Академический Документы

Профессиональный Документы

Культура Документы

Salary Tax Computation Calculator - Final 2014-15

Загружено:

Abidsid89Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Salary Tax Computation Calculator - Final 2014-15

Загружено:

Abidsid89Авторское право:

Доступные форматы

11001234 xxxxxx-x 1

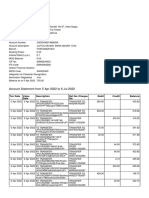

July August September October November December January February March April May June Total Exempt

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

- - - - - - - - - - - - - -

Applicable Tax Slab Not Taxable

Annual Tax Liability -

July August September October November December January February March April May June

Tax

Deducted

Total

Liability

- - - - - - - - - - - - - -

Income Tax Computation for Individuals (Salaried Persons 2014-15) "Highlighed Cells are Input Cells"

Employee Code

xxxxx-xxxxxxx-x ABC Employee Name

Department XYZ

NTN #

CNIC #

Car Ijara / Allowance

Description

Salary

P.F. Employer Contribution

Bonus / Ex-Gratia

LFA

Arrears

Over Time

Daily Allowance

Conveyance Alowwance

Relocation Allowance

Leave Encashment

Others

Monthly Tax Deduction

Description

Total

Medical Allowance

Age Below 60 Years

Age Above 60 Years

Senior Citizen Tax Credit

Tax Deducted by Employer Upto Last Month (See Section 149) - Number of Months Vehicle Usage in Current Year

Tax Deducted on Telephone/Mobile Phone Bills (See Section 236) - Purpose of Vehicle Usage

Tax Deducted at the time of Motor Vehicle Tax Payment (See Section 234) - Value of Motor Vehicle

Tax Deducted on Cash Withdrawals from Banks (See Section 231A) - Taxable Amount of Conveyance

Tax Deducted on Registration of New Car/Jeep (See Section 231B) -

Tax Deducted on Purchase of Air Tickets (See Section 236B) -

-

Loan Amount

Number of Months Loan used in Current Year

Interest Rate Charges by Company

Paid Allowable Benchmark Rate

Charitable donation - - Taxable Amount of Loan

Investment in Shares & Life Insurance Premium - -

Contribution to Approved Pension Fund - -

Profit on Debt on House Loans (purchase/construction)

- -

- - 1

Total Gratuity Received

Paid Allowable Gratuity Exempted

Charitable Donation - - Gratuity Taxable

Zakat Paid - -

Total Amount Eligible From Staight Deduction From Income - -

Taxable Amount From Salary

Taxable Amount of Conveyance and Employer's Loan

Taxable Amount of Gratuity

Zakat

Gross Taxable Income

Charitable Donation Admissible For Straight Deduction

Taxable Income

Gross Tax Chargeable on Taxable Income

Senior Citizen Tax Rebate

Tax Credit Allowed At Average Tax Rate (Section 61-64)

Income Tax Liability

Withholding Tax Adjustment (Tax Already Paid)

Income Tax Payable / (Refundable)

No. of Remaining Months in Tax Year

Monthly Deduction

Prepared By: Malik Mohammad Awais

Email: malikawais_CMA@hotmail.com

Computation of Monthly Income Tax Deductions

Withholding Income Tax Adjustments for the Year

Grand Total of WH Tax Adjustments

Official + Personal

Zakat / Charitable Donations Admissible For Straight Deductions

Tax Calculation on Interest Free Loan

Computation of Tax on Gratuity

Taxable Value of Conveyance - (If provided by employeer)

Tax Credit Adjustments for the Year

Grand Total of Tax Credit Adjustments

Received from Govt Approved Funded (PVt) Approved Unfunded (Pvt) Unapproved Unfunded

Taxable

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Balance to be

Deducted

-

Income Tax Computation for Individuals (Salaried Persons 2014-15) "Highlighed Cells are Input Cells"

5

5%

-

-

-

12

0%

14%

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

12

-

Computation of Monthly Income Tax Deductions

Tax Calculation on Interest Free Loan

Computation of Tax on Gratuity

Taxable Value of Conveyance - (If provided by employeer)

Unapproved Unfunded

- 400,000 Not Taxable

400,001 750,000 5% of amount exceeding Rs. 400 k

750,001 1,400,000 Rs. 17,500 + 10% of amount exceeding Rs. 750 k

1,400,001 1,500,000 Rs. 82,500 + 12.5% of amount exceeding Rs. 1400 k

1,500,001 1,800,000 Rs. 95,000 + 15% of amount exceeding Rs. 1500 k

1,800,001 2,500,000 Rs. 140,000 + 17.5% of amount exceeding Rs. 1800 k

2,500,001 3,000,000 Rs. 262,500 + 20% of amount exceeding Rs. 2500 k

3,000,001 3,500,000 Rs. 362,500 + 22.5% of amount exceeding Rs. 3000 k

3,500,001 4,000,000 Rs. 475,000 + 25% of amount exceeding Rs. 3500 k

4,000,001 7,000,000 Rs. 600,000 + 27.5% of amount exceeding Rs. 4000 k

7,000,001 50,000,000 Rs. 1,425,000 + 30% of amount exceeding Rs. 7000 k

Withholding Income Tax Adjustments :-

Tax Deducted on Telephone/Mobile Phone Bills (See Section 236) If connection is in the name of taxpayer

Tax Deducted at the time of Motor Vehicle Tax Payment (See Section 234) If vehicle is registered in the name of taxpayer

Tax Deducted on Cash Withdrawals from Banks (See Section 231A) If Bank Account is opened in the name of taxpayer

Tax Deducted on Registration of New Car/Jeep (See Section 231B) If vehicle is registered in the name of taxpayer

Tax Deducted on Purchase of Air Tickets (See Section 236B) If Air Ticket is booked in the name of taxpayer name.

Gratuity Taxable Criteria :-

1. Govt employee (Totally exempt)

2. Private employee

a. If gratuity is approved by CIR (Totally exempt)

b. If gratuity is approved by FBR/Board

Tax treatment: exempt upto 200,000 from the amount of gratuity

C. If gratuity is not approved

Tax treatment: Rs.75000 or 50% of amount of gratuity whichever is lesser will be exempt from amount of gratuity

Tax Credit Adjustments

Charitable donation (Section 61) A person shall be entitled to a tax credit in respect of any sum paid, or any property given by the person in the tax year as a donation to -

(a) any board of education or any university in Pakistan established by, or under, a Federal or a Provincial law;

(b) any educational institution, hospital or relief fund established or run in Pakistan by Federal Government or a Provincial Government or a 2[Local Government]; or

(c) any non-profit organization.

Eligible Amount of charitable donation for the purposes of tax credit is lower of:

Amount of charitable donations; or

* 30% of taxable income of an individual or association of persons

* and 20% of the taxable income of a company.

Investment in Shares & Life Insurance Premium (Section 62) Eligible Amount of Investment in Shares and Life Insurance for the purposes of tax credit is lower of:

* Amount of investment in new offered shares and Life Insurance; or

* 20% of the taxable income for the tax year and Rs. 1000,000 with effect from tax year 2012.

Salary Range

Investment in Shares used above, for the purpose of tax credit means cost of acquiring:

* New shares offered to public by a public company listed on a stock exchange in Pakistan, as an original allottee; or

* Shares acquired from the Privatization Commission of Pakistan.

Investment in Life Insurance used above for the purpose of tax credit means life insurance premium paid on a policy to a Life Insurance

Company registered by the Securities and Exchange Commission of Pakistan under the Insurance Ordinance, 2000.

Tax credit for investment in Life Insurance is available only to a resident individual deriving income chargeable to tax under the head salary or income from business, and with effect from tax year 2012.

Contribution to Approved Pension Fund (Section 63) Eligible Amount of contribution or premium paid to an Approved Pension Fund for the purposes of tax credit is lower of:

* Amount of contribution or premium paid by an eligible person to an Approved Pension Fund; or

* 20% of the taxable income;

Approved Pension Fund means approved under the Voluntary Pension System Rules, 2005

Profit on Debt on House Loans (purchase/construction) (Section 64) Eligible Amount of Profit on Debt etc. for the purposes of tax credit is lower of:

* Amount of profit on debt etc.;

* 50% of the taxable income; or

* Rs. 750,000

Profit on debt etc. for the purpose of tax credit means profit or share in rent and share in appreciation of value of house paid on a loan or advance for the construction of a new house or

the acquisition of house obtained from the following:

* Scheduled bank;

* Non-banking finance institution regulated by

* Securities and Exchange Commission of Pakistan;

* Statutory body;

* Public company listed on a registered stock exchange in Pakistan; or

* The Federal Government, Provincial Government or a Local Government

Zakat / Charitable Donations

Charitable Donation (See Clause 61 of Part 1 of 2nd Schedule) Donations to certain institutions specified in Clause 61 Part I Second Schedule are straight deduction from income of the donor instead of calculating rebate at average rate of tax.

However, maximum limit on donations under this clause is 30% of taxable income in case of an individual or AOP and 20% of taxable income in case of a company.

Under the said Clause 61, condition of payment thru banking channel is not applicable.

Zakat Paid (See Section 60) (1) A person shall be entitled to a deductible allowance for the amount of any Zakat paid by the person in a tax year under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980).

(2) Sub-section (1) does not apply to any Zakat taken into account under sub-section (2) of section 40.

(3) Any allowance or part of an allowance under this section for a tax year that is not able to be deducted under section 9 for the year shall not be refunded, carried

forward to a subsequent tax year, or carried back to a preceding tax year.

Senior Citizen Tax Credit

Income tax liability of tax payer aged 60 years or more on first day of tax year is reduced by 50% provided his/her taxable income (other than from FTR)

does not exceed one million rupees (see Clause (1A) of Part III of 2nd Schedule).

Valuation of conveyance.-

The value of conveyance provided by the employer to the employee shall be taken equal to an amount as below:

i) Partly for personal and partly for official use 5% of:

(a) the cost to the employer for acquiring the motor vehicle; or,

(b) the fair market value of the motor vehicle at the commencement of the lease, if the motor vehicle is taken on lease by the employer;

ii) For personal use only 10% of:

(a) the cost to the employer for acquiring the motor vehicle; or,

(b) the fair market value of the motor vehicle at the commencement of the lease, if the motor vehicle is taken on lease

Interest Free Loan:-

Benchmark rate for Tax Years 2013 & 2014 is 10% per annum

Where a loan is made, on or after the 1st day of July, 2002, by an employer to an employee and either no profit on loan is payable by

the employee or the rate of profit on loan is less than the benchmark rate, the amount chargeable to tax to the employee under the head

Salary for a tax year shall include an amount equal to :-

a) the profit on loan computed at the benchmark rate, where no profit on loan is payable by the employee, or

b) the difference between the amount of profit on loan paid by the employee in that tax year and the amount of profit on loan computed at the benchmark rate,

as the case may be:

i) Provided that this sub-section shall not apply to such benefit arising to an employee due to waiver of interest by such employee on his account with the employer

ii) Provided further that this sub-section shall not apply to loans not exceeding five hundred thousand rupees

Medical Allowance:-

Exempt upto 10% of basic salary, if free medical treatment or hospitalization or re-imbursement of medical or hospitalization charges is not provided.

(See Clause (139)(b) of Part I of Second Schedule of ITO 2001)

Special Allowance:-

Exempt if granted to meet expenses for the performance of official duties.

(See Clause (39) of Part I of Second Schedule of ITO 2001)

Teacher or Researcher:-

A reduction of 75% of tax on income from salary is available to a full time teacher or researcher, employed in a

i) non-profit education or research institution duly recognized by HEC;

ii) a board of education or a university recognized by HEC, including government training and research institution.

(See Clause (2) of Part III of Second Schedule of ITO 2001)

If connection is in the name of taxpayer

If vehicle is registered in the name of taxpayer

If Bank Account is opened in the name of taxpayer

If vehicle is registered in the name of taxpayer

If Air Ticket is booked in the name of taxpayer name.

Tax treatment: Rs.75000 or 50% of amount of gratuity whichever is lesser will be exempt from amount of gratuity

A person shall be entitled to a tax credit in respect of any sum paid, or any property given by the person in the tax year as a donation to -

(a) any board of education or any university in Pakistan established by, or under, a Federal or a Provincial law;

(b) any educational institution, hospital or relief fund established or run in Pakistan by Federal Government or a Provincial Government or a 2[Local Government]; or

Eligible Amount of charitable donation for the purposes of tax credit is lower of:

* 30% of taxable income of an individual or association of persons

* and 20% of the taxable income of a company.

Eligible Amount of Investment in Shares and Life Insurance for the purposes of tax credit is lower of:

* Amount of investment in new offered shares and Life Insurance; or

* 20% of the taxable income for the tax year and Rs. 1000,000 with effect from tax year 2012.

Investment in Shares used above, for the purpose of tax credit means cost of acquiring:

* New shares offered to public by a public company listed on a stock exchange in Pakistan, as an original allottee; or

* Shares acquired from the Privatization Commission of Pakistan.

Investment in Life Insurance used above for the purpose of tax credit means life insurance premium paid on a policy to a Life Insurance

Company registered by the Securities and Exchange Commission of Pakistan under the Insurance Ordinance, 2000.

Tax credit for investment in Life Insurance is available only to a resident individual deriving income chargeable to tax under the head salary or income from business, and with effect from tax year 2012.

Eligible Amount of contribution or premium paid to an Approved Pension Fund for the purposes of tax credit is lower of:

* Amount of contribution or premium paid by an eligible person to an Approved Pension Fund; or

Approved Pension Fund means approved under the Voluntary Pension System Rules, 2005

Eligible Amount of Profit on Debt etc. for the purposes of tax credit is lower of:

Profit on debt etc. for the purpose of tax credit means profit or share in rent and share in appreciation of value of house paid on a loan or advance for the construction of a new house or

the acquisition of house obtained from the following:

* Non-banking finance institution regulated by

* Securities and Exchange Commission of Pakistan;

* Public company listed on a registered stock exchange in Pakistan; or

* The Federal Government, Provincial Government or a Local Government

Donations to certain institutions specified in Clause 61 Part I Second Schedule are straight deduction from income of the donor instead of calculating rebate at average rate of tax.

However, maximum limit on donations under this clause is 30% of taxable income in case of an individual or AOP and 20% of taxable income in case of a company.

Under the said Clause 61, condition of payment thru banking channel is not applicable.

(1) A person shall be entitled to a deductible allowance for the amount of any Zakat paid by the person in a tax year under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980).

(2) Sub-section (1) does not apply to any Zakat taken into account under sub-section (2) of section 40.

(3) Any allowance or part of an allowance under this section for a tax year that is not able to be deducted under section 9 for the year shall not be refunded, carried

forward to a subsequent tax year, or carried back to a preceding tax year.

Income tax liability of tax payer aged 60 years or more on first day of tax year is reduced by 50% provided his/her taxable income (other than from FTR)

does not exceed one million rupees (see Clause (1A) of Part III of 2nd Schedule).

The value of conveyance provided by the employer to the employee shall be taken equal to an amount as below:

i) Partly for personal and partly for official use 5% of:

(a) the cost to the employer for acquiring the motor vehicle; or,

(b) the fair market value of the motor vehicle at the commencement of the lease, if the motor vehicle is taken on lease by the employer;

(a) the cost to the employer for acquiring the motor vehicle; or,

(b) the fair market value of the motor vehicle at the commencement of the lease, if the motor vehicle is taken on lease

Benchmark rate for Tax Years 2013 & 2014 is 10% per annum

Where a loan is made, on or after the 1st day of July, 2002, by an employer to an employee and either no profit on loan is payable by

the employee or the rate of profit on loan is less than the benchmark rate, the amount chargeable to tax to the employee under the head

Salary for a tax year shall include an amount equal to :-

a) the profit on loan computed at the benchmark rate, where no profit on loan is payable by the employee, or

b) the difference between the amount of profit on loan paid by the employee in that tax year and the amount of profit on loan computed at the benchmark rate,

i) Provided that this sub-section shall not apply to such benefit arising to an employee due to waiver of interest by such employee on his account with the employer

ii) Provided further that this sub-section shall not apply to loans not exceeding five hundred thousand rupees

Exempt upto 10% of basic salary, if free medical treatment or hospitalization or re-imbursement of medical or hospitalization charges is not provided.

(See Clause (139)(b) of Part I of Second Schedule of ITO 2001)

Exempt if granted to meet expenses for the performance of official duties.

(See Clause (39) of Part I of Second Schedule of ITO 2001)

A reduction of 75% of tax on income from salary is available to a full time teacher or researcher, employed in a

i) non-profit education or research institution duly recognized by HEC;

ii) a board of education or a university recognized by HEC, including government training and research institution.

(See Clause (2) of Part III of Second Schedule of ITO 2001)

(b) any educational institution, hospital or relief fund established or run in Pakistan by Federal Government or a Provincial Government or a 2[Local Government]; or

Tax credit for investment in Life Insurance is available only to a resident individual deriving income chargeable to tax under the head salary or income from business, and with effect from tax year 2012.

Profit on debt etc. for the purpose of tax credit means profit or share in rent and share in appreciation of value of house paid on a loan or advance for the construction of a new house or

Donations to certain institutions specified in Clause 61 Part I Second Schedule are straight deduction from income of the donor instead of calculating rebate at average rate of tax.

However, maximum limit on donations under this clause is 30% of taxable income in case of an individual or AOP and 20% of taxable income in case of a company.

(1) A person shall be entitled to a deductible allowance for the amount of any Zakat paid by the person in a tax year under the Zakat and Ushr Ordinance, 1980 (XVIII of 1980).

(3) Any allowance or part of an allowance under this section for a tax year that is not able to be deducted under section 9 for the year shall not be refunded, carried

b) the difference between the amount of profit on loan paid by the employee in that tax year and the amount of profit on loan computed at the benchmark rate,

i) Provided that this sub-section shall not apply to such benefit arising to an employee due to waiver of interest by such employee on his account with the employer

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Private Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsДокумент48 страницPrivate Credit Solutions:: A Closer Look at The Opportunity in Emerging MarketsAljon Del Rosario100% (1)

- Exercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Документ3 страницыExercise: The Market For Foreign Exchange: BMFM 33135 Oct 2020Sylvia GynОценок пока нет

- Journal Ledger & Trial BalanceДокумент32 страницыJournal Ledger & Trial BalanceMr. Demon ExtraОценок пока нет

- ECGC Export Credit Guarantee Corp of India Summer TrainingДокумент24 страницыECGC Export Credit Guarantee Corp of India Summer TrainingPhxx619Оценок пока нет

- Banking-Industry Specific and Regional Economic Determinants of NPL - Evidence From US StateДокумент3 страницыBanking-Industry Specific and Regional Economic Determinants of NPL - Evidence From US StateChinthaka PereraОценок пока нет

- Different Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedДокумент16 страницDifferent Types of Loan Products Offered by Private Commercial Banks in Bangladesh - A Case Study On Modhumoti Bank LimitedSharmin Mehenaz TonneeОценок пока нет

- Export Import Process DocumentationДокумент13 страницExport Import Process Documentationgarganurag12Оценок пока нет

- Effects of Merchant Banking on Financial Growth of ICICIДокумент62 страницыEffects of Merchant Banking on Financial Growth of ICICIij EducationОценок пока нет

- Wildcat Capital InvestorsДокумент18 страницWildcat Capital Investorsokta hutahaeanОценок пока нет

- R2. TAX (M.L) Solution CMA May-2023 ExamДокумент5 страницR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudОценок пока нет

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент1 страницаStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGenial Manifold GroupОценок пока нет

- Axis Triple Advantage Fund Application FormДокумент8 страницAxis Triple Advantage Fund Application Formrkdgr87880Оценок пока нет

- Genealogy ReportДокумент2 страницыGenealogy Reportzhaodonghk3Оценок пока нет

- Real Estate Investments and The Inflation-Hedging Question: A ReviewДокумент10 страницReal Estate Investments and The Inflation-Hedging Question: A ReviewShanza KhalidОценок пока нет

- Accounting For Foreign Currency Transactions PDFДокумент49 страницAccounting For Foreign Currency Transactions PDFDaniel DakaОценок пока нет

- Picking Stocks and 100 To 1 PDFДокумент7 страницPicking Stocks and 100 To 1 PDFJohn Hadriano Mellon FundОценок пока нет

- April JuneДокумент15 страницApril JuneSanjivОценок пока нет

- Banking Regulations SummaryДокумент20 страницBanking Regulations SummaryGraceson Binu Sebastian100% (1)

- Compiler Additional Questions For Nov 22 ExamsДокумент18 страницCompiler Additional Questions For Nov 22 ExamsRobertОценок пока нет

- Exercise 1 Investment in AssociatesДокумент7 страницExercise 1 Investment in AssociatesJoefrey Pujadas BalumaОценок пока нет

- BANGKO SENTRAL NG PILIPINAS Exchange RateДокумент7 страницBANGKO SENTRAL NG PILIPINAS Exchange RateRodolfo CorpuzОценок пока нет

- Statement of Changes in EquityДокумент3 страницыStatement of Changes in EquitybarrylucasОценок пока нет

- Epayment SeminarДокумент5 страницEpayment Seminardheeraj_ddОценок пока нет

- Amulya Kumar Verma 26asДокумент4 страницыAmulya Kumar Verma 26asSatyendra SinghОценок пока нет

- Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder Solutions ManualДокумент26 страницFinancial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder Solutions Manualhildabacvvz100% (30)

- Assignment: Financial Management: Dividend - MeaningДокумент4 страницыAssignment: Financial Management: Dividend - MeaningSiddhant gudwaniОценок пока нет

- Apr FinalДокумент48 страницApr FinalVivek PatilОценок пока нет

- Forex Trading Machine EbookДокумент0 страницForex Trading Machine EbookMahadi MahmodОценок пока нет

- CHAPTER-15 - Bank Reconciliation System Practical QuestionsДокумент49 страницCHAPTER-15 - Bank Reconciliation System Practical QuestionsBHARAT MAHAN RAI 22BBA10031Оценок пока нет

- Account Opening DisclosuresДокумент7 страницAccount Opening DisclosuresMarcus Wilson100% (1)