Академический Документы

Профессиональный Документы

Культура Документы

Federal Taxation Week 9 Assignment

Загружено:

leelee0302Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Federal Taxation Week 9 Assignment

Загружено:

leelee0302Авторское право:

Доступные форматы

Running Head: PARTNERSHIP VS.

CORPORATION 1

Week 9: Partnership vs. Corporation

Leah M. Pasternak

Dr. Jan D. Felton

Federal Taxation

June 4, 2014

Partnership vs. Corporation 2

Partnership vs. Corporation

Compare and contrast the advantages and disadvantages inherent in electing to become a

partnership and a corporation. Indicate key aspects in which the resulting choice is likely

to impact tax obligations.

To be or not to be, that is always the question. The decision on whether to elect on

becoming a partnership or a corporation is something that every company must decide on. There

are inherent advantages and disadvantages to each, and these are outlined below.

There are some differences in personal liabilities in a corporation and a partnership. In a

corporation, a shareholder may only be held liable for any amount that they may have invested in

the corporation (Quick MBA, 2010). In a partnership, a partner may be held liable for any and all

amounts invested by all parties. Within a partnership, management decisions are handled within

and by the partners, and within a corporation the management decisions are made by the board of

directors who are elected on by the shareholders. A partnership is not required by law to take

notes from their meetings, but a corporation is required to take notes, or meeting minutes (Quick

MBA, 2010). This creates an administrative cost for the corporation that the partnership typically

does not incur.

Of course, these differences between a partnership and a corporation also bring about also

bring about tax differences as well. Within a partnership, the taxes are divided equally amongst

the partners to pay the companys taxes. A corporation is a bit different. The income taxes are

paid by the corporation, and each shareholder within the corporation is required to pay taxes on

the dividends that they have received. This is topically called the double taxation effect. If a

company were to choose to be an S Corporation they would be considered a pass-through entity

Partnership vs. Corporation 3

and therefore are not required to pay corporate taxes. For this reason, the tax liability would be

less by choosing to be a partnership or an S Corporation.

Imagine that you are a Partner at Walk Upright Company. Justify to your team

why you elected to become a partnership in an effort to minimize tax liability. Prepare a

response to the objection that this election was the best choice.

Choosing a partnership for our company Walk Upright was one of the best decisions we

could have made. There are many reasons why Walk Upright Company is best handled under a

partnership than any other type of business. The ease of creating the company under a

partnership was a perk. We saved money on state filings as well as other administrative costs that

are needed when creating a corporation. We paid no state fees, no filing fees and no franchise

taxes (BizFilings, 2013). The only expenses we paid for were our business license and permits

required in order for us to operate our business. We have superior structural flexibility with our

company.

We also have very few ongoing requirements that we must follow now that we have

Walk Upright Company. We are not required to hold annual meetings, we do not need to keep

personal assets separate from business assets and we are not required to issue partnership interest

(Latham, 2013). Another perk to us having a partnership instead of a corporation is that we only

experience one level of taxation. We are never required to pay corporate taxes, and we do not

suffer from the double taxation that all corporations experience. Instead, we experience pass-

through taxation. That is, our company taxes our viewed as an extension of us, the owners for tax

purposes. We are also able to allocate the income and loss that Walk Upright Company

experiences, any way we see appropriate. We also have the ability to make ccontributions to and

distributions from a partnership without any income tax consequence whereas a corporation only

Partnership vs. Corporation 4

experiences tax free if the transferors are in control of the company after the exchange

(BizFilings, 2013). We also do not have to calculate or pay any estimated taxes, as corporations

do.

Imagine that you are the Chief Financial Officer (CFO) at No More Ice, Inc. Justify

to your management team why you elected to become a corporation.

Our company, No More Ice, Inc. has much greater benefits of being a corporation for

several different reasons. First of all, our total assets reach well over $2,000,000 and we have

many different taxation rules and regulations we must follow. We also own 85% of Voltage, Inc.

so being a corporation has lesser tax liabilities than if we were a limited liability company or a

partnership. Our total income also exceeds $1,000,000, so being a corporation is more beneficial

than not.

Even though we are subject to the double taxation rule, we still experience great

flexibility with our taxes. We are able to use income shifting in order to obtain lower tax

brackets. We are also able to offer corporate benefits such as retirement and medical. We also

experience no limits or restrictions on the amount of capital or the operating losses that No More

Ice may carry back or forward to subsequent tax years; something that a partnership is not able to

appreciate. For our corporation, only the salaries we pay and not our profits are subject to self-

employment taxes whereas companies such as a sole proprietorship experience these types of

taxes on their earnings as well. This saves us thousands of dollars per year.

Determine whether becoming a corporation was a wise choice as a potential strategy

to minimize tax liability as a result. Provide support for your rationale.

I believe that becoming a corporation was a wise choice to minimize tax liability. No

More Ice, Inc. was able to hold their loss on the stock of Leash Corp. as a short-term capital loss,

Partnership vs. Corporation 5

and is able to keep this for a three year carryback period. No More Ice, Inc. was also able to use

the Alternative Minimum Tax exemption of $40,000, which helped decrease their tax liability

greatly. No More Ice, Inc. was also able to take the dividends received deduction from the

companies it owned 20% or less in dividend income, such as AT&T Corp. and Dell Corp. No

More Ice was also able to minimize tax liability by taking 100% of the dividends received

deduction for Voltage, Inc. There are also benefits experienced because of the related

corporations rule and therefore are not taxed multiple times for multiple companies. There is

only one limit provided for each taxable income bracket.

Analyze the steps that the leadership in a partnership or a corporation must take in

order to change the entitys existing election. Provide examples of circumstance under

which changing the existing election would be appropriate. Indicate how this election

change, once complete, may either generate a tax liability or be a benefit. Provide support

for your rationale.

If your company is an LLC and would prefer to be classified as a corporation it must file

Form 2553, Entity Classification Election instead of Form 8832 (IRS, 2013). If the LLC elects to

be classified as a corporation by filing Form 8832, a copy of the LLC's Form 8832 must be

attached to the federal income tax return of each direct and indirect owner of the LLC for the tax

year of the owner that includes the date on which the election took effect (IRS, 2013). If the

company chooses to be classified as a corporation it must file a corporation tax return and pay

corporate taxes. Once the company changes its classification it must wait at least 60 months

before it can elect to change its classification again. If the company chooses to change its

classification from a partnership to a corporation, the company will be treated as if the

partnership contributed all of its assets and liabilities to the corporation in exchange for stock.

Partnership vs. Corporation 6

The partnership is then required to be immediately liquidated by distributing the stock to its

partners.

Partnership vs. Corporation 7

Resources

U. S. Internal Revenue Service. (2013).Limited Liability Companies (IRS Publication No. 3042).

Washington, DC: U.S. Government Printing Office.

Latham, A. (2013). The tax benefits of forming a general partnership. Small Business Chronicles,

Retrieved from http://smallbusiness.chron.com/tax-benefits-forming-general-partnership-

19353.html

BizFilings. (2013). Choosing the right type of business partnership [Online forum comment].

Retrieved from http://www.bizfilings.com/learn/form-partnership.aspx

Quick MBA. (2010). [Web log message]. Retrieved from

http://www.quickmba.com/law/partnership/general/

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Test Bank Chapter 11Документ25 страницTest Bank Chapter 11leelee0302Оценок пока нет

- Capstone Week 3 AssignmentДокумент7 страницCapstone Week 3 Assignmentleelee0302Оценок пока нет

- Chapter 6 Cost AccountingДокумент11 страницChapter 6 Cost Accountingleelee0302Оценок пока нет

- ACC 403 Homework CH 3 and 4Документ5 страницACC 403 Homework CH 3 and 4leelee0302Оценок пока нет

- ACC 403 Homework CH 10 and 11Документ5 страницACC 403 Homework CH 10 and 11leelee0302100% (1)

- Chapter 4 Cost AccountingДокумент14 страницChapter 4 Cost Accountingleelee0302Оценок пока нет

- ACC 403 Homework CH 7 and 8Документ2 страницыACC 403 Homework CH 7 and 8leelee0302Оценок пока нет

- CH 6 Cost AccountingДокумент4 страницыCH 6 Cost Accountingleelee0302Оценок пока нет

- Week 7 Homework Problems & AnswersДокумент4 страницыWeek 7 Homework Problems & Answersleelee0302Оценок пока нет

- Cost AccountingДокумент4 страницыCost Accountingleelee0302Оценок пока нет

- ACC410 CH 10 QuizДокумент8 страницACC410 CH 10 Quizleelee0302Оценок пока нет

- Advanced Accounting Chapter 5Документ21 страницаAdvanced Accounting Chapter 5leelee030275% (4)

- Chapter 3 Question 1Документ2 страницыChapter 3 Question 1leelee0302Оценок пока нет

- Week3 HomeworkДокумент6 страницWeek3 Homeworkleelee0302Оценок пока нет

- ACC 410 Homework CH 1Документ2 страницыACC 410 Homework CH 1leelee0302100% (1)

- Chapter 4 Question 3Документ3 страницыChapter 4 Question 3leelee0302Оценок пока нет

- Chapter 14 QuizДокумент4 страницыChapter 14 Quizleelee0302Оценок пока нет

- Chapter 14 QuizДокумент4 страницыChapter 14 Quizleelee0302Оценок пока нет

- Chapter 3 Homework Problem 2Документ2 страницыChapter 3 Homework Problem 2leelee0302Оценок пока нет

- Chapter 4 Question 3 DataДокумент1 страницаChapter 4 Question 3 Dataleelee0302Оценок пока нет

- Cost Acct CH 2 HW 2Документ2 страницыCost Acct CH 2 HW 2leelee0302Оценок пока нет

- ACC 401 Homework CH 4Документ4 страницыACC 401 Homework CH 4leelee03020% (1)

- ACC 317 Homework CH 28Документ1 страницаACC 317 Homework CH 28leelee0302Оценок пока нет

- Cost Acct CH 2 HW 1Документ2 страницыCost Acct CH 2 HW 1leelee0302Оценок пока нет

- ACC 317 Homework CH 25Документ1 страницаACC 317 Homework CH 25leelee0302Оценок пока нет

- ACC410 CH 10 QuizДокумент8 страницACC410 CH 10 Quizleelee0302Оценок пока нет

- Final Exam Part 1Документ9 страницFinal Exam Part 1leelee0302Оценок пока нет

- ACC 317 Homework CH 28Документ1 страницаACC 317 Homework CH 28leelee0302Оценок пока нет

- ACC 410 Homework CH 1Документ2 страницыACC 410 Homework CH 1leelee0302100% (1)

- Chapter-4 Debits, Credits, and The Trial BalanceДокумент17 страницChapter-4 Debits, Credits, and The Trial BalancedebojyotiОценок пока нет

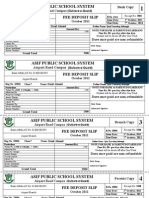

- Asif Public School System: Fee Deposit SlipДокумент1 страницаAsif Public School System: Fee Deposit SlipIrfan YousafОценок пока нет

- LIberty Power Tech - RR - 74 - 10861 - 10-Nov-22Документ5 страницLIberty Power Tech - RR - 74 - 10861 - 10-Nov-22Kristian MacariolaОценок пока нет

- 611 Banker Resignations CREDIT: AMERICAN KABUKIДокумент58 страниц611 Banker Resignations CREDIT: AMERICAN KABUKIE1ias100% (1)

- Bernanke - 1983 - Non-Monetary Effects of The Financial Crisis in The Propagation of The Great DepressionДокумент21 страницаBernanke - 1983 - Non-Monetary Effects of The Financial Crisis in The Propagation of The Great Depressionyezuh077Оценок пока нет

- Variable Production Overhead Variance (VPOH)Документ9 страницVariable Production Overhead Variance (VPOH)Wee Han ChiangОценок пока нет

- DeKalb FreePress: 06-14-19Документ24 страницыDeKalb FreePress: 06-14-19Donna S. SeayОценок пока нет

- BKM CH 06 Answers W CFAДокумент11 страницBKM CH 06 Answers W CFAKyThoaiОценок пока нет

- Cag ReportДокумент147 страницCag Reportsagar bansalОценок пока нет

- Final-Term Quiz Mankeu Roki Fajri 119108077Документ4 страницыFinal-Term Quiz Mankeu Roki Fajri 119108077kota lainОценок пока нет

- Depew v. D. Andrew Beal Et AlДокумент21 страницаDepew v. D. Andrew Beal Et AlbealbankfraudОценок пока нет

- Money (Part II) Please Go Over The Following Terms and Their DefinitionsДокумент4 страницыMoney (Part II) Please Go Over The Following Terms and Their DefinitionsDelia LupascuОценок пока нет

- Energy Access Assesment - PakistanДокумент54 страницыEnergy Access Assesment - PakistanZoune ArifОценок пока нет

- SwiggyДокумент9 страницSwiggyEsha PandyaОценок пока нет

- Submitted To: Submitted By:: Dr. Bobby B.Pandey Aniket Sao Lecturer Roshan Kumar Vijay Bharat Ravi Lal UraonДокумент15 страницSubmitted To: Submitted By:: Dr. Bobby B.Pandey Aniket Sao Lecturer Roshan Kumar Vijay Bharat Ravi Lal Uraonales_dasОценок пока нет

- Working Capital NikunjДокумент82 страницыWorking Capital Nikunjpatoliyanikunj002Оценок пока нет

- Economic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingДокумент7 страницEconomic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingSunil Kumar SahooОценок пока нет

- London Gold Pool Aftermath From Its CollapseДокумент18 страницLondon Gold Pool Aftermath From Its CollapseLarryDavid1001Оценок пока нет

- Group Five Efficient Capital Market TheoryДокумент21 страницаGroup Five Efficient Capital Market TheoryAmbrose Ageng'aОценок пока нет

- Second List NRIДокумент3 страницыSecond List NRISrishti PandeyОценок пока нет

- Strategic Management - MeezanДокумент9 страницStrategic Management - MeezanNida ShahzadОценок пока нет

- Videocon Case BriefДокумент8 страницVideocon Case BriefSejal SharmaОценок пока нет

- Financial Accounting 09 PDFДокумент48 страницFinancial Accounting 09 PDFGoutham BaskerОценок пока нет

- The PPDA Act 2003 (Uganda)Документ32 страницыThe PPDA Act 2003 (Uganda)Eric Akena100% (5)

- PBCom v. CA, 195 SCRA 567 (1991)Документ21 страницаPBCom v. CA, 195 SCRA 567 (1991)inno KalОценок пока нет

- Basel IV and Proportionality Initiatives enДокумент12 страницBasel IV and Proportionality Initiatives enJune JuneОценок пока нет

- Eco499a 1 5Документ32 страницыEco499a 1 5Usama WaqarОценок пока нет

- EJERCITO Vs SANDIGANBAYANДокумент2 страницыEJERCITO Vs SANDIGANBAYANeОценок пока нет

- The Basic Tools of FinanceДокумент25 страницThe Basic Tools of FinanceVivek KediaОценок пока нет

- Departmental Interpretation and Practice Notes No. 34 (Revised)Документ14 страницDepartmental Interpretation and Practice Notes No. 34 (Revised)Difanny KooОценок пока нет