Академический Документы

Профессиональный Документы

Культура Документы

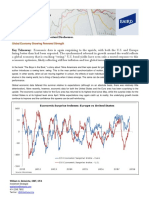

Economics Group: LEI Climbs Higher On Rebound in Labor Market Components

Загружено:

shobu_iuj0 оценок0% нашли этот документ полезным (0 голосов)

34 просмотров2 страницыeconomy outlook

Оригинальное название

LEI

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документeconomy outlook

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

34 просмотров2 страницыEconomics Group: LEI Climbs Higher On Rebound in Labor Market Components

Загружено:

shobu_iujeconomy outlook

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

April 21, 2014

Economics Group

Tim Quinlan, Economist

tim.quinlan@wellsfargo.com (704) 410-3283

Sarah Watt House, Economist

sarah.house@wellsfargo.com (704) 410-3282

Employment Components Firm

In another indication that the economy has bounced back from

a slowdown this winter, the LEI rose 0.8 percent in March with

gains widespread across components.

Improving indicators of the labor market were a key driver of

the gain in March. A rebound in average hours worked in

manufacturing and a drop in initial jobless claims contributed a

combined 0.4 percentage points to the headline.

Financial Conditions Remain Supportive of Growth

Financial conditions were also supportive of growth in March.

The yield spread posted another positive gain, while the credit

index and stock index also rose.

Three components were a drag in March, but only mildly so. A

slowdown in building permits shaved off 0.7 percentage point,

while consumer confidence and the ISM new orders index edged

slightly lower.

Source: The Conference Board and Wells Fargo Securities, LLC

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

88 90 92 94 96 98 00 02 04 06 08 10 12 14

Leading Economic Index

Composite of 10 Indicators

3-Month Annual Rate: Mar @ 4.5%

LEI Yr/Yr % Change of 3-MMA: Mar @ 5.4%

-0.4

-0.2

0.0

0.2

0.4

0.6

0.8

1.0

-0.4

-0.2

0.0

0.2

0.4

0.6

0.8

1.0

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Leading Credit Index

Net Contribution to Index

Net Contribution: Mar @ 0.15

-0.07

-0.02

-0.01

0.00

0.04

0.10

0.13

0.16

0.26

0.29

-0.2 -0.1 0.0 0.1 0.2 0.3 0.4

Building Permits

Consumer Expectations

ISM New Orders

Consumer Goods

N.D. Cap. Goods Ex-Air

Stock Prices

Leading Credit Index

Initial Claims

Manuf. Hours Worked

Interest Rate Spread

Net Contribution to Leading Economic Index

March 2014

-0.8

-0.6

-0.4

-0.2

0.0

0.2

0.4

0.6

-0.8

-0.6

-0.4

-0.2

0.0

0.2

0.4

0.6

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Building Permits

Net Contribution to Index

Net Contribution: Mar @ -0.07

LEI Climbs Higher on Rebound in Labor Market Components

The Leading Economic Index (LEI) rose 0.8 percent in March and is up 6.1 percent from a year ago. Improving

labor market and financial conditions more than offset a slowdown in building permits.

Wells Fargo Securities, LLC Economics Group

Diane Schumaker-Krieg Global Head of Research,

Economics & Strategy

(704) 410-1801

(212) 214-5070

diane.schumaker@wellsfargo.com

John E. Silvia, Ph.D. Chief Economist (704) 410-3275 john.silvia@wellsfargo.com

Mark Vitner Senior Economist (704) 410-3277 mark.vitner@wellsfargo.com

Jay H. Bryson, Ph.D. Global Economist (704) 410-3274 jay.bryson@wellsfargo.com

Sam Bullard Senior Economist (704) 410-3280 sam.bullard@wellsfargo.com

Nick Bennenbroek Currency Strategist (212) 214-5636 nicholas.bennenbroek@wellsfargo.com

Eugenio J. Alemn, Ph.D. Senior Economist (704) 410-3273 eugenio.j.aleman@wellsfargo.com

Anika R. Khan Senior Economist (704) 410-3271 anika.khan@wellsfargo.com

Azhar Iqbal Econometrician (704) 410-3270 azhar.iqbal@wellsfargo.com

Tim Quinlan Economist (704) 410-3283 tim.quinlan@wellsfargo.com

Eric Viloria, CFA Currency Strategist (212) 214-5637 eric.viloria@wellsfargo.com

Sarah Watt House Economist (704) 410-3282 sarah.house@wellsfargo.com

Michael A. Brown Economist (704) 410-3278 michael.a.brown@wellsfargo.com

Michael T. Wolf Economist (704) 410-3286 michael.t.wolf@wellsfargo.com

Zachary Griffiths Economic Analyst (704) 410-3284 zachary.griffiths@wellsfargo.com

Mackenzie Miller Economic Analyst (704) 410-3358 mackenzie.miller@wellsfargo.com

Blaire Zachary Economic Analyst (704) 410-3359 blaire.a.zachary@wellsfargo.com

Peg Gavin Executive Assistant (704) 410-3279 peg.gavin@wellsfargo.com

Cyndi Burris Senior Admin. Assistant (704) 410-3272 cyndi.burris@wellsfargo.com

Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S broker-dealer registered with the U.S.

Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the Securities Investor Protection Corp. Wells Fargo

Securities, LLC, distributes these publications directly and through subsidiaries including, but not limited to, Wells Fargo & Company, Wells Fargo

Bank N.A., Wells Fargo Advisors, LLC, Wells Fargo Securities International Limited, Wells Fargo Securities Asia Limited and Wells Fargo Securities

(Japan) Co. Limited. Wells Fargo Securities, LLC. ("WFS") is registered with the Commodities Futures Trading Commission as a futures commission

merchant and is a member in good standing of the National Futures Association. Wells Fargo Bank, N.A. ("WFBNA") is registered with the

Commodities Futures Trading Commission as a swap dealer and is a member in good standing of the National Futures Association. WFS and

WFBNA are generally engaged in the trading of futures and derivative products, any of which may be discussed within this publication. Wells Fargo

Securities, LLC does not compensate its research analysts based on specific investment banking transactions. Wells Fargo Securities, LLCs research

analysts receive compensation that is based upon and impacted by the overall profitability and revenue of the firm which includes, but is not limited

to investment banking revenue. The information and opinions herein are for general information use only. Wells Fargo Securities, LLC does not

guarantee their accuracy or completeness, nor does Wells Fargo Securities, LLC assume any liability for any loss that may result from the reliance by

any person upon any such information or opinions. Such information and opinions are subject to change without notice, are for general information

only and are not intended as an offer or solicitation with respect to the purchase or sales of any security or as personalized investment advice. Wells

Fargo Securities, LLC is a separate legal entity and distinct from affiliated banks and is a wholly owned subsidiary of Wells Fargo & Company 2014

Wells Fargo Securities, LLC.

Important Information for Non-U.S. Recipients

For recipients in the EEA, this report is distributed by Wells Fargo Securities International Limited ("WFSIL"). WFSIL is a U.K. incorporated

investment firm authorized and regulated by the Financial Conduct Authority. The content of this report has been approved by WFSIL a regulated

person under the Act. For purposes of the U.K. Financial Conduct Authoritys rules, this report constitutes impartial investment research. WFSIL

does not deal with retail clients as defined in the Markets in Financial Instruments Directive 2007. The FCA rules made under the Financial Services

and Markets Act 2000 for the protection of retail clients will therefore not apply, nor will the Financial Services Compensation Scheme be available.

This report is not intended for, and should not be relied upon by, retail clients. This document and any other materials accompanying this document

(collectively, the "Materials") are provided for general informational purposes only.

SECURITIES: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE

Вам также может понравиться

- The Institutional ETF Toolbox: How Institutions Can Understand and Utilize the Fast-Growing World of ETFsОт EverandThe Institutional ETF Toolbox: How Institutions Can Understand and Utilize the Fast-Growing World of ETFsОценок пока нет

- 2022 AUSL Purples Notes Criminal Law and Practical ExercisesДокумент305 страниц2022 AUSL Purples Notes Criminal Law and Practical ExercisesNathalie Joy Calleja100% (6)

- Point and Figure Charting: The Essential Application for Forecasting and Tracking Market PricesОт EverandPoint and Figure Charting: The Essential Application for Forecasting and Tracking Market PricesРейтинг: 5 из 5 звезд5/5 (1)

- Vector Autoregression Analysis: Estimation and InterpretationДокумент36 страницVector Autoregression Analysis: Estimation and Interpretationcharles_j_gomezОценок пока нет

- JNMF Scholarship Application Form-1Документ7 страницJNMF Scholarship Application Form-1arudhayОценок пока нет

- Eep306 Assessment 1 FeedbackДокумент2 страницыEep306 Assessment 1 Feedbackapi-354631612Оценок пока нет

- Macro UpdateДокумент5 страницMacro UpdateAnonymous Ht0MIJОценок пока нет

- Er 20130417 Bull Leading IndexДокумент3 страницыEr 20130417 Bull Leading IndexBelinda WinkelmanОценок пока нет

- September CommentaryДокумент2 страницыSeptember Commentaryapi-291251278Оценок пока нет

- March Monthly LetterДокумент2 страницыMarch Monthly LetterTheLernerGroupОценок пока нет

- Economics Group: TIC Flows Signal Less Fear in Fixed Income MarketsДокумент2 страницыEconomics Group: TIC Flows Signal Less Fear in Fixed Income MarketsMarcin LipiecОценок пока нет

- Market Outlook 22nd November 2011Документ4 страницыMarket Outlook 22nd November 2011Angel BrokingОценок пока нет

- Weekly Forex Report 4 February 2013: WWW - Epicresearch.CoДокумент6 страницWeekly Forex Report 4 February 2013: WWW - Epicresearch.Coapi-196234891Оценок пока нет

- Barclays 09ratesconf 061909Документ10 страницBarclays 09ratesconf 061909dpetro200Оценок пока нет

- Wells Fargo Market CommentaryДокумент2 страницыWells Fargo Market CommentaryAceОценок пока нет

- Market Outlook 6th January 2012Документ4 страницыMarket Outlook 6th January 2012Angel BrokingОценок пока нет

- June Monthly LetterДокумент2 страницыJune Monthly LetterTheLernerGroupОценок пока нет

- Er 20130320 Bull Leading IndexДокумент3 страницыEr 20130320 Bull Leading IndexBelinda WinkelmanОценок пока нет

- Economic UpdateДокумент2 страницыEconomic UpdateiosalcedoОценок пока нет

- Weekly Newsletter Weekly Newsletter-EquityДокумент9 страницWeekly Newsletter Weekly Newsletter-EquityNeha RajputОценок пока нет

- Macro UpdateДокумент5 страницMacro UpdateAnonymous Ht0MIJОценок пока нет

- Market Analysis Report On 12 OCTOBETRДокумент7 страницMarket Analysis Report On 12 OCTOBETRTheequicom AdvisoryОценок пока нет

- Stock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- 2015 - US Economy OutlookДокумент16 страниц2015 - US Economy Outlooknaga_yalamanchiliОценок пока нет

- AmBank FX Weekly OutlookДокумент5 страницAmBank FX Weekly Outlookr3iherОценок пока нет

- CIO Note Feb 6 2018Документ2 страницыCIO Note Feb 6 2018Anonymous 2LowCnVdfОценок пока нет

- Equity Analysis - DailyДокумент7 страницEquity Analysis - Dailyapi-198466611Оценок пока нет

- Blog - Fed Watch Nifty FiftyДокумент3 страницыBlog - Fed Watch Nifty FiftyOwm Close CorporationОценок пока нет

- Market Outlook 24th November 2011Документ3 страницыMarket Outlook 24th November 2011Angel BrokingОценок пока нет

- Weekly Commentary 4-30-12Документ3 страницыWeekly Commentary 4-30-12Stephen GierlОценок пока нет

- Mid-Quarter Monetary Policy ReviewДокумент3 страницыMid-Quarter Monetary Policy ReviewAngel BrokingОценок пока нет

- er20130213BullAusConsumerSentiment PDFДокумент2 страницыer20130213BullAusConsumerSentiment PDFAmanda MooreОценок пока нет

- er20130619BullLeadingIndex PDFДокумент3 страницыer20130619BullLeadingIndex PDFShaun SalasОценок пока нет

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Mark Baribeau Jennison Associates Navigating Global Equities ThroughДокумент9 страницMark Baribeau Jennison Associates Navigating Global Equities ThroughWarren RileyОценок пока нет

- Economics: Update: Australian March PSIДокумент4 страницыEconomics: Update: Australian March PSIChrisBeckerОценок пока нет

- RBI Monetary Policy ReviewДокумент4 страницыRBI Monetary Policy ReviewAngel BrokingОценок пока нет

- Er 20130220 Bull Leading IndexДокумент2 страницыEr 20130220 Bull Leading IndexBelinda WinkelmanОценок пока нет

- Daily News Letter 05oct2012Документ7 страницDaily News Letter 05oct2012Theequicom AdvisoryОценок пока нет

- Stock Tips - Equity Tips For 08 MayДокумент7 страницStock Tips - Equity Tips For 08 MayTheequicom AdvisoryОценок пока нет

- AmBank FXDaily Insights: Investors Pile Into Safe Havens As Dollar WeakensДокумент3 страницыAmBank FXDaily Insights: Investors Pile Into Safe Havens As Dollar Weakensr3iherОценок пока нет

- MAIA Financial Weekly Report 11.06Документ4 страницыMAIA Financial Weekly Report 11.06sandip_dОценок пока нет

- Pure Circle H1FY11 Interim SLIDESДокумент28 страницPure Circle H1FY11 Interim SLIDESuva_uvaОценок пока нет

- Technical Report 25th January 2012Документ5 страницTechnical Report 25th January 2012Angel BrokingОценок пока нет

- Market Outlook 7th September 2011Документ3 страницыMarket Outlook 7th September 2011Angel BrokingОценок пока нет

- Er 20130513 Bull Phat DragonДокумент3 страницыEr 20130513 Bull Phat DragonBelinda WinkelmanОценок пока нет

- Market Outlook: Dealer's DiaryДокумент4 страницыMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- Venture Capital & Principal Trading in The US Industry ReportДокумент32 страницыVenture Capital & Principal Trading in The US Industry Reportbsum83Оценок пока нет

- MARKET ANALYSIS ON 16oct2012Документ7 страницMARKET ANALYSIS ON 16oct2012Theequicom AdvisoryОценок пока нет

- More easing to come - Fidelity's August 2012 Investment Clock analysisДокумент4 страницыMore easing to come - Fidelity's August 2012 Investment Clock analysisJean Carlos TorresОценок пока нет

- QMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADAДокумент3 страницыQMU Underperformance in Fixed Income Markets IFS FINAL 3.22.12 ADAPaulo AraujoОценок пока нет

- File 28052013214151 PDFДокумент45 страницFile 28052013214151 PDFraheja_ashishОценок пока нет

- Market Outlook 23rd December 2011Документ4 страницыMarket Outlook 23rd December 2011Angel BrokingОценок пока нет

- Equity News Letter 15march2013Документ7 страницEquity News Letter 15march2013sandeshsp1Оценок пока нет

- West Pac Redbook February 2013Документ28 страницWest Pac Redbook February 2013Belinda WinkelmanОценок пока нет

- KeefeДокумент5 страницKeefeRochester Democrat and ChronicleОценок пока нет

- Equity Tips::market Analysis On 15 Oct 2012Документ8 страницEquity Tips::market Analysis On 15 Oct 2012Theequicom AdvisoryОценок пока нет

- August Monthly LetterДокумент2 страницыAugust Monthly LetterTheLernerGroupОценок пока нет

- Equity Market Analysis or Levels On 14th SeptemberДокумент7 страницEquity Market Analysis or Levels On 14th SeptemberTheequicom AdvisoryОценок пока нет

- Daily Technical Report: Sensex (17158) / NIFTY (5205)Документ4 страницыDaily Technical Report: Sensex (17158) / NIFTY (5205)angelbrokingОценок пока нет

- Market Outlook 27th March 2012Документ4 страницыMarket Outlook 27th March 2012Angel BrokingОценок пока нет

- Er 20130717 Bull Leading IndexДокумент3 страницыEr 20130717 Bull Leading IndexDavid SmithОценок пока нет

- March Monthly LetterДокумент2 страницыMarch Monthly LetterTheLernerGroupОценок пока нет

- Economics Group: Interest Rate WeeklyДокумент3 страницыEconomics Group: Interest Rate Weeklyd_stepien43098Оценок пока нет

- 744012678Документ3 страницы744012678shobu_iujОценок пока нет

- Electricity - Janesh PDFДокумент10 страницElectricity - Janesh PDFshobu_iujОценок пока нет

- IDLC ASSET MANAGEMENT LIMITED REPORT HIGHLIGHTS TOP FUNDSДокумент7 страницIDLC ASSET MANAGEMENT LIMITED REPORT HIGHLIGHTS TOP FUNDSshobu_iujОценок пока нет

- White Paper Global Economic Prospects and RisksДокумент14 страницWhite Paper Global Economic Prospects and Risksshobu_iujОценок пока нет

- WP36 Temin and VinesДокумент9 страницWP36 Temin and Vinesshobu_iujОценок пока нет

- Book Review An Introduction To Modern Bayesian EconometricsДокумент20 страницBook Review An Introduction To Modern Bayesian Econometricsshobu_iujОценок пока нет

- 100 Uvkv G J GVB Evsjv 'K Cövbre Ûi 86Zg Ôw Õ Gi DJVDJ - 86ZgДокумент1 страница100 Uvkv G J GVB Evsjv 'K Cövbre Ûi 86Zg Ôw Õ Gi DJVDJ - 86ZgtitusauОценок пока нет

- BBS Cables IPO Note 30 July 2017Документ6 страницBBS Cables IPO Note 30 July 2017shobu_iujОценок пока нет

- Multivariate Granger Causality Between Electricity Consumption, Economic Growth, Financial Development, Population, and Foreign Trade in PortugalДокумент30 страницMultivariate Granger Causality Between Electricity Consumption, Economic Growth, Financial Development, Population, and Foreign Trade in Portugalshobu_iujОценок пока нет

- 11150Документ36 страниц11150shobu_iujОценок пока нет

- Da Vinci Code by Dan Brown.: Digital FortressДокумент6 страницDa Vinci Code by Dan Brown.: Digital Fortressshobu_iujОценок пока нет

- Lenovo Miix 320Документ35 страницLenovo Miix 320shobu_iujОценок пока нет

- Madridnoteslarge PDFДокумент100 страницMadridnoteslarge PDFshobu_iujОценок пока нет

- Multivariate Granger Causality Between Electricity Consumption, Economic Growth, Financial Development, Population, and Foreign Trade in PortugalДокумент30 страницMultivariate Granger Causality Between Electricity Consumption, Economic Growth, Financial Development, Population, and Foreign Trade in Portugalshobu_iujОценок пока нет

- SAF FindevДокумент26 страницSAF Findevshobu_iujОценок пока нет

- Hitchhiker’s Guide to EViews and EconometricsДокумент18 страницHitchhiker’s Guide to EViews and Econometricsaftab20Оценок пока нет

- Course Introduction: Math ReviewДокумент16 страницCourse Introduction: Math Reviewshobu_iujОценок пока нет

- VARs SWДокумент8 страницVARs SWPeter XingОценок пока нет

- VARs SWДокумент8 страницVARs SWPeter XingОценок пока нет

- Gre2 PDFДокумент27 страницGre2 PDFshobu_iujОценок пока нет

- Harvard ReferencingДокумент11 страницHarvard ReferencingfakhruddinahmedrubaiОценок пока нет

- DSGE WikipediaДокумент5 страницDSGE Wikipediashobu_iujОценок пока нет

- Reserves NigeriaДокумент9 страницReserves Nigeriashobu_iujОценок пока нет

- Time Series Modelling Using Eviews 2. Macroeconomic Modelling Using Eviews 3. Macroeconometrics Using EviewsДокумент29 страницTime Series Modelling Using Eviews 2. Macroeconomic Modelling Using Eviews 3. Macroeconometrics Using Eviewsshobu_iujОценок пока нет

- Macroeconomic Bangladesh PDFДокумент20 страницMacroeconomic Bangladesh PDFshobu_iujОценок пока нет

- Program Basics: How to Create, Format, Save, Open, Execute and Run Programs in EViewsДокумент34 страницыProgram Basics: How to Create, Format, Save, Open, Execute and Run Programs in EViewsshobu_iujОценок пока нет

- Remittances Boost Growth in Countries With Less Developed Financial SystemsДокумент41 страницаRemittances Boost Growth in Countries With Less Developed Financial SystemsKhadar DaahirОценок пока нет

- Findev Growth IndiaДокумент12 страницFindev Growth Indiashobu_iujОценок пока нет

- Course Introduction: Math ReviewДокумент16 страницCourse Introduction: Math Reviewshobu_iujОценок пока нет

- Tona Totka To Achieve Self Objectives - Happy and Prosperous Married Life and Smooth Marriage, Get Married Without Any ProblemsДокумент8 страницTona Totka To Achieve Self Objectives - Happy and Prosperous Married Life and Smooth Marriage, Get Married Without Any Problemsvinitkgupta0% (1)

- Chaitanya Candra KaumudiДокумент768 страницChaitanya Candra KaumudiGiriraja Gopal DasaОценок пока нет

- Science Club-6Документ2 страницыScience Club-6Nguyễn Huyền Trang100% (1)

- Pride & Prejudice film sceneДокумент72 страницыPride & Prejudice film sceneha eunОценок пока нет

- PÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Документ33 страницыPÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Mario Davi BarbosaОценок пока нет

- Vivarium - Vol 37, Nos. 1-2, 1999Документ306 страницVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisОценок пока нет

- Why EIA is Important for Development ProjectsДокумент19 страницWhy EIA is Important for Development Projectsvivek377Оценок пока нет

- Can You Dribble The Ball Like A ProДокумент4 страницыCan You Dribble The Ball Like A ProMaradona MatiusОценок пока нет

- (Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1Документ10 страниц(Part B) APPLICATION LETTER, COVER LETTER, CV, RESUME & JOB INTERVIEW - Google Forms-1adОценок пока нет

- High-Performance Work Practices: Labor UnionДокумент2 страницыHigh-Performance Work Practices: Labor UnionGabriella LomanorekОценок пока нет

- Between The World and MeДокумент2 страницыBetween The World and Meapi-3886294240% (1)

- Week 1 and 2 Literature LessonsДокумент8 страницWeek 1 and 2 Literature LessonsSalve Maria CardenasОценок пока нет

- Revision FinalДокумент6 страницRevision Finalnermeen mosaОценок пока нет

- ISO 50001 Audit Planning MatrixДокумент4 страницыISO 50001 Audit Planning MatrixHerik RenaldoОценок пока нет

- Biffa Annual Report and Accounts 2022 InteractiveДокумент232 страницыBiffa Annual Report and Accounts 2022 InteractivepeachyceriОценок пока нет

- Language Teacher Educator IdentityДокумент92 страницыLanguage Teacher Educator IdentityEricka RodriguesОценок пока нет

- The Big Mac TheoryДокумент4 страницыThe Big Mac TheoryGemini_0804Оценок пока нет

- Work It Daily - Resume DROДокумент2 страницыWork It Daily - Resume DRODan OlburОценок пока нет

- Addressing Menstrual Health and Gender EquityДокумент52 страницыAddressing Menstrual Health and Gender EquityShelly BhattacharyaОценок пока нет

- San Beda UniversityДокумент16 страницSan Beda UniversityrocerbitoОценок пока нет

- AIESEC Experience-MBC 2016Документ25 страницAIESEC Experience-MBC 2016Karina AnantaОценок пока нет

- 2016-2017 Course CatalogДокумент128 страниц2016-2017 Course CatalogFernando Igor AlvarezОценок пока нет

- Words and Lexemes PDFДокумент48 страницWords and Lexemes PDFChishmish DollОценок пока нет

- Rubric for Evaluating Doodle NotesДокумент1 страницаRubric for Evaluating Doodle NotesMa. Socorro HilarioОценок пока нет

- APWU Contract Effective DatesДокумент5 страницAPWU Contract Effective DatesPostalReporter.comОценок пока нет

- SH-3 Sea King - History Wars Weapons PDFДокумент2 страницыSH-3 Sea King - History Wars Weapons PDFchelcarОценок пока нет

- Mixed 14Документ2 страницыMixed 14Rafi AzamОценок пока нет