Академический Документы

Профессиональный Документы

Культура Документы

1996DowAward Tim Hayes

Загружено:

fredtag43930 оценок0% нашли этот документ полезным (0 голосов)

69 просмотров5 страницTim Hayes Dow Award.

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTim Hayes Dow Award.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

69 просмотров5 страниц1996DowAward Tim Hayes

Загружено:

fredtag4393Tim Hayes Dow Award.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

17

JOURNAL of Technical Analysis Winter-Spring 2002

This indicator has always produced huge profits! In fact,

you would have doubled your money in just six months!

Such a claim could be a sales pitch. It could also be an analysts enthu-

siasm about some work just completed. But in either case, such claims

appear to be meeting increasing skepticism, perhaps because enough have

proven to be based more on fiction than quantifiable fact, perhaps because

enough investors have been burned by indicators that have failed to pan

out when put to real-time use, perhaps because the combination of ever-

strengthening computing power and ever-increasing program complexity

have made excessive optimization as easy, and dangerous, as ever.

In any case, the need to quantify accurately and thoroughly is greater

than ever. Honest and reliable quantification methods, used in the correct

way, are needed for increased research credibility. They are needed to im-

part objectivity. They are needed for effective analysis and for the sound

backing of research findings. The alternative is the purely subjective ap-

proach that uses trendlines and chart patterns alone, making no attempt to

quantify historical activity. But when the quantification process fails to

deliver, instead producing misleading messages, the subjective approach

is no worse an alternative a misguided quantification effort can be worse

than none at all. The predicament, then, is how to truly add value through

quantification.

THE CONCERNS

The major reason for quantifying results is to assess the reliability and

value of a current or potential indicator, and the major reason we have

indicators is to help us interpret the historical data. The more effective the

interpretation of historical market activity, the more accurate the projec-

tion about a markets future course. An indicator can be a useful source of

input for developing a market outlook if quantitative methods back its re-

liability.

But for several reasons, quantification must be handled with care. The

initial concern is the data used to develop an indicator. If its inaccurate,

incomplete, or subject to revision, it can do more harm than good, issuing

misleading messages about the market thats under analysis. The data should

be clean and contain as much history as possible. When it comes to data,

more is better the greater the data history, the more numerous the like

occurrences, and the greater the number of market cycles under study.

This leads to the second quantification concern, and thats sample size.

The data may be extensive and clean, and the analysis may yield an indica-

tor that foretold the markets direction with 100% accuracy. But if, for

example, the record was based on just three cases, the results would lack

statistical significance and predictive value. In contrast, there would be

fewer questions regarding the statistical validity of results based on more

than 30 observations.

The third consideration is the benchmark, or the standard for compari-

son. The test of an indicator is not whether it would have produced a profit,

but whether the profit would have been any better than a random approach,

or no approach at all. Without a benchmark, random walk suspicions

may haunt the results.

1

The fourth general concern is the indicators robustness, or fitness

the consistency of the results of indicators with similar formulas. If, for

example, the analysis would lead to an indicator that used a 30-week mov-

ing average to produce signals with an excellent hypothetical track record,

how different would the results be using moving averages of 28, 29, 31, or

32 weeks? If the answer was dramatically worse, then the indicators

robustness would be thrown into question, raising the possibility that the

historical result was an exception to the rule rather than a good example of

the rule. An indicator can be considered fit if various alterations of the

formula would produce similar results.

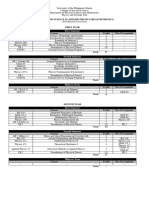

Figure 1

Summary Results From Hypothetical Indicator Tests

These results contain an impressive-looking EXCEPTION to the rule ...

Number Moving

of Average Accuracy Gain/Annum

Trades (Periods) Buy Level Sell Level Rate (%) (%)

40 70 100 110 50 11.2

39 71 99 111 50 11.3

37 72 98 112 65 15.1

37 73 97 113 52 10.1

36 74 96 114 50 9.8

These results would all be good EXAMPLES of the rule ...

50 20 15.6 8.6 55 11.8

49 21 15.8 8.4 56 12.0

48 22 16.0 8.2 56 12.1

47 23 16.2 8.0 57 12.1

46 24 16.4 7.8 56 12.0

Buy-Hold Gain/Annum 6.3

Moreover, the non-robust indicator may be a symptom of the fifth con-

cern, and thats the optimization process. In recent years, much has been

written about the dangers of excessive curvefitting and over-optimization,

often the result of unharnessed computing power. As analytical programs

have become increasingly complex and able to crunch through an ever-

expanding multitude of iterations, it has become easy to over-optimize.

The risk is that armed with numerous variables to test with minuscule in-

crements, a program may be able to pick out an impressive result that may

in fact be attributable to little more than chance. The accuracy rate and

gain per annum columns of Figure 1 compare results that include an im-

pressive-looking indicator that stands in isolation (top) with indicators that

look less impressive but have similar formulas (bottom). One could have

far more confidence using an indicator from the latter group even though

none of them could match the results using the impressive-looking indica-

tor from the top group.

What follows from these five concerns is the final general concern of

whether the indicator will hold up on a real-time basis. One approach is to

build the indicator and then let it operate for a period of time as a real-time

test. At the end of the test period, its effectiveness would be assessed. To

increase the chances that it will hold up on a real-time basis, the alterna-

tives include out-ofsample testing and blind simulation. An out-of-sample

approach might, for example, require optimization over the first half of the

date range and then a real-time simulation over the second half. The results

from the two halves would then be compared. A blind-simulation approach

might include optimization over one period followed by several tests of

the indicator over different periods.

Whatever the approach, real-time results are likely to be less impres-

THE QUANTIFICATION PREDICAMENT

Timothy W. Hayes, CMT

CHARLES H. DOW AWARD WINNER MAY 1996

18

JOURNAL of Technical Analysis Winter-Spring 2002

sive than results during an optimization period. The reality of any indica-

tor developed through optimization is that, as history never repeats itself

exactly, it is unlikely that any optimized indicator will do as well in the

real-time future. The indicators creator and user must decide how much

deterioration can be lived with, which will help determine whether to keep

the indicator or go back to the drawing board.

TRADE-SIGNAL ANALYSIS

With the general concerns in mind, the various quantification methods

can be put to use. The first, and perhaps most widely used, is the approach

that relies on buy and sell signals, as shown in Figure 2.

2

When the indi-

cator meets the condition that it deems to be bullish for the market in ques-

tion, it flashes a buy signal, and that signal remains in effect until the indi-

cator meets the condition that it deems to be bearish. A sell signal is then

generated and remains in effect until the next buy signal. Since a buy sig-

nal is always followed by a sell signal, and since a sell signal is always

followed by a buy signal, the approach lends itself to quantification as

though the indicator was a trading system, with a long position assumed on

a buy signal and closed out on a sell signal, at which point a short position

would be held until the next buy signal.

Figure 2

The methods greatest benefit is that it clearly reveals the indicators

accuracy rate, a statistic thats appealing for its simplicity all else being

equal, an indicator that had generated hypothetical profits on 30 of 40 trades

would be more appealing than an indicator that had produced hypothetical

profits on 15 of 40 trades. Also, the simulated trading system can be used

for comparing a number of other statistics, such as the hypothetical per

annum return that would have been produced by using the indicator. The

per annum return can then be compared to the gain per annum of the bench-

mark index.

But the methods greatest benefit may also be its biggest drawback. No

single indicator should ever be used as a mechanical trading system as

stated earlier, indicators should instead be used as tools for interpreting

market activity. Yet, the hypothetical and actual can be easily confused.

Although the signal-based method specifies how a market has done be-

tween the periods from one signal to the next, they are not actual records of

real-time trading performance. If they were, the results would have to ac-

count for the transaction costs per trade, with a negative effect on trading

results. Figure 3 summarizes the indicators hypothetical trade results be-

fore and after the inclusion of a quarter-percent transaction cost, illustrat-

ing the impact that transaction costs can have on results. The more numer-

ous the signals, the greater the impact.

Also, as noted in the results, another concern is the maximum draw-

down, or the maximum loss between any consecutive signals. But again,

as long as it is clear that the indicator is for perspective and not for dictat-

ing precise trading actions, indicators with trading signals can provide useful

input when determining good periods for entering and exiting the market

in question.

ZONE ANALYSIS

In contrast to indicators based on trading signals, indicators based on

zone analysis leave little room for doubt about their purpose they dont

even have buy and sell signals. Rather, zone analysis recognizes black,

white and one or more shades of gray. It quantifies the markets perfor-

mance with the indicator in various zones, which can be given such labels

as bullish, bearish or neutral depending upon the markets per an-

num performance during all of the periods in each zone. Each period in a

zone spans from the first time the indicator enters the zone to the next

observation outside of the zone. Unlike the signal-based approach, the in-

dicator can move from a bullish zone to a neutral zone and back to a bull-

ish zone. An intervening move into a bearish zone is not required.

Figure 3

Summary Results For Indicator In Figure 2 No Transaction Costs

Value Line Geometric $ 574,104 1/24/72 5/30/96

Last Profit Number Days Gain Model Buy/Hold

Signal Current of Per Per Batting Gain Per Gain Per $10,000

"Sell" Trade Trades Trade Trade Average Annum Annum Investment

5/07/96 -2.9% 240 37 1.9% 50% 18.1% 4.8% $574,104

Maximum Drawdown: -4.68%

Summary Results For Indicator In Figure 2 Including Transaction Costs

Of A Quarter Percent Per Trade

Value Line Geometric $173,271 1/24/72 5/30/96

Last Profit Number Days Gain Model Buy/Hold

Signal Current of Per Per Batting Gain Per Gain Per $10,000

"Sell" Trade Trades Trade Trade Average Annum Annum Investment

5/07/96 -3.4% 240 37 1.4% 45% 12.4% 4.8% $173,271

Maximum Drawdown: -4.68%

Zone analysis is therefore appealing for its ability to provide useful

perspective without a simulated trading system. The results simply indi-

cate how the market has done with the indicator in each zone. But this type

of analysis has land mines of its own. In determining the appropriate lev-

els, the most statistically-preferable approach would be to identify the lev-

els that would keep the indicator in each zone for roughly an equal amount

of time. In many cases, however, the greatest gains and losses will occur in

extreme zones visited for a small percentage of time, which can be prob-

lematic for several reasons:

1. if the time spent in the zone is less than a year, the per annum gain can

present an inflated picture of performance;

2. if the small amount of time meant that the indicator made only one

sortie into the zone, or even a few, the lack of observations would lend

suspicion to the indicators future reliability;

3. the indicators usefulness must be questioned if its neutral for the vast

majority of time.

A good compromise between optimal hypothetical returns and statisti-

cal relevance would be an indicator that spends about 30% of its time in

the high and low zones, like the indicator in Figure 4. For an indicator with

more than four years of data, that would ensure at least a years worth of

time in the high and low zones and would make a deficiency of observa-

tions less likely. In effect, the time-in-zone limit prevents excessive opti-

mization by excluding zone-level possibilities would look the most im-

19

JOURNAL of Technical Analysis Winter-Spring 2002

pressive based on per annum gain alone.

Another consideration is that in some cases, a closer examination of

the zone performance reveals that the bullish-zone gains and bearish-zone

losses occurred with the indicator moving in particular directions. In those

cases, the bullish or bearish messages suggested by the per annum results

would be misleading for a good portion of the time, as the market might

actually have had a consistent tendency, for example, to fall after the

indicators first move into the bullish zone and to rise after its first move

into the bearish zone.

Figure 4

It can therefore be useful to subdivide the zones into rising-in-zone and

falling-in-zone, which can have the added benefit of making the informa-

tion in the neutral zone more useful. This requires definitions for rising

and falling. One way to define those terms is through the indicators rate

of change. In Figure 5, which applies the approach to the primary stock

market model used by Ned Davis Research, the indicator is rising in the

zone if its higher than it was five weeks ago and falling if its lower.

Again, the time spent in the zones and the number of cases are foremost

concerns when using this approach.

Figure 5

Alternatively, rising and falling can be defined using percentage

reversals from extremes, in effect using zones and trading signals to con-

firm one another. In Figure 6, for example, the CRB Index indicator is

rising and on a sell signal once the indicator has risen from a trough

whereas its falling and on a buy signal after the indicator has declined

from a peak. Even though the reversal requirements resulted from optimi-

zation, the indicator includes a few poorly-timed signals and would be

risky to use on its own. But the signals could be used to provide confirma-

tion with the indicator in its bullish or bearish zone, in this case the same

zones as those used in Figure 4. For example, in late 1972 and early 1973

the indicator would have been rising and in the upper zone, a confirmed

bearish message. The indicator would then have peaked and started to lose

upside momentum, generating a falling signal and losing the confirma-

tion. That signal would not be confirmed until the indicators subsequent

drop into its lower zone.

Figure 6

The charts box shows the negative hypothetical returns with the indi-

cator on a sell signal while in the upper zone, and on a buy signal while in

the lower zone. In contrast to the rate-of-change approach to subdividing

zones, this method fails to address the market action with the indicator in

the middle zone. But it does illustrate how zone analysis can be used to in

conjunction with trade-signal analysis to gauge the strength of an indicators

message.

SUBSEQUENT-PERFORMANCE ANALYSIS

In addition to using signals and zones, results can be quantified by gaug-

ing market performance over various periods following a specified condi-

tion. In contrast to the trade-signal and zone-based quantification meth-

ods, a system based on subsequent performance calculates market perfor-

mance after different specified time periods have elapsed. Once the long-

est of the time periods passes, the quantification process becomes inactive,

remaining dormant until the indicator generates a new signal. In contrast,

the other two approaches are always active, calculating market performance

with every data update.

The subsequent-performance approach is thus applicable to indicators

that are more useful for providing indications about one side of a market,

indicating market advances or market declines. And its especially useful

for indicators with signals that are most effective for a limited amount of

time, after which they lose their relevance. The results for a good buy-

signal indicator are shown in Figure 7, which lists market performance

over several periods following signals produced by a 1.91 ratio of the 10-

day advance total to the 10-day decline total.

In its most basic form, the results might list performance over the next

five trading days, 10 trading days, etc., summarizing those results with the

average gain for each period. However, the results can be misleading if

several other questions are not addressed. First of all, how is the average

determined? If the mean and the median are close, as they are in Figure 7,

then the mean is an acceptable measure. But if the mean is skewed in one

20

JOURNAL of Technical Analysis Winter-Spring 2002

direction by one or a few extreme observations, then the median is usually

preferable. In both cases, the more observations the better.

Secondly, whats the benchmark? While the zone approach uses rela-

tive performance to quantify results, trade-signal analysis includes a com-

parison of per annum gains with the buy-hold statistic. Likewise, the sub-

sequent-performance approach can use an all-period gain statistic as a

benchmark. In Figure 7, for instance, the average 10-day gain in the Dow

Industrials has been 2% following a signal, nearly seven times the 0.3%

mean gain for all 10-day periods. This indicates that the market has tended

to perform better than normal following signals. That could not be said if

the 10-day gain was 0.4% following signals.

Figure 7

Percent Change Of Dow Industrials Following 1.91 Ratio Of 10-day

Advances To 10-Day Declines

Trading Days Later

Signal 10-Day

Date A/D 5 10 22 63 126 252

06/23/47 1.96 -0.1 2.9 5.3 0.3 0.1 3.7

03/29/48 2.05 2.2 3.2 5.8 11.2 4.0 0.6

07/13/49 2.06 1.4 1.9 3.5 7.0 15.2 28.4

11/20/50 2.01 1.5 -1.7 -1.4 10.0 9.8 18.8

01/25/54 2.00 0.5 1.1 0.3 8.3 18.2 36.4

01/24/58 2.00 -0.1 -0.4 -3.1 0.6 10.3 31.4

07/10/62 1.98 -1.4 -2.0 0.9 0.0 14.0 21.5

11/07/62 1.91 2.4 3.5 4.8 10.3 17.3 21.1

01/13/67 1.94 1.4 1.1 2.6 2.9 5.6 6.9

08/31/70 1.91 1.1 -1.8 -0.5 3.9 15.5 17.9

12/03/70 1.95 1.5 1.7 3.6 11.1 14.1 5.0

12/08/71 1.98 1.0 3.5 6.2 10.6 10.4 20.2

01/08/75 1.98 2.8 2.7 12.0 20.9 37.2 41.4

01/06/76 2.05 2.5 6.6 8.3 12.7 11.3 10.9

08/23/82 2.02 0.2 2.6 3.9 14.6 22.6 34.0

10/13/82 2.03 1.9 -0.9 2.4 6.7 13.9 24.6

01/21/85 1.93 1.3 2.3 1.4 0.4 7.6 20.1

01/14/87 2.19 2.9 6.3 7.3 10.7 22.1 -5.4

02/04/91 1.96 4.7 5.8 6.9 6.1 7.8 16.7

01/06/92 1.99 -0.5 1.7 1.8 1.5 4.3 3.4

Median 1.4 2.1 3.6 7.7 12.6 19.4

Mean 3.1 2.0 3.6 7.5 13.1 17.9

Mean All Periods 0.2 0.3 0.7 2.0 4.0 8.1

% Cases Higher 80 75 85 100 100 100

% Cases Higher All Periods 56 58 60 63 67 70

Signals based on 10-day total of NYSE advances over 10-day total of NYSE declines. Concept courtesy of

Dan Sullivan, modified by Ned Davis Research.

A third question is how much risk has there been following a buy-sig-

nal system, or reward following a sell-signal system? Using a buy-signal

system as an example, one way to address the question would be to list the

percentage of cases in which the market was higher over the subsequent

period, and to then compare that with the percentage of cases in which the

market was higher over any period of the same length. Again using the 10-

day span in Figure 7 as an example, the market has been higher after 75%

of the signals, yet the market has been up in only 58% of all 10-day peri-

ods, supporting the significance of signals. Additional risk information could

be provided by determining the average drawdown per signal i.e., the

mean maximum loss from high to low following signals. The mean for the

10-day period, for example, was a maximum loss of 0.7% per signal, sug-

gesting that at some point during the 10-day span, a decline of 0.7% could

be considered normal. The opposite approaches could be used with sell-

signal indicators, with the results reflecting the chances for the market to

follow sell signals by rising, and to what extent.

Along with those questions, the potential for double-counting must be

recognized. If, for example, a signal is generated in January and a second

signal is generated in February, the four-month performance following the

January signal would be the same as the three-month performance follow-

ing the February signal. This raises the question of whether the three-month

return reflects the impact of the first signal or the second one. Moreover,

such signal clusters give heavier weight to particular periods of market

performance, making the summary statistics more difficult to interpret. Prob-

lems related to double-counting can be reduced or eliminated by adding a

time requirement. For the signals in Figure 7, for instance, the condition

must be met for the first time in 50 days if the ratio reaches 1.92, drops to

1.90, and then returns to 1.92 two days later, only the first day will have a

signal. The time requirement eliminates the potential for double-counting

in any of the periods of less than 50 days, though the longer periods still

contain some overlap in this example.

Figure 8

Performance Of Dow Industrials Following Initial Index Confirmation

(Joint 52-week Highs For The First Time In A Year)

26 Weeks Later 39 Weeks Later 52 Weeks Later

Confirming % Mean % All % Mean % All % Mean % All Latest

Index Cases Higher % Gain Periods Higher % Gain Periods Higher % Gain Periods Close

New York Utilities 7 100 8.79 5.53 100 13.59 7.98 100 16.62 10.35 5/12/95

World Composite 6 100 8.47 5.85 80 9.74 8.88 100 12.91 11.78 9/15/95

Weekly New Highs 9 89 7.79 3.53 78 10.09 5.27 100 14.41 6.98 3/31/95

NYSE Weekly Volume 10 70 6.64 3.53 67 5.16 5.27 89 6.91 6.98 7/14/95

S&P 500 Composite 22 73 5.13 3.53 73 9.92 5.45 82 14.78 7.47 2/10/95

NYSE Composite 20 63 4.02 3.72 68 8.10 5.68 79 13.29 7.60 2/10/95

AMEX Composite 9 67 3.53 5.53 67 8.20 7.98 78 13.62 10.35 3/31/95

OTC Composite 9 56 3.77 5.53 67 7.73 7.98 78 12.38 10.35 3/17/95

Dow Transports 22 77 5.26 3.53 73 8.62 5.45 76 9.99 7.47 4/13/95

S&P High-Grade Index 12 67 5.46 3.53 75 9.73 5.27 75 10.77 6.98 2/17/95

S&P Industrials 12 58 1.66 3.53 58 4.34 5.27 75 10.15 6.98 2/10/95

NYSE Financials 11 45 0.59 3.53 55 4.86 5.24 73 10.06 6.92 4/07/95

Dow Utilities 23 70 6.00 3.27 65 7.63 5.05 73 9.18 6.95 5/05/95

Weekly A/D Line 12 58 2.44 3.53 67 5.30 5.27 73 7.31 6.98 4/13/95

S&P Low-Priced Index 11 55 1.26 3.53 40 2.88 5.27 70 7.31 6.98 7/14/95

Value Line Composite 14 50 1.35 3.53 50 3.74 5.27 69 6.26 6.98 4/13/95

Confirmation occurs, and a case identified, when the DJIA and the index in question both reach 52-

week highs, the first such joint occurrence in at least a year. Table is sorted based on percentage of cases

in which the index was higher over the subsequent 52-week periods (column shaded). % All Periods is

the DJIAs mean gain for all 26, 39, and 52 week periods starting with the beginning of the data series in

question. Table updated through 4/04/96.

Another application of subsequent-performance analysis is shown in

Figure 8, which is not prone to any double-counting. The signals require

that three conditions are met, all for the first time in year the Dow Indus-

trials much reach its highest level in a year, another index must reach its

highest level in a year, and the joint high must be the first in a year. The

significance for the various indices can then be compared in conjunction

with their benchmarks i.e., the various all-period gains. Figure 9 uses 12

of those indices to show how subsequent performance analysis for both

buy signals and sell signals can be used together in an indicator. For each

time span, the charts box lists the markets performance after buy signals,

after sell signals, and for all periods.

21

JOURNAL of Technical Analysis Winter-Spring 2002

REVERSAL-PROBABILITY ANALYSIS

Finally, the subsequent performance approach is useful for assessing

the chances of a market reversal. In Figure 10, the signal is the markets

year-to-year change at the end of the year, with the signals (years) catego-

rized by the amount of change years with any amount of change, those

with gains of more than 5%, etc. In this case, the subsequent-performance

analysis is limited to the year after the various one-year gains. But the

analysis takes an additional step in assessing the chances for a bull market

peak within the one- and two-year periods after the years with market gains,

or a bear market bottom within the one- and two-year periods after the

years with market declines.

Figure 9

This analysis requires the use of tops and bottoms identified with ob-

jective criteria for bull and bear markets in the Dow Industrials. The rever-

sal dates show that starting with 1900, there have been 30 bull market

peaks and 30 bear market bottoms, with no more than a single peak and a

single trough in any year. This means that for any given year until 1995,

there was a 31% chance for the year to contain a bull market peak and a

31% chance for the year to contain a bear market bottom (30 years with

reversals / 95 years).

Figure 10

Using this percentage as a benchmark, it can then be determined whether

theres been a significant increase in the chances for a peak or trough in the

year after a one-year gain or loss of at least a certain amount. The charts

boxes show the peak chances following up years and the trough chances

following down years, dividing the number of cases by the number of peaks

or troughs. For example, prior to 1995, there had been 31 years with gains

in excess of 15% starting with 1899. After those years, there was a 52%

chance for a bull market peak in the subsequent year (16 following-years

with peaks / 31 years with gains of more than 15%). The chances for a

peak within two years increased to 74%, which can be compared to the

benchmark chance for at least one peak in 61% of the two-year periods

(since several two-year periods contained more than one top, this is not the

exact double of the chances for a peak in any given year).

A major difference in this analysis is that in contrast to signals and

zones, which depend upon the action of an indicator, this approach de-

pends entirely on time. Each signal occurs after a fixed amount of time

(one year), with the signals classified by what they show (a gain of more

than 5%, etc.). Depending upon the classification, the risk of a peak or

trough can then be assessed.

CONCLUSION

Each one of these methods can help in the effort to assess a markets

upside and downside potential, with the method selected having a lot to do

with the nature of the indicator, the time frame, and the frequency of oc-

currences. The different analytical methods could be used to confirm one

another, the confirmation building as the green lights appeared. An alter-

native would be a common denominator approach in which several of the

approaches would be applied to an indicator using a common parameter

(i.e., a buy signal at 100). Although the parameter would most likely be

less than optimal for any of the individual methods, excessive optimiza-

tion would be held in check. But whatever approaches are used, it needs to

be stressed that each one of them has its own means of deceiving. By better

understanding the potential pitfalls of each approach, indicator develop-

ment can be enhanced, indicator attributes and drawbacks can be better

assessed, and the indicator messages can be better interpreted.

The process of developing a market outlook must be based entirely on

research, not sales. The goal of research is to determine if something works.

The goal of sales is to show that it does work. Yet in market analysis, the

lines can blur if the analyst decides how the market is supposed to per-

form, then selling himself on this view by focusing only on the evidence

that supports it. Whats worse is the potential to sell oneself on the value of

an indicator by focusing only on those statistics that support ones view,

regardless of their statistical validity. As shown by the various hazards

associated with the methods described in this paper, such self-deception is

not difficult to do.

Our goals should be objectivity, accuracy, and thoroughness. Using a

sound research approach, we can determine the relative value of using any

particular indicator in various ways. And we can assess the indicators value

and role relative to all the other indicators analyzed and quantified in a

similar way. The indicator spectrum can then provide more useful input

toward a research-based market view.

FOOTNOTES

1. Reference to Burton Malkeil's A Random Walk Down Wall Street, which

argues that stock prices move randomly and thus cannot be forecasted

through technical means.

2. The charts that accompany this paper were produced with the Ned Davis

Research computer program.

Since winning the third Dow Award in 1996, Tim Hayes has expanded upon

"The Quantification Predicament" in writing his first book, "The Research Driven

Investor," published in November 2000 by McGraw-Hill. A Global Equity Strate-

gist for Ned Davis Research, Tim and his team have developed numerous U.S. and

global asset allocation indicators and models in recent years, while also develop-

ing global market and sector ranking systems and indicators based on 18 market

sectors in 16 countries.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Active TRader-Marco Dion Interview Sep 2009Документ5 страницActive TRader-Marco Dion Interview Sep 2009fredtag4393Оценок пока нет

- Active TRader-Marco Dion Interview Sep 2009Документ5 страницActive TRader-Marco Dion Interview Sep 2009fredtag4393Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Larry Williams (Seminar Notes)Документ6 страницLarry Williams (Seminar Notes)fredtag4393100% (2)

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- BRSI Howard WangДокумент8 страницBRSI Howard Wangfredtag4393100% (1)

- Arthur MerrillДокумент20 страницArthur Merrillfredtag4393Оценок пока нет

- AQR-Introducing The New AQR SMOOTH FundДокумент2 страницыAQR-Introducing The New AQR SMOOTH Fundfredtag4393Оценок пока нет

- Arthur MerrillДокумент20 страницArthur Merrillfredtag4393Оценок пока нет

- Average Volume&Current Volume Tim Phila TSFДокумент3 страницыAverage Volume&Current Volume Tim Phila TSFfredtag4393Оценок пока нет

- Arcadia Agri 29032021Документ8 страницArcadia Agri 29032021fredtag4393Оценок пока нет

- Mulitime Frame TrendДокумент7 страницMulitime Frame Trendfredtag4393Оценок пока нет

- Arcadia Agri 01032021Документ7 страницArcadia Agri 01032021fredtag4393Оценок пока нет

- Arcadia Agri 15032021Документ7 страницArcadia Agri 15032021fredtag4393Оценок пока нет

- Futures Magazine Archives 02Документ23 страницыFutures Magazine Archives 02fredtag4393Оценок пока нет

- GannSquare FrontEndDocДокумент3 страницыGannSquare FrontEndDocfredtag4393Оценок пока нет

- Vertical Line TSFДокумент2 страницыVertical Line TSFfredtag4393Оценок пока нет

- How To Pick StocksДокумент6 страницHow To Pick Stocksfredtag4393Оценок пока нет

- Corn Jay Kaeppel 28022019Документ4 страницыCorn Jay Kaeppel 28022019fredtag4393Оценок пока нет

- Eckhardt TradingДокумент30 страницEckhardt Tradingfredtag4393Оценок пока нет

- Greg Morris Pair Analysis 1&2Документ7 страницGreg Morris Pair Analysis 1&2fredtag4393Оценок пока нет

- COT Commercials IndicatorДокумент4 страницыCOT Commercials Indicatorfredtag4393Оценок пока нет

- Bill Eckhardt The Man Who Launched 1000 SystemsДокумент17 страницBill Eckhardt The Man Who Launched 1000 Systemsfredtag4393Оценок пока нет

- Nicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical AnalystsДокумент1 страницаNicole Elliott Interview Series - Anne Whitby FSTA - Society of Technical Analystsfredtag4393Оценок пока нет

- Fibonacci Time LinesДокумент3 страницыFibonacci Time Linesfredtag4393Оценок пока нет

- Heikin Ashi Newsletter 03032019Документ34 страницыHeikin Ashi Newsletter 03032019fredtag4393Оценок пока нет

- Balance of Power Igor LivshinДокумент11 страницBalance of Power Igor Livshinfredtag4393100% (1)

- Our Technical Analysis: A Brief IntroductionДокумент8 страницOur Technical Analysis: A Brief Introductionfredtag4393Оценок пока нет

- Open High Low Close Cart in ExcelДокумент6 страницOpen High Low Close Cart in Excelfredtag4393Оценок пока нет

- Greg Morris Core Rotation StrategyДокумент7 страницGreg Morris Core Rotation Strategyfredtag4393Оценок пока нет

- Machine Learning Guide: Meher Krishna PatelДокумент121 страницаMachine Learning Guide: Meher Krishna PatelOgnjen OzegovicОценок пока нет

- Fundamentals of Physics Sixth Edition: Halliday Resnick WalkerДокумент3 страницыFundamentals of Physics Sixth Edition: Halliday Resnick WalkerAhmar KhanОценок пока нет

- The Geneva Mechanism ExplainedДокумент11 страницThe Geneva Mechanism ExplainedMonteiro727Оценок пока нет

- ANSYS Mechanical APDL Modeling and Meshing GuideДокумент236 страницANSYS Mechanical APDL Modeling and Meshing GuideJayakrishnan P SОценок пока нет

- Math g10 Activity Sheets Project Banga Week1 2Документ7 страницMath g10 Activity Sheets Project Banga Week1 2Jeffrey ManligotОценок пока нет

- POLYNOMIALS Puzzle 1Документ1 страницаPOLYNOMIALS Puzzle 1Sekhar Reddy100% (1)

- VocoderДокумент12 страницVocoderKola OladapoОценок пока нет

- Os Lab Exno 1 To 5Документ38 страницOs Lab Exno 1 To 5Vairavel ChenniyappanОценок пока нет

- Vapor Pressure of Aqueous Hydrogen Chloride SolutionsДокумент3 страницыVapor Pressure of Aqueous Hydrogen Chloride SolutionsVincent Ferrer NironОценок пока нет

- Substitution CipherДокумент7 страницSubstitution CipherphaulusОценок пока нет

- A Das Gupta MCQ PDFДокумент72 страницыA Das Gupta MCQ PDFBhavya ChawatОценок пока нет

- Difference Between Big-O and Little-O Notations - Baeldung On Computer ScienceДокумент5 страницDifference Between Big-O and Little-O Notations - Baeldung On Computer ScienceKraft DinnerОценок пока нет

- Stereotypes GendersДокумент4 страницыStereotypes Genders4jgzhmyprdОценок пока нет

- Simple Harmonic MotionДокумент17 страницSimple Harmonic MotionChirag Hablani100% (1)

- Divisibility Rules Lesson - Using Rules for 2, 5, 10Документ13 страницDivisibility Rules Lesson - Using Rules for 2, 5, 10Melyn BustamanteОценок пока нет

- Determination of Navigation System PositioningДокумент18 страницDetermination of Navigation System PositioningЮра ОксамытныйОценок пока нет

- Unexpired ReserveДокумент16 страницUnexpired ReservePreethaОценок пока нет

- Favretto PDFДокумент181 страницаFavretto PDFjfranbripi793335Оценок пока нет

- CSE 236 (B) Assignment 1: Problem DescriptionДокумент2 страницыCSE 236 (B) Assignment 1: Problem Descriptionakib95Оценок пока нет

- Oscillations IДокумент44 страницыOscillations Iapi-259436196Оценок пока нет

- Radar Systems - Delay Line CancellersДокумент7 страницRadar Systems - Delay Line Cancellersgajjala rakeshОценок пока нет

- Trading Strategies Market Colour Ravi Kashyap 2018Документ25 страницTrading Strategies Market Colour Ravi Kashyap 2018Mete İlker Sari0% (1)

- ISC Maths Paper 2006Документ4 страницыISC Maths Paper 2006Anvesha AgarwalОценок пока нет

- FIN 623 Final Exam Practice QuestionsДокумент8 страницFIN 623 Final Exam Practice QuestionsChivajeetОценок пока нет

- Prelude To Programming 6th Edition Venit Test BankДокумент10 страницPrelude To Programming 6th Edition Venit Test Bankletitiaesperanzavedhd100% (30)

- Vectors and Scalars: John O'Connor St. Farnan's PPS ProsperousДокумент15 страницVectors and Scalars: John O'Connor St. Farnan's PPS ProsperousTemesgen BihonegnОценок пока нет

- BSAP 2018 Revised CurriculumДокумент2 страницыBSAP 2018 Revised Curriculumrobles.migszanderОценок пока нет

- Hertz Electric Waves 1892Документ17 страницHertz Electric Waves 1892roberto-martins100% (1)

- Statistics LectureДокумент35 страницStatistics LectureEPOY JERSОценок пока нет

- SAT Chemistry TextbookДокумент112 страницSAT Chemistry TextbookSai Sagireddy100% (2)