Академический Документы

Профессиональный Документы

Культура Документы

Integrated Siting System

Загружено:

Sahrish Jaleel ShaikhИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Integrated Siting System

Загружено:

Sahrish Jaleel ShaikhАвторское право:

Доступные форматы

Integrated

Siting

Systems

Uneeb ul haq Mughal 16110030

Sahrish Jaleel Shaikh 16110299

Mehroze Munawar 16110197

Myra Iltefat 16110278

Integrated Siting Systems, Inc. has developed a satellite-based tracking system that

continuously updates and displays the location of every vehicle in its network. A recently signed

contract presents new technical challenges that may make the normally installed system

inadequate. While it is possible to augment the system so that it will definitely work, doing so is

costly. Alternatively, it is possible to conduct an imperfect test that will improve the company's

information about whether the normal system will work.

Current simulations indicate a 90% chance that the standard system will meet the performance

requirements of the contract. Better estimates of the environmental parameters that

determine this factor could be obtained and a new series of simulations could be run for

$50,000. The System Design team has determined that a standard system will work 96% of the

time if it were to pass this new test and, even if it failed there would be a 72% chance that it

would still work anyway.

Influence diagram (Exhibit 4)

The two decision nodes (represented by the rectangles) pertain to the following two decisions

1) Whether the test should be conducted

2) Which kind (standard or robust) of system to install for the new project

The two chance nodes (represented by the ovals) pertain to the following chance events

1) The results of the test

2) Whether the system turns out to be good or bad

The diamond represents the final target i.e the profit/ payoff.

The condition of the system and the decision of whether or not to implement the test will

determine the test result. The test result in turn will influence ISSIs decision of which type of

system to install. The decision of the system type along with the actual condition of the system

(good/bad) will finally determine what the final payoff will be.

Intangible Costs:

Contract terms stipulate that ISSIs obligations should the system fail include pre-specified

penalties for a delay in system launch time and pulling and replacing the units with more

powerful processors and receivers. The complete and total incremental cost resulting from this

in-field replacement project would be $400,000. However, this does not include any intangible

costs of lost reputation resulting from our first major failure, negative media coverage, and any

additional detracting factors. It is notable that if this cost of lost reputation can be quantified,

then this will add to the $400,000 value mentioned above and the decision tree will be made

accordingly then. The decision tree prepared for this analysis does not take into consideration

this implicit cost.

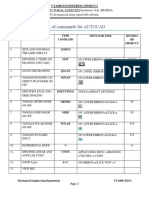

The decision tree (Exhibit 1) shows that two decisions have to be made in succession.

The first decision involves whether or not to conduct the test. If the test is conducted, a cost of

$ 50,000 is incurred. There can be two outcomes of the test if it is conducted:

The system passes the test (the probability for this as given by the case is 0.75).

The system fails the test (the probability for this as given by the case is 0.25).

Based on the test results, a second decision will be made pertaining to the type of system that

will be installed (standard or robust).

If the test is failed and the robust system is installed the profit earned will be $150,000

(850,000-700,000).

If the test is failed and the standard system is installed the revenue earned will be equal

to $300,000 (850,000-550,000). The overall profit however will depend on whether the

system turns out to be good or bad. If the system is good, no cost will be incurred so the

net profit will be equal to 250,000 (300,000-5000). The probability of this occurring

(P(System good / Fails test)) is 72%.If the system is bad, an incremental cost of

upgrading in the field from the standard to the roust system will be incurred. This cost

equals $400,000 and so the net profit will be $-150,000 (300,000-5000-400,000). The

probability of this occurring is 0.28 (P(System bad / Fails test)).

If the test is passed and the robust system is installed the profit earned will be equal to

$150,000 (850,000-700,000).

If the test is passed and the standard system is installed the revenue earned will be

equal to$300,000 (850,000-550,000). The overall profit, however will depend on

whether the system turns out to be good or bad.. If the system is good, no cost will be

incurred so the net profit will be equal to 250,000 (300,000-5000). The probability of

this occurring (P(System good / Passes test)) is 0.96. If the system is bad, an incremental

cost of upgrading in the field from the standard to the robust system will be incurred.

This cost equals $400,000 and so the net profit will be $-150,000 (300,000 -5000-

400,000). The probability of this occurring is 0.04 (P(System bad / Passes test)).

Installation of the standard system generates higher payoffs whether the test passes or fails so

that should be the option to go with in both cases, as shown by the decision tree. The EMV of

conducting the test will be equal to $210,000.

Even if the test is not conducted, either the standard system or the robust system will be

installed.

If the robust system is installed the profit earned will be $150,000 (850,000-700,000).

If the standard system is installed the revenue earned will be $300,000. The profit

earned will again depend on whether the system is good or bad. If the system is good,

no cost will be incurred so the net profit will be equal to $250,000. The probability for

this will be 0.9 (P(System Good)). If the system is bad, an incremental cost of $400,000

will cause a loss of $150,000. The probability for this will be 0.1 (P (System Bad)).

Installation of the standard system will generate higher payoff so that option will be selected in

this case too. The EMV of not conducting the test will be equal to $260,000.

The expected value of imperfect information in this case is the difference of the EMV value

obtained by incorporating the probabilities associated with new information gathered by tests

and the EMV value obtained without incorporating the information obtained from tests.

According to the calculations, EVII is equal to 0 (=260,000-260,000). This value-of-information

suggests that you should not spend anything to obtain this imperfect information because its

not worth the cost. In both the cases, the EMV remains the same i.e. information gathered does

not influence the decision that you should make.

The risk profiles in Exhibit 3 also support the decision of not taking the test. Probability chart in

risk profile shows almost same dispersion in the payoffs but the decision of taking test has

lower values (-150,000 and 250,000) as compared to the decision of not taking the test (-

100,000 and 350,000).

Moreover in cumulative risk profile chart, as decision of taking test lies always to the left of not

taking test and there is space in between them i.e. they do not perfectly overlap, we can say

that Decision of taking test is stochastically dominated by decision of not taking the test. This

result is important as it clearly rules out the option of taking the test and hence helps us to save

the cost and time of designing the test.

Optimum Strategy

ISSI should not conduct the test and it should install the standard system for the new contract

since these options have a higher EMV

Appendix___________________________________________________________________

Exhibit 1

Exhibit 2

Exhibit 3

Exhibit 4

Вам также может понравиться

- Toyota Case StudyДокумент19 страницToyota Case StudyDat BoiОценок пока нет

- Case SolutionДокумент20 страницCase SolutionKhurram Sadiq (Father Name:Muhammad Sadiq)Оценок пока нет

- Lesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case StudiesДокумент5 страницLesser Antilles Lines - The Island of San Huberto Case Solution and Analysis, HBR Case Study Solution & Analysis of Harvard Case Studiesthetpainghein one0% (1)

- Report 2Документ4 страницыReport 2Trang PhamОценок пока нет

- Kanthal CaseДокумент5 страницKanthal CaseMonica Rosa LinaОценок пока нет

- Frequent FliersДокумент4 страницыFrequent Fliersarchit_shrivast908467% (3)

- Bayonne Packaging, Inc - Case Solution QualityДокумент19 страницBayonne Packaging, Inc - Case Solution QualityCheenu JainОценок пока нет

- Curled Metal CaseДокумент5 страницCurled Metal CaseGuo YuОценок пока нет

- Case-Sports ObermeyerДокумент56 страницCase-Sports ObermeyerSiddharth MehtaОценок пока нет

- Ccbe CASE Presentation: Group 2Документ13 страницCcbe CASE Presentation: Group 2Rakesh SethyОценок пока нет

- Markstrat Report Round 0-3 Rubicon BravoДокумент4 страницыMarkstrat Report Round 0-3 Rubicon BravoDebadatta RathaОценок пока нет

- DhahranДокумент4 страницыDhahranTalha ZubairОценок пока нет

- Balancing Process Capacity - .Com - Microsoft.word - Openxmlformats.wordprocessingmlДокумент2 страницыBalancing Process Capacity - .Com - Microsoft.word - Openxmlformats.wordprocessingmlswarnima biswariОценок пока нет

- HubSpot SummaryДокумент13 страницHubSpot SummaryRifqi Al-GhifariОценок пока нет

- Design by Kate: The Power of Direct SalesДокумент8 страницDesign by Kate: The Power of Direct SalesSaurabh PalОценок пока нет

- Eli LДокумент6 страницEli LKaruna GaranОценок пока нет

- Bridgeton HWДокумент3 страницыBridgeton HWravОценок пока нет

- CiscoДокумент80 страницCiscoAnonymous fEViTz3v6Оценок пока нет

- SDM - Case-Soren Chemicals - IB Anand (PGPJ02027)Документ6 страницSDM - Case-Soren Chemicals - IB Anand (PGPJ02027)AnandОценок пока нет

- Accounting For The Intel Pentium Chip Flaw - QuestionsДокумент1 страницаAccounting For The Intel Pentium Chip Flaw - QuestionsShaheen MalikОценок пока нет

- Huron Automotive Company ExcelllДокумент6 страницHuron Automotive Company Excelllmaximus0903Оценок пока нет

- Mis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPДокумент3 страницыMis Case Submission: CISCO SYSTEMS, Inc.: Implementing ERPMalini RajashekaranОценок пока нет

- Baguette Galore International Ppts FinalДокумент23 страницыBaguette Galore International Ppts FinalSadaf KazmiОценок пока нет

- Adobe Case Study: Launching Creative Suite 3Документ11 страницAdobe Case Study: Launching Creative Suite 3sarangpetheОценок пока нет

- Crocs Inc.: Team MembersДокумент6 страницCrocs Inc.: Team MembersKshitishОценок пока нет

- Management Control System - Final AssignmentДокумент5 страницManagement Control System - Final Assignmentkollo christine jennyferОценок пока нет

- Shouldice Hospitals CanadaДокумент21 страницаShouldice Hospitals CanadaNeel KapoorОценок пока нет

- Target CorporationДокумент20 страницTarget CorporationAditiPatilОценок пока нет

- Curled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionДокумент13 страницCurled Metal Inc.-Case Discussion Curled Metal Inc. - Case DiscussionSiddhant AhujaОценок пока нет

- Avg. Daily Demand No of Days in MonthДокумент64 страницыAvg. Daily Demand No of Days in MonthNishantShah0% (2)

- Foldrite Furniture Company: CASE StudyДокумент4 страницыFoldrite Furniture Company: CASE StudyJapkirat Oberai0% (1)

- Symalit FEP 1000 Product Data SheetДокумент1 страницаSymalit FEP 1000 Product Data SheetandreshuelvaОценок пока нет

- Exercise 1 SolnДокумент2 страницыExercise 1 Solndarinjohson0% (2)

- Donner Company 2Документ6 страницDonner Company 2Nuno Saraiva0% (1)

- GE Health Care Case: Executive SummaryДокумент4 страницыGE Health Care Case: Executive SummarykpraneethkОценок пока нет

- Barilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryДокумент3 страницыBarilla Spa (Hbs 9-694-046) - Case Study Submission: Executive SummaryRichaОценок пока нет

- Levis Personal PairДокумент6 страницLevis Personal Pairarijit16Оценок пока нет

- CMI Vs Conventional Pads: Curled Metal Inc. Group - 15Документ2 страницыCMI Vs Conventional Pads: Curled Metal Inc. Group - 15Malini RajashekaranОценок пока нет

- Mars IncorporatedДокумент11 страницMars IncorporatedSanthosh Kumar Setty100% (2)

- Culinarian CookwareДокумент5 страницCulinarian CookwaremayurmachoОценок пока нет

- Oberoi Hotels: Train Whistle in The Tiger Reserve: Assignment Case ReportДокумент7 страницOberoi Hotels: Train Whistle in The Tiger Reserve: Assignment Case ReportJyotsna JeswaniОценок пока нет

- Sherman Motor CompanyДокумент5 страницSherman Motor CompanyshritiОценок пока нет

- Kanthal 2Документ3 страницыKanthal 2Ramesh MandavaОценок пока нет

- A Note On Leveraged RecapitalizationДокумент5 страницA Note On Leveraged Recapitalizationkuch bhiОценок пока нет

- QualtricsДокумент3 страницыQualtricsSaleem MunawarОценок пока нет

- Diagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?Документ2 страницыDiagnose The Underlying Cause of The Difficulties That The JITD Program Was Created To Solve. What Are The Benefits and Drawbacks of This Program?SARTHAK NAVALAKHA100% (1)

- AssgmintДокумент4 страницыAssgmintArooj HectorОценок пока нет

- HLL Distribution ChannelДокумент2 страницыHLL Distribution ChannelKunj ShahОценок пока нет

- American Connector Company: Case AnalysisДокумент5 страницAmerican Connector Company: Case AnalysisSam SamОценок пока нет

- Beer GameДокумент17 страницBeer GameDeepak S DixitОценок пока нет

- AJAX OriginalДокумент7 страницAJAX Originalreva_radhakrish1834Оценок пока нет

- Chemical Bank FinalДокумент21 страницаChemical Bank FinalMonisha SharmaОценок пока нет

- IMAGE InternationalДокумент4 страницыIMAGE InternationalJohann Barnaby RubioОценок пока нет

- Classic PenДокумент15 страницClassic PenAnkur MittalОценок пока нет

- Destin Brass ProductДокумент5 страницDestin Brass ProductRamalu Dinesh ReddyОценок пока нет

- Age Experience in SF Overall Work Ex Region Positives NegativesДокумент6 страницAge Experience in SF Overall Work Ex Region Positives NegativesireneОценок пока нет

- Sealed Air Corporation's Leveraged Recapitalization (A)Документ7 страницSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaОценок пока нет

- Issi 1Документ5 страницIssi 1Ronnie Mcguire0% (1)

- Midterm 1 Questions - AnswersДокумент8 страницMidterm 1 Questions - AnswerssokucuОценок пока нет

- RBT Cause-Effect Graphing2Документ12 страницRBT Cause-Effect Graphing2Ranjitha BasavarajОценок пока нет

- Children in The PictureДокумент18 страницChildren in The PictureSahrish Jaleel ShaikhОценок пока нет

- Free Markets and MoralityДокумент9 страницFree Markets and MoralitySahrish Jaleel ShaikhОценок пока нет

- EE 471-CS471-CS573 Computer Networks-Zartash AfzalДокумент3 страницыEE 471-CS471-CS573 Computer Networks-Zartash AfzalSahrish Jaleel ShaikhОценок пока нет

- Open Uri20140316 19925 Iao1h2Документ15 страницOpen Uri20140316 19925 Iao1h2Sahrish Jaleel ShaikhОценок пока нет

- EE 471-CS471-CS573 Computer Networks-Zartash AfzalДокумент3 страницыEE 471-CS471-CS573 Computer Networks-Zartash AfzalSahrish Jaleel ShaikhОценок пока нет

- ACF 321 - Strategic Management Accounting & Control SystemsДокумент3 страницыACF 321 - Strategic Management Accounting & Control SystemsSahrish Jaleel ShaikhОценок пока нет

- My PartДокумент3 страницыMy PartSahrish Jaleel ShaikhОценок пока нет

- PDFДокумент2 925 страницPDFSahrish Jaleel ShaikhОценок пока нет

- Instrumental Variables & 2SLS: y + X + X + - . - X + U X + Z+ X + - . - X + VДокумент21 страницаInstrumental Variables & 2SLS: y + X + X + - . - X + U X + Z+ X + - . - X + VSahrish Jaleel ShaikhОценок пока нет

- AssumptionsДокумент3 страницыAssumptionsSahrish Jaleel ShaikhОценок пока нет

- 7% After Tax Cost of Debt 4.20 %Документ2 страницы7% After Tax Cost of Debt 4.20 %Sahrish Jaleel ShaikhОценок пока нет

- Sq. Feet (Sq. Feet) 2 Price Estimated Obs (In 1000s) (In 1,000,000s) (In $1000s) PriceДокумент4 страницыSq. Feet (Sq. Feet) 2 Price Estimated Obs (In 1000s) (In 1,000,000s) (In $1000s) PriceSahrish Jaleel ShaikhОценок пока нет

- Sales: Prediction Intervals Created Using Standard Error SДокумент1 страницаSales: Prediction Intervals Created Using Standard Error SSahrish Jaleel ShaikhОценок пока нет

- DiamondsДокумент1 страницаDiamondsSahrish Jaleel ShaikhОценок пока нет

- Dat9 15Документ1 страницаDat9 15Sahrish Jaleel ShaikhОценок пока нет

- Latent Graph Diffusion A Unified Framework For Generation and Prediction On GraphsДокумент21 страницаLatent Graph Diffusion A Unified Framework For Generation and Prediction On GraphslinkzdОценок пока нет

- Advanced Statistics Course SyllabusДокумент7 страницAdvanced Statistics Course SyllabusKristina PabloОценок пока нет

- Problem Set 3 (Solution)Документ5 страницProblem Set 3 (Solution)Mark AstigОценок пока нет

- Lab Report 5Документ11 страницLab Report 5Muhammad SohaibОценок пока нет

- Computer Science 10th Class Chapter 01 Short Questions AnswersДокумент7 страницComputer Science 10th Class Chapter 01 Short Questions AnswersHamza Niaz100% (3)

- Optimum Design PrinciplesДокумент3 страницыOptimum Design PrinciplesJen Chavez100% (1)

- Frequency Distribution Table GraphДокумент10 страницFrequency Distribution Table GraphHannah ArañaОценок пока нет

- Standard Test Methods For Fire Tests of Building Construction and Materials E 119 - 07Документ22 страницыStandard Test Methods For Fire Tests of Building Construction and Materials E 119 - 07Frenzy BritoОценок пока нет

- Course SyllabusДокумент4 страницыCourse SyllabusAndrew KimОценок пока нет

- Data Structures Algorithms and Applications in C by Sartraj SahaniДокумент826 страницData Structures Algorithms and Applications in C by Sartraj SahaniMohammed Nassf100% (1)

- ME - R19 - 170 PagesДокумент170 страницME - R19 - 170 PagesKanchiSrinivasОценок пока нет

- Math 256 Statistics Spring 2011Документ5 страницMath 256 Statistics Spring 2011Laksamana NusantaraОценок пока нет

- Calculus PDF Notes 156pages59Документ13 страницCalculus PDF Notes 156pages59Pardeep Singh100% (1)

- Liceo de Pulilan CollegesДокумент2 страницыLiceo de Pulilan Collegesjv_cindyОценок пока нет

- Mphasis Aptitude Questions AnswersДокумент11 страницMphasis Aptitude Questions Answersmaccha macchaОценок пока нет

- Ip AdaptorДокумент16 страницIp Adaptorlaure9239Оценок пока нет

- Full Download Ebook Ebook PDF Longitudinal Data Analysis by Donald Hedeker PDFДокумент41 страницаFull Download Ebook Ebook PDF Longitudinal Data Analysis by Donald Hedeker PDFsarah.steir690100% (42)

- Resolução Do Capítulo 4 - Equilíbrio de Corpos Rígidos PDFДокумент231 страницаResolução Do Capítulo 4 - Equilíbrio de Corpos Rígidos PDFMalik PassosОценок пока нет

- Blended-Learning-Plan-Form (Mathematics 7)Документ2 страницыBlended-Learning-Plan-Form (Mathematics 7)KarlzОценок пока нет

- Central Force Problem: Reduction of Two Body ProblemДокумент7 страницCentral Force Problem: Reduction of Two Body ProblemParasIvlnОценок пока нет

- GATE ECE Solved Paper - 2005Документ24 страницыGATE ECE Solved Paper - 2005Shashi KanthОценок пока нет

- AI - Lecture 2 - Uninformed SearchДокумент20 страницAI - Lecture 2 - Uninformed SearchHunterxHunter03Оценок пока нет

- Physic Ss2 2019Документ4 страницыPhysic Ss2 2019sulayajannyОценок пока нет

- Chapter2 Sampling Simple Random SamplingДокумент24 страницыChapter2 Sampling Simple Random SamplingDr Swati RajОценок пока нет

- Lec 10Документ4 страницыLec 10RKD CinemaОценок пока нет

- List of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareДокумент15 страницList of Commands For Autocad: Cad Lab Tutorial Exercises Instructor: S.K. Sharma To Be Practiced Using Autocad SoftwareShakeelОценок пока нет

- Notes On Absolutely Continuous Functions of Several VariablesДокумент16 страницNotes On Absolutely Continuous Functions of Several VariablesSufyanОценок пока нет

- Eqps + Notes (TCS)Документ92 страницыEqps + Notes (TCS)vinayak pawarОценок пока нет

- Final Quiz 2 4Документ4 страницыFinal Quiz 2 4Erick GarciaОценок пока нет

- Mastercam 2017 Handbook Volume 3 SAMPLEДокумент32 страницыMastercam 2017 Handbook Volume 3 SAMPLEsekhon875115Оценок пока нет