Академический Документы

Профессиональный Документы

Культура Документы

GSE Fairholme

Загружено:

CanadianValue0 оценок0% нашли этот документ полезным (0 голосов)

622 просмотров8 страницGSE - Fairholme

Оригинальное название

GSE-Fairholme

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGSE - Fairholme

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

622 просмотров8 страницGSE Fairholme

Загружено:

CanadianValueGSE - Fairholme

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 8

FAIRHOLME

Ignore the crowd.

FAIRHOLME

Ignore the crowd.

DISCLAIMER

This presentation uses the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie

Mac) as a case study to illustrate Fairholme Capital Managements investment strategy for The Fairholme Fund (NASDAQ: FAIRX). In the pages

that follow, we show shareholders why we Ignore the crowd with regard to our portfolio positions that are currently out of favor in the

market.

However, nothing in this presentation should be taken as a recommendation to anyone to buy, hold, or sell certain securities or any other

investment mentioned herein. Our opinion of a companys prospects should not be considered a guarantee of future events. Investors are

reminded that there can be no assurance that past performance will continue, and that a mutual funds current and future portfolio holdings are

always subject to risk. As with all mutual funds, investing in The Fairholme Fund involves risk including potential loss of principal. Opinions

expressed are those of the author and/or Fairholme Capital Management, L.L.C. and should not be considered a forecast of future events, a

guarantee of future results, nor investment advice.

The Fairholme Funds holdings and sector weightings are subject to change. As of May 31, 2013, the preferred stock of Fannie Mae and Freddie

Mac comprised 6.5% and the common stock comprised 0.4% of The Fairholme Funds total net assets. The Fairholme Funds portfolio holdings

are generally disclosed as required by law or regulation on a quarterly basis through reports to shareholders or filings with the SEC within 60 days

after quarter end.

The Fairholme Fund is nondiversified, which means that it invests in a smaller number of securities when compared to more diversified funds.

As a result, The Fairholme Fund is exposed to greater individual security volatility than diversified funds. The Fairholme Fund can invest in

foreign securities which may involve greater volatility and political, economic, and currency risks and differences in accounting methods. The

Fairholme Fund may also invest in special situations to achieve its objectives. These strategies may involve greater risks than other fund

strategies. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longerterm debt

securities. Lowerrated and nonrated securities present greater loss to principal than higherrated securities.

The Fairholme Funds investment objectives, risks, charges, and expenses should be considered carefully before investing. The prospectus

contains this and other important information about The Fairholme Fund, and may be obtained by calling shareholder services at (866) 2022263

or by visiting our website at www.fairholmefunds.com. Read it carefully before investing.

FAIRHOLME

Ignore the crowd.

FACTS AND FIGURES

FAIRHOLME

Ignore the crowd.

FANNIE MAE AND

FREDDIE MAC

OTHER

U.S.

GOVERNMENT

FANNIE MAE & FREDDIE MAC

THE MORTGAGE MARKETS PRIVATE CAPITAL SOURCE

Source:SecuritiesIndustryandFinancialMarketsAssociation,2013

$38.6TRILLION

U.S.BOND MARKET

$8.2TRILLION

MORTGAGE SECURITIES MARKET

CORPORATE

BONDS

MORTGAGE

SECURITIES

OTHER

TREASURIES

$4.3T

FAIRHOLME

Ignore the crowd.

FANNIE MAE & FREDDIE MAC

STEPPING UP WHEN OTHERS WILL NOT

Sources:FederalHousingFinanceAgencyandSecuritiesIndustryandFinancialMarketsAssociation,2013

86% 86%

70%

58%

57%

64%

97%

99%

97% 97% 97%

95%

0%

20%

40%

60%

80%

100%

2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 H12013

MBSISSUANCE VOLUME

FannieMae&FreddieMac OtherPrivateCapital

FAIRHOLME

Ignore the crowd.

* Percentage of loans in a given originationyear (as measured by their principal

balance at origination) that have ever become 90days delinquent, entered

foreclosure processing, or entered real estate owned (REO) status.

Source:FederalHousingFinanceAgency,2010

FANNIE MAE & FREDDIE MAC

NOBODY DOES IT BETTER

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2001 2002 2003 2004 2005 2006 2007 2008 Average

PERCENTAGE OF LOANS EVER 90DAYS DELINQUENT BY ORIGINATION YEAR (20012008)*

FannieMae&FreddieMac OtherPrivatelyFundedMBS

27%

6%

FAIRHOLME

Ignore the crowd.

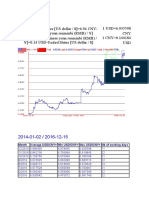

$61.8

$127.9

$155.9

$189.5 $189.5 $189.5

$189.5

$0.2

$6.8

$20.2

$36.3

$55.2

$186.2

$192.2

$0

$50

$100

$150

$200

2008 2009 2010 2011 2012 2013E Q12014E

TotalDisbursed TotalRecouped

$inbillions

Sources:U.S.Treasury,FannieMae,FreddieMac,Fairholme Research

U.S. TREASURY INVESTMENT FULLY RECOUPED IN 2014

FAIRHOLME

Ignore the crowd.

Вам также может понравиться

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketОт EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketОценок пока нет

- Ira Sohn Presentation 2014.05.05Документ111 страницIra Sohn Presentation 2014.05.05Zerohedge50% (2)

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActОт EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActОценок пока нет

- Bill Ackman Ira Sohn Freddie Mac and Fannie Mae PresentationДокумент111 страницBill Ackman Ira Sohn Freddie Mac and Fannie Mae PresentationCanadianValueОценок пока нет

- KKR KioДокумент2 страницыKKR KioHungreo411Оценок пока нет

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОт EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioОценок пока нет

- 2016 PSH Annual Update Presentation For DISTRIBUTION 1Документ95 страниц2016 PSH Annual Update Presentation For DISTRIBUTION 1ZerohedgeОценок пока нет

- Crowdfunding in 2014 (Understanding a New Asset Class)От EverandCrowdfunding in 2014 (Understanding a New Asset Class)Оценок пока нет

- Gundlach The Big Easy Slides - FINALДокумент73 страницыGundlach The Big Easy Slides - FINALZerohedge100% (1)

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsОт EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsОценок пока нет

- 2010 Q4 Letter Khrom CapitalДокумент5 страниц2010 Q4 Letter Khrom CapitalallaboutvalueОценок пока нет

- Eric Khrom of Khrom Capital 2012 Q4 LetterДокумент5 страницEric Khrom of Khrom Capital 2012 Q4 LetterallaboutvalueОценок пока нет

- Eric Khrom of Khrom Capital 2013 Q1 LetterДокумент4 страницыEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvalueОценок пока нет

- Icahn LetterДокумент3 страницыIcahn Lettergrw7Оценок пока нет

- Financial Fine Print: Uncovering a Company's True ValueОт EverandFinancial Fine Print: Uncovering a Company's True ValueРейтинг: 3 из 5 звезд3/5 (3)

- The Optimist - Bill Ackman - Portfolio - 05-2009Документ10 страницThe Optimist - Bill Ackman - Portfolio - 05-2009KuJungОценок пока нет

- Competitive Advantage in Investing: Building Winning Professional PortfoliosОт EverandCompetitive Advantage in Investing: Building Winning Professional PortfoliosОценок пока нет

- Lazard Secondary Market Report 2022Документ23 страницыLazard Secondary Market Report 2022Marcel LimОценок пока нет

- Greenlight Letter Q4Документ5 страницGreenlight Letter Q4ZerohedgeОценок пока нет

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachОт EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachОценок пока нет

- Eagle Capital Management PresentationДокумент23 страницыEagle Capital Management Presentationturnbj75Оценок пока нет

- Third Point Q109 LetterДокумент4 страницыThird Point Q109 LetterZerohedgeОценок пока нет

- China's Financial Markets: An Insider's Guide to How the Markets WorkОт EverandChina's Financial Markets: An Insider's Guide to How the Markets WorkРейтинг: 3 из 5 звезд3/5 (1)

- Private Debt Investor Special ReportДокумент7 страницPrivate Debt Investor Special ReportB.C. MoonОценок пока нет

- Wisdom on Value Investing: How to Profit on Fallen AngelsОт EverandWisdom on Value Investing: How to Profit on Fallen AngelsРейтинг: 4 из 5 звезд4/5 (6)

- Atticus Global Letter To InvestorsДокумент2 страницыAtticus Global Letter To InvestorsDealBookОценок пока нет

- Hedge Funds, Humbled: The 7 Mistakes That Brought Hedge Funds to Their Knees and How They Will Rise AgainОт EverandHedge Funds, Humbled: The 7 Mistakes That Brought Hedge Funds to Their Knees and How They Will Rise AgainОценок пока нет

- Greenlight Capital Open Letter To AppleДокумент5 страницGreenlight Capital Open Letter To AppleZim VicomОценок пока нет

- The ForeclosureS.com Guide to Advanced Investing Techniques You Won't Learn Anywhere ElseОт EverandThe ForeclosureS.com Guide to Advanced Investing Techniques You Won't Learn Anywhere ElseОценок пока нет

- Sohn Conference San Francisco 2016Документ2 страницыSohn Conference San Francisco 2016marketfolly.comОценок пока нет

- The End of Arbitrage, Part 1Документ8 страницThe End of Arbitrage, Part 1Carmine Robert La MuraОценок пока нет

- Lawsuit Against DellДокумент25 страницLawsuit Against DellDealBookОценок пока нет

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionОт EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionРейтинг: 4 из 5 звезд4/5 (13)

- ThirdPoint Q1 16Документ9 страницThirdPoint Q1 16marketfolly.comОценок пока нет

- Third Point Q2 2010 Investor LetterДокумент9 страницThird Point Q2 2010 Investor Lettereric695Оценок пока нет

- 2012 q3 Letter DdicДокумент5 страниц2012 q3 Letter DdicDistressedDebtInvestОценок пока нет

- Graham & Doddsville - Issue 36 - VF PDFДокумент40 страницGraham & Doddsville - Issue 36 - VF PDFkaya nathОценок пока нет

- Warning Flags - Past and Present 05-12-10 - 2Документ12 страницWarning Flags - Past and Present 05-12-10 - 2bess6159Оценок пока нет

- How To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007Документ145 страницHow To Save The Bond Insurers Presentation by Bill Ackman of Pershing Square Capital Management November 2007tomhigbieОценок пока нет

- Michael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesДокумент49 страницMichael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesCanadianValueОценок пока нет

- Pershing Square Q2 10 Investor LetterДокумент8 страницPershing Square Q2 10 Investor Lettereric695Оценок пока нет

- Cadbury Trian LetterДокумент14 страницCadbury Trian Letterbillroberts981Оценок пока нет

- Alluvial Tear SheetДокумент1 страницаAlluvial Tear SheetkdwcapitalОценок пока нет

- Trian GE StakeДокумент3 страницыTrian GE StakeBenzingaProОценок пока нет

- Odn 25 - CCRKДокумент1 страницаOdn 25 - CCRKNate TobikОценок пока нет

- Bridge With BuffetДокумент12 страницBridge With BuffetTraderCat SolarisОценок пока нет

- Bill Ackman's Ira Sohn JCP PresentationДокумент64 страницыBill Ackman's Ira Sohn JCP PresentationJohnCarney100% (1)

- Lemelson Capital Featured in HFMWeekДокумент32 страницыLemelson Capital Featured in HFMWeekamvona100% (1)

- Hiding in Plain Site: Diving Deeply Into SEC FilingsДокумент8 страницHiding in Plain Site: Diving Deeply Into SEC FilingsfootnotedОценок пока нет

- Justice Is Best Served Flame BroiledДокумент53 страницыJustice Is Best Served Flame Broileddude5041Оценок пока нет

- Stan Druckenmiller The Endgame SohnДокумент10 страницStan Druckenmiller The Endgame SohnCanadianValueОценок пока нет

- Greenlight UnlockedДокумент7 страницGreenlight UnlockedZerohedgeОценок пока нет

- Stan Druckenmiller Sohn TranscriptДокумент8 страницStan Druckenmiller Sohn Transcriptmarketfolly.com100% (1)

- KaseFundannualletter 2015Документ20 страницKaseFundannualletter 2015CanadianValueОценок пока нет

- Charlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFДокумент18 страницCharlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFaakashshah85Оценок пока нет

- Munger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16Документ12 страницMunger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16CanadianValueОценок пока нет

- The Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500Документ6 страницThe Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500dpbasicОценок пока нет

- Market Macro Myths Debts Deficits and DelusionsДокумент13 страницMarket Macro Myths Debts Deficits and DelusionsCanadianValueОценок пока нет

- OakTree Real EstateДокумент13 страницOakTree Real EstateCanadianValue100% (1)

- Hussman Funds Semi-Annual ReportДокумент84 страницыHussman Funds Semi-Annual ReportCanadianValueОценок пока нет

- Einhorn Consol PresentationДокумент107 страницEinhorn Consol PresentationCanadianValueОценок пока нет

- Einhorn Q4 2015Документ7 страницEinhorn Q4 2015CanadianValueОценок пока нет

- Absolute Return Oct 2015Документ9 страницAbsolute Return Oct 2015CanadianValue0% (1)

- Letter To Clients and ShareholdersДокумент3 страницыLetter To Clients and ShareholdersJulia Reynolds La RocheОценок пока нет

- Whitney Tilson Favorite Long and Short IdeasДокумент103 страницыWhitney Tilson Favorite Long and Short IdeasCanadianValueОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Investor Call Re Valeant PharmaceuticalsДокумент39 страницInvestor Call Re Valeant PharmaceuticalsCanadianValueОценок пока нет

- Starboard Value LP AAP Presentation 09.30.15Документ23 страницыStarboard Value LP AAP Presentation 09.30.15marketfolly.com100% (1)

- Team Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Документ5 страницTeam Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Raymarc Elizer AsuncionОценок пока нет

- Chapter 6 - An Introduction To The Tourism Geography of EuroДокумент12 страницChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JОценок пока нет

- A Comparative Evaluation Between National and International Trade and Explain The Concept of Geographical Indication and ItДокумент15 страницA Comparative Evaluation Between National and International Trade and Explain The Concept of Geographical Indication and ItPhalguni Mutha100% (1)

- University of Mumbai Project On Investment Banking Bachelor of CommerceДокумент6 страницUniversity of Mumbai Project On Investment Banking Bachelor of CommerceParag MoreОценок пока нет

- AD and MultiplierДокумент47 страницAD and Multipliera_mohapatra55552752100% (1)

- HI 5001 Accounting For Business DecisionsДокумент5 страницHI 5001 Accounting For Business Decisionsalka murarkaОценок пока нет

- 64 Development of Power Operated WeederДокумент128 страниц64 Development of Power Operated Weedervinay muleyОценок пока нет

- SRK 185397 - Auto Mechanica Torque WrenchДокумент1 страницаSRK 185397 - Auto Mechanica Torque WrenchTiago FreireОценок пока нет

- Swine Breeder Farms Sbfap November 29 2021Документ2 страницыSwine Breeder Farms Sbfap November 29 2021IsaacОценок пока нет

- Fund UtilizationДокумент3 страницыFund Utilizationbarangay kuyaОценок пока нет

- 6 The Neoclassical Summary Free Trade As Economic GoalДокумент4 страницы6 The Neoclassical Summary Free Trade As Economic GoalOlga LiОценок пока нет

- Maruti SuzukiДокумент17 страницMaruti SuzukiPriyanka Vaghasiya0% (1)

- Kotler - MarketingДокумент25 страницKotler - Marketingermal880% (1)

- Table of ContentsДокумент6 страницTable of ContentsRakeshKumarОценок пока нет

- Chapter 7 ExercisesДокумент2 страницыChapter 7 ExercisesShesheng ComendadorОценок пока нет

- Rhula Mozambique Weekly Media Review - 17 February To 24 February 2017Документ90 страницRhula Mozambique Weekly Media Review - 17 February To 24 February 2017davidbarskeОценок пока нет

- Perkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.Документ12 страницPerkembangan Kebun Teh Danau Kembar Dari Tahun 2000 - 2017.niaputriОценок пока нет

- Global Affairs CH - 3 @Документ34 страницыGlobal Affairs CH - 3 @Bererket BaliОценок пока нет

- COA Rail Impact Test Report 2G With Ref-BLTДокумент4 страницыCOA Rail Impact Test Report 2G With Ref-BLTmshawkiОценок пока нет

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysДокумент3 страницыMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyОценок пока нет

- Installment Sales - PretestДокумент2 страницыInstallment Sales - PretestCattleyaОценок пока нет

- Political Economy of Media - A Short IntroductionДокумент5 страницPolitical Economy of Media - A Short Introductionmatthewhandy100% (1)

- Provisions ReviewerДокумент2 страницыProvisions ReviewerKevin SantiagoОценок пока нет

- Pradhan Mantri Awas Yojana PDFДокумент17 страницPradhan Mantri Awas Yojana PDFKD Ltd.Оценок пока нет

- Us Cons Job Architecture 041315Документ11 страницUs Cons Job Architecture 041315Karan Pratap Singh100% (1)

- Global Information Technology Report 2004/2005 Executive SummaryДокумент5 страницGlobal Information Technology Report 2004/2005 Executive SummaryWorld Economic Forum50% (2)

- Unit 1. Fundamentals of Managerial Economics (Chapter 1)Документ50 страницUnit 1. Fundamentals of Managerial Economics (Chapter 1)Felimar CalaОценок пока нет

- Delegation of Powers As Per DPE GuidelinesДокумент23 страницыDelegation of Powers As Per DPE GuidelinesVIJAYAKUMARMPLОценок пока нет

- Chapter 7 - Valuation and Characteristics of Bonds KEOWNДокумент9 страницChapter 7 - Valuation and Characteristics of Bonds KEOWNKeeZan Lim100% (1)

- Closure of 26% of PH Businesses Alarms DTI - Manila BulletinДокумент7 страницClosure of 26% of PH Businesses Alarms DTI - Manila BulletinLara Melissa DanaoОценок пока нет

- How to Trade a Range: Trade the Most Interesting Market in the WorldОт EverandHow to Trade a Range: Trade the Most Interesting Market in the WorldРейтинг: 4 из 5 звезд4/5 (5)

- Scalping is Fun! 3: Part 3: How Do I Rate my Trading Results?От EverandScalping is Fun! 3: Part 3: How Do I Rate my Trading Results?Рейтинг: 3.5 из 5 звезд3.5/5 (18)

- Automated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysОт EverandAutomated Stock Trading Systems: A Systematic Approach for Traders to Make Money in Bull, Bear and SidewaysРейтинг: 5 из 5 звезд5/5 (1)

- Stock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketОт EverandStock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketРейтинг: 4 из 5 звезд4/5 (26)

- How to Start a Trading Business with $500От EverandHow to Start a Trading Business with $500Рейтинг: 4.5 из 5 звезд4.5/5 (27)

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioОт EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioРейтинг: 4.5 из 5 звезд4.5/5 (38)

- Leveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all tradersОт EverandLeveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all tradersРейтинг: 4.5 из 5 звезд4.5/5 (6)

- Systematic Trading: A unique new method for designing trading and investing systemsОт EverandSystematic Trading: A unique new method for designing trading and investing systemsРейтинг: 3.5 из 5 звезд3.5/5 (12)

- Advanced Options Trading: Master the Advanced Trading Strategy and Boost Your Income From Home: 3 Hour Crash CourseОт EverandAdvanced Options Trading: Master the Advanced Trading Strategy and Boost Your Income From Home: 3 Hour Crash CourseОценок пока нет

- The Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayОт EverandThe Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayРейтинг: 4 из 5 звезд4/5 (7)

- Scalping is Fun! 4: Part 4: Trading Is Flow BusinessОт EverandScalping is Fun! 4: Part 4: Trading Is Flow BusinessРейтинг: 4 из 5 звезд4/5 (13)

- Scalping is Fun! 2: Part 2: Practical examplesОт EverandScalping is Fun! 2: Part 2: Practical examplesРейтинг: 4.5 из 5 звезд4.5/5 (26)

- Swing Trading using the 4-hour chart 1: Part 1: Introduction to Swing TradingОт EverandSwing Trading using the 4-hour chart 1: Part 1: Introduction to Swing TradingРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Predict the Next Bull or Bear Market and Win: How to Use Key Indicators to Profit in Any MarketОт EverandPredict the Next Bull or Bear Market and Win: How to Use Key Indicators to Profit in Any MarketРейтинг: 4.5 из 5 звезд4.5/5 (6)

- How to Develop a Profitable Trading Strategy: Why You Should Do the Opposite of What the Majority of Traders are Trying to DoОт EverandHow to Develop a Profitable Trading Strategy: Why You Should Do the Opposite of What the Majority of Traders are Trying to DoРейтинг: 4 из 5 звезд4/5 (5)

- Swing Trading using the 4-hour chart 1-3: 3 ManuscriptsОт EverandSwing Trading using the 4-hour chart 1-3: 3 ManuscriptsРейтинг: 4.5 из 5 звезд4.5/5 (27)

- A Beginner's Guide To Day Trading Online 2nd EditionОт EverandA Beginner's Guide To Day Trading Online 2nd EditionРейтинг: 3.5 из 5 звезд3.5/5 (12)