Академический Документы

Профессиональный Документы

Культура Документы

Chapter 11 Illustrative Solutions

Загружено:

Samantha IslamАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 11 Illustrative Solutions

Загружено:

Samantha IslamАвторское право:

Доступные форматы

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-1

Review Questions

1. Audit sampling is the application of an audit procedure to less than 100 percent of the items in a

population for the purpose of drawing an inference about the entire population.

2. The two general types of audit sampling are statistical sampling and nonstatistical sampling.

3. Sampling risk is the risk that the internal auditors conclusion based on sample testing may be

different than the conclusion reached if the audit procedure was applied to all items in the population.

In performing tests of controls, the internal auditor is concerned with two aspects of sampling risk:

the risk of assessing control risk too low (type II risk, beta risk) and the risk of assessing control risk

too high (type I risk, alpha risk).

4. Nonsampling risk, unlike sampling risk, is not associated with testing less than 100 percent of the

items in a population. Instead, nonsampling risk occurs when an internal auditor fails to perform his

or her work correctly. For example, performing inappropriate auditing procedures, misapplying an

appropriate procedure (such as failure on the part of the internal auditor to recognize a control

deviation or a dollar error), or misinterpreting sampling results may cause a nonsampling error.

Nonsampling risk refers to the possibility of making such errors.

5. Attribute sampling is a statistical sampling approach, based on binomial distribution theory, that

enables the user to reach a conclusion about a population in terms of a rate of occurrence. The three

variations of attribute sampling described in the chapter are stratified attribute sampling, stop-or-go

sampling, and discovery sampling.

6. Attribute sampling involves the following nine steps:

Identify a specific internal control objective and the prescribed control(s) aimed at achieving that

objective.

Define what is meant by a control deviation.

Define the population and sampling unit.

Determine the appropriate values of the parameters affecting sample size.

Determine the appropriate sample size.

Randomly select the sample.

Audit the sample items selected and count the number of deviations from the prescribed control.

Determine the achieved upper deviation limit.

Evaluate the sample results.

7. There are three factors that affect the size of an attribute sample:

The acceptable risk of assessing control risk too low. The risk that the internal auditor will

incorrectly conclude that a specified control is more effective than it really is.

The tolerable deviation rate. The maximum rate of deviations the internal auditor is willing to

accept and still conclude that the control is acceptably effective.

The expected population deviation rate. The internal auditors best estimate of the actual

deviation rate in the population of items being examined.

8. Evaluating the results of an attribute sampling application involves:

Formulating a statistical conclusion.

Making an audit decision based on the quantitative sample results.

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-2

Considering qualitative aspects of the sample results.

9. What an internal auditor should do if documents pertinent to tests of control activities are missing will

depend on the specific circumstances.

If the auditor cannot find a document supporting a selected sample item, the missing support

document should be considered a control deviation.

If the auditor determines that a selected sample item has been voided and follow-up indicates that

nothing is amiss, it would be appropriate to select another item for testing purposes.

Opinions are mixed as to what an internal auditor should do if a selected sample item is missing

and the auditor is unable to obtain a reasonable explanation for why it is missing. Some internal

auditors believe this situation represents a control deviation. Others believe that another item

should be selected for testing purposes. Regardless of whether the missing sample item is

considered a deviation from the prescribed control or a different problem that warrants separate

consideration, the internal auditor should document the missing item in the working papers and

decide whether it is significant enough to be written up as an audit observation.

10. Haphazard sampling is a nonrandom selection technique that is used by internal auditors to select a

sample that is expected to be representative of the population. Haphazard, in this context, does not

mean careless or reckless. It means that the internal auditor selects the sample without deliberately

deciding to include or exclude certain items.

11. The key advantage of statistical sampling over nonstatistical sampling is that it allows the internal

auditor to quantify, measure, and control sampling risk.

12. Nonstatistical sampling allows the internal auditor more latitude regarding sample selection and

evaluation.

13. The purpose of statistical sampling in tests of monetary values is to obtain direct evidence about the

correctness of monetary values such as a recorded account balance. The purpose of statistical

sampling in tests of control activities is to obtain direct evidence about the operating effectiveness of

control activities.

14. Four factors affect PPS sample sizes:

Monetary book value of the population.

Risk of incorrect acceptance.

Tolerable misstatement.

Anticipated misstatement.

15. Key advantages of PPS sampling over classical variables sampling:

Simpler calculations make PPS sampling easier to use.

The sample size calculation does not involve any measure of estimated population variation.

PPS sampling automatically results in a stratified sample because sample items are selected in

proportion to their size.

PPS sample selection automatically identifies any individually significant population items,

that is, population items exceeding a predetermined cutoff dollar amount.

PPS sampling generally is more efficient (that is, requires a smaller sample size) when the

population contains zero or very few misstatements.

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-3

Key disadvantages of PPS sampling over classical variables sampling:

Special design considerations are required when understatements or audit values of less than

zero are expected.

Identification of understatements in the sample requires special evaluation considerations.

PPS sampling produces overly conservative results when errors are detected. This increases the

risk of incorrect rejection.

The appropriate sample size increases quickly as the number of expected misstatements

increases. When more than a few misstatements are expected, PPS sampling may be less

efficient.

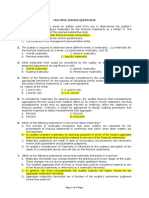

Multiple-choice Questions

1. A is the best answer. The primary benefit of statistical sampling is that it allows the internal auditor to

quantify, measure, and control sampling risk. Sampling risk is the risk that the internal auditors

conclusion based on sample testing may be different than the conclusion reached if the audit

procedure were applied to all items in the population. A secondary benefit of statistical sampling,

because it requires random sampling, is that it provides greater assurance than nonstatistical sampling

that the internal auditor will obtain a sample that is representative of the population. An internal

auditor using nonstatistical sampling must, however, select a sample that is thought to be

representative of the population, taking into consideration the factors that affect sample size. An

internal auditor must obtain competent evidence regardless of whether he or she uses statistical or

nonstatistical sampling.

2. A is the best answer. Statistical sampling allows the internal auditor to quantify, measure, and control

sampling risk.

3. D is the best answer. Attribute sampling enables the user to reach a conclusion about a population in

terms of a rate of occurrence. The most common use of attribute sampling in auditing is to evaluate

the effectiveness of a particular control. The internal auditor tests the rate of deviation from a

prescribed control to determine whether the occurrence rate is acceptable and, accordingly, whether

reliance on that control is appropriate.

4. A is the best answer. Whereas the expected population deviation rate has a direct effect on sample

size, the tolerable deviation rate has an inverse effect. Therefore, increasing the expected population

deviation rate and decreasing the tolerable deviation rate will cause the sample size to increase.

5. B is the best answer. Selecting a sample of sales invoices and matching them with shipping

documents involves vouching, the purpose of which is to test validity. In this case, the auditor is

testing the validity of billed sales. Customers should not be billed if goods were not shipped to them.

6. A is the best answer. Selecting a sample of check copies and matching them with approved vouchers

involves vouching, the purpose of which is to test validity. In this case, the auditor is testing the

validity of cash disbursements. Checks should not be issued without proper documentary support.

7. C is the best answer. Saying there is a 5% risk that the deviation rate in the population exceeds 7% is

equivalent to saying, with 95% confidence, that the deviation rate in the population is less than or

equal to 7%.

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-4

8. D is the best answer. The possibility that the deviations might be a result of fraud is of particular

importance to the internal auditor. Evidence that deviations from the control found in the sample were

caused by fraud might very well offset the quantitative results and prompt the internal auditor to

conclude that the control is not effective (that is, it cannot be relied upon to reduce residual risk to an

acceptably low level). The internal auditor also must consider what, if any, impact the discovery of

fraud might have on other aspects of the engagement.

9. D is the best answer. Using PPS sampling, or any other statistical sampling approach, does not

eliminate the need for professional judgment in determining the appropriate sample size and

evaluating the sample results.

Discussion Questions

1. a. In statistical sampling, the internal auditor must specify, using audit judgment, appropriate

quantitative values affecting sample size. The sample size is determined mathematically based on

these factors. In nonstatistical sampling, the sample size is based strictly on the internal auditors

judgment. The internal auditor using nonstatistical sampling should, however, consider the factors

that affect sample size.

b. In statistical sampling, the sample must be selected randomly. In nonstatistical sampling, the

sample need not be selected randomly. An internal auditor using nonstatistical sampling must,

however, select a sample that is thought to be representative of the population.

c. In statistical sampling, the sampling results must be evaluated mathematically based on

probability theory. In nonstatistical sampling, the conclusion about the population from which the

sample is drawn is strictly judgmental instead of being based on probability theory.

2. a. Audit risk is the risk of reaching invalid audit conclusions and/or providing faulty advice based on

the audit work conducted.

Inherent risk is the combination of internal and external risk factors in their pure, uncontrolled

state, or, the gross risk that exists, assuming there are no internal controls in place.

Control risk is the potential that controls will fail to reduce controllable risk to an acceptable

level.

Controllable risk is the portion of inherent risk that management can reduce through day-to-day

operations and management activities.

Residual risk is the portion of inherent risk that remains after management executes its risk

responses (sometimes referred to as net risk).

b. Sampling risk is the risk that the internal auditors conclusion based on sample testing may be

different than the conclusion reached if the audit procedure was applied to all items in the

population. Sampling risk varies inversely with sample size and, accordingly, is controlled by the

size of the sample selected.

c. The two aspects of sampling risk that an internal auditor is concerned with when testing controls

are the risk of assessing control risk too low and the risk of assessing control risk too high.

The risk of assessing control risk too low (type II risk, beta risk), also known as the risk of over-

reliance, is the risk that the assessed level of control risk based on the sample results is lower than

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-5

the internal auditor would have found it to be if the population had been tested 100 percent. In

other words, it is the risk that the internal auditor will incorrectly conclude that a specified control

is more effective than it really is. Stated another way, it is the risk that the internal auditor will

overstate the reliance that management can place on the control to reduce residual risk to an

acceptably low level.

The risk of assessing control risk too high (type I risk, alpha risk), also known as the risk of

under-reliance, is the risk that the assessed level of control risk based on the sample results is

higher than the internal auditor would have found if the population had been tested 100 percent.

In other words, it is the risk that the internal auditor will incorrectly conclude that a specified

control is less effective than it really is. Stated another way, it is the risk that the internal auditor

will understate the reliance that management can place on the control to reduce residual risk to an

acceptably low level.

3. a.

Attribute 1 Attribute 2

Risk of assessing control risk too low 5% 5%

Tolerable deviation rate 7% 6%

Expected population deviation rate 2% 1%

Sample size per table 88 78

Sample size used 90 80

Number of deviations uncovered 2 2

Sample deviation rate 2.2% 2.5%

Achieved upper deviation limit 6.9% 7.7%

b. Attribute 1:

Statistical conclusion: The internal auditor is 95% confident that the true, but unknown,

population deviation rate is less than or equal to 6.9%.

Audit decision based on the quantitative sample results: Since the upper deviation limit

(6.9%) is less than the tolerable deviation rate (7%), the internal auditor should decide that

the control is acceptably effective, that is, the control can be relied upon to reduce residual

risk to an acceptably low level.

Attribute 2:

Statistical conclusion: The internal auditor is 95% confident that the true, but unknown,

population deviation rate is less than or equal to 7.7%.

Audit decision based on the quantitative sample results: Since the upper deviation limit

(7.7%) is greater than the tolerable deviation rate (6%), the internal auditor should decide that

the control is not acceptably effective, that is, the control cannot be relied upon to reduce

residual risk to an acceptably low level.

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-6

Cases

Case 1

Deficiencies in the attribute sampling application:

The specific internal control objective(s) and the prescribed controls aimed at achieving the

objective(s) have not been identified.

Deviation(s) from prescribed controls have not been defined.

The population and sampling unit have not been clearly defined.

Factors influencing sample size, which are based on judgment, have not been justified. No basis for

these values has been established. Setting the expected deviation rate low is not conservative.

Based on the sample-size factors specified, the sample size is not correct.

The sample is not representative of the entire year. Valid conclusions would be limited to the two-

month period tested. It is important in tests of controls to cover the entire period being audited.

Stratification is inappropriate unless different controls are involved, which is possible. If this were the

case, stratification would be based on the need to test two different sets of controls.

The definition and treatment of deviations are not applied correctly. Deviations from prescribed

control procedures are intermingled with dollar errors. If dollar errors is the factor of interest, a

different sampling plan should be used. Deviations should not be lumped together for evaluation

purposes. They should be defined individually and evaluated separately.

The internal auditor appears to be missing the point that deviations from prescribed control

procedures increase the risk of misstatements in the financial statements. A deviation is a deviation

even if there is nothing wrong with the transaction, in other words, the appropriate control has not

been applied. No evidence of a control being applied is a deviation. Evidence of a control being

misapplied also is a deviation.

There is no basis for the conclusion reached. The internal auditors statistical conclusion is

inappropriate. Based on the information in the case, it is impossible to state an appropriate statistical

conclusion. The auditors deviation/error analysis was superficial.

Overall, there was a general lack of appropriate planning and supervision. There were numerous

failures with respect to sampling design and evaluation. Neither sampling risk nor nonsampling risk

was properly controlled.

Case 2

A. 1. Attribute sampling is defined in IDEA Help as the examination of a subset of a population (a

sample) in order to assess how frequently a particular event, or attribute, occurs in the population

as a whole. An attribute has only two possible values: true or false. In auditing, typical attributes

are whether an item is in error or not, whether a particular control has been exercised or not when

it should have been, or whether the entity complied with a particular law or not.

2. The two attribute sampling planning options described in IDEA Help are Beta Risk Control and

Beta and Alpha Risk Control. The two planning options allow the auditor to control the risks of

one or two types of incorrect decision. Some auditors do not set the risk of not relying on controls

when they are effective (Alpha Risk). They set only the risk of relying on controls when they are

not effective (Beta Risk) and the tolerable deviation rate. They set an expected deviation rate to

partially control for Alpha Risk.

CHAPTER 11

AUDIT SAMPLING

Illustrative Solutions

Internal Auditing: Assurance and Consulting Services, 2

nd

Edition. 2009 by The Institute of Internal Auditors

Research Foundation, 247 Maitland Avenue, Altamonte Springs, FL 32701 USA IS11-7

B. 1. Beta risk is defined in IDEA Help as the risk of deciding that the population deviation rate does

not exceed a specified tolerable deviation rate, when in fact it does. Per IDEA Help, synonyms

for Beta risk include Risk of Assessing Control Risk Too Low and Risk of Incorrect

Acceptance.

2. The five steps used to determine the minimum sample size and critical number of deviations, as

described in IDEA Help, are:

Enter the population size. This is the number of sampling units in the population from which

the samples are drawn.

Enter the % tolerable deviation rate. This is the maximum acceptable rate of critical

deviations or errors in the population, expressed as a percentage (must be greater than the

expected deviation rate and less than 100%).

Enter the % expected deviation rate. This [is the] rate of deviations or errors that may

reasonably be expected to occur in the population, expressed as a percentage (must be less

than the tolerable deviation rate).

Enter the desired confidence level (to control Beta Risk). IDEA Help states that This is the

level of assurance, expressed as a percentage, that [the auditor detects] a population deviation

rate that is higher than the tolerable deviation rate. This statement is not correct. IDEA Help

should state that the confidence level is the level of assurance, expressed as a percentage, that

[the auditor detects] a population deviation rate that is lower than or equal to the tolerable

deviation rate. IDEA Help goes on to state that The confidence level . . . is 100% - Beta

Risk, where Beta Risk is the risk that [the auditor fails] to detect a population deviation rate

higher than the tolerable deviation rate. This statement is correct.

Click Compute.

C. 1. If a sample size equal to that returned by the Planning (Beta Risk Control) dialog box is used,

and the number of deviations found in the sample is equal to the critical number of deviations

returned by Planning (Beta Risk Control), and the same confidence levels are used in both

Evaluation and Planning (Beta Risk Control) dialog boxes, then the 1-sided upper limit

returned by the evaluation limit is equal to or slightly less than the tolerable deviation rate

specified in the Planning (Beta Risk Control) dialog box.

2. The seven steps used to make inferences about the true rate of deviations in a population from

which a sample has been selected and tested, as described in IDEA Help, are:

Select Sampling > Attribute Planning and Evaluation . . .

Click the Sample Evaluation tab.

Enter the population size. This is the number of sampling units in the population from which

the sample [was] drawn.

Enter the sample size. Enter the number of items that were selected for inspection using

Random Record Sampling.

Enter the number of deviations in the sample. Enter the number of deviations (or other

events for which estimates of frequencies in the overall population are desired) found in the

sample.

Enter the confidence level. This is the confidence that the true population deviation rate is

less than the 1-sided upper limit . . .

Click Compute.

Вам также может понравиться

- ICAEW Advanced Level Case Study Question & Answer Bank July 2016 To November 2019Документ657 страницICAEW Advanced Level Case Study Question & Answer Bank July 2016 To November 2019Optimal Management Solution100% (6)

- 5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andДокумент2 страницы5.a in The Case That The AI Were To Have Made The Entries Themselves, It Would Ruin Their Function andAngeloОценок пока нет

- Audit Sampling PlanДокумент2 страницыAudit Sampling PlanMarjorie PagsinuhinОценок пока нет

- Louwers - Auditing and Assurance Services 6eДокумент36 страницLouwers - Auditing and Assurance Services 6eMunaf KarowaliyaОценок пока нет

- Mock PDFДокумент26 страницMock PDFCamiОценок пока нет

- Senior Internal Auditor Promotion Exam ReviewДокумент8 страницSenior Internal Auditor Promotion Exam Reviewwondimeneh AsratОценок пока нет

- Test Bank For Auditing and Assurance A Business Risk Approach 3rd Edition by JubbДокумент19 страницTest Bank For Auditing and Assurance A Business Risk Approach 3rd Edition by Jubba878091955Оценок пока нет

- Audit and Assurance: TestbankДокумент13 страницAudit and Assurance: TestbankBrandonОценок пока нет

- FIN352 - Review Questions For Midterm Exam 1Документ6 страницFIN352 - Review Questions For Midterm Exam 1Samantha IslamОценок пока нет

- Ryan M Scharetg TMobile BillДокумент3 страницыRyan M Scharetg TMobile BillJonathan Seagull LivingstonОценок пока нет

- Case Study On Aditya Birla GroupДокумент34 страницыCase Study On Aditya Birla GroupChetan Aravandekar0% (1)

- Audit Control Risk AssessmentДокумент26 страницAudit Control Risk AssessmentMary GarciaОценок пока нет

- Reviewer For Auditing TheoryДокумент10 страницReviewer For Auditing TheoryMharNellBantasanОценок пока нет

- Audit Sampling: Quiz 2Документ8 страницAudit Sampling: Quiz 2weqweqwОценок пока нет

- Auditing and Assurance ServicesДокумент49 страницAuditing and Assurance Servicesgilli1tr100% (1)

- Gramling 9e Auditing Solman Audit SamplingДокумент29 страницGramling 9e Auditing Solman Audit Samplingkimjoonmyeon22100% (1)

- Chapter 9 - Test BankДокумент67 страницChapter 9 - Test Bankjuan100% (2)

- CMPC312 QuizДокумент19 страницCMPC312 QuizNicole ViernesОценок пока нет

- MSU-CBA Internal Auditing ModuleДокумент7 страницMSU-CBA Internal Auditing ModuleNoroОценок пока нет

- Chapter 05 - Audit Evidence and DocumentationДокумент44 страницыChapter 05 - Audit Evidence and DocumentationALLIA LOPEZОценок пока нет

- T.B - CH10Документ17 страницT.B - CH10MohammadYaqoobОценок пока нет

- Quiz On Audit SamplingДокумент5 страницQuiz On Audit SamplingTrisha Mae AlburoОценок пока нет

- Chapter 15 Audit Sampling For Tests of Controls and Substantive Tests of TransactionsДокумент38 страницChapter 15 Audit Sampling For Tests of Controls and Substantive Tests of TransactionsYasmine Magdi100% (1)

- CW6 - MaterialityДокумент3 страницыCW6 - MaterialityBeybi JayОценок пока нет

- Window Dressing Tactics ExplainedДокумент10 страницWindow Dressing Tactics ExplainedMansi JainОценок пока нет

- Chapter 7 Audit Planning: Assessment of Control RiskДокумент21 страницаChapter 7 Audit Planning: Assessment of Control RiskLalaine JadeОценок пока нет

- Chapter 01 - Auditing and Assurance ServicesДокумент74 страницыChapter 01 - Auditing and Assurance ServicesBettina OsterfasticsОценок пока нет

- Chapter 5 Audit Evidence and DocumentationsДокумент18 страницChapter 5 Audit Evidence and DocumentationsAndyОценок пока нет

- Chapter 9 FinalДокумент17 страницChapter 9 FinalMichael Hu33% (3)

- AUDITINGДокумент20 страницAUDITINGAngelieОценок пока нет

- Aud Plan 123Документ7 страницAud Plan 123Mary GarciaОценок пока нет

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudДокумент25 страницLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Reviewer in AuditngДокумент32 страницыReviewer in AuditngHazel MoradaОценок пока нет

- Nfjpia Nmbe Far 2017 AnsДокумент9 страницNfjpia Nmbe Far 2017 AnsSamieeОценок пока нет

- Auditing Theory Test BankДокумент26 страницAuditing Theory Test Bankdfgmlk dsdwОценок пока нет

- Unit Four: Audit Responsibilities and ObjectivesДокумент44 страницыUnit Four: Audit Responsibilities and ObjectiveseferemОценок пока нет

- Auditing Chapter 2Документ10 страницAuditing Chapter 2byedmundОценок пока нет

- Excel Professional Services, Inc.: Discussion QuestionsДокумент7 страницExcel Professional Services, Inc.: Discussion QuestionskæsiiiОценок пока нет

- Midterm Act 2Документ4 страницыMidterm Act 2MikОценок пока нет

- RDC Review School Accountancy Audit QuizДокумент16 страницRDC Review School Accountancy Audit QuizKIM RAGAОценок пока нет

- AC316 Chapter 6 & 7 Test BankДокумент30 страницAC316 Chapter 6 & 7 Test BankNanon Wiwatwongthorn100% (1)

- Chapter 3 - Solution ManualДокумент20 страницChapter 3 - Solution Manualjuan100% (1)

- Quizzer 8Документ6 страницQuizzer 8CriscelОценок пока нет

- CORRECTING FINANCIAL STATEMENT ERRORSДокумент56 страницCORRECTING FINANCIAL STATEMENT ERRORSKimberly Pilapil MaragañasОценок пока нет

- Wroksheet Princples of Auditing IIДокумент9 страницWroksheet Princples of Auditing IIEwnetu TadesseОценок пока нет

- Week 2 Code Ethics QuizДокумент1 страницаWeek 2 Code Ethics QuizMarilou PanisalesОценок пока нет

- Acctng 402 Essay ExamДокумент2 страницыAcctng 402 Essay ExamMichael A. AlbercaОценок пока нет

- Auditing Theory - MockДокумент10 страницAuditing Theory - MockCarlo CristobalОценок пока нет

- Auditor's primary responsibility and assurance servicesДокумент14 страницAuditor's primary responsibility and assurance servicesTricia Mae FernandezОценок пока нет

- Wiley CPAexcel - AUD - Unlimited Practice Exam Testlet 2Документ10 страницWiley CPAexcel - AUD - Unlimited Practice Exam Testlet 2AimeeОценок пока нет

- At Preweek (Part 2) FinalДокумент17 страницAt Preweek (Part 2) FinalJane Michelle EmanОценок пока нет

- MAS NotesДокумент3 страницыMAS NotesMaricon Rillera PatauegОценок пока нет

- Auditing and Assurance Principles Final Exam Set AДокумент11 страницAuditing and Assurance Principles Final Exam Set APotato CommissionerОценок пока нет

- Chapter 13 Audit of The Acquisition and Payment Cycle: Auditing, 14e (Arens)Документ23 страницыChapter 13 Audit of The Acquisition and Payment Cycle: Auditing, 14e (Arens)Agnes TumandukОценок пока нет

- At01 Assurance Engagement and Related Services-W HighlightДокумент5 страницAt01 Assurance Engagement and Related Services-W HighlightPaulChristianHernandezBelaosОценок пока нет

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersДокумент2 страницыCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichОценок пока нет

- Chapter 5 MC QuestionsДокумент5 страницChapter 5 MC QuestionsjessicaОценок пока нет

- ATДокумент15 страницATSamanthaОценок пока нет

- Reviewer 2 MC Auditing Audit EvidenceДокумент31 страницаReviewer 2 MC Auditing Audit EvidenceJoanna GarciaОценок пока нет

- Testbank AuditingДокумент57 страницTestbank Auditingabc xyzОценок пока нет

- Internal Auditing Quiz 2Документ3 страницыInternal Auditing Quiz 2richarddiagmelОценок пока нет

- Uk Reporting of Intellectual CapitalДокумент71 страницаUk Reporting of Intellectual CapitalSamantha IslamОценок пока нет

- AssignmentДокумент2 страницыAssignmentSamantha IslamОценок пока нет

- NBFI Lectures PDFДокумент4 страницыNBFI Lectures PDFSamantha IslamОценок пока нет

- 8.1. - TDS ExampleДокумент1 страница8.1. - TDS ExampleSamantha IslamОценок пока нет

- IAS 1 Ts - Presentation of Financial StatementsДокумент3 страницыIAS 1 Ts - Presentation of Financial StatementsJed DíazОценок пока нет

- Corporate Tax - Prob - Assignment - 2Документ4 страницыCorporate Tax - Prob - Assignment - 2Samantha IslamОценок пока нет

- Foundation of Islamic Studies Module 1.4-BilalДокумент17 страницFoundation of Islamic Studies Module 1.4-BilalMateen Yousuf100% (1)

- 9psosm3s Parwani PDFДокумент4 страницы9psosm3s Parwani PDFSamantha IslamОценок пока нет

- Pro Man 2Документ9 страницPro Man 2Samantha IslamОценок пока нет

- AcknowledgementДокумент15 страницAcknowledgementSamantha IslamОценок пока нет

- Paper - 4: Cost Accounting andДокумент56 страницPaper - 4: Cost Accounting andemmanuel JohnyОценок пока нет

- CH 11Документ7 страницCH 11Samantha IslamОценок пока нет

- 8.1. - TDS ExampleДокумент1 страница8.1. - TDS ExampleSamantha IslamОценок пока нет

- DivДокумент3 страницыDivSamantha IslamОценок пока нет

- Bangladesh's Economic Growth, Savings and Investment RatesДокумент10 страницBangladesh's Economic Growth, Savings and Investment RatesSamantha IslamОценок пока нет

- 2010-03-14 071854 JaminДокумент2 страницы2010-03-14 071854 JaminAlem ShumiyeОценок пока нет

- Practical insights into application of BAS 18 and BAS 11Документ11 страницPractical insights into application of BAS 18 and BAS 11Samantha IslamОценок пока нет

- Corporate Tax - Prob - Assignment - 2Документ4 страницыCorporate Tax - Prob - Assignment - 2Samantha IslamОценок пока нет

- Blank PoripotraДокумент13 страницBlank PoripotraS.m. MoniruzzamanОценок пока нет

- Ifrs 8Документ3 страницыIfrs 8Samantha IslamОценок пока нет

- Vision Mission Strategy 111Документ28 страницVision Mission Strategy 111Samantha IslamОценок пока нет

- Course Outline Project ManagementДокумент3 страницыCourse Outline Project ManagementSamantha IslamОценок пока нет

- IRR Vs MIRR Vs NPV (Finatics)Документ4 страницыIRR Vs MIRR Vs NPV (Finatics)miranirfanОценок пока нет

- Resource 1Документ13 страницResource 1Samantha IslamОценок пока нет

- Salahuddin AyyubiДокумент24 страницыSalahuddin AyyubiSamantha IslamОценок пока нет

- TP ExampleДокумент3 страницыTP ExampleWasik Abdullah MomitОценок пока нет

- International Journal of Business and Society, Vol.9 No.2, 2008, 69-86: THE ADOPTION OF MOBILE BANKING IN MALAYSIAДокумент1 страницаInternational Journal of Business and Society, Vol.9 No.2, 2008, 69-86: THE ADOPTION OF MOBILE BANKING IN MALAYSIASamantha IslamОценок пока нет

- ECON2170 Homework: Regression models and hypothesis testingДокумент7 страницECON2170 Homework: Regression models and hypothesis testingPilSeung HeoОценок пока нет

- Terms of UseДокумент16 страницTerms of UseSamantha IslamОценок пока нет

- MKT 412 Lecture 12 - Crafting The Service EnvironmentДокумент34 страницыMKT 412 Lecture 12 - Crafting The Service EnvironmentEhsan Karim100% (1)

- FM11 CH 10 Capital BudgetingДокумент56 страницFM11 CH 10 Capital Budgetingm.idrisОценок пока нет

- Q9 HazopДокумент7 страницQ9 HazophemendraОценок пока нет

- Exploring The Experiences of Digital Native Entrepreneurs Participating in Online BusinessДокумент87 страницExploring The Experiences of Digital Native Entrepreneurs Participating in Online BusinessAlyssa May LaydaОценок пока нет

- Purpose of Research (Purpose)Документ8 страницPurpose of Research (Purpose)Ayushi ChoumalОценок пока нет

- 02 Kanto Region (Kaigofukushishi) 12000017Документ4 страницы02 Kanto Region (Kaigofukushishi) 12000017bnp2tkidotgodotidОценок пока нет

- Maintainance Contract FormatДокумент3 страницыMaintainance Contract Formatnauaf101Оценок пока нет

- Tea UnderstandingДокумент3 страницыTea UnderstandingSadiya SaharОценок пока нет

- Asset Quality, Credit Delivery and Management FinalДокумент21 страницаAsset Quality, Credit Delivery and Management FinalDebanjan DasОценок пока нет

- EMBMДокумент14 страницEMBMapi-19882665Оценок пока нет

- Tiong, Gilbert Charles - Financial Planning and ManagementДокумент10 страницTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongОценок пока нет

- Mission StatementДокумент10 страницMission StatementJessica JohnsonОценок пока нет

- Building Productsspring 2010Документ84 страницыBuilding Productsspring 2010Adrian GhabbhalОценок пока нет

- 0 - 265454387 The Bank of Punjab Internship ReportДокумент51 страница0 - 265454387 The Bank of Punjab Internship Reportفیضان علیОценок пока нет

- Case StudyДокумент7 страницCase StudynarenderОценок пока нет

- Fundamental RulesДокумент18 страницFundamental RulesrakeshОценок пока нет

- Greek Labour LawДокумент3 страницыGreek Labour LawSerban MihaelaОценок пока нет

- Oranjolt - Rasn-WPS OfficeДокумент3 страницыOranjolt - Rasn-WPS OfficeKaviya SkОценок пока нет

- SM MCQДокумент30 страницSM MCQWoroud Quraan100% (3)

- Contracts Construction ScaffoldДокумент2 страницыContracts Construction ScaffoldGrace HuangОценок пока нет

- SAE1Документ555 страницSAE1Aditya100% (1)

- SEED Experiment 5 PartaДокумент6 страницSEED Experiment 5 PartaDhaval GamechiОценок пока нет

- Planning, organizing, staffing and directing roles in education administrationДокумент1 страницаPlanning, organizing, staffing and directing roles in education administrationtheresaОценок пока нет

- Marketing Strategy For Millennial of AlcoholДокумент8 страницMarketing Strategy For Millennial of AlcoholKetan BedekarОценок пока нет

- Marketing Research and MISДокумент20 страницMarketing Research and MISMithun KanojiaОценок пока нет

- Batik Fabric Manila Philippines Starting US 199 PDFДокумент3 страницыBatik Fabric Manila Philippines Starting US 199 PDFAjeng Sito LarasatiОценок пока нет

- DWDM Route Planning A4 WPДокумент3 страницыDWDM Route Planning A4 WPChavara MatekweОценок пока нет