Академический Документы

Профессиональный Документы

Культура Документы

Savills Residential Market Autumn 2014

Загружено:

vdmaraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Savills Residential Market Autumn 2014

Загружено:

vdmaraАвторское право:

Доступные форматы

savills.

nl/research 01

House prices up

Over the past years houses have

become more affordable as house

prices decreased, mortgage rates

dropped, also due to Dutch pension

funds entering this market, and as the

temporary exemption gift tax, which

provides parents with the possibility to

pay off housing debts of their children,

proved helpful. NVM data shows that

the average price increased by 4.7%

yoy to 215,100 in August. The total

number of houses sold increased by

23.6%, from around 10,000 in August

2013 to over 12,300 in August 2014.

The drop in consumer condence in

August however, seems visible in the

housing market too, as the gures

August 2014 do remain well behind

those of the month before. The coming

months will show whether economic

uncertainties will expand, or whether

this is just a temporary setback.

Supply and demand

There are four major trends dening the

Brieng Note

Residential investment

volumes top 1.7 billion Autumn 2014

Savills World Research

Netherlands Residential

Economic growth

The Dutch economy grew by 1.1%

yoy in Q2 2014, mainly due to

increased exports and private sector

investments. Most noticeable key

gure concerned the stabilisation of

household consumption, after ve

years of consecutive decrease. This

stabilisation is linked with the overall

increase in consumer condence over

the past year, from -44 in February

2013 to -2 in July 2014, and is in

accordance to the improvement of

sold house prices.

In August and September however,

consumer condence, producers

condence and the Nevi Purchasing

Managers Index all decreased. This

signals that economic recovery

is still feeble and the geopolitical

instabilities in Eastern Europe and the

Middle-East are cause for uncertainty

within Europe. Reason for the ECB

to support economic growth by

cutting its interest rate to 0.05% and

introducing new stimulus measures.

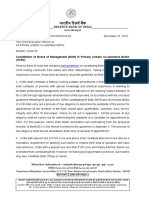

GRAPH 1

Residential investment volume Netherlands: Record

investments in H2 2014 and more to come

Graph source: Savills

future demographic landscape:

- the total number of households will

grow by around 900,000 households to

8.5 million in 2040;

- the vast majority of this growth

concerns single person households of

65 years and older;

- the increasing concentration of labour

and people towards the major cities

and the shrinkage in other areas;

- the overall ageing of the population,

resulting in an increasing demand for

neighbourhood amenities.

New residential developments should

take these trends into consideration

and thus focus on the housing of

smaller households, on the largest

cities and on dwellings and locations

suitable to the needs of elderly people.

At the supply side an increase in new

developments can be expected as

the number of building permits started

increasing this year. In H1 2014 a

total of 15,300 permits were issued, a

27.5% yoy increase. This is however

still a long way from the 37,400 new

permits issued in H1 2007 and far less

than needed to deal with the housing

needs of the growing population.

House prices and rent

levels

NVM data regarding Q2 2014 shows

that house prices in the Netherlands

increased on average by 3.5% yoy,

while in Amsterdam prices rose by

almost 10.0%. Also the average period

a residential unit is on the market

dropped substantally and stands at

just 58 days in Amsterdam, compared

to a national average of 135.

Data from Pararius shows that average

rents in the private sector remained

stable over the past year and stand

0%

1%

2%

3%

4%

5%

6%

0

200

400

600

800

1,000

1,200

09H1 09H2 10H1 10H2 11H1 11H2 12H1 12H2 13H1 13H2 14H1 14Q3

M

i

l

l

i

o

n

Investment volume Gross prime yields

Autumn 2014

savills.nl/research 02

Brieng Note | Residential market

at 12.42 per sqm per year, while for

Amsterdam rents increased by 5.6%

yoy towards a record high 19.31 per

sqm per year.

Rents within the social housing stock

rose by 4.4% yoy, as it is now possible

to increase the rent by ination plus

an income-related share. Remarkably,

the housing associations increased

their rents by 4.7%, while the rental

increase by private owners reached

3.8%. The steep increase in rents over

the past two years is partly a matter

of catching up, as in previous years

rental increases were capped at the

ination rate, and partly caused by the

landlord tax, mandatory for all owners

of regulated housing stock.

Minor changes in

regulations

Traditionally the government puts

forward their goals and budget at

Prince's Day, the third Tuesday in

September. While last year these

included substantial changes for the

housing market, this year the changes

were less substantial and most of them

were published earlier in the year. Two

elements need mentioning however.

First, the landlord tax will remain

in place in 2018 onwards and will

increase, although no percentages are

listed yet. Secondly, the maximum rent

level of social housing will be xed at

699.48 for the upcoming three years.

This will give private investors more

room for investing in the non-regulated

700+ market segment.

Investment volumes

surge

After some hesitation H1 2014 saw

a large inux of (foreign) capital into

Dutch residential portfolios. In the

months following the German-based

BNP Paribas REIM signing the rst

40m deal in April 2014, portfolio

purchases by Dutch Quadrigo (95m),

Aventicum (100m) and UK based

Round Hill Capital (180m) drove the

total investment volume up to 980m

in H1 2014, a 81% yoy increase.

In Q3 2014 German investor Patrizia

purchased* a 5,500 unit Vestia portfolio

for 577m, the largest transaction

so far, and the investment volume in

this quarter reached 730m already.

As a number of substantial portfolios

(among others Vestia, Lips, WIF) are

currently being marketed, this gure is

likely to reach well over 1bln. Already

Graph source: Savills

"Foreign investors need volume and are

aiming at 500m plus investments."

Jan de Quay, Netherlands Investments

Savills team

Please contact us for further information

Savills plc

Savills is a leading global real estate service provider listed on the London Stock Exchange. The company established in 1855, has a rich heritage with unrivalled growth. It is a company

that leads rather than follows, and now has over 600 ofces and associates throughout the Americas, Europe, Asia Pacic, Africa and the Middle East.

This report is for general informative purposes only. It may not be published, reproduced or quoted in part or in whole, nor may it be used as a basis for any contract, prospectus,

agreement or other document without prior consent. Whilst every effort has been made to ensure its accuracy, Savills accepts no liability whatsoever for any direct or consequential loss

arising from its use. The content is strictly copyright and reproduction of the whole or part of it in any form is prohibited without written permission from Savills Research.

Clive Pritchard

Investments

+31 (0) 20 301 2000

c.pritchard@savills.nl

Jan de Quay

Investments

+31 (0) 20 301 2000

j.dequay@savills.nl

Jeroen Jansen

Research

+31 (0) 20 301 2094

j.jansen@savills.nl

Rene Tim

Investments

+31 (0) 20 301 2000

r.tim@savills.nl

the total 2014 gure is topping the

record high 1.3bln of 2013. It has to

be noted that the top 5 transactions

totaled 59.3% of the total volume.

International investors

in a highly regulated

residential market

International investor have come

to embrace the Dutch residential

property market as the fundamentals

are sound: limited supply, growing

demand, low vacancy, increased

room for rental increases and relatively

low but increasing selling prices. The

regulations, albeit strict, do provide

for certainty and any loose regulatory

ends are generally incorporated in the

buying price.

More than a dozen international

investors, not present yet, are eyeing

the Dutch residential market. These

investors are generally more interested

in larger lot sizes (over 500m) than in

smaller lots, as they need substance.

Outlook

Appetite from national and foreign

investors remains high and nancing

is readily available. Coupled with low

interest levels, potential vendors might

consider bringing their residential

property to the market shortly. Over

the past months gross initial yields

contracted by 10 bps to currently

5.15%. Savills expects yields to remain

stable for the remainder of the year.

* The Minister for Housing formally still has to approve.

Вам также может понравиться

- Visa NetДокумент22 страницыVisa NetPahul WaliaОценок пока нет

- Guide to Buying a Home in Belgium: Real Estate Process & TipsДокумент1 страницаGuide to Buying a Home in Belgium: Real Estate Process & Tipsfoad888Оценок пока нет

- Annexure - 2 COS 38 Joint Hindu Family LetterДокумент2 страницыAnnexure - 2 COS 38 Joint Hindu Family LetterRahul Kumar50% (2)

- Chap 009Документ19 страницChap 009van tinh khucОценок пока нет

- Fixed Deposit - FD 082022Документ1 страницаFixed Deposit - FD 082022kainingОценок пока нет

- Savills Market in Minutes (Dec. 2014)Документ2 страницыSavills Market in Minutes (Dec. 2014)vdmaraОценок пока нет

- Colliers Residential Investment Market 2014Документ6 страницColliers Residential Investment Market 2014vdmaraОценок пока нет

- Report2E6-Boeckx-Van de Water-Budget Report December 213Документ19 страницReport2E6-Boeckx-Van de Water-Budget Report December 213blablablaОценок пока нет

- CBRE (2014 H1) Office Marketview The NetherlandsДокумент4 страницыCBRE (2014 H1) Office Marketview The NetherlandsvdmaraОценок пока нет

- house-price-movements-in-the-netherlands-or-how-a-society-could-be-dividedДокумент19 страницhouse-price-movements-in-the-netherlands-or-how-a-society-could-be-dividedyo_isoОценок пока нет

- Ober Haus Market Report Baltic States 2021Документ130 страницOber Haus Market Report Baltic States 2021Zeeshan icoОценок пока нет

- Savills Light Industrial Market Summer 2014Документ4 страницыSavills Light Industrial Market Summer 2014vdmaraОценок пока нет

- Real Estate Outlook 2017Документ4 страницыReal Estate Outlook 2017cutmytaxesОценок пока нет

- Uk Residential Market Update: Another Multi-Speed YearДокумент2 страницыUk Residential Market Update: Another Multi-Speed Yearrudy_wadhera4933Оценок пока нет

- The Dutch Mortgage MarketДокумент35 страницThe Dutch Mortgage MarketIgor StojanovОценок пока нет

- Cushman Wakefield What's in Store - European Retail Report Nov 2011 FINALДокумент20 страницCushman Wakefield What's in Store - European Retail Report Nov 2011 FINALBaby SinghОценок пока нет

- Cushman Marketbeat Industrial (2014 q2)Документ1 страницаCushman Marketbeat Industrial (2014 q2)vdmaraОценок пока нет

- Codreanu Iordache MihaelaДокумент6 страницCodreanu Iordache MihaelaIsabela RădeanuОценок пока нет

- Assessment 2A. International Monetary EconomicsДокумент6 страницAssessment 2A. International Monetary EconomicsBình MinhОценок пока нет

- Kirk LindstromДокумент15 страницKirk Lindstromrick7255Оценок пока нет

- RICS Romania Market ReportДокумент16 страницRICS Romania Market ReportRares GlodОценок пока нет

- Luxembourg Real Estate 2020:: Building Blocks For SuccessДокумент40 страницLuxembourg Real Estate 2020:: Building Blocks For SuccessShaman WhisperОценок пока нет

- Dutch Trade in Facts and Figures 2019Документ145 страницDutch Trade in Facts and Figures 2019Rohan LabdeОценок пока нет

- Mortgage Market Update | Q1 2018 | IG&HДокумент10 страницMortgage Market Update | Q1 2018 | IG&Hjohan oldmanОценок пока нет

- Eurozone Forecast Summer 2011 SpainДокумент8 страницEurozone Forecast Summer 2011 Spaindsoto913Оценок пока нет

- Ci17 5Документ11 страницCi17 5robmeijerОценок пока нет

- Spotlight Key Themes For Uk Real Estate 2016Документ6 страницSpotlight Key Themes For Uk Real Estate 2016mannantawaОценок пока нет

- Spotlight: Key Themes For UK Real Estate in 2014Документ6 страницSpotlight: Key Themes For UK Real Estate in 2014aba3abaОценок пока нет

- MR Ubs Global Real Estate Bubble Index 2019 CH enДокумент4 страницыMR Ubs Global Real Estate Bubble Index 2019 CH entrionjetОценок пока нет

- Deutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsДокумент32 страницыDeutsche Industriebank German Market Outlook 2014 Mid Cap Financial Markets in Times of Macro Uncertainty and Tightening Bank RegulationsRichard HongОценок пока нет

- Rising Domestic Demand and Net Exports Underpin German GrowthДокумент15 страницRising Domestic Demand and Net Exports Underpin German Growthapi-228714775Оценок пока нет

- Colliers H2 2014 EMEA OfficeДокумент3 страницыColliers H2 2014 EMEA OfficevdmaraОценок пока нет

- Tallinn Real Estate Market Review September 2010Документ11 страницTallinn Real Estate Market Review September 2010TallinnPropertyОценок пока нет

- Crockers Market Research: Further Growth For House Sales, in TimeДокумент2 страницыCrockers Market Research: Further Growth For House Sales, in Timepathanfor786Оценок пока нет

- An Assessment of The Maltese Housing MarДокумент21 страницаAn Assessment of The Maltese Housing MarDjamel BoulfelfelОценок пока нет

- M Winkworth: Quality Brand Delivering Quality ResultsДокумент12 страницM Winkworth: Quality Brand Delivering Quality ResultsSXC948Оценок пока нет

- IBB Housing Market Report 2013 SummaryДокумент7 страницIBB Housing Market Report 2013 SummaryOfer KulkaОценок пока нет

- Maltese Housing Market AssessmentДокумент9 страницMaltese Housing Market AssessmentDjamel BoulfelfelОценок пока нет

- International Economic (Group Assignment)Документ12 страницInternational Economic (Group Assignment)Ahmad FauzanОценок пока нет

- Housing and The Economy: AUTUMN 2013Документ16 страницHousing and The Economy: AUTUMN 2013faidras2Оценок пока нет

- PropertyДокумент5 страницPropertyapi-437469743Оценок пока нет

- David Lichtenstein - Norwegian InvestmentДокумент1 страницаDavid Lichtenstein - Norwegian InvestmentvivancesteroОценок пока нет

- Commercial Research Central London OfficesДокумент8 страницCommercial Research Central London Officesaba3abaОценок пока нет

- 1 WhiteheadДокумент19 страниц1 WhiteheadllОценок пока нет

- Report - Logistics Market BNPPRE 2019 H1 v2sДокумент11 страницReport - Logistics Market BNPPRE 2019 H1 v2sajsgdkasjgdОценок пока нет

- InterNations Munich Guide PDFДокумент21 страницаInterNations Munich Guide PDFsunny babaОценок пока нет

- JLL Industrial Capital Markets Outlook (2015 March)Документ17 страницJLL Industrial Capital Markets Outlook (2015 March)vdmaraОценок пока нет

- Portugals Upcoming Golden Visa ReformsДокумент3 страницыPortugals Upcoming Golden Visa ReformsAntoineОценок пока нет

- Ease of Doing Business in SwissДокумент13 страницEase of Doing Business in SwissSOURAV GOYALОценок пока нет

- Nordea Bank, Economic Outlook Nordics, Dec 2013. "Divergence"Документ14 страницNordea Bank, Economic Outlook Nordics, Dec 2013. "Divergence"Glenn ViklundОценок пока нет

- JLL Amsterdam Office Market Profile Q4 2014Документ2 страницыJLL Amsterdam Office Market Profile Q4 2014vdmaraОценок пока нет

- EY Attractiveness Survey 2014Документ52 страницыEY Attractiveness Survey 2014Cátia Martins Dos SantosОценок пока нет

- Firstcom Vol-01Документ4 страницыFirstcom Vol-01Zubair Afzal KhanОценок пока нет

- The Property Handbook Web PDFДокумент31 страницаThe Property Handbook Web PDFPaulo BorgesОценок пока нет

- Swiss Tax Reform EN WebДокумент3 страницыSwiss Tax Reform EN WebSwastik GroverОценок пока нет

- Germany Business Investor Residence Program 1576143248Документ9 страницGermany Business Investor Residence Program 1576143248Mai PhíОценок пока нет

- Berne Declaration PDFДокумент19 страницBerne Declaration PDFHenry Anibe Agbonika IОценок пока нет

- Sweden CounEEEEtry ProfileДокумент10 страницSweden CounEEEEtry ProfileAlyssa GoОценок пока нет

- Macro Economic Policies of SwitzerlandДокумент18 страницMacro Economic Policies of SwitzerlandShashank JoganiОценок пока нет

- M&A Review Newsletter 2014Документ28 страницM&A Review Newsletter 2014Michael WangОценок пока нет

- BNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010Документ12 страницBNP Paribas The Financial Crisis and Household Savings Behaviour in France 11102010YUGANDHAR016577Оценок пока нет

- News Coverage - France: Economy and Business News From The Past WeekДокумент6 страницNews Coverage - France: Economy and Business News From The Past Weekapi-248259954Оценок пока нет

- London Housing Bubble 2014Документ2 страницыLondon Housing Bubble 2014harshal7788Оценок пока нет

- Colliers Industrial and Logistics Rents Map 2015 H1Документ5 страницColliers Industrial and Logistics Rents Map 2015 H1vdmaraОценок пока нет

- JLL Industrial Capital Markets Outlook (2015 March)Документ17 страницJLL Industrial Capital Markets Outlook (2015 March)vdmaraОценок пока нет

- JLL Zuidas Office Market Monitor 2014 Q4 DEFДокумент16 страницJLL Zuidas Office Market Monitor 2014 Q4 DEFvdmaraОценок пока нет

- Colliers H2 2014 EMEA OfficeДокумент3 страницыColliers H2 2014 EMEA OfficevdmaraОценок пока нет

- CW The Year Ahead 2015-2016Документ32 страницыCW The Year Ahead 2015-2016vdmaraОценок пока нет

- Cushman Offices Q4 2014Документ1 страницаCushman Offices Q4 2014vdmaraОценок пока нет

- CBRE Retail Viewpoint (2015 March)Документ5 страницCBRE Retail Viewpoint (2015 March)vdmaraОценок пока нет

- CBRE EMEA Industrial and Logistics Q4 2014Документ8 страницCBRE EMEA Industrial and Logistics Q4 2014vdmaraОценок пока нет

- Savills Market in Minutes (March 2015)Документ2 страницыSavills Market in Minutes (March 2015)vdmaraОценок пока нет

- JLL Amsterdam Office Market Profile Q4 2014Документ2 страницыJLL Amsterdam Office Market Profile Q4 2014vdmaraОценок пока нет

- CBRE H2 2014 Office MVДокумент6 страницCBRE H2 2014 Office MVvdmaraОценок пока нет

- Capital Value (2014) Interest of German Banks in Dutch Residential RAДокумент6 страницCapital Value (2014) Interest of German Banks in Dutch Residential RAvdmaraОценок пока нет

- Cushman Retail Q4 2014Документ1 страницаCushman Retail Q4 2014vdmaraОценок пока нет

- Cushman Industrial Q4 2014Документ1 страницаCushman Industrial Q4 2014vdmaraОценок пока нет

- Colliers EMEA Office Snapshot H1 2014Документ3 страницыColliers EMEA Office Snapshot H1 2014vdmaraОценок пока нет

- CBRE H2 2014 Industrial MVДокумент5 страницCBRE H2 2014 Industrial MVvdmaraОценок пока нет

- Colliers Industrial and Logistics Rents Map 2014Документ5 страницColliers Industrial and Logistics Rents Map 2014vdmaraОценок пока нет

- CBRE H2 2014 Retail MVДокумент5 страницCBRE H2 2014 Retail MVvdmaraОценок пока нет

- DTZ Global Occupancy Costs: Logistics 2014Документ12 страницDTZ Global Occupancy Costs: Logistics 2014vdmaraОценок пока нет

- DTZ Europe Logistics H1 2014Документ9 страницDTZ Europe Logistics H1 2014vdmaraОценок пока нет

- CW Retail Snapshot Q3 2014Документ1 страницаCW Retail Snapshot Q3 2014vdmaraОценок пока нет

- Colliers 2015 Global Investor Sentiment ReportДокумент56 страницColliers 2015 Global Investor Sentiment ReportvdmaraОценок пока нет

- CBRE Capital Markets Outlook 2015Документ16 страницCBRE Capital Markets Outlook 2015vdmaraОценок пока нет

- CW Industrial Snapshot Q3 2014Документ1 страницаCW Industrial Snapshot Q3 2014vdmaraОценок пока нет

- CW Office Snapshot Q3 2014Документ1 страницаCW Office Snapshot Q3 2014vdmaraОценок пока нет

- Colliers Occupier Cost Index (2014)Документ2 страницыColliers Occupier Cost Index (2014)vdmaraОценок пока нет

- CBRE Residential Marketview (Nov 2014)Документ6 страницCBRE Residential Marketview (Nov 2014)vdmaraОценок пока нет

- CBRE The Emergence of Dutch Multifamily Market 2014Документ3 страницыCBRE The Emergence of Dutch Multifamily Market 2014vdmaraОценок пока нет

- Jll-Capital Markets BrochureДокумент12 страницJll-Capital Markets BrochurechloeheОценок пока нет

- Lecture 2Документ31 страницаLecture 2Daanyal Ibn UmarОценок пока нет

- Detailed Statement: Neft-Ani Integrated Services LTDДокумент3 страницыDetailed Statement: Neft-Ani Integrated Services LTDRohit raagОценок пока нет

- Paper 12 - Company Accounts and Audit Syl2012Документ116 страницPaper 12 - Company Accounts and Audit Syl2012sumit4up6rОценок пока нет

- Commercial Banks Standard - en GBДокумент25 страницCommercial Banks Standard - en GBjames jiangОценок пока нет

- PERFAST Corporation 2016 Financial StatementsДокумент9 страницPERFAST Corporation 2016 Financial StatementsMCDABCОценок пока нет

- GRC - Governance, Risk Management, and ComplianceДокумент16 страницGRC - Governance, Risk Management, and ComplianceBhavesh RathodОценок пока нет

- PressenTatIon of UBL (Loan)Документ15 страницPressenTatIon of UBL (Loan)Adeel ShahОценок пока нет

- Security MarketДокумент30 страницSecurity Marketashish_k_srivastavaОценок пока нет

- Deed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014Документ9 страницDeed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014mukund100% (1)

- Sbi - Salary Account - DetailsДокумент9 страницSbi - Salary Account - Detailsgaurav8tcsОценок пока нет

- (No Subject) - Inbox - Yahoo! MailДокумент2 страницы(No Subject) - Inbox - Yahoo! Mailpradhap87Оценок пока нет

- Account Statement From 29 Jul 2020 To 31 Jul 2020Документ1 страницаAccount Statement From 29 Jul 2020 To 31 Jul 2020Ashwin PrajapatiОценок пока нет

- Credtrans Chapter 1 AquinoДокумент3 страницыCredtrans Chapter 1 AquinoMizelle AloОценок пока нет

- Open an NPS account in 40 charactersДокумент2 страницыOpen an NPS account in 40 charactersMOHIT GUPTA jiОценок пока нет

- Project On Kotak Mahindra BankДокумент34 страницыProject On Kotak Mahindra BankMcbc Promax Ultrahd100% (1)

- Mozambique Travel Guide - Getting to Vilanculos & General InfoДокумент3 страницыMozambique Travel Guide - Getting to Vilanculos & General InfocharleneОценок пока нет

- GSL Investment Memo and ModelДокумент12 страницGSL Investment Memo and ModelMarcos CostantiniОценок пока нет

- RBI Guideline On UCBS NOTI082Документ11 страницRBI Guideline On UCBS NOTI082sroyОценок пока нет

- Money - Buying, Selling, PayingДокумент1 страницаMoney - Buying, Selling, Payingsave1407Оценок пока нет

- IKO Guide Lipiec 2019Документ32 страницыIKO Guide Lipiec 2019Damian MotylskiОценок пока нет

- FACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESДокумент29 страницFACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS.) ISLAMIC BANKING ADVANCE FIQH MUAMALAT (ISB548) GROUP PROJECT SHARI’AH CONTRACT AND ISSUESNurin HannaniОценок пока нет

- Homework #1: Nguyen Xuan Thanh Strategy division-TCBДокумент2 страницыHomework #1: Nguyen Xuan Thanh Strategy division-TCBThanh NguyenОценок пока нет

- Business ServicesДокумент11 страницBusiness ServicesBhoomi KachhiaОценок пока нет

- Indusind Bank BenefitsДокумент1 страницаIndusind Bank BenefitsParvinder MehraОценок пока нет