Академический Документы

Профессиональный Документы

Культура Документы

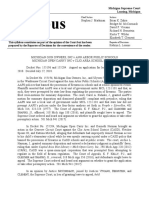

Snyder 2013 Tax Return

Загружено:

Detroit Free PressАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Snyder 2013 Tax Return

Загружено:

Detroit Free PressАвторское право:

Доступные форматы

1040

2013 U.S. Individual Income Tax Return

Filing Status

Exemptions

Income

Adjusted

Gross

Income

You Spouse

1 4

2

3 5

6a Yourself. If someone can claim you as a dependent, do not check box 6a

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Dependents:

d

7 7

8a Taxable interest. Attach Schedule B if required

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8a

b Tax-exempt interest. Do not include on line 8a

. . . . . . . . . . . . . . . . . . . .

8b Attach Form(s)

W-2 here. Also

9a 9a

attach Forms

b 9b

W-2G and

10 10

1099-R if tax

11 11 was withheld.

12 12

13 13

14 14

15a 15a b 15b

16a 16a b 16b

17 17

18 18

19 19

20a 20a b 20b

21 21

22 22

23 23

24

24

25 25

26 26

27 27

28 28

29 29

30 30

31a 31a

32 32

33 33

34

b

34

35

36 36

37

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

F

o

r

m

Make sure the SSN(s) above

and on line 6c are correct.

Check only one

box.

If more than four

dependents, see

instructions and

Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Ordinary dividends. Attach Schedule B if required

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxable refunds, credits, or offsets of state and local income taxes

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Alimony received

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Business income or (loss). Attach Schedule C or C-EZ

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you did not

Capital gain or (loss). Attach Schedule Dif required. If not required, check here u

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

get a W-2,

Other gains or (losses). Attach Form 4797

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

see instructions.

IRA distributions

. . . . . . . . . . . . . .

Taxable amount

. . . . . . . . . . . . .

Pensions and annuities

. . . . . .

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

. . . . . . . . . . .

Farm income or (loss). Attach Schedule F

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unemployment compensation

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Social security benefits

. . . . . . . . . .

Other income. List type and amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Combine the amounts in the far right column for lines 7 through 21. This is your total income

Educator expenses

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

IRA deduction

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Student loan interest deduction

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tuition and fees. Attach Form 8917

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Health savings account deduction. Attach Form 8889

. . . . . . . . . . . . . .

Moving expenses. Attach Form 3903

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deductible part of self-employment tax. Attach Schedule SE

. . . . . .

Self-employed health insurance deduction

. . . . . . . . . . . . . . . . . . . . . . . . .

Self-employed SEP, SIMPLE, and qualified plans

. . . . . . . . . . . . . . . . . .

Penalty on early withdrawal of savings

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Alimony paid Recipient's SSN u

Add lines 23 through 35

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subtract line 36 from line 22. This is your adjusted gross income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Department of the TreasuryInternal Revenue Service (99)

IRS Use OnlyDo not write or staple in this space.

For the year Jan. 1Dec. 31, 2013, or other tax year beginning , 2013, ending , 20 See separate instructions.

Your first name and initial Last name

If a joint return, spouse's first name and initial Last name

Home address (number and street). If you have a P.O. box, see instructions. Apt. no.

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Head of household (with qualifying person). (See instructions.) If

Single

the qualifying person is a child but not your dependent, enter this

Married filing jointly (even if only one had income)

child's name here. u

Married filing separately. Enter spouse's SSN above Qualifying widow(er) with dependent child

and full name here. u

if

child under

age 17 qual.

relationship to you tax credit social security number

First name Last name (see instr.)

Wages, salaries, tips, etc. Attach Form(s) W-2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Qualified dividends

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ

. . . . .

Form 1040 (2013)

DAA

u

u

Your social security number

Spouse's social security number

Boxes checked

on 6a and 6b

No. of children

on 6c who:

(4)

(3) Dependent's

lived with you

(2) Dependent's

did not live with

you due to divorce (1)

or separation

(see instructions)

Dependents on 6c

not entered above

Add numbers on

lines above u

37

Domestic production activities deduction. Attach Form 8903

. . . . . . .

35

p

check here u

Taxable amount

. . . . . . . . . . . . .

Taxable amount

. . . . . . . . . . . . .

OMB No. 1545-0074

Foreign country name

Presidential Election Campaign

Check here if you, or your spouse

if filing jointly, want $3 to go to this

fund. Checking a box below will

not change your tax or refund. Foreign province/state/county Foreign postal code

}

for child

RICHARD D SNYDER

SUSAN J SNYDER

2016 VALLEYVIEW DRIVE

ANN ARBOR MI 48105

X

X

X

2

1

3

110,430

10,014

21,971

275,541

159,168

-3,000

87

1,414

PORTFOLIO INCOME FROM K-1 125

394,611

1

1

394,610

deduction, check here

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

07

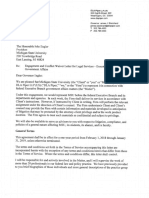

Itemized Deductions

2013

and

Dental

Expenses

Taxes You

Paid

Interest

You Paid

Gifts to

Charity

Casualty and

Theft Losses

Job Expenses

and Certain

Miscellaneous

Deductions

Other

Miscellaneous

Deductions

Total

Itemized

Deductions

(Form 1040)

u Information about Schedule A and its separate instructions is at www.irs.gov/schedulea.

Caution. Do not include expenses reimbursed or paid by others.

1 1

2 2

3

3

4 4

5

5

6 6

7 7

8

8

9 9

10 10

11

Note.

11

12

12

13

14

15 15

16

16

17

17

18 18

19 19

20 20

21

21

22 22

23

23

24 24

25 25

26 26

27 27

28

28

For Paperwork Reduction Act Notice, see Form 1040 instructions. Schedule A (Form 1040) 2013

Medical and dental expenses (see instructions)

. . . . . . . . . . . . . . . . . . . .

Enter amount fromForm1040, line 38

Multiply line 2 by 10% (.10). But if either you or your spouse was

Subtract line 3 from line 1. If line 3 is more than line 1, enter -0-

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State and local (check only one box):

Real estate taxes (see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Personal property taxes

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other taxes. List type and amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 5 through 8

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Home mortgage interest and points reported to you on Form1098

. . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Your mortgage

Points not reported to you on Form 1098. See instructions for

interest

special rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

deduction may

Investment interest. Attach Form 4952 if required. (See

be limited (see

instructions.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 10 through 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gifts by cash or check. If you made any gift of $250 or more,

Other than by cash or check. If any gift of $250 or more, see

If you made a

gift and got a instructions. You must attach Form 8283 if over $500

. . . . . . . . . . . . .

benefit for it,

Carryover from prior year

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

see instructions.

Add lines 16 through 18

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Casualty or theft loss(es). Attach Form 4684. (See instructions.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unreimbursed employee expensesjob travel, union dues,

job education, etc. Attach Form 2106 or 2106-EZ if required.

(See instructions.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax preparation fees

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other expensesinvestment, safe deposit box, etc. List type

and amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 21 through 23

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter amount fromForm1040, line 38

Multiply line 25 by 2% (.02)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subtract line 26 from line 24. If line 26 is more than line 24, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Otherfrom list in instructions. List type and amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

No. Your deduction is not limited. Add the amounts in the far right column

OMB No. 1545-0074

Department of the Treasury Attachment

Sequence No. Internal Revenue Service

Name(s) shown on Form 1040

Home mortgage interest not reported to you on Form1098. If paid to the

person fromwhomyou bought the home, see instructions and show that

person's name, identifying no., and address

. . . . . . . . . . . . . . . . . . . . . . . . . . .

DAA

Your social security number

If you elect to itemize deductions even though they are less than your standard

29

see instructions

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Mortgage insurance premiums (see instructions)

. . . . . . . . . . . . . . . . . . .

30

29

SCHEDULE A

Medical

(99)

Attach to Form 1040.

instructions).

for lines 4 through 28. Also, enter this amount on Form 1040, line 40.

a

b

Income taxes, or

General sales taxes

}

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

born before January 2, 1949, multiply line 2 by 7.5% (.075) instead

Is Form 1040, line 38, over $150,000?

Worksheet in the instructions to figure the amount to enter.

Yes. Your deduction may be limited. See the Itemized Deductions

. . . . . . . . . . . .

RICHARD D & SUSAN J SNYDER

394,610

39,461

X

76,945

69,373

674

146,992

30,592

30,592

73,304

73,304

6,426

SEE STATEMENT 1 176,302

182,728

394,610

7,892

174,836

X

* 422,886

* LIMITED BY AGI

8913

Вам также может понравиться

- Michigan Central Station Screening WaiverДокумент1 страницаMichigan Central Station Screening WaiverDetroit Free PressОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Michigan Supreme Court Guns SchoolsДокумент60 страницMichigan Supreme Court Guns SchoolsDetroit Free PressОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Oxford LawsuitДокумент46 страницOxford LawsuitDetroit Free Press100% (2)

- DLA Piper Congressional Contract 2-13-18Документ9 страницDLA Piper Congressional Contract 2-13-18Detroit Free PressОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Detroit Public Schools Community DistrictДокумент8 страницDetroit Public Schools Community DistrictDetroit Free PressОценок пока нет

- Opinion - Gary B Vs Richard Snyder 16-13292Документ40 страницOpinion - Gary B Vs Richard Snyder 16-13292Detroit Free Press100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- DLA Piper Executive Contract 2-13-18Документ9 страницDLA Piper Executive Contract 2-13-18Detroit Free PressОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Statement From Mike MorseДокумент1 страницаStatement From Mike MorseDetroit Free PressОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Village of Grosse Pointe Shores Zoning MapДокумент1 страницаVillage of Grosse Pointe Shores Zoning MapDetroit Free PressОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- DPSCD Lawsuit BrownДокумент28 страницDPSCD Lawsuit BrownDetroit Free PressОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

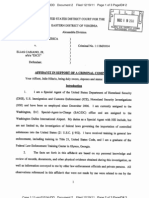

- Court Documents: FBI Translator Married ISIS LeaderДокумент9 страницCourt Documents: FBI Translator Married ISIS LeaderDetroit Free PressОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Kithier V MHSAAДокумент13 страницKithier V MHSAADetroit Free PressОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Gov. Snyder's Letter To Sen. Debbie StabenowДокумент2 страницыGov. Snyder's Letter To Sen. Debbie StabenowDetroit Free PressОценок пока нет

- Private School Funding LawsuitДокумент32 страницыPrivate School Funding LawsuitDetroit Free PressОценок пока нет

- Letter To House Energy and Commerce Chairman Fred UptonДокумент7 страницLetter To House Energy and Commerce Chairman Fred UptonDetroit Free PressОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Potential Michigan School Closures Threaten Revenues For K-12 DistrictsДокумент4 страницыPotential Michigan School Closures Threaten Revenues For K-12 DistrictsDetroit Free PressОценок пока нет

- Tate of Ichigan Ansing Tate Uperintendent: The ProcessДокумент4 страницыTate of Ichigan Ansing Tate Uperintendent: The ProcessDetroit Free PressОценок пока нет

- ACLU Letter To Eastern Michigan UniversityДокумент4 страницыACLU Letter To Eastern Michigan UniversityDetroit Free PressОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- C. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAДокумент1 страницаC. Rules of Adminissibility - Documentary Evidence - Best Evidence Rule - Loon Vs Power Master Inc, 712 SCRAJocelyn Yemyem Mantilla VelosoОценок пока нет

- Romans 12 (1 2) What Is True WorshipДокумент4 страницыRomans 12 (1 2) What Is True Worshipapi-249086759100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Alliance AirДокумент3 страницыAlliance AirvikasmОценок пока нет

- Board of Commissioners V Dela RosaДокумент4 страницыBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Regulatory RequirementsДокумент6 страницRegulatory RequirementsAmeeroddin Mohammad100% (1)

- New LLM Corporate PDFДокумент20 страницNew LLM Corporate PDFshubhambulbule7274Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- In The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJДокумент4 страницыIn The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJsid tiwariОценок пока нет

- Assignment On Satyam Scam PGDM Vii A 2009-2011Документ5 страницAssignment On Satyam Scam PGDM Vii A 2009-2011mishikaachuОценок пока нет

- (Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Документ497 страниц(Onati International Series in Law and Society) Eric L. Jensen, Jorgen Jepsen - Juvenile Law Violators, Human Rights, and The Development of New Juvenile Justice Systems - Hart Publishing (2006)Cristelle FenisОценок пока нет

- Pre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone ChennaiДокумент52 страницыPre Shipment and Post Shipment Finance: BY R.Govindarajan Head-Professional Development Centre-South Zone Chennaimithilesh tabhaneОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Comparative Financial Statement - Day4Документ28 страницComparative Financial Statement - Day4Rahul BindrooОценок пока нет

- SMB105 5 PDFДокумент65 страницSMB105 5 PDFmech430Оценок пока нет

- 2013 Interview SheetДокумент3 страницы2013 Interview SheetIsabel Luchie GuimaryОценок пока нет

- Cases-CompДокумент169 страницCases-CompDavid John MoralesОценок пока нет

- AND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteДокумент9 страницAND9201/D The Effect of Pan Material in An Induction Cooker: Application NoteRajesh RoyОценок пока нет

- Sequencing Clauses - CrimeДокумент37 страницSequencing Clauses - CrimeIsabella Henríquez LozanoОценок пока нет

- Important Notice For Passengers Travelling To and From IndiaДокумент3 страницыImportant Notice For Passengers Travelling To and From IndiaGokul RajОценок пока нет

- Smart Wealth Builder Policy Document Form 17Документ29 страницSmart Wealth Builder Policy Document Form 17Chetanshi Nene100% (1)

- E10726 PDFДокумент950 страницE10726 PDFAhmad Zidny Azis TanjungОценок пока нет

- Clerkship HandbookДокумент183 страницыClerkship Handbooksanddman76Оценок пока нет

- Powerpoint - The Use of Animals in FightingДокумент18 страницPowerpoint - The Use of Animals in Fightingcyc5326Оценок пока нет

- The Last Hacker: He Called Himself Dark Dante. His Compulsion Led Him To Secret Files And, Eventually, The Bar of JusticeДокумент16 страницThe Last Hacker: He Called Himself Dark Dante. His Compulsion Led Him To Secret Files And, Eventually, The Bar of JusticeRomulo Rosario MarquezОценок пока нет

- Application Form For Business Permit 2016Документ1 страницаApplication Form For Business Permit 2016Monster EngОценок пока нет

- Mongodb Use Case GuidanceДокумент25 страницMongodb Use Case Guidancecresnera01Оценок пока нет

- Elias Casiano Jr. AffidavitДокумент3 страницыElias Casiano Jr. AffidavitEmily BabayОценок пока нет

- Art 6. Bengzon Vs Blue Ribbon Case DigestДокумент3 страницыArt 6. Bengzon Vs Blue Ribbon Case DigestCharlotte Jennifer AspacioОценок пока нет

- PWC Permanent Establishments at The Heart of The Matter FinalДокумент24 страницыPWC Permanent Establishments at The Heart of The Matter Finalvoyager8002Оценок пока нет

- Oracle SOA 11.1.1.5.0 Admin GuideДокумент698 страницOracle SOA 11.1.1.5.0 Admin GuideConnie WallОценок пока нет

- Santos vs. BuencosejoДокумент1 страницаSantos vs. BuencosejoLiana AcubaОценок пока нет

- Two Nation Theory - Docx NarrativeДокумент14 страницTwo Nation Theory - Docx NarrativeSidra Jamshaid ChОценок пока нет

- The Courage to Be Free: Florida's Blueprint for America's RevivalОт EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalОценок пока нет

- The Next Civil War: Dispatches from the American FutureОт EverandThe Next Civil War: Dispatches from the American FutureРейтинг: 3.5 из 5 звезд3.5/5 (48)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpОт EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpРейтинг: 4.5 из 5 звезд4.5/5 (11)