctg4a 02042017 Exam Quiz1aДокумент5 страницAcctg4a 02042017 Exam Quiz1aPatOcampoОценок пока нет

- Kashato Shirt Company Financial Statements October 2010Документ18 страницKashato Shirt Company Financial Statements October 2010Aldrian Ala75% (4)

- FRA AssignmentДокумент18 страницFRA AssignmentPratik GaokarОценок пока нет

- E4-8 + P5-8Документ4 страницыE4-8 + P5-8Oliviane Theodora Wenno100% (1)

- KISIAKMДокумент1 страницаKISIAKMhgoenОценок пока нет

- Descriptive Chart of Accounts Model TemplateДокумент17 страницDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीОценок пока нет

- Excel HomeworkДокумент9 страницExcel Homeworkapi-248528639Оценок пока нет

- Opening Balance Bank Purchases of Machinery Non Current Assets Open Accumulated Balance Opening Assets - Opnening LiabilitiesДокумент12 страницOpening Balance Bank Purchases of Machinery Non Current Assets Open Accumulated Balance Opening Assets - Opnening LiabilitiesJunior HoОценок пока нет

- ACCT 101 Journal EntriesДокумент8 страницACCT 101 Journal EntriesJay NgОценок пока нет

- AP.m 1401 Correction of ErrorsДокумент12 страницAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- Problem Solving 1: RequirementsДокумент4 страницыProblem Solving 1: RequirementsMariz TimarioОценок пока нет

- Canopy Walk-Financial DataДокумент3 страницыCanopy Walk-Financial DataPrincess_Wedne_3276Оценок пока нет

- Libro 7.3 InglesДокумент10 страницLibro 7.3 InglesNathan CalhounОценок пока нет

- RPM Global Innovative Solutions Corp.: Comparative Statement of Financial PositionДокумент12 страницRPM Global Innovative Solutions Corp.: Comparative Statement of Financial PositiondoloresОценок пока нет

- Chapter 8 Solutions Cash Flow Statement: Account ClassificationДокумент43 страницыChapter 8 Solutions Cash Flow Statement: Account Classificationmit111217Оценок пока нет

- Transaction Analysis and Preparation of Statements Practice Problem SolutionДокумент6 страницTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaОценок пока нет

- Advance Accounting 2 Chapter 12Документ16 страницAdvance Accounting 2 Chapter 12Mary Joy Domantay0% (2)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОт EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionОценок пока нет

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОт EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Hardware, Plumbing & Heating Equipment Agents & Brokers Revenues World Summary: Market Values & Financials by CountryОт EverandHardware, Plumbing & Heating Equipment Agents & Brokers Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryОт EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionОценок пока нет

- Office Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryОт EverandOffice Supplies, Stationery & Gift Store Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Sporting Goods & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandSporting Goods & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryОт EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- Materials Handling Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОт EverandMaterials Handling Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- The Pattia Winery-QuestionДокумент1 страницаThe Pattia Winery-QuestionHelplineОценок пока нет

- MBAA AbdullahДокумент4 страницыMBAA AbdullahHelplineОценок пока нет

- QuizzzДокумент3 страницыQuizzzHelplineОценок пока нет

- Part - A & B: Year 0 1 2 3 4 5 6 7Документ2 страницыPart - A & B: Year 0 1 2 3 4 5 6 7HelplineОценок пока нет

- ProblemsДокумент5 страницProblemsHelplineОценок пока нет

- Determine inventory cost and value conceptsДокумент3 страницыDetermine inventory cost and value conceptsHelplineОценок пока нет

- Q. No. 1 (Material Variances) Part - 1Документ2 страницыQ. No. 1 (Material Variances) Part - 1HelplineОценок пока нет

- NumberДокумент2 страницыNumberHelplineОценок пока нет

- DullДокумент3 страницыDullHelplineОценок пока нет

- Industry AnalysisДокумент1 страницаIndustry AnalysisHelplineОценок пока нет

- Cost of Building Interest Rate 10% Loan Period 25Документ3 страницыCost of Building Interest Rate 10% Loan Period 25HelplineОценок пока нет

- RaaaДокумент6 страницRaaaHelplineОценок пока нет

- ABCДокумент9 страницABCHelplineОценок пока нет

- ExammmДокумент8 страницExammmHelplineОценок пока нет

- AccountingДокумент14 страницAccountingHelpline100% (1)

- ProjectДокумент12 страницProjectHelplineОценок пока нет

- Decentralized Organization GoalsДокумент45 страницDecentralized Organization Goalsdaylicious88Оценок пока нет

- Comparative Balance Sheets: 2013 and 2014: Current AssetsДокумент8 страницComparative Balance Sheets: 2013 and 2014: Current AssetsHelplineОценок пока нет

- EjazДокумент4 страницыEjazHelplineОценок пока нет

- DilaДокумент4 страницыDilaHelplineОценок пока нет

- FIN 310 Exam Two ReviewДокумент6 страницFIN 310 Exam Two ReviewHelplineОценок пока нет

- YoyДокумент4 страницыYoyHelplineОценок пока нет

- StarДокумент4 страницыStarHelplineОценок пока нет

- PiousДокумент37 страницPiousHelplineОценок пока нет

- FrameworkДокумент8 страницFrameworkHelplineОценок пока нет

- YoyДокумент4 страницыYoyHelplineОценок пока нет

- DeerДокумент2 страницыDeerHelplineОценок пока нет

- AzaamДокумент4 страницыAzaamHelplineОценок пока нет

- ReplyДокумент1 страницаReplyHelplineОценок пока нет

- Ifr Magazine 2019 No 2289 June 22 PDFДокумент114 страницIfr Magazine 2019 No 2289 June 22 PDFИрина ДубовскаяОценок пока нет

- List+of+Acceptable+I 9+Documents.V2Документ1 страницаList+of+Acceptable+I 9+Documents.V2Maryorie RodriguezОценок пока нет

- Breakout Boot (CBR) : Heat-Shrink Cable Breakout BootsДокумент3 страницыBreakout Boot (CBR) : Heat-Shrink Cable Breakout BootsVictorОценок пока нет

- Ethics and Social Responsibility in BusinessДокумент20 страницEthics and Social Responsibility in BusinessViễn Nguyễn KýОценок пока нет

- Jaguar Security's cross-claim against client Delta MillingДокумент3 страницыJaguar Security's cross-claim against client Delta Millingnoonalaw100% (1)

- Linux EssentialsДокумент76 страницLinux EssentialsTaryani TaryaniОценок пока нет

- PH104 AquinasReflectionPaperДокумент2 страницыPH104 AquinasReflectionPaperJigs De GuzmanОценок пока нет

- Higher Education (C) Department: Government of KeralaДокумент34 страницыHigher Education (C) Department: Government of KeralaBiju ChackoОценок пока нет

- Oversee HSE Programs and Site Audits for Construction ProjectДокумент5 страницOversee HSE Programs and Site Audits for Construction Projectrnp2007123100% (1)

- Principles of Cost Accounting 16th Edition Vanderbeck Test BankДокумент10 страницPrinciples of Cost Accounting 16th Edition Vanderbeck Test BankVanessaGriffinmrik100% (33)

- Student No.:: Music Arts Physical Education HealthДокумент1 страницаStudent No.:: Music Arts Physical Education HealthNeriliza Dela CenaОценок пока нет

- Chapter 9 Investment PropertyДокумент4 страницыChapter 9 Investment Propertymaria isabellaОценок пока нет

- Pay Slip 10949 February, 2021Документ1 страницаPay Slip 10949 February, 2021Abebe SharewОценок пока нет

- Exhibit B Scholenberg v. StrulovitchДокумент32 страницыExhibit B Scholenberg v. StrulovitchMarc TorrenceОценок пока нет

- Installation of Mobile Towers in Residential Areas Case StudyДокумент3 страницыInstallation of Mobile Towers in Residential Areas Case StudyDinesh Patra100% (1)

- Unit 4.3 Royalty Accounts Exam ProblemsДокумент4 страницыUnit 4.3 Royalty Accounts Exam ProblemsRashmi AnuththaraОценок пока нет

- War Crimes Punishment and International Law ObligationsДокумент9 страницWar Crimes Punishment and International Law ObligationsDelwarОценок пока нет

- The State of The Nation AddressДокумент2 страницыThe State of The Nation AddressLady Adelyn Castillo PontanosОценок пока нет

- Accrued Expenses and Liabilities - FinalДокумент3 страницыAccrued Expenses and Liabilities - FinalEunice WongОценок пока нет

- Lecture On Labor Law - 2Документ19 страницLecture On Labor Law - 2SamОценок пока нет

- CIR v. Cebu Portland Cement Co. DIGESTДокумент2 страницыCIR v. Cebu Portland Cement Co. DIGESTkathrynmaydeveza100% (2)

- SC Decision on Mining Act ConstitutionalityДокумент173 страницыSC Decision on Mining Act ConstitutionalityRomarie AbrazaldoОценок пока нет

- Philippine Electoral Almanac Revised and Expanded PDFДокумент298 страницPhilippine Electoral Almanac Revised and Expanded PDFJessaMarieCaberteОценок пока нет

- CR 11 Darren Dwitama PDFДокумент5 страницCR 11 Darren Dwitama PDFDarren LatifОценок пока нет

- Deed of Separation and DivorceДокумент1 страницаDeed of Separation and DivorceJaishree KaushikОценок пока нет

- Camacho Vs PangulayanДокумент2 страницыCamacho Vs PangulayanMarlouis U. PlanasОценок пока нет

- TP BaccayBautista FinalДокумент5 страницTP BaccayBautista FinalMaricel Ann Baccay100% (1)

- Child RefugeeДокумент18 страницChild Refugeestpm_mathematicsОценок пока нет

- JoS. A. Bank Investor Presentation Regarding Men's Wearhouse ProposalДокумент16 страницJoS. A. Bank Investor Presentation Regarding Men's Wearhouse ProposalTim ParryОценок пока нет

- February 5, 2015 Courier SentinelДокумент20 страницFebruary 5, 2015 Courier SentinelcwmediaОценок пока нет