Академический Документы

Профессиональный Документы

Культура Документы

Rupeetalk Tax Reckoner

Загружено:

api-207552810 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров2 страницыTax Matters Made Easy - 2009-10. Ready Mutual Fund Tax Reckoner Individual / HUF Capital Gains Taxation Equity Schemes Debt Schemes Tax Structures on Dividends declared. Short-term and long-term capital gain tax will be deducted at the time of redemption of units in case of NRI Investors only.

Исходное описание:

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документTax Matters Made Easy - 2009-10. Ready Mutual Fund Tax Reckoner Individual / HUF Capital Gains Taxation Equity Schemes Debt Schemes Tax Structures on Dividends declared. Short-term and long-term capital gain tax will be deducted at the time of redemption of units in case of NRI Investors only.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

39 просмотров2 страницыRupeetalk Tax Reckoner

Загружено:

api-20755281Tax Matters Made Easy - 2009-10. Ready Mutual Fund Tax Reckoner Individual / HUF Capital Gains Taxation Equity Schemes Debt Schemes Tax Structures on Dividends declared. Short-term and long-term capital gain tax will be deducted at the time of redemption of units in case of NRI Investors only.

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

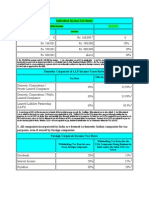

Tax Matters Made Easy – 2009-10…

Ready Mutual Fund Tax Reckoner

Individual/HUF Corporate NRI*

Capital Gains Taxation

Long Term Capital Gains (Investments for more than 12 months)

#

Equity Schemes Nil Nil Nil

Debt Schemes Lower of 10% with indexation Lower of 10% with indexation Lower of 10% with indexation

or 20% without indexation or 20% without indexation or 20% without indexation

+ 3% Cess + 10% Surcharge + 3% Cess + 3% Cess

Without Indexation 10.30% 11.33% 10.30%

With Indexation 20.60% 22.66% 20.60%

Short-Term Capital Gains (Investments for equal to or less than 12 months)

Equity Schemes# 15% + 10% Surcharge

15% + 3% Edu. Cess 15% + 3% Cess

+ 3% Cess

= 15.45% = 16.995% = 15.45%

Debt Schemes 30% + 10% Surcharge

30% + 3% Edu. Cess 30% + 3% Cess

+ 3% Cess

= 30.90% = 33.99% = 30.90%

Tax Structures on Dividends declared

Dividend

#

Equity Schemes Tax Free Tax Free Tax Free

Debt Schemes Tax Free Tax Free Tax Free

Dividend Distribution Tax (Payable by the scheme)

#

Equity Schemes Nil Nil Nil

Debt Schemes 12.5%+10% Surcharge+3% Cess 20%+10% Surcharge+3% Cess 12.5%+10% Surcharge+3% Cess

= 14.16% = 22.66% = 14.16%

Liquid and Money- 25%+10% Surcharge+3% Cess 25%+10% Surcharge+3% Cess 25%+10% Surcharge+3% Cess

market Schemes = 28.325% = 28.325% = 28.325%

* The short-term and long-term capital gain tax will be deducted at the time of redemption of units in case of NRI investors only

# STT of 0.25% to be applicable at the time of redemption and switch to other schemes

Tax Deducted at Source (TDS) - Applicable to NRI Investors only

Categories Short-term Long-term

Equity 15.45% Nil

Debt 30.90% 20.60% post indexation

www.rupeetalk.com, money matters made easy… 1

1. Income Tax Rates a. Surcharge and Education cess applicable extra

For Individuals, HUFs and Body of Individuals b. Other than dividends on which DDT has been paid

Total Income Tax Slabsc (2) Tax on non-resident sportsmen or sports associa- tion on

a,b

Up to Rs. 160,000 Nil specified income @ 10% plus applicable sur-charge and

Rs. 160,001 to Rs. 300,000 10% education cess.

Rs. 300,001 to Rs. 500,000 20% 4. Capital Gains

Rs. 500,001 and above 30% STCG1 LTCG2

a. In case of women below 65 years of age, the limit is Rs 190,000. b. Particulars rates rates

Incase of a resident indivudal above 65 years of age, the limit is Rs

Sale of equity shares/unit of an

240,000. c. Education cess is applicable @ 3 per cent on all net tax paid.

equity oriented fund which 15.0% Nil

attracts STT

2. Securities Transaction Tax (STT) Sale transaction other than

STT is levied as per the following transactions mentioned above:

Rates Payable By Individuals (resident & non- Tax Slab 20% with

Purchase/Sale of equity shares, residents) rates indexation

Buyer/

equity oriented Mutual Fund 0.125% Firms including LLP (resident & and 10%

Seller 30.0%

units (Delivery based) non-residents) without

Sale of Equity shares and equity- Resident Companies 30.0% indexation

oriented Mutual Fund units 0.025% Seller Overseas financial institutions 40%

(Non-Delivery based) specified in section 115AB

(Corporate) /

10%

30%(Non-

Sale of an option in Securities 0.017% Seller Corporate)

Sale of an option in Securities, FIIs 30.0% 10%

0.125% Buyer

where option is exercised Other Foreign Institutions 40.0% 20%/10%

Sale of futures in Securities 0.017% Seller 20% with ind-

Local authority 30.0%

Sale of equity oriented Mutual exation and

0.25% Seller Tax Slab 10% without

Fund(MF) units Co-operative society rates

rates indexation

1 Short-term capital gains, 2 Long-term capital gains;

3. Tax rates for Non-Resident Individuals (NRIs)

Surcharge and Education Cess applicable

(1) The following incomes in the case of non-resident are

taxed at special rates on gross basis:

Personal tax Scenarios

Nature of Incomes Ratesa

b Income Level

Dividend 20.0% Individual

5,00,000 1,000,000 1,500,000

Interest received on loans given

Income Tax (Rs.) 55,620 210,120 364,620

in foreign currency to Indian 20.0%

Resident women Income Level

concern or Government of India

below 65 years 5,00,000 1,000,000 1,500,000

Income received in respect of

Income Tax (Rs.) 52,530 207,030 361,530

units purchased in foreign 20%

Resident women Income Level

currency of specified MFs/UTI

below 65 years 5,00,000 1,000,000 1,500,000

@ 20% b/w May 31, 97

Income Tax (Rs.) 47,380 201,880 356,380

Royalty or fees for technical and June 01,05

services @ 10% on or after June For an easy and simple tax calculations, make use of

01, 05 our Income Tax Calculator:

Interest on FCCB, FCEB/Dividend http://www.rupeetalk.com/Calculator/income-tax-calculator.php

10.0%

on GDRsb

Disclaimer:The

Disclaimer: Theinformation

information mentioned

mentioned above

above is forisgeneral

for general information

information purposespurposes

only & it only

does &

notitprovide

does not

anyprovide anyIndividuals

tax advice. tax advice.and

Individuals and other are

other intermediaries

advised

?ntermediaries are advised to consult his/her own tax consultants before taking any final decision on income tax payments. Income tax benefits are

to consult his/her own tax consultants before taking any final decision on income tax payments. Income tax benefits related to mutual fund investments

in accordance

related with the

to mutual prevailing

fund tax laws

investments applicable

are in India.with the prevailing tax laws applicable in India.

in accordance

www.rupeetalk.com, money matters made easy… 21

Вам также может понравиться

- SGV and Co Presentation On TRAIN LawДокумент48 страницSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- Qii2007 AbcpДокумент64 страницыQii2007 Abcpkarasa1Оценок пока нет

- 4 Week RuleДокумент7 страниц4 Week RuleLoli LilaОценок пока нет

- Tax Reckoner 2010-11 - FinalДокумент2 страницыTax Reckoner 2010-11 - FinalSalahudheen SalmОценок пока нет

- The Rates Are Applicable For The Financial Year 2016-17 (AY 2017-18)Документ6 страницThe Rates Are Applicable For The Financial Year 2016-17 (AY 2017-18)sonur135Оценок пока нет

- Proposed Tax Reckoner - 2017Документ1 страницаProposed Tax Reckoner - 2017Achint KumarОценок пока нет

- Tax Reckoner For Investments in Mutual Fund-FY 17-18 PDFДокумент2 страницыTax Reckoner For Investments in Mutual Fund-FY 17-18 PDFGanesh R NavadОценок пока нет

- Tax Reckoner For Investments in Mutual Fund Schemes FY 2014-2015 PDFДокумент2 страницыTax Reckoner For Investments in Mutual Fund Schemes FY 2014-2015 PDFRupanjali Mitra BasuОценок пока нет

- Tax Ready Reckoner - 2018-2019: Snapshot of Tax Rates Specific To Mutual FundsДокумент3 страницыTax Ready Reckoner - 2018-2019: Snapshot of Tax Rates Specific To Mutual FundsKabir KhanОценок пока нет

- Tax Reckoner 2012 13Документ2 страницыTax Reckoner 2012 13mayankleo_1Оценок пока нет

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoДокумент3 страницыManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaОценок пока нет

- Tax Reckoner 2013-14: Snapshot of Tax Rates Specific To Mutual FundsДокумент2 страницыTax Reckoner 2013-14: Snapshot of Tax Rates Specific To Mutual FundsZia Ur RehmanОценок пока нет

- Axis Factsheet April 2020Документ57 страницAxis Factsheet April 2020GОценок пока нет

- Tax Reckoner 2021-22: Snapshot of Tax Rates Specific To Mutual FundsДокумент4 страницыTax Reckoner 2021-22: Snapshot of Tax Rates Specific To Mutual FundsApurva SinghiОценок пока нет

- Tata MF Tax - Reckoner - 2020 - 21Документ4 страницыTata MF Tax - Reckoner - 2020 - 21saurabhjain8414Оценок пока нет

- Sbimf Tax Reckoner 2018 19Документ2 страницыSbimf Tax Reckoner 2018 19Vinay SekharОценок пока нет

- Taxation ReportДокумент13 страницTaxation ReportShivansh BhattОценок пока нет

- Tax Reckoner 2011 - 2012Документ2 страницыTax Reckoner 2011 - 2012pgshah79Оценок пока нет

- It Compliance 2019 20Документ8 страницIt Compliance 2019 20Giri SukumarОценок пока нет

- Tax Reckoner F.Y. 2012-13 PDFДокумент4 страницыTax Reckoner F.Y. 2012-13 PDFbhaveshОценок пока нет

- IT Rates - Ready RecknorДокумент2 страницыIT Rates - Ready RecknorHitesh PandyaОценок пока нет

- Salient Proposed Changes To Tax Regulations in Bangladesh For FY 2021-22Документ19 страницSalient Proposed Changes To Tax Regulations in Bangladesh For FY 2021-22ahme farОценок пока нет

- Direct Taxes Code BookletДокумент50 страницDirect Taxes Code BookletprasadmandreОценок пока нет

- Amendment Consolidated FileДокумент128 страницAmendment Consolidated FileRanga AmarОценок пока нет

- Module 4 .1 - Schedule of Withholding TaxesДокумент2 страницыModule 4 .1 - Schedule of Withholding TaxesJimbo ManalastasОценок пока нет

- Tax Sheet - A.Y 2024-25Документ3 страницыTax Sheet - A.Y 2024-25bajajvanshica23Оценок пока нет

- Basic Concepts of TaxationДокумент5 страницBasic Concepts of TaxationMaya SharmaОценок пока нет

- Tax Reckoner 2018-19: Snapshot of Tax Rates Specific To Mutual FundsДокумент2 страницыTax Reckoner 2018-19: Snapshot of Tax Rates Specific To Mutual FundsAshish ChandaheОценок пока нет

- Income Tax Act As Amended by The Finance Act, 2008: SupplementДокумент13 страницIncome Tax Act As Amended by The Finance Act, 2008: SupplementbhavaniОценок пока нет

- March 2022 Factsheet With Direct PlanДокумент115 страницMarch 2022 Factsheet With Direct PlanPraveen KNОценок пока нет

- Fiscal Policy 2023-24Документ17 страницFiscal Policy 2023-24priyanshu15678Оценок пока нет

- Budget Impact 2013-14Документ11 страницBudget Impact 2013-14sandeepchopra23Оценок пока нет

- MF Tax Reckoner 2021 22 Revised01Документ4 страницыMF Tax Reckoner 2021 22 Revised01Alok KeswaniОценок пока нет

- Anubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianДокумент18 страницAnubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianSakshi TewariОценок пока нет

- SGV Train LawДокумент149 страницSGV Train LawEm-em CantosОценок пока нет

- Tax Reckoner: Snapshot of Tax Rates Specific To Mutual FundsДокумент3 страницыTax Reckoner: Snapshot of Tax Rates Specific To Mutual FundsSUBHASH SHARMAОценок пока нет

- Notes For Diploma SLSP HighlightedДокумент75 страницNotes For Diploma SLSP HighlightedsameehaashrafaliОценок пока нет

- Final Tax Lecture PDFДокумент7 страницFinal Tax Lecture PDFMarlo Caluya ManuelОценок пока нет

- ACE Advisory - Finance Bill 2020 Highlights PDFДокумент6 страницACE Advisory - Finance Bill 2020 Highlights PDFEmran HossenОценок пока нет

- T AXДокумент6 страницT AXKaustubh RaksheОценок пока нет

- Assignment - Com Tax Sys ChinaДокумент10 страницAssignment - Com Tax Sys ChinaTanvir SiddiqueОценок пока нет

- PRTC - TAX-Final PB - May 2022Документ16 страницPRTC - TAX-Final PB - May 2022Luna VОценок пока нет

- 5 6170280447000445052 PDFДокумент358 страниц5 6170280447000445052 PDFmanoj mohanОценок пока нет

- Group 6 Tax AssignmentДокумент14 страницGroup 6 Tax Assignmentdianaowani2Оценок пока нет

- Lesson 4 Final Income Taxation PDFДокумент4 страницыLesson 4 Final Income Taxation PDFErika ApitaОценок пока нет

- Income Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanДокумент18 страницIncome Tax Card 2019-20: Suite 021, Block B Abu Dhabi Towers, F-11 Markaz Islamabad-PakistanZain RehmanОценок пока нет

- Module 4 .1 - Schedule of Withholding TaxesДокумент2 страницыModule 4 .1 - Schedule of Withholding Taxeskrisha milloОценок пока нет

- Directors' Manual 2012Документ54 страницыDirectors' Manual 2012harshagarwal5Оценок пока нет

- 58 Corporate Individual Income Tax RatesДокумент3 страницы58 Corporate Individual Income Tax RatesKhalid QuadriОценок пока нет

- Taxation in Uganda: Tax AdministrationДокумент9 страницTaxation in Uganda: Tax AdministrationJeff QueiroОценок пока нет

- Fit Income TaxДокумент8 страницFit Income TaxadrianoedwardjosephОценок пока нет

- Direct Rax CodeДокумент14 страницDirect Rax CodedivajainОценок пока нет

- f6vnm 2007 Dec QДокумент9 страницf6vnm 2007 Dec QPhạm Hùng DũngОценок пока нет

- QuestionsДокумент15 страницQuestionsSamuelNyaungaОценок пока нет

- 1 Tax RatesДокумент5 страниц1 Tax Ratesvinod nainiwalОценок пока нет

- Income Taxation MIDTERMSДокумент7 страницIncome Taxation MIDTERMSgamit gamitОценок пока нет

- Taxes andДокумент1 страницаTaxes andYum StoriesОценок пока нет

- Tax Notes Aug 10-11Документ15 страницTax Notes Aug 10-11Reiner NuludОценок пока нет

- TXPOL 2019 Dec QДокумент14 страницTXPOL 2019 Dec QKAH MENG KAMОценок пока нет

- TDSCalculator 0809Документ2 страницыTDSCalculator 0809jeevan_v_mОценок пока нет

- JoelWestfield Unit6 Assignment 1314755232Документ5 страницJoelWestfield Unit6 Assignment 1314755232Mohammad AlfianОценок пока нет

- Format of Financial StatementsДокумент11 страницFormat of Financial StatementssarlagroverОценок пока нет

- Dividend Policy of Nepal TelecomДокумент9 страницDividend Policy of Nepal TelecomGwacheeОценок пока нет

- Dashboard Template: Business Unit Revenue ($000) Profit Margin ($000)Документ1 страницаDashboard Template: Business Unit Revenue ($000) Profit Margin ($000)GolamMostafaОценок пока нет

- Perception of Investors Towards Online Trading: IntrodutionДокумент64 страницыPerception of Investors Towards Online Trading: IntrodutionArjun S A100% (1)

- MABALAZAДокумент4 страницыMABALAZAMahasa R HajiiОценок пока нет

- Business Combination: Consolidated Financial StatementsДокумент9 страницBusiness Combination: Consolidated Financial StatementsJuuzuu GearОценок пока нет

- PDF FinanceДокумент25 страницPDF FinanceThulani NdlovuОценок пока нет

- PlanДокумент10 страницPlanHanny ValenciaОценок пока нет

- 0108 Futures MagДокумент68 страниц0108 Futures MagPaul FairleyОценок пока нет

- PAS 7 Summary NotesДокумент2 страницыPAS 7 Summary NotesdaraОценок пока нет

- Cash Flow Calculator CFO SelectionsДокумент12 страницCash Flow Calculator CFO Selections202040336Оценок пока нет

- SS Mar22 PDFДокумент8 страницSS Mar22 PDFuser mrmysteryОценок пока нет

- ADIBДокумент5 страницADIBMohamed BathaqiliОценок пока нет

- R31 Non-Current (Long-Term) Liabilities Q BankДокумент16 страницR31 Non-Current (Long-Term) Liabilities Q BankAhmedОценок пока нет

- FIN203 Tutorial 2 QДокумент6 страницFIN203 Tutorial 2 Q黄于绮Оценок пока нет

- Richard Bove's Sell Rating On Goldman SachsДокумент3 страницыRichard Bove's Sell Rating On Goldman SachsDealBookОценок пока нет

- Trading With GMMAДокумент5 страницTrading With GMMAonyxperidotОценок пока нет

- Blaine Kitchenware AssignmentДокумент5 страницBlaine Kitchenware AssignmentChrisОценок пока нет

- Audit of Accounts of Non-Corporate Entities (Bank Borrowers)Документ50 страницAudit of Accounts of Non-Corporate Entities (Bank Borrowers)Manikandan ManoharОценок пока нет

- Sol Man 1 Overview of AccountingДокумент2 страницыSol Man 1 Overview of AccountingNavi MobeОценок пока нет

- Rate NPV 351,212,178.13 365,660,986.27 290,844,716.89 207,520,203.54 Irr 180% 128% 189% 329%Документ1 страницаRate NPV 351,212,178.13 365,660,986.27 290,844,716.89 207,520,203.54 Irr 180% 128% 189% 329%pinkieОценок пока нет

- Bank Reconciliation Proof of CashДокумент15 страницBank Reconciliation Proof of CashPrinx CarvsОценок пока нет

- NOV Piggy BankДокумент4 страницыNOV Piggy BankDenzelle Anne GonzalesОценок пока нет

- Group 4 ResearchДокумент60 страницGroup 4 Researchroselletimagos30Оценок пока нет

- Company StructureДокумент3 страницыCompany StructureIndahОценок пока нет

- Week 6 Principles of MarketingДокумент9 страницWeek 6 Principles of MarketingEfrelyn ParaleОценок пока нет

- Accounting Special TransactionДокумент25 страницAccounting Special TransactionMarinel Mae ChicaОценок пока нет